Professional Documents

Culture Documents

Industrial Average of Profitability Ratio

Uploaded by

Clarisse Policios0 ratings0% found this document useful (0 votes)

7 views2 pagesFinancial management

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinancial management

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesIndustrial Average of Profitability Ratio

Uploaded by

Clarisse PoliciosFinancial management

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

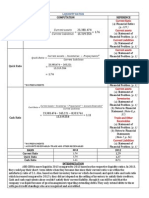

INDUSTRIAL AVERAGE OF PROFITABILITY RATIO

Profitability ABS-CBN GMA Industry

Return on assets 13.29% 0.99%

Return on assets 5 Yr. Avg 2.86% 8.61% 7.74%

Return on Investment 19.74% 19.70%

Return on Investment 5 Yr. Avg 3.89% 12.35% 44.84%

Return on Equity 19.74% 19.70%

Return on Equity - 5 Yr. Avg 8.23% 11.66% 19.95%

1. Current results: GMA is currently more profitable that ABS-CBN (by all three ratios that

measures profits) while ABS-CBN earns just about the same as the average firm in the economy.

Year on year GMA Network Inc grew revenues 7.16% from 12.09bn to 12.95bn while net income

improved 3.10% from 1.62bn to 1.67bn. And Year on year abs-cbn, both dividends per share and

earnings per share excluding extraordinary items growth increased 50.00% and 26.06%,

respectively.

2. 5-year average: the 5-year average gives us a little longer term view of the two companies.

However, even on the basis, the ranking is the same GMA is more profitable than ABS-CBN.

The positive trend in dividend payments is noteworthy since very few companies in the

Broadcasting & Cable TV industry pay a dividend. Additionally when measured on a five year

annualized basis, both dividend per share and earnings per share growth ranked in-line with the

industry average relative to its peers.

You might also like

- Dividend Irrelevance Theory DefinitionDocument2 pagesDividend Irrelevance Theory DefinitionpsyashNo ratings yet

- 404b Dividends HomeworkDocument7 pages404b Dividends HomeworkClarisse PoliciosNo ratings yet

- SyllabusDocument3 pagesSyllabusClarisse PoliciosNo ratings yet

- 404B - Financial InstDocument11 pages404B - Financial InstClarisse PoliciosNo ratings yet

- Adjust pretax income for errorsDocument2 pagesAdjust pretax income for errorsClarisse PoliciosNo ratings yet

- Diarrhea Unknown EtiologyDocument2 pagesDiarrhea Unknown EtiologyClarisse PoliciosNo ratings yet

- Manila To Cebu Airfare Air Asia: SourceDocument3 pagesManila To Cebu Airfare Air Asia: SourceClarisse PoliciosNo ratings yet

- THESIS - The Research Problem With UnderlineDocument4 pagesTHESIS - The Research Problem With UnderlineClarisse PoliciosNo ratings yet

- Thesis - Definition of TermsDocument2 pagesThesis - Definition of TermsClarisse Policios0% (1)

- Thesis403a EditedDocument3 pagesThesis403a EditedClarisse PoliciosNo ratings yet

- Thesis VariablesDocument1 pageThesis VariablesClarisse PoliciosNo ratings yet

- Thesis - The Research ParadigmDocument1 pageThesis - The Research ParadigmClarisse PoliciosNo ratings yet

- #5Document1 page#5Clarisse PoliciosNo ratings yet

- Reference 1Document2 pagesReference 1Clarisse PoliciosNo ratings yet

- Costs.: Course On Managerial EconomicsDocument2 pagesCosts.: Course On Managerial EconomicsClarisse PoliciosNo ratings yet

- Hello Ivan. Here Are Some of Our Ideas.Document1 pageHello Ivan. Here Are Some of Our Ideas.Clarisse PoliciosNo ratings yet

- For ConsultationDocument11 pagesFor ConsultationClarisse PoliciosNo ratings yet

- SyllabusDocument3 pagesSyllabusClarisse PoliciosNo ratings yet

- 404A - Balanced Scorecard BasicsDocument5 pages404A - Balanced Scorecard BasicsClarisse PoliciosNo ratings yet

- IAP Feasibility Study Outline Proposal Template Ver1.0Document12 pagesIAP Feasibility Study Outline Proposal Template Ver1.0JD MoralesNo ratings yet

- LCCM Feasibility Study Business Plan GuideDocument37 pagesLCCM Feasibility Study Business Plan GuideRadu Dimana82% (11)

- Abs CB NNNNNNDocument8 pagesAbs CB NNNNNNClarisse PoliciosNo ratings yet

- Junior Philippine Institute of Accountants School of Accountancy and Business Management Saint Louis UniversityDocument1 pageJunior Philippine Institute of Accountants School of Accountancy and Business Management Saint Louis UniversityClarisse PoliciosNo ratings yet

- Introduction AddDocument1 pageIntroduction AddClarisse PoliciosNo ratings yet

- RRL HighlightsDocument2 pagesRRL HighlightsClarisse PoliciosNo ratings yet

- Liquidity Ratios: Current RatioDocument7 pagesLiquidity Ratios: Current RatioClarisse PoliciosNo ratings yet

- MAS - 22806765-0505-MAS-PreweekDocument32 pagesMAS - 22806765-0505-MAS-PreweekClarisse PoliciosNo ratings yet

- Ratios - GmaDocument4 pagesRatios - GmaClarisse Policios100% (2)

- Tally Sheet 1Document4 pagesTally Sheet 1Clarisse PoliciosNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)