Professional Documents

Culture Documents

2010KochFiling PDF

2010KochFiling PDF

Uploaded by

Vancouver_Observer0 ratings0% found this document useful (0 votes)

10 views42 pagesOriginal Title

2010KochFiling (1).pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views42 pages2010KochFiling PDF

2010KochFiling PDF

Uploaded by

Vancouver_ObserverCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 42

file GRAPHIC print DO NOT PROCESS [As Filed Data — | DLN: 93491319013451,

Return of Private Foundation pene ss4s-0082

= 990-PF or Sectin 4947(a)(1) Nonexempt Charitable Trust

2 2010

‘Treated as a Private Foundation

coro Note, The foundaton may be able Hea copy ofthe rtm to say state reporting raters

Ina en Sere

For calendar year 2010, or tax year beginning 01-01-2010 _, and ending 12-31-2010

check ai hat apply Peintalretuin (intl return ofa former public chanty 1 Final return

Foamended return address change [Name change

Tame Rae SF Engrave BaTTRERTON Er

a aR TF Be TT TTS PA TTT Hn BHT | OTTERS 3 Teetovenonber G28 page 10 fhe macs)

ee (316) 828-8286

“capri a aT rcpt aptcaton pein, ct te

peceeecai eeeeeee: D 4, Foren organizations, check here r

icheck typ ofergoneaton F Sechon 603(eK3)ayernt prvete foundation 2: Forgnomnaatone mesing te 85% te,

[section 49470a}4) nonexempt chantabie trust [Other tanable prvate foundation techs ai cpaton

FFow market value ofall assets at end | JAccountng method T cash P Accruat | © gmat foudaton sane wasemmatcd |p

cfyear trom pri, cl (0) Totnes cepecit) neces es

ine toe$. 242,332,070 (tare 1 column fd} mst bean cash bast) 3 oan mc tematon

ESWEY Analysis of Revenue and Expenses (7 | qyncincane (@) anaes

iorbnesn cares fant ay me copevanvgand | eet nvesment | ceyadused nat | “rere

seein nan San (a pe 1 of =o ‘some ene a

Donat (omteenean)

7 Conon gs grt ecw tech ao) Ta

2 check [fhe fonfaton mot eco to aach eh 8

3 Interest on savings and temporary cash investments re aie

4 Dividends and interest tom securities... «| za Ta

Nat ntl income or (oss)

g| fami or dont tom sate faene ot on ine 20 zeae

B |b cis ne pres ran ants on ne na4ss207

5

$ | 7 cantatgainnet income (roman iv,tne2) «+ + Te

© | gs Netshort-term capital gain.

9 Income mosihentions

Lose Cost of goods sold

€ Gross profit o (loss) (attach schedule)

11 Other ncome otach schedule). ss. «aR Tama

13 Compensation of ofcers, director, tuvteos ate 7

|, [14 Oteremplayee salanes andwages we we aaa cor

$ Jas rension plans, employee tenets ss os. 767 e757

& ase Lesat toes cxtacn senesuey. ‘s Ta z J Tare

E |e accounting eos (attach schedule). {s 7 Ex J B80

2 ¢ Other professional fees (attach schedule) (s 989,305] 34,650, ‘937,442

B liz tmerest i

& | 18 towescarach cate) epg ioe wstcton) PD Er 7 mae

E 29° oenrecation (attach schedule) and cepievon «|S En

E20 occupancy oe ee eran wraai

[2 travel, conferences, and meetings. ss ss a7 S73

E faz prntimgand publications». vv ee wan man

E |23 omer expenses (attach schedule) s ae i74

3 24 total operating and adminletrative expences

R | addunes a3 throush 23 saaaarl nas of _r60a9

© los contributions, ois, grants paid. 2 we we 10,123,369] 111,096,508

26 _ Total ecendes and daburserents, Aid nes 24 and 25 ‘masa aa of isaeoar

27 Subtract ine 26 fom ine 22

2 Excuse of revenue over expenses and debursements sas.

Not investment income (fnepatve, ater -0-) ToT

€_ Adjusted net income negative enter -0-)

For Privacy Act and Paperwork Reduction Act Notice, sce page 30 of the instructions. Cat Wo 11209% Form 990-PF (2010)

Form 990-PF (2010)

Page 2

TENIEE] batance sheets Sis rent of yearammuis ony (sce manitone) | —fa) Bk ae | To) Bak Wael Par Raa

cat rene ee va Taal Tras

Savings and temporary cosh investments os. ss EEE Tae Tar

Accounts recevabla Das

Less allomance for doubitul accounts P aura nasal nas

4 Pledges recenvable

Less allowance for doubtful accounts

une

Recenvablas dus from ofters, directors, ruses, and other

dsqualiied persons (attach schedule) (seepage 35 ofthe

7 Other notes and loans recenable (attach schedule)

sg | tase allowance for doubetl accounts P

3] 9 prepeidexpenses and deferedcharpes |. sss sss saa waa wat

0a Investments—U 5 and state government obligations (attach schedule)

bb Investinante—corporate stock attach schedule)

€ Investments—corporate bonds (attachschedule). . ss

11 Investments—Iang,buldings, ang equipment baste 9.37684

Less accumulated depreciation (atch schedule) Pe aarsad sare 6,590,000

i anne cmeden ans eae

13 Investments—other(attach schedule) oss se aaah area aa

14 Land, buldings, and equipment basis iniso

Less accumulated depreciation attach schedule) Pe 682.038 s22s02rf) 01a 10504

15. Other assets (describe >

16 Total assets (obe completed by al fiers—s08 the

instructions Also, see page 1, tama) 202,205,234 2gasr aenanaaro

27 Accounts payable ang accrued expenses yy sv sana 23337

i done ee Tarr Tose

a

B20. Loans trom oticers, rectors, trustees, and other desquaited persone

B| a1 mortgages and other notes payable (attach sched)...

F]22 other liabiities (descnbe ® )

23 Total abilities (add nes 17 throwgh 22). ss sss sar 3.064 a

Foundations that follow SEAS 147, check ere PF

_,| and complete nes 24 though 26 and ines 30 and 3.

Ss en

Blas rermanceniyrestnetsd ee wipe EE

| Foundation that donot follow SFAS 337, check here Pe [-

| snctcomplete tines 27 hrowoh 28.

[27 contal stock, tart principal orcurant funds «6s ea we

2] 28 Peidn orcapitel surplus or an, bldg, and equpment tnd

2/0 Total not assets or fund balances (seepage 17 ofthe

oe sore. auizaug

2

34 Total iblities and nt sasts/fund balances (see p49® 17 of

[ETEEEE Anatysis of changes in Net Assets or Fund Balances

7 __ Total not easels or hind balances at beuianing OFFeAT=Fare TT, colina a) he 30 must Bares

wth end-ofyear figure reported on pnoryears ren) we ee ee ee La 197,947,702

2 uoieiee 23,045,144

3 Othersmcreases not ncluded i ne 2 (itemize) 3

5 Decreases not included i ine 2 (itemize) 5

6 ___Totalnet assets of fund balances at end of year (ne 4 minus ine S)—Pan i column (Wine 20. | 6 Bai7o2e46

Form 990-PF (2010)

Form 990-PF (2010)

Capital Gains and Losses for Tax on Investment Income

Page 3

(a) List and describe the kind(s) of property sold (e g real estate,

2estory orick warshouse, or common stock, 200 sh MLC Co )

[by How acquvred|

P—Purchase

Ke)

Date acqured| (4) Date sold

imo yay yr) | (mo, éay. yr)

Ta EATON VANCE LOAN OPPORTUNITIES FUND

b__ ABSOLUTE RETURN CREDIT PORTFOLIO

sienan tanta (1) Depreciation allowed (@) Cost or other basis (hy Gain or (oss)

el Sitena (orallowable) plus expense of sale (e) plus (f) minus (9)

© 2,008,195| 1,822,979] 105,225

a

‘Complete only for sasets showing goin in column (h) and owned by the foundation

en 2/31/69

() Gains (Col (hy gain manus

@) Aaqusted basis (ho Excess of col (0) col {k), Bus not lars than -0-) or

(PMV 9s 0f12/31/69 Dnata tes Seer titrees Losses (trom col (h))

= 1,369,017

. 2,936,395

Ti gain, also enterin Part ne 7

2 Capital gnin net income of (net capital loss) Illes) enter-O-imParisiine 7 F | ate

3 Net short-term capital gain or (loss) a8 defined in sections 1222(5) and (6)

Xe gam, algo enter Part ne 6 column () (S88 pages 13 and 17 ofthe mstrctons)

(loss), enter -0- ta Parti, line 8 feces eed :

Qualification Under Section 4940(e) for Reduced Tax on Net Investment Income

(For optional use by domestic private foundations subyect to the section 4940(e) tax on net investment income )

1 section 4940(4)(2) applies, leave this part blank

Was the foundation able forthe section 4942 tax on the distributable amount of any yearsn the base period? Tver F no

ives,

the foundation does not qualify under section 4940(e

Do not complete ths part

{Enter the appropriate amount in each column for each year, see page 16 of the instructions before making any entries

se pono Yrs Calendar 2 9, Dutredion ato

repemot year Calendar| pdusted qualinng dstnbutons | Net vale of nondurable use asets inert

2003 15551962 Tes a41798 0 176036

72007 10,080,287 327,673,989 0078953

Total of line 1, column (d). lea 0 500738

Average distribution rato for the 5-year base pertod—divide the total on line 2 by 5, oF by

the number of years the foundation has been m existence ifless than 5 years * La 0.100148

4 Enterthe net value of noncharitable-use assets for 2010 from Part X, line S- 4 203,468,683

6 Entera% of net investment income (18 of Part, line 278). ‘ 101,657

8 Enter qualifying distributions fom Part XII, line 4. a

Iftine 1s equal to or areater than line 7, check the box in Part VI, line 1b, and complete that part using @ its fax rate See

the Part Vi'meteuctions on page 28

Form 990-PF (2010)

Form 990-PF (2010)

Excise Tax Based on Tavestment Income (Section 4940(a), 4940(b), 4940(e), 0

Page 4

(946—see page 18 of the instructions)

1a. Exonp opratgfoufatons deed scion #4082), ck ve [= and nts WA one 1

Date of ung or determination etter (attach copy of letter if necessary-s0e

iratrctions)

bb Domestic foundations that mest the section 4940(e) requirements m Part V, cheek a 203,15

ipa ety

«Matter donedetandotns eater 2% of te 278 Erempt oem ngpnaatons ete 4S of a, ne 12, ()

22a under secon S11 (mest secon 4547()(0 tts an taablefounfations only ters ene 0-) 2

Skits poss

44 Stub Awe) tox (damese sen 4479) 5) stand aad oun ny Ole eer 0) 2

5 Tactnsed on Investment Income, Subtract ine 4 fom ine 3 Ifzereortess,enter-0-. . . . . [s possi

© Creits/Payments

‘2 2010 estimated tax payments and 2009 overpayment credited to 2010 | 6a 203,149]

bb Exempt foreign orgentations—tax wthheld atsource. . . «eb

€ Tax paid with aplication for extension of time to fle (Form 8868) f p09

Backup withholding eroneousty withheld... ee = Dee

7 Total ccedits and payments Add lines Ga through6d. . 6 ew ee 240,249

28 Enter any penalty for underpayment of estimated tex Check here [- Form 2220 is attached

2 Tax due. Ifthe total oflines Sand 8 1s more than ine 7, enteramounk owed... = 2

10° Overpayment. Ifline 7 = more than the total oflines 5 and. enter the amount overpaid... ® | a0 wae

11. Enlerthe amount te 1010 be Credited to 2041 estate tx 420 | Refunded [an

Statements Regarding Activities

1m Dung the tex year, did the foundation attempt to nfuence any national, state, or local egslation or id Yes [ne

se participate or intervene i any poltical campaign? ee Ne

bb Didi spend more than $400 during the year (either directly or indirectly) for polticl purposes (eee page 19 of

CS No

1 te answers "Yes" to 4a or Sb, attach adetaled descnption ofthe activites and copes of any materials

publiehad or distributed bythe foundation in connection with the activites

€ Did the foundation fle Form 1420-POLfoFRhiE YER? eve ee ae x No

4. Enter the amount (fany) of tax on political expenditures (section 4955) mposed during the year

(2) onthe foundation § (2) on foundation managers $

Enter the raimbursement any) por by the foundation during the year for paliicl expenditure tax mpesed

an foundation managers $

2 Has the foundation engaged n any activities that have not previously been reportedtoterns? 2... | 2 No

1 "¥ee,etach adele deserptien ofthe activites

3 Has the foundation made any changes, not previously reported tothe IRS, nt governing instrument articles

af mcorporation, or bylaws, or other similar instruments? If Ye,“attach a conformed copy af thechanges . . | 3 No

48 Did the foundation nave unrelated business gross mcome of $1,000 or mare during the yeer?. .. . . s+ [ae No

bU-Yes,"has iad a tax retutn on Form 990-TIOFEHE YER? ev ee [Law

5 Was there a hquidaton termination, diesolution, or substantia contraction dunmg the year? ss . US Ne

1 ¥05,“atach the statement requires by General Instruction T

6 Arethe requirements of section 508(¢) (relating to sections 4941 through 4945) satisfied ether

"by language the governing instrument, or

‘© by state legelation that effectively amends the governing instrument 20 that no mandatory directions

that confi wth the state law remain nthe governing natument? ve vee

7 teounaton hve at as 4,00 aets at any tne ct the yen? 1"e5 compe Pa co (©), nd Fa 7 Yer

‘8 Enter the states to which the foundation reports or mth which i= repistered (eee page 19 ofthe

instructions) POC. KS. vA

General (or designate of each state ar required by General Instruction G? If°No,"atach explanation » | vee

21s the foundation claiming status as 2 private operating foundation within the meaning of section 49420X3)

oF 4942(N5) for calendar year 2010 of the taxable year begining in 2030 (eae instructions for Part XIV on

einen ee No

40 01 any pesos acme ietanal otbrs ngthek en? I "es" atch a cc tg ther nas nd see 10 Ne

Form 990-PF (2010)

Form 990-PF (2010) Page S

EAMETON Statements Regarding Activities (continued)

41 Atany time during the year, dié the foundation, directly or indirectly, own & controlled entity within the

‘meaning of section 522(b)(13)? IF Yes.” attach schedule (see page 20 ofthe instructions). ss + + an

12. id the foundation acquire a director inauract interest n any applicable insurance contract before August 17, 2008? | 42

431d the foundation comply with the publi inspection requirements for ite annual returns and exemption application? | 43 | ves:

Website address PYNIW CGKFOUNDATION ORG

3\3

44. The books are in care of PHEATHER LOVE Telephone no (316) 828-8286

Located at sill €S7THST WICHITA KS. z1P-44 67220

45 Section 4947(a)(1) nonexempt chantable trusts fling Form 990-PF mn leu of Form 4081 —Check heres. ee

and enter the amount of tax-exempt interest received or accrued dung the year... 2. [a5

a bank, sacunties, or otherfinancial account ima foreign country. ss ve ee ee ee ee + LOO Ne

See page 20 ofthe instructions for exceptions and fling requirements for Form TD F 90-22 1 If*¥es*, enterthe

ame ofthe foreign country

‘Statements Regarding Activities for Which Form 4720 May Be Required

File Form 4720 if any item is checked in the “Yes” column, unless an exception appl Yes | no

‘Un During the year did the foundation (ether directly or indirectly)

(4) Engage inthe sale of exchange, of leasing of property with # disqualified person? P ves F Wo

(2) Borrow money from, lend money to, or otherwise extend credit to (or accept i from)

icdisquniined parsensic gets cae as eer eege ete egg faves pena

(3) Furnish goods, services, or faciities to (or accept them from) a disqualified person? F ves F No

(4) Pay compensation to, or pay or reimburse the expenses of disqualified person? F ves T Wo

(5) Transfer any income or assets to a disqualified person (or make any of either available

for the benefit or use ofa disqualiied person)? P ves F no

(6) Agree to pay money or property toa government official? (Exception. Check "No"

ifthe foundation agreed to make a grant to orto employ the ofteial for @ period

after termination of government service, terminating within 90 days ). P ver F No

bb Ifany answer's "Yes"to 1a(1)-(6), did any ofthe acts fal to qualify under the exceptions described in Regulations

section 53 4941(d)-3 oF ma curcent notice regarding disaster assistance (see page 20 of the instructions)’. - | 3b Ne

Organszations relying on @ current notice regarding disaster assistance check heres 2 ee 2 2

Did the foundation engage ina prior year im any ofthe acts described in 13, other than excepted acts,

that were not corrected before the frst day ofthe tax year beginning in2010%, . se ee ee ee | te Ne

2 Toxes on failure to distribute income (section 4942) (does not apply for years the foundation was a private

‘operating foundation defined in section 4942()(3) 49425)

> Atthe and oftax year 2010, did the foundation have any undistributed income (ines 66

and 6e, Part XI11)fortax year(s) beginning before 20107, 2... ee ee ee ve No

1e-Yes,"ust the years B20, 20__, 20__, 20__

1b Are there any years listed in 2a for which the foundation '= not applying the provisions of saction 49-42(a)(2)

(relating to incorrect valuation of assets) to the year's undistributed income? (If applying section 4942(a)(2)

te all years listed, answer "Wo" and attach statement—see page 20 ofthe instructions}. 2 ee es 2b

€ Ifthe provisions of section 4942(a)(2) are being applied to any of the years listed m 2a, ist the years here

» 20, 20, 20__, 20__

‘38 Did the foundation hold more than & 2% director indirect interest in any business

lanterprize at any time during the year? Tver F no

bb 1F7Ves," id have excess business holdings in 2010 as a result of (4) any purchase by the foundation

or aisqualiies persons after May 26, 1969, (2) the lapse of the 5-year period (or longer period approved

by the Commissioner under section 4943(C)(7)) te dispose of holdings acquired by ait or bequest, or (3)

the lapse ofthe 20-, 15-, or 20-year first phase holding period? (Use Schedule C, Ferm 4720, to determine

1 the foundation had excess business holdings 2010). 2 2 2 eee ee ee ee ee | Bh

Did the foundation make any investment n a prior year (but after December 31, 1969) that could jeopardize its

chantable purpose that had not been removed from jeopardy before the fist day ofthe tax year beginning in 20107_| 4b Ne

Form 990-PF (2010)

Form 990-PF (2010) Page 6

EAMEGIEY statements Regarding Activities for Which Form 4720 May Be Required (continued)

‘Se During the year di the foundation pay or meur any amount to

(2) Carry on propaganda, or otherwise attempt to influence legislation (Section 4945(6))? T ves F No

(2) Influence the outcome of any specific public election (see section 4955), orto carry

fon, directly or indirectly, any voter registration dnve?. 2 ee we ee ee Pen Fite

{3) Provide a grant to an individual for travel, study, or other simular purposes? Tver F No

(4) Provide a grant to an organization other than a chantable, etc, organization descnbed

sn section $09(a)(L), (2), oF (3), oF section 4940(4)(2)? (see page 22 ofthe instructions)... FF Yes [No

(5) Provide for any purpose other then religious, charitable, scientific, hterary, or

‘aducational purposes, or for the prevention of erelty to children or animals... ss» 7 Yes FNo

bb atany answers "Yes" to 5a(1)-(5), did any ofthe transactions fal to qualify under the exceptions described in

Regulations section 53 4945 orina current notice regarding disaster sssistence (see page 22 of the instructions)? No

Organizations relying on a current notice regarding disaster assistance check heres ©. es + ee

€ Ifthe answers "Yes" to question 5a(4), does the foundation claim exemption fom the

tox because it maintained expenditure responsibilty for the grant? F ves F no

1F "Yes," attach the statement required by Regulations section 53.4945-5(d)

{62 Did the foundation, dung the year, receve any funds, directly or mairacty, to pay

premiums ona personal benaht contract?. so ee te ee ee Piven No

LF Yes" t0 6, ile Form 8870.

7a ‘Atany time during the tax year, was the foundation a party toa prohibited tax shelter transaction? [7 ¥es FF No

Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees,

and Contractors.

1_List all officers, directors, trustees, Foundation managers and their compensation (see page 22 of the instructions).

(b) Tite, and average | (c) Compensation | (#) Contributions to

(a) Name and address hours perweek | Gf not patd, enter | employee benefit plans

devoted to position o) and deferred compeneation

(e) Expense account

other allowances

‘See Additional ate Table

Th none, ent

nal five highest-paid amployecs (other than these lncluded online dase page 23 of the structions),

NONE.”

(@) Contnbutions to

(b) Title, and average ea

houte per weak | (e) Compensation

devoted to position

(a) Name and aadress of each employee

paid more than $50,000

enent | (e) Expense account,

plans and deterrea | "other allowances

LoGaN MooRE Jor oF OPERATIONS 765,009] 3430} Taso

ARLINGTON,VA 22201

RYAN STOWERS paw bin nicHER 155,009] 3,683] Ferry

ARLINGTON,VA 22201 foo

ARIANNE MASSEY paw birector 137,509] Banal aae0

ARLINGTON,VA 22201 roo

CHRIS CARDIFF paw oFF- mem 730,009] 3,683] Ferry

ARLINGTON,VA 22201

DAN JORIANL par orricer 327,045] 3876 Ferry

ARLINGTON,VA 22201 roo

‘Total number af other employees paid over $50,000... 7 a5

Form 990-PF (2010)

Form 990-PF (2010) Page 7

ee =—™———seE=™

3 Five highest-paid independent contractors for professional services (see page 23 of the instructions). If none, enter "NONE.

(@) Name and address of each person paid more than $50,000 (b) Type of service (© Compensation

‘Total number of others receiving over $50,000 for professional serces.

EEGEEZN summary of Direct Charitable Activities

2KOCH INTERNSHIP PROGRAM SEE GENERAL EXPLANATION ATTACHMENT 641,323

3

4

[RISSEEY Summary of Program-Related Investments (see page 24 of te nstuchons

este theo gest ptaobe-vestras mae bythe unstn Gmg he s yen Ones a? room

Allether program related investments See page 24 ofthe instroctions

Tot

Agsines i ehrough3. ee °

Form 990-PF (2010)

Form 990-PF (2010)

EEITET. Minimum Investment Return (All domestic foundations must complete ths part. Foreign foundations,

See page 24 of the instructions.)

1 Fairmarket value of assets not used (or held or ure) Arey in caring Ov Chania, we

urposes

a Average monty irmarket value ofsecunties se ee ee ee Lae 107,911,700

i nee ane ie 92225411

€. Favrmarket value ofall other ansats (20e page 24 ofthe nettustons). we ee ee eee Dae 530,000

4. Total (add lines 38,8, and) 7 306,567,191

@Recucton cine forblockaps or athe factors reported on lines 1 and

Le attach eetaled explanation we ee ee ees Lt

Acquisition indebtedness applicable to ne 4 assets. °

Subtract ine 2fromine 6. ve ee ee ee ee ee ee ee D8 200 567.191

Cath deere held forchantableacthities Enter: 3/2% of line 3 (for areter amount, 288 page 25

eee ee a 3,090,508

5 Wet value of nonchartabla-ise asete. Suiract ine 4 from hne 3 Ener here and on Part V, line 4 5 203,460,603

i raeeee aioe eae er nie ne ef 10,173,434

fa Distributable Amount (see page 25 of the instructions) (Section 4942(})(3) and (j)(5) private operating

foundations and certain foreign organizations check here b I and do nat complete this part.)

fein etme airs eos Pan olen ees eae |r iearsasa

1 Income ta for 2010 (This does not nce the tax fom Part VE) 3b

€ Add ines 29 and 26. x 203,315

3 strbutable amount before asjustments Subtract ine 2e fom line 3 397038

5 Ads ines 3 and 5 sa7ai8

6 Deduction rom sstabutabe amount (eee page 25 ofthe instruction). <

7 Distibutable amount as asjsted Subtract ine 6 fom line 5 Enter here and on Part XIE,

Wek ee? aa70.39

TERETE quatitying Distributions (see page 25 of the structions)

1 Amounts pai (neluding administrative expenses] to accomplish chavtale, we | pupORee

Expenses, contnbutions, gis, ee ~totl fom Part I, column (é)ime26. 0 ee ee ee Lam 18,260977,

Programrelated nvestmentstotelfOmPAR KBs sv ee ee ee ee [ c

2. Amounts pid to acqure assets used (or held or use) decty in carymng out chartebe ste,

ee 40287

3) Amounts et aside forspeciicchantable projects thot sais the

Suttabity test pnor RS approval require. a °

Cash disnbution test (attach therequred schedule). se Lb 0

Qualifying dstibutions, Ad ines 18 though 3b Enter here and on Par, line 8, nd Part xt, ne & [a Tasonaee

Foundations that qualdy under section 4940(¢) forthe reduced rate of taxon nt vestinent

income Enter 1% of Part line 278 (ane page 26 ofthe nstructonsle wv we eee LS

6 Adjusted quaitying dintibtions.Subtrctine Sfomine Av we ee D8 Tas0r ae

the section 4940(e) reduction of tax in those years

he amount online 6 wll be used in Part V, column (b), in subsequent years when calculating whether the foundation qualifies for

Form 990-PF (2010)

Form 990-PF (2010)

Undistributed Income (see page 26 of the mnstructons)

Page 9

Distributable amount for 2020 from Part XI, line 7

Undistnbuted income, fany, as of the end of 2010

Enter amount for 2009 only.» 2 s+

Totalfor prior years 2008, 2007, 2006

Excess distributions carryover, fany, to 2020

@

corpus

)

Hears priorte 2009

©

2009

@

2010

From 2006... ss EXIERE

pam soo7sec ete 3:79.53

From2008. 1. ss T9257

Total oflines 3a throughe. . se ee

Qualifying distributions for 2010 trom Part

XII, ines $ 18,501,264

‘Applied to 2008, but not more than line 22

Applied to undistributed income of prior years

(Election required see page 26 af the instructions)

Treated 2¢ distributions out of corpus (Election

raquired~see page 26 ofthe imstructions). = «

Remaining amount distnbuted out of corpus

Excess aistributions carryover applied to 2010

(fan amaunt spears in column (4), the

‘Same amount must be shown in column (3))

Enter the net total of each column as

indicated below:

Corpus Add lines 34, 4c, and 4e Subtract line 5

Prior years" undistnbutes income Subtract

line 4bftomline2B eon rie ee ee eo

income for which a notice of deficiency has

Been issued, oron which the section 4842(a)

tax has been previously assessed. ss

amount—see page 27 ofthe instructions «+

Undistributed income for 2009 Subtract hme

4a from line 22 Taxable amount~eee page 27

Oftheinstructons ss ss ee ee so

Undistnbuted income for 2020 Subtract

lines 4d and 5 fromline 1 This amount must

peistrbuted in 2010+ vv ve st

Amounts traated as distributions out of

Section 170(b}(1)(F) or 4942(9)(3) (see page 27

ofthe instructions)

Excess distributions carryover from 2005 not

applied online 5 or line 7 (see page 27 of the

mmstructions)s eet eee ee

Excess distributions carryover to 2011.

Subtract ines 7 and 8fomine 6...

Analysis oftine 9

Excess from 2007.» 3.779.605

Excess from2009. » Tiss

Excess from2010._ | 3931.15

Form 990-PF (2010)

Form 990-PF (2010) Page 10

EETESVM Private Operating Foundations (see page 27 of the instructions and Part VII-A, question 9)

4a Ifthe foundation has received ruling er determination letter that ie a private operating

foundation, ana the ruling is effective for 2010, enter the date ofthe ruling. = + = +

1b Check box to indicate whether the organization is a private operating foundation described in section | _4942((3) or F 49425)

2a Enter the lesser of the adjusted net Tex veer Por 3 years

income from Part Lor the minimum (e) Tota

eee (@)2010 (2008 (©2008, (2007

yearistede ee ee tet

A

© Qualifring distributions from Part XIE,

line 4 foreach yearlisted.

{Gracive conductor exempt aces

© Qualiying distributions made directly

for active conduct of exempt activities

3 Complete 3a, , orc forthe

‘alternative test relied upon

8 “Aesete” alternative tert—enter

(2) Value ofaitassets. 2.

@) Value of aszete qualifying

Under section 49420)(3KB)6)

‘of minimum investment return shown in

“Support” alternative test—enter

(2) Total support other than gross

investment income (interest,

dividends, rents, payments

fon secunties loans (eection

512(a)(5)) orroyalties). =.

(2) Support trom general pubic

and 5 or more exempt

forgamzations as provided in

Section 4942()(3](8)(H)- = +

(2) Largest amount of support

fom an exempt organization

(8) Gross investment income

EM] Supplementary Information (Complete this part only if the organization had $5,000 or more in

assets at any time during the year—see page 27 of the instructions.)

1 Taformation Regarding Foundation Managers:

‘8 List any managers ofthe foundation who have contributed more than 2% ofthe total contributions received by the foundation

Before the close of ny tax year (but only ifthey have contnbuted more than $5,000) (See section 807 (3)(2) )

List any managers ofthe foundation who own 10% or more ofthe stock of corporation (or an equally large portion of he

fonnership of @ partnership or other entity) of which the foundation has 2 10% oF greater interest

2 Information Regarding Contribution, Grant, Git, Loan, Scholarship, ete, Programs:

‘Check here BT ifthe foundation only makes contributions to preselected charitable organizations and does not accept

Unsolicited requests for funds Ifthe foundation makes giRs, grants, ete (see page 26 of the instructions) to individuals oF organvzations

Under other conditions, complete tems 29,8, ¢) an &

1 The name, addres, and telephone number ofthe person to whom applications shouldbe addressed

SSisw countHouse noab SUITE 200

(oaye7ss600

ORGANIZATIONS SEEKING GRANTS FROM THE FOUNDATION ANO WHICH MEET THE CRITERIA LISTED IN ATTACHMENT 14

Eteanur AnD sUCcINCTLY STATE 1 PROSPECTIVE GRANTEE’ MISSION AND GOALS, SPECIFIC PROJECT FOR WHICH

EMAit aboness oF Tie paittanr CONTACT PERSON, AND, 5 CURRENT ANNUAL BUDGET ORAUDITEO FINANCIAL.

GonraisurioNs) secuneD fon THe PROJECT BECAUSE THE FOUNDATION GENERALLY ONLT SUPPORTS SECTION 503(¢)

exener Faomepenauince meranas in SECTION SOLICKO) ORGANIZATION AND IS CLASSIFIED ASA PUBLIC.

© Any submission deadlines: =

@ Any restrictions or imitations on awards, such as by geographical areas, charitable falds, kinds of institutions, or other

THE FOUNDATION PRIMARILY SUPPORTS RESEARCH AND EDUCATION PROGRAMS THAT ANALYZE THE IMPACT OF FREE

EhARLES G| KOCH CHARITAGLE FOUNDATION FOSTERS THE PARTNERSHIP OF SCIENTISTS AND PRACTITIONERS iN

Toots twat ENABLE INDIVIDUALS, INSTITUTIONS AND SOCIETIES TO FROSPCR THE CHARLES G KOCH CHARITABLE

Positive SOCIAL CHANGE THe FOUNDATION ENCOURAGES ORGANIZATIONS SEEKING SUPPORT TO FIRGT FAMILIARIZE

Foumoution munca sevenac ineiTa Tons ON THE REGUEETSIT CONGTOENE The FoUNOATION PRIWARILY MAKES

Form 990-PF (2010)

Form 990-PF (2010) Page 14

Supplementary Information (continued)

3 Grants and Contributions Paid During the Year or Approved for Future Payment

‘howany reatonshipte. | FeUm¢#29 | pursoey of grantor Amoune

See Adetonal Dafa ble

© Roprved for faare payment

See Adéivonal Date Toba

Total > FRSCR

Form 990-PF (2010)

Form 990-PF (2010)

Z

‘Analysis of Income-Producing Activities

Page 42

- lRelated or exempt

ia a 5 wm | heten income

1 Program service lurness code] armunt | exctuson code | amount _ | (Ste 9838 28 of

.

4

2 mrt on sera and emp cnh vein w ra

4 Dividends and interest rom secures. Ta

1 Debt tmances prover.

Bit dabtsnanced property. :

6 trea cone of) om pon my

8 arr (oo sso at tran vey i E08

9 Wet income or (oes) om special evente

40 Gross pratt o ons) Hom sales of avenory.

11 Otherraverue

.

4

42 Sibiotal Add columns (8), and) Waa

13 Total. Ads line 12, columns (6), (8), and (e)

(See worksheet in line 13 instructions on page 28 to vent)

EI_Relationship of Activities to the Accomplishment of Exempt Purposes.

Explain below now each activity for which income is reported n column (e) of Part XVI-A contributed importantly

the accomplishment of the organization's exempt purposes (other then by providing funds for such purposes) {See

Line No.

page 28 ofthe structions }

mETY

T2577

Form 990-PF (2010)

Form 990-PF (2010) Page 43,

EAMES Information Regarding Transfers To and Transactions and Relationships With

Noncharitable Exempt Organizations

7 Da the oanaaton duet ordre engoge many ofthe fling wil’ any Oe omanaaton SesrBed Secon je | No

S01) ofthe Coe (other tan secon 5063) ogenzatons i section 527 celingto pltealorgencatons?

CO ee ee ee lI

(2) omersssets. ee ee faet@yl me

b other transactions

(A) Sales ofassets to 8 nonchantable exempt organization, © ee ve ee ee ee ee es fae] | no

(2) Purchases of assets fom a nonchantable exampt organization, ©. ee we ee ew ee fameayl | ne

2) Rental offacities, equipment, or otherassets. 6 we eee faogay] [ne

(4) Rembursement arrangements se ee ee ee faoe@nl ne

(6) connalocienn puncammuegs 0 ees ali

(6) Performance of services or membership or fundraising solettations. ss se ee ew ee we + [aot] [no

€ Sharing offacities, equipment, mailing lists, other assets, orpaidemployees. © ev ve ee ee ee ee Lae No

4 Ifthe answer to any ofthe above i= “Yes,” complete the following schedule Column (b) should always show the fir market value

af the goods, other easels, or services given by the reporting foundation Ifthe foundation received less tha fair market value

Im any transaction or sharing arrangement, show n column (a) the value ofthe goods, other assets, or services received

(2) ne No | (@) Amount ved _| (6) Name of norsartable exempt omancaton |__(4) Descrpton of andes, tareactog an sharngarangerents

Gas the foundation dvactly or indirectly afiiated wih, or elated to one or mare teivexempt organisations

descnbed in section $04(c) of the Code (other than section 501(c)(3)) or in section 5277... . . . . . . . Yes Mo

b 1f-Yes," complete the folowing schedule

() Name of oenaaton Ley rpe otoanaaton () desapton of etwas

Under penalties of penuy, I declare that I have examined this return, including accompanying schedules and statements, and to

the best of my knowledge ang belie, it's true, correct, and complete Declaration of preparer (other than taxpayer or guclay) is

based on all information of which preparer has any knowledge

2 Date PrN

3 Check ifs

= brosares b MITCHELL CADDELL emotovea eT

S | 9, |Siansture

2 |_t2

@ |ZESlrmwsname + BKD LLP Foom's EIN

iy

74 S55E W WATERFRONT PRY STE 300

waren > WICHITA, KS 672066601 Phone no (316) 265-2614

Form 990-PF (2010)

[efie GRAPHIC print DO NOT PROCESS [As Filed bata] Dun osaoraroorsast

Schedule B Schedule of Contributors | Sue 18-0047

(Form 990, 990-2,

Seven) > tach Form 980, 990-2, oF 990-F. 2010

Name of organization ‘Employer Identification number

49-0910408

‘Organization type (check one)

Filers of: Section:

Form990 or 990-€2 T sone) (enter nunber) organzaton

T 4947(a)(1) nonexerpt chartable rust not veated as a private foundation

T 527 poltval organzation

Form990-FF F 501(c)(3) exempt private foundaton

4947(a)(1) nonexempt chartable trust reated as a prvate foundation

501(¢\3) taxable private foundation

‘Check f your organzation covered by the General Rule or a Special Rule

Note. Only @ section 501(¢)7), (8), oF (10) organzaton can check boxes for both the General Rule and @ Special Rule See instructons

General Rule—

F For an organzaton ting Form 90, $90-£2, or 990-FF that recewed, dusing the year, $5,000 or more (In money or

property) fromany one contributor Complete Parts land I

Special Rules

For 8 section 501(c)(3) organzzation fling Form 60 or 990-E2, that met the 335% support test ofthe regulations

Under sections 509(a}(1) and 170(b)(7\A)(u), and received fromany one contrButer, dung the year, a contibuton of the

greater of (1) $5,000 or (2) 2% of the amount on 1) Form380, Part Vil, ine Th, or) Form8G0-Ez, ine 1 Complete Parts land

F Fora secton 601(¢)(7), (8), oF (10) organzaton fing Form 990, or 960-62, that recenved fromany one contrbutor,

dunng the year, aggregate contnbutons of more than $1,000 for use exclusively for relgious, chartabl

sctentfc, iterary, or educational purposes, or the prevention of cruety to chidren or animals Complete Parts |, and

0

Fora section 501(c)(7), (8), oF (10) organzaton filng Form 980, or 960-€2, that recerved fromany one contributor,

dung the year, contrbutons for use exclusively tor relgous, chartable, etc , purposes, but these contributons did

not aggregate to more than $1,000 I ths box checked, enter here the total contributions that were recewed durng

the year for an exclusively reigous, chantable, etc, purpose Do not complete any of the pars unless the General Rule

apps to ths organgation because & recewed nonexcliswely rebgious, chartable, tc , contrbutons of $5,000 or mere

Snotennt eas

Caution. An Organzation thats nat covered by the General Rule andlor the Special Rules does not fle Schedule & (Form350,

{990-E2, or 860-FF), but e must answer “No” on Part W, ne 2of ts Form860, or check the box on in Hof ts

Form980-£2, or on ine 2 of ts Form 990-PF, to certfy that f does not meet the fling requrements of Schedule B (Form 990,

{990-E7, oF 860-FF)

For Paperwork Reduction At Notice ee the Inirachone at No S05Tax

(Form 990, 0.52, or 90.97) (200)

‘Schedule & (Form 990, 990-£Z, or 990-PF) (2010)

Name of organization

Pogo 1 of 1 of Parti

‘Employer Identification number

48-0918408

Contributors (see Instructons)

@

Name, address,

i)

Aggregate contributions

@

‘Type of contribution

4111 € 37TH STREET N

8 42,034,259

Person 7

Payroll

Noncash

(Complete Part I there

3 noneesh contebuton

(a)

No.

oy

Name, address, and ZIP +4

@

Aggregate contributions

@

Type of contribution

Person 7

Payroll

Noneash

©

Name, address,

@

Aggregate contributions

@

Type of contribution

Person

Payroll 7

Noneash

(a)

No.

@

Name, address, and ZIP +4

)

Aggregate contributions

@

Type of contribution

Person

Payroll

Noneash

o

Name, address, and ZIP +4

©

‘Aggregate contributions

@

Type of contribution

Person

Payroll 7

Noneash

3 noneashcontbuton

(a)

No.

@

Name, address, and ZIP + 4

i)

Aggregate contributions

@

Type of contribution

Person

Payro 7

Noncash

(Complete Part I there

3 noneesh contebuton

reese erecta Ieee

‘Schedule & (Form 990, 990-£Z, or 990-PF) (2010) Poge 1 of _1_of Parti

= Ss

— :

;

a :

Part I sf ee (see instructions)

:

oe :

Part I sf ee (see instructions)

:

:

= :

Part 4 re (see instructions)

:

a :

:

errr eee

‘Schedule & (Form 990, 990-£Z, or 990-PF) (2010)

Name of organization

Pogo _1_ of 1 of Part

Employer Identification number

45-0918408

Exclusively religious, charitable, ete, Individual contributions to section 01(¢)7), (8), oF (10) organizations

‘aggregating more than $1,000 for the year. (Complete columns (a) through (e) and the folowing ine entry )

For organzatons completing Parti enter the total of exclusively relgous, chartabe

Contributors of $1,000 oF less for the year (Enter ths formation once See nstructons ) $

ete

(a) No.

ele © © ()

pet Purpose of gift Use of itt Description of how gifts held

7

Transfer of git

‘Transferee's name, address, and ZIP +4 Relationship of transferor to transferee

Sine. © Cy (s)

ney Purpose of gift Use of gift Description of how gift is held

i)

Transfer of gift

Transferee's name, address. and ZIP +4 Relationship of transferor to transferee

we oy () @

par Purpose of gift Use of gitt Description of how gifts held

e)

Transfer of git

Transferee's name, address. and ZIP +4 Relationship of transferor to transfer

(aye. ) ) (8)

et Purpose of gift Use of gitt Description of how git is hel

i)

Transferee's name, address, and ZIP +4

Transfer of gift

Relationship of transferor to transferee

ise eceeeaee nr a

Form 990PF Part XV Line 3 - Grants and Contributions Paid During the Year or Approved for Future Payment

Recipient recipient is an nvidual, | Foundation Purpose of grant or ‘Amount

show any relationship to | status of ontribution

Name and agdress (home or business) | af foundation manager | recipient

orsubstential contnbutor

12 Pad during the year

161 OTTAWA AVENUE NW :

GRAND RAPIDS, M1 49503,

ALEXANDER HAMILTON INSTITUTE | NONE PuaLic EDUCATIONAL PROGRAMS, 14,360

CLINTON, NY 13323,

614 WSUPERIOR ST

1726 M STREET NW

AMERICAN SPECTATOR NONE PuBLIC ‘GENERAL OPERATING 10,000

1611 NORTH KENT ST

ARLINGTON, VA 22201

AMERICAN UNIVERSITY NONE PusLic EDUCATIONAL PROGRAMS, 10,000

Nw

501 COLLEGE STREET

ENTERPRISE EDUATION :

CHATTANOOGA, TN 37403

ARKANSAS TECH UNIVERSITY [NONE Puauic EDUCATIONAL PROGRAMS, 8,500

RUSSELLVILLE,AR 72801,

ARTS RSCIENCES FOUNDATION [NONE Puauic EDUCATIONAL PROGRAMS, 150,000

103 SOUTH BUILDING

CHAPEL HILL,NC 27599

300 N BEATY ST

Po 80x 7000 :

AZUSA,CA 917027000

2000 UNIVERSITY AVENUE .

PO 80x 5000

ONE BEAR PLACE

os ee 45,492,922,

Form 990PF Part XV Line 3 - Grants and Contributions Paid During the Year or Approved for Future Payment

Recipient recipient is an inavidual, | Foundation Purpose of grant or ‘Amount

show any telationship to | status of eontribution

‘Name and address (home or any foundation manager | recipient

business) orsubstential contnbutor

‘8 Pad during the year

Po 80x 495024 :

BETHEL COLLEGE NONE PuBLIc EDUCATIONAL PROGRAMS, 8,505

MESHAWAKA,IN 46545

BILL OF RIGHTS INSTITUTE NONE PuBLIC EDUCATIONAL PROGRAMS, 300,000

Surte 200

FOUNDATION "

BoIsE,1D 63706

‘BROWN UNIVERSITY NONE PuBLic EDUCATIONAL PROGRAMS, 116,978

PROVIDENCE, RI 02912

‘CAMPBELL UNIVERSITY NONE Puauic EDUCATIONAL PROGRAMS, 13,600

BUIES CREEK,NC 27506

1513 16TH ST NW SUPPORT :

1 UNIVERSITY DRIVE ;

University .

CHARLESTON, SC 29406

CHRISTENDOM COLLEGE NONE PuaLic EDUCATIONAL PROGRAMS, 5,100

FRONT ROYAL, VA. 22630

400 N CLAREMONT BLVD .

CHRISTOPHER NEWPORT UNIV [NONE PuBLic EDUCATIONAL PROGRAMS, 6,000

1 UNIVERSAL PLACE

eal 35,492,922,

Form 990PF Part XV Line 3 - Grants and Contributions Paid During the Year or Approved for Future Payment

Recipient

Name and address (home or business)

recipient isan inawidual,

‘how any felationship to

any foundation manager

Foundation

Purpose of grant or

‘Amount

‘8 Pad during the year

13 OAK ORIVE

COLLEGE OF CHARLESTON

65 GEORGE STREET

NONE

Pusuic

EDUCATIONAL PROGRAMS,

29,919

FOUNDATION

TRENTON,N3 08628

COLLEGE OF WILLIAM & MARY

WILLIAMBURG,VA 231878795

NONE

Pusuic

EDUCATIONAL PROGRAMS,

4,800

‘COLORADO COLLEGE

COLORADO SPRINGS,CO 80903

NONE

pusuic

EDUCATIONAL PROGRAMS,

9,000

Po 80x 868

SUPPORT

CALIFORNIA STATE UNIVERSITY -

25600 CARLOS BEE BLVD

NONE

pusuic

EDUCATIONAL PROGRAMS,

7,000

DELAWARE STATE UNIVERSITY

1200 NORTH DUPONT HIGHWAY

NONE

Pusuic

EDUCATIONAL PROGRAMS,

7,250

109 NORTH HENRY ST

81 BEVERLY DRIVE

DUQUESHE UNIVERSITY

600 FORBES AVENUE

FOUNDATION FOR INDIVIDUAL

601 WALNUT STREET

PHILADELPHIA,PA 19106

NONE

PuBuic

GENERAL OPERATING

475,000

FORT MVERS,FL 33965

211 WESTCOTT BUILOING

> 3

Form 990PF Part XV Line 3 - Grants and Contributions Paid During the Year or Approved for Future Payment

Recipient

Name and address (home or business)

TFrecipent isan indwidual,

‘how any relationship to

any foundation manager

orsubstential contributor

Foundation

Purpose of grant or

‘Amount

12 Pad during the year

EDUCATION

IRVINGTONONHUDSON, NY 10533

FRASER INSTITUTE

VANCOUVER, BRITISH COLUMBIA

ca

NONE

PuBLic

EDUCATIONAL PROGRAMS,

150,000

414 N MERIDIAN STREET

GEORGE MASON UNIVERSITY

4400 UNIVERSITY DRIVE

NONE

puBLic

GENERAL OPERATING

PROGRAMS

3,667,144

GEORGE WASHINGTON

805 21ST STREET NW

NONE

PUBLIC

EDUCATIONAL PROGRAMS,

15,000

university

MILLEDGEVILLE, GA 31061

(GEORGIA STATE UNIVERSITY

ONE PARK PLACE SOUTH

NONE

PuBLic

EDUCATIONAL PROGRAMS,

10,000

505 TENTH STREET

100 CAMPUS DRIVE

GROVE CITY,PA 16127

HAMPDEN-SYDNEY COLLEGE

HAMPDEN SYDNEY, VA 23943

NONE

PuBLIC

EDUCATIONAL PROGRAMS,

16,000

HANOVER,IN 47243

HENDERSON STATE UNIVERSITY

1100 HENDERSON STREET

NONE

uate

EDUCATIONAL PROGRAMS,

6515

HILUSDALE COLLEGE

HILLSDALE,ME 49242

NONE

PuBLIc

EDUCATIONAL PROGRAMS,

26,000

INDIANA UNIVERSITY

BLOOMINGTON,IN 474057000

NONE

PuBLIC

REFUND OF UNUSED FUNDS

2,400

INSTITUTE FOR HUMANE STUDIES

Suite 440,

NONE

PuBLIC

GENERAL OPERATING

2,159,500

> 38

Form 990PF Part XV Line 3 - Grants and Contributions Paid During the Year or Approved for Future Payment

Recipient Tfrecipient is an ndwidual, | Foundation Purpose of grant or ‘Amount

show any relationship to | status of ontribution

Name and agdress (home or business)| a" foundation manager | recipient

or substantial contnbutor

12 Pad during the year

111 PRESIDENTIAL BLVD :

PHILADELPHIA,PA 19004

JACKSONVILLE STATE NONE pusuic EDUCATIONAL PROGRAMS, 6,000

700 PELHAM ROAD NORTH

DAMES MADISON INSTITUTE. NONE Pusuic EDUCATIONAL PROGRAMS, 7,500

FounDaTION :

HARRISONBURG, VA 22607

601. MAIN STREET

PO 60x 359

209 WKINGSHIGHWAY

1032 W SHERIDAN RD FROM 2009 GRANT

ORLEANS :

NEWORLEANS,LA 70128

LOUISIANA STATE UNIVERSITY | NONE pusuic EDUCATIONAL PROGRAMS, 11340

3838 WEST LAKESHORE DRIVE

MARKET BASED MANAGEMENT | NONE PRIVATE | GENERAL OPERATING 445,000

MERCER UNIVERSITY NONE Pusuie EDUCATIONAL PROGRAMS, 10,500

MACON, GA 31207

DENVER FOUNDATION :

SUITE 900

503 THOMPSON STREET

304 SOUTH CASE HALL :

To ee 45,492,922,

Form 990PF Part XV Line 3 - Grants and Contributions Paid During the Year or Approved for Future Payment

Recipient recipient is an nvidual, | Foundation Purpose of grant or ‘Amount

show any relationship to | status of ontribution

Name and agdress (home or business) | af foundation manager | recipient

orsubstential contnbutor

12 Pad during the year

FOUNDATION :

WICHITA FALLS, Tx 76308

MILLIGAN COLLEGE NONE PuaLic EDUCATIONAL PROGRAMS, 3,000

MILLIGAN COLLEGE,TW_ 37682

TecHNOLOGY °

CAMBRIDGE, MA_021394301

3070 LINFIELD HALL :

MONTCLAIR STATE UNIVERSITY [NONE PuBLIC EDUCATIONAL PROGRAMS, 8,000

TNORMAL AVENUE

202 HOWELL-MCDOWELL BLDG RESEARCH

233 PENNSYLVANIA AVE SE 32D :

WASHINGTON,DC 20003

NATIONAL UNIVERSITY NONE PuBLic EDUCATIONAL PROGRAMS, 10,500

LA3OLLA,cA 92037

NETWORK OF ENLIGHTENED NONE PuaLic GENERAL OPERATING 2,500

1210 MASSACHUSETTS AVE NW

19. WATH STREET 6FL "

NORTH CAROLINA STATE NONE PuBLIc EDUCATIONAL PROGRAMS, 4,000

CAMPUS BOX 7003,

NORTHEASTERN STATE NONE PuaLic EDUCATIONAL PROGRAMS, 8,400

UNIVERSITY TAHLEQUAK

705 GRAND.

TAHLEQUAH, OK 74466

NORTHERN ILLINOTS RESEARCH [NONE PuaLic EDUCATIONAL PROGRAMS, 5,000

1425 WEST LINCOLN HWY

UNIVERSITY FOUNDATION

ALVA,OK 73717

NORTHWOOD UNIVERSITY - TEXAS [NONE PuBLic EDUCATIONAL PROGRAMS, 8,000

1114 WeM 1382

To ee 45,492,922,

Form 990PF Part XV Line 3 - Grants and Contributions Paid During the Year or Approved for Future Payment

Recipient Tfreciprent © an individual, | Foundation Purpose of grant or ‘Amount

show any relationship to | status of ontrbution

Name and address (home or business) | af foundation manager | recipient

orsubstential contnbutor

12 Pad during the year

4000 WHITING DRIVE

2031 GARBER ST "

OGLETHORPE NONE PusLic EDUCATIONAL PROGRAMS, 5,000

ATLANTA,GA 30319

Po 80x 869 :

‘OHIO UNIVERSITY FOUNDATION [NONE PuaLic EDUCATIONAL PROGRAMS, 14,000

ATHENS,OM 45701

PEPPERDINE UNIVERSITY NONE PuBLIC EDUCATIONAL PROGRAMS, 18,950

MAUIBU,cA 902634619

PHILANTHROPY ROUNDTABLE [NONE PuaLic ‘GENERAL OPERATING 25,000

SUITE 503,

ONE MASSACHUSETTS AVE NW :

WASHINGTON, DC 20002

PHILLIPS SCHOOL OF BUSINESS [NONE PuaLic EDUCATIONAL PROGRAMS, 2,000

833 MONTLIEU AVENUE

503 SOUTH BROAD STREET

PROVIDENCE COLLEGE NONE Puauic EDUCATIONAL PROGRAMS, 5250

1000 REGENT UNIVERSITY DR :

RESEARCH FOUNDATION OFTHE [NONE PuaLic EDUCATIONAL PROGRAMS, 12,000

101 BROAD STREET

2000 N PARKWAY :

6001 UNIVERSITY BOULEVARD

me a a 11,192,922

Form 990PF Part XV Line 3 - Grants and Contributions Paid During the Year or Approved for Future Payment

Recipient Tfrecipient is an ndwidual, | Foundation Purpose of grant or ‘Amount

show any relationship to | status of ontribution

Name and agdress (home or business)| a" foundation manager | recipient

or substantial contnbutor

12 Pad during the year

5050 EAST STATE STREET :

430 S MICHIGAN AVENUE "

ROYAL INSTITUTION FOR ADV OF | NONE pusuic EDUCATIONAL PROGRAMS, 6,000

855 SHERBROOKE ST W

MONTREAL, QUEBEC QC HCA2T?

805 BROWER ROAD :

SAGINAW VALLEY STATE NONE PuBuie EDUCATIONAL PROGRAMS, 4,940

7400 BAY RD BROWN 342,

FOUNDATION .

SALISBURY, MD 219022655

SALVATION ARMY NONE Pusuic EDUCATIONAL PROGRAMS, 50,000

ALEXANORIA, VA. 22323

SAN JOSE STATE UNIVERSITY [NONE Pusuic EDUCATIONAL PROGRAMS, 16,500

ONE WASHINGTON SQUARE

SAN JOSE,CA 95192

SARAH LAWRENCE COLLEGE NONE Pusuic EDUCATIONAL PROGRAMS, 9,000

BRONXVILLE,NY 10708

SETOW HALL UNIVERSITY NONE pusuic EDUCATIONAL PROGRAMS, 10,431

SOUTH ORANGE,N} 07079

815 NORTH BROADWAY

‘SMITHSONIAN INSTITUTE NONE puBic EDUCATIONAL PROGRAMS, 55,000

60 GARDEN STREET

SOUTHERN ILLINOIS UNIVERSITY | NONE PuBuic EDUCATIONAL PROGRAMS, 14,976

1235 DOUGLAS ORIVE

University

DALLAS, Tx 752750333

ST CLOUD STATE UNIVERSITY [NONE Pusuic EDUCATIONAL PROGRAMS, 5,500

720 4TH AVENUE SOUTH

To ee 45,492,922,

Form 990PF Part XV Line 3 - Grants and Contributions Paid During the Year or Approved for Future Payment

Recipient recipient is an nvidual, | Foundation Purpose of grant or ‘Amount

show any relationship to | status of ontribution

Name and agdress (home or business) | af foundation manager | recipient

orsubstential contnbutor

12 Pad during the year

3690 EAST AVENUE :

8000 UTOPIA PARKWAY "

QUEENS, NY 11435

ST LAWRENCE UNIVERSITY NONE PusLic EDUCATIONAL PROGRAMS, 10,000

CANTON,NY 13617

STILLMAN COLLEGE NONE PuaLic EDUCATIONAL PROGRAMS, 7,500

TUSCALOOSA,AL 95403

STONEHILL COLLEGE NONE PuBLic EDUCATIONAL PROGRAMS, 13,496

EASTON,MA 02357

STUDENTS FOR LIBERTY NONE PuaLic EDUCATIONAL PROGRAMS, 20,000

ARLINGTON, VA 22216

SUFFOLK UNIVERSITY NONE Pusuic EDUCATIONAL PROGRAMS, 209,697

BOSTON,MA 021082770

TEXAS STATE UINVERSITY-SAN [NONE PuaLic EDUCATIONAL PROGRAMS, 7,500

602 UNIVERSITY DRIVE

stuoles .

WASHINGTON,DC 20009

350 STH AVENUE ‘

NEWYORK,NY 10118

300 SUMMIT STREET :

Fray university Founoation wONE Puauic | EDUCATIONAL PROGRAMS 240,000

216 abams aoministaation

FFRov.au 36082

Us Founoation senvices inc [wone Puatic | EDUCATIONAL PROGRAMS 7360

UMIvEnsiTy OF ALABAMA - wone pustic _|eoUcATIOWAL PROGRAMS @000

Hd spaniovan onve nssre

os ee 45,492,922,

Form 990PF Part XV Line 3 - Grants and Contributions Paid During the Year or Approved for Future Payment

Recipient

‘Name and address (home or

business)

recipient is an inéwvidual

any foundation manager

Foundation

Purpose of grant or

‘Amount

UNIVERSITY OF ALASKA

PO 80x 755000

NONE

PuBLIC

EDUCATIONAL PROGRAMS,

11,500

FOUNDATION

Tuscon,az 85719

UNIVERSITY OF ARKANSAS

2801 SOUTH UNIVERSITY AVE

NONE

puBLic

EDUCATIONAL PROGRAMS,

6.055

Davis

DAVIS,CA 95616

Los ANGELES

LOS ANGELES,cA so09si656

UNIVERSITY OF CALIFORNIA -

900 UNIVERSITY AVENUE

NONE

PuBLIC

EDUCATIONAL PROGRAMS,

15,000

BouLDER,co 90302

UNIVERSITY OF DALLAS

IRVING, Tx_75062

NONE

PuBLic

EDUCATIONAL PROGRAMS,

16,000

UNIVERSITY OF DAYTON

DAYTON,OM 45469,

NONE

PuBLic

EDUCATIONAL PROGRAMS,

15,000

4361 HARVEST LANE

SPRINGFIELO

SPRINGFIELO, IL 62703

UNIVERSITY OF KENTUCKY

LEXINGTON, RY 40526

NONE

PuBLic

EDUCATIONAL PROGRAMS,

2,000

UNIVERSITY OF LOUISVILLE

Louisvitte,ky 40292

NONE

PuBLic

EDUCATIONAL PROGRAMS,

31,055

NINE OGRIEN AVENUE

> 38

Form 990PF Part XV Line 3 - Grants and Contributions Paid During the Year or Approved for Future Payment

Recipient Tfrecipient is an ndwidual, | Foundation Purpose of grant or ‘Amount

show any relationship to | status of ontribution

Name and agdress (home or business)| a" foundation manager | recipient

or substantial contnbutor

12 Pad during the year

couumala :

COLUMBIA, MO 652111230

UNIVERSITY OF NORTH CAROLINA | NONE pusuic EDUCATIONAL PROGRAMS, 5,000

103 SOUTH BUILDING cB 9200

UNIVERSITY OF NEBRASKA NONE PuBuic EDUCATIONAL PROGRAMS, 10,000

6001 DODGE STREET

UNIVERSITY OF NEVADA RENO [NONE Pusuie EDUCATIONAL PROGRAMS, 8,000

41664 N VIRGINIA STREET

UNIVERSITY OF NOTREOAME [NONE PuBuic EDUCATIONAL PROGRAMS, 9,650

NOTRE DAME,IN 46556

UNIVERSITY OF OKLAHOMA NONE puBuic EDUCATIONAL PROGRAMS, 3,000

NORMAN,OK 730190390

UNIVERSITY OF SAN DIEGO NONE Puuic EDUCATIONAL PROGRAMS, 9.317

SAN DIEGO,CA 92110

UNIVERSITY OF SOUTH FLORIDA | NONE Pusuic EDUCATIONAL PROGRAMS, 5,000

4202 £ FOWLER AVENUE ALC100

PASO :

EDINBURG, Tk 79968

UNIVERSITY OF TEXAS PAN NONE pusuic EDUCATIONAL PROGRAMS, 18,300

1201 WUNIVERSITY DRIVE

UNIVERSITY OF WASHINGTON [NONE PuBuie EDUCATIONAL PROGRAMS, 7,000

FOUNDATION INC :

PENSACOLA,FL 32514

CLAIRE

EAU CLAIRE, Wi 547024004

UNIVERSITY OF WISCONSIN NONE puBuic EDUCATIONAL PROGRAMS, 5400

500 LINCOLN DRIVE

26 WESTHAMPTON WAY :

To ee 45,492,922,

Form 990PF Part XV Line 3 - Grants and Contributions Paid During the Year or Approved for Future Payment

Recipient recipient is an ndwidual, | Foundation Purpose of grant or ‘Amount

show any relationship to | status of eontribution

Name and agdress (home or business)| any foundation manager | recipient

12 Pad during the year

307 UNIVERSITY BLVD W :

1400 OLD MAIN HI :

WAKE FOREST UNIVERSITY NONE pusuie EDUCATIONAL PROGRAMS, 6,610

WINSTON SALEM, NC 27106

WESLEYAN NONE puBuic EDUCATIONAL PROGRAMS, 9,000

MACON,GA 31210

WEST VIRGINIA UNIVERSITY NONE Puuic EDUCATIONAL PROGRAMS, 272,300

(ONE WATERFRONT PLACE 7TH

MORGANTOWN, WW 265071650

WESTERN KENTUCKY UNIVERSITY [NONE Pusuic EDUCATIONAL PROGRAMS, 6,000

1906 COLLEGE HEIGHTS BLVD

345 BOYER AVENUE :

University .

WINSTON SALEM,NC 27110

1903 W MICHIGAN AVENUE .

3330 N WOODLAWN SUPPORT

a el 45,492,922,

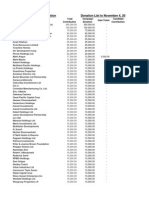

Form 990PF Part XV Line 3b - Grants and Contributions Approved for Future Payment

Recipient recipient isan individual, | Foundation Purpose of grant or ‘Amount

show eny relationship to | status of ‘contnbution

any foundation manager | recipient

Name and address (home or business) | #7 foundation manager,

fe Aoproved for future payment

FLORIDA STATE UNIVERSITY211 [NONE Pusuic EDUCATIONAL 1,043,000,

TALLAHASSEE,FL_ 323061470

(GEORGE MASON UNIVERSITY NONE Pusuic EDUCATIONAL 350,500,

Rive

ASHBURTON PLACE PROGRAMS "

FOUNDATION1113 N CHERRY AVE PROGRAMS "

TUSCON,AzZ 857210109

STATE UNIVERSITY PROGRAMS

FOUNDATIONONE WATERFRONT PROGRAMS

7TH FLOOR

HALL PROGRAMS "

CLEMSON, SC 296341301

Tole ee hb 3,019,339,

RAPHIC print DO NOT PROCESS | As Filed Data - |

TY 2010 Accounting Fees Schedule

Name: CHARLES G KOCH CHARITABLE FOUNDATION

EIN: 48-0918408

DLN:

3491319013451)

Category

‘Amount.

Net Investment

Income

‘Adjusted Net

Income

Disbursements for

Charitable

Purposes

SERVICES FEES

GRAPHIC print - DO NOT PROCESS _| As Fil

Data DLN: 93491319013451

Note: To capture the full content of this document, please select landscape mode (11" x 8.5") when printing.

TY 2010 Depreciation Schedule

Name: CHARLES G KOCH CHARITABLE FOUNDATION

EIN: 48-0918408

TY 2010 Depreciation Schedule

Description of ° Coster other ] Prior Years! | Computation Method wate / Net investment | Adjusted Wet] Cost of Goods

Property equtred ‘sie Depreciation Lite (of yoars) Income” ncome: oid Not

OmiceequiPnewt | 201-001 365500 37% |S

OmIcEequiPNewT | 2010-04-01 6653 3,806 | 5 2306

‘OFFICE EQUIPMENT 70.206 = Z 104670

RAPHIC

Note

TY 2010 Expenditure Responsi

int - DO NOT PROCESS

As Filed Data

ity Statement

‘0 capture the full content of this document, please select landscape mode (11” x 8.5'

Name: CHARLES G KOCH CHARITABLE FOUNDATION

EIN: 48-0918408

when printing.

3491319013451

Granted Nanw | Granted Address | Gant bate | amt (Gent Purpore ‘Any ] Dates of Reports By | Dateot Results of Verfcation

amount Diya By Grantee veritcation

file GRAPHIC print DO NOT PROCESS [As Filed Data — | DLN: 93491319013451,

TY 2010 General Explanation Attachment

Name: CHARLES G KOCH CHARITABLE FOUNDATION

EIN: 48-0918408

Identifier] Return Explanation

Reference

SUMMARY OF |FORMG90- | KOCH ASSOCIATES PROGRAM During 2010 the Charles G Koch Chartable Foundation sponsored mre than

ORECT PF, PART | 145 ndividuals t participate m the Koch Associate Program 27 Washington, DC area chartable organzations

cHarmaate |A and 23 chartable organzatons outside of Washington, D(C w ere partners inthe program The Koch

ACTNITES ‘Assooite Programw as establshed to dently potential future leaders and entrepreneurs interested ntberty

and help them develop the know ledge, skils, and experince necessary for careers inthe nonprofit sector,

Including careers wn market-oriented thnk tanks, poley institutes, and other educatonal msttutlons For mere

information on ths program please vist the Foundation’s website at www egktoundation org KOCH

INTERNSHIP PROGRAM During 2010 the Charles G Koch Chanttable Foundation sponsored more than 87

individuals to participate m the Koch internship Program The Charles G Koch Chartable Foundation internship

Programwas establshed to develop the next generation of iberty-mnded leaders, educators, and

entrepreneurs Over the course ofthe program Interns engage n research and educetonal activttes while

learning and applying Market-Based Management For more information on ths program please vist the

Foundation's webste at www egkfoundation org

RAPHIC print DO NOT PROCESS | As Filed Data - |

DLN:

TY 2010 Investments - Other Schedule

3491319013451)

Name: CHARLES G KOCH CHARITABLE FOUNDATION

EIN: 48-0918408

Category/ Item Listed at Cost or] Book Value _| End of Year Fair

FMV Market Value

ZAZOVE FUND FMV 6,873,232 7,454,202

EATON VANCE FUND FMV 53,295 322,199

EXCELSIOR ABSOLUTE FUND FMV 52,714 99,039

ELLIOT INTERNATIONAL FUND FMV 5,000,000 5,060,205

HIGHLAND COMMINGLED FUND FMV 10,000,000 11,260,169

MPAM FUND FMV 35,000,000 35,277,446

PILOT TRAVEL CENTERS FMV 9,860,928 10,000,000

PIMCO FUND FMV 26,345,344 27,675,757,

WEBER STEPHEN PRODUCTS FMV 24,750,000 25,083,333

OTHER INVESTMENTS, FMV 0 0

[efile GRAPHIC print — DO NOT PROCESS TAs Filed Data — J

TY 2010 Land, Etc. Schedule

DLN:

Name: CHARLES G KOCH CHARITABLE FOUNDATION

EIN: 48-0918408

3491319013451)

Category / Item Cost / Other | Accumulated ] Book Value | End of Year Fair

Basis Depreciation Market Value

OFFICE EQUIPMENT 366,620 168,100 198,520

OFFICE EQUIPMENT 46,659 7,612 39,047

OFFICE FURNITURE 270,325 7,258 193,067

LEASEHOLD IMPROVE 1,000,652 418,398 582,254

OFFICE EQUIPMENT 40,286 10,670 29,616

[efile GRAPHIC print — DO NOT PROCESS TAs Filed Data — J

TY 2010 Legal Fees Schedule

Name: CHARLES G KOCH CHARITABLE FOUNDATION

EIN: 48-0918408

DLN:

3491319013451)

Category

‘Amount

Net Investment

Income

‘Adjusted Net

Income

Disbursements for

Charitable

Purposes

GRAPHIC print DO NOT PROCESS [As Filed Data — | DLN: 93491319013451,

TY 2010 Other Expenses Schedule

Name: CHARLES G KOCH CHARITABLE FOUNDATION

EIN: 48-0918408

Description Revenue and Expenses] Net Investment | Adjusted Net Income | Disbursements for

er Books Income Charitable Purposes

TELEPHONE 20,215 28,456

MEMBERSHIP & UES 6.498 6498

AWARDS /INCENTIVES 10,266 10,266

MISCELLANEOUS 65 65

[efile GRAPHIC print — DO NOT PROCESS TAs Filed Data — J DLN:

TY 2010 Other Income Schedule

3491319013451)

Name: CHARLES G KOCH CHARITABLE FOUNDATION

EIN: 48-0918408

Description Revenue And [Net Investment | Adjusted Net Income

Expenses Per Books Income

GRAPHIC print DO NOT PROCESS [As Filed Data — | DLN: 93491319013451,

TY 2010 Other Professional Fees Schedule

Name: CHARLES G KOCH CHARITABLE FOUNDATION

EIN: 48-0918408

Category ‘Amount, Net Investment | Adjusted Net | Disbursements for

Income Income. Charitable

Purposes

PROFESSIONAL CONSULTING 26,501 103,082

TAY ESTHENT HANAGEHENT 53,156 534568 °

LAND MAINTENANCE FEES 1494 1494 °

RECRUITING FEES 12,537 12,537

TEMPORARY HELP 31,910 31,910

ADVERTISING FEES 2,797 2797

SPEAKER FEES 10,500 10,500

EQUIPMENT/MAINTENANCE 18,729 20,240

GRAPHIC print DO NOT PROCESS [As Filed Data — | DLN: 93491319013451,

TY 2010 Taxes Schedule

Name: CHARLES G KOCH CHARITABLE FOUNDATION

EIN: 48-0918408

Category ‘Amount | Net Investment | Adjusted Net | Disbursements for

Income Income Charitable

Purposes

VA BUSINESS PROPERTY TAX 24,194 24,196

Additional Data

Software 11

Software Version:

48-0918408,

CHARLES G KOCH CHARITABLE FOUNDATION

Form 990PF Part VIII Line 4 - List all officers, directors, trustees, foundation managers and their

‘compensation

(a) Name and adaress (b) Title, and average | (e) compen: (a) Contributions to. | (e) Expense account

outs per week (if not paid, enter | employee benent” | other allowances

devoted to position e plans

and deterrea

PO BOX 2256 bai

PO BOX 2256

PO BOX 2256 ae

oa oinecvoR ° ° °

aancana o ° °

PO BOX 2256 bad

ot ° ° °

1515 N COURTHOUSE RD SUITE =

ARLINGTON, VA 22201

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Judge Koenigsberg Re Coastal First Nations V British Columbia (Environment) 01-13Document70 pagesJudge Koenigsberg Re Coastal First Nations V British Columbia (Environment) 01-13Vancouver_ObserverNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Mike Duffy Diary PMO Enbridge - National ObserverDocument21 pagesMike Duffy Diary PMO Enbridge - National ObserverMychayloPrystupaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- NPA Donor ListDocument24 pagesNPA Donor ListVancouver_ObserverNo ratings yet

- The Duffy DiariesDocument248 pagesThe Duffy Diariesdavid_akinNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Vancouver Canucks - Case Study September 2013-2Document3 pagesVancouver Canucks - Case Study September 2013-2Vancouver_ObserverNo ratings yet

- Letter To Canadian Judicial Council Regarding Justice Wedge's Dismissal of Furlong CaseDocument7 pagesLetter To Canadian Judicial Council Regarding Justice Wedge's Dismissal of Furlong CaseVancouver_Observer100% (1)

- Draft Agreement and Draft Decision On Workstreams 1 and 2 of The Ad Hoc Working Group On The Durban Platform For Enhanced ActionDocument50 pagesDraft Agreement and Draft Decision On Workstreams 1 and 2 of The Ad Hoc Working Group On The Durban Platform For Enhanced ActionQuercus ANCNNo ratings yet

- Atip Carson O&g Wkggp2009Document37 pagesAtip Carson O&g Wkggp2009Vancouver_ObserverNo ratings yet

- Environics - National Observer Swing Riding Poll Report - Oct 6-15Document7 pagesEnvironics - National Observer Swing Riding Poll Report - Oct 6-15Vancouver_ObserverNo ratings yet

- Mother Canada Report by StantecDocument25 pagesMother Canada Report by StantecVancouver_ObserverNo ratings yet

- ATIP - Notes On April 23 CAPP - DFAIT WorkshopDocument6 pagesATIP - Notes On April 23 CAPP - DFAIT WorkshopVancouver_ObserverNo ratings yet

- RCMP Ito Bruce Carson CseeDocument38 pagesRCMP Ito Bruce Carson CseeVancouver_ObserverNo ratings yet

- Sen. Duffy's Schedules - Part5Document44 pagesSen. Duffy's Schedules - Part5Vancouver_ObserverNo ratings yet

- Nanos Political Index 2014-11-07Document36 pagesNanos Political Index 2014-11-07Vancouver_ObserverNo ratings yet

- Vision Vancouver Campaign Contributions 2014Document118 pagesVision Vancouver Campaign Contributions 2014Metro English CanadaNo ratings yet