Professional Documents

Culture Documents

2012KochFiling PDF

2012KochFiling PDF

Uploaded by

Vancouver_Observer0 ratings0% found this document useful (0 votes)

22 views50 pagesOriginal Title

2012KochFiling.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views50 pages2012KochFiling PDF

2012KochFiling PDF

Uploaded by

Vancouver_ObserverCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 50

[efile GRAPHIC print — DO NOT PROCESS TAs Filed Data- [DLN: 93491319023773]

one No 1545-0052

rom990-PF Return of Private Foundation

or Section 4947(a)(1) Nonexempt Charitable Trust

—

een

For calendar year 2012, or tax year beginning 01-01-2012 _, and ending 12-31-2012

Tan TOT Tempra ver aNTNCaTON Hae

‘Wer or srt (or FO” box nanbet€ aN TOT GENGIU He AIST BAUER | ROOT SIRE

[elephove number (se wanton)

(216) 026.6067

“Tiyan, ae aad Fads tr exemption aptcaton ponting, check here»

G Check all that apply [_Initial return Tinitiat return of a former public charity | © 4. Foren organeations, check here oe

Pi ree > sonore a

HCheck type of organization Section 504 (c\3) exempt private foundation

section 4947(2)(1) nonexempt chantable trust_T Other taxable pnvate foundation,

Farr market value ofall assets at end | 3Accounting method T cash P¥ accrual | © ¥ pmatefoundavonaatus was emnated |

of year (from Part II, col. (c), T other (specity) pre eneeaeiante cena

ine 16%°$ 276,881,787 (Pare 1, columm (a) musi be on cash baci.) CE lenge ater sil ef

eee —r—C—“

SE Ea — feu a|/alimesa

2 cam pete fomion not eae eh 8

2 | cross sales pce for at asets on tne 6a 136,733,912

| 3 Netshort-term capital gain. . ae i of

ross pot or oss attach schedule)

a 16a Legal fees (attach schedule) S 7219] ° a 29

id b Accounting fees (attach schedule). {so 6,103] o of 6,103

B18 toes (aach sree) (se msnton) S es ma

E 19 Depreciation (attach schedule) and depletion js 138,553]

5 |22 Printing and publications 3a] 5462

Z| 22 otnerexpenses (attach senedule) 1S naa Baz

E | 24 Total operating and administrative expenses.

a Add lines 13 through23.. 6. ee ee ee 3,577,732] 478,017 4 2,689,648

© Tas contnbutions, gits, grants paid... ee 13,993,693] 14,920,448

1 Eres of revene ver exponen an dbase sosraan

bet vestinent ince regtive,enar-0-) aaa

hg harmoee pe eeat ae 4

perwork Reduction Act Notice, see instructions: Cat No 1289% Form 990-PF (2012)

Form 990-PF (2012) Page 2

| 22 other habutities (describe )

Foundations that otow SFAS 17, check Fare BFF

_ | andcomplte nee 24 through 26 andes and 3.

E] as temporeniyrestneted 0

G2 rermanentiy restricted |

S| Foundations tat dont follow SFAS 17, check here [=

5] and complete tines 27 trough 31

$]29 Retained earnings, accumulated income, endowment or ether funds

2].30. Totatnetacetsor und balance (see poge 17 ofthe

‘31 Tota iabiltics and wet asets/fund balances (seepage 1 of

Analysis of Changes in Net Assets or Fund Balances

s Decreases not included in tine 2 (itemize) D> Ss a: 1,377,382

Form 990-PF (2012)

Form 990-PF (2012) Page 3

Capital Gains and Losses for Tax on Investment Income

(aptst andescnde te tins ofvopery seig(eguresestae, — [POFOUAEBT one acqurea]_ (aon soi

:

ci

ena aa TH DapanatonaTonsd | a) Conor ne Da

— (or allowable) plus expense of sale (e) plus (f) minus (9)

:

a

(FMV as of 12/31/ ‘as of 12/31/69 over col), ifany Losses (from col (hy)

5

z

Qualification Under Section 4940(e) for Reduced Tax on Net Investment Income

(For optional use by domestic private foundations subject tothe section 4940(e) tax on net investment income )

If section 4940(4)(2) applies, leave this part blank

Was the foundation able forthe section 4942 tax on the distnbutable amount of any year i the base period? I ves F No

1f"¥es," the foundation does not qualify under section 4940(e) Do not complete this part

11 Enter the appropriate amount in each column for each year, see page 18 ofthe instructions before making any entries

ee ee 5 21,021,467

If tine 81s equal to or greater then line 7, check the box in Part VI, line 1b, and complete that part using @ ite taxrate See

the Part Viimetructions

Form 990-PF (2012)

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Mike Duffy Diary PMO Enbridge - National ObserverDocument21 pagesMike Duffy Diary PMO Enbridge - National ObserverMychayloPrystupaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Judge Koenigsberg Re Coastal First Nations V British Columbia (Environment) 01-13Document70 pagesJudge Koenigsberg Re Coastal First Nations V British Columbia (Environment) 01-13Vancouver_ObserverNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

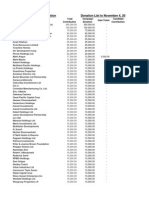

- NPA Donor ListDocument24 pagesNPA Donor ListVancouver_ObserverNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Duffy DiariesDocument248 pagesThe Duffy Diariesdavid_akinNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Vancouver Canucks - Case Study September 2013-2Document3 pagesVancouver Canucks - Case Study September 2013-2Vancouver_ObserverNo ratings yet

- Draft Agreement and Draft Decision On Workstreams 1 and 2 of The Ad Hoc Working Group On The Durban Platform For Enhanced ActionDocument50 pagesDraft Agreement and Draft Decision On Workstreams 1 and 2 of The Ad Hoc Working Group On The Durban Platform For Enhanced ActionQuercus ANCNNo ratings yet

- Letter To Canadian Judicial Council Regarding Justice Wedge's Dismissal of Furlong CaseDocument7 pagesLetter To Canadian Judicial Council Regarding Justice Wedge's Dismissal of Furlong CaseVancouver_Observer100% (1)

- Atip Carson O&g Wkggp2009Document37 pagesAtip Carson O&g Wkggp2009Vancouver_ObserverNo ratings yet

- ATIP - Notes On April 23 CAPP - DFAIT WorkshopDocument6 pagesATIP - Notes On April 23 CAPP - DFAIT WorkshopVancouver_ObserverNo ratings yet

- Environics - National Observer Swing Riding Poll Report - Oct 6-15Document7 pagesEnvironics - National Observer Swing Riding Poll Report - Oct 6-15Vancouver_ObserverNo ratings yet

- RCMP Ito Bruce Carson CseeDocument38 pagesRCMP Ito Bruce Carson CseeVancouver_ObserverNo ratings yet

- Mother Canada Report by StantecDocument25 pagesMother Canada Report by StantecVancouver_ObserverNo ratings yet

- Sen. Duffy's Schedules - Part5Document44 pagesSen. Duffy's Schedules - Part5Vancouver_ObserverNo ratings yet

- Nanos Political Index 2014-11-07Document36 pagesNanos Political Index 2014-11-07Vancouver_ObserverNo ratings yet

- Vision Vancouver Campaign Contributions 2014Document118 pagesVision Vancouver Campaign Contributions 2014Metro English CanadaNo ratings yet