Professional Documents

Culture Documents

ch02 PDF

ch02 PDF

Uploaded by

cedassssOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ch02 PDF

ch02 PDF

Uploaded by

cedassssCopyright:

Available Formats

T Accounts, Debits and Credits,

Trial Balance, and Financial

Statements

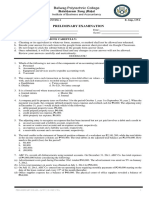

DEMONSTRATION PROBLEM

Dr. Christy Russo maintains an office for the practice of veterinary medicine. The account balances as of September 1 are given below. All are normal balances.

Assets

Cash

Accounts Receivable

Prepaid Insurance

Automobile

Furniture and Equipment

Liabilities

Accounts Payable

Owner's Equity

C. Russo, Capital

C. Russo, Drawing

$ 2,459

18,120

980

20,650

5,963

1,590

Revenue

Professional Fees

Expenses

Salary Expense

Rent Expense

Automobile Expense

Utilities Expense

Supplies Expense

$72,118

14,380

10,320

859

1,213

840

42,076

40,000

The following transactions occurred during September of this year.

a. Paid rent for the month, $1,290.

b. Paid $1,800 for one years coverage of liability insurance.

c. Bought medical equipment on account from Bennett Surgical Supply, $849, paying $200

down with the balance due in thirty days.

d. Billed patients for services performed, $9,015.

e. Paid employee salaries, $1,797.

f. Received and paid gas and electric bill, $112.

g. Received cash from patients previously billed, $11,060.

h. Received bill for gasoline for car, used only in the professional practice, from Garza Fuel

Company, $116.

i. Paid creditors on account, $1,590.

j. Dr. Russo withdrew cash for personal use, $5,000.

Instructions

1. Correctly place plus and minus signs under each T account and label the sides of the T accounts as either debit or credit in the fundamental accounting equation. Record the account

balances as of September 1.

2. Record the September transactions in the T accounts. Key each transaction to the letter

that identifies the transaction.

3. Foot the columns.

4. Prepare a trial balance dated September 30.

5. Prepare an income statement for month ending September 30, 20.

6. Prepare a statement of owners equity for month ending September 30, 20.

Copyright Houghton Mifflin Company. All rights reserved.

7. Prepare a balance sheet as of September 30, 20.

Copyright Houghton Mifflin Company. All rights reserved.

T Accounts, Debits and Credits, Trial Balance, and Financial Statements

Assets

Liabilities

+

Debit

Credit

Credit

+

Debit

Cash

Bal.

(g)

Bal.

2,459 (a)

11,060 (b)

13,519 (c)

(e)

(f)

(i)

(j)

1,290

1,800

200

1,797

112

1,590

5,000

11,789

(i)

Accounts Payable

+

Bal. 1,590

1,590 (c)

649

116

(h)

2,355

765

Bal.

CHAPTER 2

Owner's Equity

+

Debit

Credit

C. Russo, Capital

+

Bal. 42,076

C. Russo, Drawing

+

Bal. 40,000

5,000

(j)

Bal. 45,000

Prepaid Insurance

+

980

Bal.

1,800

(b)

2,780

Bal.

Bal.

(c)

Bal.

Furniture and

Equipment

+

5,963

849

6,812

Bal.

Automobile

+

20,650

ACCOUNT NAME

Copyright Houghton Mifflin Company. All rights reserved.

DEBIT

Expenses

+

Debit

Credit

Salary Expense

+

Bal. 14,380

1,797

(e)

Bal. 16,177

Rent Expense

+

Bal. 10,320

1,290

(a)

Bal. 11,610

Dr. Christy Russo

Trial Balance

September 30, 20

Cash

Accounts Receivable

Prepaid Insurance

Automobile

Furniture and Equipment

Accounts Payable

C. Russo, Capital

C. Russo, Drawing

Professional Fees

Salary Expense

Rent Expense

Automobile Expense

Utilities Expense

Supplies Expense

+

Credit

Professional Fees

+

Bal. 72,118

9,015

(d)

Bal. 81,133

1,730

Accounts Receivable

+

Bal. 18,120 (g) 11,060

9,015

(d)

27,135

Bal. 16,075

Revenue

Debit

CREDIT

1,730.00

16,075.00

2,780.00

20,650.00

6,812.00

765.00

42,076.00

Automobile Expense

+

Bal.

859

116

(h)

975

Bal.

Utilities Expense

+

1,213

Bal.

112

(f)

1,325

Bal.

45,000.00

81,133.00

16,177.00

11,610.00

975.00

1,325.00

840.00

123,974.00

Supplies Expense

+

840

Bal.

123,974.00

CHAPTER 2

T Accounts, Debits and Credits, Trial Balance, and Financial Statements

Dr. Christy Russo

Income Statement

For the Month Ending September 30, 20

Revenue:

Professional Fees

Expenses:

Salary Expense

Rent Expense

Automobile Expense

Utilities Expense

Supplies Expense

Total Expenses

Net Income

$81,133.00

$16,177.00

11,610.00

975.00

1,325.00

840.00

30,927.00

$50,206.00

Dr. Christy Russo

Statement of Owner's Equity

For the Month Ending September 30, 20

$42,076.00

C. Russo, Capital, September 1, 20

Net Income for September

Less Withdrawals for September

Increase in Capital

C. Russo, Capital, September 30, 20

$50,206.00

45,000.00

5,206.00

$47,282.00

Dr. Christy Russo

Balance Sheet

September 30, 20

Assets

$ 1,730.00

16,075.00

2,780.00

20,650.00

6,812.00

Cash

Accounts Receivable

Prepaid Insurance

Automobile

Furniture and Equipment

$48,047.00

Liabilities

$

Accounts Payable

765.00

Owner's Equity

C. Russo, Capital

Copyright Houghton Mifflin Company. All rights reserved.

47,282.00

$48,047.00

T Accounts, Debits and Credits, Trial Balance, and Financial Statements

Copyright Houghton Mifflin Company. All rights reserved.

CHAPTER 2

You might also like

- Audit of LiabilitiesDocument33 pagesAudit of Liabilitiesxxxxxxxxx96% (28)

- Note Payable: D. DiscountDocument13 pagesNote Payable: D. DiscountANDI TE'A MARI SIMBALA100% (3)

- Module 3 Practice ProblemsDocument25 pagesModule 3 Practice Problemsmaxz0% (1)

- Problem 1 Current Liability Entries and Adjustments: InstructionsDocument6 pagesProblem 1 Current Liability Entries and Adjustments: Instructionsbeeeeee100% (1)

- FABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityDocument10 pagesFABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Exercise CH3Document10 pagesExercise CH3loveshareNo ratings yet

- Week 6 Financial Accoutning Homework HWDocument7 pagesWeek 6 Financial Accoutning Homework HWDoyouknow MENo ratings yet

- Workshop Solutions T1 2014Document78 pagesWorkshop Solutions T1 2014sarah1379No ratings yet

- Basic Accounting Quizbee 2013Document8 pagesBasic Accounting Quizbee 2013MarlouieV.Batalla100% (2)

- CH 03 Review and Discussion Problems SolutionsDocument23 pagesCH 03 Review and Discussion Problems SolutionsArman Beirami57% (7)

- ACCT550 Exercises Week 1Document6 pagesACCT550 Exercises Week 1Natasha DeclanNo ratings yet

- QuzziesDocument3 pagesQuzziesKionna TamaraNo ratings yet

- Accounts Assignment 2Document12 pagesAccounts Assignment 2shoaiba167% (3)

- Soal UTS SMT 1 AkP (12-10-21)Document22 pagesSoal UTS SMT 1 AkP (12-10-21)Bayu PrasetyoNo ratings yet

- Midterm Bi ADocument13 pagesMidterm Bi AFabiana BarbeiroNo ratings yet

- Final Accounts QuestionDocument12 pagesFinal Accounts QuestionIndu Gupta50% (4)

- Financial Accounting Question SetDocument24 pagesFinancial Accounting Question SetAlireza KafaeiNo ratings yet

- 1.3 Worksheet - T Account, Trial Balance & Income StatementDocument1 page1.3 Worksheet - T Account, Trial Balance & Income StatementĐức NguyễnNo ratings yet

- Fundamentals of Accounting-I WorksheetDocument7 pagesFundamentals of Accounting-I WorksheetLee HailuNo ratings yet

- Following Is The September 30 20X8 Trial Balance For ABC: Unlock Answers Here Solutiondone - OnlineDocument1 pageFollowing Is The September 30 20X8 Trial Balance For ABC: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- ACT15 Prelim ExamDocument8 pagesACT15 Prelim ExamPaw VerdilloNo ratings yet

- Advanced AccountingDocument13 pagesAdvanced AccountingprateekfreezerNo ratings yet

- General Review AnswerDocument8 pagesGeneral Review AnsweryasiraNo ratings yet

- Level 1 AVERAGEDocument4 pagesLevel 1 AVERAGEJaime II LustadoNo ratings yet

- Lebanese Association of Certified Public Accountants - IFRS February Exam 2019Document8 pagesLebanese Association of Certified Public Accountants - IFRS February Exam 2019jad NasserNo ratings yet

- Week 3 Individual AssignmentDocument15 pagesWeek 3 Individual AssignmentMadmaxxdxxNo ratings yet

- FAR Prelim Exam FormatDocument15 pagesFAR Prelim Exam FormatCybill AiraNo ratings yet

- Financial Accounting and Reporting: ConceptualDocument9 pagesFinancial Accounting and Reporting: Conceptualben yiNo ratings yet

- Financial Accounting: Assignment#3Document2 pagesFinancial Accounting: Assignment#3RameenNo ratings yet

- Advanced Corporate AccountingDocument6 pagesAdvanced Corporate Accountingamensinkai3133No ratings yet

- Practice Test Chap 34Document7 pagesPractice Test Chap 34Mefa MefaiNo ratings yet

- F23 B01 Midterm Review QuestionsDocument9 pagesF23 B01 Midterm Review QuestionsDaniel OladejoNo ratings yet

- Quiz 3Document9 pagesQuiz 3Lê Thanh ThủyNo ratings yet

- Answer For Exam 2024 2nd TermDocument8 pagesAnswer For Exam 2024 2nd TermRabie HarounNo ratings yet

- Icwai Financial AccountingDocument17 pagesIcwai Financial Accountingmknatoo1963No ratings yet

- 3 Midterm A - AnswerDocument12 pages3 Midterm A - AnswerAllison0% (1)

- Reviewer (Cash-Accounts Receivable)Document5 pagesReviewer (Cash-Accounts Receivable)Camila Mae AlduezaNo ratings yet

- DHS Accountancy 2021Document30 pagesDHS Accountancy 2021Kuenga Geltshen100% (2)

- 02 AddDocument14 pages02 AddHà My NguyễnNo ratings yet

- Application Level Corporate Laws Practices Nov Dec 2013Document3 pagesApplication Level Corporate Laws Practices Nov Dec 2013Timothy GillespieNo ratings yet

- IMT 57 Financial Accounting M1Document4 pagesIMT 57 Financial Accounting M1solvedcareNo ratings yet

- Instructions: Answer The Following Carefully. Highlight Your Answer With Color Yellow. AfterDocument9 pagesInstructions: Answer The Following Carefully. Highlight Your Answer With Color Yellow. AfterMIKASANo ratings yet

- MT Principles of Accounting Fall 2023 UGDocument5 pagesMT Principles of Accounting Fall 2023 UGwww.kazimarzanjsbmsc570No ratings yet

- Exercises 1Document8 pagesExercises 1Altaf HussainNo ratings yet

- Accounting Battaglia 1 Question and AnswersDocument7 pagesAccounting Battaglia 1 Question and AnswersRina RaymundoNo ratings yet

- CHAPTER 8 Caselette - Audit of LiabilitiesDocument27 pagesCHAPTER 8 Caselette - Audit of LiabilitiesNovie Marie Balbin Anit100% (1)

- BUS 251 - Homework SolutionsDocument46 pagesBUS 251 - Homework SolutionsJerry He0% (2)

- Corporate Accounting - IIDocument5 pagesCorporate Accounting - IIjeganrajrajNo ratings yet

- ACC1701X ACC1002X AY2019 Sem 2 Mock Test Answers PDFDocument8 pagesACC1701X ACC1002X AY2019 Sem 2 Mock Test Answers PDFTenerezzaNo ratings yet

- Kumpulan Kuis AKM 3 UASDocument12 pagesKumpulan Kuis AKM 3 UASAlya Sufi IkrimaNo ratings yet

- Cash and Cash Equivalents (IA)Document9 pagesCash and Cash Equivalents (IA)rufamaegarcia07No ratings yet

- Asset To LiabDocument25 pagesAsset To LiabHavanaNo ratings yet

- Jesse Taylor Comprehensive Accounting ProblemDocument9 pagesJesse Taylor Comprehensive Accounting Problemapi-311367219No ratings yet

- Community College of Gingoog CityDocument2 pagesCommunity College of Gingoog CityJeffrey Lois Sereño MaestradoNo ratings yet

- Taxation: MD Mashiur Rahaman Robin KPMG-RRHDocument12 pagesTaxation: MD Mashiur Rahaman Robin KPMG-RRHZidan ZaifNo ratings yet

- Quiz On RizalDocument14 pagesQuiz On RizalYorinNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- FinalDocument13 pagesFinalKionna Tamara50% (2)

- QuzziesDocument2 pagesQuzziesKionna TamaraNo ratings yet

- Practice MT2 SolutionDocument15 pagesPractice MT2 SolutionKionna TamaraNo ratings yet