Professional Documents

Culture Documents

Eco - 10 e 2013-14

Uploaded by

deeptis17Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eco - 10 e 2013-14

Uploaded by

deeptis17Copyright:

Available Formats

ECO - 10

Bachelors Degree Programme

(BDP)

ASSIGNMENT

2013-14

Elective Course in Commerce

ECO 10: ELEMENTS OF COSTING

For July 2013 and January 2014 admission cycle

School of Management Studies

Indira Gandhi National Open University

Maidan Garhi, New Delhi -110 068

Elective Course in Commerce

ECO 10: Elements of Costing

ASSIGNMENT- 2013-14

Dear Students,

As explained in the Programme Guide, you have to do one Tutor Marked Assignment in this

Course.

Assignment is given 30% weightage in the final assessment. To be eligible to appear in the Termend examination, it is compulsory for you to submit the assignment as per the schedule. Before

attempting the assignments, you should carefully read the instructions given in the Programme

Guide.

This assignment is valid for two admission cycles (July 2013 and January 2014). The validity is

given below:

1. Those who are enrolled in July 2013, it is valid upto June2014.

2. Those who are enrolled in January 2014, it is valid upto December 2014.

You have to submit the assignment of all the courses to The Coordinator of your Study Centre.

For appearing in June Term-end Examination, you must submit assignment to the Coordinator of

your study centre latest by 15th March. Similarly for appearing in December Term-end

Examination, you must submit assignments to the Coordinator of your study centre latest by 15th

September.

TUTOR MARKED ASSIGNMENT

Course Code

Course Title

Assignment Code

Coverage

:

:

:

:

ECO - 10

Elements of Costing

ECO 10/TMA/2013-14

All Blocks

Maximum Marks: 100

Attempt all the questions.

1.

How can you install a system of costing in an organization? What are the general factors to be

considered before installing the system? What are the practical problems that come across and

how to overcome them?

(20)

2.

(a) From the following information calculate:

i. Minimum Stock Level

ii. Maximum Stock Level

iii. Re-ordering Level

Time required for delivery

Maximum consumption

Minimum consumption

Normal consumption

Re-order quantity

3 to 5 weeks

6,000 units

2,000 units

4,000 units

28,000 units

(b) Following is an extract of the record of receipts and issues of X material in a factory in

the month of March 2012.

March 1 Opening balance 1000 kg @ Rs. 20 per kg.

March 2 Issue 140 kg.

March 3 Issue 200 kg.

March 7 Issue 160 kg.

March 12 Received from supplier 400 kg. at Rs. 18 per kg.

March 15 Returned from production center to store 30 kg.

March 17 Issue 360 kg.

March 20 Received from a supplier 480 kg at Rs. 21 per kg.

March 23 Issue 230 kg.

March 25 Received from the supplier 640 kg @ Rs. 19 per kg.

March 27 Issue 230 kg.

March 28 Returned to store 30 kg.

March 29 Received form the supplier 200 tonne at Rs. 22 per kg.

Issues are to be priced on FIFO method. It was also found that there was a storage of 10

units on 16th and 20 units on 26th of March.

(10+10)

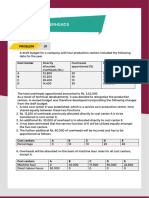

3.

The Product Y is obtained after it passes through three distinct processes. The following

information is available for the period of one month ending 31 December 2012

Particulars

Process A

Process B

Process C

6,000

4,000

1,000

2,000

3,000

2,000

2,000

3,000

1,000

Material Consumed

Direct labour

Manufacturing Exps

10,000 units introduced in Process A at the cost of Rs.8,000. There was not stock of

work-in-progress in any process. The following additional Data is also available.

Process

I

II

III

Output

(Units )

9800

9200

9350

Percentage of

Material loss

2%

5%

10%

Scrap value per unit

5 Paise

20 Paise

10 Paise

Prepare Process Account, Normal Loss & Abnormal Loss & Abnormal Gain Account.

4.

(20)

The following information relates to a building contract for Rs. 5, 00, 000.

Items

Material issued

2011

(Rs.)

1,50,000

2012

(Rs.)

42,000

Direct wages

Direct expenses

Indirect expenses

Work certified

Work uncertified

Material at cost

Plant issued

Cash received form contractor

1,15,000

11,000

3,000

3,75,000

4,000

2,500

7,000

3,00,000

52,500

5,000

700

5,00,000

3,500

1,000

5,00,000

The value of the plant at the end of 2011 and 2012 was Rs. 3,500 & 2,500 respectively. You

are required to prepare:

i.

Contract account for the years 2011 and 2012

ii.

Contractee account

(20)

5.

Distinguish between the following:

(a) Allocation and Apportionment of overheads.

(c) Job costing and Process costing.

(d) Halsey Premium Plan and Rowan Plan

(e) Bin Card and Store Ledger.

(5x4)

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- MERS Report Chain of Title ProblemsDocument85 pagesMERS Report Chain of Title ProblemsharoldebealeNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 0902 Trading The Line PDFDocument45 pages0902 Trading The Line PDFRara Laki Laki100% (2)

- 50 Powerful Tony Robbins Quotes That Have Changed My LifeDocument16 pages50 Powerful Tony Robbins Quotes That Have Changed My Lifezeeshan khan100% (1)

- Payment of Bonus Form A B C and DDocument13 pagesPayment of Bonus Form A B C and DAmarjeet singhNo ratings yet

- Philippine Private Corporations Reviewer Sec. 1-40Document11 pagesPhilippine Private Corporations Reviewer Sec. 1-40enah100% (2)

- OEM 13cDocument61 pagesOEM 13cKoushikKc Chatterjee100% (2)

- Boolean Search OperatorsDocument17 pagesBoolean Search OperatorsPrashant SawnaniNo ratings yet

- Valuation of Fixed AssetsDocument28 pagesValuation of Fixed Assetsmaster53015No ratings yet

- VikrantDocument3 pagesVikrantvikrantNo ratings yet

- Advantages of Continuous AuditDocument6 pagesAdvantages of Continuous AuditFarhad HussainNo ratings yet

- Important ProdmanDocument62 pagesImportant ProdmanTata Young100% (1)

- Dicision MakingDocument34 pagesDicision MakingArpita PatelNo ratings yet

- Environmental and Natural Resource Economics 10th Edition Tietenberg Solutions ManualDocument26 pagesEnvironmental and Natural Resource Economics 10th Edition Tietenberg Solutions ManualMatthewCurryeaqy100% (57)

- Appreciating Business, Honouring Leaders: Re: The Premium Megafest National Business AwardsDocument2 pagesAppreciating Business, Honouring Leaders: Re: The Premium Megafest National Business AwardscharleneNo ratings yet

- Ar ExportsDocument1 pageAr ExportsRais AlamNo ratings yet

- Welcome To Online Portal - Jharkhand Bijli Vitran Nigam Ltd.Document3 pagesWelcome To Online Portal - Jharkhand Bijli Vitran Nigam Ltd.prabhatNo ratings yet

- Badal Eco ProjectDocument8 pagesBadal Eco ProjectPriyank DosaniNo ratings yet

- Integrative Case - Relevant Cost PricingDocument4 pagesIntegrative Case - Relevant Cost PricingAudrey LouelleNo ratings yet

- Ricardo Theory of Land Rent ModelDocument4 pagesRicardo Theory of Land Rent ModelnyapnyapokeNo ratings yet

- Forexite TradeRoom User Guide enDocument52 pagesForexite TradeRoom User Guide enAggelos KotsokolosNo ratings yet

- Managementand Organisationalbehaviourlaurie JDocument7 pagesManagementand Organisationalbehaviourlaurie JPrabhamohanraj MohanrajNo ratings yet

- Template-IICIES-2016 - Paper No 37 (Sutarjo) - Entrepreneurial Spirit For The Growth of Start-Up A Literature StudyDocument7 pagesTemplate-IICIES-2016 - Paper No 37 (Sutarjo) - Entrepreneurial Spirit For The Growth of Start-Up A Literature StudySutarjo9No ratings yet

- IPCC Cost - Kol73cck4annhfcjovu6Document17 pagesIPCC Cost - Kol73cck4annhfcjovu6aryanraghuvanshi758No ratings yet

- Presented By:-: Sutripti DattaDocument44 pagesPresented By:-: Sutripti DattaSutripti BardhanNo ratings yet

- Petronas Media ResponseDocument5 pagesPetronas Media ResponseThe Vancouver SunNo ratings yet

- Income and ExpenditureDocument128 pagesIncome and Expenditurejoannejose2011No ratings yet

- Mantis Dock Leveler BrochureDocument2 pagesMantis Dock Leveler Brochurerochim_putech_126885No ratings yet

- CS Executive Old Syllabus ABC AnalysisDocument15 pagesCS Executive Old Syllabus ABC Analysisjanardhan CA,CSNo ratings yet

- State Level Vendor Development Programme MsmeDocument143 pagesState Level Vendor Development Programme MsmeShubham TyagiNo ratings yet