Professional Documents

Culture Documents

QS03 - Class Exercises Solution

QS03 - Class Exercises Solution

Uploaded by

lyk0tex0 ratings0% found this document useful (0 votes)

31 views3 pagesACCTG225

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentACCTG225

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

31 views3 pagesQS03 - Class Exercises Solution

QS03 - Class Exercises Solution

Uploaded by

lyk0texACCTG225

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Accounting 225 Quiz Section #3

Chapter 2-2 Class Exercises Solution

1. Slonaker Inc. has provided the following data concerning its maintenance

costs:

Management believes that maintenance cost is a mixed cost that depends on machine-hours.

Estimate the variable cost per machine-hour and the fixed cost per month using the high-low

method. Show your work!

Variable cost = Change in cost Change in activity

= ($30,388 - $30,078) (5,809 machine-hours - 5,717 machine-hours)

= $310 92 machine-hours

= $3.37 per machine-hour

Fixed cost element = Total cost - Variable cost element

= $30,078 - ($3.37 per machine-hour 5,717 machine-hours)

= $10,812

Accounting 225 Quiz Section #3

Chapter 2-2 Class Exercises Solution

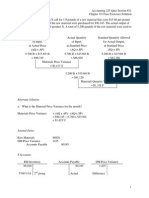

2. Pittman Corporation, a merchandising company, reported the following results for September:

a. Prepare a traditional format income statement for September.

b. Prepare a contribution format income statement for September.

Accounting 225 Quiz Section #3

Chapter 2-2 Class Exercises Solution

3. Whitman Corporation, a manufacturing company, reported sales of 7,400 units for May at a

selling price of $677 per unit. The cost of goods sold included $441 per unit and $500,000 of

fixed manufacturing overhead. The variable selling expense was $54 per unit. The total fixed

selling expense was $155,600. The variable administrative expense was $24 per unit and the total

fixed administrative expense was $370,400.

Assume beginning inventory was zero and units produced were equal to units sold. Also assume

that actual MOH was equal to applied MOH.

a. Prepare a contribution format income statement for May.

Whitman

Contribution Margin I/S

Revenue

VC: Var. COGS

Var. Selling Exp

Var. Admin Exp

Contribution Margin

FC: Fixed MOH

Fixed Selling Exp

Fixed Admin Exp

Net Operating Income (Loss)

$5,009,800

($3,263,400)

($399,600)

($177,600)

$1,169,200

($500,000)

($155,600)

($370,400)

$143,200

b. Prepare a traditional format income statement for May.

Whitman

Traditional I/S

Revenue

COGS

Gross Margin

Selling Exp

Admin Exp

Net Operating Income (Loss)

$5,009,800

($3,763,400)

$1,246,400

($555,200)

($548,000)

$143,200

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- QS11 - Class Exercises SolutionDocument8 pagesQS11 - Class Exercises Solutionlyk0tex100% (2)

- QS14 - Class Exercises SolutionDocument4 pagesQS14 - Class Exercises Solutionlyk0tex100% (1)

- QS16 - Class ExercisesDocument5 pagesQS16 - Class Exerciseslyk0texNo ratings yet

- QS16 - Class Exercises SolutionDocument5 pagesQS16 - Class Exercises Solutionlyk0texNo ratings yet

- QS15 - Class Exercises SolutionDocument5 pagesQS15 - Class Exercises Solutionlyk0tex100% (1)

- QS13 - Class Exercises SolutionDocument2 pagesQS13 - Class Exercises Solutionlyk0texNo ratings yet

- QS12 - Midterm 2 ReviewDocument5 pagesQS12 - Midterm 2 Reviewlyk0texNo ratings yet

- QS12 - Midterm 2 Review SolutionDocument7 pagesQS12 - Midterm 2 Review Solutionlyk0tex0% (1)

- QS08 - Class Exercises SolutionDocument5 pagesQS08 - Class Exercises Solutionlyk0texNo ratings yet

- QS06 - Class ExercisesDocument3 pagesQS06 - Class Exerciseslyk0texNo ratings yet

- QS06 - Class Exercises SolutionDocument2 pagesQS06 - Class Exercises Solutionlyk0texNo ratings yet

- QS09 - Class ExercisesDocument4 pagesQS09 - Class Exerciseslyk0texNo ratings yet

- QS09 - Class Exercises SolutionDocument4 pagesQS09 - Class Exercises Solutionlyk0tex100% (1)

- QS04 - Class ExercisesDocument3 pagesQS04 - Class Exerciseslyk0texNo ratings yet

- QS05 - Class Exercises SolutionDocument3 pagesQS05 - Class Exercises Solutionlyk0texNo ratings yet

- QS02 - Class ExercisesDocument3 pagesQS02 - Class Exerciseslyk0texNo ratings yet

- QS04 - Class Exercises SolutionDocument3 pagesQS04 - Class Exercises Solutionlyk0texNo ratings yet