Professional Documents

Culture Documents

Basel III Liquidity Norms

Uploaded by

aruti154Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basel III Liquidity Norms

Uploaded by

aruti154Copyright:

Available Formats

Basel III Liquidity Norms Addressing the ALM mismatches and its impact on Bank

Balance sheet

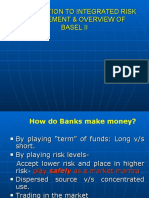

Banks are exposed to several risks in the course of their business, viz., credit

(default) risk, market risk (liquidity risk, interest rate risk, foreign exchange risk,

equity/commodity price risk) and operational (failed people, process, system) risk.

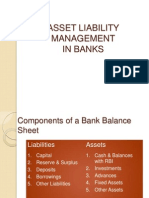

Asset Liability Management (ALM) is a distinct branch of market risk management,

predominantly covering management of Liquidity Risk and Interest Rate Risk. It is defined as

managing both assets and liabilities simultaneously for the purpose of minimizing the

adverse impact of interest rate movement, providing liquidity and enhancing the market

value of equity. It is also defined as planning procedure which accounts for all assets and

liabilities of a bank by rate, amount and maturity."

Introduction of Basel III liquidity norms has increased the significance of managing ALM

within Banks more efficiently. It has enforced more restrictions on leveraging ALM

mismatches for profit maximization. Banks need to revisit their strategies in managing ALM

duly supporting the top line and bottom line growth and also complying with the regulatory

requirements.

Project: To study the ALM profile of the Bank and analyze the impact of the Basel Liquidity

norms on Banks Balance sheet and suggest the strategies to be adopted.

Expected Outcome: The report should be able to answer the key issues discussed below

a)

b)

c)

d)

e)

Overview of ALM profile of Indian Banks

Key issues in ALM due to Basel III Norms

Expected impact on the lending and deposit profile

Profit optimisation strategies to be adopted

Scope and level of change in portfolio mix required to achieve the twin objectives

mentioned above

Skills Required:

a)

b)

c)

d)

Fare knowledge about Banking

Understanding about ALM/Basel Norms

Strong analytical skills and MS Excel skills

Knowledge about MS Access/VB would be desirable

Team Size: 3-4 members

Project duration: Maximum of one month

Point of Contact: Padmanabhan TM +91 93879 91400;

padmanabhantm@federalbank.co.in

You might also like

- The Basel II Risk Parameters: Estimation, Validation, Stress Testing - with Applications to Loan Risk ManagementFrom EverandThe Basel II Risk Parameters: Estimation, Validation, Stress Testing - with Applications to Loan Risk ManagementRating: 1 out of 5 stars1/5 (1)

- Mfi AssignmentDocument5 pagesMfi Assignmentdeepika singhNo ratings yet

- Basel I I I Presentation 1Document32 pagesBasel I I I Presentation 1madhusudhananNo ratings yet

- Asset Liability ManagementDocument35 pagesAsset Liability ManagementNiket Dattani100% (1)

- 1a. MeaningDocument33 pages1a. MeaningalpeshNo ratings yet

- Basel 3 PPT OfficialDocument32 pagesBasel 3 PPT OfficialNEERAJA N JNo ratings yet

- Index: Acknowledgement Executive Summary Chapter-1Document85 pagesIndex: Acknowledgement Executive Summary Chapter-1Kiran KatyalNo ratings yet

- Operational Risk ManagementDocument10 pagesOperational Risk ManagementUzair Shakeel100% (1)

- Liquidity Risks Management Practices by Commercial Banks in Bangladesh: An Empirical StudyDocument26 pagesLiquidity Risks Management Practices by Commercial Banks in Bangladesh: An Empirical StudyOve Kabir Eon 1731923No ratings yet

- Dissertation Main - Risk Management in BanksDocument87 pagesDissertation Main - Risk Management in Banksjesenku100% (1)

- Accenture Capital OptimizationDocument12 pagesAccenture Capital OptimizationAkshay Patrikar100% (1)

- Assessing The Value of Asset Liability Management PakistanDocument16 pagesAssessing The Value of Asset Liability Management PakistanVenkat IyerNo ratings yet

- (654180146) 282992783 Asset Liability Management in BanksDocument50 pages(654180146) 282992783 Asset Liability Management in BanksAnurag BajajNo ratings yet

- Archa - M180017MS Assgnmnet 2Document5 pagesArcha - M180017MS Assgnmnet 2Archa ShajiNo ratings yet

- Assest Liability Management On HeritageDocument76 pagesAssest Liability Management On Heritagearjunmba1196240% (1)

- Asset Liability Management: in BanksDocument44 pagesAsset Liability Management: in Bankssachin21singhNo ratings yet

- Executive SummaryDocument3 pagesExecutive SummaryArin ChattopadhyayNo ratings yet

- Accenture Tying The Knot Between Risk and Performance ManagementDocument16 pagesAccenture Tying The Knot Between Risk and Performance Managementkinky72100% (1)

- Banks Are in The Business of Managing Risk, Not Avoiding It ..Document9 pagesBanks Are in The Business of Managing Risk, Not Avoiding It ..Usaama AbdilaahiNo ratings yet

- Risk Management - Priorities For The Indian Banking SectorDocument7 pagesRisk Management - Priorities For The Indian Banking SectorLoyal QuadrasNo ratings yet

- TIOB - Asset & Liability Management For Banks in Africa 2021Document7 pagesTIOB - Asset & Liability Management For Banks in Africa 2021Alex KimboiNo ratings yet

- Basel IIDocument5 pagesBasel IIcozycapNo ratings yet

- Term PaperDocument21 pagesTerm PaperPooja JainNo ratings yet

- FIN-546 Financial Risk Management, 11713633, Roll No. A014, Section Q1E08, Ca 2Document24 pagesFIN-546 Financial Risk Management, 11713633, Roll No. A014, Section Q1E08, Ca 2Sam RehmanNo ratings yet

- Basel 2 NormsDocument11 pagesBasel 2 NormsAbhishek RajputNo ratings yet

- Risk and CapitalDocument14 pagesRisk and Capitalashwin thakurNo ratings yet

- Asset and Liability ManagementDocument57 pagesAsset and Liability ManagementMayur Federer Kunder100% (2)

- Basel Norms IIDocument3 pagesBasel Norms IImanoranjan838241No ratings yet

- Asset and Liability Management WIKIPEDIADocument18 pagesAsset and Liability Management WIKIPEDIAHAN SUKARMANNo ratings yet

- IBM 7 Risk DashboardsDocument17 pagesIBM 7 Risk Dashboardstribhuwan kharkwalNo ratings yet

- What Is ALM and ALCO PDFDocument2 pagesWhat Is ALM and ALCO PDFmackjblNo ratings yet

- Statement of Purspoe of The ReasearchDocument5 pagesStatement of Purspoe of The ReasearchSatyendra Kumar SinghNo ratings yet

- Asset Liability ManagementDocument18 pagesAsset Liability Managementmahesh19689No ratings yet

- 3 - FIG09104 Fin. Mark.& InsDocument49 pages3 - FIG09104 Fin. Mark.& InsMoud KhalfaniNo ratings yet

- This Report Is On Assets and Liability Management of Different BanksDocument22 pagesThis Report Is On Assets and Liability Management of Different BanksPratik_Gupta_3369No ratings yet

- Asset and Liability ManagementDocument12 pagesAsset and Liability ManagementBabalolaTemitopeNo ratings yet

- 1,2,3 - FullertonDocument4 pages1,2,3 - FullertonRonnyNo ratings yet

- Basel NormsDocument20 pagesBasel NormsAbhilasha Mathur100% (1)

- Methods of Quantifying Operational Risk in Banks: Theoretical ApproachesDocument7 pagesMethods of Quantifying Operational Risk in Banks: Theoretical ApproachesAJER JOURNALNo ratings yet

- Analysis OF Asset Liability Management Data OF BanksDocument32 pagesAnalysis OF Asset Liability Management Data OF BanksVinayakaMesthaNo ratings yet

- Risk Management Basel IIDocument74 pagesRisk Management Basel IImeenakshikmr09No ratings yet

- Asset Liability Management Canara BankDocument69 pagesAsset Liability Management Canara BankSanthosh Soma75% (4)

- Alm PDFDocument68 pagesAlm PDFkarthikNo ratings yet

- Literature ReviewDocument9 pagesLiterature ReviewAnkur Upadhyay0% (1)

- Article On Risk Management in BankDocument7 pagesArticle On Risk Management in Bankraihan175No ratings yet

- Tutorial 1 - Introduction To Treasury ManagementDocument2 pagesTutorial 1 - Introduction To Treasury ManagementTACN-4TC-19ACN Nguyen Thu HienNo ratings yet

- Basel 3Document8 pagesBasel 3Shuvo SDNo ratings yet

- Base 2Document20 pagesBase 2asifanisNo ratings yet

- Risk Management Framework: by Prof Santosh KumarDocument30 pagesRisk Management Framework: by Prof Santosh KumarAYUSH RAVINo ratings yet

- Moving Towards Basel Ii: Issues & ConcernsDocument36 pagesMoving Towards Basel Ii: Issues & Concernstejasdhanu786No ratings yet

- CMB Case Basel III AnswersDocument4 pagesCMB Case Basel III AnswersPranati AggarwalNo ratings yet

- Risk Management in Indian BanksDocument4 pagesRisk Management in Indian Bankssushilmishrapnb5704No ratings yet

- ALMDocument15 pagesALMGaurav PandeyNo ratings yet

- Asset - Liability Management System in Banks - Guidelines: 4. ALM Information SystemsDocument12 pagesAsset - Liability Management System in Banks - Guidelines: 4. ALM Information SystemsKevin VazNo ratings yet

- Oriental Bank of Commerce,: Head Office, DelhiDocument32 pagesOriental Bank of Commerce,: Head Office, DelhiAkshat SinghalNo ratings yet

- Asset Liability Management Canara BankDocument102 pagesAsset Liability Management Canara BankAkash Jadhav0% (1)

- Certified Banking Risks Professional (CBRP-FL)Document3 pagesCertified Banking Risks Professional (CBRP-FL)Makarand LonkarNo ratings yet

- Basel II Accord1Document7 pagesBasel II Accord1Alfaz AnsariNo ratings yet

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet