Professional Documents

Culture Documents

Heiken Ashi

Heiken Ashi

Uploaded by

David WalkerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Heiken Ashi

Heiken Ashi

Uploaded by

David WalkerCopyright:

Available Formats

Contact us

Page 1 of 2

What is Heikin-ashi?

"Trend is Your Friend", so Heikin-ashi may change your way to look at markets and charts...

In the summer of 2003 I was researching about Ichimoku technique and by chance (as it always happens) I came

across some outstanding charts. The trend was very clear, leaving no room for guessing. I was witnessing

Heikin-ashi charts or modified candlesticks.

To my surprise there was no other information available in books or on Internet so I decided to make it available

to all traders. In a matter of days I wrote an article for "Technical Analysis of Stocks and Commodities". The

article, published in February 2004 as a lead article generated very positive feedback from all corners of the

world. Financial sites, technical analysis software companies, and traders all over the world discussed and

implemented the technique.

This technique apparently has been developed by a Japanese trader who made a fortune using it and until then

was used only by Japanese traders.

Heikin-ashi is a visual instrument to assess trends, their direction, and strength. It is not the Holy Grail of

trading, but a great and simple tool to visualize the trend. It is strongly recommended to combine it with

technical indicators, patterns, and other trading techniques. The results will improve significantly.

How do we calculate modified OHLC values? Here is the answer:

http://www.educofin.com/ha/ha.html

3/21/2006

Contact us

Page 2 of 2

Modified OHLC

Definition

Modified Close

HaClose

(O+H+L+C)/4

Modified Open

HaOpen

(HaOpen(prev.bar) +

HaClose(prev.bar))/2

Modified High

HaHigh

Max(H,HaOpen,HaClose)

Modified Low

HaLow

Min(L,HaOpen,HaClose)

Heikin-ashi (modified candlesticks) follows six simple rules as shown in the table below:

Rule

Rule

description

Uptrend

Hollow candles

Downtrend

Filled candles

Strong

Hollow candles(1) with no lower

shadows

Uptrend

Strong

Filled candles(2) with no high

shadows

Downtrend

Consolidation

Change

Comments

of

Trend

A sequence of candles with small

bodies (hollow or filled) and with

upper and lower shadows

Similar to #5, but only one

occurrence. Not always reliable

as it may be also part of a

consolidation sequence.

Use these rules with the charts above and you'll see the difference... Which chart would you consult before

trading?

Each trader is continuously looking for that 'extra inch' which gives him or her an advantage in the markets.

Heikin-ashi offers you this opportunity. Take some time and consult the charts on the main page of our site.

It is not difficult to implement yourself this technique.

If you have questions about this original technique and its use, please contact me at ta@educofin.com. I will be

delighted to assist you.

Best regards and GREAT trades using modified candlesticks,

Dan Valcu

www.educofin.com

http://www.educofin.com/ha/ha.html

3/21/2006

You might also like

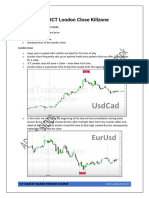

- The ICT London Close KillzoneDocument3 pagesThe ICT London Close Killzonehuda EcharkaouiNo ratings yet

- Datacom v1.0 - Single Choice Questions - Attempt ReviewDocument32 pagesDatacom v1.0 - Single Choice Questions - Attempt Reviewmike kato100% (1)

- MP KepplerDocument35 pagesMP KepplerBzasri Rao100% (1)

- Heiken Ashi Trading SystemDocument2 pagesHeiken Ashi Trading SystemlvcsterNo ratings yet

- Kanakadhara Stothram Telugu PDFDocument4 pagesKanakadhara Stothram Telugu PDFBzasri RaoNo ratings yet

- 004 DaveDocument4 pages004 DaveBzasri RaoNo ratings yet

- ICT ANIMATION Introduction 2019-2020Document27 pagesICT ANIMATION Introduction 2019-2020Kimmy Airam Ramos100% (2)

- Heikin AshiDocument3 pagesHeikin AshiYudha Wijaya50% (4)

- Heikin AshiChartsRDocument3 pagesHeikin AshiChartsRif1313100% (2)

- Section 1 Technical Analysis and The Dow TheoryDocument16 pagesSection 1 Technical Analysis and The Dow TheoryshadapaaakNo ratings yet

- The Isolation Approach To Elliott Wave Analysis: by Steve GriffithsDocument6 pagesThe Isolation Approach To Elliott Wave Analysis: by Steve Griffithssam2976No ratings yet

- Strategize Your Investment In 30 Minutes A Day (Steps)From EverandStrategize Your Investment In 30 Minutes A Day (Steps)No ratings yet

- Stochastic RSI - StochRSI DefinitionDocument9 pagesStochastic RSI - StochRSI Definitionselozok1No ratings yet

- ADX DMI Indicator - AflDocument2 pagesADX DMI Indicator - AflsureshNo ratings yet

- Edition 25 - Chartered 4th March 2011Document8 pagesEdition 25 - Chartered 4th March 2011Joel HewishNo ratings yet

- Relative Strength Index, or RSI, Is A Popular Indicator Developed by A Technical AnalystDocument2 pagesRelative Strength Index, or RSI, Is A Popular Indicator Developed by A Technical AnalystvvpvarunNo ratings yet

- (Ebook Trading) High Profit Candlestick Patterns and Conventional Technical AnalysisDocument4 pages(Ebook Trading) High Profit Candlestick Patterns and Conventional Technical AnalysisThie ChenNo ratings yet

- OUFT Fibonacci Ratio FinalDocument35 pagesOUFT Fibonacci Ratio FinalMohammad Aamir Perwaiz100% (1)

- Dynamic Zone RSIDocument2 pagesDynamic Zone RSIMiner candNo ratings yet

- How To Use RSI (Relative Strength Index)Document3 pagesHow To Use RSI (Relative Strength Index)paoloNo ratings yet

- Finding and Trading Rejection ZonesDocument3 pagesFinding and Trading Rejection ZonesalpepezNo ratings yet

- Enter High Low and CloseDocument4 pagesEnter High Low and CloseKeerthy VeeranNo ratings yet

- 2.3 - Average Directional Movement Index Rating (ADXR) - Forex Indicators GuideDocument2 pages2.3 - Average Directional Movement Index Rating (ADXR) - Forex Indicators Guideenghoss77No ratings yet

- Using Bollinger Bands To Gauge Trends - InvestopediaDocument9 pagesUsing Bollinger Bands To Gauge Trends - InvestopediarajritesNo ratings yet

- 2 Stochastic Swing TradesDocument3 pages2 Stochastic Swing TradesRon SiemensNo ratings yet

- Home Scalping Strategies RSI and CCI 5min Scalping SystemDocument6 pagesHome Scalping Strategies RSI and CCI 5min Scalping Systemspencer kaijaNo ratings yet

- Price Action Analysis Using The Wyckoff Trading MethodDocument2 pagesPrice Action Analysis Using The Wyckoff Trading MethodGuilherme OliveiraNo ratings yet

- Trading Manual: Indicator OverviewDocument101 pagesTrading Manual: Indicator OverviewMrugenNo ratings yet

- Channel Trading and Why Is It Important For This Strategy?Document10 pagesChannel Trading and Why Is It Important For This Strategy?Eko Aji WahyudinNo ratings yet

- Ichimoku Charts An Introduction To Ichimoku Kinko CloudsDocument34 pagesIchimoku Charts An Introduction To Ichimoku Kinko Cloudsamir mousaviNo ratings yet

- The Three Wise Men and The AlligatorDocument6 pagesThe Three Wise Men and The AlligatorroberNo ratings yet

- FIBO-ABCD Strategy V1.0Document5 pagesFIBO-ABCD Strategy V1.0Ariel Devulsky100% (1)

- Heikin AshiDocument3 pagesHeikin AshiLoni Scott100% (1)

- Fibonacci Golden Zone StrategyAAADocument34 pagesFibonacci Golden Zone StrategyAAAPs Christ Daniel Rocha MoralesNo ratings yet

- Oscillator Divergence and Fibonacci RetracementDocument14 pagesOscillator Divergence and Fibonacci RetracementAlex ClaudiuNo ratings yet

- Andy BushkDocument2 pagesAndy Bushklaxmicc67% (3)

- MACD RulesDocument1 pageMACD RulesJafrid NassifNo ratings yet

- Technical Trading StrategyDocument2 pagesTechnical Trading StrategyTommy LohNo ratings yet

- MWDDocument85 pagesMWDathos8000100% (2)

- Average Directional Index (ADX) - Forex Indicators GuideDocument7 pagesAverage Directional Index (ADX) - Forex Indicators GuidealpepezNo ratings yet

- Trading MethodDocument3 pagesTrading MethodkanannnNo ratings yet

- 123 of Bollinger Band1Document10 pages123 of Bollinger Band1rvsingh70No ratings yet

- KTS Free Ver 2Document16 pagesKTS Free Ver 2Nam NguyenNo ratings yet

- Aether Analytics Technical Conspectus April 11, 2014Document29 pagesAether Analytics Technical Conspectus April 11, 2014Alex Bernal, CMTNo ratings yet

- Macd PDFDocument15 pagesMacd PDFsaran21No ratings yet

- Combining RSI With RSIDocument39 pagesCombining RSI With RSIwayansiagaNo ratings yet

- Chapter 5 Part 1 - RSIDocument15 pagesChapter 5 Part 1 - RSIAjay KhadkaNo ratings yet

- Basic Fibonacci TradingDocument11 pagesBasic Fibonacci TradinghemsvgNo ratings yet

- Volume Analysis in Day Trading: Use Volume Trends To Improve Your ResultsDocument5 pagesVolume Analysis in Day Trading: Use Volume Trends To Improve Your ResultsHarish VoletiNo ratings yet

- HeikinAshi CandleStick Formulae For MetaStockDocument4 pagesHeikinAshi CandleStick Formulae For MetaStockRaviteja sNo ratings yet

- Moving Averages 2012Document6 pagesMoving Averages 2012Otmane Senhadji El RhaziNo ratings yet

- 10 Directional-Indicators-And-Timing-ToolsDocument5 pages10 Directional-Indicators-And-Timing-ToolsDeepak Paul TirkeyNo ratings yet

- 30 Min Simple SystemDocument2 pages30 Min Simple SystemRayzwanRayzmanNo ratings yet

- Step Two of The Wyckoff Method: Stock Market Trading StrategiesDocument3 pagesStep Two of The Wyckoff Method: Stock Market Trading StrategiesDeepak Paul TirkeyNo ratings yet

- Ichimoku CloudDocument44 pagesIchimoku Cloudbakchod Bojack100% (1)

- or Consider Only The 1 3 Bars. If First Bar Is Too Big For The Range Don't Consider ThatDocument1 pageor Consider Only The 1 3 Bars. If First Bar Is Too Big For The Range Don't Consider ThatAnupam MNo ratings yet

- Rediscover The Lost Art of Chart Reading Using VSADocument6 pagesRediscover The Lost Art of Chart Reading Using VSAsrdjan013No ratings yet

- (Trading) TILKIN MACD Divergences Com (PDF)Document3 pages(Trading) TILKIN MACD Divergences Com (PDF)diavolulNo ratings yet

- ElliottWave Diagonal Ending Expanding ReportDocument5 pagesElliottWave Diagonal Ending Expanding Reportpippo6056No ratings yet

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeFrom EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNo ratings yet

- The Empowered Forex Trader: Strategies to Transform Pains into GainsFrom EverandThe Empowered Forex Trader: Strategies to Transform Pains into GainsNo ratings yet

- Pascal TickDocument6 pagesPascal TickBzasri RaoNo ratings yet

- Market ProfileDocument3 pagesMarket ProfileBzasri RaoNo ratings yet

- Pacal Effective VolumeDocument1 pagePacal Effective VolumeBzasri RaoNo ratings yet

- ForumFaqsk TiosDocument48 pagesForumFaqsk TiosBzasri RaoNo ratings yet

- Renko Ashi Trading System 2Document18 pagesRenko Ashi Trading System 2pelex99100% (2)

- Amibroker ScriptingDocument2 pagesAmibroker ScriptingBzasri RaoNo ratings yet

- MFLib DLL API DocumentationDocument39 pagesMFLib DLL API DocumentationBzasri RaoNo ratings yet

- Equivolume Charting RevisitedDocument12 pagesEquivolume Charting RevisitedBzasri RaoNo ratings yet

- Market ProfileDocument4 pagesMarket ProfileBzasri Rao100% (1)

- Chqret CodeDocument2 pagesChqret CodeBzasri RaoNo ratings yet

- Secret of The Ages - Robert CollierDocument206 pagesSecret of The Ages - Robert CollieradamyeeNo ratings yet

- The Culture of ItalyDocument5 pagesThe Culture of Italyapi-455917888No ratings yet

- Bernina Deco 330 Sewing Machine Service ManualDocument31 pagesBernina Deco 330 Sewing Machine Service ManualiliiexpugnansNo ratings yet

- Low-Peak™ LPJ Class J 600Vac/300Vdc, 1-60A, Dual Element, Time-Delay FusesDocument4 pagesLow-Peak™ LPJ Class J 600Vac/300Vdc, 1-60A, Dual Element, Time-Delay FusesXin LiNo ratings yet

- OSH Safety CommitteeDocument34 pagesOSH Safety CommitteeSyed Haamid SaggaffNo ratings yet

- R0-Sliding Gate, Fence, LadderDocument90 pagesR0-Sliding Gate, Fence, LadderMariam MousaNo ratings yet

- Clo2 DIY Spreadsheets (MMS - CDS)Document1 pageClo2 DIY Spreadsheets (MMS - CDS)bagus918No ratings yet

- IT2102: Computer Systems: University of Colombo, Sri Lanka University of Colombo School of ComputingDocument11 pagesIT2102: Computer Systems: University of Colombo, Sri Lanka University of Colombo School of ComputingRavindu WeerasingheNo ratings yet

- Network Project PlanningDocument3 pagesNetwork Project PlanningChandan B BabariyaNo ratings yet

- PolygraphDocument8 pagesPolygraphMuskaan BindalNo ratings yet

- Effectiveness of Mulberry (Morus Alba) Leaves Extract in Healing Mild WoundsDocument10 pagesEffectiveness of Mulberry (Morus Alba) Leaves Extract in Healing Mild WoundsDustin LabsanNo ratings yet

- 2011 Jetta Specifications SheetDocument13 pages2011 Jetta Specifications SheetVolkswagen of AmericaNo ratings yet

- SIDS Small Islands Bigger StakesDocument32 pagesSIDS Small Islands Bigger StakesNalson MarkNo ratings yet

- HSE Induction.Document40 pagesHSE Induction.DEBASIS GUHA100% (1)

- Appraisal of Explosive Performance by Measurement of Velocity of Detonation (Vod) in Mines - DiscussionDocument9 pagesAppraisal of Explosive Performance by Measurement of Velocity of Detonation (Vod) in Mines - Discussionpartha das sharma100% (2)

- CalculationDocument12 pagesCalculationKim EllaNo ratings yet

- THE CICM AS PIONEERING AND DARING - StudentsDocument10 pagesTHE CICM AS PIONEERING AND DARING - StudentsJunmark CarbonelNo ratings yet

- Microbiology Section 3A Endorsement SheetDocument2 pagesMicrobiology Section 3A Endorsement SheetHades Luciferos PallonesNo ratings yet

- Fms Tech Company ProfileDocument42 pagesFms Tech Company ProfileDinesh Kumar DhundeNo ratings yet

- Lab 1 Ec501Document8 pagesLab 1 Ec501adamwaizNo ratings yet

- Inside Out - Critique PaperDocument2 pagesInside Out - Critique PaperLance LordNo ratings yet

- Importing Total Station DataDocument12 pagesImporting Total Station DataOrlando Francisco Cruz NarvaezNo ratings yet

- GST 662 v1Document392 pagesGST 662 v1Lavin Sharma roll no. 12No ratings yet

- Capstone Project - Guidelines On Synopsis ReportDocument2 pagesCapstone Project - Guidelines On Synopsis ReportYatin SanghviNo ratings yet

- AC3103 Seminar 19: Biosensors International Group (BIG) Valuation and Impairment Testing of IntangiblesDocument39 pagesAC3103 Seminar 19: Biosensors International Group (BIG) Valuation and Impairment Testing of IntangiblesTanisha GuptaNo ratings yet

- Iem Unit-IvDocument46 pagesIem Unit-IvChadaram Jagadish JagadishNo ratings yet

- Deleuze - From Sacher-Masoch To MasochismDocument10 pagesDeleuze - From Sacher-Masoch To Masochismzesalasze100% (2)

- Syllabus - CS8075 Data Warehousing and Data Mining L T P C 3 0 0 3Document1 pageSyllabus - CS8075 Data Warehousing and Data Mining L T P C 3 0 0 3RaghuNo ratings yet

- The Hereafter Maad PDFDocument327 pagesThe Hereafter Maad PDFSyed QalbeRazaNo ratings yet