Professional Documents

Culture Documents

Aging and Financial Inclusion Key Messages

Uploaded by

Center for Financial InclusionCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aging and Financial Inclusion Key Messages

Uploaded by

Center for Financial InclusionCopyright:

Available Formats

Aging and Financial Inclusion: An Opportunity

Aging and Financial Inclusion: An Opportunity

Key Messages

Within 25 years, the percent of the worlds population over age 60 will

nearly double. Aging%is%advancing%fast%in%developing%countries.%Within%15%years,%there%will%

be%1.3%billion%people%over%age%60%in%the%world,%constituting%13%percent%of%the%global%population.%

Over%60%percent%of%these%people%will%live%in%low%and%middle%income%economies,%and%the%majority%

of%them%will%be%women.%Rapid%population%aging%creates%challenges%and%opportunities%that%

demand%a%response%from%public%and%private%sectors.%

Older people at the base of the pyramid have varied and unpredictable

incomes. Financial services can facilitate the income strategies of older

people. While%data%are%limited,%we%know%that%incomes%later%in%life%come%from%several%sources.%

People%rely%on%pensions,%family,%employment,%small%and%micro%businesses,%assets,%and%savings.%

Many%of%these%sources%are%informal.%A%major%role%of%financial%services%in%aging%is%to%facilitate%

these%basic%income%strategies.%This%includes%supporting%strategies%in%younger%years%to%prepare%

people%for%later%life,%like%savings%and%pensions.%Financial%services%also%play%an%important%role%in%

managing%dayHtoHday%variations%in%income%and%expenses,%particularly%when%emergencies%arise.%%

Social Pensions should extend to cover everyone, especially those in the

informal sector. NonHcontributory%social%pensions%provided%by%governments%create%an%

income%floor%that%assures%recipients%that%they%can%regularly%meet%at%least%some%of%their%basic%

needs.%Governments%should%work%to%cover%a%higher%proportion%of%their%lower%income%

populations%with%such%benefits.%

!

People at the base of the pyramid need means to contribute to pensions

throughout their lifetimes. Social%pensions%are%generally%insufficient%to%meet%all%

expenditure%needs%in%older%age.%Particularly%in%countries%with%large%informal%populations,%major%

portions%of%the%labor%force%make%no%contributions%to%the%pension%scheme,%but%many%could%%and%

would%%do%so%if%given%a%chance.%However,%convenient%mechanisms%for%collecting%contributions%

have%been%costHprohibitive.%This%is%changing.%New%technologies%for%P2G%payments%could%provide%

convenient%and%inexpensive%means,%if%pension%providers%and%payments%service%providers%

collaborate.%%

!

!

Linking pensions with other financial instruments will promote deeper

financial inclusion for people. For%many%older%people,%pensions%are%their%only%contact%

with%formal%financial%services.%Pensions,%when%seen%as%an%onHramp%to%financial%services,%can%be%

linked%to%bank%accounts,%used%as%collateral%for%credit,%or%saved.%Such%linkages%and%bundling%

requires%partnerships%between%public%and%private%sector%players.%

!

Lenders and insurers should raise or eliminate the age caps that often keep

older people from accessing formal credit and insurance in light of new

demographic realities, individual variation and fairness. In%the%absence%of%

information%on%which%to%base%credit%or%insurance%decisions,%providers%often%rely%on%age%as%a%

proxy%for%risk.%Reported%age%caps%can%be%as%low%as%55,%and%disproportionately%disadvantage%

women,%who%live%longer%than%men,%on%average.%Updated%actuarial%tables,%alternative%credit%

scoring,%flexible%retirement%ages,%and%creative%collateral%could%provide%solutions%to%the%problem%

of%age%caps.%

!

Aging and Financial Inclusion: An Opportunity

Financial institutions can improve their interactions with older people and

integrate increased client protection and financial education, to increase

trust. Lack%of%trust%is%one%of%the%primary%barriers%that%financial%institutions%face%when%working%

with%older%customers.%Earning%trust%is%not%an%easy%process,%but%tailoring%customer%services%to%

the%needs%of%older%people%and%ensuring%adequate%client%protection%is%a%start.%Recognizing%that%

older%people%may%be%more%susceptible%to%mistakes%and%abuse%in%financial%services,%it%is%especially%

important%to%ensure%that%effective%monitoring%and%complaint%mechanisms%extend%to%them,%and%

to%integrate%financial%capabilityHbuilding%elements%into%product%design%and%delivery.%

!

!

!

!

This summary is based on Aging and Financial Inclusion: An Opportunity, a report that examines the

unmet financial needs of the rapidly growing global aging population, particularly in the developing

world. The report presents the findings of the joint project on aging and financial inclusion from the

Center for Financial Inclusion at Accion and HelpAge International with support from the MetLife

Foundation. The project was prompted by the demographic review carried out as part of CFIs Financial

Inclusion 2020 project, which drew attention to the rapidly aging global population and to the

immediate challenges aging poses, particularly in middle income countries. CFI joined forces with

HelpAge because of HelpAges deep knowledge about global aging issues.

About the Center for Financial

Inclusion at Accion

The Center for Financial Inclusion at Accion (CFI)

is an action-oriented think tank working toward

full global financial inclusion. Constructing a

financial inclusion sector that reaches everyone

with quality services will require the combined

efforts of many actors. CFI contributes to full

inclusion by collaborating with sector participants

to tackle challenges beyond the scope of any one

actor, using tools that include research,

convening, capacity building, and

communications. For more, visit

www.centerforfinancialinclusion.org

About HelpAge

HelpAge International is a non-profit organization and a

global network of over 100 affiliated organizations in 70

developing countries, which work together to improve

the lives of older people. We work to ensure that older

people are included in international development and

have access to emergency relief, income security,

health services and human rights. HelpAge USA, the

US-based affiliate, raises awareness about global

aging and works with our global network of affiliates

and partners to implement programs and policies that

address the needs of older people in the worlds

poorest communities. To learn more about HelpAge,

visit www.helpageusa.org.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Microfinance Industry Needs An Infrastructure FixDocument16 pagesThe Microfinance Industry Needs An Infrastructure FixCenter for Financial InclusionNo ratings yet

- FI2020 Global Forum Program BookDocument24 pagesFI2020 Global Forum Program BookCenter for Financial InclusionNo ratings yet

- By The Numbers: Benchmarking Progress Toward Financial InclusionDocument40 pagesBy The Numbers: Benchmarking Progress Toward Financial InclusionCenter for Financial Inclusion100% (1)

- FI2020 Global Forum - Agenda As of Oct 17Document5 pagesFI2020 Global Forum - Agenda As of Oct 17Center for Financial InclusionNo ratings yet

- FI2020 Roadmap PrinciplesDocument2 pagesFI2020 Roadmap PrinciplesCenter for Financial Inclusion100% (1)

- Technology Enables Full Financial Inclusion: Financial Inclusion 2020 Technology-Enabled Business Models Working GroupDocument16 pagesTechnology Enables Full Financial Inclusion: Financial Inclusion 2020 Technology-Enabled Business Models Working GroupCenter for Financial InclusionNo ratings yet

- FI2020 Global Forum - Agenda As of Oct 17Document5 pagesFI2020 Global Forum - Agenda As of Oct 17Center for Financial InclusionNo ratings yet

- FI2020 Global Forum - Agenda As of Oct 8Document4 pagesFI2020 Global Forum - Agenda As of Oct 8Center for Financial InclusionNo ratings yet

- Enabling Financial Capability Along The Road To Financial InclusionDocument18 pagesEnabling Financial Capability Along The Road To Financial InclusionCenter for Financial InclusionNo ratings yet

- Addressing Customer Needs For Full Financial Inclusion: Financial Inclusion 2020 Addressing Customer Needs Working GroupDocument16 pagesAddressing Customer Needs For Full Financial Inclusion: Financial Inclusion 2020 Addressing Customer Needs Working GroupCenter for Financial InclusionNo ratings yet

- Credit Reporting For Full Financial Inclusion: Financial Inclusion 2020 Credit Reporting Working GroupDocument14 pagesCredit Reporting For Full Financial Inclusion: Financial Inclusion 2020 Credit Reporting Working GroupCenter for Financial InclusionNo ratings yet

- Technology Enables Full Financial Inclusion: Financial Inclusion 2020 Technology-Enabled Business Models Working GroupDocument16 pagesTechnology Enables Full Financial Inclusion: Financial Inclusion 2020 Technology-Enabled Business Models Working GroupCenter for Financial InclusionNo ratings yet

- Addressing Customer Needs For Full Financial Inclusion: Financial Inclusion 2020 Addressing Customer Needs Working GroupDocument16 pagesAddressing Customer Needs For Full Financial Inclusion: Financial Inclusion 2020 Addressing Customer Needs Working GroupCenter for Financial InclusionNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- How To Control A DC Motor With An ArduinoDocument7 pagesHow To Control A DC Motor With An Arduinothatchaphan norkhamNo ratings yet

- Address MappingDocument26 pagesAddress MappingLokesh KumarNo ratings yet

- Linux For Beginners - Shane BlackDocument165 pagesLinux For Beginners - Shane BlackQuod Antichristus100% (1)

- Microwave Drying of Gelatin Membranes and Dried Product Properties CharacterizationDocument28 pagesMicrowave Drying of Gelatin Membranes and Dried Product Properties CharacterizationDominico Delven YapinskiNo ratings yet

- Escario Vs NLRCDocument10 pagesEscario Vs NLRCnat_wmsu2010No ratings yet

- The Art of Blues SolosDocument51 pagesThe Art of Blues SolosEnrique Maldonado100% (8)

- 90FF1DC58987 PDFDocument9 pages90FF1DC58987 PDFfanta tasfayeNo ratings yet

- SILABO 29-MT247-Sensors-and-Signal-ConditioningDocument2 pagesSILABO 29-MT247-Sensors-and-Signal-ConditioningDiego CastilloNo ratings yet

- Gabby Resume1Document3 pagesGabby Resume1Kidradj GeronNo ratings yet

- Polytropic Process1Document4 pagesPolytropic Process1Manash SinghaNo ratings yet

- Zelio Control RM35UA13MWDocument3 pagesZelio Control RM35UA13MWSerban NicolaeNo ratings yet

- Microsoft Word - Claimants Referral (Correct Dates)Document15 pagesMicrosoft Word - Claimants Referral (Correct Dates)Michael FourieNo ratings yet

- Doas - MotorcycleDocument2 pagesDoas - MotorcycleNaojNo ratings yet

- M2 Economic LandscapeDocument18 pagesM2 Economic LandscapePrincess SilenceNo ratings yet

- Lending OperationsDocument54 pagesLending OperationsFaraz Ahmed FarooqiNo ratings yet

- Vangood Quotation - Refrigerator Part - 2023.3.2Document5 pagesVangood Quotation - Refrigerator Part - 2023.3.2Enmanuel Jossue Artigas VillaNo ratings yet

- Lab 6 PicoblazeDocument6 pagesLab 6 PicoblazeMadalin NeaguNo ratings yet

- ESG NotesDocument16 pagesESG Notesdhairya.h22No ratings yet

- TSR KuDocument16 pagesTSR KuAngsaNo ratings yet

- CLAT 2014 Previous Year Question Paper Answer KeyDocument41 pagesCLAT 2014 Previous Year Question Paper Answer Keyakhil SrinadhuNo ratings yet

- Basic of An Electrical Control PanelDocument16 pagesBasic of An Electrical Control PanelJim Erol Bancoro100% (2)

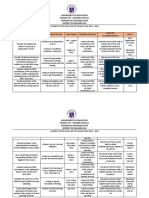

- Weekly Learning PlanDocument2 pagesWeekly Learning PlanJunrick DalaguitNo ratings yet

- DC Servo MotorDocument6 pagesDC Servo MotortaindiNo ratings yet

- Strobostomp HD™ Owner'S Instruction Manual V1.1 En: 9V DC Regulated 85maDocument2 pagesStrobostomp HD™ Owner'S Instruction Manual V1.1 En: 9V DC Regulated 85maShane FairchildNo ratings yet

- Ikea AnalysisDocument33 pagesIkea AnalysisVinod BridglalsinghNo ratings yet

- PFI High Flow Series Single Cartridge Filter Housing For CleaningDocument2 pagesPFI High Flow Series Single Cartridge Filter Housing For Cleaningbennypartono407No ratings yet

- Appendix - 5 (Under The Bye-Law No. 19 (B) )Document3 pagesAppendix - 5 (Under The Bye-Law No. 19 (B) )jytj1No ratings yet

- PC210 8M0Document8 pagesPC210 8M0Vamshidhar Reddy KundurNo ratings yet

- Forecasting of Nonlinear Time Series Using Artificial Neural NetworkDocument9 pagesForecasting of Nonlinear Time Series Using Artificial Neural NetworkranaNo ratings yet

- Action Plan Lis 2021-2022Document3 pagesAction Plan Lis 2021-2022Vervie BingalogNo ratings yet