Professional Documents

Culture Documents

CS Executive M-II P-4 Old

CS Executive M-II P-4 Old

Uploaded by

Prasad PunupuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CS Executive M-II P-4 Old

CS Executive M-II P-4 Old

Uploaded by

Prasad PunupuCopyright:

Available Formats

Free of Cost

ISBN: 978-93-5034-433-0

Appendix

CS Executive Programme Module-II

(Solution upto June - 2012 & Questions of Dec - 2012 Included)

Paper - 4: Company Law

Chapter - 1: Introduction

2012 - June [1] {C} (ii)

A company is an artificial person. It is formed and registered under the Companies Act.

It has distinct legal entity. Its personality is separate and distinct from its members. In

some cases company is treated as a natural person.

(a) It can make contract.

(b) Open a bank account.

(c) Can sue and be sued by others.

(d) It can also own property by its own name.

The companys money and property belong to the company and not the property

of members.

Similarly, the members personal property can not be held liable to pay the creditors

of the company. LEADING CASE in this point is-Saloman Vs. Saloman company Ltd.

has clearly a established the principle that once a company has been validly constituted

under the Companies Act, 1956, it becomes a legal person distinct from its members

and for this perpose it is immaterial whether any member has a large or small proportion

of the share, and whether he holds those shares beneficially or as a mere trustee.

Hence, shareholders can not be held liable for the acts of the company.

2012 - June [5] (d)

Section 11 provides that no company association or partnership consisting of more than

10 persons in case of banking business or more than 20 persons in case of any other

business which has its objects the acquisition of gain can be legally formed unless it is

registered under the Companies Act or is formed in pursuance of some other Indian law

if they are not so registered they would be considered an illegal association.

1

You might also like

- Nitya Pooja Complete VidhiDocument152 pagesNitya Pooja Complete Vidhihersh_vardhan87% (23)

- Comparison With Other Business Structures by Brian ThuraniraDocument3 pagesComparison With Other Business Structures by Brian ThuraniraRayoh SijiNo ratings yet

- Commercial LawDocument19 pagesCommercial LawTAZWARUL ISLAMNo ratings yet

- Busy Association BeckyDocument11 pagesBusy Association BeckySamuel L ENo ratings yet

- Part - IIDocument15 pagesPart - IIAnkur DixitNo ratings yet

- Companies Act 2013: Meaning of A CompanyDocument7 pagesCompanies Act 2013: Meaning of A CompanyMohit RanaNo ratings yet

- Types of Legal Business Structure in IndiaDocument18 pagesTypes of Legal Business Structure in IndiaROHAN SHELKENo ratings yet

- Answer 1Document6 pagesAnswer 1akshat brahmchariNo ratings yet

- What Is A CompanyDocument6 pagesWhat Is A CompanyAayushman SharmaNo ratings yet

- Introduction To CompanyDocument15 pagesIntroduction To CompanyShalu ThakurNo ratings yet

- Introduction To Company Law Note 1 of 7 NotesDocument30 pagesIntroduction To Company Law Note 1 of 7 NotesMusbri Mohamed100% (1)

- Company Law NotesDocument67 pagesCompany Law NotesBrian Okuku OwinohNo ratings yet

- Companies Law NotesDocument13 pagesCompanies Law NotesJyotsana GangwarNo ratings yet

- Unit 1Document23 pagesUnit 1Nikhilesh RanaNo ratings yet

- Lecture 3 Legal Personality of A Company.2023Document9 pagesLecture 3 Legal Personality of A Company.2023Faint MokgokongNo ratings yet

- Company Under The Companies Act 2013Document14 pagesCompany Under The Companies Act 2013Shubham saxenaNo ratings yet

- Business Law - Utkarsh BalamwarDocument6 pagesBusiness Law - Utkarsh BalamwarMamta BalamwarNo ratings yet

- Companies Act 2013 FullDocument46 pagesCompanies Act 2013 FullTisha JainNo ratings yet

- Assignment: Corporate Law-I Name: Adnan Yousuf Ba. LL.B 6 Semester (Regular) Roll No. 02Document13 pagesAssignment: Corporate Law-I Name: Adnan Yousuf Ba. LL.B 6 Semester (Regular) Roll No. 02saqib nisarNo ratings yet

- Unit 01 Introduction To Company: New Alliance First Grade College, CrpatnaDocument86 pagesUnit 01 Introduction To Company: New Alliance First Grade College, CrpatnaningegowdaNo ratings yet

- Introduction To Research Regarding Corporate VeilDocument12 pagesIntroduction To Research Regarding Corporate VeilFaisal AshfaqNo ratings yet

- Commercial TransactionsDocument191 pagesCommercial TransactionsDavid MunyuaNo ratings yet

- 2022 Chapter 2 Companies Legal Personality Mercantile LawDocument30 pages2022 Chapter 2 Companies Legal Personality Mercantile LawKgotso JacobNo ratings yet

- Company 1Document48 pagesCompany 1mcyhndhieNo ratings yet

- Law NotesDocument58 pagesLaw NotesSHERIN REGI VARUGHESE 2022040No ratings yet

- Limited Liability Partnerships in KenyaDocument5 pagesLimited Liability Partnerships in KenyaStephen Mallowah100% (1)

- Introduction To Company PDFDocument8 pagesIntroduction To Company PDFhasan alNo ratings yet

- BL - 3Document292 pagesBL - 3akashkumarNo ratings yet

- MRL2601-examination QaDocument10 pagesMRL2601-examination Qashyanne muruganNo ratings yet

- BUS 360 - Lecture 11Document10 pagesBUS 360 - Lecture 11JabirNo ratings yet

- Business Organisation ProjectDocument8 pagesBusiness Organisation ProjectGAME SPOT TAMIZHANNo ratings yet

- BL Unit VDocument13 pagesBL Unit VkhurshidsharifNo ratings yet

- Chapter 3 - Company Act: Industrial Law & Accounting (Hum-2231)Document7 pagesChapter 3 - Company Act: Industrial Law & Accounting (Hum-2231)Asif HossenNo ratings yet

- Term Paper - Company Law - FinalDocument37 pagesTerm Paper - Company Law - Finaltejcd1234No ratings yet

- Report On Company LawDocument35 pagesReport On Company LawacidreignNo ratings yet

- Business Associates Assign 2Document8 pagesBusiness Associates Assign 2Michael M. MukololoNo ratings yet

- Assignment On Company LawDocument15 pagesAssignment On Company Lawতাসমুন ইসলাম প্রান্তNo ratings yet

- What Is A Company?: Instructor: Dr. Manaswee K SamalDocument4 pagesWhat Is A Company?: Instructor: Dr. Manaswee K SamalSahoo SKNo ratings yet

- Difference Between LLP & Partnership and Between Private and Public Company - ERO0240651 - ITT Batch 606Document13 pagesDifference Between LLP & Partnership and Between Private and Public Company - ERO0240651 - ITT Batch 606Siddharth Shankar PaikrayNo ratings yet

- Mercantile LawDocument21 pagesMercantile LawPriyanka BarikNo ratings yet

- Overview On The Companies Act, 1994Document44 pagesOverview On The Companies Act, 1994Tawsif MahbubNo ratings yet

- Basic Features of A CompanyDocument3 pagesBasic Features of A CompanyAyesha HaroonNo ratings yet

- Company Law FullDocument100 pagesCompany Law Fullkamranmohsin mullaNo ratings yet

- p3 m2 Different Types of BorrowersDocument4 pagesp3 m2 Different Types of BorrowersMadhavKishore100% (1)

- 02 Forms of OrganizationDocument19 pages02 Forms of OrganizationAkhilesh KumarNo ratings yet

- Assignment On CompanyDocument8 pagesAssignment On CompanyHossainmoajjemNo ratings yet

- Assignment: Submitted by Navami K.V Roll No: 54 CLASS 5Document13 pagesAssignment: Submitted by Navami K.V Roll No: 54 CLASS 5sanjanaNo ratings yet

- Notes On Companies Act 1956Document87 pagesNotes On Companies Act 1956Pranay KinraNo ratings yet

- Company Law ProjectDocument28 pagesCompany Law ProjectpushpanjaliNo ratings yet

- Company Law NoteDocument23 pagesCompany Law NotegopikaNo ratings yet

- Separate Legal Identity: Section 34 (2) of The Companies Act, 2013Document16 pagesSeparate Legal Identity: Section 34 (2) of The Companies Act, 2013Manju SujayNo ratings yet

- Business Law Continuous AssessmentDocument11 pagesBusiness Law Continuous AssessmentElly FirahNo ratings yet

- Corporate Veil:: Concept of Limited LiabilityDocument9 pagesCorporate Veil:: Concept of Limited LiabilityRohan PatelNo ratings yet

- 4 TH ChapterDocument15 pages4 TH ChapterKodi NadarNo ratings yet

- Notes of Formation of CompaniesDocument8 pagesNotes of Formation of Companiesjosh mukwendaNo ratings yet

- Company LawDocument5 pagesCompany Lawshreesindhu54No ratings yet

- Company Lawbba 5TH SemDocument29 pagesCompany Lawbba 5TH SemAB ROCKSNo ratings yet

- Corp Acc-2 - Chap1-5-Material Updated-Sep2013Document64 pagesCorp Acc-2 - Chap1-5-Material Updated-Sep2013Pavan Kumar MylavaramNo ratings yet

- All About Principle of Lifting of Corporate Veil Under Companies ActDocument10 pagesAll About Principle of Lifting of Corporate Veil Under Companies ActPria MakandaNo ratings yet

- Ducon Technical Proposal - Rev00 - 15.01.2018Document24 pagesDucon Technical Proposal - Rev00 - 15.01.2018Swati Rohan Jadhav100% (1)

- Compliance Management Audit Due Diligence PAPER 3 G 1Document638 pagesCompliance Management Audit Due Diligence PAPER 3 G 1Swati Rohan JadhavNo ratings yet

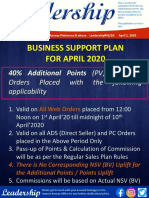

- Business Support Plan For April 2020: LeadershipDocument3 pagesBusiness Support Plan For April 2020: LeadershipSwati Rohan JadhavNo ratings yet

- Tender DocumentsDocument83 pagesTender DocumentsSwati Rohan JadhavNo ratings yet

- India Post Payments Bank Limited Income Tax Computation For The Financial Year 2019-2020Document4 pagesIndia Post Payments Bank Limited Income Tax Computation For The Financial Year 2019-2020Swati Rohan JadhavNo ratings yet

- ENPS - Contribution ManualDocument31 pagesENPS - Contribution ManualSwati Rohan JadhavNo ratings yet

- Rudra SuktaDocument9 pagesRudra SuktaSwati Rohan JadhavNo ratings yet

- Theory and Practice of Forex Treasury MGT Module IIDocument372 pagesTheory and Practice of Forex Treasury MGT Module IIK MuruganNo ratings yet

- Sr. No POP Reg No POP NameDocument8 pagesSr. No POP Reg No POP NameSwati Rohan JadhavNo ratings yet

- Anual ReportDocument210 pagesAnual ReportSwati Rohan JadhavNo ratings yet

- Nakshatra Table Free-VersionDocument3 pagesNakshatra Table Free-VersionSwati Rohan JadhavNo ratings yet

- Urn ProblemsDocument4 pagesUrn ProblemsSwati Rohan JadhavNo ratings yet

- Chandra NamaskarDocument8 pagesChandra NamaskarSwati Rohan JadhavNo ratings yet