Professional Documents

Culture Documents

REVENUE MEMORANDUM ORDER NO. 22-2008 Issued On June 10, 2008 Prescribes

Uploaded by

Gedan Tan0 ratings0% found this document useful (0 votes)

3 views1 pageASDF

Original Title

40827rmo08_22

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentASDF

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageREVENUE MEMORANDUM ORDER NO. 22-2008 Issued On June 10, 2008 Prescribes

Uploaded by

Gedan TanASDF

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

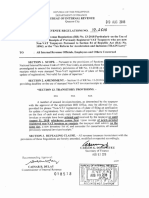

REVENUE MEMORANDUM ORDER NO.

22-2008 issued on June 10, 2008 prescribes

the guidelines for the short-audit of the 1st Quarter Value-Added Tax (VAT) for taxable year

2008 of taxpayers under the jurisdiction of the Large Taxpayers Service and the Regional

Offices.

The VAT liabilities for the 1st Quarter of taxable year 2008 of taxpayers, who were

selected for audit/verification based on the selection criteria pursuant to Revenue

Memorandum Order (RMO) No. 20-2008, shall be audited/verified by the concerned

investigating offices.

Letters of Authority (LAs) shall be issued for large taxpayers selected for audit, while

LAs shall be issued to cover the audit of VAT liabilities of regional taxpayers based on the

following thresholds:

a. Gross sales/revenues/receipts exceeding P

= 5,000,000.00 for Revenue Region Nos.

5, 6, 7 and 8 (Valenzuela, Manila, Quezon City and Makati), except RDO Nos.

35, 36, and 37 (Romblon, Puerto Princesa and San Jose, Occidental Mindoro)

b. Gross sales/revenues/receipts exceeding P

= 2,000,000.00 for all other Regions,

including RDO Nos. 35, 36, and 37 (Romblon, Puerto Princesa and San Jose,

Occidental Mindoro)

Tax Verification Notices (TVNs) shall be issued to cover the verification of VAT

liabilities of regional taxpayers as follows:

a. Gross sales/revenues/receipts amounting to P

= 5,000,000.00 and below for

Revenue Region Nos. 5, 6, 7 and 8 (Valenzuela, Manila, Quezon City and

Makati), except RDO Nos. 35, 36, and 37 (Romblon, Puerto Princesa and San

Jose, Occidental Mindoro)

b. Gross sales/revenues/receipts amounting to P

= 2,000,000.00 and below for all other

Regions, including RDO Nos. 35, 36, and 37 (Romblon, Puerto Princesa and San

Jose, Occidental Mindoro)

Based on the aforementioned thresholds, the Regional Director shall issue the

necessary LAs for cases under his jurisdiction while TVNs shall be signed by the Revenue

District Officers.

You might also like

- Income Tax - TRAINDocument27 pagesIncome Tax - TRAINSteveNo ratings yet

- Tech. Used by The BIR in Tax Audit and Investigation of Tax Payers (10.29.13)Document131 pagesTech. Used by The BIR in Tax Audit and Investigation of Tax Payers (10.29.13)Mark Lord Morales Bumagat100% (1)

- Rednotes Remedial LawDocument77 pagesRednotes Remedial LawAnthony Rupac Escasinas100% (2)

- Transmittal Letter: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument2 pagesTransmittal Letter: Republic of The Philippines Department of Finance Bureau of Internal RevenueLayne Kendee100% (2)

- Tax1 Dimaampao Lecture NotesDocument61 pagesTax1 Dimaampao Lecture NotesSui100% (1)

- 82202BIR Form 1702-MXDocument9 pages82202BIR Form 1702-MXRen A EleponioNo ratings yet

- Republic Act No. 10963: Tax Reform For Acceleration and Inclusion (Train)Document24 pagesRepublic Act No. 10963: Tax Reform For Acceleration and Inclusion (Train)Johayra AbbasNo ratings yet

- Jurisdiction ReviewerDocument96 pagesJurisdiction ReviewerGedan TanNo ratings yet

- Issues, Problems and Solutions in Tax Audit and Investigation (1-10-13)Document184 pagesIssues, Problems and Solutions in Tax Audit and Investigation (1-10-13)marygrace_apaitan100% (2)

- Train I.ppt - Vers. 10.21.2018Document103 pagesTrain I.ppt - Vers. 10.21.2018Ellard28 saturnoNo ratings yet

- Islamic Directorate of The Philippines v. CADocument2 pagesIslamic Directorate of The Philippines v. CAGedan TanNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- The Heirs of Pedro Escanlar Et Al v. CA 281 Scra 176 (1997)Document3 pagesThe Heirs of Pedro Escanlar Et Al v. CA 281 Scra 176 (1997)Gedan TanNo ratings yet

- Taxation WorkshopDocument83 pagesTaxation WorkshopLaw_Portal100% (1)

- RR 12-2007 PDFDocument7 pagesRR 12-2007 PDFnaldsdomingoNo ratings yet

- Labor Cases - Illegal DismissalDocument117 pagesLabor Cases - Illegal DismissalGedan TanNo ratings yet

- RR 1 - 1998Document3 pagesRR 1 - 1998Lady Ann CayananNo ratings yet

- Heirs of Luis Bacus Vs Court of Appeals, Spouses Faustino Duray and Victoriana DurayDocument2 pagesHeirs of Luis Bacus Vs Court of Appeals, Spouses Faustino Duray and Victoriana DurayGedan TanNo ratings yet

- RMO No.34-2018Document3 pagesRMO No.34-2018kkabness101 YULNo ratings yet

- 1999 Audit Program For - Revenue - DistrictDocument35 pages1999 Audit Program For - Revenue - Districtelizeymontes0209No ratings yet

- Digest of 1998 Revenue Memorandum OrdersDocument15 pagesDigest of 1998 Revenue Memorandum OrdersTenten ConanNo ratings yet

- 1998 RR DigestDocument16 pages1998 RR DigestJeremeh PenarejoNo ratings yet

- Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument1 pageRepublic of The Philippines Department of Finance Bureau of Internal Revenueapi-247793055No ratings yet

- 2006 RMO 18-2006 LOA CriteriaDocument3 pages2006 RMO 18-2006 LOA Criteriaedong the greatNo ratings yet

- Sanggunian Provincial, City and Municipal Treasurers and AllDocument4 pagesSanggunian Provincial, City and Municipal Treasurers and AllCarlos RabagoNo ratings yet

- SubjectDocument2 pagesSubjectapi-247793055No ratings yet

- RMC No 80-16 Lifting of Suspension of June 2016 RegulationsDocument3 pagesRMC No 80-16 Lifting of Suspension of June 2016 RegulationsGil PinoNo ratings yet

- Revenue Memorandum CircularDocument2 pagesRevenue Memorandum CircularIsmael NogoyNo ratings yet

- TAX2Document2 pagesTAX2Nicolyn Rae EscalanteNo ratings yet

- 02-2004 Vat Philippine Port Authority PpaDocument3 pages02-2004 Vat Philippine Port Authority Ppaapi-247793055No ratings yet

- Revenue Memorandum Order No. 20-2012: Bureau of Internal RevenueDocument6 pagesRevenue Memorandum Order No. 20-2012: Bureau of Internal RevenueGedan TanNo ratings yet

- RR No. 34-2020 v2Document3 pagesRR No. 34-2020 v2JejomarNo ratings yet

- RMO No.26-2018Document4 pagesRMO No.26-2018James Salviejo PinedaNo ratings yet

- RMO No. 004-16Document10 pagesRMO No. 004-16cool_peachNo ratings yet

- RMC No 23-2012 - Withholding of TaxesDocument7 pagesRMC No 23-2012 - Withholding of TaxesJOHAYNIENo ratings yet

- A State Imposes A Sales Tax of 6 Percent The: Unlock Answers Here Solutiondone - OnlineDocument1 pageA State Imposes A Sales Tax of 6 Percent The: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- RR 12-2007Document6 pagesRR 12-2007Irish BalabaNo ratings yet

- Rmo 1981Document228 pagesRmo 1981Mary graceNo ratings yet

- RMC No. 10-2020Document2 pagesRMC No. 10-2020Volt LozadaNo ratings yet

- Pa #3 PRNNDocument11 pagesPa #3 PRNNJOSUE GILMER ORE CALDERONNo ratings yet

- 82202BIR Form 1702-MXDocument9 pages82202BIR Form 1702-MXJp AlvarezNo ratings yet

- COA CIRCULAR NO. 80 141 July 28 1980Document1 pageCOA CIRCULAR NO. 80 141 July 28 1980Julius DVNo ratings yet

- RMO No 19-2015Document10 pagesRMO No 19-2015gelskNo ratings yet

- Filing of GST ReturnsDocument7 pagesFiling of GST ReturnsRabin DebnathNo ratings yet

- Flow ChartDocument2 pagesFlow ChartKristal JuditNo ratings yet

- California Tax Information For City and County OfficialsDocument83 pagesCalifornia Tax Information For City and County Officialswmartin46No ratings yet

- 80 2021 TT-BTC M 502560Document69 pages80 2021 TT-BTC M 502560XUnNo ratings yet

- Ease of Paying Taxes ActDocument4 pagesEase of Paying Taxes ActwhitekaisuNo ratings yet

- Kind of Taxes Issuance/ Legal Basis/ Reasons ATCDocument3 pagesKind of Taxes Issuance/ Legal Basis/ Reasons ATCHarryNo ratings yet

- RMO No. 4-2016Document3 pagesRMO No. 4-2016Cristelle Elaine ColleraNo ratings yet

- Notice To The Market - Amortization of Goodwill For Tax Purposes in Fiscal Years 2010 and 2011Document1 pageNotice To The Market - Amortization of Goodwill For Tax Purposes in Fiscal Years 2010 and 2011BVMF_RINo ratings yet

- April 2010 Tax BriefDocument10 pagesApril 2010 Tax BriefAna MergalNo ratings yet

- Kind of Taxes Issuance/ Legal Basis/ Reasons ATC From ToDocument2 pagesKind of Taxes Issuance/ Legal Basis/ Reasons ATC From ToHarryNo ratings yet

- Bureau of Internal Revenue Quezon CityDocument6 pagesBureau of Internal Revenue Quezon CityPeggy SalazarNo ratings yet

- Mills Announces Result of The Debentures Offer Bookbuilding: Press ReleaseDocument1 pageMills Announces Result of The Debentures Offer Bookbuilding: Press ReleaseMillsRINo ratings yet

- Self-Employed And/ or Professionals (Sep) : Lesson 5Document2 pagesSelf-Employed And/ or Professionals (Sep) : Lesson 5Ash PadillaNo ratings yet

- Revenue Memorandum Circular No. 26-2018: Bureau of Internal RevenueDocument3 pagesRevenue Memorandum Circular No. 26-2018: Bureau of Internal RevenuePaul GeorgeNo ratings yet

- Revenue Memorandum Order No.: Bureau of Internal RevenueDocument7 pagesRevenue Memorandum Order No.: Bureau of Internal RevenueJoyce Cariaga SalvadorNo ratings yet

- IRR Update On TRAIN LAWDocument6 pagesIRR Update On TRAIN LAWChrislynNo ratings yet

- FBRDocument28 pagesFBRAnonymous ykFLSpIWNo ratings yet

- BPL Process Flow - SAZDocument34 pagesBPL Process Flow - SAZRaymond LimpiadoNo ratings yet

- 111 Tax GuideDocument81 pages111 Tax Guideavelito bautistaNo ratings yet

- Internal Revenue: Republic of Pfiilippines DepartmentDocument1 pageInternal Revenue: Republic of Pfiilippines DepartmentJohn RoeNo ratings yet

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryFrom EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Lines World Summary: Market Values & Financials by CountryFrom EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Lines World Summary: Market Values & Financials by CountryNo ratings yet

- MotionDocument1 pageMotionGedan TanNo ratings yet

- EO 292 LawphilDocument215 pagesEO 292 LawphilVea Marie RodriguezNo ratings yet

- Jurisdiction FinalDocument10 pagesJurisdiction FinalMczoC.MczoNo ratings yet

- Bansamoro Basic Law - PresbiteroDocument3 pagesBansamoro Basic Law - PresbiteroGedan TanNo ratings yet

- GR No. l-11600Document22 pagesGR No. l-11600Gedan TanNo ratings yet

- Continuation of Jurisdiction Page 1Document1 pageContinuation of Jurisdiction Page 1Gedan TanNo ratings yet

- Laws Govern The Insurance Policy: P.D. No. 612Document1 pageLaws Govern The Insurance Policy: P.D. No. 612Gedan TanNo ratings yet

- Obli Cond GSTDocument18 pagesObli Cond GSTGedan TanNo ratings yet

- Case Title Page No. Aspects of Due Process Police PowerDocument2 pagesCase Title Page No. Aspects of Due Process Police PowerGedan TanNo ratings yet

- Legal Ethics.....Document87 pagesLegal Ethics.....Gedan TanNo ratings yet

- Code of Professional Responsibility List of CasesDocument6 pagesCode of Professional Responsibility List of CasesMczoC.Mczo0% (1)

- No. of Shares Name of Issuing Company Stock Certificate No. Par Value Book Value Selling PriceDocument2 pagesNo. of Shares Name of Issuing Company Stock Certificate No. Par Value Book Value Selling PriceGedan TanNo ratings yet

- Copi, Irving M. and Cohen, Carl (2014) - Introduction To Logic. Pearson Education LimitedDocument1 pageCopi, Irving M. and Cohen, Carl (2014) - Introduction To Logic. Pearson Education LimitedGedan TanNo ratings yet

- Jurisdiction - ExaminationDocument1 pageJurisdiction - ExaminationGedan TanNo ratings yet

- Muhammedan Obinay - PetitionerDocument9 pagesMuhammedan Obinay - PetitionerGedan TanNo ratings yet

- EndDocument1 pageEndGedan TanNo ratings yet

- Read The Main Decision and Resolution in Belgica VsDocument14 pagesRead The Main Decision and Resolution in Belgica VsGedan TanNo ratings yet

- 2Document2 pages2Gedan TanNo ratings yet

- CasesDocument1 pageCasesGedan TanNo ratings yet

- Odyssey Park v. CADocument3 pagesOdyssey Park v. CAGedan TanNo ratings yet

- G.R. No. 201701 June 3, 2013Document5 pagesG.R. No. 201701 June 3, 2013klad626No ratings yet

- Republic of The PhilippinesDocument9 pagesRepublic of The PhilippinesGedan TanNo ratings yet

- Jasmin Soler vs. Court of AppealsDocument3 pagesJasmin Soler vs. Court of AppealsGedan TanNo ratings yet

- G.R. No. 185829 April 25, 2012Document25 pagesG.R. No. 185829 April 25, 2012Gedan TanNo ratings yet