Professional Documents

Culture Documents

Assessment Year Sahaj Indian Income Tax Return

Uploaded by

Anit SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assessment Year Sahaj Indian Income Tax Return

Uploaded by

Anit SharmaCopyright:

Available Formats

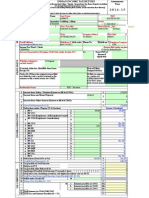

SAHAJ

FORM

ITR-1

INDIAN INCOME TAX RETURN

[For Individuals having Income from Salary / Pension / Income from One House Property (excluding

loss brought forward from previous years) /

Income from Other Sources (Excluding Winning from Lottery and Income from Race Horses)]

2014-15

PERSONAL INFORMATION

(Please see rule 12 of the Income-tax Rules,1962) (Also see attached instructions)

First Name

Middle Name

Flat / Door / Building

Name of premises / building / village

Last Name

PAN

Status

I - Individual

Date of birth Sex

00/00/0000

(Select)

Road / Street

Area / Locality

Town/City/District

State

(Select)

Email Address

Mobile no 1 (Std code) Phone No

Country (Select)

(Select)

Income Tax Ward / Circle

FILING STATUS

Are you Governed by Portugese Civil Code under Section 5A?

Whether original or

revised return?

Date of Filing

Original Return

Notice No (Where the original return filed

was defective and a notice is issued to the

assessee to file a fresh return Sec 139(9)

If filed, in response

to a notice u/s

139(9)/142(1)/148/1

53A/153C enter

date of such notice

INCOME & DEDUCTIONS

Mobile no 2 EmployerCategor

(Select)

Return filed under section

(Select)

Enter PAN of

Spouse if

applicable

(Select)

(Select)

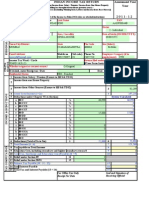

1 Income from Salary / Pension (Ensure to fill Sch TDS1)

Income from one House Property

2

TAX COMPUTATION

(Select)

Pin Code

If revised, defective, Modified then Enter

Receipt No

Residential Status

(Select)

Income from Other Sources (Ensure to fill Sch TDS2)

4 Gross Total Income (1+2+3)

5 Deductions under Chapter VI A (Section)

5a

a 80 C

5b

b 80 CCC

5c

c 80 CCD (Employees / Self Employed Contribution)

80 CCD (Employers Contribution)

5d

d

6

7

8

9

10

11

12

13

14

15

17

18

Assessment

Year

5e

e 80 CCG

5f

f 80 D

5g

g 80 DD

5h

h 80 DDB

5i

i 80 E

5j

j 80 EE

5k

k 80 G

5l

l 80 GG

5m

m 80 GGA

5n

n 80 GGC

5o

o 80 QQB

5p

p 80 RRB

5q

q 80 TTA

5r

r 80 U

6

Deductions (Total of 5a to 5r)

Taxable Total Income (4 - 6)

Tax payable on Total Income

Rebate u/s 87A

Tax payable after Rebate (8-9)

Surcharge if Taxable Total Income (7) exceeds 1 crore

Education Cess, including secondary and higher secondary cess on 10+11

Total Tax,Surcharge and Education Cess (Payable) (10+11+12)

Relief under Section 89

14

Balance Tax Payable (13 - 14 )

16

a Interest payable u/s 234 A

b Interest payable u/s 234 B

c Interest payable u/s 234 C

Total Interest u/s 234A 234B 234C

Total Tax and Interest Payable (15 + 17)

0

System Calculated

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0 6

7

8

9

10

11

12

13

0

15

16a

16b

16c

17

18

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

You might also like

- Gross Total Income (1+2+3) 4: System CalculatedDocument8 pagesGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamNo ratings yet

- Assessment Year Indian Income Tax Return SahajDocument7 pagesAssessment Year Indian Income Tax Return SahajallipraNo ratings yet

- Indian Income Tax Return Assessment Year SahajDocument7 pagesIndian Income Tax Return Assessment Year SahajSubrata BiswasNo ratings yet

- INDIAN INCOME TAX RETURN FOR SALARY AND HOUSE PROPERTY INCOMEDocument6 pagesINDIAN INCOME TAX RETURN FOR SALARY AND HOUSE PROPERTY INCOMEKuldeep HoodaNo ratings yet

- ITR Form 1Document7 pagesITR Form 1gj29hereNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument7 pagesITR-3 Indian Income Tax Return: Part A-GENSudeha ShirkeNo ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument12 pagesITR-2 Indian Income Tax Return: Part A-GENMankamesachinNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument7 pagesITR-3 Indian Income Tax Return: Part A-GENmohitsharma1996No ratings yet

- Itr-2 Indian Income Tax Return: (For Individuals and Hufs Not Having Income From Business or Profession) Assessment YearDocument7 pagesItr-2 Indian Income Tax Return: (For Individuals and Hufs Not Having Income From Business or Profession) Assessment YearVarun ChhabraNo ratings yet

- 2012 Itr1 Pr21Document5 pages2012 Itr1 Pr21MRLogan123No ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument8 pagesITR-3 Indian Income Tax Return: Part A-GENRahul SharmaNo ratings yet

- SAHAJ ITR-1 FORM FOR INDIVIDUALS WITH INCOME FROM SALARY/PENSION, HOUSE PROPERTY, OTHER SOURCESDocument7 pagesSAHAJ ITR-1 FORM FOR INDIVIDUALS WITH INCOME FROM SALARY/PENSION, HOUSE PROPERTY, OTHER SOURCESrajshri58No ratings yet

- SAHAJ FORM INDIAN INCOME TAX RETURN FOR SALARY AND HOUSE PROPERTY INCOMEDocument3 pagesSAHAJ FORM INDIAN INCOME TAX RETURN FOR SALARY AND HOUSE PROPERTY INCOMESachin KumarNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument7 pagesITR-3 Indian Income Tax Return: Part A-GENAvani GadaNo ratings yet

- Tax computation and deductionsDocument9 pagesTax computation and deductionsAkshay Kumar SahooNo ratings yet

- IT Return 2011 2012Document3 pagesIT Return 2011 2012swapnil6121986No ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument12 pagesITR-3 Indian Income Tax Return: Part A-GENmehtakvijayNo ratings yet

- Indian Numbering SystemDocument8 pagesIndian Numbering SystemelangomduNo ratings yet

- 2016 Itr4 PR3Document165 pages2016 Itr4 PR3TejasNo ratings yet

- Form ITR2 2012-2013Document9 pagesForm ITR2 2012-2013N.PalaniappanNo ratings yet

- Itr 2Document9 pagesItr 2Arvind PaulNo ratings yet

- File ITR-1 online in minutes with pre-filled dataDocument3 pagesFile ITR-1 online in minutes with pre-filled datathakurrobinNo ratings yet

- 2015 Itr1 PR3Document18 pages2015 Itr1 PR3shubham sharmaNo ratings yet

- 2011 - ITR2 - r6Document33 pages2011 - ITR2 - r6Bathina Srinivasa RaoNo ratings yet

- File ITR-1 Form for Individuals with Income from Salary and InterestDocument6 pagesFile ITR-1 Form for Individuals with Income from Salary and InterestManjunath YvNo ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument10 pagesITR-2 Indian Income Tax Return: Part A-GENNeeraj AgarwalNo ratings yet

- Form ITR-1Document3 pagesForm ITR-1Rajeev PuthuparambilNo ratings yet

- Gross Total Income (1+2c) 4: Import Previous VersionDocument4 pagesGross Total Income (1+2c) 4: Import Previous Versionbalajiv_mailNo ratings yet

- 2011 ITR1 r2Document3 pages2011 ITR1 r2Zafar IqbalNo ratings yet

- SUGAM ITR-4S Presumptive Business Income Tax ReturnDocument11 pagesSUGAM ITR-4S Presumptive Business Income Tax ReturncachandhiranNo ratings yet

- Tax ReturnDocument7 pagesTax Returnsyedfaisal_sNo ratings yet

- INDIAN INCOME TAX RETURN FOR INDIVIDUALS WITH INCOME FROM SALARY, HOUSE PROPERTY AND OTHER SOURCES (ITR-1 FORMDocument3 pagesINDIAN INCOME TAX RETURN FOR INDIVIDUALS WITH INCOME FROM SALARY, HOUSE PROPERTY AND OTHER SOURCES (ITR-1 FORMDHARAMSONINo ratings yet

- Akhtar Tax ReturnDocument7 pagesAkhtar Tax Returnsyedfaisal_sNo ratings yet

- INDIVIDUAL INCOME TAX RETURN FORM ITR-1Document22 pagesINDIVIDUAL INCOME TAX RETURN FORM ITR-1rahul srivastavaNo ratings yet

- Form PDF 197504840210823Document9 pagesForm PDF 197504840210823jassramgarhia2812No ratings yet

- Itr 3Document58 pagesItr 3Anurag SharmaNo ratings yet

- Return ChallanDocument20 pagesReturn Challansyedfaisal_sNo ratings yet

- Form PDF 345858330310722Document10 pagesForm PDF 345858330310722narasimhahanNo ratings yet

- V. N. Hari,: Sudhakar & Kumar AssociatesDocument28 pagesV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaNo ratings yet

- Sugam: (Please See Instruction)Document10 pagesSugam: (Please See Instruction)MAHESHANAND NAUTIYALNo ratings yet

- ITR-1 filing guide for AY 2012-13Document4 pagesITR-1 filing guide for AY 2012-13Manohj ViswanathanNo ratings yet

- ITR-4 filing for individual with income up to Rs. 50 lakhDocument10 pagesITR-4 filing for individual with income up to Rs. 50 lakhRaghav SharmaNo ratings yet

- Sugam: (Please See Instruction)Document10 pagesSugam: (Please See Instruction)Sourabh PunshiNo ratings yet

- Form PDF 344472690310722Document11 pagesForm PDF 344472690310722NandhakumarNo ratings yet

- Form_pdf_179843840280722Document10 pagesForm_pdf_179843840280722rakeshkaydalwarNo ratings yet

- For BIR Use Only Annual Income Tax ReturnDocument12 pagesFor BIR Use Only Annual Income Tax Returnmiles1280No ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryFrom EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Sports & Recreation Instruction Revenues World Summary: Market Values & Financials by CountryFrom EverandSports & Recreation Instruction Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- J.K. Lasser's Your Income Tax 2024, Professional EditionFrom EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNo ratings yet

- English AbstractDocument2 pagesEnglish AbstractAnit SharmaNo ratings yet

- Chapter 3Document27 pagesChapter 3Anit SharmaNo ratings yet

- Chapter 5Document47 pagesChapter 5Anit SharmaNo ratings yet

- Ph.D. ThesisDocument304 pagesPh.D. ThesisAnit Sharma100% (1)

- Chapter 1Document35 pagesChapter 1Anit SharmaNo ratings yet

- To Whomsoever It May Concern: Intracranial Neoplasm (Brain Tumour)Document1 pageTo Whomsoever It May Concern: Intracranial Neoplasm (Brain Tumour)Anit SharmaNo ratings yet

- qh jfowzdo ;kfjp dh ehosB gozgok ns/ fJ; Bkb iV/ ;w{j ehosBhnKDocument7 pagesqh jfowzdo ;kfjp dh ehosB gozgok ns/ fJ; Bkb iV/ ;w{j ehosBhnKAnit SharmaNo ratings yet

- B. R. Ambedkar - Father of Indian ConstitutionDocument12 pagesB. R. Ambedkar - Father of Indian ConstitutionAnit SharmaNo ratings yet

- Beauty Parlor AmanDocument81 pagesBeauty Parlor AmanAnit SharmaNo ratings yet

- Final Report On India S Foreign TradeDocument29 pagesFinal Report On India S Foreign TradeAnit SharmaNo ratings yet

- Dr. Ashish Gupta Senior Consultant/Neurosurgeon Max Super Speciality Hospital MohaliDocument1 pageDr. Ashish Gupta Senior Consultant/Neurosurgeon Max Super Speciality Hospital MohaliAnit SharmaNo ratings yet

- EDocument18 pagesEAnit SharmaNo ratings yet

- Classroom Issues and Students in TroubleDocument6 pagesClassroom Issues and Students in TroubleAnit SharmaNo ratings yet

- Affidavit of Support for Indian Cousin Kuldeep SinghDocument2 pagesAffidavit of Support for Indian Cousin Kuldeep SinghAnit SharmaNo ratings yet

- Project Report On IMPORT-EXPORT PolicyDocument32 pagesProject Report On IMPORT-EXPORT PolicyRohit Sinha80% (15)

- Multinational Corporation: Corporation (TNC), Also Called Multinational Enterprise (MNE), Is A Corporation or EnterpriseDocument15 pagesMultinational Corporation: Corporation (TNC), Also Called Multinational Enterprise (MNE), Is A Corporation or EnterpriseVicky Kumar67% (3)

- Name - ClassDocument5 pagesName - ClassAnit SharmaNo ratings yet

- Resume: Subject:-For Six Month Training in Networking at Your Company Career ObjectiveDocument2 pagesResume: Subject:-For Six Month Training in Networking at Your Company Career ObjectiveAnit SharmaNo ratings yet

- KKLDocument295 pagesKKLAnit SharmaNo ratings yet

- Chapter IVDocument296 pagesChapter IVAnit SharmaNo ratings yet

- MNC or Multinational CorporationDocument26 pagesMNC or Multinational CorporationTanzila khan100% (6)

- 2 SBDXDocument14 pages2 SBDXAnit SharmaNo ratings yet

- Athletic-cum-Sports Meet 2014 Duty AssignmentsDocument10 pagesAthletic-cum-Sports Meet 2014 Duty AssignmentsAnit SharmaNo ratings yet

- Discrimination and Harassment SlideshowDocument36 pagesDiscrimination and Harassment SlideshowAnit SharmaNo ratings yet

- 013265797X PDFDocument28 pages013265797X PDFMimi Aringo100% (1)

- Resume: Subject:-For Six Month Training in Networking at Your Company Career ObjectiveDocument2 pagesResume: Subject:-For Six Month Training in Networking at Your Company Career ObjectiveAnit SharmaNo ratings yet

- TME7Document22 pagesTME7Vibhavari SahaneNo ratings yet

- 135 - KVS Admission 2014-15Document28 pages135 - KVS Admission 2014-15Anit SharmaNo ratings yet

- Optsub Att Computer 6 Use of CompASWATHYDocument17 pagesOptsub Att Computer 6 Use of CompASWATHYAnit SharmaNo ratings yet