0% found this document useful (0 votes)

2K views3 pagesTDS Certificate Form No. 16 Guide

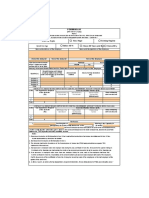

This document is a certificate issued under Section 203 of the Income Tax Act of 1961 for tax deducted at source on salary. It provides details of the salary paid and tax deducted for an employee in the financial year.

The key details included are the name and PAN of the deductee (employee), gross salary paid, allowances, deductions, total income, tax calculated, rebates or reliefs, tax deducted at source, and net tax payable or refundable.

The certificate is certified by the deducting officer (employer) confirming the amount of tax deducted from salary and paid to the government based on books of accounts and records.

Uploaded by

api-247505461Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOC, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

2K views3 pagesTDS Certificate Form No. 16 Guide

This document is a certificate issued under Section 203 of the Income Tax Act of 1961 for tax deducted at source on salary. It provides details of the salary paid and tax deducted for an employee in the financial year.

The key details included are the name and PAN of the deductee (employee), gross salary paid, allowances, deductions, total income, tax calculated, rebates or reliefs, tax deducted at source, and net tax payable or refundable.

The certificate is certified by the deducting officer (employer) confirming the amount of tax deducted from salary and paid to the government based on books of accounts and records.

Uploaded by

api-247505461Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOC, PDF, TXT or read online on Scribd