0% found this document useful (0 votes)

297 views4 pagesForm 16

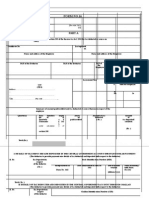

This document is a certificate under section 203 of the Income Tax Act of 1961 for tax deducted at source on salary. It contains details of the employer and employee, including PAN numbers and TAN of the deductors. It summarizes the amount paid/credited to the employee each quarter and tax deducted. It also provides details of tax deducted and deposited to the central government account through book adjustment and challan methods. Finally, it includes verification by the person responsible for tax deduction and details of salary paid and other deductions.

Uploaded by

harit sharmaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

297 views4 pagesForm 16

This document is a certificate under section 203 of the Income Tax Act of 1961 for tax deducted at source on salary. It contains details of the employer and employee, including PAN numbers and TAN of the deductors. It summarizes the amount paid/credited to the employee each quarter and tax deducted. It also provides details of tax deducted and deposited to the central government account through book adjustment and challan methods. Finally, it includes verification by the person responsible for tax deduction and details of salary paid and other deductions.

Uploaded by

harit sharmaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd