Professional Documents

Culture Documents

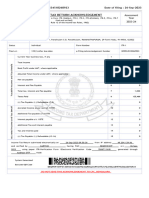

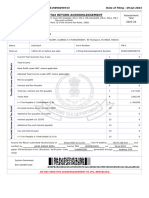

Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source

Uploaded by

Jeevabinding xeroxOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source

Uploaded by

Jeevabinding xeroxCopyright:

Available Formats

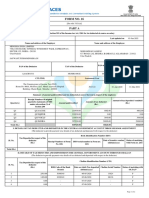

FORM NO.

16 Certificate under section 203 of the Income-tax Act, 1961 for tax deducted at source

[See rule 31(1)(a)]

PART - A

Name and address of the Employer Name and designation of the Employe

PAN No. of the Deductor TAN No. of the Deductor PAN No. of the Employee

Assessment Year Period

Address: From To

SUMMARY OF TAX DEDUCTED AT SOURCE

Amount of tax deducted Amount of tax

Receipt number of original statements of TDS inrespect of the deposited in respect of

Quarter under sub-section (3) of section 200 employee the employee

PART - B (REFER NOTE 1)DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

1 Gross Salary

(a) Salary as per provisions contained in insection 17(1)

(b) Value of perquisites u/s 17(2) (as per Form No 12BA,

wherever applicable

(c) Profits in lieu of salary under section 17(3) (as per Form

No.12BA

(d) Total

2 Less: Allowance to the extent exempt under Section 10

Allownce Rs.

HRA

3 Balance (1 – 2)

4 Deductions: (a) entertainment allowance

(b) Tax on employment

5 Aggregate of 4(a) and (b) Rs.

6 Income chargeable under the head Salaries (3-5)

7 Add : Any other income reported by the Employee

Income Rs.

House loan interest

8 Gross total income (6 + 7) Rs.

9 Deductions under Chapter VI-A Rs.(A) sections 80C, 80CCC and 80CCD

Deductabl

(a) section 80C e amount

Gross Amount

(i) GPF

(ii) APGLIC

(iii) GIS

(iv) LIC

(v) Housing loan repayment

(vi)

(vii)

(b) section 80CCC Rs. Rs.

(c) section 80CCD Rs. Rs.

Note: Aggregate amount deductible under the three sections, i.e., 80C, 80CCC and 80CCD, shall not exceed

one lakh rupees

(B) other sections (e.g., 80E, 80G etc.) under Chapter VI-A

Gross Qualifying Deductable

Amount Amount in Amount In

(a) Section 80c in Rs. Rs. Rs.

(i) Section 80 D

(ii) Section 80 G

(iii) Section

(iv) Section

(v) Section

10 Aggregate of deductible amount under Chapter VI-A

11 Total income (8-10)

12 Tax on total income

13 Education Cess @ 3% (on tax at S. No. 12)

14 Tax payable (12+13)

15 Relief under section 89 (attach details) Rs. Rs.

16 Tax payable (14-15)

ANNEXURE

DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT

THROUGH BOOK ENTRY

(The employee to provide payment wise details of tax deucted an deposited with respect to the employee)

Book Identification Number (BIN)

DDO Sequence Number in

Tax deposited in respect of the book Adjestment Mini

Sl. No the Employee (rS.) Reciept numbers of Form No.24G statement

Total

Note:1. In the column for TDS give total amount for TDS, surcharge (if applicable) and Education Cess

DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT

(The employee is to provide tranction - wise details of tax deducted an deposited)

Date on which Tax

BSR code of deposited Transfer voucher/ Challan

S.No. Total tax deposited Rs. Cheque/ DD No (if any) Bank Branch (dd/mm/yyyy) Identification No.

VERIFICATION

I ___________________________ Son/daughter of ______________________________ workig in the capacity

of _____________________ (designation) do hereby certify that a sum of Rs.____________(Rupess____________

________________________________________________________________________________(in words)

been deducted and deposited to the Central Government. I further certify that the information given above is true,

has complete and correct and is based on the books of account, documents , TDS statement, TDS deposited and

other available records.

Place: Signature of the person responsible for deduction of tax

date: Full name:

Designation

in the capacity

ess____________

__(in words)

You might also like

- Form 16 FormatDocument2 pagesForm 16 FormatParthVanjaraNo ratings yet

- Form 16 in Excel Format For AY 2020 21Document8 pagesForm 16 in Excel Format For AY 2020 21Vikas PattnaikNo ratings yet

- Form 16 651746Document4 pagesForm 16 651746Arslan1112No ratings yet

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument2 pagesForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAnonymous glyBR9No ratings yet

- 255 PartA PDFDocument2 pages255 PartA PDFRamyaMeenakshiNo ratings yet

- Difference Bill NewDocument76 pagesDifference Bill NewMuneeb Usmani100% (1)

- HeheDocument1 pageHeheMuhammad Ahmad JavedNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnsar ValiNo ratings yet

- Template - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKDocument9 pagesTemplate - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKajaykrsinghpintuNo ratings yet

- DFCPS4106B Ay201920 16 Unsigned PDFDocument6 pagesDFCPS4106B Ay201920 16 Unsigned PDFAnuj SrivastavaNo ratings yet

- Form 16Document4 pagesForm 16Aruna Kadge JhaNo ratings yet

- 2019 08 30 10 26 32 104 - 1567140992104 - XXXPK6719X - Acknowledgement PDFDocument1 page2019 08 30 10 26 32 104 - 1567140992104 - XXXPK6719X - Acknowledgement PDFRaviranjan KumarNo ratings yet

- Pay Bill New JEST Basit AliDocument4 pagesPay Bill New JEST Basit AliMujeeb Rehman PanhwarNo ratings yet

- LNL Iklcqd /: Page 1 of 10Document10 pagesLNL Iklcqd /: Page 1 of 10Manoj ValeshaNo ratings yet

- GSTR1 08axvpp9576c1zl 062018 PDFDocument5 pagesGSTR1 08axvpp9576c1zl 062018 PDFkrishan chaturvediNo ratings yet

- PDF 236811830140623Document1 pagePDF 236811830140623Akeybo 340No ratings yet

- Pay Slip March 2017Document4 pagesPay Slip March 2017Anonymous AsVoWD04c0% (1)

- 7th Assam Pay & Productivity Pay Commission PDFDocument208 pages7th Assam Pay & Productivity Pay Commission PDFSounok Kashyap50% (2)

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearNarayan KumbharNo ratings yet

- Minor Project BcomDocument1 pageMinor Project BcomYash DadheechNo ratings yet

- Form of Leave Account Under The Revised Leave RulesDocument3 pagesForm of Leave Account Under The Revised Leave Rulesmohammad sibtainNo ratings yet

- 2019 08 28 15 18 21 048 - 1566985701048 - XXXPL5235X - Acknowledgement PDFDocument1 page2019 08 28 15 18 21 048 - 1566985701048 - XXXPL5235X - Acknowledgement PDFmaxNo ratings yet

- Form 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument4 pagesForm 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySyedNo ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument13 pagesITR-2 Indian Income Tax Return: Part A-GENHarish100% (1)

- Dr. Vikash (Offer Letter)Document1 pageDr. Vikash (Offer Letter)Swapnil VermaNo ratings yet

- A 40029127 Part-ADocument2 pagesA 40029127 Part-Adeepak_cool4556No ratings yet

- BCC Sindh Forms 2018-19Document29 pagesBCC Sindh Forms 2018-19Sarmad SamejoNo ratings yet

- Insync CTC Breakup PDFDocument1 pageInsync CTC Breakup PDFSocialIndostoriesNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSagar Kumar GuptaNo ratings yet

- 14374752Document2 pages14374752Anshul MehtaNo ratings yet

- Salary Break Up HRDocument4 pagesSalary Break Up HRnaman156No ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:305534510260923 Date of Filing: 26-Sep-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:305534510260923 Date of Filing: 26-Sep-2023SadiqNo ratings yet

- ACK833415090290723Document1 pageACK833415090290723prashanth.financialpanditNo ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- PrintTax14 PDFDocument2 pagesPrintTax14 PDFarnieanuNo ratings yet

- Salary Breakup Calculator Excel 1Document2 pagesSalary Breakup Calculator Excel 1Rajinder KumarNo ratings yet

- Form 16 - TCSDocument3 pagesForm 16 - TCSBALANo ratings yet

- Computation 3Document2 pagesComputation 3Sai DyNo ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 273151Document3 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 273151AVINASH TIWASKARNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDipak Ranjan RathNo ratings yet

- Aabpf9762b 2018-19Document2 pagesAabpf9762b 2018-19piyushkumar patelNo ratings yet

- Form TR 20 Gaz TAbill 2018 2Document2 pagesForm TR 20 Gaz TAbill 2018 2abc100% (1)

- Telephone Number: +91 141 267 0101, Facsimile Number: +91 141 267 0303 Amber Fort Road, Opposite Jal Mahal, Jaipur, 302002, IndiaDocument3 pagesTelephone Number: +91 141 267 0101, Facsimile Number: +91 141 267 0303 Amber Fort Road, Opposite Jal Mahal, Jaipur, 302002, IndiaRamnish MishraNo ratings yet

- Annexure ADocument1 pageAnnexure Apanduram tiyuNo ratings yet

- 2019 11 01 21 37 31 963 - 1572624451963 - XXXPP7803X - Acknowledgement PDFDocument1 page2019 11 01 21 37 31 963 - 1572624451963 - XXXPP7803X - Acknowledgement PDFKunal PaulNo ratings yet

- Form 16Document2 pagesForm 16robin0903No ratings yet

- Proof of Investment Guidelines FY 2023-24Document15 pagesProof of Investment Guidelines FY 2023-24shravan.hegdeNo ratings yet

- Form 16 ADocument5 pagesForm 16 Anisha_khanNo ratings yet

- TDS ChallanDocument1 pageTDS ChallanJayNo ratings yet

- FSRID11020Document8 pagesFSRID11020SaleemNo ratings yet

- PART B (Annexure)Document4 pagesPART B (Annexure)AnbarasanNo ratings yet

- Study Gap CertificateDocument1 pageStudy Gap CertificateHarbrinder GurmNo ratings yet

- Renewed RegistrationDocument1 pageRenewed Registrationharsh dutt vardhanNo ratings yet

- GST Invoice FormatDocument1 pageGST Invoice FormatMaulin Patel100% (1)

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Manav ChaudharyNo ratings yet

- Form 16Document3 pagesForm 16Bijay TiwariNo ratings yet

- A SimDocument4 pagesA Simsana_rautNo ratings yet

- Form 16Document4 pagesForm 16harit sharmaNo ratings yet

- Form No 16Document4 pagesForm No 16Md ZhidNo ratings yet

- Final A4Document28 pagesFinal A4Jeevabinding xeroxNo ratings yet

- A4 3Document29 pagesA4 3Jeevabinding xeroxNo ratings yet

- A Study On Sales Promotion at Yamaha Show Room, Tirupati.: Bachelor of CommerceDocument5 pagesA Study On Sales Promotion at Yamaha Show Room, Tirupati.: Bachelor of CommerceJeevabinding xeroxNo ratings yet

- A Study On Customer Satisfaction at MRF Tyres, Chennai.: Bachelor of CommerceDocument5 pagesA Study On Customer Satisfaction at MRF Tyres, Chennai.: Bachelor of CommerceJeevabinding xeroxNo ratings yet

- 1619069016human Rights Judgments On Human Rights and Policing in IndiaDocument100 pages1619069016human Rights Judgments On Human Rights and Policing in IndiaJeevabinding xeroxNo ratings yet

- Acknowledgemen: Mr. M. ThejamoorthyDocument7 pagesAcknowledgemen: Mr. M. ThejamoorthyJeevabinding xeroxNo ratings yet

- Schedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668CDocument2 pagesSchedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668CJeevabinding xeroxNo ratings yet

- B.naresh 194m1e0016Document69 pagesB.naresh 194m1e0016Jeevabinding xeroxNo ratings yet

- Economic Impact of TourismDocument22 pagesEconomic Impact of TourismBalachandar PoopathiNo ratings yet

- (Lesson Part-II) - Chapter 5. Producer Behavior TheoryDocument55 pages(Lesson Part-II) - Chapter 5. Producer Behavior TheoryШохрух МаджидовNo ratings yet

- 2C00346Document1,233 pages2C00346Rajat BansalNo ratings yet

- Ifrs 12 Disclosure of Interests in Other Entities SummaryDocument7 pagesIfrs 12 Disclosure of Interests in Other Entities SummaryajejeNo ratings yet

- EY Making India Brick by Brick PDFDocument96 pagesEY Making India Brick by Brick PDFRKVSK1No ratings yet

- EsmaDocument16 pagesEsmamikekvolpeNo ratings yet

- Advanced Auditing and EDP: QUEENS College School of Post Graduate Studies Department of ACCOUNTING and FinanceDocument53 pagesAdvanced Auditing and EDP: QUEENS College School of Post Graduate Studies Department of ACCOUNTING and FinanceRas Dawit100% (1)

- Annex B-1 RR 11-2018 - 1Document1 pageAnnex B-1 RR 11-2018 - 1Brianna MendezNo ratings yet

- Determination of Annual Value (Section 23)Document15 pagesDetermination of Annual Value (Section 23)AlezNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceP. C. BaloniNo ratings yet

- Case Studies AssignmentDocument4 pagesCase Studies Assignment9xy42xfqgcNo ratings yet

- Signal 2023 05 20 135538Document5 pagesSignal 2023 05 20 135538Shahid NadeemNo ratings yet

- Project Workbook Information: Suggested Sheets For All ProjectsDocument46 pagesProject Workbook Information: Suggested Sheets For All ProjectsFaizahKadirNo ratings yet

- Week 5 - Global Business Strategy Case - BMW at 100Document3 pagesWeek 5 - Global Business Strategy Case - BMW at 100Edgard Alberto Cuellar IriarteNo ratings yet

- SR - No. Name of The Company: 1 2 3 4 5 6 Tata Motors 7 Persistent 8 9 10Document4 pagesSR - No. Name of The Company: 1 2 3 4 5 6 Tata Motors 7 Persistent 8 9 10Sandeep M PatilNo ratings yet

- B8af108 Audit Solutions Summer 2018Document21 pagesB8af108 Audit Solutions Summer 2018Eizam Ben JetteyNo ratings yet

- Research Proposal MemoDocument3 pagesResearch Proposal Memoapi-665796662No ratings yet

- Abstract On CRMDocument3 pagesAbstract On CRMsampathjobsNo ratings yet

- Aramyan 2006Document19 pagesAramyan 2006regaNo ratings yet

- Multiple Choice QuestionsDocument6 pagesMultiple Choice QuestionsCandy DollNo ratings yet

- Gittinger (1) 2Document204 pagesGittinger (1) 2athulahsenaratneNo ratings yet

- Implementation of Excise For Manufacturers in TallyERP 9Document197 pagesImplementation of Excise For Manufacturers in TallyERP 9tgbyhn111No ratings yet

- Supply Chain Management: Indian Institute of Management LucknowDocument29 pagesSupply Chain Management: Indian Institute of Management LucknowParidhi VarmaNo ratings yet

- Lease Contract EnglishDocument7 pagesLease Contract EnglishRajendra T PankhadeNo ratings yet

- Union Carbide CaseDocument3 pagesUnion Carbide CaseAli WaqarNo ratings yet

- Sec of Finance v. LazatinDocument10 pagesSec of Finance v. Lazatinana abayaNo ratings yet

- THEORY OF DEMOGRAPHIE Lecture02Document67 pagesTHEORY OF DEMOGRAPHIE Lecture02taik khiderNo ratings yet

- 0612223836development AssistantDocument39 pages0612223836development AssistantAbdul GaffarNo ratings yet

- J. P Morgan - Tata Steel LTDDocument15 pagesJ. P Morgan - Tata Steel LTDvicky168No ratings yet

- Ca Cash Flow StatementDocument16 pagesCa Cash Flow StatementRahul MishraNo ratings yet