Professional Documents

Culture Documents

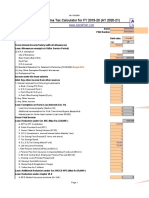

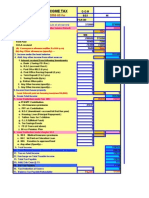

Schedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668C

Uploaded by

Jeevabinding xeroxOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Schedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668C

Uploaded by

Jeevabinding xeroxCopyright:

Available Formats

EMP-ID: 0619388 PAN: ALCPB3668C

Schedule of Income Tax for the Year 2021-2022

P.V.K.N Govt.

Name of the Office/Institution: CollegeCHITTOOR

1) Name (Block Letters)

B.GOPIRYA NAICK

Lecturer in Telugu

2) Designation

1471378

3) Gross salary

4) Whether living in a Rented or Own House

5) Exemption U/S 10 (13A)

a) HRA Received

b) Actual Rent Paid - 10% of the Salary (12000*12=144000-1097630)

c) 40% of the salary

6) Deduct (a) or (b) or ( c) which ever is less [ 3 - 5 ] 1471378

7) a) Special/Conveyance/Travel allowance U/S 10(14) Standard deduction: 50000

b) Entertainment allowance U/S 16 (ii) 0

c) Professoinal Tax U/S 16(iii) 2400

TOTAL ( a + b + c ) 52400

8) Income Chargeable under the head Salaries [ 6 - 7] 1418978

9) a) Loss under House Property 0

Deduction of Interest upto Rs. 2,00,000/- or actuals (Least) 199976

b) Income from other source (PG REMUNERATION) 0

10) Gross total Income [ 8 - 9a + 9b ] 1219002

11) Deduction under chapter VI-A

Deductions U/S 80 C

a) PF/GPF 0

b) APGLI 24000

c) GIS 1440

d) LIC 0

e 10/15 CTD 0

f) NSC and NSS/CMRF 0

g) Refund of House Building Loans 0

h) House Loan deposit 58623

i) Subscription to Mutual funds 0

j) Tution fee paid for education of any two Children 0

k) Investments in eligible shares/Debentures

l) Term / fixed deposit ( for a period of 5 years or more) 0

in Scheduled Banks

m) Other U/S 80 C 0

n) Contribution to Pension / annuity funds U/S 80CCC 0

o) Contribution to Pension schme of Central

Government for New entrants only 0

( Maximum of 10% of salary) U/S 80 CCD

p) Eligible Deductions U/S 80C, 80CCC and 80 CCD 84063

( i.e total of 'a' to 'p' not exceeding Rs.1,50,000/-) 150000

q) Addl. Deductions for Contribution to Pension Scheme

upto Rs.50000/- U/s 80CCD(1B) 50000

r) Rajiv Gandhi Equity Saving Scheme U/s 80CCG (ie 50% of 0

the Amount or Rs.25000/-whichever is less)

s)1.Preventive health check-up upto Rs.5000/-(Within the overall limitsU/s 80D) 0

2.Medical Insurance Premium U/s 80 D (NAVI) 7000

t) Deposit made or maintenance and expenditure for treatment of

handicapped dependent U/s 80 DD upto Rs.75,000/-.

(for severe disability, upto Rs.1,25,000/-) 0

u) Deduction in respect of Medical treatment U/s 80DDB

upto Rs. 40,000/- (or Rs.60,000/- including thatof

dependents aged above 65 years 0

[ Enclose form No. 10-1 ]

v) Deduction in respect of interest on loan taken for 0

Higher education U/s 80 E (Self) 1,00,000

w) Donations U/s 80G 0

x) House Rent Deduction upto Rs.5000/-per month,

if HRA is not received U/s 80GG ( form 10BA to be submitted)

y) Deductions U/s 80U to PH Persons upto Rs75,000/-

(for severe disability upto Rs. 1,25,000/-) 0

0

z) Any other eligible deductions/EWF/SWF

TOTAL DEDUCTIONS [ ie 'p' to' z' ] 207000

12) Net total Income [ 10 -11 ] 9,12,002

13) Tax on net Total Income(i.e on 12)

Net Total Income (Man or Woman) Senior Citizens above TAX

Citizen below 60 years 60 years

Upto Rs. 2,50,000 NIL NIL NIL

Rs.2,50,001 to Rs.5,00,000 Up to Rs. 2,50,000 - NIL Up to Rs.3,00,000 - NIL 12,500

5% of income exceeding Rs.2,50,000 5% of income exceeding Rs.3,00,000

Rs.12,500+20% of Income exceeding Rs.10,000+20% of Income exceeding

Rs.5,00,001 to Rs.10,00,000

Rs.5,00,000 Rs.5,00,000

66,612

Rs.1,12,500+30% of Income Rs.1,10,000+30% of Income

10,00,001 and above

exceeding Rs.10,00,000 exceeding Rs.10,00,000 67393.5

1,46,506

224644

14) Rebate u/s 87A upto Rs.5000/- (if Net total income(i.e on 12) lessthan Rs.5,00,000/-) 0

15) Income Tax Payable(13-14) 79116 146505.50

16)Health & Education Cess on ( i.e on 15) 5860.22

15) Total Tax : Tax Payable + Education Cess

152365.72

18) Income tax deduction from the salary

Income tax already deducted upto

76763

a) Up to November 2021 57000 1,33,763.00

b) December 2021 10000 10,000.00

b) January 2022 10000 9000

c) February 2022 12000 0

TOTAL 1,52,763.00

SiGNATURE:

COUNTER SIGNED DESIGNATION :

You might also like

- Three Statement Financial ModelingDocument13 pagesThree Statement Financial ModelingJack Jacinto100% (1)

- Requirements To Be Accredited As Tax AgentDocument3 pagesRequirements To Be Accredited As Tax AgentAvril Reina0% (1)

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- IT Calculation New RegimeDocument4 pagesIT Calculation New Regimeyelrihs23No ratings yet

- Income Tax Calculation F.Y.2019-20 AGIPC1111K Particulars AmountDocument3 pagesIncome Tax Calculation F.Y.2019-20 AGIPC1111K Particulars AmountNihit SandNo ratings yet

- Sunil BDocument2 pagesSunil Bplacementcell Govt ITI AttingalNo ratings yet

- ASWATHYDocument2 pagesASWATHYplacementcell Govt ITI AttingalNo ratings yet

- LALYDocument2 pagesLALYplacementcell Govt ITI AttingalNo ratings yet

- Annexure Ii Income Tax Calculation For The Financial Year 2020-2021 Name: Jeevana Jyothi. B Designation: Junior Lecturer in ZoologyDocument3 pagesAnnexure Ii Income Tax Calculation For The Financial Year 2020-2021 Name: Jeevana Jyothi. B Designation: Junior Lecturer in ZoologySampath SanguNo ratings yet

- Afsal TaxDocument2 pagesAfsal Taxplacementcell Govt ITI AttingalNo ratings yet

- Bose Tax 2024Document2 pagesBose Tax 2024placementcell Govt ITI AttingalNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document8 pagesIncome Tax Calculator Fy 2020 21 v1Yogesh BajajNo ratings yet

- INCOME TAX 2015-16. Annexure - IDocument5 pagesINCOME TAX 2015-16. Annexure - IPhani PitchikaNo ratings yet

- AMJITHDocument2 pagesAMJITHplacementcell Govt ITI AttingalNo ratings yet

- Income Tax Calculator Fy 2020 21 v2Document12 pagesIncome Tax Calculator Fy 2020 21 v2Anonymous Clm40C1No ratings yet

- Calculation Sheet 2022 - 23 OLDDocument2 pagesCalculation Sheet 2022 - 23 OLDmandalsomithmandal1986No ratings yet

- Income Tax CalculatorDocument9 pagesIncome Tax Calculatorchandu halwaeeNo ratings yet

- Income TaxDocument11 pagesIncome Taxci_balaNo ratings yet

- F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentDocument1 pageF0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentSourabhthakral_1No ratings yet

- Income Tax Calculation 2023-24 (Old Tax Regime) : Annexure - IiDocument1 pageIncome Tax Calculation 2023-24 (Old Tax Regime) : Annexure - IiGOKUL HD LIVE EVENTSNo ratings yet

- Income Tax Calculator Fy 2019 20 v4Document9 pagesIncome Tax Calculator Fy 2019 20 v4Anil KesarkarNo ratings yet

- IT Calculator 2018 LiteDocument6 pagesIT Calculator 2018 LiteHr PoonamNo ratings yet

- New Microsoft Excel WorksheetDocument4 pagesNew Microsoft Excel WorksheetpalkwahNo ratings yet

- It Return BHK 2022-23Document2 pagesIt Return BHK 2022-23Ganesh PawarNo ratings yet

- Gopi IT2021 Tentative CalculationsheetDocument4 pagesGopi IT2021 Tentative CalculationsheetAR G.KAPILANNo ratings yet

- 4 Chapter VI-ADocument11 pages4 Chapter VI-AVENKATESWARLUMCOMNo ratings yet

- PARTICULARS FOR F.Y. 2023 - 24 Old FormateDocument3 pagesPARTICULARS FOR F.Y. 2023 - 24 Old Formateiwd.abhiNo ratings yet

- T K ArumugamDocument7 pagesT K ArumugamThangamNo ratings yet

- Salary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Document1 pageSalary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Siddhartha SharmaNo ratings yet

- Income Tax Calculator Fy 2021 22 v2Document15 pagesIncome Tax Calculator Fy 2021 22 v2KumardasNsNo ratings yet

- Pravin Shinde-ARMS-01-TDS-FY 2019-20Document12 pagesPravin Shinde-ARMS-01-TDS-FY 2019-20Udaysinh PatilNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument7 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaSARAVANAN PNo ratings yet

- Income Tax Slab 2 Scheme2021Document14 pagesIncome Tax Slab 2 Scheme2021palharjeetNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument8 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaGeetanjali BarejaNo ratings yet

- Wa0016Document3 pagesWa0016Vinay DahiyaNo ratings yet

- ANIL GANVIR Old New Regime ComputationDocument1 pageANIL GANVIR Old New Regime ComputationDrAndrew WillingtonNo ratings yet

- Income Tax Planner FY 2020-21Document12 pagesIncome Tax Planner FY 2020-21RedNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 449048510080820 Assessment Year: 2020-21Document8 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 449048510080820 Assessment Year: 2020-21రాకేష్ బాబు చట్టిNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inKATHI JAYANo ratings yet

- Income Tax Calculator For F.YDocument8 pagesIncome Tax Calculator For F.YRavindra BagateNo ratings yet

- Thiroo - Income Tax - 09-10Document6 pagesThiroo - Income Tax - 09-10thiroo_2008No ratings yet

- Latest Tax CalculatIor 3.3.2Document16 pagesLatest Tax CalculatIor 3.3.2Bijender Pal Choudhary100% (3)

- Anil Ganvir Form 16 (21 22)Document3 pagesAnil Ganvir Form 16 (21 22)DrAndrew WillingtonNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryR S RatanNo ratings yet

- Screenshot 2023-02-28 at 4.57.32 PMDocument2 pagesScreenshot 2023-02-28 at 4.57.32 PMTanushree MishraNo ratings yet

- Employee Declaration Form 1Document4 pagesEmployee Declaration Form 1rifas caNo ratings yet

- Form No.16 Aa-1Document2 pagesForm No.16 Aa-1Vishnu Vardhan ANo ratings yet

- Salary On IncomeDocument22 pagesSalary On IncomeManjunathNo ratings yet

- CA Intermediate Taxation November 2022 Suggested AnswersDocument19 pagesCA Intermediate Taxation November 2022 Suggested AnswersBhawna KapoorNo ratings yet

- 031508996Document2 pages031508996Lokesh KumarNo ratings yet

- Matekar PDFDocument1 pageMatekar PDFdharmveer singhNo ratings yet

- DR Ali FinalDocument3 pagesDR Ali FinalbuxartaxNo ratings yet

- Form 12 BBSampleDocument2 pagesForm 12 BBSampleAbhishekChauhanNo ratings yet

- Income Tax CalculationDocument2 pagesIncome Tax CalculationMadhan Kumar BobbalaNo ratings yet

- Tax Calculator - Indian Income Tax 2008-09Document7 pagesTax Calculator - Indian Income Tax 2008-09Jayamohan100% (29)

- Income Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)Document1 pageIncome Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)ikbalbahar1992No ratings yet

- Form16 (2022-2023)Document3 pagesForm16 (2022-2023)mamtakumaripihooNo ratings yet

- Periyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Document2 pagesPeriyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Indumadhi SalemNo ratings yet

- Finding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesFrom EverandFinding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Final A4Document28 pagesFinal A4Jeevabinding xeroxNo ratings yet

- A4 3Document29 pagesA4 3Jeevabinding xeroxNo ratings yet

- A Study On Customer Satisfaction at MRF Tyres, Chennai.: Bachelor of CommerceDocument5 pagesA Study On Customer Satisfaction at MRF Tyres, Chennai.: Bachelor of CommerceJeevabinding xeroxNo ratings yet

- Acknowledgemen: Mr. M. ThejamoorthyDocument7 pagesAcknowledgemen: Mr. M. ThejamoorthyJeevabinding xeroxNo ratings yet

- A Study On Sales Promotion at Yamaha Show Room, Tirupati.: Bachelor of CommerceDocument5 pagesA Study On Sales Promotion at Yamaha Show Room, Tirupati.: Bachelor of CommerceJeevabinding xeroxNo ratings yet

- 1619069016human Rights Judgments On Human Rights and Policing in IndiaDocument100 pages1619069016human Rights Judgments On Human Rights and Policing in IndiaJeevabinding xeroxNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument4 pagesForm No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceJeevabinding xeroxNo ratings yet

- B.naresh 194m1e0016Document69 pagesB.naresh 194m1e0016Jeevabinding xeroxNo ratings yet

- Taxation of Companies: Group Members: Akanksha Gupta Lakshmikant Patnaik Khushboo Goel Pulkit SachdevaDocument21 pagesTaxation of Companies: Group Members: Akanksha Gupta Lakshmikant Patnaik Khushboo Goel Pulkit Sachdevabunny36100% (1)

- BPCL Engineers Geologist Recruitment Notice 28 04Document25 pagesBPCL Engineers Geologist Recruitment Notice 28 04chaitanya babarNo ratings yet

- Donor S Tax Exam AnswersDocument6 pagesDonor S Tax Exam AnswersAngela Miles DizonNo ratings yet

- Exercise 1: Schedule of Expected Cash CollectionDocument7 pagesExercise 1: Schedule of Expected Cash CollectionLenard Josh IngallaNo ratings yet

- ILS in BFDocument10 pagesILS in BFNicole Andrea TuazonNo ratings yet

- Assignment - Mandalika Land ConflictDocument3 pagesAssignment - Mandalika Land Conflictwahyu sulistya affarahNo ratings yet

- Transfer Certificate of Land Title in The PhilippinesDocument4 pagesTransfer Certificate of Land Title in The PhilippinesNea QuiachonNo ratings yet

- Od 430486422854927100Document2 pagesOd 430486422854927100khushichoudhary5664No ratings yet

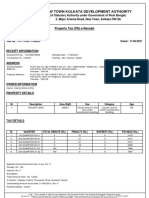

- New Town Kolkata Development Authority: Property Tax (PD) E-ReceiptDocument2 pagesNew Town Kolkata Development Authority: Property Tax (PD) E-ReceiptSSK DEVELOPERSNo ratings yet

- Sale Vouching TemplateDocument23 pagesSale Vouching TemplateMurtuza DilawarNo ratings yet

- Modern History USA 1919-1941 NotesDocument13 pagesModern History USA 1919-1941 NotesOliver Al-MasriNo ratings yet

- Management Equity Incentives and Corporate Tax AvoDocument13 pagesManagement Equity Incentives and Corporate Tax AvoWenXingyue ArielNo ratings yet

- The Role and Environment of Managerial Finance: True/FalseDocument23 pagesThe Role and Environment of Managerial Finance: True/FalseKenjiNo ratings yet

- A Study On Self-Assessment Tax System Awareness in MalaysiaDocument11 pagesA Study On Self-Assessment Tax System Awareness in MalaysiaEfriani SipahutarNo ratings yet

- Example Withholding TaxDocument2 pagesExample Withholding TaxRaudhatun Nisa'No ratings yet

- Case C-132/88 Commission V GreeceDocument7 pagesCase C-132/88 Commission V GreeceJane Chan Ee NinNo ratings yet

- Sun Maxilink 100Document11 pagesSun Maxilink 100Maloucel DiazNo ratings yet

- Vol - CXXI-No .163 PDFDocument64 pagesVol - CXXI-No .163 PDFTony Ras MwangiNo ratings yet

- Up Land LawsDocument22 pagesUp Land LawsLakshit100% (1)

- DTC Agreement Between Papua New Guinea and New ZealandDocument40 pagesDTC Agreement Between Papua New Guinea and New ZealandOECD: Organisation for Economic Co-operation and DevelopmentNo ratings yet

- A2 Level Essential Vocabulary: The Global Economy (Economics)Document10 pagesA2 Level Essential Vocabulary: The Global Economy (Economics)A Grade EssaysNo ratings yet

- Chapter 3 Part 2Document22 pagesChapter 3 Part 2ISLAM KHALED ZSCNo ratings yet

- Duplichecker Plagiarism ReportDocument3 pagesDuplichecker Plagiarism ReportMadan ViswanathanNo ratings yet

- Batch 3 - Taxation 1 / Atty. Dante MarananDocument9 pagesBatch 3 - Taxation 1 / Atty. Dante MarananJNo ratings yet

- 2462 Fine JewelryDocument129 pages2462 Fine JewelrySkinnerAuctions100% (9)

- MGFP BrochureDocument26 pagesMGFP BrochureAbhinesh KumarNo ratings yet

- Annual-Report-13-14 AOP PDFDocument38 pagesAnnual-Report-13-14 AOP PDFkhurram_66No ratings yet

- Nigeria WHT Need To KnowDocument6 pagesNigeria WHT Need To KnowphazNo ratings yet