Professional Documents

Culture Documents

Periyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)

Uploaded by

Indumadhi Salem0 ratings0% found this document useful (0 votes)

6 views2 pagesOriginal Title

247-INDHUMATHI

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesPeriyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)

Uploaded by

Indumadhi SalemCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

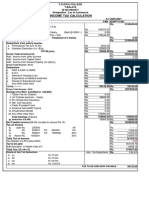

PERIYAR UNIVERSITY

(NAAC Reaccredited with 'A++' Grade - State University-NIRF Rank 73- ARIIA RANK 10)

INCOME TAX CALCULATION STATEMENT FOR THE FINANCIAL YEAR 2021-2022

Silver Jubilee(1997-2022) Assessment Year 2022 - 2023

EMP.NO. : 247 NAME. : Tmt. R. Indumathi Designation. : Office Assistant

1. Gross Salary Income(As per enclosed statement) : Rs. 278644.00

(a) LESS Standard Deduction (Rule 16(i)(a))(salaried employee) : Rs. 50000.00

2. LESS HRA exempted to the least of the following : Rs. 0.00

Balance(1-2) : Rs. 228644.00

3. LESS:Professional Tax U/s (iii) : Rs. 0.00

Net Salary : Rs. 228644.00

4. LESS:Loss fromhouse property as per form12-C : Rs. 0.00

U/s 24(b)(iv)(Int. on Home Loan Max upto 200000)

5. ADD:Income fromOther Source + Additional income : Rs. 0.00

(GTI) Gross Total Income : Rs. 228644.00

DEDUCTIONS UNDER CHAPTER VI-A:

[MaximumRs.1,50,000(U/s 80C, 80CCC, 80CCD)]

6 (A) GPF / CPS Subscription : Rs. 230277.00

New Health Insurance Scheme : Rs. 0.00

SPF & FBF : Rs. 1860.00

LIC Premium- Salaray Savings Scheme : Rs. 0.00

LIC Premium- Direct Remittance : Rs. 107507.00

Post Office Scheme : Rs. 0.00

National Savings Certificate (NSC) : Rs. 0.00

Notified Equity Linked Savings Scheme : Rs. 0.00

Five Years Fixed Deposit in Banks : Rs. 0.00

Public Provident Fund (PPF) : Rs. 0.00

Repayment of Housing Loan (Principal Only) : Rs. 11524.00

Tution Fees (Only 2 Children Allowed) : Rs. 34650.00

Notified Bonds of NABARD : Rs. 0.00

Notified Units of Mutual Funds : Rs. 0.00

6 (B) Deduction U/s 80 CCC (Jeevan Suraksha, etc) : Rs. 0.00

6 (C) Deduction U/s 80 CCD (Pension Plan) : Rs. 0.00

Total (A+B+C) - (Max upto Rs. 150000) : Rs. 150000.00

6 (D) 80-D Premiumpaid on Mediclaim(Max upto Rs. 50000) : Rs. 2160.00

additional deduction upto Rs. 50000 /- in respect of parents : Rs. 0.00

60 yrs old

6 (E) 80-U Permanent Phy. Disability below 80%Max Rs. 75000 : Rs. 0.00

PERIYAR UNIVERSITY

(NAAC Reaccredited with 'A++' Grade - State University-NIRF Rank 73- ARIIA RANK 10)

INCOME TAX CALCULATION STATEMENT FOR THE FINANCIAL YEAR 2021-2022

Silver Jubilee(1997-2022)

EMP.NO. : 247 NAME. : Tmt. R. Indumathi Designation. : Office Assistant

80%and above Rs.125000 : Rs. 0.00

6(F) U/s.80CCD(1B): Addl Contribution to NPS ( : Rs. 26543.00

Max.Rs.50000/=)

6(G) 80DD: Exp. on medical treatment of handicapped : Rs. 0.00

dependents Max.100000/=)

6(H) U/s.80DDB: Medical expenses towards treatment (Form10i : Rs. 0.00

should be enclosed.)

6(I) U/s.80E: Interest on loan taken for higher studies availed by : Rs. 0.00

the assessee or children

6(J) U/s.80G: Donation to Univ, National Relief Funds , etc. : Rs. 738.00

6(K) Others : Rs. 0.00

Total Deduction : Rs. 179441.00

7. Total Income(GTI- Total Deductions) : Rs. 49210.00

8. Tax on Total Income

(i) On the first Rs.250000/- : Rs. 0.00

(ii) On the next 250000 (Rs.250001/-to Rs.500000/-)@5% : Rs. 0.00

(iii) On the next(Rs.500001/-to Rs.1000000/-)@20% : Rs. 0.00

(iv) On the next(Rs.1000001/-to Rs.10000000/-)@30% : Rs. 0.00

9. Tax Payable : Rs. 0.00

LESS : Rebate Max.Rs.12500 for Total income upto Rs.500000/- : Rs. 12500

Less 89(1) : Rs. 0.00

Total : Rs. -12500.00

10 ADD :Educational Cess @4%on Tax Payable : Rs. 0.00

11 Total Tax Payable : Rs. 0.00

Total Tax Paid (Already Deducted) : Rs. 0.00

Total Refundable : Rs. 0.00

Countersigned Signature of the Person responsible for deduction of tax

Head of Office / Head of the Department Full Name : Tmt. R. Indumathi [ 247 ]

Designation : Office Assistant

Place : Salem

Date : 23-02-2022

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Income Tax Calculation Lec in CommerceDocument2 pagesIncome Tax Calculation Lec in CommerceMadhan Kumar BobbalaNo ratings yet

- Income Tax Statement For The Financial Year 2022-23 of K.sasiDHAR On 09-01-2023Document8 pagesIncome Tax Statement For The Financial Year 2022-23 of K.sasiDHAR On 09-01-2023Katari SasidharNo ratings yet

- Salary TaxDocument4 pagesSalary Taxapi-3810632No ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inKATHI JAYANo ratings yet

- Gopi IT2021 Tentative CalculationsheetDocument4 pagesGopi IT2021 Tentative CalculationsheetAR G.KAPILANNo ratings yet

- Financial Year 2020-21 Annual Income Tax Declaration ComparisonDocument4 pagesFinancial Year 2020-21 Annual Income Tax Declaration ComparisonHaresh RajputNo ratings yet

- Income Tax Calculation 2023-24 (Old Tax Regime) : Annexure - IiDocument1 pageIncome Tax Calculation 2023-24 (Old Tax Regime) : Annexure - IiGOKUL HD LIVE EVENTSNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inGOKUL HD LIVE EVENTSNo ratings yet

- Computation of Toatal IncomeDocument4 pagesComputation of Toatal IncomePRITAM PATRANo ratings yet

- Tax CalculationDocument3 pagesTax Calculationreach2hardyNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document8 pagesIncome Tax Calculator Fy 2020 21 v1Yogesh BajajNo ratings yet

- IT Calculation New RegimeDocument4 pagesIT Calculation New Regimeyelrihs23No ratings yet

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- Income Tax Calculator titleDocument12 pagesIncome Tax Calculator titleUdaysinh PatilNo ratings yet

- Income Tax Statement for Retired PharmacistDocument4 pagesIncome Tax Statement for Retired PharmacistSUREMAN FINANCIAL SERVICESNo ratings yet

- Principles of Taxation - DeductionsDocument7 pagesPrinciples of Taxation - Deductions20047 BHAVANDEEP SINGHNo ratings yet

- Income Tax Calculator Fy 2020 21 v2Document12 pagesIncome Tax Calculator Fy 2020 21 v2Anonymous Clm40C1No ratings yet

- You Have Opted For Old Tax RegimeDocument2 pagesYou Have Opted For Old Tax RegimeRamsheed Ashraf100% (1)

- Master File of CalculationDocument4 pagesMaster File of Calculationjitendriyasahoo994No ratings yet

- Income TaxDocument11 pagesIncome Taxci_balaNo ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document18 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Arjun VermaNo ratings yet

- Comprehensive Tax Practices and ExercisesDocument45 pagesComprehensive Tax Practices and ExercisesWS KNIGHTNo ratings yet

- Cps Tax Form Format For 23-24Document11 pagesCps Tax Form Format For 23-24sr91919No ratings yet

- New CTCDocument3 pagesNew CTCChristiissacNo ratings yet

- Salary On IncomeDocument22 pagesSalary On IncomeManjunathNo ratings yet

- Tax Calculator - Indian Income Tax 2008-09Document7 pagesTax Calculator - Indian Income Tax 2008-09Jayamohan100% (29)

- Latest Tax CalculatIor 3.3.2Document16 pagesLatest Tax CalculatIor 3.3.2Bijender Pal Choudhary100% (3)

- Income Tax Calculator GuideDocument9 pagesIncome Tax Calculator Guidechandu halwaeeNo ratings yet

- Form 16 certificate for salary incomeDocument1 pageForm 16 certificate for salary incomeSourabhthakral_1No ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument7 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaSARAVANAN PNo ratings yet

- Bose Tax 2024Document2 pagesBose Tax 2024placementcell Govt ITI AttingalNo ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- Tax Income TitleDocument10 pagesTax Income TitleAyushi RajputNo ratings yet

- Developed By-Office Automation Division, IIT Kanpur Page No.1Document2 pagesDeveloped By-Office Automation Division, IIT Kanpur Page No.1Kishan OmarNo ratings yet

- Degree Application 2018Document2 pagesDegree Application 2018ldineshkumarNo ratings yet

- Income Tax Details for Assistant Engineer in 2015-16Document5 pagesIncome Tax Details for Assistant Engineer in 2015-16Phani PitchikaNo ratings yet

- Assessment of Charitable Trusts: Tax SupplementDocument3 pagesAssessment of Charitable Trusts: Tax SupplementCA Ved Parkash AroraNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument8 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaGeetanjali BarejaNo ratings yet

- B1 Renand Dsouza TYBFMDocument8 pagesB1 Renand Dsouza TYBFMRenandNo ratings yet

- I JT Statement For F.Y 2022-23Document7 pagesI JT Statement For F.Y 2022-23Sasidhar KatariNo ratings yet

- Income Tax Calculator 2018-19Document15 pagesIncome Tax Calculator 2018-19Raju Ranjan SinghNo ratings yet

- Income Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)Document1 pageIncome Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)ikbalbahar1992No ratings yet

- Income Tax CalculatorDocument11 pagesIncome Tax Calculatorsaty_76No ratings yet

- March 2019Document1 pageMarch 2019Anonymous 2uvubjzzNo ratings yet

- Faq'S & Guidlines On Income TaxDocument50 pagesFaq'S & Guidlines On Income TaxRavikarthik GurumurthyNo ratings yet

- Income Tax Calculator Fy 2021 22 v2Document15 pagesIncome Tax Calculator Fy 2021 22 v2KumardasNsNo ratings yet

- Sunil BDocument2 pagesSunil Bplacementcell Govt ITI AttingalNo ratings yet

- Dit Sem V SolnDocument10 pagesDit Sem V Solnmaaz11052020No ratings yet

- Oofits: Qualifying (27 885) U/S 8octo Donation Rounded Off U/S 288A of Tax of DR For AyDocument8 pagesOofits: Qualifying (27 885) U/S 8octo Donation Rounded Off U/S 288A of Tax of DR For AyKushagra BurmanNo ratings yet

- IT Calculator 2018 LiteDocument6 pagesIT Calculator 2018 LiteHr PoonamNo ratings yet

- 97Document2 pages97rusingh932No ratings yet

- Income Tax Calculator Fy 2019 20 v4Document9 pagesIncome Tax Calculator Fy 2019 20 v4Anil KesarkarNo ratings yet

- Tax Guide for Manufacturing CompanyDocument10 pagesTax Guide for Manufacturing CompanynikhilramaneNo ratings yet

- NitishDocument1 pageNitishkaushikdutta176No ratings yet

- TDS Certificate Form 16Document3 pagesTDS Certificate Form 16Apte SatishNo ratings yet

- Basic Concepts PDFDocument14 pagesBasic Concepts PDFsumitNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- The Place of Race in Conservative and Far-Right MovementsDocument10 pagesThe Place of Race in Conservative and Far-Right Movementsapi-402856696No ratings yet

- ChallanDocument1 pageChallanIMRAN ALI (Father Name:RAZIQUE DINO)No ratings yet

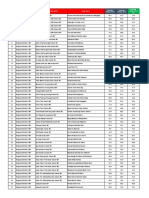

- No. Branch (Mar 2022) Legal Name Organization Level 4 (1 Mar 2022) Average TE/day, 2019 Average TE/day, 2020 Average TE/day, 2021 (A)Document7 pagesNo. Branch (Mar 2022) Legal Name Organization Level 4 (1 Mar 2022) Average TE/day, 2019 Average TE/day, 2020 Average TE/day, 2021 (A)Irfan JauhariNo ratings yet

- (Revised) Scribe Declaration Anx IIDocument2 pages(Revised) Scribe Declaration Anx IIDeepesh kumarNo ratings yet

- Government Building Act summaryDocument1 pageGovernment Building Act summarysajinbrajNo ratings yet

- An Allonge Is Not An AssignmentDocument3 pagesAn Allonge Is Not An Assignmentdbush2778No ratings yet

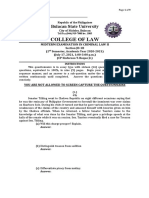

- 509 Assignment-1Document11 pages509 Assignment-1mayani musumaliNo ratings yet

- Snuggie TM Cancellation PleadingsDocument19 pagesSnuggie TM Cancellation PleadingsDaniel BallardNo ratings yet

- Rizal Course ReviewerDocument6 pagesRizal Course ReviewerMarianne AtienzaNo ratings yet

- O7EWWX Roelderpdfmod - 230523 - 110842Document2 pagesO7EWWX Roelderpdfmod - 230523 - 110842Eddy FernándezNo ratings yet

- Midterm Examination Crim Law 2 JD-1B 2020-2021 AYDocument9 pagesMidterm Examination Crim Law 2 JD-1B 2020-2021 AY师律No ratings yet

- Case DigestDocument4 pagesCase DigestXing Keet LuNo ratings yet

- Fundraising Consulting AgreementDocument7 pagesFundraising Consulting AgreementjustinR1210% (1)

- Topic 2: Burden of Proof: Common LawDocument11 pagesTopic 2: Burden of Proof: Common LawnicoleNo ratings yet

- CA FINAL IDT QUESTION BANK FOR MAYNOV 2021 Atul AgarwalDocument463 pagesCA FINAL IDT QUESTION BANK FOR MAYNOV 2021 Atul AgarwalRonita DuttaNo ratings yet

- Mahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahDocument4 pagesMahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahMUHAMMAD SALEEM RAZANo ratings yet

- Gul v. Bush Reply in Support of Motion To Review Certain Detainee MaterialsDocument30 pagesGul v. Bush Reply in Support of Motion To Review Certain Detainee MaterialsWashington Free BeaconNo ratings yet

- 84 - GUINGONA vs. CARAGUE - EDUCATIONCASE DIGESTDocument1 page84 - GUINGONA vs. CARAGUE - EDUCATIONCASE DIGESTJasenNo ratings yet

- IACAT Workshop Tickets, Notes & Travel RemindersDocument1 pageIACAT Workshop Tickets, Notes & Travel RemindersKarah JaneNo ratings yet

- Format of Final Research PaperDocument10 pagesFormat of Final Research PaperHaroon AhmedNo ratings yet

- Ifrs Unit 1Document9 pagesIfrs Unit 1Deven LadNo ratings yet

- Ansi Saia A92 5 2006 R2014 Boom Supported Elevating Work PlatformsDocument62 pagesAnsi Saia A92 5 2006 R2014 Boom Supported Elevating Work PlatformsLuis Carcamo Martinez100% (1)

- Calimlim-Canullas V Fortun Sales CaseDocument1 pageCalimlim-Canullas V Fortun Sales Caseruth_pedro_2100% (1)

- Maths 2 Answer Sheet PDFDocument1 pageMaths 2 Answer Sheet PDFvinitha2675No ratings yet

- Republic of The Philippines Office of The City Prosecutor Puerto Princesa CityDocument4 pagesRepublic of The Philippines Office of The City Prosecutor Puerto Princesa CityHezro Inciso CaandoyNo ratings yet

- Toto Jurisdiction-of-the-High-Court-to-Punish-for-ContemptDocument105 pagesToto Jurisdiction-of-the-High-Court-to-Punish-for-Contemptravi_bhateja_2No ratings yet

- Ohio Domestic Violence Fatalities 2022Document2 pagesOhio Domestic Violence Fatalities 2022Sarah McRitchieNo ratings yet

- 13 Am Crim LRev 235Document15 pages13 Am Crim LRev 235aristo01No ratings yet

- Nutrition LabelDocument10 pagesNutrition LabelJoe D.No ratings yet

- Budget Fy21Document138 pagesBudget Fy21ForkLogNo ratings yet