Professional Documents

Culture Documents

B1 Renand Dsouza TYBFM

Uploaded by

RenandCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

B1 Renand Dsouza TYBFM

Uploaded by

RenandCopyright:

Available Formats

Q1) from the following details calculate taxable income from house property of Ms.

Saakshi for PY

2022/2023.

Particulars Hp1 Hp2

Rent received 40000 PM -

Reasonable letting value 500000 515500

Municipal value 485000 438000

Municipal tax 10% 15%

Interest in loan 245000 -

House number 2 was purchased out of funds borrowed by mortgaging house number 1, housing loan

was taken on 01-08-2020.

Solution:

Statement of income from house property-

Particulars Hp1 (LOP) Hp2 (SOP)

1) Municipal value 485000 -

2) Fair rent 500000 -

3) Whichever of above is 500000

higher

4) Standard rent - -

5) Expected rent 500000 -

6) Actual rent received 480000 -

Gross annual value 500000 -

Less- municipal tax paid by the (48500) -

landlord

Net annual value 451500 -

Less- deduction under section

24-

A) Standard deduction (30% (135450) -

of NAV)

B) Interest in housing loan - (200000)

Taxable income from house 316050 200000

property

Total taxable income from house property –

Hp1 316050

Hp2 200000

Total 516050

2) MR Dsa is employed with Om LTD. Provides following details of his salary income for PY 2022-

2023.

A) basic salary of rupees 38000 PM.

B) dearness allowance of rupees 18000 PM.

C) travelling allowance of rupees 7000 PM. (Amount spent 22000)

D) expenses on lunch reimbursement of rupees 1600 PM in cash.

E) uniform allowance of rupees 1300 PM. (Amount spent 5700)

F) project allowance of rupees 10000 PM.

G) overtime allowance of rupees 2000 PM.

H) servant allowance of rupees 85500. (Amount spent 47000)

I) medical allowance of rupees 42000. (Amount spent 11500)

J) children education allowance of rupees 500 PM per child. (MR Dsa has 3 children)

K) helper allowance of rupees 200 PM.

L) professional tax paid during the year of rupees 2000.

M) other expenses incidental to employment of rupees 100000.

Calculate taxable salary.

Solution:

Statement of income from salary –

Particulars Amount Amount

Basic salary 456000

Dearness allowance 216000

Travelling allowance 84000

Less- exempt (22000) 62000

Lunch allowance 19200

Uniform allowance 15600

Less- exempt (5700) 9900

Project allowance 120000

Overtime allowance 24000

Servant allowance 85500

Medical allowance 40000

Children education allowance 18000

Less- exempt (2400) 15600

Helper allowance 9600

Less- exempt (9600) Nil

Gross taxable salary 951800

Less- standard deduction (50000)

Less entertainment allowance -

Less- professional tax (2000)

Net taxable salary 1948000

3) MR Dharmik provides you with the following

information.

A) basic salary of rupees 70000 PM.

B) dearness allowance of rupees 28000 PM.

C) turnover commission 2%. (Turnover being 4500000)

D) MR Dharmik contribution to provident fund. (12000 PM)

E) employer’s contribution to provident fund. (12000 PM)

F) interest credited to provident fund at 11% of rupees 59000.

G) he has paid professional tax of rupees 300 PM.

Calculate his income from salary for AY 2023-2024, If PF is SPF and RPF.

Solution:

Statement of income from salary SPF

Particulars Amount Amount

Basic salary 840000

Dearness allowance 336000

Bonus 230000

Turnover commission 90000

Employer’s contribution to SPF 144000

Less- exempt (144000) Nil

Employer’s interest 59000

Less- exempt (59000) Nil

Gross taxable salary 1496000

Less – standard deduction (50000)

Less – professional tax (3600)

Net taxable salary 1442400

Statement of income from salary RPF

Particulars Amount Amount

Basic salary 840000

Dearness allowance 336000

Bonus 230000

Turnover commission 90000

Employer’s contribution to 144000

RPF

Less- exempt (132000) 12000

Employer’s interest 59000

Less- exempt (50955) 8045

Gross taxable salary 1516045

Less- standard deduction (50000)

Less – professional tax (3000)

Net taxable salary 1463045

4) SHRI Shubham, an Indian citizen left India for the first time on 21/08/2022 for employment in

New York City and did not return till 31st March 2023. Determine his residential status for AY 2023-

2024.

Solution:

Conditions No. of days Satisfied or not Reason

satisfied

Basic condition-

1) Stay of 182 days 143 days Not satisfied

or more in India in

previous year. OR 2)

a) stay of 60 days or NA

more in India in

previous year. And

b) stay of 365 days NA

or more in India in

last 4 previous years

Additional

conditions - NA

1) resident in India

in at least 2 out of

10 previous years

AND 2) stay of 730 NA

days or more in India

in last 7 previous

years

Space for working

Conclusion – SHRI Shubham failed

to satisfy the first condition and

second basic condition is not

Year Days applicable for him because he is

covered under the exception.

2021-2022

Therefore, Shubham is NR in

2022-2023 143 PY 2022-2023 and AY 2023-2024.

2023-2024

2024-2025

2025-2026

Months April May June

Days 30 31 30

Months July August September

Days 31 21

Months October November December

Days

Months January February March

Days

Total 143

5) From the following information MS Rashmi for the previous year 2021-2022, Compute the gross

total income for the assessment year 2022. If she is a) ROR, b) RNOR, c) NR.

Income Amount

1)Income from business in Dubai controlled 60000

from England.

2)rent from house in UK received in Spain. 100000

3) income earned in Spain in past, but 50000

brought to India during current previous

year.

4) dividend from German company 60000

received in England.

5) income from agriculture in Japan 200000

received in India.

6)royalty from company in England 150000

received in Russia.

7)Interest credited to HSBC Bank, New York 81500

branch.

8)Income from profession in Bhutan 185000

received n Bhutan.( Profession was setup in

India)

Solution:

Particulars ROR RNOR NR

1)Income received in 60000 - -

England

2)rent received in Spain 100000 - -

3) income earned in Exempt Exempt Exempt

past brought in India in

current PY

4) dividend received in 60000 - -

England

5) income received in 200000 200000 200000

India

6)Royalty received in 150000 - -

Russia

7)Interest credited in 81500 - -

bank in England

8)income from 185000 185000 -

profession

Total 836500 385000 200000

6) Mrs. Prajakta purchased a Flat as on 1st June 2010 for ₹25,00,000. She also paid Stamp Duty and

Registration charges of ₹30,000 and paid a brokerage of ₹8,800. She renovated her flat on 1st July

2014 and spent ₹1,00,000. She again renovated her Flat again on 5th November 2018 and Spent

₹2,30,000.

On 31st October 2022, She sold her flat for ₹2,00,00,000. She had to pay ₹2,00,000 as brokerage for

selling her flat. You are required to Calculate the Taxable income from Long Capital Gains of Mrs.

Prajakta for P.Y. 2022 – 2023.

Solution:

ICOA=COA X Index of the ½ of trf

Index of the ½ of Acq

ICOA=2538800 X 331 = 5031993

167

ICOI=COI X Index of the ½ of trf

Index of the ½ of Imp

ICOI=100000 X 331 = 137917

240

ICOI=230000 X 331 = 271893

280

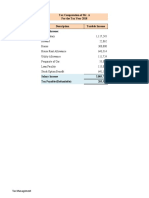

STATEMENT OF INCOME FROM CAPITAL GAINS

Particulars Amount (₹) Amount (₹)

Full value of consideration 2,00,00,000

Less : cost of transfer (2,00,000) 1,98,00,000

Less : Index cost of Acquisition (50,31,993)

Less : Index cost of

Improvement (1) (1,37,917)

(2) (2,71,893) (54,41,803)

Long term capital gains 1,43,58,197

7) From the following Information given by Ms. Sharon, Calculate her taxable Income from other

sources for previous year 2022 – 2023.

1. Dividend from Indian Company ₹15,000 [Dividend collection Charges ₹3000].

2. Dividend from a Foreign Company ₹30,000. Bank Charges ₹5,000 as collection charges. Interest on

Loan borrowed for purchasing shares ₹1,000.

3. Winnings from Lotteries ₹12,000 [Lottery Tickets purchased ₹1,000]

4. Interest on Debentures ₹2,500 from Indian Company.

5. Income of a Minor Child ₹1,000.

6. Rent from Plant & Machinery ₹3,500 p.m. Expense incurred ₹3,000 for repairs ₹2,000 as

depreciation and other expenses ₹1,000.

7. Gross Salary ₹5000 from XYZ Ltd.

8. Agricultural Income from India ₹8,000.

9. Income Tax Refund [including interest ₹25,000] ₹35,000.

Solution:

STATEMENT OF INCOME FROM OTHER SOURCES

Particulars Amount (₹) Amount (₹)

Dividend from Indian Co. 15,000

(-) Deduction (3,000) 12,000

Dividend from Foreign Co. 30,000

(-) Deduction

1) Bank charges (5,000)

2) Interest (1,000) 24,000

Winnings 12,000

Interest on Debenture 2,500

Income of a Minor 1,000

(-) Exempt (1,500) Nil

Rent from P&M 42,000

(-) Deduction

1) Depreciation (2,000)

2) Repairs (3,000)

3) Other Expense (1,000) 36,000

Agriculture Income Nil

Interest on Refund 25,000

Taxable Income From Other 82,500

Sources

You might also like

- Veronica Rozario's tax calculation for AY 2021-2022Document5 pagesVeronica Rozario's tax calculation for AY 2021-2022Shakib studentNo ratings yet

- Module 3 Illustrations Ans KeyDocument11 pagesModule 3 Illustrations Ans KeyKirstine LabuguinNo ratings yet

- Tax statement for Mrs. Elizabeth FarajiDocument29 pagesTax statement for Mrs. Elizabeth FarajiDead Beat's RandomNo ratings yet

- How To Calculate Total IncomeDocument16 pagesHow To Calculate Total IncomeAshish ChatrathNo ratings yet

- HRA and SalaruDocument1 pageHRA and SalaruAnushree DeyNo ratings yet

- Quiz 1 - StrataxDocument3 pagesQuiz 1 - Strataxspongebob SquarepantsNo ratings yet

- Tax Skills RolandDocument2 pagesTax Skills Rolandtafadzwamapfumo980No ratings yet

- CTC 4000000 Particulars: 1 Performance Linked Incentive 2 Basic 3 House Rent AllowanceDocument12 pagesCTC 4000000 Particulars: 1 Performance Linked Incentive 2 Basic 3 House Rent AllowanceNamita BhattNo ratings yet

- SFS U.G. B.com. Income TaxDocument3 pagesSFS U.G. B.com. Income TaxAbinash VeeraragavanNo ratings yet

- Case Study 2Document2 pagesCase Study 2Anil NagarajNo ratings yet

- Assignment TAX (21 AIS 039)Document18 pagesAssignment TAX (21 AIS 039)Amran OviNo ratings yet

- AliDocument38 pagesAliAzam JamalNo ratings yet

- Homework 1: D09, Q2 (B) (B) (I) Due Date For Submission of Tax ReturnDocument11 pagesHomework 1: D09, Q2 (B) (B) (I) Due Date For Submission of Tax ReturnBryan EngNo ratings yet

- R2. TAX (M.L) Solution CMA May-2023 ExamDocument5 pagesR2. TAX (M.L) Solution CMA May-2023 ExamSharif MahmudNo ratings yet

- Degree Application 2018Document2 pagesDegree Application 2018ldineshkumarNo ratings yet

- Salary On IncomeDocument22 pagesSalary On IncomeManjunathNo ratings yet

- Toaz - Info 89bf91d5 1612761367237 PRDocument7 pagesToaz - Info 89bf91d5 1612761367237 PRAEHYUN YENVYNo ratings yet

- Taxation Module 3: Numerical Problems Income From Business or ProfessionDocument5 pagesTaxation Module 3: Numerical Problems Income From Business or ProfessionShankar HunnurNo ratings yet

- Final AccountsDocument19 pagesFinal AccountsHammadNo ratings yet

- Solution SalariesDocument16 pagesSolution SalariesAniket AgrawalNo ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- Malaysian Taxation Case StudyDocument6 pagesMalaysian Taxation Case StudyPushpa ValliNo ratings yet

- Periyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Document2 pagesPeriyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Indumadhi SalemNo ratings yet

- Income From Salary Solution ZDocument3 pagesIncome From Salary Solution ZMuhammad FaisalNo ratings yet

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- Sample Payroll CalculationDocument5 pagesSample Payroll CalculationArajrubanNo ratings yet

- Examples Salary 2019Document18 pagesExamples Salary 2019Asma ZeeshanNo ratings yet

- Pitino Acquired 90 Percent of Brey's Outstanding SharesDocument40 pagesPitino Acquired 90 Percent of Brey's Outstanding SharesKailash KumarNo ratings yet

- Rodel's 2020 Income Tax Computation with Itemized DeductionsTITLE Mulry's 2020 Taxable Income and Tax Payable TITLE Sharon's Various 2020 Tax Computations as Resident, Non-Resident ETB and NETBDocument5 pagesRodel's 2020 Income Tax Computation with Itemized DeductionsTITLE Mulry's 2020 Taxable Income and Tax Payable TITLE Sharon's Various 2020 Tax Computations as Resident, Non-Resident ETB and NETByezaquera100% (1)

- Solution Tax667 - Jun 2016-1Document8 pagesSolution Tax667 - Jun 2016-1Zahiratul QamarinaNo ratings yet

- TM PQsDocument10 pagesTM PQsAnooshayNo ratings yet

- Tax Chapter SummaryDocument4 pagesTax Chapter SummaryAriin TambunanNo ratings yet

- Tax Ek Prem KathaDocument267 pagesTax Ek Prem Kathasahil lathiNo ratings yet

- Financial Year 2020-21 Annual Income Tax Declaration ComparisonDocument4 pagesFinancial Year 2020-21 Annual Income Tax Declaration ComparisonHaresh RajputNo ratings yet

- Square Bridge: Salary Structure Monthly Gross Annual Gross Rs. Rs. A Gross EarningsDocument1 pageSquare Bridge: Salary Structure Monthly Gross Annual Gross Rs. Rs. A Gross EarningsVikas gowdruNo ratings yet

- Payslip Categori Zat I OnDocument3 pagesPayslip Categori Zat I OnKrishna Chaitanya PuvvadaNo ratings yet

- Salary CalculationDocument1 pageSalary CalculationushasathyaNo ratings yet

- 8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Document8 pages8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Roselyn LumbaoNo ratings yet

- Income tax payable of partners Ron and Nor from general professional partnership (GPP) and other sourcesDocument4 pagesIncome tax payable of partners Ron and Nor from general professional partnership (GPP) and other sourcesNicole BatoyNo ratings yet

- Tax Income TitleDocument10 pagesTax Income TitleAyushi RajputNo ratings yet

- FTX MockDocument12 pagesFTX MockFatemah MohamedaliNo ratings yet

- Income Tax Calculation SheetDocument8 pagesIncome Tax Calculation SheetArajrubanNo ratings yet

- Gross Reportable Compensation Income 285,000Document3 pagesGross Reportable Compensation Income 285,000WenjunNo ratings yet

- Motilal Excel PlanDocument8 pagesMotilal Excel Plansourajit kunduNo ratings yet

- PSBA REFRESHER TAXATION QUIZDocument10 pagesPSBA REFRESHER TAXATION QUIZEdnalyn CruzNo ratings yet

- Taxation - Final ExamDocument4 pagesTaxation - Final ExamKenneth Bryan Tegerero Tegio100% (1)

- Adobe Scan 11-Apr-2023Document4 pagesAdobe Scan 11-Apr-2023sanudutta191No ratings yet

- Computation Sheet 2022-11Document4 pagesComputation Sheet 2022-11Harsha KumarNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Cost Model Skeletal Approach Ans KeysDocument4 pagesCost Model Skeletal Approach Ans KeysMelvin BagasinNo ratings yet

- Presented by Archana Gupta 0221031 Bharat Gaikwad 0221023Document12 pagesPresented by Archana Gupta 0221031 Bharat Gaikwad 0221023Bharat GaikwadNo ratings yet

- Tax ReportDocument5 pagesTax ReportHanna Lyn BaliscoNo ratings yet

- AEC-7 MIDTERM EXAMINATION SOLUTIONSDocument9 pagesAEC-7 MIDTERM EXAMINATION SOLUTIONSDaisy TañoteNo ratings yet

- Designlabproject 1517400951Document27 pagesDesignlabproject 1517400951Pritam ThapaNo ratings yet

- EXERCISES - Gross IncomeDocument4 pagesEXERCISES - Gross IncomeDanna ClaireNo ratings yet

- Semi FinalDocument17 pagesSemi FinalJane TuazonNo ratings yet

- RA - M16UCM12 - B.Com. - 24.03.2021 - FNDocument4 pagesRA - M16UCM12 - B.Com. - 24.03.2021 - FNkavinilavan14072004No ratings yet

- Membership Fees 147000 Sponsorship During Tourn 113600: Revenues AssetsDocument4 pagesMembership Fees 147000 Sponsorship During Tourn 113600: Revenues AssetsJAY BHAVIN SHETH (B14EE014)No ratings yet

- Income Tax Calculation Lec in CommerceDocument2 pagesIncome Tax Calculation Lec in CommerceMadhan Kumar BobbalaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Look Inside Pocket Notes Acca TaxationDocument5 pagesLook Inside Pocket Notes Acca TaxationSync ZazoNo ratings yet

- Tiu vs. CADocument2 pagesTiu vs. CABryce KingNo ratings yet

- PVAODocument20 pagesPVAOFarica Arradaza ZgamboNo ratings yet

- Statistics For The Behavioral Sciences 4th Edition Nolan Test BankDocument35 pagesStatistics For The Behavioral Sciences 4th Edition Nolan Test Banksurgicalyttriumj52b100% (22)

- Ishikawajma-Harima Heavy Industries Ltd. Director of Income-TaxDocument6 pagesIshikawajma-Harima Heavy Industries Ltd. Director of Income-TaxpriyaNo ratings yet

- Proper execution of tax waiverDocument2 pagesProper execution of tax waiversmtm06No ratings yet

- Law of Business Assignment 3Document2 pagesLaw of Business Assignment 3Maria QadirNo ratings yet

- PGBPDocument13 pagesPGBPAyush AwasthiNo ratings yet

- List of QuotesDocument6 pagesList of QuotesنورإيماننبيلةNo ratings yet

- 03the Economic Times WealthDocument5 pages03the Economic Times WealthvivoposNo ratings yet

- Expenditure StatementDocument100 pagesExpenditure StatementTaghral FarhanNo ratings yet

- Value Added Tax (Quarterly)Document6 pagesValue Added Tax (Quarterly)Kaisha CastroNo ratings yet

- 3rd PRC PresentationDocument25 pages3rd PRC Presentationshubhankar_psNo ratings yet

- Consti 2 DigestsDocument31 pagesConsti 2 DigestsMarc kevin LeoncitoNo ratings yet

- UzAuto Motors IFRS Report FY2022Document41 pagesUzAuto Motors IFRS Report FY2022id00001875No ratings yet

- GST Tax InvoiceDocument1 pageGST Tax InvoiceSunnyNo ratings yet

- Stretagy For New India @75Document240 pagesStretagy For New India @75Deep GhoshNo ratings yet

- Film As International Business: ThomasDocument12 pagesFilm As International Business: Thomashrishikesh arvikarNo ratings yet

- Renata Limited - Conso Accounts 2013Document139 pagesRenata Limited - Conso Accounts 2013kakoli akterNo ratings yet

- Tax systems of countriesDocument12 pagesTax systems of countriesIryna HoncharukNo ratings yet

- Crowdfunding InsuranceDocument7 pagesCrowdfunding InsuranceCognizantNo ratings yet

- Demonetisation: By: Shalvi, XII Commerce Delhi Public School International, Kampala, UgandaDocument15 pagesDemonetisation: By: Shalvi, XII Commerce Delhi Public School International, Kampala, UgandaShalvi RanjanNo ratings yet

- The Budget and Economic Outlook - 2024 To 2034Document102 pagesThe Budget and Economic Outlook - 2024 To 2034Hari HaranNo ratings yet

- Taxation: Unit 1: Income Tax Basic Concepts Residential Status and Incidence of TaxDocument32 pagesTaxation: Unit 1: Income Tax Basic Concepts Residential Status and Incidence of TaxnikkiNo ratings yet

- Nigeria's History of Water Pollution Policy (1960-2004Document16 pagesNigeria's History of Water Pollution Policy (1960-2004awulu1No ratings yet

- Get NoticeDocument3 pagesGet NoticeLetsoai MalesaNo ratings yet

- Pag-IBIG Fund Housing Benefits GuideDocument19 pagesPag-IBIG Fund Housing Benefits GuideReynaldo PogzNo ratings yet

- A Primer On Production PaymentsDocument40 pagesA Primer On Production PaymentsST KnightNo ratings yet

- City of Camden and Camden Redevelopment Agency v. Victor Urban Renewal Et Al.Document120 pagesCity of Camden and Camden Redevelopment Agency v. Victor Urban Renewal Et Al.jalt61No ratings yet

- Wipro AR 2006 07 Part 2Document133 pagesWipro AR 2006 07 Part 2Santosh RamuNo ratings yet