Professional Documents

Culture Documents

Tax Skills Roland

Uploaded by

tafadzwamapfumo980Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Skills Roland

Uploaded by

tafadzwamapfumo980Copyright:

Available Formats

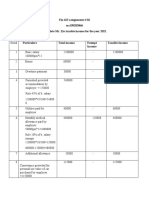

Mr Samson Mbanje Taxable Income as at 31 December 2020

Gross Income :

Salary 960000

Bonus 84000

Entertainment allowance (40%*4800) 19200

Cash in lieu of leave 48000

Income received for injury at work 120000

cash inheritance from late father 72000

Directors fees from local company 36000

Directors fees from foreign company 60000

Representative allowance (50%*24000) 12000

Housing benefit (7000-3000)*12 48000

Furniture (8%*600000) 48000

Loan (7%+5%)-4%= 8%*150000 12000

Motoring benefit (3100cc) 144000

Medical contribution by employer 84000

1747200

Less Exemptions

Directors fees from foreign company 60000

Income received for injury at work 120000

Bonus 5000

cash inheritance from late father 72000 257000

1490200

Less allowable deducations

Subscriptions to Internal Auditors( Zimb 96000

Contribution to Pension 43200

Joining fees to Internal Auditors 132000

wages for his housemaid 24000 295200

Taxable Income 1195000

Tax @ 50% -597500

597500

Less Tax Credits

Medical Aid Contribution (PSMAS) (50%*64000) 32000

32000

Tax before Aids Levy 565500

Add Aid levy 3% 16955

Taxable liability 582465

You might also like

- Income From Business-ProblemsDocument20 pagesIncome From Business-Problems24.7upskill Lakshmi V100% (1)

- Income From Salary Solution ZDocument3 pagesIncome From Salary Solution ZMuhammad FaisalNo ratings yet

- B1 Renand Dsouza TYBFMDocument8 pagesB1 Renand Dsouza TYBFMRenandNo ratings yet

- Assignment TAX (21 AIS 039)Document18 pagesAssignment TAX (21 AIS 039)Amran OviNo ratings yet

- Tax Answerrs and QuestionsDocument33 pagesTax Answerrs and QuestionsoluwafunmilolaabiolaNo ratings yet

- Income Tax Calculation SheetDocument8 pagesIncome Tax Calculation SheetArajrubanNo ratings yet

- HRA and SalaruDocument1 pageHRA and SalaruAnushree DeyNo ratings yet

- Particulars Amount Exemption Net AmountDocument29 pagesParticulars Amount Exemption Net AmountDead Beat's RandomNo ratings yet

- Tax Accounting CH 14Document4 pagesTax Accounting CH 14Ariin TambunanNo ratings yet

- TaxcomputationDocument3 pagesTaxcomputationVIPIN SHARMANo ratings yet

- INCOME TAX AssignmentDocument5 pagesINCOME TAX AssignmentShakib studentNo ratings yet

- Motilal Excel PlanDocument8 pagesMotilal Excel Plansourajit kunduNo ratings yet

- Module 3 Illustrations Ans KeyDocument11 pagesModule 3 Illustrations Ans KeyKirstine LabuguinNo ratings yet

- Sample Payroll CalculationDocument5 pagesSample Payroll CalculationArajrubanNo ratings yet

- Case Study 1 SolutionDocument2 pagesCase Study 1 Solutiongaurilakhmani2003No ratings yet

- R2. TAX (M.L) Solution CMA May-2023 ExamDocument5 pagesR2. TAX (M.L) Solution CMA May-2023 ExamSharif MahmudNo ratings yet

- Fin - 623 Assignment 2Document5 pagesFin - 623 Assignment 2Abdussalam gillNo ratings yet

- Tax 9Document2 pagesTax 9Anusha SharmaNo ratings yet

- Mbotela Taxable IncomeDocument1 pageMbotela Taxable IncomeMohamed AhmedNo ratings yet

- Examples Salary 2019Document18 pagesExamples Salary 2019Asma ZeeshanNo ratings yet

- Tax 3702 Exam Pack 2016Document18 pagesTax 3702 Exam Pack 2016nhlakaniphoNo ratings yet

- Spice Deals MemoDocument2 pagesSpice Deals MemoSelma IilongaNo ratings yet

- Solution Past Year Exam Financial Statements GCDocument12 pagesSolution Past Year Exam Financial Statements GCFara husnaNo ratings yet

- Salary Solution 97Document4 pagesSalary Solution 97Al SukranNo ratings yet

- Salary Solution 97Document4 pagesSalary Solution 97Al SukranNo ratings yet

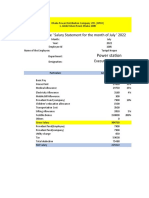

- Tariqul Hoque ' Salary Statement For The Month of July ' 2022Document6 pagesTariqul Hoque ' Salary Statement For The Month of July ' 2022Sadman Rafid FardeenNo ratings yet

- Computation of Total Income of DR Gurumoorthy For The A.Y 2016-2017Document2 pagesComputation of Total Income of DR Gurumoorthy For The A.Y 2016-2017sumitNo ratings yet

- Salary-breakup-TAMAL DEBDocument1 pageSalary-breakup-TAMAL DEBAlika DebNo ratings yet

- FS With AdjustmentsDocument25 pagesFS With AdjustmentsBlack NightNo ratings yet

- Atx PTDocument15 pagesAtx PTamy najatNo ratings yet

- AliDocument38 pagesAliAzam JamalNo ratings yet

- Name: Shamal Vivek Singh ID: s11172656: Af314 AssignmentDocument8 pagesName: Shamal Vivek Singh ID: s11172656: Af314 AssignmentShamal SinghNo ratings yet

- Advanced Taxation (Malaysia) : March/June 2017 - Sample QuestionsDocument12 pagesAdvanced Taxation (Malaysia) : March/June 2017 - Sample QuestionsKiyong TanNo ratings yet

- Tax Ek Prem KathaDocument267 pagesTax Ek Prem Kathasahil lathiNo ratings yet

- Case Study 2Document2 pagesCase Study 2Anil NagarajNo ratings yet

- Assignment No 02 Business Law and Taxation: Tauraira Arshad 16320 SolutionDocument2 pagesAssignment No 02 Business Law and Taxation: Tauraira Arshad 16320 SolutionSYEDA -No ratings yet

- Assingment 3-2Document4 pagesAssingment 3-2Shira HaizanNo ratings yet

- Bnaking Profit and Loss Account 1Document12 pagesBnaking Profit and Loss Account 1madhumathi100% (1)

- Salary Certificate For Visa IssuanceDocument1 pageSalary Certificate For Visa IssuanceTanvir AhmedNo ratings yet

- Income From SalaryDocument5 pagesIncome From Salarydbgdemo6No ratings yet

- Shashaank Industries LTD - Session 3Document6 pagesShashaank Industries LTD - Session 3Srijan SaxenaNo ratings yet

- Solution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsDocument7 pagesSolution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsIsyraf Hatim Mohd TamizamNo ratings yet

- Final AcDocument7 pagesFinal Acvinothselvaraj462No ratings yet

- Taxation Module 3: Numerical Problems Income From Business or ProfessionDocument5 pagesTaxation Module 3: Numerical Problems Income From Business or ProfessionShankar HunnurNo ratings yet

- Profit and Loss Statement For The Y.E. 31.1.20XX Balance Sheet As On 31.1.20XX Income: AssetsDocument4 pagesProfit and Loss Statement For The Y.E. 31.1.20XX Balance Sheet As On 31.1.20XX Income: AssetsSmriti singhNo ratings yet

- Tax Midterm Practise SolutionsDocument5 pagesTax Midterm Practise SolutionsShan Ali ShahNo ratings yet

- Income Taxation Answer ExamDocument5 pagesIncome Taxation Answer Examyezaquera100% (1)

- Offer Letter Faizan (RT)Document2 pagesOffer Letter Faizan (RT)mfa_786No ratings yet

- Ea 14Document4 pagesEa 14Nicole BatoyNo ratings yet

- Activity Midterm 1 Income TaxDocument1 pageActivity Midterm 1 Income TaxAngelica MijaresNo ratings yet

- Answer 26 Sophia Test 2017Document2 pagesAnswer 26 Sophia Test 2017skye SNo ratings yet

- Tax DetailsDocument2 pagesTax DetailsRahul AgarwalNo ratings yet

- 1714, Khitab, FS1Document4 pages1714, Khitab, FS1Ahmad KhitabNo ratings yet

- Business Income Template (Ain)Document9 pagesBusiness Income Template (Ain)Imran FarhanNo ratings yet

- Answer Exercise 1Document2 pagesAnswer Exercise 1MUHAMMAD SYAZWAN MAZLANNo ratings yet

- Exercise Financial Statements Without AdjustmentsDocument3 pagesExercise Financial Statements Without AdjustmentsShahrillNo ratings yet

- Homework 1: D09, Q2 (B) (B) (I) Due Date For Submission of Tax ReturnDocument11 pagesHomework 1: D09, Q2 (B) (B) (I) Due Date For Submission of Tax ReturnBryan EngNo ratings yet

- Presented by Archana Gupta 0221031 Bharat Gaikwad 0221023Document12 pagesPresented by Archana Gupta 0221031 Bharat Gaikwad 0221023Bharat GaikwadNo ratings yet

- Salary Structure CreationDocument4 pagesSalary Structure CreationPriyankaNo ratings yet