Professional Documents

Culture Documents

Bose Tax 2024

Uploaded by

placementcell Govt ITI Attingal0 ratings0% found this document useful (0 votes)

12 views2 pagesOriginal Title

BOSE TAX 2024

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views2 pagesBose Tax 2024

Uploaded by

placementcell Govt ITI AttingalCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

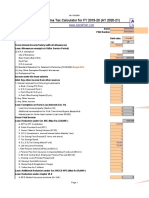

Old Regime

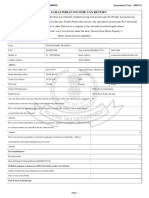

Name of Employee : BOSE N PAN : APMPN6372D

Designation & Office : SENIOR INSTRUCOR, GOVERNMENT ITI ATTINGAL Cat: Others

1 i) Gross Salary (a+b+c) 725498

a) Salary as per Section 17(1) 725498

b) Value of Perquisites 0

c) Profits in lieu of salary under section 17(3) 0

Less Recoveries Like Dies Non, Excess Pay Drawn, etc 0

Balance 0 725498

ii) Less Allowances to the extent excempt u/s 10 (First inclued it in salary)

HRA in the case of persons who actually incur expenditure by way of Rent

a) Actual HRA Received 0

b) Rent paid in excess 1/10th of the salary 0

c) 40% of Salary (Salary means Basic + DA) 0

(a) to (c) whichever is least is exempted 0

Other Allowances to the extent exempt u/s 10 0 0

iii) Net Salary ( i-ii) 725498

iv) Deduction u/s 16 (iv-a + iv-b + iv-c ) 52500

a) Standard Deduction 50000

b) Entertainment Allowance 0

c) Professional Tax 2500

v) Income Chargeable under the head Salaries (iii-iv) 672998

2 Income from House Property () 0

(Net Annual Rent - Municipal Tax) -30% - Ineterest on Housing Loan

Max Loss Allowed 2Lac 0

3 Income from Business 0

4 Income from Capital Gains 0

5 Income from Other Sources : Interest on Savings Bank Deposits 0 0

Interest on Fixed / Term Deposits 0

Any Other - 0

6 Gross Total Income (Total of 1 to 5) 672998

7 A - Deduction under section 80C

a) Life Insurance Premia of self, spouse and children 67740

b) Purchase of NSC VII issue 0

c) State Life Insurance Policy (SLI) 18000

d) Group Insurance Scheme (GIS) 9600

e) Contribution towards approved Provident Fund including PPF 60000

f) Tax saver Fixed Deposits in bank / Post Office ( 5 years or more) 0

g) Deposit scheme or pension fund set up by NHB 0

h) Tuition Fees ( Paid to university, college, school or educational institution

situated within India for full time education to any two children) 0

i) Housing Loan Repayment(Principal),Stamp duty paid for purchase 0

j) Subscription to equity shares or debentures of an eligible issue 0

k) Subscription to eligible units of Mutual Fund 0

l) GPAIS 875

m) Any Others Items-2 0

B Contribution to Pension Fund (80CCC) 0

C NPS (Total :0). Deducion U/s 80CCD(1) (Max.10% of Basic+DA of this Yr) 0

Totalto

Contribution Deduction u/s 80 CCE(Max

NPS u/s 80CCD(1B) (A+B+C) =156215

Rs.50,000)

150000

8 a) Contribution to NPS u/s 80CCD(1B) (Max Rs.50,000) 0

b) Mediclaim ( Maximum of Rs.25,000 for self, spouse, dependent children and

Rs.25000 for Parents. if Parents are senior citizens Rs. 50,000) U/s 80D 6000

c) Expenditure on Medical treatment of mentally or physically handicapped

dependents (including the amount deposited in their name. ( Max.

Rs. 75,000/- in case of 80% disability max. Rs.1,25,000) U/s 80DD 0

d) Expenditure on medical treatment of the employee/dependent for specified diseases

or ailment like cancer, AIDS, etc. ( Max. Rs.40,000/- in case of treatment is made to a

person who is a senior citizen Rs.1,00,000) U/s 80DDB 0

e) Interest paid for Educational Loan for higher education U/s 80E 0

f) Donation to various charitable and other funds including PM's National Relief Fund 80-G 0

g) Deduction for interest on loan taken this year for residential house property (80EE) 13432

h) Interest on loan taken for purchase of Electronic Vehicles (80EEB)-Max 1.5 Lakhs 0

i) Dedution for Handicapped Employees (80U) 0

j) Contribution made to Political Party (80GGC) 0

k) Deduct Rent Paid (If not receiving HRA and incuring Rent) (80GG) 0

l) Deduct Interest on SB Deposit (Max.Rs.10000 u/s 80TTA) 0

Total of (a) to (l) 19432

9 Total Deduction (7+8) 169432

10 Total Income (6-9) (Rounded to the nearest multiple of ten as per Sec. 288 A ) 503570

11 Tax on Total Income 13214

12 Less : Rebate u/s 87A 0

13 Income Tax after Rebate 13214

14 Health and Education cess @ 4% of 13 529

15 Total Tax Payable (13+14) 13743

16 Less : Relief for Arrears of Salary u/s 89(1) 0

17 Balance Tax Payable (15-16) 13743

18 Total Amount of Tax already deducted 0

19 Balance Tax to be paid 13743

20 Monthly TDS = Rs.13743/10 Months 1374

ATTINGAL THIRUVANANTHAPURAM Signature

29-03-2023 BOSE N

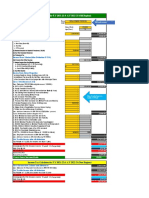

SALARY PARTICULARS - 2023-24

Month Basic DA HRA CCA Other Gross PF SLI GIS LIC NPS M.Sep Ded

Mar-23 52600 3682 3156 59438 5000 1500 800 5645 500 13445

Apr-23 52600 3682 3156 59438 5000 1500 800 5645 500 13445

May-23 52600 3682 3156 59438 5000 1500 800 5645 500 13445

Jun-22 52600 3682 3156 59438 5000 1500 800 5645 500 13445

Jul-23 52600 3682 3156 59438 5000 1500 800 5645 500 13445

Aug-23 53800 3766 3228 60794 5000 1500 800 5645 500 13445

Sep-23 53800 3766 3228 60794 5000 1500 800 5645 500 13445

Oct-23 53800 3766 3228 60794 5000 1500 800 5645 500 13445

Nov-23 53800 3766 3228 60794 5000 1500 800 5645 500 13445

Dec-23 53800 3766 3228 60794 5000 1500 800 5645 500 13445

Jan-24 53800 3766 3228 60794 5000 1500 800 5645 500 13445

Feb-24 53800 3766 3228 60794 5000 1500 800 5645 500 13445

Sal.Arr 0 0

DA Arr 0 0

PR Arr 0 0 0

Earned Leave Surrender 0

Festival Allowance 2750

Total 639600 44772 38376 0 0 725498 60000 18000 9600 67740 0 6000 161340

Details of Tax already paid

Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 Sep-23 Oct-23 Nov-23 Dec-23 Jan-24 Feb-24 Other Direct Bank

Printed on 29-03-2023 at 12:45:50 Easy Tax : by alrahiman

You might also like

- Sunil BDocument2 pagesSunil Bplacementcell Govt ITI AttingalNo ratings yet

- ASWATHYDocument2 pagesASWATHYplacementcell Govt ITI AttingalNo ratings yet

- LALYDocument2 pagesLALYplacementcell Govt ITI AttingalNo ratings yet

- AMJITHDocument2 pagesAMJITHplacementcell Govt ITI AttingalNo ratings yet

- Afsal TaxDocument2 pagesAfsal Taxplacementcell Govt ITI AttingalNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document8 pagesIncome Tax Calculator Fy 2020 21 v1Yogesh BajajNo ratings yet

- Income Tax Slab 2 Scheme2021Document14 pagesIncome Tax Slab 2 Scheme2021palharjeetNo ratings yet

- Income Tax Calculator Fy 2019 20 v4Document9 pagesIncome Tax Calculator Fy 2019 20 v4Anil KesarkarNo ratings yet

- Income Tax Calculator titleDocument12 pagesIncome Tax Calculator titleUdaysinh PatilNo ratings yet

- Income Tax Calculator Fy 2020 21 v2Document12 pagesIncome Tax Calculator Fy 2020 21 v2Anonymous Clm40C1No ratings yet

- IT Calculation New RegimeDocument4 pagesIT Calculation New Regimeyelrihs23No ratings yet

- Income Tax Calculator GuideDocument9 pagesIncome Tax Calculator Guidechandu halwaeeNo ratings yet

- Income Tax Calculator Fy 2021 22 v2Document15 pagesIncome Tax Calculator Fy 2021 22 v2KumardasNsNo ratings yet

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- IT Calculator 2018 LiteDocument6 pagesIT Calculator 2018 LiteHr PoonamNo ratings yet

- Calculation FormatDocument13 pagesCalculation FormatSahil Swaynshree SahooNo ratings yet

- Schedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668CDocument2 pagesSchedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668CJeevabinding xeroxNo ratings yet

- Income Tax Calculation F.Y.2019-20 AGIPC1111K Particulars AmountDocument3 pagesIncome Tax Calculation F.Y.2019-20 AGIPC1111K Particulars AmountNihit SandNo ratings yet

- Income TaxDocument11 pagesIncome Taxci_balaNo ratings yet

- Latest Tax CalculatIor 3.3.2Document16 pagesLatest Tax CalculatIor 3.3.2Bijender Pal Choudhary100% (3)

- Free Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Document16 pagesFree Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Bijender Pal ChoudharyNo ratings yet

- Tax Calculator - Indian Income Tax 2008-09Document7 pagesTax Calculator - Indian Income Tax 2008-09Jayamohan100% (29)

- Income Tax Calculator For F.YDocument8 pagesIncome Tax Calculator For F.YRavindra BagateNo ratings yet

- Calculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10Document10 pagesCalculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10api-19754583No ratings yet

- Form 16 certificate for salary incomeDocument1 pageForm 16 certificate for salary incomeSourabhthakral_1No ratings yet

- It Return BHK 2022-23Document2 pagesIt Return BHK 2022-23Ganesh PawarNo ratings yet

- Tax CalculationDocument3 pagesTax Calculationreach2hardyNo ratings yet

- Income Tax Calculator 2018-19Document15 pagesIncome Tax Calculator 2018-19Raju Ranjan SinghNo ratings yet

- Anil Ganvir Form 16 (21 22)Document3 pagesAnil Ganvir Form 16 (21 22)DrAndrew WillingtonNo ratings yet

- IT Calculation for FY 2020-2021Document3 pagesIT Calculation for FY 2020-2021Sampath SanguNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 927956830281220 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 927956830281220 Assessment Year: 2020-21Nannuri KrishnaNo ratings yet

- Income Tax Calculator FY 2016 17Document11 pagesIncome Tax Calculator FY 2016 17JITENDRA SHERKHANENo ratings yet

- Salary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Document1 pageSalary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Siddhartha SharmaNo ratings yet

- Itr-1 Sahaj Individual Income Tax Return: Part A General InformationDocument5 pagesItr-1 Sahaj Individual Income Tax Return: Part A General Informationrajesh kumar sharmaNo ratings yet

- RupalDocument6 pagesRupalsivaganga MNo ratings yet

- Tax Calculator For Individual Tax Payer: Data Tax Calculation Old Regime New RegimeDocument3 pagesTax Calculator For Individual Tax Payer: Data Tax Calculation Old Regime New RegimeDevi PrasannaNo ratings yet

- Calculation Sheet 2022 - 23 OLDDocument2 pagesCalculation Sheet 2022 - 23 OLDmandalsomithmandal1986No ratings yet

- Calculate Income Tax in Old Tax RegimeDocument1 pageCalculate Income Tax in Old Tax RegimeSRINIVAS MNo ratings yet

- Income Tax Calculator For F.Y 2021 22 A.Y 2022 23 ArthikDishaDocument8 pagesIncome Tax Calculator For F.Y 2021 22 A.Y 2022 23 ArthikDishaKunal KhandualNo ratings yet

- ANIL GANVIR Old New Regime ComputationDocument1 pageANIL GANVIR Old New Regime ComputationDrAndrew WillingtonNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 524687300050920 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 524687300050920 Assessment Year: 2020-21asmit somNo ratings yet

- Form 16Document4 pagesForm 16Rakesh KumarNo ratings yet

- c91cdcb0-2b62-4b4a-9f3a-c2f82124965bDocument11 pagesc91cdcb0-2b62-4b4a-9f3a-c2f82124965bAvnish KhuranaNo ratings yet

- Income Tax Calculator Guide for FY 2022-23 & AY 2023-24Document9 pagesIncome Tax Calculator Guide for FY 2022-23 & AY 2023-24SamratNo ratings yet

- ITR-1 SAHAJ for Salaried Individual with House Property IncomeDocument6 pagesITR-1 SAHAJ for Salaried Individual with House Property Incomeరాకేష్ బాబు చట్టిNo ratings yet

- PARTICULARS FOR F.Y. 2023 - 24 Old FormateDocument3 pagesPARTICULARS FOR F.Y. 2023 - 24 Old Formateiwd.abhiNo ratings yet

- Income Tax Form 2020 IDocument1 pageIncome Tax Form 2020 ISuvashreePradhanNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Raj KatochNo ratings yet

- Income Tax Details for Assistant Engineer in 2015-16Document5 pagesIncome Tax Details for Assistant Engineer in 2015-16Phani PitchikaNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 449048510080820 Assessment Year: 2020-21Document8 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 449048510080820 Assessment Year: 2020-21రాకేష్ బాబు చట్టిNo ratings yet

- Periyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Document2 pagesPeriyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Indumadhi SalemNo ratings yet

- Wa0016Document3 pagesWa0016Vinay DahiyaNo ratings yet

- 2021-2022 Shrikant Jadhav Form 16-Part B PDFDocument6 pages2021-2022 Shrikant Jadhav Form 16-Part B PDFVidya JadhavNo ratings yet

- FormDocument4 pagesFormUtkarsh GurjarNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Nonfinancial Defined Contribution Pension Schemes in a Changing Pension World: Volume 1, Progress, Lessons, and ImplementationFrom EverandNonfinancial Defined Contribution Pension Schemes in a Changing Pension World: Volume 1, Progress, Lessons, and ImplementationNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- CertificatebinuDocument1 pageCertificatebinuplacementcell Govt ITI AttingalNo ratings yet

- ASHOK LELYLAND - APPRENTICESHIP - CANDIDATE DATA FOR JOB APPLICATION (Responses) - Form Responses 1Document3 pagesASHOK LELYLAND - APPRENTICESHIP - CANDIDATE DATA FOR JOB APPLICATION (Responses) - Form Responses 1placementcell Govt ITI AttingalNo ratings yet

- Work Readiness Programme - Kkem - Asap Kerala TRAINING SCHEDULE (01/03/2023-03/03/2023)Document1 pageWork Readiness Programme - Kkem - Asap Kerala TRAINING SCHEDULE (01/03/2023-03/03/2023)placementcell Govt ITI AttingalNo ratings yet

- Bose Tax 2024Document2 pagesBose Tax 2024placementcell Govt ITI AttingalNo ratings yet

- B&FS - Session 2 - Insurance PrinciplesDocument58 pagesB&FS - Session 2 - Insurance PrinciplesKunal ObhraiNo ratings yet

- Insurance Claim FormDocument4 pagesInsurance Claim FormIhjaz VarikkodanNo ratings yet

- Ass. 1 Insurance LawDocument5 pagesAss. 1 Insurance LawRossette Anasario100% (1)

- Ghana's Health Care SystemDocument14 pagesGhana's Health Care SystemTheophilus BaidooNo ratings yet

- GPA Policy Part 1Document5 pagesGPA Policy Part 1lalitakashyaphrbpNo ratings yet

- XXXXDocument1 pageXXXXITNo ratings yet

- Separation Agreement Template 04Document5 pagesSeparation Agreement Template 04rob De MayoNo ratings yet

- Miquela Anderson - ResumeDocument4 pagesMiquela Anderson - Resumeapi-631992517No ratings yet

- Preq KSCDocument83 pagesPreq KSCHamza FaheemNo ratings yet

- Zudo (2w)Document4 pagesZudo (2w)hemuuuNo ratings yet

- Implement The Business PlanDocument6 pagesImplement The Business PlanChrisjhel EturaldeNo ratings yet

- Financing International Trade Methods Payment AgenciesDocument17 pagesFinancing International Trade Methods Payment AgenciesMASPAKNo ratings yet

- Incoterms 2000Document25 pagesIncoterms 2000Praygod ManaseNo ratings yet

- Club Rules 2021 WebDocument128 pagesClub Rules 2021 WebJayant KhedkarNo ratings yet

- Exploring Takaful Principles Instruments and StructuresDocument498 pagesExploring Takaful Principles Instruments and StructuresMuhammad Ali KhanNo ratings yet

- PWD Form 203DB (Rev. 2007)Document67 pagesPWD Form 203DB (Rev. 2007)Jael YinianNo ratings yet

- Insurance Broker Liability QuestionnaireDocument4 pagesInsurance Broker Liability QuestionnaireHrehorciuc BogdanNo ratings yet

- EBPM Dalam Audit Operasional BPJS KesehatanDocument8 pagesEBPM Dalam Audit Operasional BPJS KesehatanluciaNo ratings yet

- Beth Poff Zoo LetterDocument3 pagesBeth Poff Zoo LetterUploadedbyHaroldGaterNo ratings yet

- PAYSLIp - JOEY May 30Document1 pagePAYSLIp - JOEY May 30bktsuna0201No ratings yet

- Sample Shared Services AgreementDocument20 pagesSample Shared Services AgreementHamna Waqar100% (1)

- Calculate Income Tax DueDocument8 pagesCalculate Income Tax DueKhaira PeraltaNo ratings yet

- Transcribeme ComDocument2 pagesTranscribeme ComTumuhimbise MosesNo ratings yet

- IG 1 Element 1Document38 pagesIG 1 Element 1Abdo Al-farsi100% (1)

- Residential Rental Agreement: Robert AckleyDocument11 pagesResidential Rental Agreement: Robert AckleyStephen VargasNo ratings yet

- SMC 2021 Budget FinalDocument39 pagesSMC 2021 Budget Finalprassna_kamat1573No ratings yet

- Topic 2 - Regulatory Controls&Practice Effect Financial PlanDocument27 pagesTopic 2 - Regulatory Controls&Practice Effect Financial PlanArun GhatanNo ratings yet

- Two Wheeler Package Policy Proposal Form PDFDocument2 pagesTwo Wheeler Package Policy Proposal Form PDFdeepakNo ratings yet

- EPFO Social Security NotesDocument7 pagesEPFO Social Security Notes570Akash Pawarjan22No ratings yet

- UpgardDocument4 pagesUpgardTraining & PlacementsNo ratings yet