Professional Documents

Culture Documents

Anil Ganvir Form 16 (21 22)

Uploaded by

DrAndrew WillingtonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Anil Ganvir Form 16 (21 22)

Uploaded by

DrAndrew WillingtonCopyright:

Available Formats

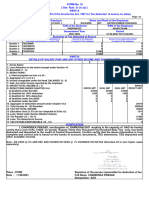

Form 16 {See rule 31(1)(a)}

PART A (Please download from Traces website)

Certificate Under Section 203 of The Income - Tax Act, 1961 For Tax Deducted At Source on Salary

Name & Address of the Employer Name & Designation of the Employee

Frist Name Middle Name Surname

SHRI PANDHARINATH ARTS AND COMMERCE COLLEGE

NARKHED ANIL JAYDEO GANVIR

TAN No. of Deductor NGPS05861C PAN of the Employee ANSPG0826H Designation

Assesment year 2023 - 2024 MALE Period From 01/04/2022 To 31/03/2023 ASSISTANT PROFESSOR

PART B (Refer Note 1) Old Tax

DETAILS OF SALARY PAID AND OTHER INCOME AND TAX DEDUCTED Regime

1. Gross Salary a) Salary as per provisions contained in sec. 17(1) 1864699

b) Value of perquisites u/s 17 (2) (as per form No. 12BA- 0

c) Profits in lieu of salary U/S17 (3) --wherever applicable) 0

2. Less Allowance exempt u/s 10 T.A. 0

H.R.A. 0

Other 0 Total 0 0

3. Balance (1-2) 1864699

4. Deductions a) Entertainment Allowance 0

b) LESS : STANDARD DEDUCTION {Sec. 16(1(ia) } 50000

c) Tax on Employment 2500

5. Aggregate of 4 (a) to (b) 52500 52500

6. Income Chargeable under the head Salaries (3-5) 1812199

7. Add : Any Other Income Reported By The Employee

a) Add : Other Interest 0

b) Less : Interest due on borrowed capital for self occupied -49123 -49123

house building

8. Gross Total Income (6+7) 1763076

9 Deduction Unrder Chapter VI-A ( Section 80C,80CCC,80CCD) Gross Qualifing Deductibl

A. Section 80C Amount Amount e Amount

i. GPF / DCPS / NPS - Employee Contribution 144193 144193 144193

ii. PPF 0 0 0

iii. LIC / Other Life Insurance 11832 11832 11832

iv. GIS + PLI + ULIP 2400 2400 2400

vi. New NSC Purchased 0 0 0

vii. Repayment of House Loan (PRINCIPAL) 93457 93457 93457

viii. Children Tution Fees 0 0 0

ix. Bank Fixed Diposit 0 0 0

x. Equity linked Mutual Fund 0 0 0

d. Aggregate of (A+B+C) Deductible u/c 80CCE 251882 150000 150000 150000

B. Other Section (e.g. 80E, 80G, 80D ect.)

i. U/ S 80 G 0 0 0

ii. U/S 80 D 0 0 0

iii. U/ S 80 U 0 0 0

iv. U/ S 80 E / 80DD / 80DDB 0 0 0

v. U/ S 80CCD (1B) Investment in NPS 0 0 0

vi. U/ S 80CCD(2) Employer Contribution 0 0 0 0

10 Aggregate of Deductible Amount Under Chapter VI A (9A+9B) 150000

1613076 ………………………………………………

1613080

11 Total Income (8-10) (Rounded off to nearest multiple of 10)……………………………………………………………………………………………………

12 Tax on Total Income ………………………………………………………………………………………………………………………………………………………

296424

13 Less Rebate u/s 87A 0

14 Tax after Rebate 87 A 296424

15 Education cess 4% ( On Tax at Sr. No. 12 & Surcharge at Sr. No. 13) …………………………………………………………………………………………

11857

16 Tax Payable (14 + 15 ) ……………………………………………………………………………………………………………………………………………………

308,281

17 Less : Relief U/s 89 (i) (attach details ) ………………………………………………………………………………………………………………………………

25670

18 Tax Payable (16 -17 ) ……………………………………………………………………………………………………………………………………………………

282611 282611

u Less : Tax Deducted at Source (a) TDS U/s 192(i)..................................…………………………………………………………. 282611

20 Tax Payable/Refundable (18-19 ) 0

I son / daughter of

working in the capacity of . (designation) do hereby certify that a sum of

Rs. 282611 (Rupees..... TWO EIGHT TWOSIX ONE ONE (in words) has been deducted at source and paid

of the Central Government, I further certify that the information given above is true and correct based on the books of account,

documents and other available records. Signature of the person responsible for

Place Deduction of tax

Date / / 2023 Full Name

1 Pre By. Ashish Datamatics, 207 NIT Complex, Near Cinemax, Mor Bhawan, Sitabuldi, Nagpur, Ph : 2520011, 937-3100088 23/01/2023 12:28

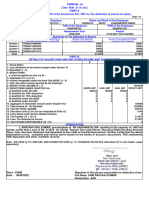

Computation of Total Income for the Financial Year 2022-2023

Name ANIL JAYDEO GANVIR

Old Tax

Designation ASSISTANT PROFESSOR PAN ANSPG0826H

Office SHRI PANDHARINATH ARTS AND COMMERCE COLLEGE NARKHED

Regime

A INCOME FROM SALARIES

1. PAY 1037600 7. Other Taxfree 0

2. Grade Pay 0 8. Other Taxable 0

3. D.A. 404258 9. NPS Emploer Cont. 0

4. H.R.A. 95850 9. AREARS (C.Y.) 29909

5. C.L.A. 0 10. AREARS (P.Y.) 271882

6. Con.Allowance 25200 11. Recovery 0

B. GROSS SALARY - 1864699

11.ADD : VALUATION OF PERQUISITES U/S 17(since taxfree perks already inclu.in salary) 0

12.LESS : ALLOWANCES TO THE EXTENT EXEMPT U/S 10 ………………………………………………………………………….. 0

(A) Other Taxfree Con. Allowance

0 0 0

(B) LESS : HRA U/S 10 (13A) & RULE 2A ……………………………………………………………………

0

(i) Actual HRA Received 0

(ii) Rent Paid - 10 % of Basic + DA +Grade Pay

0 - 0 0

(iii) 40 % of Salary (Basic+ DA) 0

13A) LESS : STANDARD DEDUCTION {Sec. 16(1(ia) } 50000

13B.LESS : U/S 16(iii)PROFESSIONAL TAX 2500 52500

14. INCOME UNDER THE HEAD SALARY 1812199

C INCOME FROM HOUSE PROPERTY (SELF OCCUPIED ) -49123

1.Interest from House Loan U/S 24 49123 49123

D INCOME FROM OTHER SOURCES ……………………………………………………………………………………………………………………………………

0

(i) Bank / Post Office Interest 0

(ii) NSC intersest 0

(iv) Other 0 0

E GROSS TOTAL INCOME 1763076

F DEDUCTIONS UNDER CHAPTER VI A

A. Deduction Unrder Chapter VI-A ( Section

Gross Qualifing Deductible

80C,80CCC,80CCD)

Amount Amount Amount

G. (A) Section 80C

i. GPF / DCPS / NPS - Employee Contribution 144193 144193 144193

ii. PPF 0 0 0

iii. LIC / Other Life Insurance 11832 11832 11832

iv. GIS + PLI + ULIP 2400 2400 2400

vi. New NSC Purchased 0 0 0

vii. Repayment of House Loan (PRINCIPAL) 93457 93457 93457

viii. Children Tution Fees 0 0 0

ix. Bank Fixed Diposit 0 0 0

x. Equity linked Mutual Fund 0 0 0 251882

c Section 80CCD (Central Govt. Pension Plan) 0 0 0

d Aggregate of (A+B+C) Deductible u/c 80CCE 251882 150000 150000 150000

(B) Other Section (e.g. 80E, 80G, 80D ect.)

i. U/ S 80 G 0 0 0

ii. U/S 80 D 0 0 0

iii. U/ S 80 U 0 0 0

iv. U/ S 80 E / 80DD / 80DDB 0 0 0

v. U/ S 80CCD (1B) Investment in NPS 0 0 0 0

vi. U/ S 80CCD(2) Employer Contribution 0 0 0 0

H. Aggregate of Deductible Amount Under Chapter VI A (A+B) 150000

I. Total Income ( E - H ) (Rounded off to nearest multiple of 10) …………………………………………………………………………………………………

1613076 1613080

J. Calculation of Tax - Old Tax Regime

i First Rs. 250000 NILL 0

ii Next Rs 2,50,000 to 5,00,000 5% 12500

iii Next Rs 5,00,001 to 10,00,000 20% 100000

iv Above Rs 10,00,000 30% 183924 296424 Total Tax

K. Less Rebate u/s 87A 0

L. Tax After Rebate 87 A 296424

M. ADD. 4% Education Cess on Tax …………………………...……………………………..…………………………………………………………… 11857

N Gross Tax (Including Education cess) ( L + M ) …………………………………………………………………………………………….. 308281

O RELIEF U/S 89 (i)…………………………………………………………………………………………………………………………………….. 25670

P Total Tax Payable ( N - O ) ………………………………………………………………………………………………………………………….. 282611

Q. Total Tax (Rounded off to nearest multiple of 10) …………………………...…………………………..……………………………………………..

282611

R Tax Already Paid…………………………………………………………………………………………………………………………………….. 192000

S Balance Tax Refundable / Payable 90611

Date / / 2023 Signature of

Place Employee :

1 Pre By. Ashish Datamatics, 207 NIT Complex, Near Cinemax, Mor Bhawan, Sitabuldi, Nagpur - 2520011, 937-3100088 23/01/2023 12:28

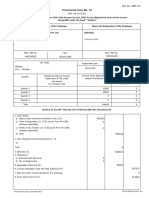

FORM NO. 10E

Particulars of income under section 192(2A) for year ending 31st March ,2023 for claming

relief under section 89(i) by a Government Employee.

1 Name and address of the Employee ANIL GANVIR

SHRI PANDHARINATH ARTS AND COMMERCE COLLEGE NARKHED

2 PAN ANSPG0826H

3 Residential Status Individual

Particular of income referred to the rule 21A of the Income Tax Rules 1962 during the previous year

relevant to assesment year 2023-2024

1 (a) Salary received in arrears in accordance with the previ,rule 21A(2) Rs. 271882

(b) Payment in the nature of gratuity in accordance with the prov. Of rule 21A(3) Rs. Nill

(c)Pay in the nature of compensation in accordance with tha prov. Rule 21A(4) Rs. Nill

(d) Payment in commutation of pension in accordance with the prov. Rule 21A(5) Rs. Nill

2 Detailed particulars of payments referred to above may be given in Ann. Of rule as case may be

Signature of Employee

VERIFICATION

I. ANIL do hereby that what is stated above is true to the best of my knowledge and belief.

Verified today the……..31st day of march 2023

Place

Signature of Employee

Date / / 2023

TABLE A

Salary received

Total Income Total Income Tax on Total Tax on

Previous year in arrears

of the relevant Increased by Income Total Income Difference

(Financial year) of the relevant

Previous year Arrears as per col. 2 as per col. 4

Previous year

1 2 3 4 = (2+3) 5 6 7=(6-5)

2015-16 417560 12561 430,121 15199 16492 1293

2016-17 491070 74703 565,773 19680 39300 19620

2017-18 558610 77871 636,481 24949 40990 16041

2018-19 584460 87854 672,314 30568 48842 18274

2019-20 743090 18893 761,983 63563 67493 3930

2020-21 0 0 0 0 0 0

2021-22 0 0 0 0 0 0

Total 271,882 Total 59158

ANNEXURE – 1 Arrears Salary OLD

1. Total Income ( excluding salary received in arrears ) 1341198

2. Salary received in arrears ( Total ) 271882

3. Total Income ( as incresed by salary received in arrears as per item no. 2 ) 1613080

4. Tax on total income ( as per item no. 3 ) incl : Education cess @ 4% 308281

5. Tax on total income ( as per item no. 1 ) incl : Education cess @ 4% 223453

6. Tax on salary received in arrears ( difference of 4-5 ) 84828

7. Tax computed in accordance with Table A ( as per col. 7 of Table A ) 59158

8. Relief under section 89(i) ( difference of col. 6 & 7 ) 25670

Date / / 2023

Place Signature of Employee

You might also like

- Form 1621052023 115217Document2 pagesForm 1621052023 115217sandeep kumarNo ratings yet

- Form 16 Salary Certificate TDS DetailsDocument1 pageForm 16 Salary Certificate TDS DetailsJashanNo ratings yet

- ANIL GANVIR Old New Regime ComputationDocument1 pageANIL GANVIR Old New Regime ComputationDrAndrew WillingtonNo ratings yet

- Form 1621032023 201318 PDFDocument3 pagesForm 1621032023 201318 PDFManvendraNo ratings yet

- Form 1622072023 022228Document2 pagesForm 1622072023 022228Kajal RandiveNo ratings yet

- Matekar PDFDocument1 pageMatekar PDFdharmveer singhNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryKrishna Chaitanya JonnalagaddaNo ratings yet

- Form_1609042024_112352Document3 pagesForm_1609042024_112352rs3071029No ratings yet

- Form 16 TDS CertificateDocument2 pagesForm 16 TDS CertificateRanjeet RajputNo ratings yet

- Form16 W0000000 GS164200X 2021 20211Document1 pageForm16 W0000000 GS164200X 2021 20211gaganNo ratings yet

- Form 1622052023 130017Document3 pagesForm 1622052023 130017Amit Singh NegiNo ratings yet

- FORM 16 TAX DETAILSDocument2 pagesFORM 16 TAX DETAILSAkshay ShettyNo ratings yet

- Form 1615052023 141937Document3 pagesForm 1615052023 141937Pawan KumarNo ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- Form 1601012023 101258Document3 pagesForm 1601012023 101258Bhura SinghNo ratings yet

- Form16 1945007 JC570193L 2020 2021Document2 pagesForm16 1945007 JC570193L 2020 2021Ranjeet RajputNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryNavneet SharmaNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Part B: Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesForm No. 16 (See Rule 31 (1) (A) ) Part B: Details of Salary Paid and Any Other Income and Tax Deductedrahul patidarNo ratings yet

- Form 1625062023 043026Document2 pagesForm 1625062023 043026SHIV BHAJANNo ratings yet

- Salary and Tax DetailsDocument1,320 pagesSalary and Tax DetailsAnonymous pKsr5vNo ratings yet

- Form 1606032021 195902Document3 pagesForm 1606032021 195902Kalyan KumarNo ratings yet

- G Vittal 16 FrontDocument1 pageG Vittal 16 FrontSRINIVAS MNo ratings yet

- Salary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Document1 pageSalary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Siddhartha SharmaNo ratings yet

- FORM NO. 16 PART B TAX DEDUCTION CERTIFICATEDocument2 pagesFORM NO. 16 PART B TAX DEDUCTION CERTIFICATEGloryNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryR S RatanNo ratings yet

- Form16 W0000000 GS186523X 2021 20211Document1 pageForm16 W0000000 GS186523X 2021 20211Raman OjhaNo ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- Calculate Income Tax in Old Tax RegimeDocument1 pageCalculate Income Tax in Old Tax RegimeSRINIVAS MNo ratings yet

- 2021-2022 Shrikant Jadhav Form 16-Part B PDFDocument6 pages2021-2022 Shrikant Jadhav Form 16-Part B PDFVidya JadhavNo ratings yet

- Form 16 TDS CertificateDocument4 pagesForm 16 TDS Certificateqwerty9999499949No ratings yet

- Form16 W0000000 GO004610X 2022 20221Document1 pageForm16 W0000000 GO004610X 2022 20221Dharamveer SinghNo ratings yet

- Booklet of Forms For House Building AdvanceDocument2 pagesBooklet of Forms For House Building AdvanceJITHU MNo ratings yet

- Abhishek - Provisional Form 16Document2 pagesAbhishek - Provisional Form 16hrrecruiter.vhtbsNo ratings yet

- Quarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeDocument2 pagesQuarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeSanjoy SamantaNo ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)P v v RaoNo ratings yet

- Form 1617082023 112227Document2 pagesForm 1617082023 112227rinsha.sherinNo ratings yet

- Abhishek - Form 16Document2 pagesAbhishek - Form 16hrrecruiter.vhtbsNo ratings yet

- 2018-19 - Part B - 1Document4 pages2018-19 - Part B - 1Shivam DixitNo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)bhagesh sharmaNo ratings yet

- Salary Details and Tax DeductionsDocument1 pageSalary Details and Tax DeductionsArsalan KhanNo ratings yet

- 7562 Form16-B-201819-379 PDFDocument1 page7562 Form16-B-201819-379 PDFAnonymous vlaen0sHNo ratings yet

- (C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Document2 pages(C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Yashwant KumarNo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)COMMON SERVICE CENTERNo ratings yet

- Form 16 - BLMPB2218K - 2019-20 - Part B PDFDocument6 pagesForm 16 - BLMPB2218K - 2019-20 - Part B PDFUmair BaigNo ratings yet

- Form 1612052021 111453Document3 pagesForm 1612052021 111453SandhyaNo ratings yet

- Form 1602102023 160124Document3 pagesForm 1602102023 160124isantbasnet3561No ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)Anushka PoddarNo ratings yet

- PAYSLIP DETAILSDocument3 pagesPAYSLIP DETAILSamitNo ratings yet

- Afipg9432r Partb 2023-24Document4 pagesAfipg9432r Partb 2023-24SUPERINTENDENT WOMEN ITI JAMMUNo ratings yet

- Akapr6662d Partb 2020-21Document3 pagesAkapr6662d Partb 2020-21defencerajkumarraiNo ratings yet

- Payslip Oct-2022 NareshDocument3 pagesPayslip Oct-2022 NareshDharshan Raj0% (1)

- Bmypp3076q Partb 2021-22 1Document4 pagesBmypp3076q Partb 2021-22 1KALIA PRADHANNo ratings yet

- Adobe Scan Sep 09, 2023Document2 pagesAdobe Scan Sep 09, 2023krampravesh199No ratings yet

- 7705 Form16-B-201819-461 PDFDocument1 page7705 Form16-B-201819-461 PDFAnonymous vlaen0sHNo ratings yet

- 7523 Form16-B-201819-353Document1 page7523 Form16-B-201819-353Anonymous vlaen0sHNo ratings yet

- BBJPS2377D Partb 2023-24Document4 pagesBBJPS2377D Partb 2023-24Ajay GokulNo ratings yet

- PAYSLIP Nov-2022 - NareshDocument3 pagesPAYSLIP Nov-2022 - NareshDharshan RajNo ratings yet

- BBTPN4386D Partb 2022-23Document3 pagesBBTPN4386D Partb 2022-23basit.000No ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)Saras ShendeNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Front Andrew 1Document1 pageFront Andrew 1DrAndrew WillingtonNo ratings yet

- Andrew LastDocument1 pageAndrew LastDrAndrew WillingtonNo ratings yet

- Andrew LastDocument1 pageAndrew LastDrAndrew WillingtonNo ratings yet

- Front Andrew 1Document1 pageFront Andrew 1DrAndrew WillingtonNo ratings yet

- My Name Change TestimonialDocument2 pagesMy Name Change TestimonialDrAndrew WillingtonNo ratings yet

- BTHDocument1 pageBTHDrAndrew WillingtonNo ratings yet

- History British I 11 Wil S GoogDocument635 pagesHistory British I 11 Wil S GoogDrAndrew WillingtonNo ratings yet

- Ordnatn OneDocument1 pageOrdnatn OneDrAndrew WillingtonNo ratings yet

- X0640 Confirmation Latin Cross Anglican CrestDocument1 pageX0640 Confirmation Latin Cross Anglican CrestDrAndrew WillingtonNo ratings yet

- Last PageDocument1 pageLast PageDrAndrew WillingtonNo ratings yet

- Blessing of The Lord (Eng)Document65 pagesBlessing of The Lord (Eng)DrAndrew WillingtonNo ratings yet

- World & Indian Church History (Hindi)Document70 pagesWorld & Indian Church History (Hindi)DrAndrew WillingtonNo ratings yet

- Wa0000.Document1 pageWa0000.DrAndrew WillingtonNo ratings yet

- My Full Version of Gazatte.Document126 pagesMy Full Version of Gazatte.DrAndrew WillingtonNo ratings yet

- Neo Buddhsit CcEditedDocument1 pageNeo Buddhsit CcEditedDrAndrew WillingtonNo ratings yet

- Andrew Willington 22008 - Official-Transcript - 2022!07!11Document4 pagesAndrew Willington 22008 - Official-Transcript - 2022!07!11DrAndrew WillingtonNo ratings yet

- World & Indian Church History (Eng)Document59 pagesWorld & Indian Church History (Eng)DrAndrew WillingtonNo ratings yet

- Mozambique Mining Legal RegimeDocument17 pagesMozambique Mining Legal RegimeAdebayorMazuzeNo ratings yet

- Merck Innovation Centre Case StudyDocument11 pagesMerck Innovation Centre Case StudyGokul ThilakNo ratings yet

- Uyanage Heshan Ruwantha de Silva (21478284)Document6 pagesUyanage Heshan Ruwantha de Silva (21478284)Natasha de SilvaNo ratings yet

- 04.may 2022Document138 pages04.may 2022Dream creatorsNo ratings yet

- Saving and Loan Mobilization in Cooperative: (With Reference To Samuhik Saving and Credit Co Operative Ltd. Bhojpur)Document82 pagesSaving and Loan Mobilization in Cooperative: (With Reference To Samuhik Saving and Credit Co Operative Ltd. Bhojpur)Pratik100% (1)

- SIMBIZ Annual Report ExerciseDocument13 pagesSIMBIZ Annual Report ExerciseViona Putri WijayaNo ratings yet

- Globalization and EducationDocument7 pagesGlobalization and Educationbambi rose espanola50% (2)

- Strategic Plan 2021/22-2026: Ethiopian Skylight HotelDocument47 pagesStrategic Plan 2021/22-2026: Ethiopian Skylight HotelLamesginew Mersha100% (4)

- TPM PresentationDocument16 pagesTPM PresentationGauri PrayagNo ratings yet

- VAT Compilation CAP IIDocument15 pagesVAT Compilation CAP IIbinuNo ratings yet

- Grade 8 Accounting BookletDocument24 pagesGrade 8 Accounting BookletLisandra SantosNo ratings yet

- Tata Motors' Acquisition of Jaguar Land RoverDocument17 pagesTata Motors' Acquisition of Jaguar Land Roverashish singhNo ratings yet

- Jio Oct-23Document1,714 pagesJio Oct-23Mohit KhatriNo ratings yet

- Global Logistics Issues & SolutionsDocument6 pagesGlobal Logistics Issues & SolutionsAllyah Paula PostorNo ratings yet

- To Whom So Ever It May ConsernDocument1 pageTo Whom So Ever It May ConsernrajNo ratings yet

- DEMAND AND SUPPLY dqs156Document3 pagesDEMAND AND SUPPLY dqs156asyiqinNo ratings yet

- English For Economics: Case Study 3 - Trade War (International Trade)Document21 pagesEnglish For Economics: Case Study 3 - Trade War (International Trade)Ngọc Phương Linh LêNo ratings yet

- Customer List Hand OverDocument381 pagesCustomer List Hand OverLokesh Reddy100% (1)

- FP&A Industry Background and Arthayantra's JourneyDocument19 pagesFP&A Industry Background and Arthayantra's JourneyAbhi SangwanNo ratings yet

- CAD designer passionate about circular economyDocument2 pagesCAD designer passionate about circular economyRodrigoCastagnoNo ratings yet

- Research Project Report On Supply Chain ManagmentDocument111 pagesResearch Project Report On Supply Chain ManagmentSakshi VermaNo ratings yet

- DCSL SBD 04-2024 Tender Invitation - Supply, Install and Deliver of 14 High Mask Lighting For KZNDocument2 pagesDCSL SBD 04-2024 Tender Invitation - Supply, Install and Deliver of 14 High Mask Lighting For KZNdavid selekaNo ratings yet

- Creating A Business NameDocument5 pagesCreating A Business NameNader MehdawiNo ratings yet

- Case Study #3 - Gigantone, JustineDocument2 pagesCase Study #3 - Gigantone, JustineJustine LinesNo ratings yet

- Global Marketing Channels and Physical DistributionDocument24 pagesGlobal Marketing Channels and Physical DistributiondipanajnNo ratings yet

- Survey of Econ 3rd Edition Sexton Solutions ManualDocument11 pagesSurvey of Econ 3rd Edition Sexton Solutions Manualdariusarnoldvin100% (23)

- 12 Activity 1Document2 pages12 Activity 1Jong-suk OppxrNo ratings yet

- Mba GST Project ReportDocument178 pagesMba GST Project ReportBONU SAI VENKATA DEEPAK NAIDUNo ratings yet

- STEP 1: Setting Up Your UCC Contract Trust Account: (FIRST Package To Treasury)Document2 pagesSTEP 1: Setting Up Your UCC Contract Trust Account: (FIRST Package To Treasury)Jahe El97% (58)

- B170219B BBFN3323 InternationalfinanceDocument23 pagesB170219B BBFN3323 InternationalfinanceLIM JEI XEE BACC18B-1No ratings yet