Professional Documents

Culture Documents

Form 1625062023 043026

Uploaded by

SHIV BHAJANOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 1625062023 043026

Uploaded by

SHIV BHAJANCopyright:

Available Formats

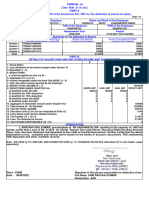

FORM No.

16

[ See Rule 31 (1) (a) ]

PART-A

Certificate under Section 203 of the Income-tax Act, 1961 for Tax deducted at source on salary

Page 1 2

Employer - PAO Code Name and Rank of the Employee

74 SHIV BHAJAN

PAN of the Deductor TAN of the Deductor PAN of the Employee

AKRPA2127P PNEP10199A AJVPB2234K

CIT(TDS) Address Assessment Year / Tax Option Period

2021-2022/OLD 01/04/2020 TO 31/03/2021

Summary of Tax deducted at Source

Quarter Receipt Numbers of original statements of Amount of tax deducted Amount of tax deducted/remitted

TDS under sub-section(3) of section 200 in respect of the employee in respect of the employee

Quarter 1 031009600208226 0 0

Quarter 2 031009600212286 8930 8930

Quarter 3 031009600216276 12154 12154

Quarter 4 18181 18181

Total 39265 39265

PART-B

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

` ` ` `

1. Gross Salary * 830060

2. Standard Deduction * 50000

3. Less Allowance to the extent exempt under Section 10 2400

4. BALANCE (1 - 2) 777660

5. DEDUCTIONS :

a. Interest payable on loan u/s 24 : 0

6. Aggregate of 5 ( a to b ) 0

7. Income chargeable under the Head 'SALARIES' (3 - 5) 777660

8. Add: Any other income reported by the employee 0

9. GROSS TOTAL INCOME (6 + 7) 777660

10. DEDUCTIONS UNDER CHAPTER VI-A GROSS AMT QUAL AMT QUAL AMT DEDUCT AMT

a) Qualified under Sec.80C 185955 150000 150000

b) Qualified for 100% deduction 1386 1386 1386

c) Qualified for 50% deduction 0 0 0

d) Qualified under Sec.80DD 0 0 0

e) Qualified under Sec.80U 0 0 0

11. Aggregate of deductible amount under Chapter VI-A 151386

12. Total Income (8 - 10) Rounded 626270

13. TAX ON TOTAL INCOME 37754

14. Health & Education Cess @4% (on tax computed at Sl.No.12) 1511

15. Tax Payable (12 + 13) 39265

16. Less: Relief under Section 89(attach Details) 0

17. Less : Tax Deducted 39265

18. TAX PAYABLE/REFUNDABLE (15 - 16) 0

VERIFICATION

I, Parvez Alam, son/daughter of MD . SALAHUDDIN working in the capacity of AAO do hereby certify

that a sum of Rs. 39265 (in words) Rupees Thirty Nine Thousand Two Hundred Sixty Five only. has been

deducted and deposited to the credit of Central Government. I further certify that the above information is true,

complete and correct and is based on the books of account, documents, TDS statements, TDS deposited and

other available records.

Note : Health and Education Cess @4% Charged On Income Tax (Rounded off to next higher rupee)

Place : Signature of the person responsible for deduction of tax

Date : 21/05/2021 Full Name Parvez Alam

Designation AAO

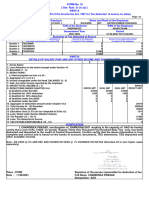

BREAK UP OF TAXABLE EMOLUMENTS FINANCIAL YEARWISE Page 2 2

Employer - PAO Code Name and Rank of the Employee

74 SHIV BHAJAN

For the financial year from 01/03/2008 to 28/02/2009 = -928.0

For the financial year from 01/03/2019 to 29/02/2020 = 62962.0

For the financial year from 01/03/2020 to 28/02/2021 = 768026.0

Total taxable emoluments 830060.0

You might also like

- BIR Regulations On Service ChargeDocument3 pagesBIR Regulations On Service ChargeMichelle Ann S. FerriolNo ratings yet

- Tax AssessmentDocument2 pagesTax AssessmentJohn Lester Juan PagdilaoNo ratings yet

- Quiz Accounting For Income TaxDocument5 pagesQuiz Accounting For Income TaxCmNo ratings yet

- Form 16Document2 pagesForm 16robin0903No ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- Payslip Oct-2022 NareshDocument3 pagesPayslip Oct-2022 NareshDharshan Raj0% (1)

- Payslip Sep-2022 NareshDocument3 pagesPayslip Sep-2022 NareshDharshan RajNo ratings yet

- Employee DataDocument1 pageEmployee DataomkassNo ratings yet

- C - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFDocument5 pagesC - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFPrudhvi Raj ChowdaryNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- Salary details and tax deductionsDocument3 pagesSalary details and tax deductionsBALANo ratings yet

- Accenture Form 16Document7 pagesAccenture Form 16Srikrishna PadmannagariNo ratings yet

- PAYSLIP Nov-2022 - NareshDocument3 pagesPAYSLIP Nov-2022 - NareshDharshan RajNo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)Anushka PoddarNo ratings yet

- Corporate Income Tax ModuleDocument1 pageCorporate Income Tax ModuleEdz Votefornoymar Del RosarioNo ratings yet

- Form 1622052023 130017Document3 pagesForm 1622052023 130017Amit Singh NegiNo ratings yet

- Form 1606032021 195902Document3 pagesForm 1606032021 195902Kalyan KumarNo ratings yet

- Form 16 TDS CertificateDocument2 pagesForm 16 TDS CertificateRanjeet RajputNo ratings yet

- Form 1621052023 115217Document2 pagesForm 1621052023 115217sandeep kumarNo ratings yet

- Form16 W0000000 GO004610X 2022 20221Document1 pageForm16 W0000000 GO004610X 2022 20221Dharamveer SinghNo ratings yet

- Form16 1945007 JC570193L 2020 2021Document2 pagesForm16 1945007 JC570193L 2020 2021Ranjeet RajputNo ratings yet

- Form 1622072023 022228Document2 pagesForm 1622072023 022228Kajal RandiveNo ratings yet

- Form_1609042024_112352Document3 pagesForm_1609042024_112352rs3071029No ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- Form 1615052023 141937Document3 pagesForm 1615052023 141937Pawan KumarNo ratings yet

- Form16 W0000000 GS164200X 2021 20211Document1 pageForm16 W0000000 GS164200X 2021 20211gaganNo ratings yet

- Form 1612052021 111453Document3 pagesForm 1612052021 111453SandhyaNo ratings yet

- Booklet of Forms For House Building AdvanceDocument2 pagesBooklet of Forms For House Building AdvanceJITHU MNo ratings yet

- Quarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeDocument2 pagesQuarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeSanjoy SamantaNo ratings yet

- Form 1601012023 101258Document3 pagesForm 1601012023 101258Bhura SinghNo ratings yet

- Form 1602102023 160124Document3 pagesForm 1602102023 160124isantbasnet3561No ratings yet

- Form 1617082023 112227Document2 pagesForm 1617082023 112227rinsha.sherinNo ratings yet

- Form 1621032023 201318 PDFDocument3 pagesForm 1621032023 201318 PDFManvendraNo ratings yet

- Form16 W0000000 GS186523X 2021 20211Document1 pageForm16 W0000000 GS186523X 2021 20211Raman OjhaNo ratings yet

- Form 1607022022 205546Document2 pagesForm 1607022022 205546Mahesh VayiboyinaNo ratings yet

- Form 1608112023 131300Document3 pagesForm 1608112023 131300baisanebuddheshNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Part B: Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesForm No. 16 (See Rule 31 (1) (A) ) Part B: Details of Salary Paid and Any Other Income and Tax Deductedrahul patidarNo ratings yet

- HDFC Bank Limited: Dear Mr. Vijay Anand A.Document5 pagesHDFC Bank Limited: Dear Mr. Vijay Anand A.A Vijay AnandNo ratings yet

- Apr 2022Document1 pageApr 2022Rohit AdnaikNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryKrishna Chaitanya JonnalagaddaNo ratings yet

- Matekar PDFDocument1 pageMatekar PDFdharmveer singhNo ratings yet

- Form 16 - 13-14Document4 pagesForm 16 - 13-14NITIN CHOUDHARYNo ratings yet

- Form 16 - BLMPB2218K - 2019-20 - Part B PDFDocument6 pagesForm 16 - BLMPB2218K - 2019-20 - Part B PDFUmair BaigNo ratings yet

- (C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Document2 pages(C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Yashwant KumarNo ratings yet

- Anil Ganvir Form 16 (21 22)Document3 pagesAnil Ganvir Form 16 (21 22)DrAndrew WillingtonNo ratings yet

- Form16 10-11Document4 pagesForm16 10-11voiceofindia811No ratings yet

- Ajay Kumar Jaiswal TDS 2019-20Document10 pagesAjay Kumar Jaiswal TDS 2019-20AJAY KUMAR JAISWALNo ratings yet

- Adobe Scan Sep 09, 2023Document2 pagesAdobe Scan Sep 09, 2023krampravesh199No ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryNavneet SharmaNo ratings yet

- Income Tax Calculation Worksheet: Thermax LTD Ascent PayrollDocument1 pageIncome Tax Calculation Worksheet: Thermax LTD Ascent PayrollAnuragNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryR S RatanNo ratings yet

- Interview Questions Based On Thermal Power PlantDocument3 pagesInterview Questions Based On Thermal Power Plantrohit_me083No ratings yet

- Abhishek - Provisional Form 16Document2 pagesAbhishek - Provisional Form 16hrrecruiter.vhtbsNo ratings yet

- CHLPR4183D Partb 2023-24Document4 pagesCHLPR4183D Partb 2023-24JMLNo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)bhagesh sharmaNo ratings yet

- TDS Reconciliation and Analysis Enabling Centralized ProcessingDocument3 pagesTDS Reconciliation and Analysis Enabling Centralized Processingkeerthi vasanNo ratings yet

- PART B (Annexure)Document4 pagesPART B (Annexure)AnbarasanNo ratings yet

- 2021-2022 Shrikant Jadhav Form 16-Part B PDFDocument6 pages2021-2022 Shrikant Jadhav Form 16-Part B PDFVidya JadhavNo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)COMMON SERVICE CENTERNo ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)P v v RaoNo ratings yet

- Form 16 Salary Certificate TDS DetailsDocument1 pageForm 16 Salary Certificate TDS DetailsJashanNo ratings yet

- Salary and Tax DetailsDocument1,320 pagesSalary and Tax DetailsAnonymous pKsr5vNo ratings yet

- Aavpv5058l Partb 2023-24Document3 pagesAavpv5058l Partb 2023-24ankushNo ratings yet

- IT Calculation New RegimeDocument4 pagesIT Calculation New Regimeyelrihs23No ratings yet

- DGT Form&COR-TerrascopeDocument3 pagesDGT Form&COR-TerrascopeNovi IndrianiNo ratings yet

- RR 11 2018 - Annex C - Withholding Agent Sworn DeclarationDocument1 pageRR 11 2018 - Annex C - Withholding Agent Sworn DeclarationJames Salviejo PinedaNo ratings yet

- s.5 Ent Paper 2 Midterm 2Document4 pagess.5 Ent Paper 2 Midterm 2King KetNo ratings yet

- Direct and Indirect TaxDocument3 pagesDirect and Indirect TaxKb AliNo ratings yet

- Double Taxation ReliefDocument2 pagesDouble Taxation Reliefs4sahithNo ratings yet

- TRAIN Final PubSem April 4 PDFDocument98 pagesTRAIN Final PubSem April 4 PDFYuri SheenNo ratings yet

- Effects of Socio-Economic Factors on BusinessDocument11 pagesEffects of Socio-Economic Factors on BusinessBen ZerepNo ratings yet

- CHAPTER 10 ALLOWABLE DEDUCTIONSDocument17 pagesCHAPTER 10 ALLOWABLE DEDUCTIONSKyle BacaniNo ratings yet

- sOURCES OF INCOMEDocument4 pagessOURCES OF INCOMERosemarie CruzNo ratings yet

- UNIT-3: Assessment of Firms Section-ADocument6 pagesUNIT-3: Assessment of Firms Section-ANaveenNo ratings yet

- Course Syllabus in Fundamentals of Taxation: Course Intended Learning Outcomes (Cilo) and Time AllotmentDocument8 pagesCourse Syllabus in Fundamentals of Taxation: Course Intended Learning Outcomes (Cilo) and Time AllotmentPATATASNo ratings yet

- Capital Budgeting Sample ProblemsDocument10 pagesCapital Budgeting Sample ProblemsMark Gelo WinchesterNo ratings yet

- IRS Tax and Earnings Tables for Form 1040Document26 pagesIRS Tax and Earnings Tables for Form 1040tiahNo ratings yet

- Income Tax Rebate under Section 87A - Guide for IndividualsDocument3 pagesIncome Tax Rebate under Section 87A - Guide for IndividualskajshdiNo ratings yet

- 2023 12 31 PayslipDocument2 pages2023 12 31 PayslipSami SayyedNo ratings yet

- Plotno.14, Rajiv Gandhi Infotech Park, Hinjewadi, Phase-Iii, Midc-Sez, Village Man Taluka Mulshi, Pune, Maharashtra, 411057Document3 pagesPlotno.14, Rajiv Gandhi Infotech Park, Hinjewadi, Phase-Iii, Midc-Sez, Village Man Taluka Mulshi, Pune, Maharashtra, 411057Ravi RanjanNo ratings yet

- Understanding Taxation Level II Midterm Exam at Yanet CollegeDocument3 pagesUnderstanding Taxation Level II Midterm Exam at Yanet CollegeBiniam Hunegnaw BitewNo ratings yet

- CONSUMPTION and SAVINGSDocument26 pagesCONSUMPTION and SAVINGShyunsuk fhebieNo ratings yet

- Intacc2 Assignment 6.1 AnswersDocument6 pagesIntacc2 Assignment 6.1 AnswersMingNo ratings yet

- Front - Maintain Training FacilitiesDocument5 pagesFront - Maintain Training FacilitiesRechie Gimang AlferezNo ratings yet

- Rental Income StatementDocument3 pagesRental Income StatementDaniel Gaspar SilvaNo ratings yet

- Income Tax On Partnerships - QuestionsDocument9 pagesIncome Tax On Partnerships - QuestionsJembrain CanubasNo ratings yet

- CDoc - Taxation Law Project TopicsDocument3 pagesCDoc - Taxation Law Project TopicsFaizan Bin Abdul HakeemNo ratings yet

- Final Withholding Tax: BIR Quarterly, Monthly or Annually DeadlineDocument2 pagesFinal Withholding Tax: BIR Quarterly, Monthly or Annually DeadlineMary Christine Formiloza MacalinaoNo ratings yet

- Income Tax Quiz 6Document3 pagesIncome Tax Quiz 6Calix CasanovaNo ratings yet