Professional Documents

Culture Documents

Matekar PDF

Uploaded by

dharmveer singhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Matekar PDF

Uploaded by

dharmveer singhCopyright:

Available Formats

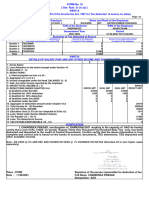

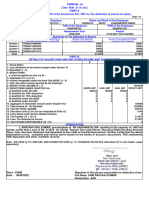

FORM

NO. 16

[See rule 31(1)(a)]

Certificate under section 203 of the Income-tax Act, 1961 for tax deducted at source on Salary .

Name and address of the Employer Name, EmpNo, Bill Unit and designation of the Employee

Ministry of Railways, Govt. of India, Rail Bhawan DEVIRAM MATEKAR, 00100439861, 0101271, PEON

PAN of the Deductor. TAN of the Deductor. PAN of the Employee.

MUMF03899A ARRPM6978P

CIT (TDS) Period

Assessment Year

Address: From To

City: Pin Code: 2020-2021 01/APR/2019 31/MAR/2020

PART B( Refer Note 1 )

Details of Salary paid and any other income and tax deducted.

1. Gross salary

(a) Salary as per provisions contained in sec. 17(1) 629101

(b) Value of perquisites u/s 17(2) (as per Form No.12BA, wherever applicable) 0

(c) Profits in lieu of salary u/s 17(3) (as per Form No.12BA,wherever applicable) 0

(d) Total 629101

2. Less : Allowance to the extent exempt u/s 10

(a)House Rent Allowance 0

(b)Education and Hostel Allowances For Child 0

(c) STANDARD DEDUCTION U/s 16(a) 50000

Total 50000

3. Balance (1-2) 579101

4. Deductions :

(a) Entertainment allowance 0

(b) Tax on Employment 2500

5. Aggregate of 4 (a) and (b) 2500

6. Income chargeable under the head. Salaries (3 - 5) 576601

7. Add : Any other income reported by the employee

Total 0

8. Gross total income (6 + 7) 576601

9. Deductions under Chapter VIA

Gross Deductible

(A) sections 80C, 80CCC and 80CCD

Amount Amount

(a) section 80C

(1) PF+VPF 32668

(2) GIS 360

(3) LIC & INSURANCE 3240

(4) TUTION FEES (FOR TWO CHILDREN) 44375

Total 80643 80643

(b) section 80CCC 0 0

(c) section 80CCD(2)(GOVT CONTRIBUTION REBATE) 0 0

Note : 1. aggregate amount deductible under section 80C shall not exceed one lakh fifty thousand rupees

2. aggregate amount deductible under three sections, i.e., 80C, 80CCC and 80CCD,shall not exceed one lakh fifty thousand

rupees

Gross Qualifying Deductible

(B) other sections (for e.g., 80E, 80G etc.) under Chapter VIA

Amount Amount Amount

Total 0 0 0

10. Aggregate of deductible amounts under Chapter VI-A 80643

11. Total income (8-10) 495960

12. Tax on total income 0

13. Education Cess @4%(on tax computed at S. No. 12 ) 0

14. Tax payable (12+13) 0

15. Less: Relief under section 89 (attach details) 0

16. Tax payable (14-15) 0

17. Total Tax Paid 11100

18. Tax payable/Refundable (16-17) -11100

I, ASHOK RAMACHANDANI son/daughter of MOTUMAL working in the capacity of ASST. PERS.

OFFICER-B-JR do hereby certify that a sum of Rs. 11100 [Rs. Eleven Thousand One Hundred Only (in

words)] has been deducted at source and paid to the credit of the Central Government. I further certify that the

information given above is true and correct based on the books of account, documents and other available

records.

Place: MUMBAI

Signature of the person responsible for deduction

Date : 11/07/2020

of tax

Full Name : ASHOK RAMACHANDANI

Designation : ASST. PERS. OFFICER-B-JR

You might also like

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryKrishna Chaitanya JonnalagaddaNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Part B: Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesForm No. 16 (See Rule 31 (1) (A) ) Part B: Details of Salary Paid and Any Other Income and Tax Deductedrahul patidarNo ratings yet

- Form 16 - BLMPB2218K - 2019-20 - Part B PDFDocument6 pagesForm 16 - BLMPB2218K - 2019-20 - Part B PDFUmair BaigNo ratings yet

- Form16 W0000000 GS164200X 2021 20211Document1 pageForm16 W0000000 GS164200X 2021 20211gaganNo ratings yet

- Form 16 Salary Certificate TDS DetailsDocument1 pageForm 16 Salary Certificate TDS DetailsJashanNo ratings yet

- Form 1621052023 115217Document2 pagesForm 1621052023 115217sandeep kumarNo ratings yet

- Salary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Document1 pageSalary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Siddhartha SharmaNo ratings yet

- Form 1622072023 022228Document2 pagesForm 1622072023 022228Kajal RandiveNo ratings yet

- Form16 1945007 JC570193L 2020 2021Document2 pagesForm16 1945007 JC570193L 2020 2021Ranjeet RajputNo ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- Anil Ganvir Form 16 (21 22)Document3 pagesAnil Ganvir Form 16 (21 22)DrAndrew WillingtonNo ratings yet

- Form_1609042024_112352Document3 pagesForm_1609042024_112352rs3071029No ratings yet

- Form 1606032021 195902Document3 pagesForm 1606032021 195902Kalyan KumarNo ratings yet

- 2021-2022 Shrikant Jadhav Form 16-Part B PDFDocument6 pages2021-2022 Shrikant Jadhav Form 16-Part B PDFVidya JadhavNo ratings yet

- Form 1615052023 141937Document3 pagesForm 1615052023 141937Pawan KumarNo ratings yet

- Adobe Scan Sep 09, 2023Document2 pagesAdobe Scan Sep 09, 2023krampravesh199No ratings yet

- Form 1601012023 101258Document3 pagesForm 1601012023 101258Bhura SinghNo ratings yet

- Salary and Tax DetailsDocument1,320 pagesSalary and Tax DetailsAnonymous pKsr5vNo ratings yet

- Form 1625062023 043026Document2 pagesForm 1625062023 043026SHIV BHAJANNo ratings yet

- Form 1612052021 111453Document3 pagesForm 1612052021 111453SandhyaNo ratings yet

- FORM 16 TAX DETAILSDocument2 pagesFORM 16 TAX DETAILSAkshay ShettyNo ratings yet

- 7562 Form16-B-201819-379 PDFDocument1 page7562 Form16-B-201819-379 PDFAnonymous vlaen0sHNo ratings yet

- Form 16 TDS CertificateDocument4 pagesForm 16 TDS Certificateqwerty9999499949No ratings yet

- (C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Document2 pages(C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Yashwant KumarNo ratings yet

- 7705 Form16-B-201819-461 PDFDocument1 page7705 Form16-B-201819-461 PDFAnonymous vlaen0sHNo ratings yet

- Form 16Document2 pagesForm 16robin0903No ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryR S RatanNo ratings yet

- Form 1622052023 130017Document3 pagesForm 1622052023 130017Amit Singh NegiNo ratings yet

- Form 1602102023 160124Document3 pagesForm 1602102023 160124isantbasnet3561No ratings yet

- form16 2022-23Document3 pagesform16 2022-23Mela RavalNo ratings yet

- Form16 W0000000 GO004610X 2022 20221Document1 pageForm16 W0000000 GO004610X 2022 20221Dharamveer SinghNo ratings yet

- Form 16 TDS CertificateDocument2 pagesForm 16 TDS CertificateRanjeet RajputNo ratings yet

- Form 1617082023 112227Document2 pagesForm 1617082023 112227rinsha.sherinNo ratings yet

- Form 1621032023 201318 PDFDocument3 pagesForm 1621032023 201318 PDFManvendraNo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)Anushka PoddarNo ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- JUNE 2021 PAYSLIPDocument3 pagesJUNE 2021 PAYSLIPamitNo ratings yet

- Form16 (2022-2023)Document3 pagesForm16 (2022-2023)mamtakumaripihooNo ratings yet

- Payslip Oct-2022 NareshDocument3 pagesPayslip Oct-2022 NareshDharshan Raj0% (1)

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)P v v RaoNo ratings yet

- Booklet of Forms For House Building AdvanceDocument2 pagesBooklet of Forms For House Building AdvanceJITHU MNo ratings yet

- Form16 16 2015-16Document4 pagesForm16 16 2015-16BDO KhandalaNo ratings yet

- 7523 Form16-B-201819-353Document1 page7523 Form16-B-201819-353Anonymous vlaen0sHNo ratings yet

- Ajppm3616g Partb 2022-23Document3 pagesAjppm3616g Partb 2022-23niel doriftoNo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)bhagesh sharmaNo ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)Saras ShendeNo ratings yet

- PAYSLIP Nov-2022 - NareshDocument3 pagesPAYSLIP Nov-2022 - NareshDharshan RajNo ratings yet

- PAYSLIP DETAILSDocument3 pagesPAYSLIP DETAILSamitNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- HDFC Bank Limited: Dear Mr. Vijay Anand A.Document5 pagesHDFC Bank Limited: Dear Mr. Vijay Anand A.A Vijay AnandNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryNavneet SharmaNo ratings yet

- 2018-19 - One97 Communications LTDDocument2 pages2018-19 - One97 Communications LTDBALBINDER MALLNo ratings yet

- Harsh 22-24Document2 pagesHarsh 22-24sanghviharsh202No ratings yet

- Form16 10-11Document4 pagesForm16 10-11voiceofindia811No ratings yet

- Tax Calculator For Individual Tax Payer: Data Tax Calculation Old Regime New RegimeDocument3 pagesTax Calculator For Individual Tax Payer: Data Tax Calculation Old Regime New RegimeDevi PrasannaNo ratings yet

- Form No. 16: Part BDocument3 pagesForm No. 16: Part BAjay AjNo ratings yet

- 20092010form16 004355Document3 pages20092010form16 004355Hemen BrahmaNo ratings yet

- IncomeTax - Computation - DOMPXXXXXK-Sakshi Kakkar-AT-0201-2021Document1 pageIncomeTax - Computation - DOMPXXXXXK-Sakshi Kakkar-AT-0201-2021deepanshu sapraNo ratings yet

- Case Summary ContractDocument47 pagesCase Summary ContractIkra Saleem KhanNo ratings yet

- ACC 311 Exam 3 Review KeyDocument7 pagesACC 311 Exam 3 Review KeySummerNo ratings yet

- Classical Management Approaches: Scientific, Bureaucratic & AdministrativeDocument22 pagesClassical Management Approaches: Scientific, Bureaucratic & AdministrativemedzabubakarNo ratings yet

- INT Company Profile .Document7 pagesINT Company Profile .Pitichai PakornrersiriNo ratings yet

- Chapter 3 (A) : The Economic Circular Flow ModelDocument43 pagesChapter 3 (A) : The Economic Circular Flow ModelNtsikelelo MosikareNo ratings yet

- Performance Management System: A Study OnDocument86 pagesPerformance Management System: A Study OnDrPallati SujendraNo ratings yet

- PDF of PGBPDocument7 pagesPDF of PGBPCHENDUCHAITHUNo ratings yet

- Workfoce Diversity MCQDocument3 pagesWorkfoce Diversity MCQRiya KaushikNo ratings yet

- Reading Test 3 - OfficialDocument30 pagesReading Test 3 - OfficialThanh NgânNo ratings yet

- Compliance ChecklistDocument66 pagesCompliance ChecklistSushanta PadhiNo ratings yet

- VRT TorDocument7 pagesVRT Tornirav16No ratings yet

- Mandatory OvertimeDocument6 pagesMandatory Overtimeapi-402775925No ratings yet

- Project On SurveyorsDocument40 pagesProject On SurveyorsamitNo ratings yet

- E Clio1 041 0089Document22 pagesE Clio1 041 0089Ludmila Franca-LipkeNo ratings yet

- Manavooru Manapranalika Chinna MandadiDocument7 pagesManavooru Manapranalika Chinna MandadirajNo ratings yet

- Foot Prints Indian Railways Technical Supervisors Association GOLDEN JUBILEE YEAR A Look Back at The Glorious Journey Glimpse of 50 Glorious Years of Struggle & Achievements (1965 - 2015)Document82 pagesFoot Prints Indian Railways Technical Supervisors Association GOLDEN JUBILEE YEAR A Look Back at The Glorious Journey Glimpse of 50 Glorious Years of Struggle & Achievements (1965 - 2015)navtejpvsNo ratings yet

- Analysis of Effectiveness of Quality of Work LifeDocument38 pagesAnalysis of Effectiveness of Quality of Work LifeSarathKumarNo ratings yet

- Brgy. San Dionisio Group 4 ICTDocument8 pagesBrgy. San Dionisio Group 4 ICTFrangelico De veraNo ratings yet

- Problems and Prospects of Tea Factory Workers - A Study With Reference To The Nilgiris District, Tamil NaduDocument5 pagesProblems and Prospects of Tea Factory Workers - A Study With Reference To The Nilgiris District, Tamil NaduarcherselevatorsNo ratings yet

- The Safety and Health Movement - Historical Perspective: Bpa32202: Occupational & Environmental HealthDocument26 pagesThe Safety and Health Movement - Historical Perspective: Bpa32202: Occupational & Environmental HealthQayyumNo ratings yet

- Coa Audit ReportDocument53 pagesCoa Audit ReportEmma Ruth Francisco-PelayoNo ratings yet

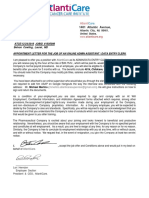

- AtlantiCare 2018 - Belvon CowlingDocument2 pagesAtlantiCare 2018 - Belvon CowlingBelvon CowlingNo ratings yet

- Colter Adams Resume 2020Document2 pagesColter Adams Resume 2020api-523371314No ratings yet

- Chain of CommandDocument3 pagesChain of CommandSekla ShaqdieselNo ratings yet

- The Placement & Performance Management System.: Exposys Data Labs Internship ProgramDocument75 pagesThe Placement & Performance Management System.: Exposys Data Labs Internship ProgramSena Ahammed 4MH18CS100No ratings yet

- PT ORD QHSE Training ProviderDocument11 pagesPT ORD QHSE Training ProviderWijaya Kusuma SubrotoNo ratings yet

- TAX320Document14 pagesTAX320Faiz MohamadNo ratings yet

- Development of Public Fiscal AdministrationDocument10 pagesDevelopment of Public Fiscal Administrationmitzi samsonNo ratings yet

- ESOP AnnexureDocument4 pagesESOP AnnexureDeepika GuptaNo ratings yet

- Form 16 TDS certificate summaryDocument7 pagesForm 16 TDS certificate summaryrajNo ratings yet