Professional Documents

Culture Documents

Form 16 Salary Certificate TDS Details

Uploaded by

JashanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 16 Salary Certificate TDS Details

Uploaded by

JashanCopyright:

Available Formats

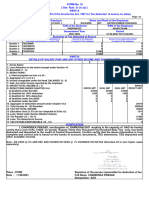

NEW FORM NO 16

{see Rule 31(1)(a)of income tax rules1962}

certificate under section 203 of the income tax Act,1961 for tax deduction at source

from income chargeable under the head"salaries"

NAME & ADDRESS OF THE EMPLOYER NAME & DESIGNATION OF EMPLOYEE

MANJIT KAUR

PRINCIPAL,GSSS KILLI NIHAL SINGH WALA(BATHINDA) COMPUTER TEACHER

GSSS KILLI NIHAL SINGH WALA

PAN /GIR NO. TAN PAN /GIR NO. AOVPK4357F

under section 206 is to be filed

Quarter Acknowledgement No. PERIOD

FROM TO ASSESMENT YEAR

1

2 01.04.21 31.03.22 2022-23

3

4

DETAILS OF SALARY PAID &OTHER INCOME TAX DEDUCTED

1) Gross Salary 768426

a) Salary as per Provisions contained in sec.17(1)

b)Value of prequisties u/s17(2) (as per form no.12

BA, wherever applicable)

c)Profits in lieu of salary under section 17(3)(as per

Form no.12BA, wherever applicable)

d) Total 768426

2. Less:Allowance to the extent exempt under section 10

0

(-) TRANSPORT ALLOWANCE 0

TOTAL OF (2) 0

3.Balance(1-2) 768426

4.Deductions

(a) Entertainment Allowance 0

(b)Tax on Employment 2400

5. Aggregate of 4(a) & (b) 2400

6.Income Chargeable under the head salaries(3-5) 766026

7.Add:Any Other income reported by the employee 0 0

8.Gross Total income(6+7) 766026

9.Deductions under chapter VI A Gross Deductible

(A) Sections 80C,80CCC &80CCD Amount Amount

(a) Sections 80C

A.

1) Provident Fund

2)P.P.F.

3)L.I.C. 0

4)Accrued Interest on NSC's 0

5)NSC's Purchased 0

6)GIS

7)Tution Fees

8)Repayment Of House Building Loan 0

9)Infrastructure Tax Saving Bonds 0

10) POSTAL LIFE INSURANCE 0

11)Any Other 0

TOTAL OF A 0

B.

(a)80-CCC 0

(b)80-CCCD 0

(c)80-CCE 0

(d)80-DD 0

(e)80-DDB 0

principal home loan 12000

(g)80-G 0

(h)80-GG 0

(i)80-U 75000

TOTAL OF B 87000

10.Total Deductions under chapter VI A 87000

11. NET TAXABLE INCOME 479026

12. ROUNDED OFF NET TAXABLE INCOME 479030

13. TOTAL INCOME TAX 11452

14. LESS TAX REBATE U/S 87 (A) 11452

(10-11) 0

14. Health and Education Cess 0

15. Tax Payable 0

16. Relief under Sec 89 0

17. Tax Payable(15-16) 0

18. Less(a)Tax deducted at source u/s192(1)

(b) Tax paid by emloyer on behalf of emloyee

Balance Tax Payable/Refundable

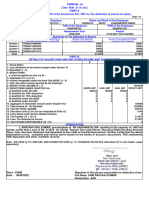

DETAILS OF TAX DEDUCTED AND DEPOSITED INTO CENTRAL GOVERNMENT ACCOUNT

Of Working In The Capacity Of Principal GSSS KILLI NIHAL SINGH WALA

Do hereby certify That a Sum Of Rs NIL Rs 0

Has Been Deducted At Source And Paid To The Credit Of The Central Govt.I Further Certify That The

Information Given Above Is True And Correct Based On The Books Of Accounts, Documents And

Other Available Records

You might also like

- Candle Anomaly Volume WarningDocument55 pagesCandle Anomaly Volume Warningsuresh100% (2)

- Technical Note On LBO Valuation and Modeling - 150309 - 4!10!2015 - SAMPLEDocument30 pagesTechnical Note On LBO Valuation and Modeling - 150309 - 4!10!2015 - SAMPLEJayant Sharma100% (1)

- SOX Compliance With SAP TreasuryDocument57 pagesSOX Compliance With SAP Treasurymarinas800% (1)

- Form 16Document2 pagesForm 16robin0903No ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- CMBS 101 Slides (All Sessions)Document41 pagesCMBS 101 Slides (All Sessions)Karan MalhotraNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- Accenture Form 16Document7 pagesAccenture Form 16Srikrishna PadmannagariNo ratings yet

- RECALLED QUESTIONS (2016-18) : (Ibps Different Banks Promotion Test)Document11 pagesRECALLED QUESTIONS (2016-18) : (Ibps Different Banks Promotion Test)Arun PrakashNo ratings yet

- Matekar PDFDocument1 pageMatekar PDFdharmveer singhNo ratings yet

- Anil Ganvir Form 16 (21 22)Document3 pagesAnil Ganvir Form 16 (21 22)DrAndrew WillingtonNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryKrishna Chaitanya JonnalagaddaNo ratings yet

- 7562 Form16-B-201819-379 PDFDocument1 page7562 Form16-B-201819-379 PDFAnonymous vlaen0sHNo ratings yet

- Salary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Document1 pageSalary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Siddhartha SharmaNo ratings yet

- 7523 Form16-B-201819-353Document1 page7523 Form16-B-201819-353Anonymous vlaen0sHNo ratings yet

- 7705 Form16-B-201819-461 PDFDocument1 page7705 Form16-B-201819-461 PDFAnonymous vlaen0sHNo ratings yet

- Form_1609042024_112352Document3 pagesForm_1609042024_112352rs3071029No ratings yet

- 2021-2022 Shrikant Jadhav Form 16-Part B PDFDocument6 pages2021-2022 Shrikant Jadhav Form 16-Part B PDFVidya JadhavNo ratings yet

- Form 1621052023 115217Document2 pagesForm 1621052023 115217sandeep kumarNo ratings yet

- Form 16 - BLMPB2218K - 2019-20 - Part B PDFDocument6 pagesForm 16 - BLMPB2218K - 2019-20 - Part B PDFUmair BaigNo ratings yet

- Form 1622072023 022228Document2 pagesForm 1622072023 022228Kajal RandiveNo ratings yet

- Form 1601012023 101258Document3 pagesForm 1601012023 101258Bhura SinghNo ratings yet

- Form16 1945007 JC570193L 2020 2021Document2 pagesForm16 1945007 JC570193L 2020 2021Ranjeet RajputNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Part B: Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesForm No. 16 (See Rule 31 (1) (A) ) Part B: Details of Salary Paid and Any Other Income and Tax Deductedrahul patidarNo ratings yet

- Form 1621032023 201318 PDFDocument3 pagesForm 1621032023 201318 PDFManvendraNo ratings yet

- Form 16 TDS CertificateDocument2 pagesForm 16 TDS CertificateRanjeet RajputNo ratings yet

- FORM 16 TAX DETAILSDocument2 pagesFORM 16 TAX DETAILSAkshay ShettyNo ratings yet

- Form 16 TDS CertificateDocument4 pagesForm 16 TDS Certificateqwerty9999499949No ratings yet

- ANIL GANVIR Old New Regime ComputationDocument1 pageANIL GANVIR Old New Regime ComputationDrAndrew WillingtonNo ratings yet

- Form 16 Salary DetailsDocument2 pagesForm 16 Salary DetailsSanjay DuaNo ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- Tax Calculator For Individual Tax Payer: Data Tax Calculation Old Regime New RegimeDocument3 pagesTax Calculator For Individual Tax Payer: Data Tax Calculation Old Regime New RegimeDevi PrasannaNo ratings yet

- Form 16Document2 pagesForm 16lcharansahithNo ratings yet

- Form 1602102023 160124Document3 pagesForm 1602102023 160124isantbasnet3561No ratings yet

- Form 1606032021 195902Document3 pagesForm 1606032021 195902Kalyan KumarNo ratings yet

- Form 1625062023 043026Document2 pagesForm 1625062023 043026SHIV BHAJANNo ratings yet

- A MukherjeeDocument3 pagesA MukherjeeBrahmankhanda Basapara HIGH SCHOOLNo ratings yet

- Form16 W0000000 GS164200X 2021 20211Document1 pageForm16 W0000000 GS164200X 2021 20211gaganNo ratings yet

- 2018-19 - One97 Communications LTDDocument2 pages2018-19 - One97 Communications LTDBALBINDER MALLNo ratings yet

- Ajppm3616g Partb 2022-23Document3 pagesAjppm3616g Partb 2022-23niel doriftoNo ratings yet

- Salary and Tax DetailsDocument1,320 pagesSalary and Tax DetailsAnonymous pKsr5vNo ratings yet

- IT Calculation New RegimeDocument4 pagesIT Calculation New Regimeyelrihs23No ratings yet

- 20092010form16 004355Document3 pages20092010form16 004355Hemen BrahmaNo ratings yet

- Calculate Income Tax in Old Tax RegimeDocument1 pageCalculate Income Tax in Old Tax RegimeSRINIVAS MNo ratings yet

- New Form 16 AY 11 12Document5 pagesNew Form 16 AY 11 12RMD Financial ServicesNo ratings yet

- Form 12 BBDocument2 pagesForm 12 BBHarsh GandhiNo ratings yet

- Form 1615052023 141937Document3 pagesForm 1615052023 141937Pawan KumarNo ratings yet

- Form 16 - TCS Part BDocument4 pagesForm 16 - TCS Part BSai SekharNo ratings yet

- FORM NO.16 AA-1Document2 pagesFORM NO.16 AA-1Vishnu Vardhan ANo ratings yet

- G Vittal 16 FrontDocument1 pageG Vittal 16 FrontSRINIVAS MNo ratings yet

- Form 1622052023 130017Document3 pagesForm 1622052023 130017Amit Singh NegiNo ratings yet

- Form16 W0000000 GO004610X 2022 20221Document1 pageForm16 W0000000 GO004610X 2022 20221Dharamveer SinghNo ratings yet

- PAYSLIP DETAILSDocument3 pagesPAYSLIP DETAILSamitNo ratings yet

- Form 12 BBDocument2 pagesForm 12 BBSanjay SalunkheNo ratings yet

- JUNE 2021 PAYSLIPDocument3 pagesJUNE 2021 PAYSLIPamitNo ratings yet

- BBTPN4386D Partb 2022-23Document3 pagesBBTPN4386D Partb 2022-23basit.000No ratings yet

- FormDocument4 pagesFormUtkarsh GurjarNo ratings yet

- IncomeTax - Computation - DOMPXXXXXK-Sakshi Kakkar-AT-0201-2021Document1 pageIncomeTax - Computation - DOMPXXXXXK-Sakshi Kakkar-AT-0201-2021deepanshu sapraNo ratings yet

- ITProjection (2022-2023)Document3 pagesITProjection (2022-2023)mamtakumaripihooNo ratings yet

- FORM NO. 16 PART B TAX DEDUCTION CERTIFICATEDocument2 pagesFORM NO. 16 PART B TAX DEDUCTION CERTIFICATEGloryNo ratings yet

- Form 16 Fy 2020-2021 Ahbpd9289q Partb Ay 2021-2022Document3 pagesForm 16 Fy 2020-2021 Ahbpd9289q Partb Ay 2021-2022CrcNo ratings yet

- Form 1612052021 111453Document3 pagesForm 1612052021 111453SandhyaNo ratings yet

- Form 1617082023 112227Document2 pagesForm 1617082023 112227rinsha.sherinNo ratings yet

- 16 - PartB - G C VANAJA (1) - 2023-24Document2 pages16 - PartB - G C VANAJA (1) - 2023-24fininfinity ctaNo ratings yet

- Online payment receipt for housing society chargesDocument1 pageOnline payment receipt for housing society chargesjawa bike 42No ratings yet

- FNCE20005 Corporate Financial Decision MakingDocument12 pagesFNCE20005 Corporate Financial Decision MakingFungai MukundiwaNo ratings yet

- Management: Main provisions of Minimum Wages ActDocument2 pagesManagement: Main provisions of Minimum Wages ActRushikesh KaleNo ratings yet

- f7 RQB 15 SampleDocument134 pagesf7 RQB 15 SampleCorrineTanNo ratings yet

- EC Assignment 1Document9 pagesEC Assignment 1Shubhankar BansalNo ratings yet

- India Infoline Finance LTD.": Analytical Study of Mutual FundsDocument60 pagesIndia Infoline Finance LTD.": Analytical Study of Mutual FundsPRIYANo ratings yet

- 01 - Activity - 1 - AuditingDocument4 pages01 - Activity - 1 - AuditingMillania ThanaNo ratings yet

- Financing Indonesia's Independent SmallholdersDocument38 pagesFinancing Indonesia's Independent SmallholdersboimmnrgNo ratings yet

- APICS - CPIM - 2019 - PT 2 - Mod 1 - SecFDocument23 pagesAPICS - CPIM - 2019 - PT 2 - Mod 1 - SecFS.DNo ratings yet

- What Is The Definition of Investment?: StocksDocument3 pagesWhat Is The Definition of Investment?: StocksJhesnil SabundoNo ratings yet

- Pag-Ibig Mp2 Application FormDocument2 pagesPag-Ibig Mp2 Application Formroy czar pableoNo ratings yet

- Muhammad Aqeel Alvi: Work Experience SkillsDocument1 pageMuhammad Aqeel Alvi: Work Experience SkillsaqeelNo ratings yet

- Capital BudgetingDocument12 pagesCapital BudgetingFrankline RickyNo ratings yet

- FAQ's by ICAI RVO - 8.07.2020Document20 pagesFAQ's by ICAI RVO - 8.07.2020SiddNo ratings yet

- PN DeedDocument8 pagesPN DeedSunita SinghNo ratings yet

- Caguioa,: en Banc G.R. No. 225433 - Lara'S Gifts & Decors, Inc., Midtown Industrial Sales, Inc.Document50 pagesCaguioa,: en Banc G.R. No. 225433 - Lara'S Gifts & Decors, Inc., Midtown Industrial Sales, Inc.PhilAeonNo ratings yet

- Lesson 2Document40 pagesLesson 2Sarah JaneNo ratings yet

- Future Generali Flexi Online Term Plan Provides Affordable Life Cover and Income Protection for Your FamilyDocument19 pagesFuture Generali Flexi Online Term Plan Provides Affordable Life Cover and Income Protection for Your FamilySangeeta LakhoteNo ratings yet

- Basel III: Bank Regulation and StandardsDocument13 pagesBasel III: Bank Regulation and Standardskirtan patelNo ratings yet

- Receipt: Received From (Client Name) Amount PaidDocument3 pagesReceipt: Received From (Client Name) Amount PaidNoman AreebNo ratings yet

- Comparing Services of Co-operative BanksDocument89 pagesComparing Services of Co-operative BanksVijay Rane100% (1)

- FN3092 - Corporate Finance - 2008 Exam - Zone-ADocument5 pagesFN3092 - Corporate Finance - 2008 Exam - Zone-AAishwarya PotdarNo ratings yet

- Lecture 4. StockDocument26 pagesLecture 4. StockazizbektokhirbekovNo ratings yet

- Bond Price Volatility - Problem SetDocument3 pagesBond Price Volatility - Problem SetHitesh JainNo ratings yet

- EMBA Class Directory FINAL LowresDocument12 pagesEMBA Class Directory FINAL Lowresssss1234dNo ratings yet