Professional Documents

Culture Documents

ITProjection (2022-2023)

Uploaded by

mamtakumaripihooOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ITProjection (2022-2023)

Uploaded by

mamtakumaripihooCopyright:

Available Formats

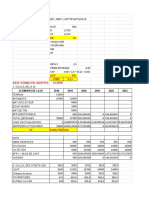

AS DRAWN PARTICULARS FOR THE COMPUTATION OF INCOME TAX FOR THE FINANCIAL YEAR: 2022-2023

(1stAPR-31stMAR)

JE(MECH

EMPLOYEE NO. 524NPS00078 NAME MAMTA KUMARI DESIGNATION STATION BELA BILL UNIT 2414603 PAN NUMBER BUPPK1391G

)

HEAD MAR APR MAY JUN JUL AUG SEP OCT NOV DEC JAN FEB MAR TOTAL

PAY 47600 47600 47600 47600 49000 49000 49000 49000 49000 49000 49000 49000 0 582400

DA 14756 16184 16184 16184 16660 16660 16660 18620 18620 18620 18620 18620 0 206388

AR DA 0 4284 0 0 0 0 0 5880 0 0 0 0 0 10164

HRA 4284 4284 0 0 0 0 0 0 0 0 0 0 0 8568

TRAN ALL(TAXABLE) 2358 2412 2412 2412 2412 2412 2412 2484 2484 2484 2484 2484 0 29250

AR T/AL-G 0 162 0 0 0 0 0 216 0 0 0 0 0 378

PLB 0 0 0 0 0 0 0 17951 0 0 0 0 0 17951

CH.EDU-ALL 0 0 54000 0 0 0 0 0 0 0 0 0 0 54000

NPST-GOV 8730 9530 8930 8930 9192 9192 9192 10290 9467 9467 9467 9467 0 111854

DRESS AL ANNUAL 0 0 0 0 0 5000 0 0 0 0 0 0 0 5000

CGIS-C 30 30 30 30 30 30 30 30 30 30 30 30 0 360

NPST-I 6236 6807 6378 6378 6566 6566 6566 7350 6762 6762 6762 6762 0 79895

INC TAX 0 1803 1803 1803 1803 1803 1803 1803 1803 10217 10217 10216 0 45074

P-TAX-BR 0 0 0 0 0 0 0 2500 0 0 0 0 0 2500

1. GROSS INCOME....(EXCLUDING CHILD EDUALL. REBATE 2400) 1023553

2. LESS DEDUCTION:-

(a) HR U/s. 10(13A) 0

(b) PROFESSIONAL TAX U/s 16(b) 2500

(c) STANDARD DEDUCTION U/s 16(a) 50000

3. INCOME CHARGEBALE UNDER THE HEAD OF SALARIES(1-2) 966053

4. (a) OTHER INCOME REPORTED BY EMPLOYEE 0

(b) GAIN FROM HOUSE PROPERTY 0

(c) LOSS FROM HOUSE PROPERTY 0

5. TOTAL INCOME (3+4) 966053

6. DEDUCTIONS (VI-A)

SAVINGS UNDER SEC. 80C(MAX. 150000/-)

a) NPS 79895

b) GIS 360

c) LIC & INSURANCE 36456

d) NSC/NSS/FD (5+ YEARS) 0

e) INT. ON NSC 0

f) HBA 0

g) MUTUAL FUND 0

h) PPF 42000

i) TUTION FEES (FOR TWO CHILDREN) 12000

j) ULIP 0

k) PLI 0

l) CTD 0

m) SUKANYA YOJANA 30000

TOTAL INVESTMENT 200711

80C : SAVING INCLUDING PENSION PLAN 0/-> 150000

80CCD(2): GOVT CONTRIBUTION REBATE 111854

80CCF: INV FRA. STRU. BOND 0

80D : GIC MEDICAL INSURANCE PREMIA (MEDICLAIM) 0

80E : INTEREST ON EDUCATION LOAN 0

80DD : TREATMENT OF HANDICAPPED DEPENDENT 0

80GGA: DONATION FOR SCIENTIFIC R & D DEVELOPMENT 0

80RRA: FOREIGN SERVICE (SPONSERED) 0

80G : DONATIONS 0

80U : PHYSICALLY HANDICAPPED PERSON 0

80DDA: MAINTENANCE OF HANDICAP DEPENDANT 0

80DDB: MEDICAL TREATMENT 0

7. TOTAL DEDUCTIONS 311854

8. TOTAL INCOME 654199 654200

9. TAX ON TOTAL INCOME

(a) UPTO Rs. 250000/-.............................. NIL

(b) ON Rs. 250000 @ 5.0% ( UPTO Rs. 500000)..... 12500

(c) ON Rs. 154200 @ 10.0% ( UPTO Rs. 750000)..... 15420

(d) ON Rs. 0 @ 15.0% ( ABOVE Rs. 750000)..... 0

(e) TAX ON INCOME 0

10. EDUCATION CESS

(a) EDUCATION CESS 2%.OF 9(a) 1734

(b) EDUCATION CESS 1%.(Sec & Higher)OF 9(a) 0

TOTAL TAX INCLUDING CESS 45074

11. TOTAL TAX DEDUCTED 45074

12. TAX TO BE DEDUCTED 0

13. TAX TO BE DEDUCTED PER MONTH 0

You might also like

- Negotiable Instruments LawDocument33 pagesNegotiable Instruments LawEj Clemena100% (1)

- Journal Entries For Stockholders' EquityDocument2 pagesJournal Entries For Stockholders' EquityMary100% (11)

- AirThreads Valuation SolutionDocument20 pagesAirThreads Valuation SolutionBill JoeNo ratings yet

- Bank Reconciliation ExercisesDocument8 pagesBank Reconciliation ExercisesBrian Reyes Gangca67% (12)

- Technical Indicator ExplanationDocument4 pagesTechnical Indicator ExplanationfranraizerNo ratings yet

- Self-Occupied: Com Putati On of I Ncom E and Tax Pai DDocument5 pagesSelf-Occupied: Com Putati On of I Ncom E and Tax Pai DAnshika GoelNo ratings yet

- MCQ Accounts For 10+2 TS Grewal SirDocument66 pagesMCQ Accounts For 10+2 TS Grewal SirYash ChhabraNo ratings yet

- Project Report: Name and Address:-Of The ApplicantDocument10 pagesProject Report: Name and Address:-Of The Applicantakki_6551No ratings yet

- PBTC Vs Dahican Lumber Co - Case DigestDocument2 pagesPBTC Vs Dahican Lumber Co - Case DigestsescuzarNo ratings yet

- Preparation and Checking Interim ValuationsDocument3 pagesPreparation and Checking Interim Valuationsමනෝජ් තුඩුගලNo ratings yet

- It Projection Pdf2023-2024Document3 pagesIt Projection Pdf2023-2024Sumit SanjanNo ratings yet

- ITProjection (2020-2021)Document2 pagesITProjection (2020-2021)mainsicklinetataNo ratings yet

- Manjit Form16Document1 pageManjit Form16JashanNo ratings yet

- Tax Cal - 2020 - 21 MalayDocument8 pagesTax Cal - 2020 - 21 MalayGaming PlazaNo ratings yet

- Exam Gestion Financier Ratt 2018 Prof MESK - Faculté HASSAN 2 CASABLANCADocument1 pageExam Gestion Financier Ratt 2018 Prof MESK - Faculté HASSAN 2 CASABLANCAAbdoNo ratings yet

- Webcrche 2019Document2 pagesWebcrche 2019DANKOIRE HMNo ratings yet

- P.Saralakshmi: Head Clerk LW MSD PerDocument4 pagesP.Saralakshmi: Head Clerk LW MSD Permayur1980No ratings yet

- ANIL GANVIR Old New Regime ComputationDocument1 pageANIL GANVIR Old New Regime ComputationDrAndrew WillingtonNo ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document9 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Madan ChaturvediNo ratings yet

- Screenshot 2023-02-28 at 4.57.32 PMDocument2 pagesScreenshot 2023-02-28 at 4.57.32 PMTanushree MishraNo ratings yet

- Expences Sheet July 2016 To June 2017Document2 pagesExpences Sheet July 2016 To June 2017Abdul RaqeebNo ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document9 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Madan ChaturvediNo ratings yet

- Proposed Line Item CutsDocument13 pagesProposed Line Item Cutsbmcauliffe8808No ratings yet

- New Microsoft Excel WorksheetDocument1 pageNew Microsoft Excel Worksheetm.v.reddyNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryKrishna Chaitanya JonnalagaddaNo ratings yet

- Central Electricity Authority Fuel Management Division Monthly Report of Import of Coal MAY-2020Document2 pagesCentral Electricity Authority Fuel Management Division Monthly Report of Import of Coal MAY-2020g.subhadeep6890No ratings yet

- 9 - Sample - Income TaxDocument2 pages9 - Sample - Income TaxShreyash MoharirNo ratings yet

- Income Tax Data 53001003 2023-2024Document4 pagesIncome Tax Data 53001003 2023-2024biswanathdas2888No ratings yet

- Computation Sheet 2022-11Document4 pagesComputation Sheet 2022-11Harsha KumarNo ratings yet

- IT Calculation New RegimeDocument4 pagesIT Calculation New Regimeyelrihs23No ratings yet

- UntitledDocument4 pagesUntitledDushmanta mishraNo ratings yet

- Pawan Hans Helicopters Ltd. Balance SheetDocument3 pagesPawan Hans Helicopters Ltd. Balance SheetSonal ThukralNo ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document18 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Arjun VermaNo ratings yet

- Scan Oct 05, 2021Document5 pagesScan Oct 05, 2021zk9958112No ratings yet

- Form 1609042024 112352Document3 pagesForm 1609042024 112352rs3071029No ratings yet

- TDSWorkings AspxDocument2 pagesTDSWorkings Aspxchandruv29eNo ratings yet

- Acrow MisrDocument66 pagesAcrow MisrAmir MamdouhNo ratings yet

- Form 1626042024 112515Document2 pagesForm 1626042024 112515harshkaliramna2007.hkNo ratings yet

- Anil Ganvir Form 16 (21 22)Document3 pagesAnil Ganvir Form 16 (21 22)DrAndrew WillingtonNo ratings yet

- AYAR-07: TotalDocument1 pageAYAR-07: TotalJohn Francis Raspado AnchetaNo ratings yet

- DR Ali FinalDocument3 pagesDR Ali FinalbuxartaxNo ratings yet

- PRARZOODocument14 pagesPRARZOOrahul dantkaleNo ratings yet

- CPC 100 Brochure ENUDocument1 pageCPC 100 Brochure ENUAmmar Khalid MayoNo ratings yet

- Tax Practice Assignmenment Edited 2 Ketty Dec 2022Document6 pagesTax Practice Assignmenment Edited 2 Ketty Dec 2022ketty sambaNo ratings yet

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- Demand No. 16 Wms A/C 207215 S&T Work Shops/Lallaguda Control Over Expenditure For The Month ofDocument1 pageDemand No. 16 Wms A/C 207215 S&T Work Shops/Lallaguda Control Over Expenditure For The Month ofpasamvNo ratings yet

- Ipao Report Master SubmitDocument49 pagesIpao Report Master SubmitProject 3No ratings yet

- Matekar PDFDocument1 pageMatekar PDFdharmveer singhNo ratings yet

- Acca Single EntryDocument10 pagesAcca Single Entrythakkert25No ratings yet

- New ItDocument9 pagesNew Itஇரா.மே.கார்த்திக் ராசாNo ratings yet

- Form16 1945007 JC570193L 2020 2021Document2 pagesForm16 1945007 JC570193L 2020 2021Ranjeet RajputNo ratings yet

- Income Tax CalculatorDocument11 pagesIncome Tax Calculatorsaty_76No ratings yet

- Income Tax Planner FY 2020-21Document12 pagesIncome Tax Planner FY 2020-21RedNo ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document11 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Madan ChaturvediNo ratings yet

- 202112eerDocument3 pages202112eerSSEPWIC DOINo ratings yet

- Form 1621052023 115217Document2 pagesForm 1621052023 115217sandeep kumarNo ratings yet

- Midc Progect Pap2222Document8 pagesMidc Progect Pap2222akki_6551No ratings yet

- DownloadDocument2 pagesDownloadShaji CpNo ratings yet

- 2022 2 Bbac 322 ExamDocument18 pages2022 2 Bbac 322 ExamsipanjegivenNo ratings yet

- Case Study 3 SolutionDocument2 pagesCase Study 3 Solutiongaurilakhmani2003No ratings yet

- Boildiy Mostas Legube: BuildaDocument6 pagesBoildiy Mostas Legube: BuildaInvestearn repeatNo ratings yet

- Example Problem Petro EconomyDocument68 pagesExample Problem Petro Economyal zam zamNo ratings yet

- CONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Document2 pagesCONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Akshay ShettyNo ratings yet

- 423 BOD & Budget ForecastDocument19 pages423 BOD & Budget ForecastshariqwaheedNo ratings yet

- Assessment of Working Capital Requirements Form - IDocument11 pagesAssessment of Working Capital Requirements Form - IAyush SharmaNo ratings yet

- Fluidic Components and Equipment 1968–9: Pergamon Electronics Data SeriesFrom EverandFluidic Components and Equipment 1968–9: Pergamon Electronics Data SeriesNo ratings yet

- Engine, Turbine & Power Transmission Equipment World Summary: Market Values & Financials by CountryFrom EverandEngine, Turbine & Power Transmission Equipment World Summary: Market Values & Financials by CountryNo ratings yet

- Electric Traction MCQ Questions AnswersDocument2 pagesElectric Traction MCQ Questions AnswersmamtakumaripihooNo ratings yet

- Question Bank StoresDocument34 pagesQuestion Bank StoresmamtakumaripihooNo ratings yet

- Receipt - 4 - 28 - 2023 12 - 00 - 00 AMDocument1 pageReceipt - 4 - 28 - 2023 12 - 00 - 00 AMmamtakumaripihooNo ratings yet

- FDocument1 pageFmamtakumaripihooNo ratings yet

- Receipt - 4 - 28 - 2023 12 - 00 - 00 AMDocument1 pageReceipt - 4 - 28 - 2023 12 - 00 - 00 AMmamtakumaripihooNo ratings yet

- PaymentReceipt 978461Document1 pagePaymentReceipt 978461mamtakumaripihooNo ratings yet

- Bonds Payable: Prepare The Entries To Record The Above TransactionsDocument6 pagesBonds Payable: Prepare The Entries To Record The Above TransactionsJay-L TanNo ratings yet

- ACC200 - Group Statements Chapter 5 - Part 1Document38 pagesACC200 - Group Statements Chapter 5 - Part 1kchabalala91No ratings yet

- 1f9b0008-a5aa-48b6-923f-33607527d48bDocument2 pages1f9b0008-a5aa-48b6-923f-33607527d48bNihad ƏhmədovNo ratings yet

- IL&FS Letter To LIC Chairman 1 Oct 2018Document3 pagesIL&FS Letter To LIC Chairman 1 Oct 2018Moneylife FoundationNo ratings yet

- List of Masters Courses Dec 17Document3 pagesList of Masters Courses Dec 17Anan AghbarNo ratings yet

- The Future of Payment in AfricaDocument17 pagesThe Future of Payment in AfricaNegera AbetuNo ratings yet

- Yash ParakDocument31 pagesYash ParakYash ParakNo ratings yet

- ISFIRE Dec'22 (Web Version)Document100 pagesISFIRE Dec'22 (Web Version)Wan RuschdeyNo ratings yet

- Reasons Why The 14th Finance Commission Removed Grants-In-Aid Benefit To StatesDocument2 pagesReasons Why The 14th Finance Commission Removed Grants-In-Aid Benefit To StatesPGurusNo ratings yet

- Chapter 9Document14 pagesChapter 9Yousef M. AqelNo ratings yet

- PDF DownloadDocument2 pagesPDF DownloadKnitting ProductionNo ratings yet

- Non Exclusive AtsDocument1 pageNon Exclusive Atsmichael uybengkeeNo ratings yet

- CrossTech LLC Operating AgreementDocument10 pagesCrossTech LLC Operating AgreementMikhael HarianjaNo ratings yet

- Accounting Grade 8 YEAR PLAN 2024Document3 pagesAccounting Grade 8 YEAR PLAN 2024jemimanzinu6No ratings yet

- Confirmation For Booking ID # 694245897 SarathDocument1 pageConfirmation For Booking ID # 694245897 Sarathbindu mathaiNo ratings yet

- GDBDocument1 pageGDBsajidschannelNo ratings yet

- Emperor IndexDocument3 pagesEmperor IndexJabbar KhanNo ratings yet

- (Palgrave Macmillan Studies in Banking and Financial Institutions) Franco Fiordelisi, Philip Molyneux (Auth.) - Shareholder Value in Banking-Palgrave Macmillan UK (2006) PDFDocument359 pages(Palgrave Macmillan Studies in Banking and Financial Institutions) Franco Fiordelisi, Philip Molyneux (Auth.) - Shareholder Value in Banking-Palgrave Macmillan UK (2006) PDFAbouDickyNo ratings yet

- Solutions Totutorial 1-Fall 2022Document8 pagesSolutions Totutorial 1-Fall 2022chtiouirayyenNo ratings yet

- 1Q 2013 Data Book Investor RelationsDocument19 pages1Q 2013 Data Book Investor Relationsgiba269No ratings yet

- Deposist AccountDocument6 pagesDeposist AccountwaheedarifNo ratings yet

- Title of Business Plan Food Industry Business PlanDocument26 pagesTitle of Business Plan Food Industry Business PlanIsmail AzhariNo ratings yet