Professional Documents

Culture Documents

Form 1617082023 112227

Uploaded by

rinsha.sherinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 1617082023 112227

Uploaded by

rinsha.sherinCopyright:

Available Formats

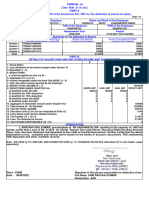

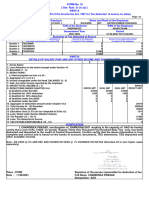

FORM No.

16

[ See Rule 31 (1) (a) ]

PART-A

Certificate under Section 203 of the Income-tax Act, 1961 for Tax deducted at source on salary

Page 1 2

Employer - PAO Code Name and Rank of the Employee

57 YASIR FIRDHOUSE PA

PAN of the Deductor TAN of the Deductor PAN of the Employee

BFSPK8596R JBPP01619C CXAPP7735A

CIT(TDS) Address Assessment Year / Tax Option Period

1(2) 2023-2024/OLD 01/04/2022 TO 31/03/2023

Summary of Tax deducted at Source

Quarter Receipt Numbers of original statements of Amount of tax deducted Amount of tax deducted/remitted

TDS under sub-section(3) of section 200 in respect of the employee in respect of the employee

Quarter 1

Quarter 2

Quarter 3

Quarter 4

Total

PART-B

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

` ` ` `

1. Gross Salary 644748

2. Standard Deduction 50000

3. Less Allowance to the extent exempt under Section 10 0

4. BALANCE (1 - 2) 594748

5. DEDUCTIONS :

a. Interest payable on loan u/s 24 : 0

6. Aggregate of 5 ( a to b ) 0

7. Income chargeable under the Head 'SALARIES' (3 - 5) 594748

8. Add: Any other income reported by the employee * 0

9. GROSS TOTAL INCOME (6 + 7) 594748

10. DEDUCTIONS UNDER CHAPTER VI-A GROSS AMT QUAL AMT QUAL AMT DEDUCT AMT

a) Qualified under Sec.80C 173500 150000 150000

b) Qualified for 100% deduction 0 0 0

c) Qualified for 50% deduction 0 0 0

d) Qualified under Sec.80DD 0 0 0

e) Qualified under Sec.80U 0 0 0

11. Aggregate of deductible amount under Chapter VI-A 150000

12. Total Income (8 - 10) Rounded 444750

12. TAX ON TOTAL INCOME - SEC 87A REBATE(Rs.9738) 0

14. Health & Education Cess @4% (on tax computed at Sl.No.12) 0

15. Tax Payable (12 + 13) 0

16. Less: Relief under Section 89(attach Details) 0

17. Less : Tax Deducted 0

18. TAX PAYABLE/REFUNDABLE (15 - 16) 0

VERIFICATION

I, Rakesh Kumar , son/daughter of MOHAN ROY working in the capacity of AAO do hereby certify that

a sum of Rs. 0 (in words) Rupees Zero has been deducted and deposited to the credit of Central Government. I

further certify that the above information is true, complete and correct and is based on the books of account,

documents, TDS statements, TDS deposited and other available records.

Note * : Sl.No.8 above Other Income includes taxable interest accrued on Fund Subscription above 500000 Rupees

Place : JABALPUR Signature of the person responsible for deduction of tax

Date : 23/06/2023 Full Name Rakesh Kumar

Designation AAO

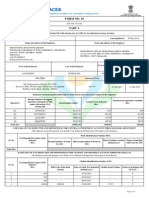

BREAK UP OF TAXABLE EMOLUMENTS FINANCIAL YEARWISE Page 2 2

Employer - PAO Code Name and Rank of the Employee

57 YASIR FIRDHOUSE PA

For the financial year from 01/03/2021 to 28/02/2022 = 37375.0

For the financial year from 01/03/2022 to 28/02/2023 = 607373.0

Total taxable emoluments 644748.0

You might also like

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- Booklet of Forms For House Building AdvanceDocument2 pagesBooklet of Forms For House Building AdvanceJITHU MNo ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- Quarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeDocument2 pagesQuarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeSanjoy SamantaNo ratings yet

- Form 1615052023 141937Document3 pagesForm 1615052023 141937Pawan KumarNo ratings yet

- Form 1607022022 205546Document2 pagesForm 1607022022 205546Mahesh VayiboyinaNo ratings yet

- Form 1608112023 131300Document3 pagesForm 1608112023 131300baisanebuddheshNo ratings yet

- Form 1622072023 022228Document2 pagesForm 1622072023 022228Kajal RandiveNo ratings yet

- Form16 W0000000 GS186523X 2021 20211Document1 pageForm16 W0000000 GS186523X 2021 20211Raman OjhaNo ratings yet

- Form 1612052021 111453Document3 pagesForm 1612052021 111453SandhyaNo ratings yet

- Form 1621052023 115217Document2 pagesForm 1621052023 115217sandeep kumarNo ratings yet

- Form 1606032021 195902Document3 pagesForm 1606032021 195902Kalyan KumarNo ratings yet

- Form 1622052023 130017Document3 pagesForm 1622052023 130017Amit Singh NegiNo ratings yet

- Form 1625062023 043026Document2 pagesForm 1625062023 043026SHIV BHAJANNo ratings yet

- Form16 W0000000 GO004610X 2022 20221Document1 pageForm16 W0000000 GO004610X 2022 20221Dharamveer SinghNo ratings yet

- Form 1609042024 112352Document3 pagesForm 1609042024 112352rs3071029No ratings yet

- Form 1602102023 160124Document3 pagesForm 1602102023 160124isantbasnet3561No ratings yet

- Form 1601012023 101258Document3 pagesForm 1601012023 101258Bhura SinghNo ratings yet

- Form 1626042024 112515Document2 pagesForm 1626042024 112515harshkaliramna2007.hkNo ratings yet

- Form 1619042024 085917Document3 pagesForm 1619042024 085917SODHI SINGHNo ratings yet

- Form16 W0000000 GS164200X 2021 20211Document1 pageForm16 W0000000 GS164200X 2021 20211gaganNo ratings yet

- Form16 1951051 17631 04570193K 2021 2022Document2 pagesForm16 1951051 17631 04570193K 2021 2022Ranjeet RajputNo ratings yet

- Form 1621032023 201318 PDFDocument3 pagesForm 1621032023 201318 PDFManvendraNo ratings yet

- Form16 1945007 JC570193L 2020 2021Document2 pagesForm16 1945007 JC570193L 2020 2021Ranjeet RajputNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- Res FormDocument1,320 pagesRes FormAnonymous pKsr5vNo ratings yet

- (C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Document2 pages(C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Yashwant KumarNo ratings yet

- Harsh 22-24Document2 pagesHarsh 22-24sanghviharsh202No ratings yet

- Form 16 - BLMPB2218K - 2019-20 - Part B PDFDocument6 pagesForm 16 - BLMPB2218K - 2019-20 - Part B PDFUmair BaigNo ratings yet

- HDFC Bank Limited: Dear Mr. Vijay Anand A.Document5 pagesHDFC Bank Limited: Dear Mr. Vijay Anand A.A Vijay AnandNo ratings yet

- Apr 2022Document1 pageApr 2022Rohit AdnaikNo ratings yet

- Form 16 - 13-14Document4 pagesForm 16 - 13-14NITIN CHOUDHARYNo ratings yet

- Form 16 - TCSDocument3 pagesForm 16 - TCSBALANo ratings yet

- C - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFDocument5 pagesC - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFPrudhvi Raj ChowdaryNo ratings yet

- Judicial Reforms in IndiDocument1 pageJudicial Reforms in IndiArsalan KhanNo ratings yet

- 2021-2022 Shrikant Jadhav Form 16-Part B PDFDocument6 pages2021-2022 Shrikant Jadhav Form 16-Part B PDFVidya JadhavNo ratings yet

- 2018-19 - Part B - 1Document4 pages2018-19 - Part B - 1Shivam DixitNo ratings yet

- Form 16Document2 pagesForm 16robin0903No ratings yet

- PART B (Annexure)Document4 pagesPART B (Annexure)AnbarasanNo ratings yet

- Form 16 Pareshbhai PatelDocument3 pagesForm 16 Pareshbhai PatelAkshat ShahNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedAYUSH PRADHANNo ratings yet

- Abhishek - Provisional Form 16Document2 pagesAbhishek - Provisional Form 16hrrecruiter.vhtbsNo ratings yet

- Anil Ganvir Form 16 (21 22)Document3 pagesAnil Ganvir Form 16 (21 22)DrAndrew WillingtonNo ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)P v v RaoNo ratings yet

- Form 16 651746Document4 pagesForm 16 651746Arslan1112No ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryNavneet SharmaNo ratings yet

- Accenture Form 16Document7 pagesAccenture Form 16Srikrishna PadmannagariNo ratings yet

- CONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Document2 pagesCONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Akshay ShettyNo ratings yet

- Matekar PDFDocument1 pageMatekar PDFdharmveer singhNo ratings yet

- Rajesh Bora Itr PLBS 2022Document5 pagesRajesh Bora Itr PLBS 2022ABDUL KHALIKNo ratings yet

- Income Tax Calculation Worksheet: Thermax LTD Ascent PayrollDocument1 pageIncome Tax Calculation Worksheet: Thermax LTD Ascent PayrollAnuragNo ratings yet

- Form16 16 2015-16Document4 pagesForm16 16 2015-16BDO KhandalaNo ratings yet

- MCQs All Sets F 1Document46 pagesMCQs All Sets F 1PSK WRITINGSNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryR S RatanNo ratings yet

- F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentDocument1 pageF0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentSourabhthakral_1No ratings yet

- Form PDF 525292250230922Document12 pagesForm PDF 525292250230922Vikash KumarNo ratings yet

- IT Calculator 2018 LiteDocument6 pagesIT Calculator 2018 LiteHr PoonamNo ratings yet

- DR Ali FinalDocument3 pagesDR Ali FinalbuxartaxNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryKrishna Chaitanya JonnalagaddaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Zorbas ExcelDocument23 pagesZorbas ExcelRoderick Jackson Jr100% (6)

- AFAR Answer KeyDocument9 pagesAFAR Answer KeyFery AnnNo ratings yet

- Multiple Choice Problems 111618Document2 pagesMultiple Choice Problems 111618Dominic Dalton Caling75% (4)

- PROFITABILITY RATIOS MCQs PDFDocument30 pagesPROFITABILITY RATIOS MCQs PDFSylvester StanisNo ratings yet

- Microeconomics Review WorkbookDocument73 pagesMicroeconomics Review WorkbookMike FladlienNo ratings yet

- 2014 mlc703 AssignmentDocument6 pages2014 mlc703 AssignmentToral ShahNo ratings yet

- "Financial Analysis of Shriram Life Insurance": A Summer Training Report ONDocument61 pages"Financial Analysis of Shriram Life Insurance": A Summer Training Report ONSIDHARTH TiwariNo ratings yet

- New Dogs, Old Tricks. Why Do Ponzi Schemes SucceedDocument16 pagesNew Dogs, Old Tricks. Why Do Ponzi Schemes SucceedJonathan JonesNo ratings yet

- Liquidity RatioDocument13 pagesLiquidity RatioVandita KhudiaNo ratings yet

- ESTANISLAO Vs COSTALESDocument2 pagesESTANISLAO Vs COSTALESDach S. Casiple100% (3)

- Taxation Law ProjectDocument9 pagesTaxation Law ProjectPrince RajNo ratings yet

- LoeaDocument21 pagesLoeahddankerNo ratings yet

- Lab Exercise in Ms ExelDocument7 pagesLab Exercise in Ms ExelSakeen NoufalNo ratings yet

- Business HomeworkDocument2 pagesBusiness HomeworkClaudia Sanchez0% (1)

- P2Document18 pagesP2YusufNo ratings yet

- ch17 - Modern Auditing - 8e - Boynton - 2006 Auditing The Investing and Financing CyclesDocument27 pagesch17 - Modern Auditing - 8e - Boynton - 2006 Auditing The Investing and Financing CyclesAvon Jade RamosNo ratings yet

- 01 China Banking Corporation vs. Court of Appeals, 403 SCRA 634, G.R. No. 146749, G.R. No. 147938 June 10, 2003Document37 pages01 China Banking Corporation vs. Court of Appeals, 403 SCRA 634, G.R. No. 146749, G.R. No. 147938 June 10, 2003Galilee RomasantaNo ratings yet

- Comparison Partnership and LLPDocument9 pagesComparison Partnership and LLPSiti Nazatul MurnirahNo ratings yet

- Adv. Aud All Class Short-1Document223 pagesAdv. Aud All Class Short-1Abraha Aregay100% (2)

- QM Preparatory Data SetsDocument16 pagesQM Preparatory Data SetsmadanNo ratings yet

- Bcom I Fa 103 MCQSDocument11 pagesBcom I Fa 103 MCQSTushar GuptaNo ratings yet

- Awg Hearing RequestDocument1 pageAwg Hearing RequestHaley SlaughterNo ratings yet

- Chopra Scm6 Inppt 13Document63 pagesChopra Scm6 Inppt 13arpitNo ratings yet

- Meezan Islamic Income Fund MIIFDocument48 pagesMeezan Islamic Income Fund MIIFMuhammad Ashraf YousufNo ratings yet

- Employee BenefitsDocument18 pagesEmployee BenefitsCielo Mae Parungo100% (1)

- Ch.1 Profit or Loss Pre and Post Incorporation - OrganizedDocument14 pagesCh.1 Profit or Loss Pre and Post Incorporation - OrganizedMonikaNo ratings yet

- Form 26AS - What Is It and How Does It Help in Filing Income Tax Return - The Economic TimesDocument3 pagesForm 26AS - What Is It and How Does It Help in Filing Income Tax Return - The Economic TimesAnupNo ratings yet

- FINS1613 File 04 - All 3 Topics Practice Questions PDFDocument16 pagesFINS1613 File 04 - All 3 Topics Practice Questions PDFisy campbellNo ratings yet

- Macroeconomics Unit 11Document3 pagesMacroeconomics Unit 11kunjapNo ratings yet

- 28 Lladoc v. Commissioner of Internal Revenue PDFDocument2 pages28 Lladoc v. Commissioner of Internal Revenue PDFKJPL_1987No ratings yet