Professional Documents

Culture Documents

Income Tax Quiz 6

Uploaded by

Calix CasanovaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Quiz 6

Uploaded by

Calix CasanovaCopyright:

Available Formats

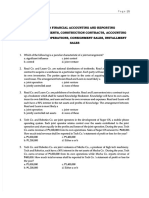

Write the letter that pertains to the best answer.

1. Which of the following associations is subject to corporate income tax?

(a) General professional partnership

(b) Joint venture or consortium agreement for construction projects

(c) Joint venture or consortium agreement for petroleum, coal, geothermal and other

energy operations pursuant to an operating or consortium agreement under a

service contract with the government

(d) Co-ownership where the property that is not under administration proceedings or

trust remains undivided for more than ten (10) years

2. X, Y and Z are lawyers who practiced their legal profession in the same building.

They hired a common secretary and shared equally for her salary as well as the

rental and electricity expenses of their offices. However, they have their own

clients and individually collect their respective fees, except in some court cases

handled by the two or three of them where they ratably share their professional

fees.

Which of the following statements is true?

a) X, Y and Z will file a quarterly corporate ITR and report their incomes and

expenses jointly therein as partners

b) X, Y and Z will file an annual corporate ITR and report their incomes and

expenses jointly therein as partners

c) X, Y and Z will file an annual Information Return for the partnership and report

their incomes and expenses separately in their respective individual ITRs

d) X, Y and Z will file their annual individual ITRs and report their incomes and

expenses separately therein

3. X and Y, both Civil Engineers by profession, executed an Articles of Partnership

wherein they would engage in the business of supplying building construction

materials. X provided the necessary cash and equipment for the firm’s capital

while Y would solely provide his services as an expert engineer. X and Y would

share their profits in the ratio or 4-1, respectively

The association of X and Y, for income tax purposes, will be classified as:

a) Taxable business partnership

b) Exempt general professional partnership

c) Exempt joint venture

d) None of the foregoing

4 Which of these statements relative to a general partnership is false?

a) The firm shall file an information return but the partners shall file their individual

ITRs and separately pay their income tax liabilities thereon

b) The firm may claim as a deduction any contributions which are deductible with

limit, whereas the individual partners may claim as a deduction any contributions

which are deductible in full

c) The distributive shares of the partners shall be subject to 10-15% creditable

withholding tax

d) Any partnership loss may be claimed by the partners proportionately in their

respective

5 X and Y inherited a piece of agricultural land from their recently deceased

parents. The last will and testament of the decedent provided that the said

property shall not be partitioned and should remain jointly owned by the siblings

for a period of twenty (20) years

What organization is deemed to exist for income tax purposes

a) Corporation

b) Unregistered partnership

c) Co-ownership

d) Trust

6 Which of the following contributions may be claimed as a deduction by a

business partnership?

a) Donation to street beggars

b) Donation to Parish Church

c) Both (a) and (b)

d) Neither (a) nor (b)

7 Which of the following contributions may be claimed as a deduction by a general

professional partnership?

a) Donation to Rotary Club

b) Donation to the city

c) Both (a) and (b)

d) Neither (a) nor (b)

8 A taxable partnership shall adopt as its taxable year the:

a) Calendar year

b) Fiscal year

c) Either (a) or (b)

d) Neither (a) nor (b)

9 A taxable business partnership which does not keep any books of accounts to

record its transactions shall adopt as its taxable year the:

a. Calendar year

b. Fiscal year

c. Either (a) or (b)

d. Neither (a) nor (b)

10. An exempt general professional partnership shall adopt as its taxable year the:

a. Calendar year

b. Fiscal year

c. Either (a) or (b)

d. Neither (a) nor (b)

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- US Internal Revenue Service: I1040ez - 2001Document32 pagesUS Internal Revenue Service: I1040ez - 2001IRSNo ratings yet

- Law On Partnership and Corporation ReviewerDocument8 pagesLaw On Partnership and Corporation ReviewerNoreen Delizo100% (1)

- SRL Limited: Payslip For The Month of JANUARY 2019Document1 pageSRL Limited: Payslip For The Month of JANUARY 2019Giri PriyaNo ratings yet

- WWDocument7 pagesWWNico evansNo ratings yet

- Florida Real Estate Exam Prep: Everything You Need to Know to PassFrom EverandFlorida Real Estate Exam Prep: Everything You Need to Know to PassNo ratings yet

- Quiz - Partnership Law Nov 7 2020Document4 pagesQuiz - Partnership Law Nov 7 2020eunicemaraNo ratings yet

- Advacc 1 Quiz 1 With AnswersDocument9 pagesAdvacc 1 Quiz 1 With AnswersGround ZeroNo ratings yet

- US Master Dep Guide 2016 Product-BrochureDocument1,217 pagesUS Master Dep Guide 2016 Product-BrochureAdinaOanaPrihorNo ratings yet

- IAS 16 Property Plant and Equipment CostsDocument41 pagesIAS 16 Property Plant and Equipment CostsVictory M. Dankard67% (3)

- Solar Proposal for Dan Glaser Saves $315K Over 25 YearsDocument13 pagesSolar Proposal for Dan Glaser Saves $315K Over 25 YearsAdewale BamgbadeNo ratings yet

- Partnership ExerciseDocument11 pagesPartnership ExerciseCris Tarrazona Casiple0% (1)

- Pre Qualifying ExamDocument14 pagesPre Qualifying ExamGelyn CruzNo ratings yet

- University of Nueva Caceres College of Business and Accountancy Business Laws and Regulations Preliminary ExamDocument12 pagesUniversity of Nueva Caceres College of Business and Accountancy Business Laws and Regulations Preliminary ExamRence MarcoNo ratings yet

- TAX by MamalateoDocument38 pagesTAX by MamalateoTheresa Montales0% (1)

- Test Bank - PNC CPARDocument6 pagesTest Bank - PNC CPARChristian Blanza LlevaNo ratings yet

- Payment of Bonus Act, 1965Document28 pagesPayment of Bonus Act, 1965Apoorva JhaNo ratings yet

- When Is A Notice of Donation Needed?: NEDA - National Economic Development AuthorityDocument4 pagesWhen Is A Notice of Donation Needed?: NEDA - National Economic Development AuthorityJonabelle BiliganNo ratings yet

- Partnership ReviewerDocument11 pagesPartnership Reviewerbae joohyun0% (1)

- Ipasa Nyo Po Kami Sa LawDocument79 pagesIpasa Nyo Po Kami Sa LawAnne Thea AtienzaNo ratings yet

- Philippine Tax Principles SummaryDocument12 pagesPhilippine Tax Principles SummaryRaLph Lopez BAyran100% (2)

- Partnership Agreement Between Two Limited CompaniesDocument7 pagesPartnership Agreement Between Two Limited CompaniesSam Ta0% (1)

- BSA BL2 Prelims 2022Document6 pagesBSA BL2 Prelims 2022Joy Consigene100% (1)

- First Semester Assiut University Partnership Accounting Test BankDocument8 pagesFirst Semester Assiut University Partnership Accounting Test BankAbanoub AbdallahNo ratings yet

- Questions and Answers (PARTNERSHIP)Document3 pagesQuestions and Answers (PARTNERSHIP)cerpubac67% (3)

- Project Report of MBA On Taxation - 309668020Document69 pagesProject Report of MBA On Taxation - 309668020Shashank Kurakula0% (1)

- Fundamentals 2024 PDF SPCCDocument82 pagesFundamentals 2024 PDF SPCCJeetalal GadaNo ratings yet

- ACCOUNTS FIRST TERM REVISION TEST 2013Document5 pagesACCOUNTS FIRST TERM REVISION TEST 2013NivpreeNo ratings yet

- Accounting for joint operations and joint ventures (39Document4 pagesAccounting for joint operations and joint ventures (39Maurice AgbayaniNo ratings yet

- Afar QuestionsDocument16 pagesAfar QuestionsJessarene Fauni Depante50% (18)

- Saint Vincent College of CabuyaoDocument4 pagesSaint Vincent College of CabuyaoRovic OrdonioNo ratings yet

- Pamantasan ng Cabuyao Partnership Law ExamDocument4 pagesPamantasan ng Cabuyao Partnership Law ExamDan RyanNo ratings yet

- Practice Questions On Partnership BusinessDocument4 pagesPractice Questions On Partnership BusinessBamidele AdegboyeNo ratings yet

- Chapter 14, 15, 17 QuestionsDocument10 pagesChapter 14, 15, 17 Questionsgabie stgNo ratings yet

- AFAR - PreWeek - May 2022Document31 pagesAFAR - PreWeek - May 2022Miguel ManagoNo ratings yet

- The Following Instances Do Not Necessarily Establish A PartnershipDocument4 pagesThe Following Instances Do Not Necessarily Establish A PartnershipGIRLNo ratings yet

- Law 2 Test BankDocument4 pagesLaw 2 Test BankCELRennNo ratings yet

- Advanced Financial Accounting TopicsDocument16 pagesAdvanced Financial Accounting TopicsNhel AlvaroNo ratings yet

- 2nd Grading Exam - 2Document15 pages2nd Grading Exam - 2Amie Jane MirandaNo ratings yet

- Partnership Formation QuizDocument6 pagesPartnership Formation QuizPhilip Dan Jayson LarozaNo ratings yet

- COMPREHENSIVE EXAM TWO PREPDocument13 pagesCOMPREHENSIVE EXAM TWO PREPYander Marl BautistaNo ratings yet

- Joint Arrangements: Quiz 1Document5 pagesJoint Arrangements: Quiz 1Amira SawadjaanNo ratings yet

- Midterm Examination in RFBTDocument16 pagesMidterm Examination in RFBTSherie Love LedamaNo ratings yet

- Wassim Zhani Income Taxation of Corporations (Chapter 9)Document38 pagesWassim Zhani Income Taxation of Corporations (Chapter 9)wassim zhaniNo ratings yet

- Account Ch-1 Partnership Firm - FundamentalsDocument3 pagesAccount Ch-1 Partnership Firm - Fundamentalsapsonline8585No ratings yet

- Assessment Test 2 Joint ArrangementsDocument8 pagesAssessment Test 2 Joint ArrangementsJas TanNo ratings yet

- Acctg13 Unit-Test For-PrintingDocument5 pagesAcctg13 Unit-Test For-Printinggeorgia cerezoNo ratings yet

- Accountancy Class XII Practice PaperDocument7 pagesAccountancy Class XII Practice PaperмŕίȡùĻ νέŕмάNo ratings yet

- QuizDocument3 pagesQuizKaren GarciaNo ratings yet

- 1 ACCT 2A&B P. FormationDocument7 pages1 ACCT 2A&B P. FormationHillary Grace VeronaNo ratings yet

- Take Home Quiz in PartnershipDocument5 pagesTake Home Quiz in PartnershipSheena EstrellaNo ratings yet

- ACC 603 Advanced Accounting Theory ExamDocument7 pagesACC 603 Advanced Accounting Theory ExamSteph Stevens0% (1)

- Saint Vincent College of Cabuyao Brgy. Mamatid, City of Cabuyao, Laguna Law On Partnerships Midterm ExamDocument17 pagesSaint Vincent College of Cabuyao Brgy. Mamatid, City of Cabuyao, Laguna Law On Partnerships Midterm ExamDan RyanNo ratings yet

- Class 12 Accountancy Question Bank Nov 2023Document105 pagesClass 12 Accountancy Question Bank Nov 2023vansh555palNo ratings yet

- 5VIFYKT8CDocument6 pages5VIFYKT8CKisha Faburada RiveraNo ratings yet

- Regulatory Framework in Business Transactions: Law On PartnershipDocument16 pagesRegulatory Framework in Business Transactions: Law On PartnershipDan DiNo ratings yet

- 07M Midterm ExaminationDocument4 pages07M Midterm ExaminationMarko IllustrisimoNo ratings yet

- PartnershipDocument3 pagesPartnershipIbiang DeleozNo ratings yet

- Partnership QuestionDocument6 pagesPartnership QuestionRon AceNo ratings yet

- Dwnload Full Pearsons Federal Taxation 2019 Corporations Partnerships Estates Trusts 32nd Edition Anderson Test Bank PDFDocument36 pagesDwnload Full Pearsons Federal Taxation 2019 Corporations Partnerships Estates Trusts 32nd Edition Anderson Test Bank PDFsportfulscenefulzb3nh100% (13)

- Legal Fundamentals For Canadian Business Canadian 4th Edition Yates Test BankDocument48 pagesLegal Fundamentals For Canadian Business Canadian 4th Edition Yates Test Bankgalvinegany3a72j100% (29)

- Take Home QuizDocument2 pagesTake Home Quizlancelotroyal21No ratings yet

- BillDocument3 pagesBillLucky Lucky0% (3)

- TOA Multiple Choice QuestionsDocument22 pagesTOA Multiple Choice QuestionsDesiree Dawn GabalesNo ratings yet

- RFBT 8608 1Document45 pagesRFBT 8608 1HanaNo ratings yet

- Partnership ActivitiesDocument32 pagesPartnership Activitiesandrea.huerto0730No ratings yet

- FINALEXMGNTACCTGDocument1 pageFINALEXMGNTACCTGCalix CasanovaNo ratings yet

- Brief Agency ProfileDocument3 pagesBrief Agency ProfileCalix CasanovaNo ratings yet

- Ad Agency Profile.Document18 pagesAd Agency Profile.Calix CasanovaNo ratings yet

- Asus SOSTAC AnalysisDocument4 pagesAsus SOSTAC AnalysisCalix CasanovaNo ratings yet

- Income Tax Quiz 5Document3 pagesIncome Tax Quiz 5Calix CasanovaNo ratings yet

- Statements of Financial Position As at December 31 Assets Current AssetsDocument8 pagesStatements of Financial Position As at December 31 Assets Current AssetsCalix CasanovaNo ratings yet

- San Beda University: Integration Test On Midterm PeriodDocument3 pagesSan Beda University: Integration Test On Midterm PeriodCalix CasanovaNo ratings yet

- San Beda University: Integration Test On Midterm PeriodDocument4 pagesSan Beda University: Integration Test On Midterm PeriodCalix CasanovaNo ratings yet

- San Beda University: Integration Test On Midterm PeriodDocument3 pagesSan Beda University: Integration Test On Midterm PeriodCalix CasanovaNo ratings yet

- Narrative Report 049 Camus QDocument2 pagesNarrative Report 049 Camus QHanabishi RekkaNo ratings yet

- Income Tax Fundamentals 2019 37th Edition Whittenburg Solutions ManualDocument15 pagesIncome Tax Fundamentals 2019 37th Edition Whittenburg Solutions ManualMarvinGarnerfedpm100% (14)

- ITR 1 ChangesDocument11 pagesITR 1 ChangesNanu9711 JaiswalNo ratings yet

- Allowances Under Income Tax Act1961Document12 pagesAllowances Under Income Tax Act1961Sahil14JNo ratings yet

- List of Requirements BIR - Transfer of Shares of StockDocument1 pageList of Requirements BIR - Transfer of Shares of Stockiris_irisNo ratings yet

- Ba 118.3 Nov 18Document5 pagesBa 118.3 Nov 18Lorenz De Lemios NalicaNo ratings yet

- Shri Vedavyas Co Operative Credit Society LTD Vs Income Tax Officer 6aeaa3c543bd92250fef9d363c6aa9 DocumentDocument8 pagesShri Vedavyas Co Operative Credit Society LTD Vs Income Tax Officer 6aeaa3c543bd92250fef9d363c6aa9 Documentbharath289No ratings yet

- E-tax Acknowledgement for Form 26QB TDS SubmissionDocument1 pageE-tax Acknowledgement for Form 26QB TDS SubmissionVyapar NitiNo ratings yet

- Form PDF 616972870051022Document6 pagesForm PDF 616972870051022Manish AroraNo ratings yet

- David Cole Mi Informe de AuschwitzDocument6 pagesDavid Cole Mi Informe de AuschwitzrosaNo ratings yet

- Proposed Rule: Income Taxes: Partnership Equity For ServicesDocument9 pagesProposed Rule: Income Taxes: Partnership Equity For ServicesJustia.comNo ratings yet

- Nmba FM 03: Tax Planning and Management Unit IDocument19 pagesNmba FM 03: Tax Planning and Management Unit IParul GargNo ratings yet

- Quiz 2.1 - Individual Taxpayers and Quiz 3.1 - INCOME TAX ON CORPORATIONSDocument5 pagesQuiz 2.1 - Individual Taxpayers and Quiz 3.1 - INCOME TAX ON CORPORATIONSHunternotNo ratings yet

- Insurance BusinessDocument23 pagesInsurance BusinessLetsah BrightNo ratings yet

- Based on the information provided, the taxable recovery for each case is:Case A - P40,000 Case B - P10,000Case C - P0Document17 pagesBased on the information provided, the taxable recovery for each case is:Case A - P40,000 Case B - P10,000Case C - P0Peng GuinNo ratings yet

- Exclusion from gross incomeDocument11 pagesExclusion from gross incomeMychie Lynne MayugaNo ratings yet

- Gross Taxable Income Tax DueDocument19 pagesGross Taxable Income Tax DueEdcelyn SamaniegoNo ratings yet

- A Dissertation: Submitted in Partial Fulfilment of The Requirements For The Degree ofDocument57 pagesA Dissertation: Submitted in Partial Fulfilment of The Requirements For The Degree ofBÐ BøYNo ratings yet

- NBSM Nepal Budget 2073 PDFDocument20 pagesNBSM Nepal Budget 2073 PDFnabin shresthaNo ratings yet

- Tax Return Filing and Estimation for Marble Sdn BhdDocument1 pageTax Return Filing and Estimation for Marble Sdn BhdNik Syarizal Nik MahadhirNo ratings yet