Professional Documents

Culture Documents

Form16 (2021-2022)

Uploaded by

COMMON SERVICE CENTEROriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form16 (2021-2022)

Uploaded by

COMMON SERVICE CENTERCopyright:

Available Formats

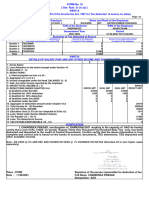

FORM NO.

16 Signature Not Verified

Digitally signed by SAMINDRA NATH

DAS

[See rule 31(1)(a)] Date: 2022.06.08 00:14:43 IST

Reason: Form16 Authorization

Location: ipas

Certificate under section 203 of the Income-tax Act, 1961 for tax

deducted at source on Salary .

Name and address of the Employer Name, EmpNo, Bill Unit and designation of the Employee

Ministry of Railways, Govt. of India, SINGRAY HEMBRAM, 50714103974, 0702266, TRACK MNTR-III

Rail Bhawan

PAN of the TAN of the PAN of the Employee.

Deductor. Deductor.

CALD04983G AELPH4938M

CIT(TDS) Period

Assessment Year

Address: From To

City: Pin Code: 2022-2023 01/APR/2021 31/MAR/2022

PART B( Refer Note 1 )

Details of Salary paid and any other income and tax deducted.

1. Gross salary

(a) Salary as per provisions contained 619469

in sec. 17(1)

(b) Value of perquisites u/s 17(2) (as 0

per Form No.12BA, wherever applicable)

(c) Profits in lieu of salary u/s

17(3) (as per Form No.12BA,wherever 0

applicable)

(d) Total 619469

2. Less : Allowance to the extent

exempt u/s 10

(a)House Rent Allowance 0

(b)Education and Hostel Allowances For 1200

Child

(c) STANDARD DEDUCTION U/s 16(a) 50000

Total 51200

3. Balance (1-2) 568269

4. Deductions :

(a) Entertainment allowance 0

(b) Tax on Employment 2400

5. Aggregate of 4 (a) and (b) 2400

6. Income chargeable under the head. 565869

Salaries (3 - 5)

7. Add : Any other income reported by

the employee

Total 0

8. Gross total income (6 + 7) 565869

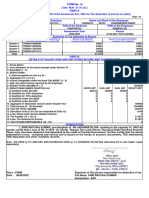

9. Deductions under Chapter VIA

(A) sections 80C, 80CCC and 80CCD Gross Amount Deductible Amount

(a) section 80C

(1) NPS 39040

(2) GIS 360

Total 39400 39400

(b) section 80CCC 0 0

(c) section 80CCD(2)(GOVT CONTRIBUTION 54657 54657

REBATE)

Note : 1. aggregate amount deductible under section 80C shall not exceed one lakh fifty

thousand rupees

2. aggregate amount deductible under three sections, i.e., 80C, 80CCC and 80CCD,shall not

exceed one lakh fifty thousand rupees

(B) other sections (for e.g., 80E, 80G Gross Amount Qualifying Amount Deductible Amount

etc.) under Chapter VIA

Total 0 0 0

10. Aggregate of deductible amounts 94057

under Chapter VI-A

11. Total income (8-10) 471810

12. Tax on total income 0

13. Education Cess @ 3%(on tax 0

computed at S. No. 12 )

14. Tax payable (12+13) 0

15. Less: Relief under section 89 0

(attach details)

16. Tax payable (14-15) 0

17. Total Tax Paid 0

18. Tax payable/Refundable (16-17) 0

I, SAMINDRA NATH DAS son/daughter of LATE SUDHANGSHU KR DAS working in the capacity of

ASST. DIVL. FINANCE MANAGER-B do hereby certify that a sum of Rs. 0 [Rs. Rs. Zero Only Only

(in words)] has been deducted at source and paid to the credit of the Central Government. I

further certify that the information given above is true and correct based on the books of

account, documents and other available records.

Place: KHARAGPUR

Date: 06/05/2022 Signature of the person responsible for deduction of tax

Full Name: SAMINDRA NATH DAS

Designation: ASST. DIVL. FINANCE MANAGER-B

(*)Since this is a system generated-report and has been digitally signed,no separate signatures

are required.

You might also like

- Nike Inc - Cost of Capital - Syndicate 10Document16 pagesNike Inc - Cost of Capital - Syndicate 10Anthony KwoNo ratings yet

- Fabm1 Module 5Document16 pagesFabm1 Module 5Randy Magbudhi50% (4)

- University of Lusaka: School of Economics, Business & ManagementDocument92 pagesUniversity of Lusaka: School of Economics, Business & ManagementDixie Cheelo100% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Form 16Document2 pagesForm 16robin0903No ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- Factors that Create Wealth: A Study of Top Indian CompaniesDocument16 pagesFactors that Create Wealth: A Study of Top Indian CompaniesavlakhiaNo ratings yet

- Form No. 16: (See Rule 31 (1) (A) )Document5 pagesForm No. 16: (See Rule 31 (1) (A) )amit kr AdhikaryNo ratings yet

- Payslip Sep-2022 NareshDocument3 pagesPayslip Sep-2022 NareshDharshan RajNo ratings yet

- C - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFDocument5 pagesC - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFPrudhvi Raj ChowdaryNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- H12021 Egypt Venture Investment ReportDocument17 pagesH12021 Egypt Venture Investment ReportAmr ShakerNo ratings yet

- Tan No. of The Deductor Address of The Employee Nabagram C Block, Bara Bahera, Pin - 712 246Document1 pageTan No. of The Deductor Address of The Employee Nabagram C Block, Bara Bahera, Pin - 712 246Bhairab PrasadNo ratings yet

- FORM 16 CERTIFICATEDocument3 pagesFORM 16 CERTIFICATEDebesh KuanrNo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)Anushka PoddarNo ratings yet

- Form 16 Part B 2016-17Document4 pagesForm 16 Part B 2016-17atulsharmaNo ratings yet

- PIL Bitcoin WatermarkDocument43 pagesPIL Bitcoin WatermarkDjjdjdjdNo ratings yet

- ACFrOgDrfk9wT 7y1 fbRMiv4xjP7hNTGwqfzNJ1G27r3eTgtVDid9F7RrBmpGFgcOsGtPT0J6IIB0RUl JaXR7YG0rDWVbPsPWL0 - H4w111trlgzjhfck669j7oooo PDFDocument3 pagesACFrOgDrfk9wT 7y1 fbRMiv4xjP7hNTGwqfzNJ1G27r3eTgtVDid9F7RrBmpGFgcOsGtPT0J6IIB0RUl JaXR7YG0rDWVbPsPWL0 - H4w111trlgzjhfck669j7oooo PDFAmitNo ratings yet

- Form 16 651746Document4 pagesForm 16 651746Arslan1112No ratings yet

- Report On Wealth ManagementDocument68 pagesReport On Wealth ManagementSANDEEP ARORA69% (13)

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryNavneet SharmaNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryShantru RautNo ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)Saras ShendeNo ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)P v v RaoNo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)bhagesh sharmaNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryR S RatanNo ratings yet

- Form16 (2022-2023)Document3 pagesForm16 (2022-2023)mamtakumaripihooNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument4 pagesDetails of Salary Paid and Any Other Income and Tax Deductedmurthy66No ratings yet

- Form16 W0000000 GS186523X 2021 20211Document1 pageForm16 W0000000 GS186523X 2021 20211Raman OjhaNo ratings yet

- (C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Document2 pages(C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Yashwant KumarNo ratings yet

- 2018-19 - Part B - 1Document4 pages2018-19 - Part B - 1Shivam DixitNo ratings yet

- Salary and Tax DetailsDocument1,320 pagesSalary and Tax DetailsAnonymous pKsr5vNo ratings yet

- Booklet of Forms For House Building AdvanceDocument2 pagesBooklet of Forms For House Building AdvanceJITHU MNo ratings yet

- BEMPG0977B - Sumit Suresh Gamare - 20192020 - Form16Document1 pageBEMPG0977B - Sumit Suresh Gamare - 20192020 - Form16Anil kadamNo ratings yet

- HDFC Bank Limited: Dear Mr. Vijay Anand A.Document5 pagesHDFC Bank Limited: Dear Mr. Vijay Anand A.A Vijay AnandNo ratings yet

- Form16 W0000000 GS164200X 2021 20211Document1 pageForm16 W0000000 GS164200X 2021 20211gaganNo ratings yet

- 031508996Document2 pages031508996Lokesh KumarNo ratings yet

- Adobe Scan Sep 09, 2023Document2 pagesAdobe Scan Sep 09, 2023krampravesh199No ratings yet

- Form 1622072023 022228Document2 pagesForm 1622072023 022228Kajal RandiveNo ratings yet

- Form 1615052023 141937Document3 pagesForm 1615052023 141937Pawan KumarNo ratings yet

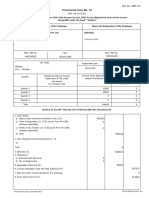

- Quarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeDocument2 pagesQuarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeSanjoy SamantaNo ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- Form 16 Part A: WWW - Taxguru.inDocument10 pagesForm 16 Part A: WWW - Taxguru.inAjit KhurdiaNo ratings yet

- Form 16 TDS certificateDocument2 pagesForm 16 TDS certificateSuchitra BakulyNo ratings yet

- Abhishek - Form 16Document2 pagesAbhishek - Form 16hrrecruiter.vhtbsNo ratings yet

- Anil Ganvir Form 16 (21 22)Document3 pagesAnil Ganvir Form 16 (21 22)DrAndrew WillingtonNo ratings yet

- Form 16Document3 pagesForm 16tid_scribdNo ratings yet

- BBJPS2377D Partb 2023-24Document4 pagesBBJPS2377D Partb 2023-24Ajay GokulNo ratings yet

- Bmypp3076q Partb 2021-22 1Document4 pagesBmypp3076q Partb 2021-22 1KALIA PRADHANNo ratings yet

- Form 1625062023 043026Document2 pagesForm 1625062023 043026SHIV BHAJANNo ratings yet

- Form16 W0000000 GO004610X 2022 20221Document1 pageForm16 W0000000 GO004610X 2022 20221Dharamveer SinghNo ratings yet

- Form 1617082023 112227Document2 pagesForm 1617082023 112227rinsha.sherinNo ratings yet

- Form 16 TDS certificateDocument8 pagesForm 16 TDS certificateVikas PattnaikNo ratings yet

- Abhishek - Provisional Form 16Document2 pagesAbhishek - Provisional Form 16hrrecruiter.vhtbsNo ratings yet

- Form 1622052023 130017Document3 pagesForm 1622052023 130017Amit Singh NegiNo ratings yet

- Form 16 NikitaDocument3 pagesForm 16 Nikitaravinder singhalNo ratings yet

- Form 1607022022 205546Document2 pagesForm 1607022022 205546Mahesh VayiboyinaNo ratings yet

- PART B (Annexure)Document4 pagesPART B (Annexure)AnbarasanNo ratings yet

- Ablpt1672m Partb 2021-22Document3 pagesAblpt1672m Partb 2021-22foni123No ratings yet

- BSBPG6820L Partb 2020-21Document3 pagesBSBPG6820L Partb 2020-21Arun PVNo ratings yet

- Interview Questions Based On Thermal Power PlantDocument3 pagesInterview Questions Based On Thermal Power Plantrohit_me083No ratings yet

- Form No. 2E Naya Saral Its - 2E: VerificationDocument3 pagesForm No. 2E Naya Saral Its - 2E: Verificationapi-3854061No ratings yet

- Form 16 - 13-14Document4 pagesForm 16 - 13-14NITIN CHOUDHARYNo ratings yet

- Shoeb - Form 16 PARTB - 2022-23Document3 pagesShoeb - Form 16 PARTB - 2022-23Sourabh PunshiNo ratings yet

- Amlpb7761l Partb 2023-24Document4 pagesAmlpb7761l Partb 2023-24कृष्ण दत्त भट्टNo ratings yet

- ADEPY3125F 2018-19 Form 16 Part BDocument2 pagesADEPY3125F 2018-19 Form 16 Part BAnilNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- International Business Management: AssignmentDocument16 pagesInternational Business Management: AssignmentkeshavNo ratings yet

- Investing in China Offers Low Costs and Huge MarketDocument10 pagesInvesting in China Offers Low Costs and Huge MarketUroOj SaleEmNo ratings yet

- Contoh 9 Data PanelDocument22 pagesContoh 9 Data Panelnoel_manroeNo ratings yet

- Solution Manual For Entrepreneurship Starting and Operating A Small Business 5th Edition Caroline Glackin Steve MariottiDocument18 pagesSolution Manual For Entrepreneurship Starting and Operating A Small Business 5th Edition Caroline Glackin Steve MariottiDeanBucktdjx100% (35)

- A Project Report On: "Research On Capital Market With Indiainfoline LTDDocument94 pagesA Project Report On: "Research On Capital Market With Indiainfoline LTDgauravNo ratings yet

- Midterm Exam Review for Accounting StudentsDocument5 pagesMidterm Exam Review for Accounting StudentsRuby Amor Doligosa100% (1)

- Form GSTR-3B ReturnDocument3 pagesForm GSTR-3B Returnhussain28097373No ratings yet

- Simon Property Group - Quick ReportDocument1 pageSimon Property Group - Quick Reporttkang79No ratings yet

- 01 Quiz 1Document3 pages01 Quiz 1Emperor SavageNo ratings yet

- Nedai, Abbas (562-388-900) and Hosseini Ssayadnavard, MaryamDocument122 pagesNedai, Abbas (562-388-900) and Hosseini Ssayadnavard, Maryamirajiraj77No ratings yet

- 163019-375293 20191231 PDFDocument6 pages163019-375293 20191231 PDFAmran KeloNo ratings yet

- Orientation to EntrepreneurshipDocument68 pagesOrientation to EntrepreneurshipManish Kumar SinhaNo ratings yet

- Functions of Central Bank PDFDocument27 pagesFunctions of Central Bank PDFPuja BhardwajNo ratings yet

- China's Growing Online Interior Design Platform MarketDocument2 pagesChina's Growing Online Interior Design Platform MarketSon HaNo ratings yet

- Pontipedra Rex Cotoner CVDocument4 pagesPontipedra Rex Cotoner CVCassandra LopezNo ratings yet

- Sunil Sangwan Report On Capital BudgetDocument28 pagesSunil Sangwan Report On Capital BudgetRahul ShishodiaNo ratings yet

- S & P 500 IndexDocument4 pagesS & P 500 IndexAastha TandonNo ratings yet

- Auditing Lecture 8 VouchingDocument40 pagesAuditing Lecture 8 VouchingMr BalochNo ratings yet

- Philippine tax obligations calculation resident citizenDocument3 pagesPhilippine tax obligations calculation resident citizenKatrina Dela CruzNo ratings yet

- Financial Risk Management - WikipediaDocument4 pagesFinancial Risk Management - WikipediaPranay JaipuriaNo ratings yet

- Banking in India - Reforms and Reorganization: Rajesh - Chakrabarti@mgt - Gatech.eduDocument27 pagesBanking in India - Reforms and Reorganization: Rajesh - Chakrabarti@mgt - Gatech.eduilusonaNo ratings yet

- Try Ko LaagiDocument68 pagesTry Ko LaagiUtshav PoudelNo ratings yet

- RHB BG Application FormDocument4 pagesRHB BG Application Formken limNo ratings yet