Professional Documents

Culture Documents

Abhishek - Form 16

Uploaded by

hrrecruiter.vhtbsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Abhishek - Form 16

Uploaded by

hrrecruiter.vhtbsCopyright:

Available Formats

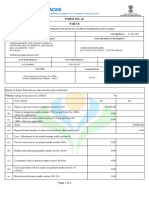

Assessment Year : 2024-2025 Ref. No.

- EMP-137

Form No. 16

Name of the Employer Name and designation of the Employee

Samagra Development Associates Pvt. Ltd. Abhishek

Emerging Leader

PAN / GIR No. TAN PAN / GIR No.

AASCS5052P DELS51192B CJKPA4180N

PART B (Annexure)

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

1. Gross Salary

a) Salary as per provisions contained in sec.17(1) 563523

b) Value of perquisites u/s. 17(2) (as per Form No.12BA, 0

wherever applicable)

c) Profits in lieu of salary u/s 17(3)(as per Form No.12BA, 0

wherever applicable)

d) Total 563523

e) Reported total amount of salary received from other 0

employer(s)

2. Less: Allowance to the extent exempt u/s. 10 :

a) Travel concession or assistance under section 10(5) 0

b) Death-cum-retirement gratuity under section 10(10) 0

c) Commuted value of pension under section 10(10A) 0

d) Cash equivalent of leave salary encashment under section 0

10(10AA)

e) House rent allowance under section 10(13A) 0

f) Amount of any other exemption under section 10

g) Total amount of any other exemption under section 1

h) Total amount of exemption claimed under section 10 0

[2(a)+2(b)+2(c)+2(d)+2(e)+2(g)]

3. Total amount of salary received from current employer [1(d)-2(h)] 563523

4. Less: Deductions under section 16

a) Standard Deduction under section 16(ia) 50000

b) Entertainment Allowance under section 16(ii) 0

c) Tax on Employment under section 0

5. Total16(iii)

amount of deductions under section 16 [4(a)+4(b)+4(c)] 50000

6. Income chargeable under the head "Salaries" [(3+1(e)-5] 513523

7. Add: Any other income reported by the employee under as per

section 192 (2B)

8. Total amount of other income reported by the employee [7(a)+7(b)] 0

9. Gross total income 513523

10. Deductions under Chapter VIA

(A) Sections 80C,80CCC and 80CCD Gross Amount Deductible Amount

Provident Fund 13740 13740

Gross Amount Qualifying Amount Deductible Amount

(B) Other sections (for e.g.,80E,80G etc.) under chapter VIA

11.Aggregate of deductible amount under Chapter VI-A 0 0

[10(a)+10(b)+10(c)+10(d)+10(e)+10(f)+10(g)+10(h)+10(i)+10(j)

12. Total Income (8-11) 513523

13. Tax on total income 10676

14. Rebate under section 87A, if applicable 10676

15. Surcharge whereever applicable 0

16. Health and Education Cess

0

17. Tax payable (13 +15+16-14) 0

18. Less: Relief under section 89 (attach details) 0

19. Tax payable (17-18) 0

Printed from HrmThread contact@sensysindia.com

Assessment Year : 2024-2025 Ref. No.- EMP-137

VERIFICATION

I son/daughter of working in the capacity of (designation) do hereby certify the information given above is true,

complete and correct and is based on the books of account, documents, TDS statements, and other available records..

Signature of the person responsible for deduction of tax

Place :

Date : 08/12/2023 Full Name :

Printed from HrmThread contact@sensysindia.com

You might also like

- Form 16Document3 pagesForm 16mkm969No ratings yet

- Form16 (2022-2023)Document3 pagesForm16 (2022-2023)mamtakumaripihooNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryR S RatanNo ratings yet

- BBJPS2377D Partb 2023-24Document4 pagesBBJPS2377D Partb 2023-24Ajay GokulNo ratings yet

- Afipg9432r Partb 2023-24Document4 pagesAfipg9432r Partb 2023-24SUPERINTENDENT WOMEN ITI JAMMUNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryNavneet SharmaNo ratings yet

- ACFrOgDrfk9wT 7y1 fbRMiv4xjP7hNTGwqfzNJ1G27r3eTgtVDid9F7RrBmpGFgcOsGtPT0J6IIB0RUl JaXR7YG0rDWVbPsPWL0 - H4w111trlgzjhfck669j7oooo PDFDocument3 pagesACFrOgDrfk9wT 7y1 fbRMiv4xjP7hNTGwqfzNJ1G27r3eTgtVDid9F7RrBmpGFgcOsGtPT0J6IIB0RUl JaXR7YG0rDWVbPsPWL0 - H4w111trlgzjhfck669j7oooo PDFAmitNo ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)P v v RaoNo ratings yet

- Form 16 20-21 PartbDocument3 pagesForm 16 20-21 PartbTEMPORARY TEMPNo ratings yet

- FTVPS3817J Partb 2022-23Document3 pagesFTVPS3817J Partb 2022-23Jasvinder SolankiNo ratings yet

- Aljpn5103d Partb 2022-23Document3 pagesAljpn5103d Partb 2022-23Md shamirNo ratings yet

- Adobe Scan Sep 09, 2023Document2 pagesAdobe Scan Sep 09, 2023krampravesh199No ratings yet

- PAYSLIP DETAILSDocument3 pagesPAYSLIP DETAILSamitNo ratings yet

- Form No. 16 Part B (2020)Document3 pagesForm No. 16 Part B (2020)Dharmendra ParmarNo ratings yet

- Form 16 Pareshbhai PatelDocument3 pagesForm 16 Pareshbhai PatelAkshat ShahNo ratings yet

- BJZPP3740D Partb 2021-22Document3 pagesBJZPP3740D Partb 2021-22sagar lovzNo ratings yet

- Aakpe0936f Partb 2020-21Document4 pagesAakpe0936f Partb 2020-21Mahendar ErramNo ratings yet

- FRE31713 - Form16 - Part B - FY 2022 23 - AY 2023 24Document3 pagesFRE31713 - Form16 - Part B - FY 2022 23 - AY 2023 24Deum degOnNo ratings yet

- 112029X - 2022 For 16 Part BDocument3 pages112029X - 2022 For 16 Part BMeetanshi AggarwalNo ratings yet

- Bmypp3076q Partb 2021-22 1Document4 pagesBmypp3076q Partb 2021-22 1KALIA PRADHANNo ratings yet

- Alvpc7596b Partb 2021-22Document4 pagesAlvpc7596b Partb 2021-22Vinay GuptaNo ratings yet

- Form No. 16 Tax DetailsDocument3 pagesForm No. 16 Tax DetailsYashika ChoudharyNo ratings yet

- Adbpu6308h Partb 2023-24Document4 pagesAdbpu6308h Partb 2023-24SUPERINTENDENT WOMEN ITI JAMMUNo ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)Saras ShendeNo ratings yet

- JUNE 2021 PAYSLIPDocument3 pagesJUNE 2021 PAYSLIPamitNo ratings yet

- BBTPN4386D Partb 2022-23Document3 pagesBBTPN4386D Partb 2022-23basit.000No ratings yet

- gCrRkGia1x70UY6uSVN PS 9cipP836ak7GDocument3 pagesgCrRkGia1x70UY6uSVN PS 9cipP836ak7Gjay krishnaNo ratings yet

- Ablpt1672m Partb 2021-22Document3 pagesAblpt1672m Partb 2021-22foni123No ratings yet

- Form No. 16: Part BDocument4 pagesForm No. 16: Part Britik tiwariNo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)COMMON SERVICE CENTERNo ratings yet

- Anil Ganvir Form 16 (21 22)Document3 pagesAnil Ganvir Form 16 (21 22)DrAndrew WillingtonNo ratings yet

- Abhishek - Provisional Form 16Document2 pagesAbhishek - Provisional Form 16hrrecruiter.vhtbsNo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)bhagesh sharmaNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument4 pagesDetails of Salary Paid and Any Other Income and Tax Deductedmurthy66No ratings yet

- Aqcpd7787k Partb 2020-21Document4 pagesAqcpd7787k Partb 2020-21Addl. C. E. FZOKNo ratings yet

- Aavpv5058l Partb 2023-24Document3 pagesAavpv5058l Partb 2023-24ankushNo ratings yet

- BEMPG0977B - Sumit Suresh Gamare - 20192020 - Form16Document1 pageBEMPG0977B - Sumit Suresh Gamare - 20192020 - Form16Anil kadamNo ratings yet

- Form 16 TDS certificate summaryDocument3 pagesForm 16 TDS certificate summaryniranjansankaNo ratings yet

- Booklet of Forms For House Building AdvanceDocument2 pagesBooklet of Forms For House Building AdvanceJITHU MNo ratings yet

- Salary Details and Tax DeductionsDocument1 pageSalary Details and Tax DeductionsArsalan KhanNo ratings yet

- Form 16 - IT DEPT TCS Eserve Part B - 20222023Document3 pagesForm 16 - IT DEPT TCS Eserve Part B - 20222023Suraj KumarNo ratings yet

- Acgpd0388n Partb 202122Document3 pagesAcgpd0388n Partb 202122David Raj ArapallyNo ratings yet

- Abrph5659n Partb 2021-22Document3 pagesAbrph5659n Partb 2021-22foni123No ratings yet

- Form16.part B 630430Document4 pagesForm16.part B 630430mohammadNo ratings yet

- Tds 2021-1-4Document4 pagesTds 2021-1-4varun mahajanNo ratings yet

- CHLPR4183D Partb 2023-24Document4 pagesCHLPR4183D Partb 2023-24JMLNo ratings yet

- Form No. 16: Part BDocument4 pagesForm No. 16: Part BSAURABH GOELNo ratings yet

- Form 1622072023 022228Document2 pagesForm 1622072023 022228Kajal RandiveNo ratings yet

- Gtlpd1974e Partb 2022-23Document4 pagesGtlpd1974e Partb 2022-233 AM FactsNo ratings yet

- BSBPG6820L Partb 2020-21Document3 pagesBSBPG6820L Partb 2020-21Arun PVNo ratings yet

- Form 1615052023 141937Document3 pagesForm 1615052023 141937Pawan KumarNo ratings yet

- Form 16 TDS certificate summaryDocument3 pagesForm 16 TDS certificate summarykumar reddyNo ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)Anushka PoddarNo ratings yet

- Akapr6662d Partb 2020-21Document3 pagesAkapr6662d Partb 2020-21defencerajkumarraiNo ratings yet

- FORM NO. 16 PART B TAX DEDUCTION CERTIFICATEDocument2 pagesFORM NO. 16 PART B TAX DEDUCTION CERTIFICATEGloryNo ratings yet

- Form No. 16: Part BDocument4 pagesForm No. 16: Part Bchinmaya jatiNo ratings yet

- Payslip Sep-2022 NareshDocument3 pagesPayslip Sep-2022 NareshDharshan RajNo ratings yet

- Form No. 16: Part BDocument4 pagesForm No. 16: Part Bvirajsonawane22No ratings yet

- ADEPY3125F 2018-19 Form 16 Part BDocument2 pagesADEPY3125F 2018-19 Form 16 Part BAnilNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- MayadaDocument4 pagesMayadaprachititalathiNo ratings yet

- HR AssistantDocument2 pagesHR Assistantnawa alarmaniNo ratings yet

- EMPLOYMENT FORMS - Abroad All Doc 5107 07 10 2010 10 32Document4 pagesEMPLOYMENT FORMS - Abroad All Doc 5107 07 10 2010 10 32Melikhaya Melz NoqamzaNo ratings yet

- Asbestos Sampling and AbatementDocument2 pagesAsbestos Sampling and AbatementKimura HiroyaNo ratings yet

- Using Contractors: A Brief GuideDocument7 pagesUsing Contractors: A Brief GuideHonest Raj GanapathyNo ratings yet

- RA 8042 As Amended by RA 10022Document27 pagesRA 8042 As Amended by RA 10022Niq PolidoNo ratings yet

- 3.5. Labour MarketsDocument15 pages3.5. Labour Marketseco2dayNo ratings yet

- HRM Report On Employee DevelopmentDocument29 pagesHRM Report On Employee DevelopmentPrerna Sinha100% (1)

- Compensation Management in a NutshellDocument17 pagesCompensation Management in a NutshellIrfaN TamimNo ratings yet

- 457 Fact Sheet - ToolmakerDocument4 pages457 Fact Sheet - ToolmakerSadasivam NarayananNo ratings yet

- HRM Course OutlineDocument5 pagesHRM Course OutlineShah VickyNo ratings yet

- Clare BerminghamDocument93 pagesClare BerminghamBryan Ken TanNo ratings yet

- Asking For Information EmailDocument1 pageAsking For Information EmaildarioNo ratings yet

- UNIT 1 - Perspectives in HRMDocument16 pagesUNIT 1 - Perspectives in HRMPhilip George OommenNo ratings yet

- Intervew QuestionDocument12 pagesIntervew QuestionVivek KumarNo ratings yet

- Economics Exam GuideDocument5 pagesEconomics Exam GuideMegha BansalNo ratings yet

- Power to suspend terminationDocument4 pagesPower to suspend terminationAE KONo ratings yet

- STR401 SWOT Analysis v1.0Document4 pagesSTR401 SWOT Analysis v1.0Nadia AfzalNo ratings yet

- Ex-HART Interim CEO Violated Policy, Year-Long Investigation FindsDocument11 pagesEx-HART Interim CEO Violated Policy, Year-Long Investigation FindsWTSP 10No ratings yet

- ExecutiveNewswire November2009Document12 pagesExecutiveNewswire November2009momtchilNo ratings yet

- 02CHAPTER 01-2nd Portion-Pg30 To 55-To PRINTDocument27 pages02CHAPTER 01-2nd Portion-Pg30 To 55-To PRINTVANNo ratings yet

- Literature Review On Unemployment in South AfricaDocument4 pagesLiterature Review On Unemployment in South Africafvf2j8q0No ratings yet

- Cat 17042014Document120 pagesCat 17042014Sourabh SharafNo ratings yet

- Unit 5 Corporate Social Responsibility and SustainabilityDocument12 pagesUnit 5 Corporate Social Responsibility and Sustainabilitysnehal dhumalNo ratings yet

- 7499 RA Onboarding Talent AcquisitionDocument25 pages7499 RA Onboarding Talent AcquisitionemmalyneNo ratings yet

- Labour Constant Untuk Brick LayerDocument8 pagesLabour Constant Untuk Brick LayerIntan Farhana Mohd RoslanNo ratings yet

- Attract, Motivate and RetainDocument12 pagesAttract, Motivate and RetainTonyNo ratings yet

- 03 Labour CostingDocument5 pages03 Labour CostingPolice Station Mauli JagranNo ratings yet

- Share 'Rafael Torres Payrol - XLSX'Document3 pagesShare 'Rafael Torres Payrol - XLSX'rafael torresNo ratings yet