Professional Documents

Culture Documents

Income Tax Calculation 2023-24 (Old Tax Regime) : Annexure - Ii

Uploaded by

GOKUL HD LIVE EVENTS0 ratings0% found this document useful (0 votes)

4 views1 pageOriginal Title

IT-Annexure2-APTEACHER.NET (5)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageIncome Tax Calculation 2023-24 (Old Tax Regime) : Annexure - Ii

Uploaded by

GOKUL HD LIVE EVENTSCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

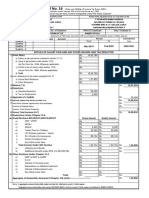

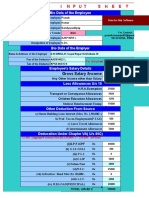

INCOME TAX CALCULATION 2023-24(OLD TAX REGIME)

Financial Year 2023-24 ANNEXURE - II Assessment year 2024-25

Name : N. V. L. Deepika Age : Below 60 Years Office: MPPS, chinanindrakolanuno. 1

Designation SGT Address: MPPS, chinanindrakolanuno. 1, Nidamarru mandal, Eluru

Living in : Rented House PAN No : BAIPN0772K Treasury Id. No. 0457059

1 Gross Salary Rs. 649581

2 H.R.A. Exemption as per eligibility U/s 10(13-A)

a) Actual HRA received Rs. 48813

b) Rent paid in excess of 10% Salary -(Rent Rs.8300 Monthly )x12-10%(PAY+DA) Rs. 39523

c) 40% of Salary (Salary means Basic Pay + D.A) Rs. 240307 39523

3 Total Salary (1-2) Rs. 610058

4 Deductions from Salary Income

a) Exemption from Conveyance Allowance U/s. 10(14) (i) Rs. 0

b) Profession Tax U/s 16 (3) B Rs. 2400 2400

5 Income From Salary (3-4(a & b)) Rs. 607658

6 Less: Standard deduction- u/s16 (Ia) Rs. 50000

7 Net Income from Salary (5-6) Rs. 557658

8 a)Income form Other Source 00

b)Employer Contribution Towards NPS U/s 80CCD2 60076

Net Income from Salary (7+8) Rs. 617734

9 Deductions

a) E.W.F. / S.W.F / CMRF Rs. 70

b) Interest of Housing Loan U/s 24 Rs. 0

c) 80G Donations to Charities Rs. 0

d) 80DD/80U Self/Dependent Expenditure Rs. 0

e) Employees Health Cards Premium in AP Rs. 0

g) Employer Contribution Towards NPS U/s 80CCD2 Rs. 60076

Total Deductions Rs. 60146 60146

10 Gross Total Income (8-9) Rs. 557588

11 Savings U/s 80C ( Limited to Rs.1,50,000 )

a) CPS Rs. 10076

b) APGLI Rs. 36000

c) GIS Rs. 360

d) LIC Policies premium Yearly Rs. 0

e) Tuition Fee for Two children Rs. 0

Total Savings (Deductions) u/s 80C, 80CCC, 80CCD Rs. 46436 46436

12 Additional Benefit CPS Employee U/s 80CCD (1B)(upto Rs.50,000/-) Rs. 50000 50000

13 Gross Total Income (10-(11+12)) Rs. 461152

14 Net Taxable Income (12-13) Rounded to multiples of 10 Rs. 461150

15 Tax on Net Income (i.e on Rs.461150)

a) Upto-2,50,000/- Rs. Nil

b) 2,50,001/- to 5,00,000/- 5% ( 211150 @ 5% ) Rs. 10558

c) 5,00,001/- to 10,00,000/- 20% ( 0 @ 20% ) Rs. 0

d) Above 10,00,001/ - 30% ( 0 @ 30% ) Rs. 0

15 Tax on Income Rs 10558

16 Tax Rebate(U/s 87A-Rs.12500) below Rs.500,000 Rs. 10558

17 Cess(Health 1% + Education 3% ) Rs. 0

18 Net Tax Payble (16+17) Rs. 0

19 Details of Adv.Tax Deductions

Q1:(0+0+0=0) Q2: (0+0+0 = 0) Rs.

Total Advance Tax 0

Q3: (0+0+0 = 0) Q4: (0+0+0 = 0) Rs.

20 Tax to be Paid Amount (18-19) Rs. 0

Signature of the Employee Signature of the DDO

Programme Developed by S Seshadri SA(MM), www.apteacher.net, www.ibadi.in mail:sesadri@gmai.com, Ph:7013145637

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

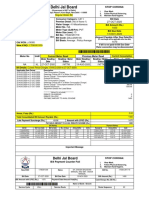

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inKATHI JAYANo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inGOKUL HD LIVE EVENTSNo ratings yet

- ITDocument4 pagesITMahesh KumarNo ratings yet

- Income Tax Statement for Retired PharmacistDocument4 pagesIncome Tax Statement for Retired PharmacistSUREMAN FINANCIAL SERVICESNo ratings yet

- Income Tax Calculation Lec in CommerceDocument2 pagesIncome Tax Calculation Lec in CommerceMadhan Kumar BobbalaNo ratings yet

- FORM NO.16 AA-1Document2 pagesFORM NO.16 AA-1Vishnu Vardhan ANo ratings yet

- Periyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Document2 pagesPeriyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Indumadhi SalemNo ratings yet

- Financial Year 2020-21 Annual Income Tax Declaration ComparisonDocument4 pagesFinancial Year 2020-21 Annual Income Tax Declaration ComparisonHaresh RajputNo ratings yet

- Income Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)Document1 pageIncome Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)ikbalbahar1992No ratings yet

- Cps Tax Form Format For 23-24Document11 pagesCps Tax Form Format For 23-24sr91919No ratings yet

- Ecr CHLN Rec Brpat2063029000 1402309005471 1694668661190 202309143886119015Document1 pageEcr CHLN Rec Brpat2063029000 1402309005471 1694668661190 202309143886119015Atul KumarNo ratings yet

- Ecr CHLN Rec THVSH0097217000 3192305011415 1684399226400 2023051851026400901Document1 pageEcr CHLN Rec THVSH0097217000 3192305011415 1684399226400 2023051851026400901Nova TransfersNo ratings yet

- July 22 CDocument1 pageJuly 22 CPritam KumarNo ratings yet

- IT Calculation for FY 2020-2021Document3 pagesIT Calculation for FY 2020-2021Sampath SanguNo ratings yet

- TDS Certificate Form 16Document3 pagesTDS Certificate Form 16Apte SatishNo ratings yet

- FORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesFORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedMadhan Kumar BobbalaNo ratings yet

- Schedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668CDocument2 pagesSchedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668CJeevabinding xeroxNo ratings yet

- Ecr CHLN Rec GRCDP0075620000 1212207007746 1659013738489 2022072867138490836Document1 pageEcr CHLN Rec GRCDP0075620000 1212207007746 1659013738489 2022072867138490836VS Avilala-2No ratings yet

- ECR CHLN May-2023Document1 pageECR CHLN May-2023Pradeep SaraswatNo ratings yet

- Ecr CHLN Rec CBSLM1563373000 4132106004223 1623647158165 2021061438158165867Document1 pageEcr CHLN Rec CBSLM1563373000 4132106004223 1623647158165 2021061438158165867Kbg ConsultancyNo ratings yet

- Ecr CHLN Rec Upvns0045398000 4362109001431 1630943625959 2021090677025959825Document1 pageEcr CHLN Rec Upvns0045398000 4362109001431 1630943625959 2021090677025959825brijeshNo ratings yet

- Form No. 16: (See Rule 31 (1) (A) )Document5 pagesForm No. 16: (See Rule 31 (1) (A) )amit kr AdhikaryNo ratings yet

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- Income Tax Calculation StatementDocument36 pagesIncome Tax Calculation StatementKingKamalNo ratings yet

- Ecr CHLN Rec Orbbs1776619000 3602306010495 1686668037869 2023061373437869765Document1 pageEcr CHLN Rec Orbbs1776619000 3602306010495 1686668037869 2023061373437869765Babula BarikNo ratings yet

- ECR - CHLN - REC - Jeet RamDocument1 pageECR - CHLN - REC - Jeet Rampro gamingNo ratings yet

- Ecr CHLN Rec Apkkp0068211000 1282310006315 1697285648378 2023101463848378762Document1 pageEcr CHLN Rec Apkkp0068211000 1282310006315 1697285648378 2023101463848378762aravindm1110No ratings yet

- IT Calculation New RegimeDocument4 pagesIT Calculation New Regimeyelrihs23No ratings yet

- Tax CalculationDocument3 pagesTax Calculationreach2hardyNo ratings yet

- ECR_CHLN_REC_WBPRB1364026000_4782404002607_1712746022881_2024041058622881222Document1 pageECR_CHLN_REC_WBPRB1364026000_4782404002607_1712746022881_2024041058622881222Chandan ChatterjeeNo ratings yet

- Ecr CHLN Rec BGBNG2000403000 2402006012472 1592203682553 2020061544282553359Document1 pageEcr CHLN Rec BGBNG2000403000 2402006012472 1592203682553 2020061544282553359Venkatesh HaNo ratings yet

- Ecr CHLN Rec Mdmdu0041830000 4122306000926 1685774411799 2023060343811799618Document1 pageEcr CHLN Rec Mdmdu0041830000 4122306000926 1685774411799 2023060343811799618Arun Nahendran SNo ratings yet

- Gopi IT2021 Tentative CalculationsheetDocument4 pagesGopi IT2021 Tentative CalculationsheetAR G.KAPILANNo ratings yet

- Anb Form 16 ITR (Saral II) 2010 ModelDocument7 pagesAnb Form 16 ITR (Saral II) 2010 Modelvanbu1967No ratings yet

- Degree Application 2018Document2 pagesDegree Application 2018ldineshkumarNo ratings yet

- IT Statement 20-21Document2 pagesIT Statement 20-21Santhosh KumarNo ratings yet

- Automated Form 16 FY 10-11Document8 pagesAutomated Form 16 FY 10-11Pranab BanerjeeNo ratings yet

- ProjectDocument1 pageProjectSaurabh ShrivastavaNo ratings yet

- EPFO ChalleenDocument1 pageEPFO ChalleenAlok S YadavNo ratings yet

- INCOME TAX 2009-2010: EarningsDocument6 pagesINCOME TAX 2009-2010: EarningsgsreddyNo ratings yet

- Nov 22 CDocument1 pageNov 22 CPritam KumarNo ratings yet

- ECR_CHLN_REC_WBTLO0047925000_4712404003953_1712746534443_2024041059134443702Document1 pageECR_CHLN_REC_WBTLO0047925000_4712404003953_1712746534443_2024041059134443702Chandan ChatterjeeNo ratings yet

- T K ArumugamDocument7 pagesT K ArumugamThangamNo ratings yet

- Combined Challan for Trumpf India Pvt Ltd EPF AccountsDocument1 pageCombined Challan for Trumpf India Pvt Ltd EPF AccountsbhavikaNo ratings yet

- Oofits: Qualifying (27 885) U/S 8octo Donation Rounded Off U/S 288A of Tax of DR For AyDocument8 pagesOofits: Qualifying (27 885) U/S 8octo Donation Rounded Off U/S 288A of Tax of DR For AyKushagra BurmanNo ratings yet

- MS Xii Accountancy Set 1Document10 pagesMS Xii Accountancy Set 1arikoff07No ratings yet

- Profarma No.2: Detailed Salary Grant For The Month ofDocument2 pagesProfarma No.2: Detailed Salary Grant For The Month ofdhiraj bhumareNo ratings yet

- GCM Challan - 10Document1 pageGCM Challan - 10neeraj bansalNo ratings yet

- Ecr CHLN Rec KNSHG1953169000 2512301001140 1673275821436 2023010973221437489Document1 pageEcr CHLN Rec KNSHG1953169000 2512301001140 1673275821436 2023010973221437489Nagaraj NNo ratings yet

- Income Tax Details for Assistant Engineer in 2015-16Document5 pagesIncome Tax Details for Assistant Engineer in 2015-16Phani PitchikaNo ratings yet

- Salary On IncomeDocument22 pagesSalary On IncomeManjunathNo ratings yet

- APRIL23Document7 pagesAPRIL23Awadh GroupNo ratings yet

- Ecr CHLN Rec Mrnoi1627714000 4372005006244 1589531030815 2020051550030815546 PDFDocument1 pageEcr CHLN Rec Mrnoi1627714000 4372005006244 1589531030815 2020051550030815546 PDFRanjit SamalNo ratings yet

- Income Tax Computation StatementDocument2 pagesIncome Tax Computation StatementCA Kaushik Ranjan GoswamiNo ratings yet

- NitishDocument1 pageNitishkaushikdutta176No ratings yet

- Ecr CHLN Rec Tbtam0060869000 4182309009610 1695386986304 2023092265986304262Document1 pageEcr CHLN Rec Tbtam0060869000 4182309009610 1695386986304 2023092265986304262SAMPATH KUMARNo ratings yet

- INCOME TAX 2009-2010: (Stu-Balayapalli)Document6 pagesINCOME TAX 2009-2010: (Stu-Balayapalli)gsreddyNo ratings yet

- 1 JAN-24 CHALLANDocument1 page1 JAN-24 CHALLANshashankstsNo ratings yet

- Income Tax Statement For The Financial Year 2022-23 of K.sasiDHAR On 09-01-2023Document8 pagesIncome Tax Statement For The Financial Year 2022-23 of K.sasiDHAR On 09-01-2023Katari SasidharNo ratings yet

- Concise trial balance correctionsDocument9 pagesConcise trial balance correctionsArcherAcs86% (7)

- Module 8 (FINP7)Document4 pagesModule 8 (FINP7)David VillaNo ratings yet

- Overview of Financial Management and The Financial EnvironmentDocument27 pagesOverview of Financial Management and The Financial EnvironmentsoochwelfareNo ratings yet

- Chapter 9 - Ending The VentureDocument60 pagesChapter 9 - Ending The VentureTeku ThwalaNo ratings yet

- Raoul Pal GMI July2015 MonthlyDocument61 pagesRaoul Pal GMI July2015 MonthlyZerohedge100% (4)

- Impact of Recent Global Slump On Indian Capital MarketDocument70 pagesImpact of Recent Global Slump On Indian Capital MarketVandana Insan100% (3)

- Central Government Act: The Foreign Exchange Regulation Act, 1973Document50 pagesCentral Government Act: The Foreign Exchange Regulation Act, 1973Nilesh MandlikNo ratings yet

- Module 5 ResearchDocument4 pagesModule 5 Researchmusanide1986No ratings yet

- Direct Credit Facility Form 2023Document3 pagesDirect Credit Facility Form 2023AnnyssSyahidaNo ratings yet

- Consumer Buying Behaviour Towards Mutual Funds InvestmentDocument80 pagesConsumer Buying Behaviour Towards Mutual Funds InvestmentChandan SrivastavaNo ratings yet

- Institute of Corporate Secretaries of Pakistan: Icsp - Admission GuideDocument8 pagesInstitute of Corporate Secretaries of Pakistan: Icsp - Admission GuideARquam JamaliNo ratings yet

- Will the Renminbi Replace the US Dollar as the World CurrencyDocument12 pagesWill the Renminbi Replace the US Dollar as the World Currencyadhia_saurabhNo ratings yet

- 0096 Primary Maths Stage 2 Scheme of Work - tcm142-594956Document96 pages0096 Primary Maths Stage 2 Scheme of Work - tcm142-594956Tatenda HapazariNo ratings yet

- Undergraduate Story Templates for IBDocument4 pagesUndergraduate Story Templates for IBKerr limNo ratings yet

- Introduction To Islamic Capital MarketsDocument5 pagesIntroduction To Islamic Capital MarketsSon Go HanNo ratings yet

- HSBC London Corporate Refund Undertaking LetterDocument1 pageHSBC London Corporate Refund Undertaking LetterHelge Sandoy50% (2)

- Book Economy SIP+ CA (English)Document134 pagesBook Economy SIP+ CA (English)tiwarishashank8830No ratings yet

- 07 Activity 1-EnTREPDocument2 pages07 Activity 1-EnTREPClar PachecoNo ratings yet

- DJBBill 170461291719Document2 pagesDJBBill 170461291719sunilchhindraNo ratings yet

- Taxation NotesDocument54 pagesTaxation Notesmuskansethi2001No ratings yet

- SORTIS RE Presentation 20090403 enDocument21 pagesSORTIS RE Presentation 20090403 enmvpaevNo ratings yet

- UBL UK Application Form FinalDocument6 pagesUBL UK Application Form Finalfaisal_ahsan7919No ratings yet

- Accounting process and debit-credit rulesDocument20 pagesAccounting process and debit-credit rulesHimanshu RayNo ratings yet

- Raffles Fact SheetDocument5 pagesRaffles Fact SheetsergejNo ratings yet

- Gold Futures ContractDocument2 pagesGold Futures ContractVictor Hugo Fernández ArrayaNo ratings yet

- Falling Indian RupeeDocument3 pagesFalling Indian RupeeAutonomo UsNo ratings yet

- Wincorp Investment Dispute Ruling AnalyzedDocument42 pagesWincorp Investment Dispute Ruling AnalyzedCatherine DimailigNo ratings yet

- Soal Test (Dragged)Document3 pagesSoal Test (Dragged)Salsabila AufaNo ratings yet

- FORM A2 Revised FormDocument6 pagesFORM A2 Revised Formcopy catNo ratings yet

- 57 Managing Supplier Risk in The Transportation and Infrastructure IndustryDocument14 pages57 Managing Supplier Risk in The Transportation and Infrastructure IndustryAmineDoumniNo ratings yet