Professional Documents

Culture Documents

Income Tax Computation Statement

Uploaded by

CA Kaushik Ranjan Goswami0 ratings0% found this document useful (0 votes)

18 views2 pagesComputation

Original Title

Salary Computation Ass Yr 2017-18

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentComputation

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views2 pagesIncome Tax Computation Statement

Uploaded by

CA Kaushik Ranjan GoswamiComputation

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

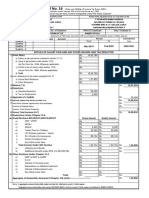

INCOME TAX COMPUTATION STATEMENT

FOR THE FINANCIAL YEAR 2016-2017 (ASSESSMENT YEAR 2017-2018)

NAME AND DESIGNATION OF INCUMBENT :- PAN NO :-

PRESENT ADDRESS :- TAN NO :-

1 a) Gross salary from 1/03/2016 to 28/02/2017 Rs.

b) Arrear Salary of previous year(s) received during the year Rs.

c) Government contribution to New Pension Scheme Rs.

TotalRs.

2 Deduct allowance(s) to the extent exempt U/S 10(14) (Notes overleaf) Rs.

3 Deduct allowances to the extent exempt U/S(13A)

i) H.R.A received during the year Rs.

ii) H.R. Paid in excess of 10% of Salary Rs.

iii) 40% of Salary Rs.

(H.R.A. admissible (i), (ii) & (iii) whichever is least)

TotalRs.

4 a) Entertainment allowance (U/S 16(ii)) Rs.

b) Tax on Employment ( U/S16(iii)/ Professional Tax) Rs.

TotalRs.

5 Add any other Income reported by the employee Rs.

Grand Total Income Rs.

6 Deduction under Chapter VIA

A) U/S 80 C

a) GPF (Subscription only) Rs.

b) GIS (Subscription only) Rs.

c) LIC (Subscription only) Rs.

d) NSC (Purchased during the Financial Year) Rs.

e) Repayment of HBA Loan (Principal) Rs.

f) ULIP/P.P.F Rs.

g) Tution fees ( Limited two Children only) Rs.

h) CTD (ten year/fifteen year/) Infrastructure Bonds Rs.

i) Sub in Sukanya samridhi Account in the girl child name Rs.

B) U/S 80 CCD (1) Employee's contribution to NPS Rs.

C) U/S 80 CCD (1-B) Additional Rs. 50,000/- Rs.

D) U/S 80 CCC (Pension Fund of LIC) Rs.

( Limited Maximum Rs. 1,50,000/-) Total Rs.

E) U/S 80 CCD (2) Government contribution to New Pension Scheme Rs.

F) U/S-80 D : Mediclaim Maximum of Rs. 25,000/- only in case of dependent, for Rs.

Senior Citizens Rs. 30,000/-

G) U/S- 80 DD : Physicaly Handicaped for dependent Max. Of Rs 75,000/-, for Rs.

Severe disease up to Rs. 1,25,000/-

H) U/S-80 DDA Rs.

I) U/S-80 DDB : Medical treatment, Cancer/ AIDS Maximum Rs. 40,000/- Rs.

J) U/S-80 E : Educational Loan Interest of Rs. 1,00,000/- after S.S. Exam. Rs.

K) U/S-80G : Donation For Earthquke ect (50% donation receipt) Rs.

L) U/S-80U : Rs. 75,000/- in the case of assesses who is a person with

disability, and Rs. 1,25,000/- if he is a person with severe disability. Rs.

M) U/S 80 TTA Rs.

TotalRs.

7 Deduction U/S-24 (b) Interest amount of Housing Loan/H.B. Loan Rs.

8 Net Taxable Income of the Year Rs.

9 Tax on Total Income Rs.

10 Tax Rebate ( Section 87-A) Rs.

a) Tax Payable on Total Income (9-10) Rs.

11

b) Surcharge Rs.

12 Relief U/S 89 ( attach details) Rs.

13 Tax Payable on Total Income after Relief u/s 89 (11(a)-12) Rs.

14 Educational Cess and Higher Education Cess 3% Rs.

15 Tax Payable (16+17) Rs.

16 Advance Tax paid Rs.

17 Tax Deducted at Source U/S 192 (1) Rs.

18 Tax Payable (15-16-17) Rs.

Signature of Employee Signature of DDO

Department Seal

You might also like

- Proforma For Calculation of Income Tax For Tax DeductionDocument1 pageProforma For Calculation of Income Tax For Tax DeductionManchala Devika100% (1)

- Form 16 Excel FormatDocument12 pagesForm 16 Excel Formatankeet3No ratings yet

- Form 16 ExcelDocument2 pagesForm 16 Excelapi-372756271% (7)

- 502647F 2018Document2 pages502647F 2018Tilak RajNo ratings yet

- Recent Trends in Finance Reporting The IndependentDocument26 pagesRecent Trends in Finance Reporting The Independentamolmarathe19860% (2)

- ITDocument4 pagesITMahesh KumarNo ratings yet

- Income Tax Statement for Retired PharmacistDocument4 pagesIncome Tax Statement for Retired PharmacistSUREMAN FINANCIAL SERVICESNo ratings yet

- Income Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)Document1 pageIncome Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)ikbalbahar1992No ratings yet

- (I) Total Gross Salary Income: (If Above 60, Indicate Senior Citizen)Document4 pages(I) Total Gross Salary Income: (If Above 60, Indicate Senior Citizen)dpfsopfopsfhopNo ratings yet

- Form 16Document2 pagesForm 16Joyal JoseNo ratings yet

- Form No 16Document2 pagesForm No 16Anonymous 7KR8DpqNo ratings yet

- IT FormDocument4 pagesIT FormVimal PatelNo ratings yet

- FORM NO.16 AA-1Document2 pagesFORM NO.16 AA-1Vishnu Vardhan ANo ratings yet

- Financial Year 2020-21 Annual Income Tax Declaration ComparisonDocument4 pagesFinancial Year 2020-21 Annual Income Tax Declaration ComparisonHaresh RajputNo ratings yet

- Income tax calculation memo titleDocument3 pagesIncome tax calculation memo titleajeetpoly100% (3)

- Blank Income Tax FormDocument3 pagesBlank Income Tax FormmmmukhtarNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inKATHI JAYANo ratings yet

- Form 16 TDS CertificateDocument3 pagesForm 16 TDS Certificatessanju_bhatNo ratings yet

- Form No 16 - Ay0607Document4 pagesForm No 16 - Ay0607api-3705645100% (1)

- Income Tax Calculation Statement: (Financial Year 2021-2022, and The Assessment Year 2022 - 2023)Document18 pagesIncome Tax Calculation Statement: (Financial Year 2021-2022, and The Assessment Year 2022 - 2023)mohamed ismailNo ratings yet

- Gopi IT2021 Tentative CalculationsheetDocument4 pagesGopi IT2021 Tentative CalculationsheetAR G.KAPILANNo ratings yet

- Form No. 16: (See Rule 31 (1) (A) )Document5 pagesForm No. 16: (See Rule 31 (1) (A) )amit kr AdhikaryNo ratings yet

- Form 16Document3 pagesForm 16Vikas PandyaNo ratings yet

- Form 16Document6 pagesForm 16balaramappana2No ratings yet

- Anb Form 16 ITR (Saral II) 2010 ModelDocument7 pagesAnb Form 16 ITR (Saral II) 2010 Modelvanbu1967No ratings yet

- IT Statement 20-21Document2 pagesIT Statement 20-21Santhosh KumarNo ratings yet

- Income Tax Calculation 2023-24 (Old Tax Regime) : Annexure - IiDocument1 pageIncome Tax Calculation 2023-24 (Old Tax Regime) : Annexure - IiGOKUL HD LIVE EVENTSNo ratings yet

- FORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesFORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedMadhan Kumar BobbalaNo ratings yet

- Form16 Applicable From 01.04Document3 pagesForm16 Applicable From 01.04Vishaal TalwarNo ratings yet

- Income Tax Calculation StatementDocument36 pagesIncome Tax Calculation StatementKingKamalNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inGOKUL HD LIVE EVENTSNo ratings yet

- Employee salary and tax detailsDocument13 pagesEmployee salary and tax detailsseeyem2000No ratings yet

- Income Tax Calculation: Name: S. Ram Mohan ReddyDocument6 pagesIncome Tax Calculation: Name: S. Ram Mohan ReddyCA Swamyreddy MvNo ratings yet

- Form No 16Document2 pagesForm No 16saran2rasuNo ratings yet

- Cps Tax Form Format For 23-24Document11 pagesCps Tax Form Format For 23-24sr91919No ratings yet

- TDS Certificate Form 16Document3 pagesTDS Certificate Form 16Apte SatishNo ratings yet

- 2020 Declaration of Assets ProformaDocument4 pages2020 Declaration of Assets ProformaMuhammad Anees YousafNo ratings yet

- Income Tax Calculation Lec in CommerceDocument2 pagesIncome Tax Calculation Lec in CommerceMadhan Kumar BobbalaNo ratings yet

- Periyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Document2 pagesPeriyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Indumadhi SalemNo ratings yet

- IT Calculation for FY 2020-2021Document3 pagesIT Calculation for FY 2020-2021Sampath SanguNo ratings yet

- Ministry of Finance amends Income Tax RulesDocument7 pagesMinistry of Finance amends Income Tax RulesShabeer UppotungalNo ratings yet

- Income Tax Details for Assistant Engineer in 2015-16Document5 pagesIncome Tax Details for Assistant Engineer in 2015-16Phani PitchikaNo ratings yet

- AssignmentDocument5 pagesAssignmentSuyash PrakashNo ratings yet

- Calculation Sheet 2022 - 23 OLDDocument2 pagesCalculation Sheet 2022 - 23 OLDmandalsomithmandal1986No ratings yet

- Digitally Signed by DINESH MOHAN: (Refer Annexure)Document3 pagesDigitally Signed by DINESH MOHAN: (Refer Annexure)Er Mayank UppalNo ratings yet

- PARTICULARS FOR F.Y. 2023 - 24 Old FormateDocument3 pagesPARTICULARS FOR F.Y. 2023 - 24 Old Formateiwd.abhiNo ratings yet

- AssignmentDocument5 pagesAssignmentSuyash PrakashNo ratings yet

- Certified Under Section 203 of The Income - Tax Act, 1961 For Tax Deducted at Source From Income Chargeable Under The Head "Salaries"Document4 pagesCertified Under Section 203 of The Income - Tax Act, 1961 For Tax Deducted at Source From Income Chargeable Under The Head "Salaries"Aravind ReddyNo ratings yet

- Zakat Form PDFDocument6 pagesZakat Form PDFDan MichiNo ratings yet

- Form 16Document3 pagesForm 16ganesh_korgaonkarNo ratings yet

- 38 - 16 & I6a (A.y.2009-10) With MarginalDocument4 pages38 - 16 & I6a (A.y.2009-10) With Marginalrajudutta11No ratings yet

- T K ArumugamDocument7 pagesT K ArumugamThangamNo ratings yet

- Ecr CHLN Rec GRCDP0043475000 1212204007476 1651122031576 2022042837831576920Document1 pageEcr CHLN Rec GRCDP0043475000 1212204007476 1651122031576 2022042837831576920Shaik BashaNo ratings yet

- Form 16 Part A: WWW - Taxguru.inDocument10 pagesForm 16 Part A: WWW - Taxguru.inAjit KhurdiaNo ratings yet

- Adobe Scan 19-Jun-2023Document3 pagesAdobe Scan 19-Jun-2023Nirmala DeviNo ratings yet

- Declaration of Income and Asset Letter and ProformaDocument6 pagesDeclaration of Income and Asset Letter and ProformaImran-ul-Haq WahlaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Bhutan and the Asian Development Bank: Partnership for Inclusive GrowthFrom EverandBhutan and the Asian Development Bank: Partnership for Inclusive GrowthNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- FaqDocument22 pagesFaqemail2pr2639No ratings yet

- Application For LICI Maturity DetailsDocument1 pageApplication For LICI Maturity DetailsCA Kaushik Ranjan GoswamiNo ratings yet

- Application For LICI Maturity DetailsDocument1 pageApplication For LICI Maturity DetailsCA Kaushik Ranjan GoswamiNo ratings yet

- Application For LICI Maturity DetailsDocument1 pageApplication For LICI Maturity DetailsCA Kaushik Ranjan GoswamiNo ratings yet

- Visitors From The VillageDocument2 pagesVisitors From The VillageCA Kaushik Ranjan GoswamiNo ratings yet

- Dolly ProjectDocument3 pagesDolly ProjectCA Kaushik Ranjan GoswamiNo ratings yet

- Indian Agriculture - An OverviewDocument16 pagesIndian Agriculture - An OverviewCA Kaushik Ranjan Goswami100% (3)

- Arithmetic MeanDocument20 pagesArithmetic MeanCA Kaushik Ranjan GoswamiNo ratings yet

- Indian Agriculture - An OverviewDocument16 pagesIndian Agriculture - An OverviewCA Kaushik Ranjan Goswami100% (3)

- Factura GuatemalaDocument1 pageFactura Guatemalazt3venNo ratings yet

- Quarter 1 - Module 6: Applied EconomicsDocument8 pagesQuarter 1 - Module 6: Applied EconomicsYannah LongalongNo ratings yet

- United States v. Markeith Hart, 4th Cir. (2015)Document4 pagesUnited States v. Markeith Hart, 4th Cir. (2015)Scribd Government DocsNo ratings yet

- Case 3 - Final-1Document18 pagesCase 3 - Final-1Haktan DemirNo ratings yet

- Salatul Jama'AhDocument26 pagesSalatul Jama'AhAatif ZaidiNo ratings yet

- Law and Rural Development SynopsisDocument5 pagesLaw and Rural Development SynopsisShaswat JoshiNo ratings yet

- Types of Bailment: Compressive Study Special Contract: Parinsha Sharma Division B Roll No 53 Class 2013-18 ofDocument13 pagesTypes of Bailment: Compressive Study Special Contract: Parinsha Sharma Division B Roll No 53 Class 2013-18 ofNiyati BagweNo ratings yet

- Business Law FinalDocument1 pageBusiness Law FinalpohweijunNo ratings yet

- LGU Budget Process GuideDocument3 pagesLGU Budget Process GuideDelfinNo ratings yet

- Om Trading Display Claim Augst Claim 2023 NewDocument37 pagesOm Trading Display Claim Augst Claim 2023 NewHanif ShaikhNo ratings yet

- Configuring Hub and Spoke Vpns Using NHTBDocument52 pagesConfiguring Hub and Spoke Vpns Using NHTBAssis UbiratanNo ratings yet

- HR &TQM BBALLB (2018-23) Division A Case Study TopicsDocument3 pagesHR &TQM BBALLB (2018-23) Division A Case Study TopicsHarsh GargNo ratings yet

- ALL AND THE: OctrfeDocument4 pagesALL AND THE: OctrfeDilg ConcepcionNo ratings yet

- DG1000 OpsDocument24 pagesDG1000 OpsYury GonzalesNo ratings yet

- First Merit List - Private Sector HITEC/HBS Medical/Dental CollegesDocument2 pagesFirst Merit List - Private Sector HITEC/HBS Medical/Dental CollegesIftikhar hussain shahNo ratings yet

- Gate Valve: Typical Use Valve ConstructionDocument4 pagesGate Valve: Typical Use Valve ConstructionCegrow Ber BersabalNo ratings yet

- Data Privacy Consent:: General Evaluation FormDocument2 pagesData Privacy Consent:: General Evaluation FormIreish Mae RutaNo ratings yet

- Fin440 Sample Report-Kohinoor-Keya PDFDocument35 pagesFin440 Sample Report-Kohinoor-Keya PDFTamim ChowdhuryNo ratings yet

- Tema 8 Texto LamptonDocument20 pagesTema 8 Texto LamptonKriseweteNo ratings yet

- CO Traffic Crash Report on I25 at Milepoint 242Document6 pagesCO Traffic Crash Report on I25 at Milepoint 242Debra DreilingNo ratings yet

- Wen Audit BSC Report: Mars Dogecoin (MDC) Contract Address: 0XA55A484CDocument9 pagesWen Audit BSC Report: Mars Dogecoin (MDC) Contract Address: 0XA55A484CFahmi RosyadiNo ratings yet

- Faculty of Hospitality and Tourism ManagementDocument2 pagesFaculty of Hospitality and Tourism Managementizumi tandukarNo ratings yet

- How The Maxwell Sausage Was Made: CTDOCS/1678042.1Document5 pagesHow The Maxwell Sausage Was Made: CTDOCS/1678042.1tomili85No ratings yet

- WORKSHEET NoDocument4 pagesWORKSHEET NoMica MellizoNo ratings yet

- Customer No.: 22536396 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressDocument6 pagesCustomer No.: 22536396 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressjunedrkaziNo ratings yet

- Duties of A Lawyer Lecture Notes 3 PDFDocument12 pagesDuties of A Lawyer Lecture Notes 3 PDFSaidatulnajwaNo ratings yet

- Crowdfunding in Fintech: Rewards and Equity ModelsDocument6 pagesCrowdfunding in Fintech: Rewards and Equity ModelshukaNo ratings yet

- Mercado v. VitrioloDocument1 pageMercado v. VitrioloCy Panganiban100% (1)

- 21 OSINT Research Tools For Threat Intelligence 1643105531Document15 pages21 OSINT Research Tools For Threat Intelligence 1643105531dbfgablxzanbqtvybx100% (2)