Professional Documents

Culture Documents

Gopi IT2021 Tentative Calculationsheet

Uploaded by

AR G.KAPILANOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gopi IT2021 Tentative Calculationsheet

Uploaded by

AR G.KAPILANCopyright:

Available Formats

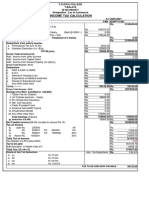

INCOME TAX CALCULATION STATEMENT

FINANCIAL YEAR 2021-22/ASSESSMENT YEAR 2022 - 2023

SNo Name & Designation of the Employee Name & Address of the Employer

Gopinath M Government of Tamil Nadu.

Sub Registrar Gr.II

PAN No: AFGPG6624M D.O.B.:02/04/1974 Male Employee

1 SALARY INCOME: Including HRA, Hon.

Taxable allowances, Taxable Perquisites Rs. 910678

(Excluding cash allowance if any)

2 LESS: House Rent Allowance (Sec.10(13A) & Rule 2A) (The Amount of exemption shall of the

lease of A, B or C)

B. Actual Rent Paid Rs. 0

A. Actual HRA received or Rs. 90600

C. Rent paid in excess of 10% of Salary Rs. 0

C. Amount equal to 50% of Salary Rs. 401039.00 0

3 GROSS SALARY INCOME (1 - 2) Rs. 910678

STANDARD DEDUCTION (Rs.50000) Rs. 50000 50000

4 LESS: PROFESSIONAL TAX PAID

Rs. 2500 2500

(u/s 16(III))

5 TAXABLE SALARY INCOME (3 - 4)

(i.e) Deduct Professional Tax from Gross Rs. 858178

Salary Income)

6 INCOME FROM HOUSE / PROPERTY

Gross Annual Value Rs. 0

LESS: Deduction for interest payable on

housing loan Rs. 0

9 Refer Note 1 in page 3)

LESS: Additional tax exemption for 1st time

Rs. 0

Home Buyers (from 2016 Budget)

7 ADD: Any other income (if any) ie., bank

Rs. 0

interest, NSC interest etc.,

8 GROSS TOTAL INCOME Rs. 858178

9 LESS: Deductions under chapter VI A

(i) U/s 80 C: As per details attached (Note 4)

a. LIC Premium (Note 3) Rs. 1200 1200

b. GPF Rs. 180000 180000

c. PPF/RPF Rs. 0

d. SPF, & FBF Rs. 1620 1620

e. CTD Rs. 0

f. UTI (ULIP)/PLI Rs. 0

g. NSC VIII Issue Rs. 0

h. Interest accrued on NSC's Rs. 0

i. Repayment of Housing Loan (Principal) Rs. 0

j. Tution Fees (Please Refer Note No.2 in

Rs. 0

page no.3)

k. Equity linked saving scheme (ELSS) Rs. 0

l. Subscription to Equity shares/Debentures or

Units of Infrastructure sectors --(like ICICI,

Rs. 0

IDBI infrastructure bonds)

m. PLI Premium Rs. 0

n. TD in Post office Rs. 0

TOTAL QUALIFYING AMOUNT (9(I)A-N)

Maximum amount of Deduction u/s 80 C is Rs. 182820 150000

Rs.150000/-

ii) U/s 80 CCD(1B) Investment in NPS

Rs. 0

Max.Rs.50,000/-

iii) U/s 80 D: Medical Insurance premium paid

in the name of assessee, spouse, dependent

Normal

parents or dependent children (Maximum Rs. 30724 25000

Rs.25000/- for senior citizens - Rs.50000/-)

iv) U/s 80DD: Expension on medical

Disabilities

treatment etc., and deposit made for

Severe

maintenance of handicapped dependents Rs. 0

(Max. Rs.75000/-) in case of severe

disabilities Rs. 125000/-

v) U/s 80 DDB: Medical Expenses towards

treatment of himself or a dependent relative

Normal

for specified diseases and ailments. (Amount

Rs. 0

actually paid or Rs.40000/- whichever is less

from 10 I should be enclosed) For senior

citizens Rs.100000/- or expenditure incurred.

vi) U/s 80 E: Interest on Education loan

Rs. 0

(Entire amount of interest)

vii) U/s 80G: Donation to approved funds and

Rs. 2472 2472

charitable institutions.

viii) U/s 80 U: Deduction in respect of

> 80%

physically disabled Assesse (max. Rs.75,000/-

Rs. 0

, in case of severe disabilities Rs.125000/-)

ix) U/S 80TTA - Interest on Bank Acct.

Rs. 0

exempted upto Rs.10000

x) U/s 80 TTB - Sr.Citizen - Interest on bank

Rs. 0

acct. exempted upto Rs.50000

xi) U/s 80 EEA - Interest on Home Loan for

Rs. 0

affordable Home (upto Rs.150000)

xii) U/s 80 EEB - Interest on Auto Loan for

Rs. 0

Electronic Vehicle (upto Rs.150000)

xiii) Sum of 9(i) to 9(xii) Rs. 33196 177472

10 TAXABLE INCOME (8-9)

(Rounded off to nearest ten rupees)

Rs. 680710

Note: All Deductions under column 9(i) to

9(xii) cannot exceed the gross total income

COMPUTATION OF TAX: (Rounded off to nearest one rupee) The basic exemption limit has

been raised to Rs.2,50,000, for Senior Citizen (60-80 years) Rs.3,00,000/- and for very senior

citizen (more than 80 yrs) Rs.5,00,000)

Table: 1. Tax rates applicable to individuals (Male/Female).

Taxable income Income Tax Tax working

Upto Rs.2,50,000 Nill 0

Rs.2,50,001/- - Rs.5,00,000/- 5% of the amount between

(If individual total income does not exceed Rs.2,50,001/- and

12500

5,00,000/-, amount of rebate shall be 100% Rs.5,00,000/-

or 12500/- whichever is less. )

Rs.5,00,001/- - Rs10,00,000/- 20% of the amount

between Rs.5,00,001/- and 36142

Rs.10,00,000/-

30% of the amount

Exceeding 10,00,000/- 0

exceeding Rs.10,00,000/-

Total 48642

Table 4: Surcharge

11 Tax payable on Taxable income of Rs. (as

Rs. 48642

per table 1 or 2 or 3 as above)

13 ADD: Health & Education Cess @ 4% on Net

Rs. 1946

Tax Payable

15 ADD: Surcharge @ 10/15% on Net Tax

0

Payable if exceeds 50 L/1 Cr respectively

15 Total Tax Payable Rs. 50590

16 LESS: Rebate u/s 86, 89, 90 or 91. Rs.

17 LESS: Pre paid taxes 9 Advance tax, TDS Rs. 22880

18 Balance of Income Tax to be deducted. Rs. 27710

CERTIFICATE

1. Certified that I am occupying the house allotted by the accommodation Controller (PWD/TNHB on

payment of rent of Rs. /- Per menth.

2. Certificate that I am occupying rental house and paying monthly rent of Rs.-------/- Per month.

3. Certified that I am paying sum of Rs......../- towards L.I.C. premium and the policies are kept alive.

4. Certified that a sum of Rs............. is being paid by me towards a C.T.D. and the cummlative Time

is for 10/15 years.

Station: Chennai Signature :

Date: . .2022

Designation:

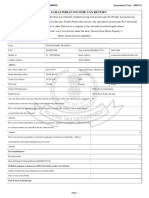

INCOME PARTICULARS FOR THE YEAR 2021 - 2022

Name: Gopinath M O/o the Sub Registrar, Chennai South Jt.1 D.O.B: 02-04-1974

Designation: Sub Registrar Gr.II Chennai. Pan No: AFGPG6624M

(bonus)

Covid

Other

Spl. HBA IT Prof. LIC/

All.

Month & Year Pay DP/ GP DA HRA CCA MA PP Total GPF FBF SPF IT HBA NHIS Total

Alw FBF Cess Tax PLI

Releif

Mar-21 55700 9469 7500 1200 300 74169 15000 60 50 80 2000 100 180 17470

Apr-21 55700 9469 7500 1200 300 74169 15000 60 50 80 2000 2472 100 180 19942

May-21 55700 9469 7500 1200 300 74169 15000 60 50 80 2000 100 180 17470

Jun-21 55700 9469 7500 1200 300 74169 15000 60 50 80 2000 100 180 17470

Jul-21 55700 9469 7500 1200 300 74169 15000 60 50 80 2000 100 300 17590

Aug-21 55700 9469 7500 1200 300 74169 15000 60 50 80 1250 2000 100 300 18840

Sep-21 55700 9469 7500 1200 300 74169 15000 110 50 80 2000 100 300 17640

Oct-21 55700 9469 7500 1200 300 74169 15000 110 50 80 2000 100 300 17640

Nov-21 55700 9469 7500 1200 300 74169 15000 110 50 80 2000 100 300 17640

Dec-21 55700 9469 7500 1200 300 74169 15000 110 50 80 2000 100 300 17640

Jan-22 57400 17794 7800 1200 300 84494 15000 110 50 80 1250 2000 100 300 18890

Feb-22 57400 17794 7800 1200 300 84494 15000 110 50 100 300 15560

Sal.Total 671800 0 130278 90600 14400 3600 0 0 0 910678 180000 1020 600 0 880 2500 22000 0 2472 1200 3120 213792

Bonus 0 0

DA Arrear1 0 0

DA Arrear2 0 0

Surrender LS 0 0

Arrear_1 0 0

Arrear_2 0 0

0 0

Total 671800 0 130278 90600 14400 3600 0 0 0 910678 180000 1020 600 0 880 2500 22000 0 2472 1200 3120 213792

HEAD OF OFFICE

Name of the Employer : Inspector General of Registration,

Address of the Employer : 100, Santhome High Road, Chennai - 28.

Period : Mar'2021 - Feb'22

You might also like

- Periyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Document2 pagesPeriyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Indumadhi SalemNo ratings yet

- Investment Declaration Form For FY - 2017-18Document2 pagesInvestment Declaration Form For FY - 2017-18arunNo ratings yet

- 2016-17 ItDocument36 pages2016-17 ItKingKamalNo ratings yet

- Cps Tax Form Format For 23-24Document11 pagesCps Tax Form Format For 23-24sr91919No ratings yet

- F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentDocument1 pageF0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentSourabhthakral_1No ratings yet

- Tax CalculationDocument3 pagesTax Calculationreach2hardyNo ratings yet

- Schedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668CDocument2 pagesSchedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668CJeevabinding xeroxNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inKATHI JAYANo ratings yet

- Old Scheme: Radhamani K SDocument4 pagesOld Scheme: Radhamani K SSUREMAN FINANCIAL SERVICESNo ratings yet

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- B) Excess of Rent Paid Over 10% of Basic+DADocument4 pagesB) Excess of Rent Paid Over 10% of Basic+DAHaresh RajputNo ratings yet

- Income Tax Calculation 2023-24 (Old Tax Regime) : Annexure - IiDocument1 pageIncome Tax Calculation 2023-24 (Old Tax Regime) : Annexure - IiGOKUL HD LIVE EVENTSNo ratings yet

- Income Tax CalculatorDocument9 pagesIncome Tax Calculatorchandu halwaeeNo ratings yet

- Tax Calculator - Indian Income Tax 2008-09Document7 pagesTax Calculator - Indian Income Tax 2008-09Jayamohan100% (29)

- Income Tax Calculator Fy 2020 21 v1Document8 pagesIncome Tax Calculator Fy 2020 21 v1Yogesh BajajNo ratings yet

- Proforma For Calculation of Income Tax For Tax DeductionDocument1 pageProforma For Calculation of Income Tax For Tax DeductionManchala Devika100% (1)

- Automated Form 16 FY 10-11Document8 pagesAutomated Form 16 FY 10-11Pranab BanerjeeNo ratings yet

- Salary Computation Ass Yr 2017-18Document2 pagesSalary Computation Ass Yr 2017-18CA Kaushik Ranjan GoswamiNo ratings yet

- IT Calculation New RegimeDocument4 pagesIT Calculation New Regimeyelrihs23No ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inGOKUL HD LIVE EVENTSNo ratings yet

- Income Tax Calculator Fy 2010 11Document8 pagesIncome Tax Calculator Fy 2010 11manishchemicalNo ratings yet

- Sunil BDocument2 pagesSunil Bplacementcell Govt ITI AttingalNo ratings yet

- Income Tax CalculationDocument2 pagesIncome Tax CalculationMadhan Kumar BobbalaNo ratings yet

- Pravin Shinde-ARMS-01-TDS-FY 2019-20Document12 pagesPravin Shinde-ARMS-01-TDS-FY 2019-20Udaysinh PatilNo ratings yet

- Income Tax Calculator Fy 2020 21 v2Document12 pagesIncome Tax Calculator Fy 2020 21 v2Anonymous Clm40C1No ratings yet

- ITDocument4 pagesITMahesh KumarNo ratings yet

- Bose Tax 2024Document2 pagesBose Tax 2024placementcell Govt ITI AttingalNo ratings yet

- Calculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10Document10 pagesCalculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10api-19754583No ratings yet

- T K ArumugamDocument7 pagesT K ArumugamThangamNo ratings yet

- (I) Total Gross Salary Income: (If Above 60, Indicate Senior Citizen)Document4 pages(I) Total Gross Salary Income: (If Above 60, Indicate Senior Citizen)dpfsopfopsfhopNo ratings yet

- Income Tax Calculation Statement: (Financial Year 2021-2022, and The Assessment Year 2022 - 2023)Document18 pagesIncome Tax Calculation Statement: (Financial Year 2021-2022, and The Assessment Year 2022 - 2023)mohamed ismailNo ratings yet

- Form 12 BBSampleDocument2 pagesForm 12 BBSampleAbhishekChauhanNo ratings yet

- Free Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Document16 pagesFree Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Bijender Pal ChoudharyNo ratings yet

- Atria Institute of TechnologyDocument3 pagesAtria Institute of TechnologykiranNo ratings yet

- Case Study 2Document2 pagesCase Study 2Anil NagarajNo ratings yet

- Blank Income Tax FormDocument3 pagesBlank Income Tax FormmmmukhtarNo ratings yet

- Latest Tax CalculatIor 3.3.2Document16 pagesLatest Tax CalculatIor 3.3.2Bijender Pal Choudhary100% (3)

- Form No.16 Aa-1Document2 pagesForm No.16 Aa-1Vishnu Vardhan ANo ratings yet

- IT FormDocument4 pagesIT FormVimal PatelNo ratings yet

- Adobe Scan 19-Jun-2023Document3 pagesAdobe Scan 19-Jun-2023Nirmala DeviNo ratings yet

- Salary On IncomeDocument22 pagesSalary On IncomeManjunathNo ratings yet

- PARTICULARS FOR F.Y. 2023 - 24 Old FormateDocument3 pagesPARTICULARS FOR F.Y. 2023 - 24 Old Formateiwd.abhiNo ratings yet

- New Microsoft Excel WorksheetDocument4 pagesNew Microsoft Excel WorksheetpalkwahNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 449048510080820 Assessment Year: 2020-21Document8 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 449048510080820 Assessment Year: 2020-21రాకేష్ బాబు చట్టిNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument7 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaSARAVANAN PNo ratings yet

- Wa0016Document3 pagesWa0016Vinay DahiyaNo ratings yet

- Investment Declaration Format FY 2022-23Document3 pagesInvestment Declaration Format FY 2022-23Divya WaghmareNo ratings yet

- DeclarationDocument3 pagesDeclarationPatrick Jude Lucas PsychologyNo ratings yet

- Income TaxDocument11 pagesIncome Taxci_balaNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument8 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaGeetanjali BarejaNo ratings yet

- ASWATHYDocument2 pagesASWATHYplacementcell Govt ITI AttingalNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Toward a National Eco-compensation Regulation in the People's Republic of ChinaFrom EverandToward a National Eco-compensation Regulation in the People's Republic of ChinaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Planning Concept Overall Concept Sustainable Concept: Project - 1Document1 pagePlanning Concept Overall Concept Sustainable Concept: Project - 1AR G.KAPILANNo ratings yet

- Space Standardisation of Low-Income Housing Units in India: Ijhma 9,1Document20 pagesSpace Standardisation of Low-Income Housing Units in India: Ijhma 9,1Ritika GuptaNo ratings yet

- Field Guide To Human-Centered Design - IDEOorg - EnglishDocument192 pagesField Guide To Human-Centered Design - IDEOorg - EnglishPedro Muñoz del RioNo ratings yet

- Case Study HousingDocument10 pagesCase Study HousingAR G.KAPILANNo ratings yet

- 2016 Barch Curriculum Syllabus PDFDocument95 pages2016 Barch Curriculum Syllabus PDFmanonmaniNo ratings yet

- Ecistics The Science of Human SettlementsDocument15 pagesEcistics The Science of Human SettlementsCyhn GieNo ratings yet

- India Government Affordable Housing SchemeDocument10 pagesIndia Government Affordable Housing SchemeMohd RehanNo ratings yet

- Teachings of Lord Kapil ADocument333 pagesTeachings of Lord Kapil AAR G.KAPILAN100% (1)

- Chennai Unified Metropolitan Transport Authority (Cumta) Terms of Reference For Transport PlannerDocument11 pagesChennai Unified Metropolitan Transport Authority (Cumta) Terms of Reference For Transport PlannerAR G.KAPILANNo ratings yet

- EOI Document 23rdjuly FinalDocument42 pagesEOI Document 23rdjuly FinalBonaventure NzeyimanaNo ratings yet

- Assignment 3 Mohammed Shalabi CRM SNM 201810028Document5 pagesAssignment 3 Mohammed Shalabi CRM SNM 201810028Mohammed ShalabiNo ratings yet

- HP Magazine 2017 Spreads Web - AwDocument13 pagesHP Magazine 2017 Spreads Web - AwFernando RomoNo ratings yet

- FR FEMA Group 1 (W)Document83 pagesFR FEMA Group 1 (W)rohanNo ratings yet

- Aniket Doshi-86 Devrath Kadam-87 Nikita Kamath-88 Saloni Parikh-99 Ushma Thakker-114Document8 pagesAniket Doshi-86 Devrath Kadam-87 Nikita Kamath-88 Saloni Parikh-99 Ushma Thakker-114Nikita KamathNo ratings yet

- Tourism Planning and Their Planning ImplicationsDocument11 pagesTourism Planning and Their Planning ImplicationsPatricia Mae Ramos BisenioNo ratings yet

- Risk Evaluation FormDocument8 pagesRisk Evaluation FormJhon F SinagaNo ratings yet

- Eminence Capital & Fincorp Web Page ContentDocument37 pagesEminence Capital & Fincorp Web Page ContentChinmaya DasNo ratings yet

- How Will You Measure Your LifeDocument19 pagesHow Will You Measure Your LifeSpencerNo ratings yet

- Delta CaseDocument8 pagesDelta CaseSeemaNo ratings yet

- My Pay PDFDocument1 pageMy Pay PDFbuckwheat122507No ratings yet

- FinmanDocument18 pagesFinmanMaryllon VillardoNo ratings yet

- Strategic Choices - Getz PharmaDocument21 pagesStrategic Choices - Getz PharmaYashra NaveedNo ratings yet

- Assignment 1 Management AccountingDocument7 pagesAssignment 1 Management AccountingAmy SamerchitNo ratings yet

- P2 - Non Current AssetsDocument43 pagesP2 - Non Current AssetsSidra QamarNo ratings yet

- Marketing Plan: Company LogoDocument6 pagesMarketing Plan: Company LogoKing OtneyNo ratings yet

- Knowlegde Test 1 and 2Document69 pagesKnowlegde Test 1 and 2Đăng TríNo ratings yet

- IFP - Loan CalutationDocument23 pagesIFP - Loan CalutationnishiNo ratings yet

- MDMS Diagram ExplainedDocument30 pagesMDMS Diagram ExplainedspamtdebNo ratings yet

- AFAR Final Preboard 2018 PDFDocument22 pagesAFAR Final Preboard 2018 PDFcardos cherryNo ratings yet

- Zahida Perveen: Career Summary: Position / TitleDocument5 pagesZahida Perveen: Career Summary: Position / TitleHASAN EJAZ KAZMINo ratings yet

- Human Resource ManagementDocument16 pagesHuman Resource ManagementMd Hassan100% (1)

- Bachelor of Accountancy - AU Table & Curriculum Structure - Group ADocument3 pagesBachelor of Accountancy - AU Table & Curriculum Structure - Group AYong JiaNo ratings yet

- Chapter 2 (Developing Marketing Strategies and Plans)Document23 pagesChapter 2 (Developing Marketing Strategies and Plans)Magued MamdouhNo ratings yet

- Case StudyDocument3 pagesCase StudyJUVY ALEJANDRO100% (2)

- Case StudyDocument84 pagesCase StudykenNo ratings yet

- Cost Volume Profit AnalysisDocument7 pagesCost Volume Profit AnalysisMeng DanNo ratings yet

- Annual Report 2020Document256 pagesAnnual Report 2020VYAPAR INDIANo ratings yet

- Morning Slot: (09:30 AM To 10:30 AM) : Course OutcomesDocument12 pagesMorning Slot: (09:30 AM To 10:30 AM) : Course OutcomesSachin BhartiNo ratings yet

- Myndtree NewDocument9 pagesMyndtree NewlohithNo ratings yet