Professional Documents

Culture Documents

Nust Tax Module Jan 2018

Uploaded by

Phebieon MukwenhaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nust Tax Module Jan 2018

Uploaded by

Phebieon MukwenhaCopyright:

Available Formats

lOMoARcPSD|4169582

NUST Tax Module Jan 2018

APPLIED TAXATION (Midlands State University)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

NATIONAL UNIVERSITY OF SCIENCE AND TECHNOLOGY

[IN COLLABORATION WITH NORTH WEST UNIVERSITY SOUTH AFRICA]

APPLIED ZIMBABWE TAXATION 2018

ZCTA LEVEL 2 [CAZ 2]

TAXATION MODULE

Prepared by:

Maxwell Ngorima

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

CONTENTS

NUST TAXATION MODULE

1. Introduction …………………………………………………………………………. 4

2. ZCTA 2018 Syllabus ………………………………………………………………… 4

3 Course Outline ,……………………………………………………………………. 19

4. Outline of the Tax System………………………………………………………… 23

5. Tutorial 1 / Test 1

Study Unit 1.1 Administration framework………………………………………..24

Study Unit 1.2 Gross Income…………………………………………...................30

Study Unit 1.3 Exemptions ……………………………………………………….39

Study Unit 1.4 General deduction formula ……………………………………….41

Study Unit 1.5 Taxation of Employment Income ………………………………..42

Study Unit 1.6 Taxation of Corporates……………………………………….......56

Study Unit 1.7 Capital allowances, recoupments ………………………………...71

Study Unit 1.8 Lease premiums ……………………………………………….....81

Study Unit 1.9 Suspensive sales ……………………………………………….....87

6. Tutorial 2 / Test 2

Study Unit 2.1 Withholding Taxes …………………………………………….....92

Study Unit 2.2 Transfer Pricing ……………………………………………..........95

Study Unit 2.3 International tax, permanent establishment ……………………. 100

Study Unit 2.4 Capital Gains tax …………………………………………..........103

7. Tutorial 3 / Test 3

Study Unit 3.1 Value Added Tax ………………………………………………..112

8. Tutorial 4 / Test 4

Study Unit 4.1 Taxation of partnerships ………………………………………...158

Study Unit 4.2 Deceased estates and trusts ……………………………………...161

Study Unit 4.3 Farming operations ………………………………………….......165

Study Unit 4.4 Mining ……………………………………………………….......173

NUST 2018 CTA 2 TAX MODULE

PAGE 2

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

APPLIED ZIMBABWE TAXATION

TUTORIAL 1

1 Introduction

2 ZCTA 2018 Syllabus

3 Course Outline

4 Outline of the Tax System

Tutorial 1 / Test 1

Study Unit 1.1 Administration framework

Study Unit 1.2 Gross Income

Study Unit 1.3 Exemptions

Study Unit 1.4 General deduction formula

Study Unit 1.5 Special deductions

Study Unit 1.6 Taxation of Employment Income

Study Unit 1.7 Taxation of Corporates

Study Unit 1.8 Capital allowances, recoupments

Study Unit 1.9 Lease premiums

Study Unit 1.9 Suspensive sales

NUST 2018 CTA 2 TAX MODULE

PAGE 3

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

TUTORIAL 1

1. INTRODUCTION AND WELCOME

Candidates who sit for this paper are expected to have acquired comprehensive knowledge of the

main features of the Zimbabwe Taxation Statues which incorporate The Income Tax Act [ Chapter

23 : 06]; together with the current year Finance Act [ Cap 23:04] which sets out the latest rates of

tax and duties.

In addition, candidates should be familiar with legal precedents [decisions from court cases] that

help explain the acceptable interpretations of the tax statutes.

At this level, the paper will test the candidate’s application and analytical skills as well as

evaluation skills for the purposes of providing professional tax advice on proposed current and

past business transactions, and structures.

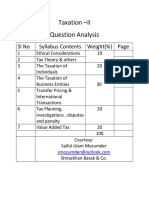

2. SYLLABUS

CTA 2018 SYLLABUS

TAXATION EXAMINABLE PRONOUNCEMENTS

1. Core legislation under examination and level description

The syllabus is principally concerned with the taxes and duties levied in terms of the following five

statutes:

The Income Tax Act Chapter 23:06

The Value Added Tax Act Chapter 23:12

The Capital Gains Tax Act Chapter 23:01

The Finance Act Chapter 23:04

The Estate Duty Act Chapter 23:03

All other taxes, duties and levies payable in terms of various statutes have been excluded from the

syllabus, unless specifically mentioned in this document. References to the relevant Act have been

inserted in the syllabus where appropriate.

Regulations, interpretation notes and binding general rulings are to be covered on the same level as

the applicable provision in the Act.

Knowledge levels as defined in the Competency Framework are summarised as follows:

Level 1 (Basic)

At this level the candidate is required to acquire a knowledge and understanding of the

core/essence of the subject matter which includes that the subject matter exists, the significance and

relevance thereof, and its defining attributes.

Consequently, the candidate is required to have knowledge and understanding of:

the purpose and objective of the subject matter;

the underlying principles/practices/legislation/requirements (hereafter “content”);and

how the content relates to the discipline as a whole and to other disciplines (how it “fits in”)

at a broad conceptual level.

At this level, knowledge and understanding of detail, including procedural or numerical aspects

specific to the subject matter, are not required.

NUST 2018 CTA 2 TAX MODULE

PAGE 4

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

APPLIED TAXATION

TAX 402

At this level the candidate should be equipped with the extent and depth of knowledge and

understanding which enable the candidate to recognise issues when encountered and to seek

further depth of knowledge and understanding.

Level 2 (Intermediate)

At this level the candidate is required to acquire a detailed knowledge and understanding of the

central ideas and issues that comprise the substance of the subject matter.

Consequently, the candidate is required to have a knowledge and understanding of:

those aspects of the content that are central to the subject matter, so as to achieve a sound

conceptual understanding; and

the detail, including procedural and numerical aspects specific to the subject matter, where

appropriate.

Knowledge and understanding of complexities and unusual/exceptional aspects are, however, not

required.

At this level the candidate should be equipped with a sound knowledge and understanding of the

substance of the subject matter to enable them to deal with issues and solve problems that are central

to the topic. The candidate should have a sound conceptual knowledge which enables them to further

explore and understand complexities, if necessary.

This level includes the level of knowledge and understanding required for level 1 (Basic).

Level 3 (Advanced)

At this level the candidate is required to acquire a thorough knowledge and understanding of the

subject matter. This level of knowledge and understanding extends beyond a sound understanding of

central issues, to include complexities and unusual/exceptional aspects associated with the subject

matter.

Consequently, the candidate is required to have a knowledge and understanding of:

All content that is required to develop a thorough understanding of the subject matter;

Complexities; and

Sufficient depth to clearly locate content in the general field of accountancy and to identify

implications and relationships.

At this level the candidate should be equipped with a level of knowledge and understanding of the

substance of the subject matter that enables them to perform tasks and solve problems with a high

degree of rigour, exercising sound judgement.

This level includes the level of knowledge and understanding required for level 1 (Basic) and level 2

(Intermediate).

NUST 2018 CTA 2 TAX MODULE

PAGE 5

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

APPLIED TAXATION

TAX 402

2. Tax legislation Reference to the legislation

Topics Knowledge level

Income Tax Act

PART I -PRELIMINARY

S 1 (1) Short title

S 2 (2) Interpretations (Definitions) Excluded Affiliate Petroleum

Petroleum agreements

Petroleum operations

Petroleum operator

Petroleum special grant

Special court

Level 1

Agent Industrial park

Industrial park developer

Insolvency and insolvent

Investment licence Licenced investor

Private Business Corporation

Special court Special mining lease

Special mining lease agreement

Special mining lease area

Special mining lease operation

Level 2

Amount

Approved employee share ownership trust

Assessed loss

Assessment

Beneficiary with a vested right

Benefit fund

Charging Act

Child Commissioner Company

Credit Farmer Holder

Income derived from mining operations

Income derived from trade and investments

Income the subject of a trust to which no beneficiary is entitled

NUST 2018 CTA 2 TAX MODULE

PAGE 6

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

APPLIED TAXATION

TAX 402

Reference to the legislation

Topics Knowledge level

Level 3

Law

Lawful minor child

LIBOR

Local Authority

Marriage

Married woman

Medical aid society

Mineral

Mining location

Mining operations’

Mine Minister

Minor Child

Near relative

Nominee

Parent Pension Fund

Period of assessment

Person

Prescribed

Previous law

Recoupment from capital expenditure

Retirement annuity fund

Return Securities

Self-assessment return

Spouse Statutory Corporation

Tax

Tax clearance certificate

Taxpayer

Trade

Trade mark

Trading stock

Trust instrument

Trustee Year of assessment

Zimbabwe Revenue Authority

S 2A When persons deemed to be associates 1

S 2B When person deemed to control company 3

NUST 2018 CTA 2 TAX MODULE

PAGE 7

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

APPLIED TAXATION

TAX 402

Reference to the legislation

Topics Knowledge level

PART II –

ADMINISTRATION

S 3 & 4 Repealed

S5 Preservation of secrecy Excluded

PART III –

INCOME TAX

S6 Levy of Income Tax 3

S7 Calculation of Income Tax 3

S8 Interpretation of terms relating to income tax 3

S9 Special provisions in connection with income derived from sale of mining

claims -Repealed Excluded

S10 Special circumstances in which income is deemed to have accrued 3

S11 Special provisions in connection with income derived from assets in deceased

and insolvent estates 3

S12 Circumstances in which amounts are deemed to have accrued from sources

within Zimbabwe 3

S13 Commissioner may approve of benefit funds and medical aid societies for the

purpose of this Act 1

S14 Exemptions 3

S15 Deductions allowed in determination of taxable Income 3

S 16 Cases in which no deduction shall be made 3

S 17 Special provisions relating to hire purchase or other agreements providing for

the postponement of passing of ownership of property 3

S 18 Special provisions relating to credit sales 3

S 19 Special provisions relating to persons carrying on business which extends

beyond Zimbabwe 1

S 20 Special provisions relating to insurance business Excluded

S 21 Special provisions relating to petroleum businesses Excluded

S 22 Special provisions relating to special mining lease operations Excluded

S 23 Special provisions relating to determination of taxable income of persons

buying and selling any property at a price in excess of or less than the fair

market price Excluded

S 24 Special provisions relating to determination of taxable income in accordance

with double taxation agreements 3

S 25 Deduction of tax from dividends 3

PART IV –

TAX ON SHAREHOLDERS, INTEREST, FEES, REMMITTANCES &

ROYALTIES

S 26 Non-resident shareholders tax 3

S 27 Branch profit tax – repealed excluded

S 28 Resident shareholders tax 3

S 29 Non-resident’s tax on interest -repealed Excluded

S 30 Non-resident’s tax on fees 3

S 31 Non-resident tax on remittances 3

S 32 Non-resident tax on royalties 3

NUST 2018 CTA 2 TAX MODULE

PAGE 8

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

APPLIED TAXATION

TAX 402

Reference to the legislation

Topics Knowledge level

S 33 Additional profit tax in respect of special mining lease areas Excluded

S 34 Resident tax on interest 3

S 35 Exemption of petroleum operators and affiliates from certain taxes Excluded

S 36 Exemption of holders of special mining leases from certain taxes Excluded

S 36A Tobacco Levy 1

S 36B Automated Financial Transaction Tax 1

S 36C Presumptive Tax 1

S 36D Demutualisation levy Excluded

S 36E Carbon Tax 1

S 36F -J Excluded

PART V –

RETURNS AND ASSESSMENTS

S 37 Notice by commissioner requiring for assessment under this Act and manner of

furnishing returns and interim returns 1

S 38 Income of minor children 3

S 39 Duty to furnish further returns and information 1

S 40 Commissioner to have access to all public records 1

S 41 Returns as to shareholdings 1

S 42 Duties of companies to furnish returns and copy of memorandum and articles

of association. Excluded

S 43 Duty of person submitting accounts in support of return or preparing accounts

of other person Excluded

S 44 Production of documents and evidence on oath Excluded

S 45 Estimated assessments 1

S 46 Additional tax in event of default or omission 1

S 47 Additional assessments 1

S 48 Reduced assessments of loss 1

S 49 Amended assessment of loss 1

S 50 Adjustment of tax Excluded

S 51 Assessments and recording thereof excluded

S 52 Copies of assessments Excluded

PART VI –

REPRESENTATIVE TAXPAYERS S 53 to S61

EXCLUDED

EXCLUDED

PART VII –

OBJECTIONS AND APPEALS S 62 to S 70

EXCLUDED

PART VIII –PAYMENT AND RECOVERY OF TAX

S 71 Appointment of day and place for payment of tax 1

S 72 Payment of provisional tax 2

S 73 Payment of employees tax 2

S 74 Persons by whom the tax is payable 2

S 75 Temporary trade 1

S 76 No tax payable in certain circumstances 1

S 77 Recovery of tax. 1

S 78 Form of proceedings. Excluded

NUST 2018 CTA 2 TAX MODULE

PAGE 9

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

APPLIED TAXATION

TAX 402

S 79 Evidence as to assessments Excluded

S 80 Withholding of amounts payable under contracts with state or statutory

corporations. Excluded

PART IX –

GENERAL

S 81 Offences – General. 1

S 82 Offences – wilful failure to comply with requirements of commissioner of keep

proper accounts and obstruction. 1

S 83 Offences – increased penalty on subsequent conviction. Excluded

S 84 Offences – Wilful failure to submit correct returns, information etc. 1

S 85 Offences – false statements. 1

S 86 Offences – wilful making of false statements and keeping of false accounts, and

fraud.

1 S 87 Evidence. Excluded

S 88 Proofs of certain facts by affidavit or orally. Excluded

S 89 Forms and authentication and service of documents. Excluded

S 90 Regulations. Excluded

S 91 Relief from double taxation. 3

S 92 Reduction of tax payable as a result of double taxation agreements. 3

S 93 Relief from double taxation in cases where no double taxation agreements have

been made. 3

S 94 Credit where non-residents’ tax on interest is withheld – repealed. Excluded

S 95 Credit where non-residents’ tax on fees has been withheld. 1

S 96 Credit where non-residents’ tax on royalties has been withheld. 1

S 97 Credit where residents’ tax on interest has been withheld. 3

S 97 C Credit where tax on non-executive directors’ fees has been withheld. 3

S 98 Tax Avoidance generally. 2

S 98A Income splitting. 3

S 98B Transactions between associates, employers and employees. 3

S 99 Transitional provisions relating to separate taxation of married woman. Excluded

First Schedule

Amounts received or accrued by way of lump sum payments which shall not be

included in Gross Income.

1 Second Schedule

Valuation of trading stock.

3 Third Schedule

Exemptions from Income tax.

NUST 2018 CTA 2 TAX MODULE

PAGE 10

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

APPLIED TAXATION

TAX 402

Reference to the legislation

Topics Knowledge level

Fourth Schedule

Deductions to be allowed in respect of buildings, improvements,

machinery and equipment used for commercial, industrial and farming

purposes.

Fifth schedule

Allowances and deductions in respect of Income derived from mining

operations and other provisions thereto.

Sixth schedule

Deductions in respect of contributions to benefit and pension funds

and the consolidated revenue fund.

Excluded

Seventh schedule Deductions in respect of income derived from farming operations.

Eighth schedule

Determination of taxable income or assessed loss attributable to the business of Insurance.

Excluded

Ninth schedule Non-resident shareholders tax.

Tenth schedule Branch profit tax – repealed. Excluded

Eleventh schedule Decisions of the commissioner to which any person may object. Excluded

Twelfth schedule Rules for regulating appeals. Excluded

Thirteenth Schedule

Employees’ tax.

Fourteenth Schedule

Deductions in respect of Income derived from business operations in

Growth point areas – repealed.

Excluded

Fifteenth schedule Residents shareholders tax

Sixteenth Schedule Non-resident tax on interest-repealed Excluded

Seventeenth schedule

Non-residents tax on fees.

Eighteenth Schedule

Non-resident tax on remittances.

Nineteenth schedule

Non-residents tax on Royalties.

Twentieth schedule

Determination of gross income and taxable income or assessed loss

from petroleum operations.

Excluded

Twenty-first schedule

Residents’ tax on interest.

Twenty-second schedule

Determination of gross income and taxable income or assessed loss

from special mining lease operations.

Excluded

NUST 2018 CTA 2 TAX MODULE

PAGE 11

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

Twenty – third schedule

Determination of additional profits tax in respect of special mining

lease area.

Excluded

Twenty-fourth schedule

Tobacco Levy. Excluded

Twenty – Fifth schedule

Automated financial transactions tax Excluded

Twenty-sixth schedule

Presumptive tax Excluded

Twenty – seventh schedule

Demutualisation levy Excluded

Twenty-eighth schedule

Carbon tax Excluded

Thirtieth schedule Intermediated money transfer tax Excluded

Thirty-First schedule

Noczim debt redemption & Strategic reserve levy Excluded

Reference to the legislation

Topics

Knowledge level

Thirty-second schedule

Property or Insurance commission tax Excluded

Thirty-third schedule

Tax on non-executive directors’ fees

Thirty-fourth schedule

Petroleum Importer levy Excluded

Thirty-fifth schedule

Transfer pricing

Reference to the legislation

Topics

Knowledge level

NUST 2018 CTA 2 TAX MODULE

PAGE 12

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

APPLIED TAXATION

TAX 402

Value added Tax Act

Part I – PRELIMINARY

S 1 Short title and date of commencement 1

S 2 Interpretations (definitions) 3

S 3 Determination of open market value 1

PART II – ADMINISTRATION

S 4 Act to be administered by the commissioner 1

S 5 Delegation of functions by the commissioner 1

PART III – VALUE ADDED TAX

S 6 Value added tax 3

S 7 Certain supplies of goods or services deemed to be made or not made 3

S 8 Time of supply 3

S 9 Value of supply of goods or services 3

S10 Zero rating 3

S 11 Exempt supplies 3

S 12 Collection of tax on importation of goods, determination of value thereof, and

exemptions from tax 3

S 13 Collection of tax on imported services, determination of value thereof, and

exemptions from tax

3 S 14 Accounting basis 3

S 15 Calculation of tax payable 3

S 16 Permissible deductions in respect of input tax 3

S 17 Adjustments 3

S 18 Adjustments in consequence of acquisition of a going concern wholly or partly

for purposes other than making taxable supplies 3

S 19 Goods or services acquired before incorporation 3

S 20 Tax invoices 3

S 21 Credit and debit notes 3

S 22 Irrecoverable debts 3

PART IV – REGISTRATION

S 23 Registrations of persons making supplies in the course of trade 3

S 24 Cancellation of registration 3

S 25 Registered operator to notify change of status 2

S 26 Liabilities not affected by person ceasing to be a registered operator 2

PART V-RETURNS, PAYMENTS AND ASSESSMENTS

S 27 Tax Periods 3

S 28 Returns and payment of tax 3

S 29 Special returns 1

S 30 Other returns 1

S 31 Assessments 3

NUST 2018 CTA 2 TAX MODULE

PAGE 13

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

APPLIED TAXATION

TAX 402

Reference to the legislation

Topics Knowledge level

PART VI – OBJECTIONS AND APPEALS

S 32 Objections to certain assessments and decisions 1

S 33 Appeals to Fiscal appeal court 1

S 34 Appeals against decisions of fiscal appeals court 1

S 35 Members of fiscal appeals court not disqualified from adjudicating Excluded

S 36 Payment of tax pending appeal Excluded

S 37 Burden of proof Excluded

PART VII – PAYMENT, RECOVERY AND REFUND OF TAX

S 38 Manner in which tax shall be paid 1

S 39 Penalty and interest for failure to pay tax when due 3

S 40 Recovery of tax Excluded

S 41 Liabilities for tax for certain past supplies or importations Excluded

S 42 Evidence as to assessments Excluded

S 43 Security for tax Excluded

S 44 Refunds 1

S 45 Interest on delayed refunds Excluded

S 45A Refunds of tax to exempted persons Excluded

S 46 Calculation of interest payable under this Act 1

PART VIII – REPRESENTATIVE REGISTERED OPERATORS

S 47 Persons acting in a representative capacity. Excluded

S 48 Power to appoint agent. Excluded

S 49 Liability of representative registered operators. Excluded

S 50 Remedies of Commissioner against agent or trustee. Excluded

PART IX – SPECIAL PROVISIONS

S 51 Repealed Excluded

S 52 Separate persons carrying on same trade under certain circumstances deemed

to be single person. Excluded

S 53 Bodies of persons, corporate or unincorporated, other than companies. Excluded

S 54 Pooling arrangements. Excluded

S 55 Death or insolvency of registered operator. 1

S 56 Agents and auctioneers. 1

NUST 2018 CTA 2 TAX MODULE

PAGE 14

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

APPLIED TAXATION

TAX 402

Reference to the legislation

Topics Knowledge level

PART IXA SPECIAL

PROVISIONS APPLICABLE TO SALES OF MOTOR VEHICLES (repealed)

PART X – COMPLIANCE

S 57 Records. 1

S 58 General provisions with regard to information, documents or items. 1

S 59 Furnishing of information, documents or items by any person. 1

S 60 Obtaining of information, documents or items at certain premises. 1

S 61 Powers of entry, search, etc. Excluded

S 62 Offences. 1

S 63 Offences and penalties in regard to tax evasion. 1

S 64 Offences: increased penalty on subsequent conviction. Excluded

S 65 Imposition of fine by Commissioner. Excluded

S 66 Additional tax in case of evasion 1

S 67 Recovery of tax from recipient. Excluded

S 68 Reporting of unprofessional conduct. Excluded

PART XA -APPLICATION OF INFORMATION TECHNOLOGY TO ACT

S 68A – S68K EXCLUDED

PART XI -MISCELLANEOUS

S 69 Prices deemed to include tax. Excluded

S 70 Prices advertised or quoted to include tax. Excluded

S 71 Rounding-off tables. Excluded

S 72 Contract price or consideration may be varied according to rate of tax. Excluded

S 73 Application of increased or reduced tax rate Excluded

S 74 Tax relief allowable to certain diplomats and diplomatic and consular missions. Excluded

S 75 Forms and authentication and service of documents. Excluded

S 76 Arrangements and directions to overcome difficulties, anomalies or

incongruities Excluded

S 77 Schemes for obtaining undue tax benefits Excluded

S 78 Regulations. Excluded

PART XII -AGREEMENTS

S 79 Tax agreements. Excluded

S 80 President may suspend tax payable under agreement. Excluded

PART XIII -GENERAL

S 81 Notice of variation of rate of tax. Excluded

S 82 Transitional matters Excluded

S 83 Act binding on State, and effect of certain exemptions from taxes. Excluded

S 84 Repeal of Cap. 23:08 and savings. Excluded

SCHEDULES

First Schedule: [Repealed].

Capital Gains Tax Act

PART I – PRELIMINARY

S 1 Short title

S 2 Interpretations (definitions) 3

PART II – ADMINISTRATION

S 3 Delegation of functions by Commissioner. 1

S 4 & 5 Repealed

PART III -CAPITALGAINS TAX

S 6 Charging of capital gains tax. 3

S 7 Calculation of capital gains tax. 3

S 8 Interpretation of terms relating to capital gains tax. 3

S 9 When capital amount deemed to have accrued. 3

S 10 Exemptions from capital gains tax. 3

S 11 Deductions allowed in determination of capital gain. 3

S 12 Circumstances in which no deductions may be made. 3

S 13 Damage to or destruction of specified asset 3

NUST 2018 CTA 2 TAX MODULE

PAGE 15

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

S 14 Determination of fair market price of specified assets. 1

S 15 Transfers of specified assets between companies under the same control. 3

S 16 Transfers of specified assets between spouses. 3

S 17 Transfer of business property by individual to company under his control. 3

S 18 Provisions for sales of immovable property under suspensive conditions. 3

S 19 Provisions relating to credit sales where ownership passes. 3

S 20 Provisions for the reductions in costs of specified assets. 1

S 21 Provision for sales of principal private residences. 3

S 22 Substitution of business property. 1

PART IIIA -CAPITAL GAINS WITHHOLDING TAX

S 22A Interpretation in Part IIIA. 1

S 22B Capital gains withholding tax. 3

S 22C Depositaries to withhold tax. 1

S 22D Agents to withhold tax not withheld by depositaries. 1

S 22E Payee to pay tax not withheld by depositary or agent. 1

NUST 2018 CTA 2 TAX MODULE

PAGE 16

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

APPLIED TAXATION

TAX 402

Reference to the legislation

Topics Knowledge level

S 22F Exemptions. 3

S 22FA Registration of depositaries. 1

S 22G Depositaries to furnish returns. 1

S 22H Penalty for non-payment of tax. 1

S 22I Refund of overpayments 1

S 22J Credit where tax has been withheld 3

S 22K Application of Part IIIA to sales concluded before 1.1.1999 Excluded

S 22L Suspension of provisions of Part II A to marketable securities. 1

PART IV -RETURNS AND ASSESSMENTS

S 23 Application of provisions of Taxes Act relating to returns and assessments 1

PART V -REPRESENTATIVE TAXPAYERS

S 24 Application of provisions of Taxes Act relating to representative taxpayer. Excluded

PART VI -OBJECTIONS AND APPEALS

S 25 Objections and appeals 1

PART VII -PAYMENT AND RECOVERY OF TAX

S 26 Day and place for payment of tax. 1

PART VIII – GENERAL

S 27 Application of provisions of Taxes Act relating to offences, evidence, forms and

regulations. Excluded

S 28 Application of provisions of Taxes Act relating to relief from double taxation. 1

S 29 Application of provisions of Taxes Act relating to tax avoidance. Excluded

S 30 Transitional provision re capital gains and losses of married women Excluded

S 30A Capital gains tax not withheld in terms of Part IIIA to be paid before transfer of

specified asset. Excluded

S 31 Returns by Registrar of Deeds, financial institutions and other persons. Excluded

Finance Act

S 1 Short title

S 2 Interpretations l

S 2A Meaning of small or medium enterprises or business Excluded

S 3 Regulations Excluded

CHAPTER I INCOME TAX AND OTHER TAXES LEVIED IN TERMS OF THE INCOME

TAX ACT:

PART I – PRELIMINARY

S 4 Interpretation 1

S 4A Payment of certain taxes in foreign currency 1

PART II – CREDITS TO BE DEDUCTED FROM INCOME TAX

S 7 Credits to which section 7 of the Income tax act relates 3

S 10 Taxpayers over 55 years of age 3

S 11 Blind persons 3

S 12 Invalid appliances and medical expenses 3

S 13 Mentally or physically disabled persons 3

NUST 2018 CTA 2 TAX MODULE

PAGE 17

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

APPLIED TAXATION

TAX 402

PART III – RATES OF INCOME TAXES AND OTHER TAXES LEVIED IN TERMS OF

THE INCOME TAX ACT

S 14 Income taxes for period of assessment after 01.01.14 3

S 15 Non-resident shareholders tax 3

S 17 Resident shareholders tax 3

S 19 Non-residents’ tax on fees 3

S 20 Non-residents’ tax on remittances 3

S 21 Non-residents’ tax on royalties 3

S 22 Resident tax on interest 3

S 22J Tax on non-executive directors’ fees 3

S 22K Tax on share options granted before 1st February 2009 3

PART IV – EMPLOYEES TAX

S 23 Matters to be regarded by the commissioner in relation to employees tax 3

Schedule to Chapter I : Credits and rates of Income Tax 3

CHAPTER II : STAMP DUTIES

S 24 -25 Stamp duties 2

CHAPTER III : LICENCES TARIFFS

S 26 -27 Licence tariffs Excluded

CHAPTER IV : VALUE ADDED TAX

S 28 Interpretations in chapter IV 3

S 29 Rates of Value added tax 3

S 30 Amendments imposed by section 29 1

S 31 Adjustment of tax 1

Schedule to chapter IV : Rates of Value Added Tax 3

Chapter V : Betting and Gaming tax –

REPEALED

CHAPTER VI : ESTATE DUTY

S 34 Interpretation in chapter VI 3

S 35 Rate of estate duty 3

Schedule to chapter VI : Rates of estate duty

CHAPTER VII: MINING ROYALTIES, DUTY & FEES

S 36 – 37B Mining royalties Excluded

CHAPTER VIII : CAPITAL GAINS TAX

S 37A Interpretation in chapter VIII 3

S 38 Rates of Capital Gains Tax 3

S 39 Rates of Capital Gains Withholding Tax 3

S 39A Payment of capital gains tax in foreign currency in certain circumstances 1

CHAPTER IX – XII Excluded

NUST 2018 CTA 2 TAX MODULE

PAGE 18

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

3. COURSE OUTLINE

3.1 LEGISLATION CUT OFF FOR EXAM PURPOSES

The questions will be based on legislation in force as at 31 December 2017. For planning type

questions, candidates should also be aware of the legislative changes which have recently been

promulgated, following the parliamentary approval of the National Budget presented by the

Minister of Finance to Parliament in November 2017.

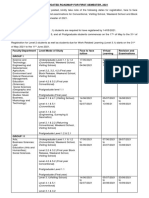

3.2 TESTS (FORMATIVE ASSESSMENT)

Four tests will be written during the year in order to give you the opportunity to have your progress

evaluated. These tests will constitute 20% of the final exam mark.

TIMETABLE

Scope Test Number

Tutorial 1 Test 1

Tutorial 2 Test 2

Tutorial 3 Test 3

Tutorial 4 Test 4

NUST 2018 CTA 2 TAX MODULE

PAGE 19

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

3.3 TAX RATES YEAR ENDED 31ST DECEMBER 2017

RATES OF TAX: EMPLOYMENT INCOME

2017 ANNUAL PAYE TABLE

1ST JANUARY 2017 – 31ST DECEMBER 2017 (USD)

Band of Taxable Amount Tax Tax Cumulative Tax

Income US$ Rate

US$

US$ % US$

1 – 3 000 3,000 0% Nil Nil

3 001 – 12 000 9,000 20% 1,800 1,800

12 001 – 24 000 12,000 25% 3,000 4,800

24 001 – 60 000 36,000 30% 10,800 15,600

60 001 – 90 000 30,000 35% 10,500 26,100

90 001 - 120 000 30,000 40% 12,000 38,100

120 001 - 240 000 120,000 45% 54,000 92,100

240 001 - and more 50%

Plus 3 % Aids Levy chargeable income tax payable less credits.

TAX FREE BONUS

The tax free threshold is US$1,000 per annum with effect from 1 November 2012.

RETRENCHMENT PACKAGES

With effect from 1st January 2013, the tax-free portion of a retrenchment package is

pegged at the greater of US$10,000 or one third of the retrenchment package provided it

does not exceed US$60,000.

TAX CREDITS $ (p.a.)

Elderly person (55 years and over) 900

Physically disability person 900

Blind person 900

Medical aid and expenses 50% of amount paid in each year

PENSION CONTRIBUTIONS BY EMPLOYEE

Maximum permissible deductions $

Contribution to employer’s pension fund 5,400

Retirement annuity fund/Self-employed pension fund 5,400

National Social Security: 3,5% of the first $700 per year

Aggregate maximum contribution to all above per employee per year: 5,400

NUST 2018 CTA 2 TAX MODULE

PAGE 20

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

DEEMED ANNUAL MOTORING BENEFITS

Engine capacity

Up to 1 500cc 3,600

1 501 – 2 000cc 4,800

2 001 – 3 000cc 7,200

3 001 and above 9,600

EXEMPTIONS FOR ELDERLY TAXPAYERS (55 years and over)

$

Rental income 3 000

Interest on deposits with financial institutions 3 000

Interest on discounted instruments 3 000

Pensions no limit

Gain on disposal of Principal Private Residence no limit

Gain on disposal of marketable securities 1,800

On acquisition of motor vehicle from employee no limit

FINES FOR GENERAL OFFENCES

Level of offence Fine($US) Level of offences Fine($)

1 5 8 500

2 10 9 600

3 20 10 700

4 100 11 1,000

5 200 12 2,000

6 300 13 3,000

7 400 14 5,000

NUST 2018 CTA 2 TAX MODULE

PAGE 21

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

TAX RATES

%

14(2)(b) Taxable income of individual from trade or investment 25

14(2)(d) Taxable income of pension fund from trade or investment 15

14(2)(e) Taxable income of licenced investor (taxed at 0% up to the

fifth year of his operations as such) 25

14(2)(f) Taxable income of holder of special mining lease 15

14(2)(g) Taxable income of company or trust derived from mining

Operations 25

14(2)(h) Taxable income of person engaged in approved BOOT or

BOT arrangement: First five years of the arrangement 0

Second five years of the arrangement 15

14(2)(i) Taxable income of industrial park developer (after being taxed

at 0% for the first five years of his operations as such) 25

14(2)(j) Taxable income of operator of a tourist facility in approved

tourist development zone (after being taxed at 0% for the first 25

five years of his operation as such)

Operator of a tourist facility where 60% or more of the 20

turnover from such operations is in foreign currency

14(3) Taxable income of manufacturing company which exports

50% or more of its output 20

The rate of income tax that generally applies to companies is 25% of taxable income and an

AIDS levy of 3% of tax payable, giving an effective rate of 25.75%.

WITHHOLDING TAXES

Residents

Withholding tax on tenders 10%

Resident shareholder’s tax – By a company listed on the ZSE 10%

Resident shareholder’s tax – By any other company 15%

Residents’ tax on interest from financial institution 15%

Residents’ tax on interest from financial institution on fixed term deposits 5%

Non-residents’ tax

Non-residents shareholder’s tax – by a company listed on the ZSE 10%

Non-resident shareholder’s tax – by other company 15%

Non-resident tax on interest Nil

Non-resident tax on certain fees and remittances 15%

Non-resident tax on royalties 15%

NB: Reduced rates may apply to non-residents where a double taxation agreement (DTA) exits

NUST 2018 CTA 2 TAX MODULE

PAGE 22

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

4. OUTLINE OF THE TAX SYSTEM

LEGAL FRAMEWORK

In terms of section 6 of the Income Tax Act (Cap 23:06) there shall

be charged, levied and collected income tax calculated on taxable

income for the benefit of the Consolidated Revenue Fund.

The calculation of a taxpayer’s tax liability shall be made by reference to:-

- the taxable income of the taxpayer in the year of assessment

- the appropriate rates of tax per the charging act for the year ; and

- the credits* to which taxpayer is entitled to per the charging act for that

year. (section 7)

* Only taxpayers who are natural persons are entitled to tax credits.

The basic model for calculating any taxpayer’s (individuals, trusts and companies)

taxable income is as follows:-

Accruals and total receipts in tax year

Less Amounts proved by taxpayer to be capital in nature

= Gross Income (section 8)

less Exemptions (section 14 and 3rd schedule)

= Income

less Allowable Deductions (section 15 and various schedules)

= Taxable Income

Sections 8, 14 and 15 are cornerstones of Zimbabwe Income Tax

legislation.

NUST 2018 CTA 2 TAX MODULE

PAGE 23

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

STUDY UNIT 1.1

ADMINISTRATIVE FRAMEWORK

1.1 Administration

The administration of all taxes (Value Added Tax, Capital Gains Tax, Income Tax, etc.)

fall under the responsibility of the Zimbabwe Revenue Authority (ZIMRA), which

Authority came into being with effect from 19 January 2001. The Commissioner-General

of the Zimbabwe Revenue Authority is vested with the power and responsibility of

administering the tax statutes. He does this through regional offices and ports established

across the country.

1.1.1 Returns and Assessments

Every year, three to four months after the end of a tax year the Commissioner publishes a

notice in the most commonly read press inviting taxpayers to obtain tax returns from their

nearest tax office; truthfully complete them and return them to the respective offices for

assessment. The duty to obtain a tax return rests with each individual taxpayer who falls

within the specifications outlined in The Commissioner’s public notice.

Self-assessment legislation was introduced with effect from 1 January 2007. Taxpayers,

so specified by the Commissioner General as being those registered or required to have

registered under Category “C” for Value Added Tax (VAT) in terms of the VAT Act as

at 31st December 2007 and thereafter or registered under the Banking Act or registered

under the Insurance Act, are required to furnish self-assessment returns within four

months from the end of the tax year. Employees paying Pay As You Earn (PAYE) under

the Final Deduction System (FDS) are not liable to furnish self-assessment returns unless

specifically requested to do so. Under the self-assessment legislation, the return will

constitute an assessment on either the due date of furnishing the return or on the date that

it is actually furnished.

Self-assessment returns are due for submission to ZIMRA within 4 months of the end of

the tax year i.e. by 30 April.

Notwithstanding the lodgement of the self-assessment return, the Commissioner General

is still empowered to raise an assessment where he has justifiable reasons for doing so.

All employers have been placed on FDS. Under the FDS, any employee who receives

employment income only (i.e. has no source of income other than remuneration), does not

need to submit a tax return. The employer is responsible for deducting the correct amount

of PAYE for the year, and no further return needs to be made to the employee.

The Commissioner General is empowered to estimate any taxpayer’s taxable income if

one fails to submit a return. In addition to the tax payable, the Commissioner is also

empowered to impose penalties for any default. These penalties are 100% of the basic tax

chargeable. Section 46 outlines some grounds for penalties.

It is a legal requirement for P.A.Y.E. to be deducted from all emoluments payable to

employees on a monthly basis. The P.A.Y.E. withheld has to be remitted to the

Commissioner within 10 days from the end of the month to which such P.A.Y.E. refers.

The penalty for late payment of PAYE is 100% of the tax payable, and interest is also

charged on late payment at a rate of 10%. (See sections 73 and 74 as read together with

schedule 13.)

NUST 2018 CTA 2 TAX MODULE

PAGE 24

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

The PAYE remittance form [P2 Form] must be completed and submitted with the PAYE

due.

Taxpayers who are not employees, but are in receipt of other income, (e.g. sole traders,

consultants and companies), are required to be on Quarterly Payment Dates (Section 72).

Under this scheme the taxpayers pay their estimated tax liabilities, for the current tax year

in which they are trading, in four instalments on dates allocated throughout the year, as

follows:

25 March 10% of tax payable

25 June 25% of tax payable

25 September 30% of tax payable

20 December 35% of tax payable

Representative Taxpayers

The duties and rights of representative taxpayers are outlined in the Income Tax Act. The

Commissioner of Taxes also has remedies against defaulting representatives. Where a

representative has met an obligation of the principal out of his resources, he is empowered

by the Act to seek restitution from the principal.

The administrative sections of the Act are fairly simple to read. Students should read them

in order to have an understanding of the overall administrative framework.

1.1.2 Income Tax Objections

1.1.3 When Can An Objection be Made?

When a person is not satisfied with the assessment issued by ZIMRA, they may

object to all or part of the assessment issued.

Objections may be lodged against decisions made by the Commissioner. Such

objections may be on the liability for registration, the cancellation of a registration,

the refusal by the Commissioner to authorize a refund or a ruling which the registered

operator may have good reason for disagreeing with.

1.1.4 Lodging an Objection – Section 62

A person wishing to make an objection to the Commissioner’s assessment or

decision must:

Put the objection in writing

Specify in detail the grounds of the objection

Submit the objection within 30 days after the date of the decision or assessment. In the

event of a dispute, the date of the assessment or decision will be the date the registered

mail was posted to the person raising the objection.

NUST 2018 CTA 2 TAX MODULE

PAGE 25

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

If the objection is received by the Commissioner within the stipulated time period, the

Commissioner will either:

Alter the decision

Alter or reduce the assessment, or

Disallow the objection

A written notice must be sent to the person objecting to the Commissioner’s

ruling/assessment etc. informing him of his decision.

1.1.5 Grounds of Objection

The grounds of objection should be stated clearly and it is important to raise all the

grounds at the time of objection. The Commissioner may, on good cause shown, give

leave to the objector to amend or add to the grounds.

1.1.6 Late Objections

If there is a delay in lodging a written objection, the Commissioner may accept it

provided good reasons are given for the delay. If the objection is not lodged, the

assessment/decision becomes final after 30 days.

1.1.7 Appeals – Section 65

An appeal is only lodged if and when a person’s objection was disallowed. A taxpayer

must appeal against the disallowance of the objection within 21 days of the date of the

notice,

Alternatively if the Commissioner has not notified the person who lodged the objection

of his decision on it within 3 months after receiving the objection, then the objection

shall be deemed to have been disallowed.

An appeal can be made to the High Court or to the Special Court depending on the

nature of the dispute.

The appeal must be:-

Made in writing

Lodged with the Commissioner within 21 days after the date of the

notice of disallowance of the objection.

If there is a delay in the lodging of a written appeal, the Commissioner may condone

the delay, depending on the reasons.

The appellant is limited to the grounds of objection stated in his original objection

unless, on good cause shown, leave is given to amend the grounds.

1.1.8 12th Schedule

The Special Court shall have all the powers of the High Court.

After providing the notice of appeal within 21 days, the taxpayer must prepare the

“Applicant’s Case” statement with the Commissioner in duplicate within 60 days of the

date of the notice of appeal.

The Commissioner shall within 60 days of receipt of the appeal case prepare the

“Commissioner’s Case”

NUST 2018 CTA 2 TAX MODULE

PAGE 26

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

1.1.9 Tax Amnesty

In order to encourage taxpayers to voluntarily regularise their tax affairs,

effective from the 1st of October 2014, a Tax Amnesty was granted to

taxpayers who disclosed their tax obligations in respect of any irregularities

arising from any tax or duty administered by the Zimbabwe Revenue

Authority, within a period of six months from the 1st October 2014 to 31st

March 2015.

The amnesty coved all tax irregularities in respect of the period 1 February

2009 to 30 September 2014.

In terms of the Amnesty provisions the Commissioner could absolve

taxpayers from the following:

Prosecution for false declarations or tax evasions

Payment of interest and penalties on tax covered

Prosecution for non-submission of tax returns or payment of tax

Penalties for fraud, negligence or wilful default with respect to covered tax.

When amnesty has been granted, taxpayers will be required to pay the

outstanding tax by 31st December 2015 or any further period as may be

granted by the Commissioner.

Amnesty granted could be withdrawn where a taxpayer made false declaration in

the application for amnesty to the Commissioner, defaults from the payment plan

agreed, or without reasonable grounds fail to pay the current tax or duty liabilities

in full and by the due dates.

Taxpayers who made an early payment of the assessed tax qualified for a

discount.

Amnesty for interest and penalty

With effect from 1 December 2017, an amnesty for interest and penalties for

outstanding taxes accrued up to 1 December 2017 is applicable to taxpayers

who come forward and settle their tax obligations by 30 June 2018.

NUST 2018 CTA 2 TAX MODULE

PAGE 27

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

STUDY UNIT 1.2

GROSS INCOME

Gross Income is defined as:-

the total amount ..

received by or accrued to or in favour of a person..

or deemed received or accrued..

in any year of assessment…

from a source within or deemed to be within Zimbabwe… excluding

amounts proved by the taxpayer to be of a capital nature.

1.2 Components of Gross Income

1.2.1 Amount

o Section 2 of the Act defines “amount” as money or any other property corporeal or

incorporeal having an ascertainable money value.

1.2.2 Received By

o The words “received by” means “received by the taxpayer on his own behalf for his

own benefit” (Geldenhuys v C.I.R., 14 S.A.T.A. 419). A person cannot, therefore, be

taxed on amounts received by him for the benefit of another person, e.g., rent

received by an estate agent on behalf of a client landlord is not gross income in the

hands of the estate agent.

o It is important to note that a deposit received by a person who sells commodities in

returnable containers constitutes gross income unless the deposit is received only in

trust and cannot be mixed with the taxpayer’s own funds, or there is an obligation on

the customer to return the container and the deposit is merely security to ensure

performance of the obligation.

o The case of S.I.R v. Silverglen Investments (Pty.) Ltd., 30 S.A.T.C. 199 has thrown

considerable doubts on the proposition that the phrase “received by or accrued to”

bestows on the Commissioner the right to tax income on a receipts or accruals basis,

as he wishes (C.I.R. v. Delfos, 6 S.A.T.C. 92). In practice, ZIMRA does not allow

taxpayers to render returns other than on an accruals basis.

o An important exception to the general rule is the use of this phrase to include payments

received in advance for the supply of goods or services in the future in gross income

at the time of receipt, and not allow the payments to be carried forward until the date

of accrual from an accountancy point of view, but care must be taken

not to tax moneys voluntarily advanced before the date of accrual has arrived.

o Where, for any reason, tax has not been imposed on an amount in the year of accrual

it may be included by the Commissioner in gross income in the year of receipt

(Maguire v. C. of T., 28 S. A. T.C. 146: J.232). There is, of course, a necessary

implication that no amount can be taxed twice –as a receipt and as an accrual.

NUST 2018 CTA 2 TAX MODULE

PAGE 28

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

1.2.3 Accrued to

o Income accrues when a taxpayer becomes entitled to it or when it is due and payable

to the taxpayer.

o The meaning of the word “accrued” is not settled law. In Lategan v C.I.R., 2 S.A.T.C.

16, the judge concluded that income accrues to a person when one becomes “entitled

to it.” the income. Section 10(7) of the Act affirms the decision in the Lategan

case.The courts, however, both here and in South Africa, appear to be moving towards

the views expressed in Delfos’s case and in Hersov’s Estate v. C.I.R., 21 S.A.T.C. 106,

that “accrued” means, due and payable”.

o Delfos vs CIR in which the learned judge asserted that income accrues when it

becomes “due and payable”.

o ZIMRA follows the latter approach where there is any conflict and has found support

for this view in the cases of Rishworth v. S.I.R., 26 S.A.T.C 275, and I.T.C. 1068. 27

o In the great majority of cases, of course, the application of either test will give the same

result. The essential difference is that, under Lategan’s rule, a right to payment in a

future year gives rise to an accrual which would be taxed at “present value:

Under the other interpretation there is only an accrual when the taxpayer has the right

to claim payment in the year of assessment – i.e., when the money has become due

and payable.

o Partnerships present a particular problem in accrual. Although gross income may

accrue to a partnership, say from dentistry, daily throughout the year, there is no accrual

to the individual dentist partners until the conclusion of the agreed period for the taking

of account of the profits or dissolution of the partnership (Sacks v. C.I.R., 13 S.A.T.C.

343 and I.T.C. 1042, 26 S.A.T.C. 189: Reynolds v. C. of T., J. 187).

1.2.4 Deemed received or deemed accrued:

o The Commissioner will invoke receipt or accrual under the circumstances outlined in

section 10, although the income might not have been physically received. An amount

will be deemed to have accrued to a person if it has been invested on behalf of the

person.

o Section 10(2) provides that partnership business income accrues on the accounting

date. This provision reinforces the decision established in the case Sacks v CIR.

Sections 10(3) to 10(6) provide for the taxation of income that accrue from donated

assets.

o Section 10(3) deems income accruing to a minor child as a result of a donation,

settlement or other disposition, to be income accruing to the parent.

o Section 10(4) counteracts tax avoidance schemes. If a minor child becomes entitled

to income in pursuance of a donation, etc. made by a third party, i.e. a person other

than his parent and the parent or near relative of the minor child has made a donation

to the third party or his near relative, the child’s income will be taxable in the hands

of the parent.

1.2.5 From a source in, or deemed in Zimbabwe:

o Income is not taxable in Zimbabwe unless it is from a Zimbabwean source or has been

deemed to be from a Zimbabwean source (section 12). Source is one of the words

used extensively in tax matters, but is not defined in the Act. Although there is no

definition of “source” in the statutes, many legal precedents have dealt with the word

NUST 2018 CTA 2 TAX MODULE

PAGE 29

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

at length. Specific circumstances under which income is deemed to be from a

Zimbabwean source are outlined in section 12 of the Act. The most common

examples are interest and dividends from outside Zimbabwe which are deemed to be

from a Zimbabwean source in terms of section 12(2).

o The following quotations are from celebrated tax cases on source of income:-

(a) Lord Atkin, Privy Council, UK: - in Rhodesia Metals (in liquidation) v COT:-

“…. As a hard matter of fact the only proper conclusion appears to be that

the company received the sum in question from a source within the territory

(Rhodesia), viz the claims they had acquired and developed there for the very

purpose of obtaining the particular receipt….”

“…. Source means.. not a legal concept but something which the practical

man would regard as the real originating cause of the income….”

(b) Watermayer CJ in CIR v Lever Bros and Unilever Ltd 1946 AD 441:-

“ …. source of receipts, received as income, is not the quarter whence they come, but the

originating cause of their being received as income …. the quid pro quo which he gives

in return for which he receives them …. “

o The following are some important legal precedents:-

o Directors’ fees - ITC 235 (1932) 6 SATC 262 :- “It is quite clear that the director’s

fees are derived from the fact that the appellant is a director of the company, and

therefore must be assumed to have earned the fees at the headquarters of the

company. It is there only that he can make his voice heard as a director.”

o Interest - “ ….. Provision of credit is the originating cause hence the place where

exercised is the source ….” This was the majority decision in CIR v Lever Bros

and Unilever Ltd 1946, 14 SATC1.

o Sale of mineral rights/immovable property - Some mining claims were bought and

sold in the Territory in a profit making scheme ….. source is the Territory ….

(where the immovable property was situated).

o International Trade - Transvaal Association Hide & Skin Merchants v COT

Botswana Court of Appeal (May 1962 SATC 97). Company bought hides from a

Botswana Abattoir via Botswana subsidiary, treated them with salt and bound them

into bales in Botswana. The company headquarters in Johannesburg marketed the

hides and gave delivery instructions to the Botswana subsidiary to deliver direct to

customers, whether in Botswana or outside Botswana.

o The decision was that there were two activities: - curing and marketing. Curing was

the dominant activity, hence the source was deemed to be Botswana. However, it

appears from ITC 1103 (1967) 29 SATC 35, that it is possible for the source of

income to be found partly in one country and partly in another.

NUST 2018 CTA 2 TAX MODULE

PAGE 30

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

Components of Gross Income Continued

Gains on Stock Market - CIR v Black 1957 (3) SA 536 (A) 21 SATC 244. Important factors identified

in this case were the employment of capital and the undertaking of business. It was ruled that the dominant

factor was the

o carrying on of transactions hence the source was deemed to be London, where shares were

bought and sold …., though under instruction from South Africa.

Services Rendered - (COT V Shein 1958 14 SATC 12)

“ …. the source of earnings is the work done in return for those earnings …. It now seems settled

law that generally the source of such income is the place where the services for which the salary

is paid have been rendered.”

o Royalties - Millin v CIR 1928 SATC 170 The originating cause of the author’s royalties is the

wit and labour exercised in writing the book in South Africa, therefore the source is South Africa

(not England were the book was published).

o Rental Income - COT v British United Shoe Machinery (SA) (Pty) Ltd 1964 26 SATC 163

o Immovable property: source is the country/place where property is situated.

o Movable property : source is the country where lessor carries out his business.

o Source: means not a legal concept but something, which the practical man would regard as the

real originating cause of the income. The following have been ruled by the courts as the true

sources of the respective incomes:

Nature of Income True source

Dividends Where the share register is kept

Income from business operations Where the business is being conducted

Rent from immovable property Where the immovable property is situated

Rent on movable property In the case of long leases (5 years and

above) the source is the place where

the lessee uses the asset. In the case of

short leases the source would be where

the lessor conducts his business

Income from services rendered Where the services are rendered

Director fees The head office of the company

Royalties Where the author exercised his wits,

labour and intellect

Interest Where the credit was provided

Annuities The act or document under which it is

created

NUST 2018 CTA 2 TAX MODULE

PAGE 31

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

1.2.6 Deemed Source – Section 12

The definition of “gross income” modifies the fundamental principle of taxing only income that

has its source in Zimbabwe. Section 12 sets out the circumstances in which certain types of income

are subject to tax in this country although the real source may be elsewhere or where the

determination of the actual source presents considerable practical difficulties.

Section 12(1)(a) – Sale of goods by a person conducting business operations – The proceeds

made in Zimbabwe for the sale of goods are deemed to be from a source in this

of any contract

country.

Section 12(1)(b) – Income from services rendered – Receipts for any services rendered in the

carrying on in Zimbabwe of any trade irrespective of where or by whom payment is made, are

deemed to be from a source in Zimbabwe.

Section 12 (1) (c ) – Income from services rendered by an employee (includes

a company director), who is

ordinarily resident in Zimbabwe, during a period of temporary absence from

Zimbabwe shall be deemed to be from a source within Zimbabwe. “Temporary absence” means

an absence for a period not exceeding in the aggregate 183 days in any year of assessment.

Section 12 (1) (d) – Income from services rendered to the Zimbabwe Government either within or

outside Zimbabwe shall be deemed to be from a Zimbabwe source. However an amount received

by or accrued to or in favour of a person by virtue of services rendered outside Zimbabwe shall

not be deemed to be from a source within Zimbabwe if the person was not ordinarily resident

outside Zimbabwe solely for the purpose of rendering such service.

Section 12(1) (e) – Pensions or annuities arising from services rendered which are granted by any

person wherever resident, the government of the former Federation or the Zimbabwe government

shall be deemed to be from a source within Zimbabwe. However provisos eliminate all or part of

some of those pensions arising in the following circumstances:-

A pension for services rendered wholly outside Zimbabwe is, except where the services were

rendered to the Zimbabwean government and the remuneration for those services was

deemed to be from a Zimbabwean source under the preceding subsection.

A pension or part of a pension granted by the former Federation if a particular condition is

fulfilled. It is necessary to check the various tests, which are set out and if none of these apply

then the pension will remain taxable. On the dissolution of the former federation, federal

officers were accorded a home territory on the basis of criteria, which covered his place of

birth, in which territory he had the longest services and other factors.

Section 12(2) – Foreign interest and foreign company dividends shall be deemed to be from a

Zimbabwe if at the time the income accrues the person is ordinarily resident in

source within

Zimbabwe.

Section 12(3) – An annuity (purchased from an insurance company) from a source outside

Zimbabwe shall be deemed to be from a source within Zimbabwe if the person was ordinarily

resident in Zimbabwe when he first became a member of the fund.

NUST 2018 CTA 2 TAX MODULE

PAGE 32

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

1.2.6 Capital and Revenue: Accruals and outlays in general

of gross income specifically excludes amounts proved by the taxpayer to be capital

The definition

in nature.

The onus of proving that an amount is of a capital nature and thus not part of gross income and,

ultimately, not liable to tax rests fairly and squarely on the taxpayer.

1.2.7 Fixed and Floating Capital

The words “of a capital nature” are not defined. It is not a precise term and has led to much

difficulty, as no single infallible test has emerged from the welter of cases. A rough guide is to

look at a receipt or accrual as would an accountant, to determine whether or not it was on revenue

or capital account – if the amount flowed from the asset but the asset remained in ownership

(e.g., rent from a building) it is on revenue account but if it flowed from the sale or exchange of

the asset (e.g., factory no longer required by a manufacturer) it is on capital account. In so doing,

however, it is essential to bear in mind the difference between “fixed” and “floating” capital.

Fixed capital is the factory of a manufacturer, the delivery van of a grocer, the X-ray plant of a

radiologist, etc., whereasfloating capital is that which “is consumed or disappears in the very

process of production”.

(C.I.R. v. George Forest Timber Co. Ltd., 1 S.A.T.C. 20) and which, consequently, gives rise

to income on revenue account. Such floating capital can be money in the hands of moneylenders

(the unreported case of: J. & A. Cowan (Pvt) Ltd, v C. Of R., J.211), or stocks and shares in the

hands of dealers (C. Of T. V. B.S.A. Company Investments Ltd., 28 S.A.T.C. 1: J.221), as well

items such as raw materials of the manufacturer or packets of soap in the

as the more usual

grocer’s store.

Another useful guide is to apply the metaphor that capital is a tree and income is its fruit e.g. an

investor’s holding in 5 per cent. Stock, as compared with the interest thereon. This is most useful

win. Certainly, these

when considering fortuitous accretions, such as an inheritance or a lottery

are not the fruit of any tree and are, accordingly, of a capital nature,

Examples of other amounts which are capital in nature are the proceeds of life insurance policies

and the proceeds of the sale of assets in which the taxpayer does not trade, e.g., the sale of a

house in Harare by an employee transferred to another town.

Unless the beneficiary continues to carry on the appropriate trade or mixes the assets with his

existing trading assets the realisation of inherited assets results in a capital accrual. This is so

even if it has been necessary to expend money, time or energyon, for example, a growing crop to

bring it to fruition or the reduction of a piece of land saleable parcels.

35 S.A.T.C. 235: Newmarch

Darwendale Estate Ltd., v. C. of T., J.329 and I.T.C. 1196,

Investment and Trust Co. (Pvt) Ltd, v. C. of T., J.331).

NUST 2018 CTA 2 TAX MODULE

PAGE 33

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

Regard must be paid to intention antecedent to the date of acquisition (Lace Proprietary Mines

Ltd, v.C.I.R., 9 S.A.T.C. 349), change of intention (C.I.R., v. Lydenburg Platinum, 4 S.A.T.C.

8) and mixed and dominant intentions (S, v. C. of T., 24 S.A.T.C. 744: Smith v. C. of T., J.95,

v S.I.R., 31S.A.T.C. 163).

C. of T., v. Glass, 24 S.A.T.C 499: J. 110 and African Life Investment Corporation (Pty) Ltd.,

Mixed and dominant intentions and possible change of intention or change in the nature of the

investment (from direct ownership to participation through a company) were all discussed in

Davenport v. C. of T., 34 S.A.T.C. 94: J.316.

That the intention to earn “capital appreciation” does not result in a capital profit is shown by

I.T.C. 1236, 37 S.A.T.C. 237: Indprop Investments (Pvt) Ltd., v C. of T., J. 370. Similarly in the

unreported case “D” v. C. of T,: J.415, where profits on share dealing with inherited funds in

South Africa to provide for retirement were held to be taxable and from a source in Zimbabwe,

being an extension of similar transaction in this country.

1.2.7 Damages and compensation

An amount received by way of damages or compensation for the loss, surrender or sterilisation

of a fixed capital asset or of the taxpayer’s income-producing machine is a receipt of a capital

nature (Glenboig Union Fireclay Co. Ltd., v. I.R.C.., 12 T.C. 427). Such an amount

commonly met with is a receipt in terms of an agreement restraining a taxpayer from selling or

using goods other than those supplied by the payer. Care must, however, be used, as certain

similar agreements provide for the payment to be by way of discounts or rebates, and the

receipts

is, therefore, of a revenue nature in these cases and not to be excluded from gross

income.

Burmah Steamship Co. Ltd., I.R.C. 16 T.C. 67, provides a useful test-whether the damages or

compensation go to fill a hole in the profits of the taxpayer or whether they go to fill a hole in

his fixed capital assets. If the latter, they are of a capital nature.

1.2.8 Restraint of Trade

It is essential to remember, at this stage, that none of these tests for distinguishing income from

capital mentioned in the preceding paragraphs is necessary if the amount received or accrued

(although possibly of a capital nature) falls within the terms of paragraphs (a) to (t) of the

definition. These are dealt with in detail below and, in considering them, it must be borne in

mind that in every case the source must be Zimbabwe.

Legal precedence has recognised the principle that a person’s right to trade freely is an

incorporeal asset and that an amount received for a restriction on that right is

compensation for its sterization. Receipts in respect of restraint of trade are thus

generally of a capital nature.

Capital Receipts – Gross Income excludes any amount so received or accrued, which is proved

by the taxpayer to be of a capital nature. Examples of capital receipts are, insurance proceeds,

goodwill, lottery wins, inheritance and proceeds from sale of assets in which taxpayer does not

trade. A rough guide to determine whether income is of revenue or capital nature would be as

follows:-

If the amount flowed from the asset but the asset remained in ownership it should be

considered as revenue.

If the amount flowed from the sale or exchange of an asset it should be considered as capital.

Capital receipts may be referred to as the tree while revenue receipts may be regarded as the fruit.

NUST 2018 CTA 2 TAX MODULE

PAGE 34

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

1.2.9 Specific Inclusions in Gross Income

Although the definition of gross income outlined in section 8(1) is all embracing, paragraphs

8(1)(a) to 8(1)(t) outline various types of amounts which must be included in gross income

whether or not they may appear like they are capital in nature.

1.2.10 Section 8(1)(a) :

Annuities/pension receipts:-

Definition:-

“…. an annual payment in perpetuity for the life of grantee or for a limited period ….”. ITC 826

(1956) 21 SATC 189.

Characteristics:-

- Claimable from another person or body

- must be a fixed annual amount (which can be divided into monthly or weekly payments)

- must be repetitive for a period ITC 761 (1952) 19 SATC 103

Types:-

Purchased annuity

- only interest content is taxable if there was no tax deduction or credit allowed at or during time of

payment of contributions.

Basic formula for determining taxable portion

I= A–P

N

w P P = annual payments (gross annuity

h = received per year)

e N N = number of annual payments expected g

r = A = purchase price of annuity (excluding r

e A any deductions contributions). a

: n

= t

e

d

Example

Purchase price of annuity $40,000

$ Annual receipts$ $ 5,000

Expected number of years payable 10 years

Annual interest content = 5, 000 – 40,000

10 years

= 1,000

NB: - All amounts received after the expiry of the 10 years are taxable in full.

NUST 2018 CTA 2 TAX MODULE

PAGE 35

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

Annuity from gift or legacy:

This type of annuity is taxable in full, even if paid out of capital

funds.

Annuity from services rendered:

This annuity is taxable in full except where portions of contributions

were disallowed as a deduction for tax purposes - in such cases the

taxable portion is determined using the formulae in the purchased

annuity section above.

S8 (1) (b) Income for services rendered - e.g. salaries, commission, cash in lieu of leave

etc.

S8 (1) (c) Lump sum receipts of accruals from pension or benefit funds. detailed in the

1st schedule of the Income Tax Act [Chapter 23:06])

S8 (1) (d) and (e) Premiums and lease improvements. [Provisions detailed in later section of this study

Guide].

S8 (1) (f) Advantages or benefits from employment, service, office or gainful

employment.

The value of the benefit is determined by reference to: Value to

employees in the case of occupation of quarters, residence or furniture;

and cost to employer in the case of any other benefit

Some examples:

Soft / loans: -

lf loans are awarded to an employee at an interest rate in excess of 5% plus

LIBOR rate , there is no benefit accruing to employee.

Motoring benefits:-

(As outlined in the rates section of this guide).

Housing: in municipal areas- The benefit is determined by reference to the market value;

outside municipal areas value - The value is determined as a maximum of 12,5% of

salary or 7% of cost of house or any other amount proposed by the entity providing

the benefit, but subject to approval by the Zimbabwe Revenue Authority.

NUST 2018 CTA 2 TAX MODULE

PAGE 36

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

furniture:- annual benefit is 8% of cost of furniture items

passage:- see definition, apportion if dual purpose.

allowance: - taxable in full except portion utilised on employer's business.

NB:- Some benefits availed by the State to its employees are exempt (para 4(d)

of 3rd schedule.) and specifically transport , housing and representation

allowances are exempt.

The Income Tax Act in section 8, Part II of the definition of advantage or benefit provides that

the grant of an advantage or benefit other than the payment of an allowance, shall be determined:

(a) in the case of occupation of or use of quarters, residence or furniture,

by reference to its value to the employee, and

(b) in the case of any other advantage or benefit, by reference to the cost

to the employer.

NUST 2018 CTA 2 TAX MODULE

PAGE 37

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

S8(1)(g) Timber and growing crops sold with land

Where land is sold with growing crops or timber which in the opinion of the

Commissioner General has been grown for sale, the market value of such crops or

timber is taxable income, except where such assets have been acquired through

inheritance or donation and the assets do not form part of trade assets.

S8(1) (h) Closing stock, including stock consumed or assigned by trader.

S8(i) mining recoupments

S8 (j) – (k) recoupments re: capital expenditure and concessions

S8 (1)(I) recoupments of rent premium where this arises as a result of acquisition of property

formerly leased. Taxpayer can elect to spread taxation of these recoupments over six

years.

S8 (1)(m) Subsidies-

S8(1)(n) Portion of lump sum commuted in excess of one-third of total pension

entitlement from retirement annuity fund.

S8(1)(r) Portion of commutation from pension fund in excess of one-third of pension entitlement.

S8(2) Where amount accrued differs from amount actually received due to fluctuations in

exchange rates, effect must be given to tax amount actually received.

NUST 2018 CTA 2 TAX MODULE

PAGE 38

Downloaded by Phebieon Mukwenha (pmukwena3@gmail.com)

lOMoARcPSD|4169582

STUDY UNIT 1.3

1.3 EXEMPTIONS

Paragraph 1 exempts the receipts and accruals of Local Authorities, The Reserve Bank of

Zimbabwe, The Zambezi River Authority, The Environment Management Board and The People’s

Own Savings Bank.

Paragraph 2 exempts the receipts and accruals of for example:

agricultural, mining and commercial societies not operating for the profit of the