Professional Documents

Culture Documents

(Juan Ramirez) Accounting For Atives Advance (BookFi - Org) (1) 79

Uploaded by

JasmeetOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(Juan Ramirez) Accounting For Atives Advance (BookFi - Org) (1) 79

Uploaded by

JasmeetCopyright:

Available Formats

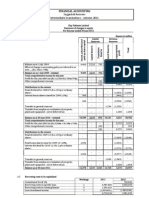

Hedging Foreign Exchange Risk

63

Expected Purchase Fair Value

The changes in fair value of the expected cash flow were calculated as follows:

Expected cash flow in USD

Spot rate

Cash flow value in EUR at

spot

Difference

Discount factor for 30

June 20X5

Cash flow fair value due to

spot

Cash flow fair value due to

spot change

Oct 1, 20X4

Dec 31, 20X4

Mar 31, 20X5

Jun 30, 20X5

100,000,000

/ 1.2350

80,972,000

100,000,000

/ 1.2700

78,740,000

100,000,000

/ 1.2950

77,220,000

100,000,000

/ 1.3200

75,758,000

0

x 0.9804

<2,232,000>

x 0.9839

<3,752,000>

x 0.9901

<5,214,000>

x 1.0000

<2,196,000>

<3,715,000>

<5,214,000>

<2,196,000>

<1,519,000>

<1,499,000>

Retrospective Tests

A retrospective test was performed at each reporting date and at hedge maturity. ABC used

the ratio analysis method. The ratio compared (i) the change (since hedge inception) in the

fair value due to changes in the spot rate of the expected cash flow with (ii) the change (since

hedge inception) in fair value due to changes in the spot rate of the FX forward. The hedge

was assumed to be effective retrospectively if the ratio was between 80 % and 125 %.

All the changes in fair value of the FX forward due to changes in the forward points were

excluded from the hedge relationship, and consequently were considered ineffective. The hedge

relationship terminated on 31 March 20X5, so no further calculations of the hedge effective

and ineffective parts were needed after that date.

31 Dec 20X4

31 Mar 20X5

Cumulative fair value change of expected cash

flow due to spot movement

Cumulative fair value change of hedging

instrument due to spot movement

Retrospective test: Ratio

<2,196,000> <3,715,000>

Cash flow fair value change during period

Forward fair value change due to spot rate

Hedge: effective part

<2,196,000> <1,519,000>

2,196,000

1,519,000

2,196,000

1,519,000

Hedge: ineffective part due to spot rate

Forward fair value change due to forward points

Hedge: total ineffective part

2,196,000

3,715,000

100 %

100 %

0

<351,000>

<351,000>

0

<317,000>

<317,000>

Accounting Entries

The required journal entries were as follows:

1) To record the forward contract trade on 1 October 20X4:

No entries in the financial statements were required as the fair value of the forward contract

was zero.

You might also like

- Rupees in 000: Page 1 of 6Document6 pagesRupees in 000: Page 1 of 6Royal XpreSsNo ratings yet

- B407F Consolidated Cash Flow StatementDocument19 pagesB407F Consolidated Cash Flow StatementTomson ChungNo ratings yet

- Ch17,21,19 NotesDocument24 pagesCh17,21,19 NotesScott ZiplowNo ratings yet

- Cash FlowDocument1 pageCash FlowsandipNo ratings yet

- IND AS 33 Addl QuestionsDocument6 pagesIND AS 33 Addl QuestionsTejas RaoNo ratings yet

- Illustration 1: Debt Component Equity ComponentDocument10 pagesIllustration 1: Debt Component Equity ComponentTrang LêNo ratings yet

- BFM - Case Studies PDFDocument23 pagesBFM - Case Studies PDFDevety Dileep RoyalNo ratings yet

- Inflation AccountingDocument34 pagesInflation AccountingUnbeatable 9503No ratings yet

- Example of Contingent RentalsDocument62 pagesExample of Contingent Rentalsdotaadik11No ratings yet

- Chapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document26 pagesChapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (1)

- 2.3 Paper 2.3 - Accounting For Business - 1Document6 pages2.3 Paper 2.3 - Accounting For Business - 1Himanshu SinghNo ratings yet

- CMA April - 14 Exam Question SolutionDocument55 pagesCMA April - 14 Exam Question Solutionkhandakeralihossain50% (2)

- Daily Trade Journal - 31.10.2013Document6 pagesDaily Trade Journal - 31.10.2013Randora LkNo ratings yet

- Daily Trade Journal - 24.12.2013Document6 pagesDaily Trade Journal - 24.12.2013Randora LkNo ratings yet

- Acc 401 Module 5 AnswersDocument14 pagesAcc 401 Module 5 AnswersJoe IdnfuyNo ratings yet

- Assignment Solution - Yield Curve and HedgingDocument12 pagesAssignment Solution - Yield Curve and HedgingAkashNo ratings yet

- Installment Sales - ReportDocument50 pagesInstallment Sales - ReportDanix Acedera100% (1)

- Bfmnumericalsallmods 150103081956 Conversion Gate01Document39 pagesBfmnumericalsallmods 150103081956 Conversion Gate01Nikhil GhumareNo ratings yet

- Receivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearDocument6 pagesReceivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearJC Del MundoNo ratings yet

- 1 - 4-1Document11 pages1 - 4-1sandeshjhanbia021No ratings yet

- Chapter 6 - Effective Interest MethodDocument62 pagesChapter 6 - Effective Interest MethodCeline Therese BuNo ratings yet

- Chapter 26 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document31 pagesChapter 26 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Tender Evaluation ExampleDocument15 pagesTender Evaluation ExampleNhial Panom PuotNo ratings yet

- Exercise 13.22Document3 pagesExercise 13.22MynameNo ratings yet

- Yield Curve: DR HK Pradhan XLRI JamshedpurDocument38 pagesYield Curve: DR HK Pradhan XLRI JamshedpurzerocoolrklNo ratings yet

- FAR MA-2023 Suggested AnswersDocument10 pagesFAR MA-2023 Suggested AnswersMd HasanNo ratings yet

- Daily Derivative 23 September 2013Document10 pagesDaily Derivative 23 September 2013hemanggorNo ratings yet

- Pulic Sector AssignmentDocument11 pagesPulic Sector AssignmentAlex Nkole MulengaNo ratings yet

- Accounting For Changes in Acctg Policy and Estimate and Subsequent EventsDocument20 pagesAccounting For Changes in Acctg Policy and Estimate and Subsequent EventsGonzalo Jr. RualesNo ratings yet

- SolutionCH9 CH11Document9 pagesSolutionCH9 CH11qwerty1234qwer100% (1)

- Financial Reporting Tutorial QSN Solutions 2021 JC JaftoDocument31 pagesFinancial Reporting Tutorial QSN Solutions 2021 JC JaftoInnocent GwangwaraNo ratings yet

- Narnolia Securities Limited Stock Market Diary 20.12.2013Document4 pagesNarnolia Securities Limited Stock Market Diary 20.12.2013Narnolia Securities LimitedNo ratings yet

- Tutorial Week7Document14 pagesTutorial Week7Yaonik HimmatramkaNo ratings yet

- All 9 Homeworks FAR 1Document22 pagesAll 9 Homeworks FAR 1Ahmed RazaNo ratings yet

- Funds Flow AnalysisDocument16 pagesFunds Flow AnalysisGyan PrakashNo ratings yet

- AP 5902Q Liabs Supporting NotesDocument2 pagesAP 5902Q Liabs Supporting NotesEmms Adelaine TulaganNo ratings yet

- Solved Scanner CS Professional Model II, Paper-3 Financial, Treasury and Forex Management (I) AnsDocument13 pagesSolved Scanner CS Professional Model II, Paper-3 Financial, Treasury and Forex Management (I) AnskalbhorkNo ratings yet

- Solutions Chapter 16Document7 pagesSolutions Chapter 16Kakin WanNo ratings yet

- 03-Chapter Three-Installment and Consignment ContractsDocument22 pages03-Chapter Three-Installment and Consignment ContractsHaile100% (1)

- Suggested Answers Intermediate Examinations - Autumn 2011: Financial AccountingDocument6 pagesSuggested Answers Intermediate Examinations - Autumn 2011: Financial AccountingUssama AbbasNo ratings yet

- Case 7 Don't Leave Your Hand in The Cookie JarDocument8 pagesCase 7 Don't Leave Your Hand in The Cookie JarGuang ZengNo ratings yet

- Financial Accounting Cat 1 JonathanDocument14 pagesFinancial Accounting Cat 1 JonathanjonathanNo ratings yet

- Particulars Amount Amount Rs. (DR.) Rs. (DR.)Document14 pagesParticulars Amount Amount Rs. (DR.) Rs. (DR.)Alka DwivediNo ratings yet

- Funds Flow AnalysisDocument16 pagesFunds Flow AnalysisPravin CumarNo ratings yet

- Loss Absorption BalanceDocument2 pagesLoss Absorption BalanceCelineAbbeyMangalindanNo ratings yet

- Revision Questions 2Document12 pagesRevision Questions 2Vivian WongNo ratings yet

- IGNOU ms04 AnsDocument12 pagesIGNOU ms04 AnsmiestalinNo ratings yet

- SamigroupDocument9 pagesSamigroupsamidan tubeNo ratings yet

- 4a Methods of Demand ForecastingDocument44 pages4a Methods of Demand ForecastingMovie PostersNo ratings yet

- Sirius XM Holdings Inc.: FORM 10-QDocument62 pagesSirius XM Holdings Inc.: FORM 10-QguneetsahniNo ratings yet

- 02 FAR02-answersDocument18 pages02 FAR02-answersBea GarciaNo ratings yet

- Financial Accounting 1 Unit 10Document21 pagesFinancial Accounting 1 Unit 10chuchuNo ratings yet

- Far 7 Flashcards - QuizletDocument31 pagesFar 7 Flashcards - QuizletnikoladjonajNo ratings yet

- Notes ReceivableDocument47 pagesNotes ReceivableAlexandria Ann FloresNo ratings yet

- SBFRS 7 Ie (2013)Document9 pagesSBFRS 7 Ie (2013)Tareq ChowdhuryNo ratings yet

- Ma Dec2010Document2 pagesMa Dec2010Ankit BajajNo ratings yet

- Sample Questions and Solutions - Final ExamDocument4 pagesSample Questions and Solutions - Final ExamNadjah JNo ratings yet

- SECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2023 + TEST BANKFrom EverandSECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2023 + TEST BANKNo ratings yet

- SERIES 57 EXAM STUDY GUIDE 2023+ TEST BANKFrom EverandSERIES 57 EXAM STUDY GUIDE 2023+ TEST BANKNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet