Professional Documents

Culture Documents

Flow Lines

Uploaded by

nrd97710 ratings0% found this document useful (0 votes)

21 views1 pageflowlines

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentflowlines

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views1 pageFlow Lines

Uploaded by

nrd9771flowlines

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

810-4-1-.

15 Distinction between Flowlines, Gathering lines and Pipelines for Assessment

(1) Purpose: To establish guidelines and procedures for reporting and assessing

business personal property used in the oil & gas industry.

(2) Flowlines: In small oil or gas fields, flowlines typically serve one wellhead.

Flowlines carry the fluids or gas from the wellhead to and in-between individual vessels in

separation, treating, heating, dehydrating, compression, pumping or other processing

equipment generally located at or near the well site. In multiple well fields producers more

commonly lay flowlines from individual wells to a central facility to perform future production

processes.

(3) Gathering lines: Gathering lines can and do perform some of the same

functions as flowlines, the principal difference being that flowlines are a network of lines

tied to individual wells or equipment which move wellhead fluids or gas to the first point of

accumulation of the same lines from like wells or equipment. Gathering lines are tied to the

flowlines through an intermediary manifold and are the next segment of the gathering

system. If separation, treating, heating, dehydrating, compression, pumping or other

processing has not occurred along the flowline before the fluid or gas is gathered, then the

gathering lines will transport the fluids or gasses through a processing point such as a

central facility. After the oil or gas is processed through the central facility, it must be

moved to a point where it can be sold and/or access a common carrier pipeline.

(4) Common Carrier Pipeline: A pipeline operated for the purpose of transporting a

product from a producer to a user, refiner, purchaser or other owner, usually for a fee or

tariff.

(5) For the purposes of ad valorem taxation, flowlines and gathering lines owned

and controlled by the owner or owners of the wells are to be locally assessed as Class II

business personal property in a like manner as other production equipment located at the

well.

(6) Gathering lines which transport oil or gas of persons other than the owners of

the wells for either a fee or tariff shall be considered common carriers and will be centrally

assessed by the State Revenue Department as Class I pipeline property.

(7) All common carrier pipelines will be assessed by the State Revenue Department

as Class I utility pipelines.

Author:

Authority:

History:

John D. Dewberry

40-7-64

Filed with LRS August 16, 1991, effective January 28, 1992

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Slug Flow: (Sample Model: Slug - Dat)Document7 pagesSlug Flow: (Sample Model: Slug - Dat)nrd9771No ratings yet

- Age Acceleration: DK598X - Book - FM Page 95 Monday, January 24, 2005 11:11 PMDocument10 pagesAge Acceleration: DK598X - Book - FM Page 95 Monday, January 24, 2005 11:11 PMnrd9771No ratings yet

- Nonparametric Statistical Methods: DK598X - Book - FM Page 105 Monday, January 24, 2005 11:11 PMDocument30 pagesNonparametric Statistical Methods: DK598X - Book - FM Page 105 Monday, January 24, 2005 11:11 PMnrd9771No ratings yet

- System Structures: Defn. 2.1 ReliabilityDocument20 pagesSystem Structures: Defn. 2.1 Reliabilitynrd9771No ratings yet

- Reliability Over TimeDocument27 pagesReliability Over Timenrd9771No ratings yet

- Rosen Intel PigsDocument1 pageRosen Intel Pigsnrd9771No ratings yet

- DK598X - Book - FM Page 1 Monday, January 24, 2005 11:11 PMDocument6 pagesDK598X - Book - FM Page 1 Monday, January 24, 2005 11:11 PMnrd9771No ratings yet

- 0927 Glenunga International Secondary School Zone: Norwood/Morialta Marryatville AdelaideDocument1 page0927 Glenunga International Secondary School Zone: Norwood/Morialta Marryatville Adelaidenrd9771No ratings yet

- Field Installed Flanges Ss 202Document1 pageField Installed Flanges Ss 202nrd9771No ratings yet

- Impact Test For CS MaterialDocument1 pageImpact Test For CS Materialnrd9771No ratings yet

- Spec Met CodesDocument28 pagesSpec Met Codesnrd9771No ratings yet

- New Met-Online Api RP 580 Rbi Cert: Matthews Training LTDDocument2 pagesNew Met-Online Api RP 580 Rbi Cert: Matthews Training LTDnrd9771No ratings yet

- Tuboscope PWEPDocument2 pagesTuboscope PWEPnrd9771No ratings yet

- Polyken 2019 PrimerDocument5 pagesPolyken 2019 Primernrd9771No ratings yet

- OrderDocument2 pagesOrdernrd9771No ratings yet

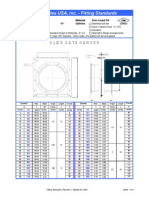

- Slide Gate Damper: Composites USA, Inc. - Fitting StandardsDocument1 pageSlide Gate Damper: Composites USA, Inc. - Fitting Standardsnrd9771No ratings yet