Professional Documents

Culture Documents

Unit 1a

Unit 1a

Uploaded by

akhiljindalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit 1a

Unit 1a

Uploaded by

akhiljindalCopyright:

Available Formats

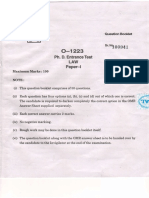

Unit 1

1. Define Banking and its characteristics. Critically examine the provisions of Banking Regulations Act,

1949 in their application to Banking companies and Public Sector Banks.

2. Discuss the role of Reserve Bank of India in the development, control and functioning of Banks. Also

discuss the salient features of the Reserve Bank of India Act 1934.

Unit 2

3. Define Negotiable Instrument and also discuss its features? Enumerate the various kinds of

negotiable instruments?

4. Write explanatory notes on the following:

a) Endorsement in blank and endorsement in full.

b) Liability of drawer and drawee of a cheque.

Unit 3

5. Discuss the various kinds of endorsements and its effects. Enumerate the difference between

negotiation by delivery and by endorsement.

6. Define cheque as given under the Negotiable Instrument Act. What do you understand by 'Crossing

of Cheque'? Discuss the different kinds of crossing and its effects on negotiability and transferability of

the cheque.

Unit 4

7. Discuss the nature and principles of Insurance Law. Also explain the essential ingredients of a valid

insurance contract.

8. Write a note on licensing of Insurance Agents.

Unit 5

9. State the facts and principles of law laid down in Mithy lal Vs. Life Insurance Corporation of India

AIR 1962 SC 814.

10. What is 'marine insurance'? Discuss its nature and scope in detail.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5811)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Foremost Challenge in Governance Today Is To Maintain The Highest Standards of Probity, Integrity, Accountability, Transparency and Fair PlayDocument3 pagesThe Foremost Challenge in Governance Today Is To Maintain The Highest Standards of Probity, Integrity, Accountability, Transparency and Fair PlayakhiljindalNo ratings yet

- By B.S. Chauhan, Media Advisor To Comptroller & Auditor GeneralDocument4 pagesBy B.S. Chauhan, Media Advisor To Comptroller & Auditor GeneralakhiljindalNo ratings yet

- Many Species, One Planet, One Future: by Ahmad Noor KhanDocument2 pagesMany Species, One Planet, One Future: by Ahmad Noor KhanakhiljindalNo ratings yet

- Deputy Director (M & C), Press Information Bureau, New DelhiDocument4 pagesDeputy Director (M & C), Press Information Bureau, New DelhiakhiljindalNo ratings yet

- Public Sector Policy: Monopolies and Restrictive Trade Practices Act (MRTP Act)Document1 pagePublic Sector Policy: Monopolies and Restrictive Trade Practices Act (MRTP Act)akhiljindalNo ratings yet

- EgyptDocument1 pageEgyptakhiljindalNo ratings yet

- Network Neutrality-To Stay or Go?Document3 pagesNetwork Neutrality-To Stay or Go?akhiljindalNo ratings yet

- Differences Between The Two Schools in SuccessionDocument3 pagesDifferences Between The Two Schools in SuccessionakhiljindalNo ratings yet

- Essay 2012Document2 pagesEssay 2012akhiljindalNo ratings yet

- Code SR' N1oog41 Ph. D.'Entrance Test: Paper-LDocument6 pagesCode SR' N1oog41 Ph. D.'Entrance Test: Paper-LakhiljindalNo ratings yet

- Britain, Australia, Canada, Western Europe, and Japan: India Table of ContentsDocument2 pagesBritain, Australia, Canada, Western Europe, and Japan: India Table of ContentsakhiljindalNo ratings yet

- Note of Issue of Fully Convertible DebenturesDocument3 pagesNote of Issue of Fully Convertible DebenturesakhiljindalNo ratings yet

- "Easement" Defined: Explanation: in The First and Second Clauses of This Section The, Expression "Land" Includes AlsoDocument1 page"Easement" Defined: Explanation: in The First and Second Clauses of This Section The, Expression "Land" Includes AlsoakhiljindalNo ratings yet

- Essence of UPSC: Learning For IAS AspirantsDocument1 pageEssence of UPSC: Learning For IAS AspirantsakhiljindalNo ratings yet

- Essay (Compulsory) 2012: Write An Essay On AnyDocument2 pagesEssay (Compulsory) 2012: Write An Essay On AnyakhiljindalNo ratings yet

- Judicial Review: Indian SituationDocument1 pageJudicial Review: Indian SituationakhiljindalNo ratings yet