Professional Documents

Culture Documents

l3 Question

Uploaded by

shanecarl0 ratings0% found this document useful (0 votes)

7 views2 pagesThe document provides a table showing oil production and well drilling data for a water-flood field over 20 years. It then asks the reader to use provided software to calculate economic indicators like discounted cash flow, net present value, and profitability index for the field over 20 years assuming $100/bbl oil price, 10% discount rate, 40% tax, and 3% inflation. It also asks the reader to determine the real rate of return and examine the impact of changing the discount rate to 6%, oil price to $80/bbl, and increasing facilities costs to $1.8 billion, keeping other factors constant.

Original Description:

petroleum economics questions

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides a table showing oil production and well drilling data for a water-flood field over 20 years. It then asks the reader to use provided software to calculate economic indicators like discounted cash flow, net present value, and profitability index for the field over 20 years assuming $100/bbl oil price, 10% discount rate, 40% tax, and 3% inflation. It also asks the reader to determine the real rate of return and examine the impact of changing the discount rate to 6%, oil price to $80/bbl, and increasing facilities costs to $1.8 billion, keeping other factors constant.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesl3 Question

Uploaded by

shanecarlThe document provides a table showing oil production and well drilling data for a water-flood field over 20 years. It then asks the reader to use provided software to calculate economic indicators like discounted cash flow, net present value, and profitability index for the field over 20 years assuming $100/bbl oil price, 10% discount rate, 40% tax, and 3% inflation. It also asks the reader to determine the real rate of return and examine the impact of changing the discount rate to 6%, oil price to $80/bbl, and increasing facilities costs to $1.8 billion, keeping other factors constant.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

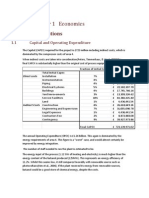

Q.

The table below shows oil production and well drilling for a water-flood field

Year

Wells (inj + prod)

0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

0

15

10

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

RESERVES

Oil rate (bopd)

0

13,333

26,667

40,000

40,000

40,000

40,000

40,000

40,000

32,877

27,223

22,697

19,045

16,075

13,644

11,642

9,981

8,597

7,437

6,460

5,633

168,379,042

Facilities costs are assumed to be spread evenly over three years. If wells cost $10 mm each and total facilities

costs are $1.2 billion, use the software provided ('economic indicators') to calculate Discounted Cash Flow, Net

Present Value and PI over 20 years of production assuming an oil price of $100/bbl, a discount rate of 10%,

taxation at 40% and inflation at 3%. Plot the results.

Use the software provided to determine the real rate of return (RROR)

Look at the effect of changing the following (keeping everything else constant)

1.

2.

3.

reducing discount rate to 6%

decreasing the oil price to $80/bbl

increasing facilities costs to $ 1.8 billion

You might also like

- Fuel Pumps & Fuel Tanks (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandFuel Pumps & Fuel Tanks (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- American Chemical CorporationDocument8 pagesAmerican Chemical CorporationAnastasiaNo ratings yet

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- GF520 Unit5 Assignment With CorrectionsDocument13 pagesGF520 Unit5 Assignment With CorrectionsPriscilla Morales100% (3)

- Air & Gas Compressors World Summary: Market Values & Financials by CountryFrom EverandAir & Gas Compressors World Summary: Market Values & Financials by CountryNo ratings yet

- Answer - D, E, F, GDocument4 pagesAnswer - D, E, F, GAkash SharmaNo ratings yet

- Cement World Summary: Market Values & Financials by CountryFrom EverandCement World Summary: Market Values & Financials by CountryRating: 5 out of 5 stars5/5 (1)

- Chap 009Document68 pagesChap 009Mnar Abu-ShliebaNo ratings yet

- Marine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandMarine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Project of Manufacture of Embroidery Saree PDFDocument12 pagesProject of Manufacture of Embroidery Saree PDFRanaHassanNo ratings yet

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsFrom EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsNo ratings yet

- Cash Flow AnalysisDocument12 pagesCash Flow AnalysisHassan SaeedNo ratings yet

- Petroleum Bulk Stations & Terminals Revenues World Summary: Market Values & Financials by CountryFrom EverandPetroleum Bulk Stations & Terminals Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- End of Chapter 11 SolutionDocument19 pagesEnd of Chapter 11 SolutionsaniyahNo ratings yet

- Clay Refractory Products World Summary: Market Sector Values & Financials by CountryFrom EverandClay Refractory Products World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Biomass CHP: Lovro Foretic Josipa Ljubicic Marin GalicDocument22 pagesBiomass CHP: Lovro Foretic Josipa Ljubicic Marin GalicMarin GalicNo ratings yet

- Final Economy 2010 SolutionDocument6 pagesFinal Economy 2010 SolutionValadez28No ratings yet

- ACCT550 Homework Week 7Document4 pagesACCT550 Homework Week 7Natasha Declan100% (2)

- 326 Chapter 9 - Fundamentals of Capital BudgetingDocument20 pages326 Chapter 9 - Fundamentals of Capital BudgetingAbira Bilal HanifNo ratings yet

- Pacs Operational ManualDocument10 pagesPacs Operational ManualKhushrajNo ratings yet

- Engineering Economy Jan 2014Document2 pagesEngineering Economy Jan 2014Prasad C MNo ratings yet

- 19ptrl12io s2 Exam - May 2019Document3 pages19ptrl12io s2 Exam - May 2019abdelfatahshirefNo ratings yet

- The Martin Luther King Jr. East Busway: A Cost-Benefit AnalysisDocument46 pagesThe Martin Luther King Jr. East Busway: A Cost-Benefit AnalysisSatyavan L RoundhalNo ratings yet

- Chapter 11Document5 pagesChapter 11River Wu0% (1)

- Chapter 11Document10 pagesChapter 11Syed Sheraz AliNo ratings yet

- Treatment GP Graphs and HitsoDocument20 pagesTreatment GP Graphs and HitsodavidNo ratings yet

- Lecturer QDocument161 pagesLecturer QXandae MempinNo ratings yet

- CF 11th Edition Chapter 06 Excel Master StudentDocument32 pagesCF 11th Edition Chapter 06 Excel Master StudentAdrian Gonzaga0% (1)

- 2-4 2005 Jun QDocument10 pages2-4 2005 Jun QAjay TakiarNo ratings yet

- Chapter 1 Economics: 1 NPV CalculationsDocument7 pagesChapter 1 Economics: 1 NPV CalculationsTom DaltonNo ratings yet

- AssignmentDocument5 pagesAssignmentPrashanthRameshNo ratings yet

- Engineering Economics Tutorial Chapter Five (1) - 2Document4 pagesEngineering Economics Tutorial Chapter Five (1) - 2saugat pandeyNo ratings yet

- Chapter13 Income TaxesDocument17 pagesChapter13 Income TaxesKhilbran MuhammadNo ratings yet

- Sinorix N2 300 BarDocument41 pagesSinorix N2 300 BarDien HuynhNo ratings yet

- Financial Decision Making ExercisesDocument57 pagesFinancial Decision Making Exercisescvilalobos198527100% (1)

- Middlesex University Coursework 1: 2020/21 CST2330 Data Analysis For Enterprise ModellingDocument8 pagesMiddlesex University Coursework 1: 2020/21 CST2330 Data Analysis For Enterprise ModellingZulqarnain KhanNo ratings yet

- Malaysia PSCDocument19 pagesMalaysia PSCRedzuan Ngah100% (1)

- CHAPTER 2 Time Value of Money: Be in The Account Immediately After The FifthDocument2 pagesCHAPTER 2 Time Value of Money: Be in The Account Immediately After The FifthNazmulAhsanNo ratings yet

- NPV Practice CompleteDocument5 pagesNPV Practice CompleteShakeel AslamNo ratings yet

- Bethesda Mining: Input AreaDocument15 pagesBethesda Mining: Input AreaJenkins Qing100% (1)

- Practice ProblemsDocument4 pagesPractice ProblemsshaiwanaNo ratings yet

- Revision Pack 2009-10Document9 pagesRevision Pack 2009-10Tosin YusufNo ratings yet

- Replacement Examples ImportantDocument7 pagesReplacement Examples Importantsalehin1969No ratings yet

- Bethesda Mining CompanyDocument8 pagesBethesda Mining CompanyKaushik KanumuriNo ratings yet

- Brigham Chap 11 Practice Questions Solution For Chap 11Document11 pagesBrigham Chap 11 Practice Questions Solution For Chap 11robin.asterNo ratings yet

- Cash Flow Estimation & Risk AnalysisDocument6 pagesCash Flow Estimation & Risk AnalysisShreenivasan K AnanthanNo ratings yet

- Industrial Organization SolutionsDocument89 pagesIndustrial Organization SolutionsDavide Rossetto80% (5)

- Practice Problems in DPDocument6 pagesPractice Problems in DPSpandana AchantaNo ratings yet

- Final Exam EconomicsDocument1 pageFinal Exam Economicsasel ElmadneNo ratings yet

- Chapter 13 Capital Budgeting Estimating Cash Flow and Analyzing Risk Answers To End of Chapter Questions 13 3 Since The Cost of Capital Includes A Premium For Expected Inflation Failure 1Document8 pagesChapter 13 Capital Budgeting Estimating Cash Flow and Analyzing Risk Answers To End of Chapter Questions 13 3 Since The Cost of Capital Includes A Premium For Expected Inflation Failure 1ghzNo ratings yet

- LixingcunDocument7 pagesLixingcunmuhammad iman bin kamarudinNo ratings yet

- Solved Problems in Mining EconomicsDocument19 pagesSolved Problems in Mining Economicsrdmknc100% (2)

- FCF Ch10 Excel Master StudentDocument68 pagesFCF Ch10 Excel Master StudentSilviaKartikaNo ratings yet

- Financial Decision Making - Sample Suggested AnswersDocument14 pagesFinancial Decision Making - Sample Suggested AnswersRaymond RayNo ratings yet

- EEE May 12Document7 pagesEEE May 12Kah Wai TeowNo ratings yet

- Ade Meyli (Hal 337-364)Document47 pagesAde Meyli (Hal 337-364)Untung PriambodoNo ratings yet

- Assignment 5 AmirulramlanDocument11 pagesAssignment 5 AmirulramlanAmirul RamlanNo ratings yet

- Tut 9-11Document3 pagesTut 9-11Riya khungerNo ratings yet

- CAPCOST ProjectDocument16 pagesCAPCOST ProjectJonathanNo ratings yet

- Auto Leaf SpringDocument11 pagesAuto Leaf SpringVijayKrishnaAmaraneniNo ratings yet

- Rich Dad Balance-SheetDocument1 pageRich Dad Balance-SheetshanecarlNo ratings yet

- Rich Dad Balance-SheetDocument1 pageRich Dad Balance-SheetshanecarlNo ratings yet

- Petroleum Production Engineering - Lecture 2 - Production From Undersaturated Oil Reservoirs - FinalDocument23 pagesPetroleum Production Engineering - Lecture 2 - Production From Undersaturated Oil Reservoirs - FinalshanecarlNo ratings yet

- Learning Plan AX Project ManagerDocument2 pagesLearning Plan AX Project Managerpdfme123No ratings yet

- 1.0 Introduction To Formation Evaluation Log AnalysisDocument3 pages1.0 Introduction To Formation Evaluation Log AnalysisshanecarlNo ratings yet