Professional Documents

Culture Documents

NFL

Uploaded by

Himesh AnandOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NFL

Uploaded by

Himesh AnandCopyright:

Available Formats

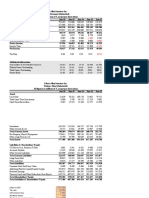

Fixed Assets

Current Assets

Current Liabilities and Provisions

Debtors

Total Assets

Inventories

Net Sales

EBITDA

Depreciation and Amortization

EBIT

Interest

PAT

Long term debts

Shareholders' funds

Cash flow from operations

Current Liabilites

Dividend

Dividend tax

PAT - Dividend on pref. shares

No. of equity shares

2012-13

(in Rs. Crore)

3500.52

4285.00

3729.50

3146.17

11074.23

417.61

6720.23

17.00

117.67

(100.67)

130.00

(171.00)

3311.61

1583.70

(678.39)

3733.75

--(171.00)

490578400.00

2013-14

(in Rs. Crore)

4682.24

6696.84

5874.85

4629.31

13752.25

418.25

8017.03

172.00

129.17

42.83

204.00

(89.71)

2846.68

1493.99

(1608.43)

5874.85

--(89.71)

490578400.00

Current market price as on 06/11/2014

Book value of share

-32.28

38.35

30.45

Liquidity Ratio

Earnings Per Share

Profitability Ratios

Cash Flow Ratio

Asset Utilization Ratios

Capital Structure Ratios

PE Ratio

Return Ratios

2012-13

2013-14

Current Ratio

Quick Ratio

1.15

1.04

1.14

1.07

Basic EPS

(3.49)

(1.83)

Gross Profit Ratio

Operating Profit Ratio

Net Profit Ratio

0.35

0.25%

(0.03)

0.46

2.15%

(0.01)

Operating Cash Flow Ratio

(0.18)

(0.27)

Total Assets Turnover Ratio

Current Assets Turnover Ratio

Accounts Receivable Ratio

0.61

1.57

2.14

0.58

1.20

1.73

Debt Equity Ratio

Fixed Assets to Long-term debts Ratio

Interest Coverage Ratio

2.09

1.06

(0.77)

1.91

1.64

0.21

Price to Book Value Ratio

PE Ratio

---

1.26

(20.97)

Return on Equity

(0.11)

(0.06)

You might also like

- Valuasi Saham MppaDocument29 pagesValuasi Saham MppaGaos FakhryNo ratings yet

- Profitability of simple fixed strategies in sport betting: Soccer, Italy Serie A League, 2009-2019From EverandProfitability of simple fixed strategies in sport betting: Soccer, Italy Serie A League, 2009-2019No ratings yet

- Balance Sheet of RaymondDocument5 pagesBalance Sheet of RaymondRachana Yashwant PatneNo ratings yet

- Shree Cement AnalysisDocument12 pagesShree Cement AnalysisManikanthBhavirisettyNo ratings yet

- Finance TermpaperDocument10 pagesFinance TermpaperSabiha IslamNo ratings yet

- Growth Rates (%) % To Net Sales % To Net SalesDocument21 pagesGrowth Rates (%) % To Net Sales % To Net Salesavinashtiwari201745No ratings yet

- EIH DataSheetDocument13 pagesEIH DataSheetTanmay AbhijeetNo ratings yet

- Nestle Balance Sheet Common SizeDocument8 pagesNestle Balance Sheet Common SizeHimanshu Koli0% (1)

- Start Date End Date Template VersionDocument52 pagesStart Date End Date Template VersionshobuzfeniNo ratings yet

- Fu-Wang Foods Ltd. AnalysisDocument27 pagesFu-Wang Foods Ltd. AnalysisAynul Bashar AmitNo ratings yet

- Asian PaintsDocument10 pagesAsian PaintsNeer YadavNo ratings yet

- M&M Annual ReportDocument21 pagesM&M Annual ReportThakkar GayatriNo ratings yet

- Financial Highlights: Hinopak Motors LimitedDocument6 pagesFinancial Highlights: Hinopak Motors LimitedAli ButtNo ratings yet

- Bluedart AnalysisDocument14 pagesBluedart AnalysisVenkat Sai Kumar KothalaNo ratings yet

- SR DM 05Document42 pagesSR DM 05Sumit SumanNo ratings yet

- ICI Pakistan Limited Condensed Interim Unconsolidated Balance Sheet (Unaudited) As at March 31, 2011Document9 pagesICI Pakistan Limited Condensed Interim Unconsolidated Balance Sheet (Unaudited) As at March 31, 2011Sehrish HumayunNo ratings yet

- Sun TV Networks FinancialsDocument11 pagesSun TV Networks FinancialsVikas SarangalNo ratings yet

- Ashok LeylandDocument1,832 pagesAshok Leylandjadhavshankar100% (1)

- Financial Modelling Assignment - Ghizal Naqvi (Attock Petroleum Limited)Document13 pagesFinancial Modelling Assignment - Ghizal Naqvi (Attock Petroleum Limited)Ghizal NaqviNo ratings yet

- Business Analyis Report - ChaturthiDocument2 pagesBusiness Analyis Report - ChaturthiRavi Pratap Singh TomarNo ratings yet

- Associated Cement Company LTD: Profit & Loss Account Balance SheetDocument3 pagesAssociated Cement Company LTD: Profit & Loss Account Balance SheetZulfiqar HaiderNo ratings yet

- Balance Sheet: AssetsDocument25 pagesBalance Sheet: AssetsAsif AhmedNo ratings yet

- Table of Datfva AnalysisDocument12 pagesTable of Datfva AnalysisManoj PrabaNo ratings yet

- FR 11 66 ValuationOfAnIndianTelcomCompanyDocument23 pagesFR 11 66 ValuationOfAnIndianTelcomCompanyAlen MinjNo ratings yet

- Asian Paints - Financial Modeling (With Solutions) - CBADocument47 pagesAsian Paints - Financial Modeling (With Solutions) - CBAavinashtiwari201745No ratings yet

- Biocon - Ratio Calc & Analysis FULLDocument13 pagesBiocon - Ratio Calc & Analysis FULLPankaj GulatiNo ratings yet

- Year End (In Crore Rupees) 2014 2013 2012 2011 2010 Average Sources of FundsDocument6 pagesYear End (In Crore Rupees) 2014 2013 2012 2011 2010 Average Sources of FundsKamakshi KaulNo ratings yet

- Strabag 2010Document174 pagesStrabag 2010MarkoNo ratings yet

- Standalone Profit & Loss AccountDocument5 pagesStandalone Profit & Loss AccountTarun BangaNo ratings yet

- 1Document617 pages1Nelz CayabyabNo ratings yet

- First Resources: Singapore Company FocusDocument7 pagesFirst Resources: Singapore Company FocusphuawlNo ratings yet

- Bajaj Auto Financial Analysis: Presented byDocument20 pagesBajaj Auto Financial Analysis: Presented byMayank_Gupta_1995No ratings yet

- Peak Sport Products (1968 HK) : Solid AchievementsDocument9 pagesPeak Sport Products (1968 HK) : Solid AchievementsSai Kei LeeNo ratings yet

- Vertical and Horizontal Analysis of OGDCLDocument7 pagesVertical and Horizontal Analysis of OGDCLMuhammad Tayyab JavaidNo ratings yet

- Fin Feasibiltiy Zubair Reg 54492Document9 pagesFin Feasibiltiy Zubair Reg 54492kzubairNo ratings yet

- ITC Ten Years at GlanceDocument1 pageITC Ten Years at Glancevicky_maddy248_86738No ratings yet

- Profit & Loss Rs. in Crores)Document4 pagesProfit & Loss Rs. in Crores)Gobinathan Rajendra PillaiNo ratings yet

- Fauji Fertilizer Company Vs Engro Fertilizer CompanyDocument14 pagesFauji Fertilizer Company Vs Engro Fertilizer CompanyArslan Ali Butt100% (1)

- Group 2 RSRMDocument13 pagesGroup 2 RSRMAbid Hasan RomanNo ratings yet

- Singer Pakistan LTDDocument2 pagesSinger Pakistan LTDMuhammad AliNo ratings yet

- Consolidated Balance Sheet: As at 31st December, 2011Document21 pagesConsolidated Balance Sheet: As at 31st December, 2011salehin1969No ratings yet

- Information On Dena BankDocument17 pagesInformation On Dena BankPradip VishwakarmaNo ratings yet

- Financial - CocaColaDocument45 pagesFinancial - CocaColadung nguyenNo ratings yet

- KingfisherDocument2 pagesKingfishersunnypatel8686No ratings yet

- M Book 1Document2 pagesM Book 1marianmadhurNo ratings yet

- Analysis of Financial StatementDocument4 pagesAnalysis of Financial StatementArpitha RajashekarNo ratings yet

- Nandan Denim LimitedDocument14 pagesNandan Denim LimitedAnkit SainiNo ratings yet

- Ace AnalyserDocument2 pagesAce AnalyserAnshuman TewariNo ratings yet

- NPV (Net Present Value)Document4 pagesNPV (Net Present Value)Jalpa DesaiNo ratings yet

- Income Statement: Assets Non-Current AssetsDocument213 pagesIncome Statement: Assets Non-Current AssetsAhmed_Raza_ShahNo ratings yet

- PT Indoexchange TBK.: Financial Performance: The Company Still Suffered Net Loss atDocument2 pagesPT Indoexchange TBK.: Financial Performance: The Company Still Suffered Net Loss atIsni AmeliaNo ratings yet

- Audited Financial FY2014Document11 pagesAudited Financial FY2014Da Nie LNo ratings yet

- Operational / Financial Analysis 2007 2008 2009 2010 2011 Audited Audited Audited Estimates ProjectedDocument1 pageOperational / Financial Analysis 2007 2008 2009 2010 2011 Audited Audited Audited Estimates ProjectedparamsnNo ratings yet

- Britannia DCF CapmDocument12 pagesBritannia DCF CapmRohit Kamble100% (1)

- Balance Sheet - 7 July, 2014: Currency: BirrDocument1 pageBalance Sheet - 7 July, 2014: Currency: BirrSeife ShiferawNo ratings yet

- Financial Statements ForecastingDocument16 pagesFinancial Statements ForecastingDeep AnjarlekarNo ratings yet

- Start Date End Date Template VersionDocument52 pagesStart Date End Date Template VersionshobuzfeniNo ratings yet

- Bajaj Bal SheetDocument3 pagesBajaj Bal SheetSukshith ShettyNo ratings yet

- Year 0 1 2 3 Income StatementDocument56 pagesYear 0 1 2 3 Income StatementKhawaja Khalid MushtaqNo ratings yet

- DCOILWTICODocument1 pageDCOILWTICOBathuNo ratings yet

- Focus: Fieldwork/Data Collection ProcessDocument3 pagesFocus: Fieldwork/Data Collection ProcessHimesh AnandNo ratings yet

- Iron Ores in IndiaDocument42 pagesIron Ores in IndiaMohammad Azim100% (1)

- Chad Cameroon - Data SheetsDocument52 pagesChad Cameroon - Data SheetsHimesh AnandNo ratings yet

- Currfx EurusdDocument2 pagesCurrfx EurusdHimesh AnandNo ratings yet

- The Road Ahead: A Snapshot of Macroeconomics Sai Kumarswamy Pgpmiim-BDocument53 pagesThe Road Ahead: A Snapshot of Macroeconomics Sai Kumarswamy Pgpmiim-BHimesh AnandNo ratings yet

- Ancova 12Document1 pageAncova 12Himesh AnandNo ratings yet

- Knowledge Transfer and Sharing: (Chapter 8, Notes Chapter 9, Textbook)Document18 pagesKnowledge Transfer and Sharing: (Chapter 8, Notes Chapter 9, Textbook)Himesh AnandNo ratings yet

- Event Description-Be The TycoonDocument2 pagesEvent Description-Be The TycoonHimesh AnandNo ratings yet

- LogisticDocument49 pagesLogisticAlok Kumar Singh100% (1)

- Microsoft Word - ETH 600 - Cycle 08 - Business Ethics PDFDocument7 pagesMicrosoft Word - ETH 600 - Cycle 08 - Business Ethics PDFAdam PhillipsNo ratings yet

- I Need You - Informal'14: Your Your Attributes Bargaining Limit: 400 - 700 BucksDocument6 pagesI Need You - Informal'14: Your Your Attributes Bargaining Limit: 400 - 700 BucksHimesh AnandNo ratings yet

- HEC Hall-X (2014-15) : Minutes: 1st Meeting of The HEC, 2nd August, 2014Document2 pagesHEC Hall-X (2014-15) : Minutes: 1st Meeting of The HEC, 2nd August, 2014Himesh AnandNo ratings yet

- I Need You - Informal'14: Your Your Attributes Bargaining Limit: 400 - 700 BucksDocument6 pagesI Need You - Informal'14: Your Your Attributes Bargaining Limit: 400 - 700 BucksHimesh AnandNo ratings yet

- I Need You - Informal'14: Your Your Attributes Bargaining Limit: 400 - 700 BucksDocument6 pagesI Need You - Informal'14: Your Your Attributes Bargaining Limit: 400 - 700 BucksHimesh AnandNo ratings yet

- Data VastDocument11 pagesData VastHimesh AnandNo ratings yet

- Page No Line No Correct Spelling/CorrectionDocument1 pagePage No Line No Correct Spelling/CorrectionHimesh AnandNo ratings yet

- Baca Dulu SayangDocument1 pageBaca Dulu SayangKapten HanzwiraNo ratings yet

- Page No Line No Correct Spelling/CorrectionDocument1 pagePage No Line No Correct Spelling/CorrectionHimesh AnandNo ratings yet

- Party ContestedDocument11 pagesParty ContestedHimesh AnandNo ratings yet

- Flaubert ReleaseDocument1 pageFlaubert ReleaseHimesh AnandNo ratings yet

- Dienacaseanalysis 140120100457 Phpapp02Document6 pagesDienacaseanalysis 140120100457 Phpapp02Himesh AnandNo ratings yet

- 5 CsDocument8 pages5 CsValliappan Petha PerumalNo ratings yet

- Binomial ProbDocument1 pageBinomial ProbHimesh AnandNo ratings yet

- Anti RaggingDocument6 pagesAnti RaggingLakshay GargNo ratings yet

- Individual and Market Demand: Questions For ReviewDocument21 pagesIndividual and Market Demand: Questions For ReviewHimesh AnandNo ratings yet

- RemainingDocument8 pagesRemainingHimesh AnandNo ratings yet

- Dienacaseanalysis 140120100457 Phpapp02Document6 pagesDienacaseanalysis 140120100457 Phpapp02Himesh AnandNo ratings yet

- RemainingDocument8 pagesRemainingHimesh AnandNo ratings yet