Professional Documents

Culture Documents

Income Statement: Multi-Step Format

Uploaded by

Jahja AjaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Statement: Multi-Step Format

Uploaded by

Jahja AjaCopyright:

Available Formats

INCOME STATEMENT

Multi-Step Format

1. Operation Section

Revenues/Sales : presents various revenue sources, including information on

discounts, allowances and returns.

Less:

Cost of goods/services sold : presents direct costs of goods sold or costs

of services provided in generating the revenues.

Equals:

Gross profit : the difference between revenues and cost of goods sold.

Less:

Selling expenses : presents expenses incurred by the company in its efforts to

generate revenues such as salaries and marketing expenses, delivery costs, and

overhead allocated to sales generating activities.

Administrative and general expenses : presents expenses related to

personnel, accounting, and finance activities, and the operating costs of

headquarters.

Equals:

Income from operations : the difference between gross profit and selling,

general and administrative expenses.

Plus or Minus:

2. Non-operating section

Non-operating items: presents income and expense items that are routine and

ordinary but not components of the companys operations such interest income and

expense, royalty income and dividend income.

Equals:

Net income before tax : presents the amount of taxable income from

operations.

Less:

Income tax expense : presents the income tax expense applicable to income

recognized up to this point in the statement.

Equals:

Net income from operations before extraordinary items

Plus or Minus:

Discontinued operations : presents gains and losses, net of income tax,

resulting from the disposal of a segment of a business.

Extraordinary items: presents gains or losses, net of income tax, resulting

from unusual and infrequent items.

Equals:

NET INCOME

You might also like

- RoarDocument19 pagesRoarFrank HernandezNo ratings yet

- CH 04 Income StatementDocument6 pagesCH 04 Income Statementnreid2701No ratings yet

- Net Revenue and Net ProfitDocument2 pagesNet Revenue and Net ProfitZahid5391No ratings yet

- Example Income Statement:: Gross SalesDocument2 pagesExample Income Statement:: Gross Salesabdirahman YonisNo ratings yet

- Income StatementDocument36 pagesIncome StatementTiffany VinzonNo ratings yet

- Income StatementDocument8 pagesIncome StatementDanDavidLapizNo ratings yet

- Weak Leaner ActivityDocument5 pagesWeak Leaner ActivityAshwini shenolkarNo ratings yet

- Principles of Accounting: Income StatementDocument5 pagesPrinciples of Accounting: Income StatementAhmad GraphicsNo ratings yet

- Income StatementDocument1 pageIncome StatementHabib Ul HaqNo ratings yet

- Income Statement Account TitlesDocument16 pagesIncome Statement Account Titlesmaria cacaoNo ratings yet

- Income StatementsDocument5 pagesIncome StatementsAdetunbi TolulopeNo ratings yet

- Summary Ch4 & Ch5Document10 pagesSummary Ch4 & Ch5beenishyousafNo ratings yet

- Profit and Loss Statement TemplateDocument8 pagesProfit and Loss Statement TemplateJerarudo BoknoyNo ratings yet

- Income StatementDocument3 pagesIncome StatementMamta LallNo ratings yet

- Inc StatmentDocument3 pagesInc StatmentDilawarNo ratings yet

- Left Column For Inner Computation - Right Column For Totals - Peso Sign at The Beginning Amount and at Final Answer TwoDocument6 pagesLeft Column For Inner Computation - Right Column For Totals - Peso Sign at The Beginning Amount and at Final Answer Twoamberle smithNo ratings yet

- Statement of Comprehensive IncomeDocument18 pagesStatement of Comprehensive IncomeCharies Dingal100% (1)

- Buying and Selling: and Net Profit/LossDocument19 pagesBuying and Selling: and Net Profit/LossMarc Graham NacuaNo ratings yet

- 5.3 Income StatementsDocument3 pages5.3 Income StatementsannabellNo ratings yet

- How To Write A Traditional Business Plan: Step 1Document5 pagesHow To Write A Traditional Business Plan: Step 1Leslie Ann Elazegui UntalanNo ratings yet

- Income Statement: Presented by HARI PRIYA - 102114025 JENKINS-102114026 ARVIND-102114027Document47 pagesIncome Statement: Presented by HARI PRIYA - 102114025 JENKINS-102114026 ARVIND-102114027Jenkins Jose Shirley100% (1)

- Income Statement: Profit/Loss Account Dr. Satish Jangra (2009A229M)Document14 pagesIncome Statement: Profit/Loss Account Dr. Satish Jangra (2009A229M)Dr. Satish Jangra100% (1)

- Income Statement: Profit and LossDocument7 pagesIncome Statement: Profit and LossNavya NarulaNo ratings yet

- Statement of Comprehensive IncomeDocument38 pagesStatement of Comprehensive IncomeDaphne Gesto SiaresNo ratings yet

- Statement of Comprehensive IncomeDocument25 pagesStatement of Comprehensive IncomeAngel Nichole ValenciaNo ratings yet

- Inc StatDocument9 pagesInc StatAleem JafferyNo ratings yet

- Lecture 5Document4 pagesLecture 5zehratmuzaffarNo ratings yet

- Fabm 2 - Lesson 2 - SCIDocument20 pagesFabm 2 - Lesson 2 - SCIwendell john medianaNo ratings yet

- Multi Step Income Statement For Merchadising BusinessDocument10 pagesMulti Step Income Statement For Merchadising Businessjesi zamoraNo ratings yet

- How To Prepare A Profit and Loss (Income) Statement: Zions Business Resource CenterDocument16 pagesHow To Prepare A Profit and Loss (Income) Statement: Zions Business Resource CenterSiti Asma MohamadNo ratings yet

- Variable Costs and Fixed CostsDocument2 pagesVariable Costs and Fixed CostsDon McArthney TugaoenNo ratings yet

- Fabm2 Week 4Document28 pagesFabm2 Week 4Jeremy SolomonNo ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive IncomeBlessylyn AguilarNo ratings yet

- What Is The Income Statement?Document3 pagesWhat Is The Income Statement?Mustaeen DarNo ratings yet

- Wiley - Chapter 4: Income Statement and Related InformationDocument42 pagesWiley - Chapter 4: Income Statement and Related InformationIvan Bliminse86% (7)

- Chapter 4 - StudentDocument46 pagesChapter 4 - StudenttsatsrallNo ratings yet

- 8 Financial StatementDocument11 pages8 Financial StatementLin Latt Wai AlexaNo ratings yet

- Accounting DocumentsDocument6 pagesAccounting DocumentsMae AroganteNo ratings yet

- Lesson 1.2: SciDocument4 pagesLesson 1.2: SciIshi MaxineNo ratings yet

- 2 Income Statement FormatDocument3 pages2 Income Statement Formatapi-299265916No ratings yet

- Chapter 4 - Reporting Financial PerformanceDocument6 pagesChapter 4 - Reporting Financial PerformanceCait PostNo ratings yet

- Finals - Fina 221Document14 pagesFinals - Fina 221MARITONI MEDALLANo ratings yet

- Understanding The Income StatementDocument4 pagesUnderstanding The Income Statementluvujaya100% (1)

- Business Studies: 5.3 - Income StatementsDocument9 pagesBusiness Studies: 5.3 - Income StatementsUpasana ChaubeNo ratings yet

- Financial Statement DefinitionsDocument4 pagesFinancial Statement Definitionsj_osire7483No ratings yet

- Income Statement TemplateDocument4 pagesIncome Statement TemplateAnonymous gFcnQ4goNo ratings yet

- Operating Income: Gross Profit Total Sales CogsDocument2 pagesOperating Income: Gross Profit Total Sales CogsBeth GuiangNo ratings yet

- Income Statement - Format - Types - ExampleDocument3 pagesIncome Statement - Format - Types - ExampleIoana DragneNo ratings yet

- Financial StatementDocument83 pagesFinancial StatementDarkie DrakieNo ratings yet

- Accounting For Non - Accountants - Simple - Business OperationsDocument37 pagesAccounting For Non - Accountants - Simple - Business OperationsTesda CACSNo ratings yet

- 2-Income StatementDocument22 pages2-Income StatementSanz GuéNo ratings yet

- FABM 2 Module 3 Statement of Comprehensive IncomeDocument10 pagesFABM 2 Module 3 Statement of Comprehensive IncomebabyjamskieNo ratings yet

- Expense - Expense Is A Type of Expenditure Which Go Through The Income Statement, ItDocument5 pagesExpense - Expense Is A Type of Expenditure Which Go Through The Income Statement, ItDanielNo ratings yet

- Statement of Comprehensive Income (SCI)Document35 pagesStatement of Comprehensive Income (SCI)Jung WonnieNo ratings yet

- Key Terms and Concepts - CH 09Document2 pagesKey Terms and Concepts - CH 09danterozaNo ratings yet

- Statement of Comprehensive IncomeDocument33 pagesStatement of Comprehensive IncomeZalvy Gwen RecimoNo ratings yet

- CFI Team 05072022 - Income StatementDocument8 pagesCFI Team 05072022 - Income StatementDR WONDERS PIBOWEINo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Hotel Aryaduta: The Heart of Contemporary IndonesiaDocument1 pageHotel Aryaduta: The Heart of Contemporary IndonesiaJahja AjaNo ratings yet

- Group 5 - Grolsch GloballyDocument3 pagesGroup 5 - Grolsch GloballyJahja AjaNo ratings yet

- WAC Apollo Hospitals - JahjaDocument2 pagesWAC Apollo Hospitals - JahjaJahja Aja0% (1)

- Exam International MarketingDocument1 pageExam International MarketingJahja AjaNo ratings yet

- Group 5 - Grolsch GloballyDocument3 pagesGroup 5 - Grolsch GloballyJahja AjaNo ratings yet

- Boiler Installation Project 1Document3 pagesBoiler Installation Project 1Jahja AjaNo ratings yet

- Ses 9 - The Fifth P in MarketingDocument5 pagesSes 9 - The Fifth P in MarketingJahja AjaNo ratings yet

- Ses 9 - Nissan's Carlos GhosnDocument14 pagesSes 9 - Nissan's Carlos GhosnJahja Aja100% (1)

- KPI Dictionary Vol1 PreviewDocument12 pagesKPI Dictionary Vol1 PreviewJahja Aja64% (11)

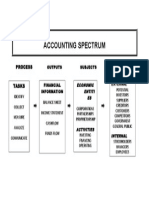

- Accounting SpectrumDocument1 pageAccounting SpectrumJahja AjaNo ratings yet

- Wendys AnalysisDocument31 pagesWendys AnalysisJahja Aja100% (1)