Professional Documents

Culture Documents

Etf Guide 814

Etf Guide 814

Uploaded by

itsjaideepCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Etf Guide 814

Etf Guide 814

Uploaded by

itsjaideepCopyright:

Available Formats

August 2014

MUTUAL FUND Investor Guide

The eTF Investor Guide

MutualFundInvestorGuide.com

Matthew d. Sauer

Founder & Chief

Investment Officer

Matthew Sauer is the

Founder and Chief

Investment Officer of the

Mutual Fund Investor Guide

family of newsletters.

Each month he analyzes

and provides buy, sell and

hold recommendations for

hundreds of mutual funds

and ETFs in three

newsletters: The Investor

Guide to Fidelity Funds,

The ETF Investor Guide

and The Investor Guide to

Vanguard Funds.

Prior to starting the Mutual

Fund Investor Guide,

Matthew was President and

Chief Investment Officer

of the Fidelity Independent

Adviser, ETF Report &

Sector Momentum Tracker

newsletters.

IN THIS

ISSUE

1 Perspective

2 Portfolio Updates

3 Model Portfolios

4 Data & Rankings

15 The Best

Biotechnology

ETFs

Market Perspective:

Manufacturing Data Reinforces

Optimistic Outlook

The U.S. economy has rebounded from its poor showing

in the first quarter of the year as the initial estimate for second-quarter GDP growth is 4 percent. The government will

report two more revisions for second-quarter GDP, one at

the end of August and one at the end of September. Already,

economists are raising their expectations to approximately

4.2 percent since recent reports show that the trade deficit

declined in June. GDP records final sales in order to estimate domestic production, so goods imported from abroad

are subtracted and goods exported are added. Since oil prices

have been falling and oil remains a major import, economists

are also raising their growth forecasts for the third quarter.

In addition to rising GDP forecasts, the manufacturing

PMI remains in expansionary territory. At 57.1 in July (any

number above 50 signals expansion), the reading was 1.8

points higher than it was in June. This continued increase

signals that the American economy has indeed been accelerating as economists predicted. This positive data was

offset somewhat by concerns about slowing consumer

spending after Julys retail sales were reported to be flat.

A deeper look at the economic data shows why investors

should focus on the strong manufacturing number and not

the weaker consumer number. The Bureau of Economic

Analysis calculates the nations GDP report each quarter, but

it also calculates another statistic called gross output (GO).

Instead of measuring just final sales, GO measures all sales

in the economy. For example, GDP will record the final sale

of an automobile as the economy having produced a car,

whereas gross output will record all the intermediary steps

in the production process. GDP records a $16 trillion U.S.

economy, but gross output records an economy worth more

than $30 trillion.

Looking at the economy from the perspective of gross

output paints a different picture and calls into question the

aptness of the oft-used phrase the consumer economy. Instead of 70 percent of GDP, GO measures consumption to

be responsible for 40 percent of gross output. The retail sector comprises only 5 percent of gross output. Conversely, at

more than 20 percent, manufacturing contributes a far higher

percentage of the total economy than is typically thought.

The picture that emerges is an economy affected not only by

the consumer, but also by manufacturing as a driving force

behind expansion. Unfortunately, collecting all the data

needed to calculate GO is time-consuming, so we wont

know the result for the second quarter until October, when

third-quarter GDP is also released. However, we do have

up-to-date manufacturing data, such as the monthly PMI,

to give us some indication of the impact manufacturing will

have on GO when that data is finally released.

Even without gross output data, the excessive focus on consumers doesnt make a lot of sense. Everyone in the economy is a consumer, and we know that as people become

wealthier they consume more goods and services. Consumption is a good measure of the current state of the economy,

but it doesnt tell us anything about the future, other than

possibly that consumers may be starting to spend more

of their savings or may be more willing to borrow. From

a simplistic perspective, in order to increase consumption,

workers must increase their wages. In order for wages to

increase, production needs to increase. Moreover, entrepreneurs must invest in factories, machinery, software and other

goods that assist the increase in productivity. Investment and

manufacturing are the sources of future economic growth,

while consumption tells us what happened in these sectors

months or even years earlier. For example, back in December 2007, the PMI turned negative (below 50) and stayed

there for months, but many economists were too focused

on consumer spending to realize until September 2008 that

there was an underlying problem.

This year, the manufacturing PMI plunged from around 56

in late 2013 to 51.3 in January, which was largely blamed

on the brutal winter in North America. Since then, it has

been climbing steadily, hitting 57.1 in July. This increasingly

strong manufacturing data points to faster GDP growth in

the second half of the year. Growth in manufacturing should

ultimately lead to an increase in consumption, so the strong

manufacturing data overshadows the current weaker consumption data. Even with this said, and despite the flat consumer spending this year, the growth in consumer spending

is on track to be 2.5 percent for the year in aggregate, which

would be the highest since 2006.

But investors are focused on short-term issues, which is

why all the major indexes were down over the past month,

save for the Nasdaq, which rallied 1.10 percent. Tensions in

Ukraine, instability in Iraq, economic sanctions on Russia,

the Ebola outbreak and even the drought in the western U.S.

states are all headlines that create a negative mood among

investors, even if they dont directly impact the markets. On

top of this, the Federal Reserve is still planning to end quantitative easing in October and theres disagreement about

what this means for the economy, which leads to some uncertainty.

Our look beyond the headlines shows that the United States

economy is getting stronger. In addition to the PMI indicating an ongoing positive trend for the overall economy, there

(continued on next page)

1

The ETF Investor Guide

(continued from page 1)

are other positive signs. Railroads are still moving goods at a high rate, and many of these goods

are raw materials that will turn into manufactured

goods over the months ahead. The fact that unemployment climbed 0.1 percent to 6.2 percent in

July is not necessarily a bad sign for the economy.

In fact, the U.S. economy created 209,000 new

jobs in July, marking the first time since 1997 that

more than 200,000 jobs were created in each of

six consecutive months. A meaningful portion of

the falling unemployment rate since 2008 was due

to workers leaving the workforce. When workers

become discouraged and stop looking for employment, they are no longer counted as part of the

workforce and therefore do not figure in unemployment calculations. However, if the economy

is finally going to break out of the slow growth

period of the past five years, unemployment could

rise for months and stay elevated as many potential workers begin looking for jobs once again. The

fact that these formerly discouraged workers are

re-entering the workforce is actually a grassroots

positive sign.

Portfolio Updates

month. A rally in the Nasdaq was good news for

the two technology holdings in the portfolio as

well.

The S&P 500 Index fell 0.92 percent over the past

month, decreasing its return to 5.77 percent for

the year through August 15. The Dow Jones Industrial Average lost 2.33 percent over the past

month, while the Russell 2000 and the MSCI

EAFE declined 1.05 and 2.74 percent, respectively. The Nasdaq performed well, gaining 1.10

percent.

We will make one change to the Model Portfolios

this month. In the ETF Aggressive Value Portfolio, we sold half of Vanguard European Stock

(VGK) and purchased Market Vector Russia

(RSX). With the continued conflict between Russia and the Ukraine, RSX declined significantly

over the past month. Similar to our trade a few

months ago, we see a short-term rebound opportunity.

The Model Portfolios continue to outperform,

relative to their objectives. Year-to-date, the moderate and aggressive portfolios have outpaced the

S&P 500, while the conservative income model

trails only slightly. Given the risk adverse positioning of our income portfolio, we are pleased

with its performance.

The ETF Aggressive Sector Portfolio advanced

0.56 percent in the past month and is now up

6.47 percent in 2014. SPDR S&P Biotech (XBI)

rallied 9.66 percent thanks to a successful phase

three trial of a breast cancer drug. The company

behind the success, Puma Biotechnology (PBYI),

is up more than 300 percent in the past month.

By itself, this translated into a gain of several

percentage points for XBI - on top of a generally

good month for the sector. Strength in biotechnology also helped carry Fidelity MSCI Healthcare (FHLC) to a gain of 1.59 percent in the past

One point that may be good for investors, although not necessarily for workers, is that despite

the sustained, strong job creation, average hourly

wages have remained essentially flat for the last

12 months. Since wage inflation has not arisen,

the Fed has more flexibility about when it might

raise interest rates. The current historically low

rates, strong GDP growth and job increases lead

one to expect interest rates to start to rise. This is

likely in the medium term, but the fact that hourly

wages, which are a closely watched component

of overall inflation, remain flat means the Fed can

The ETF Straight Growth Portfolio fell 1.18

percent over the past month; it has now gained

6.02 percent this year. iShares U.S. Pharmaceuticals (IHE) lost 1.12 percent as the sector failed

to join the broader rally in the healthcare sector.

Rydex S&P MidCap 400 Pure Growth (RFG)

slipped 1.41 percent, hurt by weakness in smaller

and mid cap stocks. Vanguard Dividend Appreciation (VIG) counts industrials and consumer

staples among its largest sector holdings, two

of the weaker sectors last month. The fund also

doesnt have much in the way of biotechnology in

its healthcare exposure, resulting in a slide of 1.92

percent slide for the fund.

The ETF Balanced Growth Portfolio fell 0.72

percent over the past month and is up 5.86 percent in 2014. ProShares High Yield Interest Rate

Hedged (HYHG) slipped 1.09 percent as high

yield bonds remained under pressure. Treasury

yields fell over the past month and that costs

HYHG due to having a short position on these

bonds. PIMCO Short Maturity Bond Fund provided a modest gain, increasing 0.06 percent.

Given its objective, the model continues to perform well, outperforming the S&P 500 this year.

The ETF Conservative Income Portfolio declined 0.59 percent for the month; overall, the

portfolio is up 4.32 percent this year. iShares High

Dividend Equity (HDV) fell 0.99 percent, slightly

worse than the S&P 500 Index due to HDV having three pharmaceutical firms in the top ten holdings. iShares High Yield Bond (HYG) gained 0.20

percent. The fund initially sold off in July, but it

recovered in August and the dividend payment

pushed it into positive territory. SPDR Barclays

2 AUGUST 2014 | PHONE: (888) 252-5372

allow the expansion to run longer before hinting

at coming rate increases. As of now, the Fed has

given no indications about the timing of any rate

hikes, although that will likely change, certainly by

next year. Additionally, flat wages in recent months

mean that, with continued production increases,

there could be some pent-up upward pressure on

wages. If this does materialize, it would mean the

potential for higher consumption numbers, giving

the expansion a stronger base.

Investors should stay focused on the key economic

data points and discount the headlines. As mentioned above, the PMI turned negative in late 2007,

which signaled caution was warranted. Today, the

manufacturing heart of the economy is sending the

opposite signal: optimism is warranted. Looking

ahead to 2015, the data is telling us that a stronger

economy and higher interest rates are likely.

Convertible Securities (CWB) performed well

considering it tracks with the stock market; shares

slid only 0.37 percent last month.

The ETF Global Portfolio declined 1.33 percent

in the past month and is now up 5.45 percent for

the year. PowerShares International Dividend

Achievers (PID) was the best performer for the

third straight month, this time down only 0.36

percent. WisdomTree Global Equity (DEW) was

the second best performer, down 1.32 percent. It

was a challenging month for international shares

due to continued weakness in the euro and European markets, as well as the yen and Japanese

stocks, putting pressure on foreign shares denominated in foreign currency. Still, the model significantly outperformed the MSCI EAFE this month.

The ETF Aggressive Value Portfolio slipped

1.36 percent in the past month and is now up 6.75

percent for the year. Following up on the theme

from the ETF Global Portfolio, weakness in European shares hit Vanguard European Stock (VGK)

for a 3.41 percent loss. PowerShares DB Energy

(DBE) also slipped for the second straight month

as crude oil and natural gas prices fell. Portfolio

losses were limited thanks to the 0.97 percent

rally in Vanguard Information Technology (VGT).

The ETF Absolute Return Portfolio fell 1.18

percent on the month, and is down 1.21 percent

this year. Consumer Staples Select SPDR (XLP)

and Utilities Select SPDR (XLU) both underperformed in the past month. iShares Comex Gold

(IAU) and PowerShares DB U.S. Dollar Bullish

Fund (UUP) both rallied, the former 0.72 percent

and the latter 1.21 percent. Weakness in the yen

and euro versus the dollar explains the rise in

UUP, while gold remains in an uptrend this year

following its huge correction in 2013.

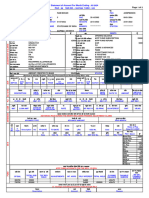

Model Portfolios

ETF Aggressive Sector Portfolio

Ticker

IYK

XBI

IGV

FHLC

IYJ

IYF

XLK

Name

iShares DJ US Cons Non-Cyc

SPDR Biotech

iShares NA Software

Fidelity MSCI Healthcare

iShares DJ US Industrial

iShares DJ US Financial

Technology Select Sect SPDR

TOTAL

ETF Straight Growth Portfolio

Ticker

Name

HDV

VIG

SPY

IHE

RFG

iShares High Dividend Equity

Vanguard Div Appreciation

SPDR S&P 500

iShares DJ US Pharma

Rydex S&P MidCap 400 Pure

TOTAL

ETF Balanced Growth Portfolio

Ticker

Name

HDV

RPG

HYHG

MINT

CWB

iShares High Dividend Equity

Gugg S&P 500 Pure Growth

ProShares High Rate Hedged

PIMCO Short Maturity

SPDR Barc Convertible Secs

TOTAL

ETF Conservative Income Portfolio

Ticker

Name

HDV

HYG

IVV

HYHG

MINT

CWB

iShares High Dividend Equity

iShares High Yield Bond

iShares S&P 500 Index

ProShares High Rate Hedged

PIMCO EnhShort Maturity

SPDR Barc Convertible Secs

TOTAL

ETF Global Portfolio

Ticker

Name

DOO

DEW

PID

IOO

IDV

WTree Intl Div Ex-Fin

WTree Global Equity

PwrShrs Int'l Divid Ach.

iShares S&P Global 100

iShares DJ Intl Select Div Idx

TOTAL

ETF Aggressive Value Portfolio

Ticker

Name

IJR

EDIV

DBE

VGT

VGK

RSX

iShares Core Small Cap

SPDR S&P Emg Mkts Div

PwrShrs DB Energy

Vanguard Info Tech

Vanguard European Stock

Market Vectors Russia

TOTAL

(Data provided as of 8/15/14)

Price

Shares

Allocation

1-Month

Price

Shares

Allocation

1-Month

YTD

Value

74.66

76.49

195.72

132.07

121.73

653.91

370.03

96.17

236.51

225.52

31.57%

18.30%

12.17%

20.20%

17.75%

100.00%

-0.99%

-1.92%

-0.28%

-1.12%

-1.41%

-1.18%

7.97%

-1.92%

7.54%

12.71%

-0.94%

6.02%

$48,821.16

$28,303.94

$18,823.23

$31,235.25

$27,452.97

$154,636.54

Price

Shares

Allocation

1-Month

YTD

Value

74.66

77.33

78.85

101.43

50.07

774.44

248.64

342.49

199.00

349.17

40.80%

13.57%

19.06%

14.24%

12.34%

100.00%

-0.99%

-0.48%

-1.09%

0.01%

-0.37%

-0.72%

7.97%

10.48%

0.86%

0.51%

8.82%

5.86%

$57,819.51

$19,227.28

$27,005.42

$20,184.19

$17,482.91

$141,719.30

98.95

155.35

85.75

29.63

101.49

82.61

39.29

Ticker

Name

Cons Staples Select SPDR

Utilities Select Sector SPDR

iShares Comex Gold

PwrShrs DB Dollar Bullish

PIMCO Short Maturity

TOTAL

9.35%

9.04%

10.83%

19.15%

15.35%

20.54%

15.74%

100.00%

-0.78%

9.66%

1.53%

1.59%

-2.14%

-1.72%

0.41%

0.56%

YTD

1.18%

20.35%

4.78%

6.54%

1.68%

4.14%

11.19%

6.47%

Value

$14,827.72

$14,349.00

$17,176.25

$30,391.16

$24,355.65

$32,591.63

$24,974.72

$158,666.12

Price

Shares

Allocation

1-Month

YTD

Value

74.66

94.05

197.02

78.85

101.43

50.07

480.33

174.02

87.21

343.14

253.18

222.12

26.91%

12.28%

12.89%

20.30%

19.27%

8.35%

100.00%

-0.99%

0.20%

-0.74%

-1.09%

0.01%

-0.37%

-0.59%

7.97%

0.49%

7.60%

0.86%

0.51%

8.82%

4.32%

$35,861.25

$16,366.22

$17,182.45

$27,056.89

$25,679.56

$11,121.42

$133,267.78

Price

Shares

Allocation

1-Month

YTD

Value

49.32

48.56

19.26

77.65

38.35

745.11

542.07

2212.39

246.74

397.79

26.23%

18.79%

30.42%

13.68%

10.89%

100.00%

-1.93%

-1.32%

-0.36%

-1.51%

-2.29%

-1.33%

6.39%

4.28%

6.91%

3.01%

4.39%

5.45%

$36,748.89

$26,322.90

$42,610.56

$19,159.23

$15,255.09

$140,096.66

Price

Shares

Allocation

1-Month

YTD

Value

108.03

40.05

28.43

98.68

56.91

24.41

247.78

569.22

585.63

331.94

241.98

564.15

21.16%

18.02%

13.16%

25.89%

10.89%

10.89%

100.00%

-1.00%

-0.94%

-3.46%

0.97%

-3.41%

N/A

-1.36%

4.01%

3.23%

-2.47%

10.21%

-0.16%

N/A

6.75%

$26,767.58

$22,797.20

$16,649.46

$32,755.84

$13,770.87

$13,770.87

$126,511.83

Price

Shares

Allocation

1-Month

YTD

Value

44.52

41.97

12.63

21.70

101.43

427.16

290.73

781.32

657.91

321.79

21.61%

13.87%

11.21%

16.22%

37.09%

100.00%

-1.18%

-1.39%

0.72%

1.21%

0.01%

-0.17%

4.83%

12.37%

-5.75%

0.84%

1.39%

-1.21%

$19,017.34

$12,201.80

$9,868.05

$14,276.65

$32,639.33

$88,003.18

ETF Absolute Return/Down Market Portfolio

XLP

XLU

IAU

UUP

MINT

149.85

92.37

200.31

1025.58

239.98

394.52

635.65

www.MutualFundInvestorGuide.com | AUGUST 2014 3

The ETF Investor Guide

Data & Rankings (Data provided as of 8/15/14)

% Return (3 and 5 Years Annualized)

Symbol

Fund

Price

Rank

FTC

IUSG

IVW

IWF

JKE

MGK

ONEQ

PWB

QQEW

QQQ

QQXT

RPG

SPYG

VUG

First Trust Large Cap Gr AlphaDEX ETF

iShares Core US Growth

iShares S&P 500 Growth

iShares Russell 1000 Growth

iShares Morningstar Large-Cap Growth

Vanguard Mega Cap Growth ETF

Fidelity Nasdaq Composite Index Tr Stk

PowerShares Dynamic Large Cap Growth ETF

First Trust NASDAQ-100 Equal Wtd ETF

PowerShares QQQ ETF

First Trust NASDAQ-100 ex-Tech Sect ETF

Guggenheim S&P 500 Pure Growth ETF

SPDR S&P 500 Growth ETF

Vanguard Growth ETF

43.66

74.19

105.65

90.93

107.80

77.26

175.17

26.95

39.69

97.40

36.93

77.33

91.48

99.28

89

87

96

96

91

81

86

90

96

97

96

95

89

80

DGRO

DSI

EPS

EXT

FEX

ITOT

IVV

IWB

IWL

IWV

IYY

JKD

KLD

MGC

MOAT

NYC

OEF

ONEK

PBP

PFM

PKW

PXLC

RSP

SPHQ

SPY

THRK

VIG

VTI

VV

XLG

iShares Core Dividend Growth

iShares MSCI KLD 400 Social

WisdomTree Earnings 500

WisdomTree Total Earnings

First Trust Large Cap Core AlphaDEX ETF

iShares Core S&P Total US Stock Mkt

iShares Core S&P 500

iShares Russell 1000

iShares Russell Top 200

iShares Russell 3000

iShares Dow Jones US

iShares Morningstar Large-Cap

iShares MSCI USA ESG Select

Vanguard Mega Cap ETF

Market Vectors Wide Moat ETF

iShares NYSE Composite

iShares S&P 100

SPDR Russell 1000 ETF

PowerShares S&P 500 BuyWrite ETF

PowerShares Dividend Achievers ETF

PowerShares Buyback Achievers ETF

PowerShares Fundamental Pure Lg Core ETF

Guggenheim S&P 500 Equal Weight ETF

PowerShares S&P 500 High Quality ETF

SPDR S&P 500

SPDR Russell 3000 ETF

Vanguard Dividend Appreciation ETF

Vanguard Total Stock Market ETF

Vanguard Large-Cap ETF

Guggenheim Russell Top 50 Mega Cap ETF

24.83

73.03

68.33

70.54

43.76

89.36

197.02

109.42

44.52

116.72

98.82

113.71

81.67

67.04

30.82

98.28

87.14

92.57

21.66

20.79

44.69

38.32

76.06

21.19

195.72

147.06

76.49

101.27

90.00

136.12

83

87

87

86

89

93

96

86

87

82

92

94

81

83

87

73

88

88

80

91

82

93

93

85

95

85

84

82

83

88

CVY

DEF

DHS

DIA

DLN

DTD

DTN

EZY

FDL

FTA

Guggenheim Multi-Asset Income ETF

Guggenheim Defensive Equity ETF

WisdomTree Equity Income

SPDR Dow Jones Industrial Average

WisdomTree LargeCap Dividend

WisdomTree Total Dividend

WisdomTree Dividend ex-Financials

WisdomTree LargeCap Value

First Trust Morningstar Div Leaders ETF

First Trust Large Cap Val AlphaDEX ETF

25.63

38.09

59.04

166.35

70.54

71.16

73.07

60.67

23.48

42.88

83

97

91

90

87

89

86

85

94

85

4 AUGUST 2014 | PHONE: (888) 252-5372

Advice

YTD

1 Month 3 Month

Large Cap Growth

Buy

Hold

Strong Buy

Buy

Buy

Buy

Buy

Buy

Buy

Strong Buy

Buy

Strong Buy

Buy

Buy

6.93

5.77

7.72

6.54

8.70

7.25

7.56

4.31

9.94

11.75

7.07

10.48

7.64

7.31

Large Cap Blend

Buy

Buy

Buy

Buy

Buy

Buy

Strong Buy

Buy

Buy

Buy

Buy

Buy

Buy

Buy

Hold

Buy

Buy

Buy

Buy

Buy

Hold

Buy

Buy

Buy

Strong Buy

Buy

Strong Buy

Hold

Buy

Buy

6.32

6.87

6.37

6.85

6.52

7.09

6.97

6.90

6.36

6.71

6.41

6.83

7.09

6.87

4.97

6.79

7.63

6.57

5.37

4.22

7.45

7.55

4.63

6.95

6.43

2.65

6.48

7.07

5.95

Large Cap Value

Hold

Strong Buy

Buy

Buy

Buy

Buy

Buy

Buy

Strong Buy

Buy

5.94

11.44

8.94

1.71

7.47

7.50

7.90

5.91

8.97

7.52

1 Year

3 Year

-0.43 6.56 22.90 18.12

-0.13 5.85 21.16 19.12

-0.33 6.33 22.67 19.64

-0.02 5.77 22.04 19.22

0.36

7.97 26.18 20.17

-0.03 6.72 23.97 20.42

1.17 9.81 24.72 21.79

-1.28 5.87 21.68 20.75

1.22 9.52 26.21 21.19

1.98 12.08 30.97 23.00

1.79 8.59 21.59 21.14

-0.35 8.37 29.12 22.41

-0.29 6.39 22.66 19.67

0.00 6.61 23.14 19.90

5 Year

17.51

17.30

17.42

17.29

17.69

17.57

18.68

17.60

19.10

20.95

19.50

22.44

17.88

17.77

-1.19

-0.71

-0.61

-0.79

-0.97

-0.82

-0.74

-0.70

-0.99

-0.65

-0.74

-0.79

-1.27

-0.68

-0.29

-1.57

-0.71

-0.28

0.46

-1.27

-0.78

-0.98

-0.77

-1.40

-0.77

-0.58

-1.92

-0.69

-0.61

-0.46

4.65

4.56

4.44

4.52

4.89

4.98

4.96

4.81

4.97

4.90

3.72

4.36

5.10

4.23

2.42

5.13

5.53

3.02

2.32

4.13

3.98

4.72

2.09

4.94

5.03

1.50

5.09

5.10

4.99

19.55

19.55

18.93

20.34

19.58

20.09

20.19

20.07

19.47

19.60

17.43

18.19

20.17

20.47

15.94

19.02

20.54

14.38

14.52

19.15

18.16

20.59

16.10

19.95

19.64

13.86

19.74

20.16

18.55

19.69

20.24

20.43

20.04

19.92

20.07

20.11

19.96

19.87

19.87

21.68

17.62

20.08

15.61

16.57

17.00

18.14

16.79

16.59

16.84

15.66

19.50

20.24

11.25

16.80

23.91

21.44

21.00

19.63

19.99

19.95

16.82

20.15

20.06

18.89

13.05

15.61

16.89

8.80

15.33

20.53

16.60

18.66

17.28

16.53

16.87

14.83

17.06

16.81

14.69

-1.16

0.50

-0.73

-2.26

-0.89

-0.81

-0.34

-2.04

-1.63

-1.11

2.27

3.96

3.73

1.66

3.82

3.85

3.11

4.41

2.78

3.31

12.78

18.10

16.76

12.47

17.85

17.77

17.69

18.21

15.02

19.00

14.51

17.41

18.76

15.93

19.10

19.27

19.58

19.48

17.71

21.38

15.71

17.08

17.49

15.06

16.51

17.06

19.44

15.48

16.86

18.62

16.77

16.83

16.71

15.11

16.52

Yield %

1.14

1.52

1.23

0.63

1.36

0.95

0.49

0.45

1.34

1.26

1.39

1.69

1.86

1.75

1.85

1.68

1.67

1.88

1.34

1.97

1.65

2.22

1.87

1.73

1.43

2.74

0.39

1.67

2.01

1.70

2.07

1.84

1.89

4.96

Beta

3 Year

SD

3 Year

Expense

Ratio

1.05

1.04

0.96

1.01

1.05

1.02

1.08

1.10

1.14

1.00

1.06

1.19

0.95

1.06

13.36

12.95

11.82

12.62

13.56

12.85

14.16

14.09

15.33

13.74

14.56

15.36

11.80

13.27

0.70

0.09

0.18

0.20

0.25

0.11

0.21

0.59

0.60

0.20

0.60

0.35

0.20

0.09

0.96

0.98

1.01

1.11

1.02

1.00

1.02

0.97

1.05

1.03

0.93

1.01

0.99

11.82

11.99

12.39

13.83

12.50

12.19

12.51

11.89

12.80

12.64

11.56

12.61

12.02

1.10

0.95

1.01

0.69

0.73

0.95

0.86

1.13

0.87

1.00

1.04

0.88

1.05

1.02

0.91

13.67

11.66

12.34

9.56

9.76

12.08

10.82

14.02

10.86

12.17

12.72

11.14

12.84

12.40

11.32

0.12

0.50

0.28

0.28

0.66

0.07

0.07

0.15

0.15

0.20

0.20

0.20

0.50

0.11

0.49

0.25

0.20

0.10

0.75

0.58

0.71

0.39

0.40

0.29

0.09

0.10

0.10

0.05

0.09

0.20

0.84 11.11

0.56 8.94

0.59

9.17

0.91 11.42

0.78 9.91

0.81 10.24

0.72 9.68

1.03 12.91

0.40 8.66

1.16 14.61

0.82

0.65

0.38

0.17

0.28

0.28

0.38

0.38

0.45

0.67

% Return (3 and 5 Years Annualized)

Symbol

Fund

Price

Rank

Advice

YTD

1 Month 3 Month

1 Year

3 Year

5 Year

16.38

Yield %

Beta

3 Year

SD

3 Year

Expense

Ratio

Large Cap Value (continued)

FVD

HDV

IUSV

IVE

IWD

IWX

JKF

MGV

NY

PRF

PWV

RWL

SDY

SPYV

VOOV

VTV

VYM

First Trust Value Line Dividend ETF

iShares Core High Dividend

iShares Core US Value

iShares S&P 500 Value

iShares Russell 1000 Value

iShares Russell Top 200 Value

iShares Morningstar Large-Cap Value

Vanguard Mega Cap Value ETF

iShares NYSE 100

PowerShares FTSE RAFI US 1000 ETF

PowerShares Dynamic Large Cap Value ETF

RevenueShares Large Cap ETF

SPDR S&P Dividend ETF

SPDR S&P 500 Value ETF

Vanguard S&P 500 Value ETF

Vanguard Value ETF

Vanguard High Dividend Yield ETF

22.52

74.66

130.38

89.82

100.13

42.39

84.29

58.21

87.41

87.91

30.40

38.46

75.24

97.46

86.35

80.68

66.09

88

97

77

82

79

87

78

85

81

90

92

86

94

82

85

85

92

DWAQ

FAD

IJK

IWP

JKH

MDYG

PDP

PXMG

RFG

VOT

PowerShares DWA NASDAQ Momentum ETF

First Trust Multi Cap Gr AlphaDEX ETF

iShares S&P Mid-Cap 400 Growth

iShares Russell Mid-Cap Growth

iShares Morningstar Mid-Cap Growth

SPDR S&P 400 Mid Cap Growth ETF

PowerShares DWA Momentum ETF

PowerShares Fundamental Pure Mid Gr ETF

Guggenheim S&P MidCap 400 Pure Gr ETF

Vanguard Mid-Cap Growth ETF

67.73

45.91

153.03

88.45

148.54

113.67

39.02

30.83

121.73

95.92

76

87

85

93

91

79

87

81

79

76

CSD

EWRI

EWRM

EZM

FNX

FVL

IJH

IWR

JKG

MDY

NFO

PWC

RSCO

TTFS

VO

VXF

Guggenheim Spin-Off ETF

Guggenheim Russell 1000 Equal Wt ETF

Guggenheim Russell MidCap Equal Wt ETF

WisdomTree MidCap Earnings

First Trust Mid Cap Core AlphaDEX ETF

First Trust Value Line 100 ETF ETF

iShares Core S&P Mid-Cap

iShares Russell Mid-Cap

iShares Morningstar Mid-Cap

SPDR S&P MidCap 400

Guggenheim Insider Sentiment ETF

PowerShares Dynamic Market ETF

SPDR Russell Small Cap Completeness

AdvisorShares TrimTabs Float Shrink ETF

Vanguard Mid-Cap ETF

Vanguard Extended Market ETF

44.66

49.71

49.90

89.93

51.62

20.03

139.52

159.84

139.71

254.07

47.81

71.65

84.28

51.43

117.55

85.54

81

85

86

90

80

89

88

94

94

88

78

86

86

90

82

78

CZA

DON

DVY

FAB

IJJ

IVOV

IWS

JKI

PEY

PXMV

RPV

RWK

SPHB

Guggenheim Mid-Cap Core ETF

WisdomTree MidCap Dividend

iShares Select Dividend

First Trust Multi Cap Val AlphaDEX ETF

iShares S&P Mid-Cap 400 Value

Vanguard S&P Mid-Cap 400 Value ETF

iShares Russell Mid-Cap Value

iShares Morningstar Mid-Cap Value

PowerShares High Yld Eq Div Achiev ETF

PowerShares Fundamental Pure Mid Val ETF

Guggenheim S&P 500 Pure Value ETF

RevenueShares Mid Cap ETF

PowerShares S&P 500 High Beta ETF

48.46

80.32

74.73

46.33

123.93

93.90

71.17

121.92

12.53

26.88

53.11

46.65

33.00

91

92

94

83

84

84

87

89

87

89

94

93

86

Buy

Strong Buy

Buy

Buy

Buy

Buy

Buy

Strong Buy

Buy

Buy

Buy

Buy

Strong Buy

Buy

Buy

Buy

Strong Buy

6.77

7.98

6.62

6.21

7.40

6.54

6.19

6.97

4.29

6.79

7.98

6.09

4.76

6.39

6.31

6.80

7.50

Mid Cap Growth

Buy

Hold

Hold

Buy

Buy

Hold

Buy

Buy

Hold

Buy

3.61

1.84

2.29

5.39

4.42

1.98

6.47

6.58

-0.83

6.30

Mid Cap Blend

Hold

Buy

Buy

Strong Buy

Buy

Buy

Buy

Buy

Buy

Buy

Hold

Buy

Hold

Buy

Buy

Buy

-0.78

7.58

7.75

4.45

2.62

8.91

4.89

7.36

8.69

4.63

2.05

5.37

2.78

6.06

6.87

3.46

Mid Cap Value

Buy

Strong Buy

Strong Buy

Buy

Buy

Buy

Buy

Buy

Buy

Buy

Strong Buy

Buy

Hold

6.74

9.08

6.43

4.80

7.39

7.38

9.32

7.56

8.26

9.26

7.60

4.78

8.47

-0.88

-0.99

-1.43

-1.23

-1.14

-1.40

-1.67

-1.09

-2.10

-1.07

-0.96

-0.83

-1.23

-1.19

-1.15

-1.19

-0.97

2.61

2.88

3.87

3.40

4.10

4.00

3.33

3.86

2.43

4.03

4.09

3.82

1.85

3.55

3.46

3.78

4.05

14.92

14.93

17.56

16.96

18.29

17.16

15.97

17.54

14.91

19.16

18.74

20.15

14.21

17.01

17.13

17.83

17.99

17.91

18.21

20.58

20.23

20.71

20.28

17.42

19.98

17.95

21.14

21.57

22.07

18.46

20.45

20.33

20.16

20.27

0.00

-1.33

-1.04

0.20

0.68

-1.05

-0.26

0.41

-1.41

0.21

0.00

5.03

4.00

5.49

6.02

3.92

6.38

3.81

4.36

6.04

19.05

17.76

15.15

18.85

17.52

14.89

20.52

18.57

15.37

18.45

17.25

17.02

16.53

18.67

16.49

16.71

18.33

16.01

15.65

17.28

15.09

17.06

18.23

18.51

18.22

18.22

19.33

16.38

19.84

18.56

-1.02

-0.96

-0.88

-1.37

-1.75

-1.43

-1.09

-0.34

-0.99

-1.09

-1.75

-1.94

-0.62

-0.08

-0.59

-0.56

2.31

4.24

4.57

4.13

3.14

5.53

4.06

5.00

4.93

4.03

2.90

2.80

4.73

3.66

4.93

4.85

15.89

20.32

19.85

18.95

17.29

24.72

17.03

19.84

21.98

16.86

14.43

22.33

17.23

19.15

19.76

17.49

27.33

20.07

20.10

22.24

19.08

18.84

18.91

20.29

21.31

18.68

17.11

22.17

20.02

23.65

0.01

-0.75

-1.55

-1.49

-1.12

-1.29

-0.95

-1.13

-0.72

-0.70

-2.19

-0.61

-1.08

4.96

4.13

2.01

2.61

4.05

4.09

4.30

3.96

3.69

4.83

2.78

4.01

8.01

18.89

20.19

16.43

17.86

18.63

18.46

20.86

20.31

18.03

22.72

24.05

16.75

26.94

20.79

20.93

18.88

21.66

21.15

21.33

21.64

23.02

19.56

24.66

27.33

21.44

20.66

16.09

15.50

16.22

13.88

15.43

14.40

17.02

17.49

17.70

16.17

15.57

15.87

16.89

3.65

2.11

2.08

2.18

2.23

2.86

2.45

2.19

1.97

2.46

2.30

2.14

2.34

2.41

2.99

0.24

0.76

0.74

0.16

0.77

0.28

0.05

0.78

0.77

0.48

1.05

1.05

1.03

1.01

0.96

0.95

0.97

1.03

0.91

1.06

0.78

1.04

1.05

0.98

0.77

10.24

9.20

13.04

12.94

12.80

12.55

12.16

11.96

12.06

12.71

11.57

13.12

10.45

12.92

12.98

12.19

10.05

0.70

0.12

0.09

0.18

0.21

0.20

0.25

0.11

0.20

0.39

0.59

0.49

0.35

0.20

0.15

0.09

0.10

1.19

1.12

1.19

1.18

1.21

1.19

0.96

1.19

1.19

1.22

16.84

14.41

15.45

15.13

15.90

15.42

12.89

15.23

15.93

15.94

0.61

0.70

0.25

0.25

0.30

0.25

0.74

0.39

0.35

0.09

15.45

14.49

15.09

16.24

16.21

19.35

15.40

14.35

14.88

15.35

18.13

16.37

15.85

20.66

18.67

16.94

18.22

18.81

19.91

18.01

17.14

17.00

18.95

1.49

1.25

1.02

1.15

1.18

1.26

1.26

1.51

1.20

1.14

1.17

1.20

1.44

1.30

1.23

19.64 18.83

20.01 18.71

1.35

1.21

1.16 14.65

1.27 16.34

0.65

0.40

0.41

0.38

0.66

0.70

0.15

0.22

0.25

0.25

0.65

0.60

0.10

0.99

0.09

0.10

1.03

0.99

0.67

1.26

1.21

1.21

1.10

1.14

0.63

1.25

1.25

1.33

1.80

0.68

0.38

0.40

0.70

0.27

0.20

0.28

0.30

0.57

0.39

0.35

0.54

0.25

19.45

20.19

17.65

18.88

18.02

19.03

18.96

16.79

18.35

23.11

18.79

1.19

1.42

1.21

3.56

1.55

1.63

1.99

2.14

4.30

1.55

12.99

12.66

9.89

15.86

15.57

15.58

13.86

14.31

9.78

15.73

16.46

17.31

23.58

www.MutualFundInvestorGuide.com | AUGUST 2014 5

The ETF Investor Guide

% Return (3 and 5 Years Annualized)

Symbol

Fund

Price

Rank

Advice

YTD

1 Month 3 Month

1 Year

3 Year

5 Year

Yield %

Beta

3 Year

SD

3 Year

Expense

Ratio

MID CAP VALUE (continued)

VOE

Vanguard Mid-Cap Value ETF

85.65 87

IJT

IWO

JKK

PXSG

RZG

SLYG

VBK

VTWG

iShares S&P Small-Cap 600 Growth

iShares Russell 2000 Growth

iShares Morningstar Small-Cap Growth

PowerShares Fundamental Pure Sm Gr ETF

Guggenheim S&P SmallCap 600 Pure Gr ETF

SPDR S&P 600 Small Cap Growth ETF

Vanguard Small-Cap Growth ETF

Vanguard Russell 2000 Growth ETF

115.68

132.95

128.36

24.12

77.50

173.80

122.76

96.62

82

77

81

86

77

83

69

63

EES

FDM

FYX

IJR

IWC

IWM

JKJ

PRFZ

RWJ

SLY

VB

WisdomTree SmallCap Earnings

First Trust Dow Jones Sel MicroCap ETF

First Trust Small Cap Core AlphaDEX ETF

iShares Core S&P Small-Cap

iShares Micro-Cap

iShares Russell 2000

iShares Morningstar Small-Cap

79.45

31.09

46.88

108.03

71.88

113.39

132.90

97.49

53.97

101.54

113.51

77

70

74

81

71

76

85

81

85

77

77

DES

IJS

IWN

JKL

PXSV

PZI

RFV

RZV

SLYV

VBR

WisdomTree SmallCap Dividend

iShares S&P Small-Cap 600 Value

iShares Russell 2000 Value

iShares Morningstar Small-Cap Value

PowerShares Fundamental Pure Sm Val ETF

PowerShares Zacks Micro Cap ETF

Guggenheim S&P MidCap 400 Pure Val ETF

67.79

111.86

98.04

124.12

24.79

16.07

52.88

61.52

106.10

102.75

88

76

65

82

82

75

77

70

81

81

PowerShares FTSE RAFI US 1500 Sm-Mid ETF

RevenueShares Small Cap ETF

SPDR S&P 600 Small Cap ETF

Vanguard Small-Cap ETF

Guggenheim S&P SmallCap 600 PureVal ETF

SPDR S&P 600 Small Cap Value ETF

Vanguard Small-Cap Value ETF

AOA

AOR

IYLD

iShares Aggressive Allocation

iShares Growth Allocation

iShares Morningstar Multi-Asset Income

46.30 90

39.95 85

26.73 76

BAL

CORN

COW

DBA

DBC

DJP

GCC

GSG

GSP

JO

RJI

SGG

WEAT

iPath DJ-UBS Cotton TR Sub-Idx ETN

Teucrium Corn ETF

iPath DJ-UBS Livestock TR Sub-Idx ETN

PowerShares DB Agriculture ETF

PowerShares DB Commodity Tracking ETF

iPath DJ-UBS Commodity Index TR ETN

GreenHaven Continuous Commodity ETF

iShares S&P GSCI Commodity-Indexed Trust

iPath S&P GSCI Total Return Index ETN

iPath DJ-UBS Coffee TR Sub-Idx ETN

ELEMENTS Rogers Intl Commodity ETN

iPath DJ-UBS Sugar TR Sub-Idx ETN

Teucrium Wheat ETF

43.21

26.60

29.48

26.27

24.94

36.53

26.20

31.20

31.60

36.37

8.02

48.04

12.91

35

33

42

53

53

49

54

52

54

66

51

35

23

FCOM

IXP

IYZ

PBS

VOX

Fidelity MSCI Telecom Svcs ETF

iShares Global Telecom

iShares US Telecommunications

PowerShares Dynamic Media ETF

Vanguard Telecommunication Services ETF

26.44

63.20

30.03

25.06

86.80

80

73

81

85

84

BJK

Market Vectors Gaming ETF

48.69

71

6 AUGUST 2014 | PHONE: (888) 252-5372

Buy

7.38

Small Cap Growth

Hold

Hold

Sell

Buy

Hold

Hold

Buy

Hold

-2.17

-1.56

-3.06

2.54

-2.71

-2.58

0.39

-1.94

Small Cap Blend

Hold

Sell

Hold

Hold

Hold

Hold

Hold

Hold

Hold

Hold

Buy

-2.22

-4.18

-3.42

-0.44

-3.82

-1.07

2.70

0.11

0.22

-0.60

3.25

Small Cap Value

Buy

Buy

Buy

Buy

Hold

Hold

Buy

Hold

Hold

Buy

1.38

1.22

-0.56

3.98

0.16

-4.37

4.84

-0.90

0.35

5.55

Allocation

Buy

Buy

Buy

5.03

4.96

11.40

-1.42

3.74 21.02 21.82 18.94

-1.04

-0.03

-0.44

-0.86

-1.29

-1.22

-0.54

-0.12

4.41

6.24

5.18

3.98

5.10

4.15

5.27

6.08

12.58

12.89

10.64

14.87

14.15

12.64

13.69

12.58

18.80 18.93

18.52 17.93

17.49 17.71

15.98 16.68

18.81 18.66

18.66 19.51

18.92 19.12

18.34

-1.56

-1.40

-1.80

3.12

2.91

3.38

4.01

3.85

4.54

3.68

4.14

3.07

3.91

4.82

12.97

11.95

12.46

14.09

12.22

12.49

16.10

15.01

17.23

14.24

16.53

20.03

18.19

19.35

20.36

19.31

18.40

18.46

19.99

22.95

20.34

20.32

18.51

15.43

18.13

18.35

15.94

16.70

17.50

18.27

19.12

18.75

18.75

-1.96

-1.37

-2.06

-2.31

-1.01

-1.50

-1.72

-1.05

3.07

3.49

2.79

3.38

3.02

3.62

4.62

3.56

3.03

4.59

13.50

15.29

12.07

16.11

15.90

10.35

16.19

17.07

14.47

19.13

20.84

21.65

18.20

21.32

22.72

19.10

23.12

22.93

21.37

21.42

18.24

17.68

15.33

18.79

17.98

13.30

18.74

15.59

17.96

18.13

-0.86

-0.40

0.79

2.80 14.96

2.56 12.65

2.51 15.66

-1.28

-1.01

-1.72

-1.17

-1.39

-1.08

-0.88

-1.20

Commodities

Sell

Sell

Sell

Hold

Sell

Sell

Hold

Sell

Sell

Sell

Sell

Sell

Sell

-18.75 -5.66 -22.35 -26.76

-13.03 -0.95 -19.75 -25.96

8.62 -9.41 -5.15

7.51

8.33

0.11 -8.18 3.83

-2.81 -2.62 -4.95 -5.71

-0.60 -3.33 -8.19 -3.99

1.95 -2.57 -7.81 -2.38

-3.08 -3.67 -6.39 -5.65

-2.98 -3.26 -6.59 -5.92

67.56 16.58 -5.75 42.48

-1.84 -3.02 -6.74 -5.54

-13.43 -8.02 -17.14 -20.04

-12.47 -0.39 -19.36 -21.76

Communications

Hold

Sell

Hold

Sell

Hold

4.07

1.92

2.14

-5.69

3.75

-2.73

-1.63

-1.38

-0.40

-2.43

Consumer Discretionary

Sell

-8.83

-2.16

14.70 13.33

11.30 10.42

-12.74

-17.76

1.92

1.10

13.72

0.09

0.67

0.73

0.31

-0.46

1.21

1.35

1.25

1.21

1.22

1.21

1.32

1.35

16.04

18.18

16.87

15.81

16.67

16.01

17.44

18.20

0.26

0.25

0.30

0.41

0.35

0.25

0.09

0.20

1.31

1.44

1.32

1.25

1.32

1.31

1.34

1.35

1.36

1.24

1.29

17.30

19.23

17.50

16.26

18.21

17.23

17.33

17.57

17.90

16.23

16.56

0.38

0.60

0.70

0.17

0.72

0.24

0.25

0.39

0.54

0.20

0.09

1.32

1.84

1.12

1.28

1.27

1.24

1.40

1.43

1.26

1.47

1.28

1.25

14.60

16.68

16.58

15.91

18.16

19.05

16.50

20.11

16.65

15.96

0.38

0.30

0.36

0.30

0.39

0.93

0.38

0.35

0.25

0.09

2.14

2.22

1.44

0.99

11.98

8.25

0.30

0.30

0.60

0.74

1.34

-0.11

0.75

0.95

0.99

0.89

0.98

1.02

1.20

0.93

0.67

24.56

26.99

12.81

14.54

15.11

15.58

14.30

16.21

16.84

39.13

14.79

20.71

0.75

2.68

0.75

0.85

0.85

0.75

0.85

0.75

0.75

0.75

0.75

0.75

3.67

0.62

0.80

0.42

1.00

1.13

1.39

0.84

0.94

1.04

1.37

1.25

1.93

2.46

0.70

0.50

6.50

-6.95

-4.97

-8.52

-8.31

-2.29

-2.39

-17.00

-4.16

-19.58

2.09

0.55

1.90

-1.11

2.08

0.79

1.50

-1.06

2.44

-6.24

10.54

14.35

25.55

14.80

10.73

14.62

21.69

15.56

5.41

3.23

0.57

3.09

0.61 11.75

0.68 14.16

1.07 17.72

0.52 12.05

0.12

0.48

0.46

0.63

0.14

0.83 14.89 15.72

18.71

1.52

1.37 22.47

0.65

0.10

1.01

1.71

7.87

0.40

15.06

12.60

15.23

12.30

% Return (3 and 5 Years Annualized)

Symbol

Fund

Price

Rank

Advice

YTD

1 Month 3 Month

1 Year

3 Year

5 Year

8.11

18.36

11.99

3.92

8.99

14.96

11.54

16.45

7.24

16.67

6.51

33.23

24.69

23.13

21.92

21.70

23.51

19.28

24.31

29.21

24.26

22.38

13.42

21.79

23.70

18.34

0.55

0.98

0.97

0.61

22.26

17.35

23.18

16.95

22.82

23.62

1.18

1.26

0.72

1.22

0.68

5.28

5.54

19.69

13.01

10.20

11.10

13.15

13.15

17.08

13.03

12.72

20.10

17.28

14.06

16.26

19.12

18.27

20.67

17.47

17.34

Yield %

Beta

3 Year

SD

3 Year

Expense

Ratio

CONSUMER DISCRETIONARY (continued)

FDIS

ITB

IYC

PEJ

PMR

PSCD

RCD

RXI

VCR

XHB

XLY

XRT

Fidelity MSCI Consumer Discretionary ETF

iShares US Home Construction

iShares US Consumer Services

PowerShares Dynamic Leisure & Entmnt ETF

PowerShares Dynamic Retail ETF

CROP

FSTA

FXG

IYK

KXI

PBJ

PSCC

PSL

RHS

VDC

XLP

IQ Global Agribusiness Small Cap ETF

Fidelity MSCI Consumer Staples Index ETF

First Trust Cnsmr Staples AlphaDEX ETF

iShares US Consumer Goods

iShares Global Consumer Staples

PowerShares Dynamic Food & Beverage ETF

Vanguard Consumer Staples ETF

Consumer Staples Select Sector SPDR ETF

AMJ

BNO

DBE

DBO

ENY

FCG

FENY

FXN

GAZ

GEX

ICLN

IEO

IEZ

IXC

IYE

KOL

PBD

PBW

PSCE

PUW

PXE

PXI

PXJ

TAN

UNG

UNL

USO

VDE

XES

XLE

XOP

JPMorgan Alerian MLP ETN

52.94 94

United States Brent Oil

41.34 64

PowerShares DB Energy ETF

28.43 62

PowerShares DB Oil ETF

28.33 55

Guggenheim Canadian Energy Income ETF

16.60 51

First Trust ISE-Revere Natural Gas ETF

20.11 68

Fidelity MSCI Energy Index ETF

27.96 78

27.89 76

First Trust Energy AlphaDEX ETF

iPath DJ-UBS Natural Gas TR Sub-Idx ETN

2.39 57

63.25 90

Market Vectors Global Alt Energy ETF

iShares Global Clean Energy

11.68 79

iShares US Oil&Gas Explor&Prodtn

92.13 78

iShares US Oil Equipment&Services

71.45 73

iShares Global Energy

46.35 62

iShares US Energy

54.67 76

19.50 38

Market Vectors Coal ETF

PowerShares Global Clean Energy ETF

13.26 47

PowerShares WilderHill Clean Energy ETF

6.60 41

PowerShares S&P SmallCap Energy ETF

47.66 72

PowerShares WilderHill Prog Engy ETF

32.41 78

PowerShares Dynamic Engy Explr&Prdtn ETF 35.97 84

PowerShares DWA Energy Momentum ETF

61.30 87

PowerShares Dynamic Oil & Gas Svcs ETF

27.32 66

Guggenheim Solar ETF

42.24 81

United States Natural Gas

20.85 61

United States 12 Month Natural Gas

17.48 66

United States Oil

35.44 47

Vanguard Energy ETF

138.46 91

SPDR S&P Oil & Gas Equipment & Svcs ETF

44.37 61

96.37 75

Energy Select Sector SPDR ETF

SPDR S&P Oil & Gas Explor & Prod ETF

74.88 68

FNCL

FXO

Fidelity MSCI Financials Index ETF

First Trust Financials AlphaDEX ETF

PowerShares S&P SmCap Cnsmr Discret ETF

Guggenheim S&P 500 Eq Wt Cons Discr ETF

iShares Globl Consumer Discretionary

Vanguard Consumer Discretionary ETF

SPDR S&P Homebuilders ETF

Consumer Discret Select Sector SPDR ETF

SPDR S&P Retail ETF

PowerShares S&P SmallCap Cnsmr Stapl ETF

PowerShares DWA Consumer Staples Mom ETF

Guggenheim S&P 500 Eq Wt Cons Stapl ETF

27.07

22.97

124.10

33.39

32.97

45.50

80.79

82.30

109.00

30.58

67.12

84.63

73

73

85

80

79

71

83

84

75

76

90

77

27.52

27.01

38.88

98.95

88.63

28.19

49.81

46.21

96.72

115.38

44.52

71

86

93

94

86

92

75

94

96

83

93

26.85

22.07

91

91

0.80

-7.31

2.70

-1.95

-4.78

-7.06

1.49

-1.14

0.87

-6.84

1.08

-3.52

-0.40

-3.24

-0.31

-0.59

-1.88

-2.09

0.01

-1.97

-0.37

-1.70

-0.34

-0.72

5.91

-0.44

5.46

6.10

1.41

0.19

5.95

3.13

5.85

1.43

6.41

3.02

0.07

4.97

9.93

4.29

4.18

7.83

0.00

5.46

8.31

4.81

4.83

-0.09

-1.13

-1.62

-0.78

-1.54

1.29

-0.35

0.96

-0.35

-1.22

-1.11

3.93

2.13

3.63

3.36

0.05

7.31

4.87

8.34

3.04

2.10

1.85

16.99

-7.18

-2.47

2.26

14.18

3.52

9.33

10.97

-5.16

13.03

12.82

12.45

10.87

8.57

9.17

0.31

10.23

4.05

2.89

1.50

5.21

10.81

6.05

20.07

0.77

-4.74

0.34

9.52

1.90

9.92

9.69

2.80

-3.93

-3.46

-3.77

-0.12

-8.17

-2.37

-2.62

-8.78

0.73

2.91

-2.52

-5.36

-2.85

-2.48

5.12

-1.41

0.76

-6.03

-3.22

-3.31

-2.40

-5.76

0.40

-7.46

-4.64

-3.90

-2.45

-6.25

-2.48

-3.42

8.90

-5.59

-3.76

-2.24

3.07

-7.28

3.30

4.09

-19.53

9.13

11.44

2.29

3.78

1.17

3.15

2.96

5.18

10.24

-3.14

3.22

-0.80

5.44

1.27

10.66

-15.35

-10.95

-4.32

3.18

-1.02

3.39

1.04

Sell

Sell

Hold

Sell

Sell

Sell

Hold

Hold

Hold

Sell

Hold

Hold

Consumer Staples

Sell

Buy

Buy

Buy

Buy

Buy

Sell

Buy

Buy

Buy

Buy

Energy

Buy

Hold

Hold

Hold

Buy

Hold

Buy

Hold

Hold

Hold

Hold

Buy

Hold

Hold

Buy

Sell

Hold

Hold

Hold

Hold

Hold

Buy

Hold

Sell

Hold

Hold

Hold

Buy

Hold

Buy

Hold

Financials

Strong Buy

Buy

4.10

2.26

-1.72

-1.12

20.45

17.15

14.93

17.55

17.11

18.97

16.49

15.98

22.00 19.23 23.23

-2.08 4.04

-1.93 0.01 2.94

1.91 2.44 1.98

7.39

18.75 -0.84

16.29 0.64 6.89

26.17

3.02

32.77

27.66

23.88

19.90

18.61

20.06

4.23

27.50

23.63

14.01

15.89

20.99

24.91

14.23

65.69

15.45

3.76

-7.32

20.74

10.18

20.40

21.59

4.30

4.16 14.55

10.51

-28.61

12.53

-1.02

13.63

8.23

9.64

13.11

-21.25

6.58

-1.23

11.23

11.68

16.98

17.17

7.53

-5.13

-19.95

-16.87

1.17

12.80

7.42

13.70

11.91

15.82

-30.20

-1.86

-9.95

15.78

15.56

10.40

14.59

-6.38

-2.23

-6.73

10.06

21.29

22.06

13.20

-11.47

-26.90

-0.33

15.21

13.84

15.73

17.34

21.76 16.23

1.98

2.38

1.77

1.86

2.56

2.49

2.37

0.02

3.05

0.42

0.28

2.10

1.32

2.58

0.22

-0.22

0.34

1.74

1.84

-0.15

1.94

0.57

1.74

0.54

0.12

0.46

0.46

0.63

0.63

0.29

0.40

0.48

0.14

0.35

0.16

0.35

1.24

0.79

0.97

0.83

1.09

1.02

1.01

0.93

1.27

0.87

0.99

25.04

12.58

16.60

15.20

18.00

15.93

15.07

14.59

22.92

13.77

16.48

0.74

11.52

0.65

0.58

0.57

0.52

0.59

0.60

0.48

0.43

0.41

13.04

10.23

10.64

11.12

12.31

11.65

10.08

9.83

9.89

0.58

0.96

0.95

0.98

1.44

1.40

14.16

18.33

16.95

21.44

24.17

25.91

1.56

0.78

1.37

1.60

1.56

1.68

1.20

1.21

1.73

1.54

1.69

1.72

1.44

1.55

1.44

1.72

2.44

0.72

0.47

1.04

1.25

1.66

1.25

1.67

24.99

42.37

25.64

29.22

25.56

28.16

18.67

19.21

30.24

26.69

30.97

28.11

21.99

25.13

23.30

29.25

52.38

35.28

23.54

23.18

19.91

27.33

20.01

27.35

0.85

0.90

0.75

0.75

0.70

0.60

0.12

0.70

0.75

0.62

0.48

0.46

0.46

0.48

0.46

0.59

0.81

0.70

0.29

0.70

0.65

0.66

0.62

0.70

0.85

0.90

0.61

0.14

0.35

0.16

0.35

1.00 15.50

0.12

0.70

0.75

0.12

0.70

0.46

0.48

0.63

0.29

0.65

0.40

0.14

0.16

www.MutualFundInvestorGuide.com | AUGUST 2014 7

The ETF Investor Guide

% Return (3 and 5 Years Annualized)

Symbol

Fund

Price

Rank

Advice

YTD

1 Month 3 Month

1 Year

3 Year

20.82

12.24

7.46

11.99

14.33

3.63

14.27

14.65

5.00

13.18

14.12

14.40

20.92

21.76

21.58

15.80

20.89

19.61

20.57

23.60

22.76

8.84

20.65

21.73

5 Year

Yield %

Beta

3 Year

SD

3 Year

Expense

Ratio

FINANCIALS (continued)

IAI

IAK

IAT

IXG

IYF

KBE

KCE

KIE

KRE

PGF

VFH

XLF

iShares US Broker-Dealers

iShares US Insurance

iShares US Regional Banks

iShares Global Financials

iShares US Financials

SPDR S&P Bank ETF

SPDR S&P Capital Markets ETF

SPDR S&P Insurance ETF

SPDR S&P Regional Banking ETF

PowerShares Financial Preferred ETF

Vanguard Financials ETF

Financial Select Sector SPDR ETF

FBT

FHLC

FXH

IBB

IHE

IHF

IHI

IXJ

IYH

PBE

PJP

PTH

RYH

VHT

XBI

XLV

XPH

First Trust NYSE Arca Biotech ETF

Fidelity MSCI Health Care Index ETF

First Trust Health Care AlphaDEX ETF

iShares Nasdaq Biotechnology

iShares US Pharmaceuticals

iShares US Healthcare Providers

iShares US Medical Devices

iShares Global Healthcare

iShares US Healthcare

PowerShares Dynamic Biotech & Genome ETF

PowerShares Dynamic Pharmaceuticals ETF

PowerShares DWA Healthcare Momentum ETF

Guggenheim S&P 500 Eq Weight HC ETF

Vanguard Health Care ETF

SPDR S&P Biotech ETF

Health Care Select Sector SPDR ETF

SPDR S&P Pharmaceuticals ETF

38.02

46.83

32.61

56.73

82.61

31.61

47.61

63.02

37.81

18.10

45.92

22.58

80

77

63

77

91

56

73

70

59

91

75

74

Hold

Buy

Hold

Hold

Strong Buy

Hold

Sell

Hold

Hold

Strong Buy

Strong Buy

Buy

86.36

29.64

54.19

263.41

132.07

105.36

101.34

94.15

130.30

45.72

60.95

47.91

126.04

113.46

155.35

61.96

98.15

98

97

98

98

93

98

95

95

98

98

98

91

97

87

98

98

94

Strong Buy

Strong Buy

Strong Buy

Strong Buy

Strong Buy

Strong Buy

Buy

Strong Buy

Strong Buy

Strong Buy

Strong Buy

Buy

Strong Buy

Strong Buy

Strong Buy

Strong Buy

Strong Buy

86

86

73

90

71

79

84

91

89

71

90

84

69

75

80

84

EXI

FIDU

FLM

FXR

GII

IGF

ITA

IYJ

IYT

PKB

PPA

PRN

PSCI

SEA

VIS

XLI

iShares Global Industrials

Fidelity MSCI Industrials Index ETF

First Trust ISE Glb Engnrg And Const ETF

First Trust Indtls/PrdcrDurbAlphaDEXETF

SPDR S&P Global Infrastructure

iShares Global Infrastructure

iShares US Aerospace & Defense

iShares US Industrials

iShares Transportation Average

PowerShares Dynamic Building & Const ETF

PowerShares Aerospace & Defense ETF

PowerShares S&P SmallCap Industrials ETF

Guggenheim Shipping ETF

Vanguard Industrials ETF

Industrial Select Sector SPDR ETF

70.66

27.47

51.01

29.87

49.64

43.42

105.70

101.49

148.14

21.52

31.74

46.53

43.18

22.39

101.76

52.87

AGOL

DBB

DBP

DBS

GDX

GDXJ

GLD

GLDX

IAU

JJM

JJP

ETFS Physical Asian Gold Shares

PowerShares DB Base Metals ETF

PowerShares DB Precious Metals ETF

PowerShares DB Silver ETF

Market Vectors Gold Miners ETF

Market Vectors Junior Gold Miners ETF

SPDR Gold Shares

Global X Gold Explorers ETF

iShares Gold Trust

iPath DJ-UBS Ind Metals TR Sub-Idx ETN

iPath DJ-UBS Prec Metals TR Sub-Idx ETN

129.15

17.26

41.72

32.39

26.82

42.30

125.48

16.00

12.63

30.69

64.18

PowerShares DWA Industrials Momentum ETF

8 AUGUST 2014 | PHONE: (888) 252-5372

-1.06

-0.33

-0.70

2.39

3.79

-4.08

-4.15

0.65

-6.25

11.26

4.16

4.08

Healthcare

24.83

12.03

12.73

16.19

12.71

13.10

9.51

10.50

12.50

24.05

14.24

1.27

14.46

12.23

20.06

12.57

11.88

Industrials

Hold

Buy

Hold

Buy

Hold

Hold

Buy

Strong Buy

Buy

Hold

Buy

Hold

Sell

Buy

Buy

Buy

0.14

1.03

0.06

5.70

12.90

13.09

0.83

0.85

12.81

-3.95

2.48

-2.34

-5.22

5.16

1.73

2.11

2.34

-2.78

-6.19

-1.15

-1.75

-5.11

-1.10

-1.99

-5.76

0.28

-1.75

-1.78

6.47

2.68

1.25

2.36

4.26

1.90

4.85

2.45

1.57

1.90

4.31

4.37

8.82

15.09

11.27

7.69

12.08

8.31

8.01

15.83

13.48

9.16

12.07

11.33

5.86 16.00 44.41 34.90 27.12

1.59 8.09

1.96 8.45 30.58 27.68 24.91

4.35 15.30 39.70 41.49 28.38

-1.06

4.17 27.49 27.31 24.19

1.95 8.66 22.50 24.40 20.94

-0.53 5.25 23.88 20.25 16.69

-0.54 3.92 22.57 23.34 17.78

1.28

7.40 25.91 27.06 19.88

7.68 20.64 43.81 33.77 23.63

0.15

7.35 35.33 35.76 31.34

1.12

7.35 13.88 21.09 19.19

1.29 8.02 29.29 26.09 21.58

1.58

7.91 26.75 27.23 20.43

9.59 24.18 34.95 36.06 24.37

1.09

7.32 26.76 26.76 19.50

-3.44 3.64 33.08 30.01 27.46

-2.64

-2.52

-0.93

-1.58

-1.29

-0.87

-2.05

-2.11

-0.90

-1.91

-2.28

-2.08

-3.15

0.60

-2.57

-2.79

-0.47

0.50

0.70

2.36

3.50

4.08

-1.54

1.19

6.44

1.91

-0.59

3.43

0.01

3.19

0.72

0.21

1.06

1.52

1.58

2.02

1.52

1.58

1.40

1.40

1.65

6.74

2.10

1.50

Sell

Sell

Sell

Sell

Hold

Hold

Sell

Hold

Sell

Sell

Sell

10.13

2.37

6.46

0.31

26.93

36.23

8.06

45.45

8.13

3.26

5.89

7.71

20.06

8.83

10.84

21.24

18.51

18.77

13.95

17.93

18.94

2.94

3.94

1.06

1.39

1.22

0.35

1.10

0.89

19.07

18.84

4.18

1.74

1.82

6.17

6.31

-2.95

5.15

0.60

0.12

0.70

0.48

0.46

0.46

0.46

0.48

0.46

0.63

0.63

0.65

0.40

0.14

0.35

0.16

0.35

1.05 15.37

14.53

25.30

22.40

22.56

21.86

17.75

32.09

10.67

20.24

16.12

13.15

24.44

19.94

19.95

-1.12

4.88

4.25

-6.73

0.97 23.46

2.12

14.13

1.01

1.14 -4.48 -10.09

-1.20 7.54 -0.17 -8.40

-0.62 0.34 -7.58 -13.42

-5.71 0.72 -16.69 -22.49

4.03 13.55 -11.04 -23.35

2.00 20.34 -14.72 -31.26

0.77 0.57 -4.71 -9.94

-0.99 21.49 -7.78 -34.97

0.72 0.56 -4.61 -9.83

-2.08 4.24 0.39 -9.71

-1.50 0.69 -8.48 -14.14

0.46

0.46

0.46

0.48

0.46

0.35

0.35

0.35

0.35

0.64

0.19

0.16

1.31

1.39

1.42

0.95

1.32

0.09

0.28

1.58

1.50

-0.54

0.84

-0.29

Materials & Precious Metals

47

37

51

30

54

52

46

47

57

44

39

21.01

17.00

16.69

18.81

16.46

18.92

21.06

16.62

20.92

8.27

16.84

17.82

0.68

0.69

0.56

0.84

0.80

0.63

0.59

0.86

0.67

0.81

0.70

0.61

0.97

0.57

0.66

14.67 15.22

11.75

24.00

12.27

12.96

25.88

20.98

22.10

24.99

24.96

22.29

20.29

11.26

21.95

20.92

1.20

1.06

0.87

1.28

1.06

1.05

1.32

1.03

1.14

0.74

1.08

1.13

0.34

-0.16

13.20

18.88

12.51

15.48

14.48

10.74

10.83

21.04

13.55

15.72

11.98

11.09

27.69

10.46

15.59

1.28

1.06

0.55

0.76

0.78

0.98

0.87

1.25

0.81

1.11

1.12

1.28

0.99

0.95

19.52

17.07

10.61

12.15

13.71

15.26

16.58

20.73

13.68

18.90

18.95

22.42

15.64

14.93

0.48

0.12

0.70

0.70

0.40

0.48

0.46

0.46

0.46

0.63

0.66

0.65

0.29

0.65

0.14

0.16

0.89

0.72

1.07

1.74

0.42

1.07

0.89

1.28

0.91

0.80

1.11

21.04

20.59

22.75

35.64

32.43

45.00

21.04

48.46

22.07

21.90

23.60

0.39

0.75

0.75

0.75

0.53

0.57

0.40

0.65

0.25

0.75

0.75

% Return (3 and 5 Years Annualized)

Symbol

Fund

Price

Rank

Advice

YTD

1 Month 3 Month

1 Year

3 Year

5 Year

Yield %

Beta

3 Year

SD

3 Year

Expense

Ratio

Materials & Precious Metals (continued)

PALL

PGM

PPLT

PSAU

RING

SIL

SLV

WITE

ETFS Physical Palladium Shares

iPath DJ-UBS Platinum TR Sub-Idx ETN

ETFS Physical Platinum Shares

PowerShares Global Gold & Prec Mtls ETF

iShares MSCI Global Gold Miners

Global X Silver Miners ETF

iShares Silver Trust

ETFS Physical White Metals Basket Shares

86.96

31.90

141.69

22.96

11.31

14.06

18.86

40.45

71

47

52

48

47

49

32

45

COPX

CU

CUT

FIW

FMAT

FXZ

GNAT

GRES

HAP

IGE

IYM

LIT

MOO

MXI

PAGG

PHO

PIO

PYZ

PZD

REMX

RTM

SLX

URA

VAW

WOOD

XLB

Global X Copper Miners ETF

First Trust ISE Global Copper ETF

Guggenheim Timber ETF

First Trust ISE Water ETF

Fidelity MSCI Materials Index ETF

First Trust Materials AlphaDEX ETF

WisdomTree Global Natural Resources

IQ Global Resources ETF

Market Vectors Natural Resources ETF

iShares North American Natural Resources

iShares US Basic Materials

Global X Lithium ETF

Market Vectors Agribusiness ETF

iShares Global Materials

PowerShares Global Agriculture ETF

PowerShares Water Resources ETF

PowerShares Global Water ETF

PowerShares DWA Basic Materials Mom ETF

PowerShares Cleantech ETF

Market Vectors Rare EarthStrat Mtls ETF

Guggenheim S&P 500 Eq Wt Materials ETF

Market Vectors Steel ETF

Global X Uranium ETF

Vanguard Materials ETF

iShares Global Timber & Forestry

Materials Select Sector SPDR ETF

10.29

24.11

24.03

32.87

28.30

33.12

22.54

29.11

39.73

47.93

87.38

13.40