Professional Documents

Culture Documents

Management of Financial Institutions

Uploaded by

kannnamreddyeswarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Management of Financial Institutions

Uploaded by

kannnamreddyeswarCopyright:

Available Formats

UNIT 1

OVERVIEW OF FINANCIAL INSTITUTION

LESSON 1:

INTRODUCTION TO INDIAN FINANCIAL

SYSTEM

MANAGEMENT OF FINANCIAL INSTITUTION

Learning Objectives financial enterprises manufacture products (e.g., cars, steel,

After reading this lesson, you will understand computers) and/or provide non-financial services (e.g.,

transportation, utilities, computer programming). Financial

• Significance and definition of financial system

enterprises, more popularly referred to as financial

• Importance Of Financial Institutions institutions, provide services related to one or more of the

• Role Of Financial Intermediaries following: let us see what are those.

al

• Financial System – Various Types Of Classification • Transforming financial assets acquired through the market

• Functions Of Financial Institution and constitution them into a different, and more widely

i

preferable, type of asset-which becomes their liability. This is

Dear students, today is our first lecture on Management of

com Tr

the function performed by financial intermediaries, the

Financial Institution. Before we get deep into the subject, the

most important type of financial institution.

primary basic thing for us to understand is the significance, role,

importance and function of financial institution. • Exchanging of financial assets on behalf of customers.

• Exchanging of financial assets for their own accounts.

What is the Significance and Definition of Financial

rd. F

• Assisting in the creation of financial assets for their

System? customers, and then selling those financial assets to other

We all know that the growth of output in any economy market participants.

iza D

depends on the increase in the proportion of savings/

investment to a nation’s output of goods and services. So the

financial system and financial institutions help in the diversion

• Providing investment advice to other market participants.

• Managing the portfolios of other market participants.

dfw P

of rising current income into savings/investments. So now you are aware that financial intermediaries include

We can define financial system as a set of institutions, depository institutions (commercial banks, savings and loan

instruments and markets, which foster savings and channels associates, savings banks, and credit unions), which acquire the

w.p m

them to their most efficient use. The system consists of bulk of their funds by offering their liabilities to the public

individuals (savers), intermediaries, markets and users of mostly in the form of deposits: insurance companies (life and

savings. Economic activity and growth are greatly facilitated by property and casualty companies); pension funds; and finance

ww Co

the existence of a financial system developed in terms of the companies.

efficiency of the market in mobilising savings and allocating What are the Role of Financial Intermediaries?

them among competing users. Financial intermediaries obtain funds by issuing financial claims

Well-developed financial markets are required for creating a against themselves to market participants, and then investing

balanced financial system in which both financial markets and those funds; the investments made by financial intermediaries-

cu

financial institutions play important roles. Deep and liquid their assets- can be in loans and/or securities. These

markets provide liquidity to meet any surge in demand for investments are referred to as direct investments. Market

liquidity in times of financial crisis. Such markets are also participants who hold the financial claims issued by financial

necessary to derive appropriate reference rates for pricing intermediaries are said to have made indirect investments.

Do

financial assets. We can elaborate this further by understanding that financial

This lesson introduces the financial intermediary. Intermediaries institutions are business organisations that act as mobilisers

include commercial banks, savings and loan associations, and depositories of savings, and as purveyors of credit or

investment companies, insurance companies, and pension finance. They also provide various financial services to the

funds. The most important contribution of intermediaries is a community. They differ from non-financial (industrial and

steady and relatively inexpensive flow of funds from savers to commercial) business organisations in respect of their dealings,

final users or investors. Every modern economy has i.e., while the former deal in financial assets such as deposits,

intermediaries, which perform key financial functions for loans, securities, and so on, the latter deal in real assets such as

individuals, households, corporations, small and new machinery, equipment, stocks of goods, real estate, and so on.

businesses, and governments. You should not think that the distinction between the financial

What is the Importance of Financial Institutions? sector and the “real sector” is something ephemeral or

Now coming to the importance of Financial Institution that i.e. unproductive about finance. At the same time, it means that the

why is financial intermediaries so important in any country or role of financial sector should not be overemphasised. The

for that matter in any economy. The answer is simple. Business activities of different financial institutions may be either

entities include non-financial and financial enterprises. Non- specialised or they may overlap; quite often they overlap. Yet you

© Copy Right: Rai University

11.621.6 1

need to classify financial institutions and this is done on the interlinked by the laws, contracts, covenants and

MANAGEMENT OF FINANCIAL INSTITUTION

basis of their primary activity or the degree of their communication networks.

specialisation with relation to savers or borrowers with whom Financial markets are sometimes classified as primary (direct)

they customarily deal or the manner of their creation. In other and secondary (indirect) markets. You all must be well aware

words, the functional, geographic, sectoral scope of activity or that primary markets deal in the new financial claims or new

the types of ownership are some of the criteria, which are often securities and, therefore, they are also known as new issue

used to classify a large markets. On the other hand, secondary markets deal in securities

Financial System – Various Types of Classification already issued or existing or outstanding. The primary markets

We can classify financial institutions into banking and non- mobilise savings and supply fresh or additional capital to

banking institutions. You know that the banking institutions business units. Although secondary markets do not contribute

have quite a few things in common with the non-banking ones, directly to the supply of additional capital, they do so indirectly

but their distinguishing character lies in the fact that, unlike by rendering securities issued on the primary markets liquid.

other institutions, they participate in the economy’s payments Stock markets have both primary and secondary market

al

mechanism, i.e., they provide transactions services, their deposit segments.

liabilities constitute a major part of the national money supply, Very often financial markets are classified as money markets

and they can, as a whole, create deposits or credit, which is and capital markets, although there is no essential difference

i

money. Banks, subject to legal reserve requirements, can advance between the two as both perform the same function of

com Tr

credit by creating claims against themselves, while other transferring resources to the producers. This conventional

institutions can lend only out of resources put at their disposal distinction is based on the differences in the period of maturity

by the savers, and the latter as mere “purveyors” of credit. of financial assets issued in these markets. While money

While the banking system in India comprises the commercial markets deal in the short-term claims (with a period of maturity

rd. F

banks and co-operative banks, the examples of non-banking of one year or less), capital markets do so in the long-term

financial institutions are Life Insurance Corporation (LIC), Unit (maturity period above one year) claims. Contrary to popular

Trust of India (UTI), and Industrial Development Bank of usage, the capital market is not only co-extensive with the stock

iza D

India (IDBI). We shall discuss this in detail later.

There are also few other ways to classify financial institution.

market; but it is also much wider than the stock market.

Similarly, it is not always possible to include a given participant

in either of the two (money and capital) markets alone.

dfw P

Like they can be classified as intermediaries and non-

Commercial banks, for example, belong to both. While treasury

intermediaries. As we have seen earlier, intermediaries

bills market, call money market, and commercial bills market are

intermediate between savers and investors; they lend money as

examples of money market; stock market and government

well as mobilise savings; their liabilities are towards the ultimate

w.p m

bonds market are examples of capital market.

savers, while their assets are from the investors or borrowers.

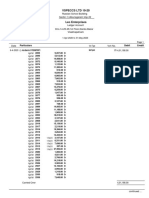

Non--intermediary institutions do the loan business but their The above classification can be tabulated in the table format as

resources are not directly obtained from the savers. All banking given below:

ww Co

institutions are intermediaries. Many non-banking institutions Table 1

also act as intermediaries and when they do so they are known

as Non-Banking Financial Intermediaries (NBFI). UTI, Classification by nature of claim:

Debt Market

LIC, General Insurance Corporation (GIC) is some of the Equity Market

NBFIs in India. Non-intermediary institutions like IDBI,

cu

Classification by maturity of claim:

Industrial Finance Corporation (IFC), and National Bank for Money Market

Capital Market

Agriculture and Rural Development (NABARD) have come Classification by seasoning of claim :

into existence because of governmental efforts to provide Primary Market

Secondary Market

assistance for specific purposes, sectors, and regions. Their

Do

Classification by immediate delivery or future delivery:

creation as a matter of policy has been motivated by the Cash or spot Market

Derivative Market

philosophy that the credit needs of certain borrowers might not Classification by organizational structure:

be otherwise adequately met by the usual private institutions. Auction Market

Over -the-counter Market

Since they have been set up by the government, we can call them Intermediated Market

Non-Banking Statutory Financial Organisations (NBSFO).

Let us now shift our focus to financial markets. Financial

markets are the centers or arrangements that provide facilities What are the points of difference related to financial

for buying and selling of financial claims and services. The instruments? These instruments differ from each other in

corporations, financial institutions, individuals and respect of their investment characteristics, which of course, are

governments trade in financial products in these markets either interdependent and interrelated. Among the investment

directly or through brokers and dealers on organised exchanges characteristics of financial assets or financial products, the

or off--exchanges. The participants on the demand and supply following are important: (i) liquidity, (ii) marketability, (iii)

sides of these markets are financial institutions, agents, brokers, reversibility, (iv) transferability, (v) transactions costs, (vi) risk of

dealers, borrowers, lenders, savers, and others who are default or the degree of capital and income uncertainty, and a

wide array of other risks, (vii) maturity period, (viii) tax status,

© Copy Right: Rai University

2 11.621.6

(ix) options such as call-back or buy-back option, (x) volatility

MANAGEMENT OF FINANCIAL INSTITUTION

of prices, and (xi) the rate of return-nominal, effective, and real.

What are the Functions of Financial Institution?

After a detailed discussion on financial institution it becomes

easy for us to determine the functions of financial institution.

Financial institutions or intermediaries offer various types of

transformation services. They issue claims to their customers

that have characteristics different from those of their own

assets. For example, banks accept deposits as liability and

convert them into assets such as loans. This is known as

“liability-asset transformation” function. Similarly they

choose and manage portfolios whose risk and return they alter

by applying resources to acquire better information and to

al

reduce or overcome transaction costs. They are able to do so

through economies of scale in lending and borrowing. They

provide large volumes of finance on the basis of small deposits

i

or unit capital. This is called “size-transformation” function.

com Tr

Further, they distribute risk through diversification and thereby

reduce it for savers as in the case of mutual funds. This is called

“risk-transformation” function. Finally they offer savers

alternate forms of deposits according to their liquidity

preferences, and provide borrowers with loans of requisite

rd. F

maturities. This is known as “maturity-transformation”

function.

iza D

A financial system also ensures that transactions are effected

safely and swiftly on an on-going basis. It is important that

dfw P

both buyers and sellers of goods and services should have the

confidence that instruments used to make payments will be

accepted and honoured by all parties. The financial system

ensures the efficient functioning of the payment mechanism.

w.p m

In a nutshell, financial markets can be said to perform

proximate functions such as

1. Enabling economic units to exercise their time preference,

ww Co

2. Separation, distribution, diversification, and reduction of

risk,

3. Efficient operation of the payment mechanism,

4. Transmutation or transformation of financial claims so as to

cu

suit the preferences of both savers and borrowers,

5. Enhancing liquidity of financial claims through securities

trading, and

Do

6. Portfolio management.

Questions to Discuss

1. What is the Significance And Definition of Financial System?

2. What is the Importance Of Financial Institutions?

3. What is the Role Of Financial Intermediaries?

4. What are the various classifications of Financial Institutions?

5. What are the functions of Financial Institutions?

Notes:

© Copy Right: Rai University

11.621.6 3

MANAGEMENT OF FINANCIAL INSTITUTION

LESSON 2:

INTRODUCTION TO INDIAN FINANCIAL SYSTEM

Learning Objectives This economic function of financial intermediaries-

After reading this lesson, you will understand transforming more risky assets into less risky ones- is called

diversification. Although individual investors can do it on their

• Maturity Intermediation

own, they may not be able to do it as cost-effectively as a

• Reducing Risk Via Diversification financial intermediary, depending on the amount of funds they

• Reducing The Costs Of Contracting And Information have to invest. Attaining cost-effective diversification in order to

Processing deduce risk by purchasing the financial assets of a financial

al

• Providing A Payments Mechanism intermediary is an important economic benefit for financial

markets.

• Asset/ Liability Management Of The Financial Institutions

Reducing the Costs of Contracting and Information

i

• Nature Of Liabilities

com Tr

• Liquidity Concerns Processing

• Brokerage and asset transformation

You can also reduce the cost of contracting and information

processing. Suppose you are an investor purchasing financial

• Advantages of financial institutions

assets. You should take the time to develop skills necessary to

• Criteria To Evaluate Financial Institutions understand how to evaluate an investment. Once these skills are

rd. F

After getting aware of the characteristics of financial institution, developed you should apply them to the analysis of specific

let us understand some other related concepts. financial assets that are candidates for purchase (or subsequent

iza D

What do you Mean by Maturity Intermediation?

The commercial bank by issuing its own financial claims in

sale). If you as an investor wants to make a loan to a consumer

or business you will need to write the loan contract.

dfw P

essence transforms a longer-term asset into a shorter-term one Although there are some people who enjoy devoting leisure

by giving the borrower a loan for the length of time sought and time to their task, most prefer to use that time for just that-

the investor/depositor a financial asset for the desired leisure. Most of us find that leisure time is in short supply, so

investment horizon. This function of a financial intermediary is to sacrifice it, we have to be compensated; the form of

w.p m

called maturity intermediation. compensation could be a higher return that we obtain from an

investment.

You should understand that maturity intermediation has two

implications for financial markets. First, it provides investors In addition to the opportunity cost of the time to process the

ww Co

with more choices concerning maturity for their investments; information about the financial asset and its issuer, there is the

borrowers have more choices for the length of their debt cost of acquiring that information. All these costs are called

obligations. Second, because investors are naturally reluctant to information processing costs. The costs of writing loan

commit funds for a long period of time, they will require that contracts are referred to as contracts are referred to as contracting

long-term borrowers pay a higher interest rate than on short- costs. There is also another dimension to contracting costs, the

cu

term borrowing. A financial intermediary is willing to make cost of enforcing the terms of the loan agreement.

longer-term loans, and at a lower cost to the borrower than an With this in mind, consider the two examples of financial

individual investor would, by counting on successive deposits intermediaries- the commercial bank and the investment

providing the funds until maturity. Thus, the second company. People who work for these intermediaries include

Do

implication is that the cost of longer-term borrowing is likely to investment professionals who are trained to analyse financial

be reduced. assets and manage them. In the case of loan agreements, either

standardised contracts can be prepared, or legal counsel can be

What is Reducing Risk Via Diversification?

part of the professional staff that writes contracts involving

Next shall discuss the way to reduce the risk through

more complex transactions. The investment professional can

diversification. Consider the example of the investor who places

monitor compliance with the terms of the loan agreement and

funds in an investment company. Suppose that the investment

take any necessary action to protect the interests of the financial

company invests the funds received in the stock of a large

intermediary. The employment of such professionals is cost-

number of companies. By doing so, the investment company

effective for financial intermediaries because investing funds is

has diversified and reduced its risk. Investors who have a small

their normal business.

sum to invest would find it difficult to achieve the same degree

of diversification because they do not have sufficient funds to In other words, there are economies of scale in contracting and

buy shares of a large number of companies. Yet by investing in processing information about financial assets because of the

the investment company for the same sum of money, investors amount of funds managed by financial intermediaries. The

can accomplish this diversification, thereby reducing risk. lower costs accrue to the benefit of the investor who purchases

© Copy Right: Rai University

4 11.621.6

a financial claim of the financial intermediary and to the issuers investment company that agrees to repurchase shares at any

MANAGEMENT OF FINANCIAL INSTITUTION

of financial assets, who benefit from a lower borrowing cost. time.

Providing a Payments Mechanism Nature of Liabilities

You have seen that most transactions made today are not done By the liabilities of the financial institution we mean the

with cash. Instead, payments are made using cheques, credit amount and timing of the cash outlays that must be made to

cards, and electronic transfers of funds. These methods for satisfy the contractual terms of the obligations issued. The

making payments are provided by certain financial liabilities of any financial institution can be categorized

intermediaries. according to four typed as shown in the below table. The

At one time, non-cash payments were restricted to cheques categorisation in the table assumes that the entity that must be

written against non-interest-bearing accounts at commercial paid the obligation will not cancel the financial institution’s

banks. Similar check writing privileges were provided later by obligation prior to any actual or projected payout date.

savings and loan associations and saving banks, and by certain The descriptions of cash outlays as either known or uncertain

types of investment companies. Payment by credit card was also are undoubtedly broad. When you refer to a cash outlay as

al

one time the exclusive domain of commercial banks, but now being uncertain, you do not mean that it cannot be predicted.

other depository institutions offer this service. Debit cards are There are some liabilities where the “law of large numbers”

offered by various financial intermediaries. I am sure all of us makes it easier to predict the timing and/or amount of cash

i

present over here must be having at least one debit card apart outlays. This is the work typically done by actuaries, but of

com Tr

from credit cards. And you all must also be aware that a debit course even actuaries cannot predict natural catastrophes such as

card differs from a credit card in that, in the latter case, a bill is floods and earthquakes.

sent to the credit card holder periodically (usually once a month) Table 2

requesting payment for transactions made in the past. In the

rd. F

case of a debit card, funds are immediately withdrawn (that is, Nature of Liabilities of Financial Institutions

debited) from the purchaser’s account at the time the transaction Liability type Amount of Cash Outlay Timing of Cash Outlay

takes place

iza D

The ability to make payments without the use of cash is critical

for the functioning of a financial market. In short, depository

Type I

Type II

Type III

Type IV

Known

Known

Uncertain

Uncertain

Known

Uncertain

Known

Uncertain

dfw P

institutions transform assets that cannot be used to make

payments into other assets that offer that property.

Let us illustrate each one of them

Asset/ Liability Management of the Financial

Type I Liabilities

w.p m

Institutions Both the amount and the timing of the liabilities are known

To understand the reasons mangers of financial institutions with certainty. A liability requiring a financial institution to pay

invest in particular types of financial assets and the types of Rs.50, 000 six months from now would be an example. For

ww Co

investment strategies they employ, it is necessary that you have a example, depository institutions know the amount that they are

general understanding of the asset/ liability problem faced. committed to pay (principal plus interest) on the maturity date

The nature of the liabilities dictates the investment strategy a of a fixed-rate deposit, assuming that the depositor does not

financial institution will pursue. For example, depository withdraw funds prior to the maturity date.

institutions seek to generate income by the spread between the

cu

Type I Liabilities

return that they earn on assets and the cost of their funds. That

however, are not limited to depository institutions. A major

is, they buy money and sell money. They buy money by

product sold by life insurance companies is a guaranteed

borrowing from depositors or other sources of funds. They sell

investment contract, popularly referred to as a GIC. The

money when they lend it to businesses or individuals. In

Do

obligation of the life insurance company under this contract is

essence, they are spread businesses. Their objective is to sell

that, for a sum of money (called a premium), it will guarantee

money for more than it costs to buy money. The cost of the

an interest rate up to some specifies maturity date. For example,

funds and the return on the funds sold is expressed in terms of

suppose a life insurance company for a premium of Rs.10

an interest rate per unit of time. Consequently, the objective of

million issues a five-year GIC agreement to pay 10%

a depository institution is to earn a positive spread between the

compounded annually. The life insurance company knows that

assets it invests in (what it has sold the money for) and the

it must pay Rs16.11 million to the GIC policyholder in five

costs of its funds (what it has purchased the money for).

years.

Life insurance companies- and, to a certain extent, property and

casualty insurance companies- are in a spread business. Pension Type II Liabilities

funds are not in the spread business in that they do not raise The amount of cash outlay is known, but the timing of the

funds themselves in the market. They seek to cover the cost of cash outlay is uncertain. The most obvious example of a Type

pension obligations at a minimum cost that is borne by the II liability is a life insurance policy. There are many types of life

sponsor of the pension plan. Investment companies face no insurance policies but the most basic type is that, for an annual

explicit costs for the funds they acquire and must satisfy no premium, a life insurance company agrees to make a specified

specific liability obligations; one exception is a particular type of

© Copy Right: Rai University

11.621.6 5

dollar payment to policy beneficiaries upon the death of the certain types of investment companies, it means not being able

MANAGEMENT OF FINANCIAL INSTITUTION

insured. to find new buyers for shares.

Type III Liabilities Brokerage and Asset Transformation

With this type of liability, the timing of the cash outlay is Now let us move ahead to discuss the services. Intermediary

known, but the amount is uncertain. An example is where a services are of two kinds, brokerage function and asset

financial institution has issued an obligation in which the transformation activity. Brokerage function as represented by

interest rate adjusts periodically according to some interest rate the activities of brokers and market operators, processing and

benchmark. Depository institutions, for example, issue supplying information is a part and parcel of all intermediation

accounts called certificates of deposit, which have a stated by all institutions. Brokerage function brings together lenders

maturity, the interest rate paid need not be fixed over the life of and borrowers and reduces market imperfections such as search,

he deposit but may fluctuate. If a depository institution issues information and transaction costs. The asset transformation

a three-year floating-rate certificate of deposit that adjusts every activity is provided by institutions issuing claims against

three months and the interest rate paid is the three-month themselves, which differ, from the assets they acquire. Mutual

al

Treasury bill rate plus one percentage point, the depository funds, insurance companies, banks and depositors with a share

institution knows it has a liability that must be paid off in three of a large asset or issuing debt type liabilities against equity type

years, but the dollar amount of the liability is not known. It assets. While providing asset transformation, financial firms

i

will depend on three-month Treasury bill rates over the three differ in the nature of transformation undertaken and in the

com Tr

years. nature of protection or guarantees, which are offered. Banks

Type IV Liabilities and depository institutions offer liquidity, insurance against

There are numerous insurance products and pension contingent losses to assets and mutual funds against loss in

obligations that present uncertainty as to both the amount and value of assets.

rd. F

the timing of the cash outlay. Probably the most obvious Through their intermediary activities banks provide a package of

examples are automobile and home insurance policies issued by information and risk sharing services to their customers. While

doing so they take on part of heir risk. Banks have to manage

iza D

property and casualty insurance companies. When, and if, a

payment will have to be made to the policyholder is uncertain.

Whenever damage is done to an insured asset, the amount of

the risks through appropriate structuring of their activities and

hedge risks through derivative contracts to maximize their

dfw P

the payment that must be made is uncertain. profitability.

What are the Liquidity Concerns? Financial institutions provide three transformation services.

By liquidity concerns what do you understand? Because of the Firstly, liability, asset and size transformation consisting of

mobilization of funds and their allocation (provision of large

w.p m

uncertainty about the timing and/ or the amount of the cash

outlays, a financial institution must be prepared to have loans on the basis of numerous small deposits). Secondly,

sufficient cash to satisfy its obligations. Here it has been maturity transformation by offering the savers the relatively

assumed that the entity that holds the obligation against the short- term claim or liquid deposit they prefer and providing

ww Co

financial institution may have the right to change the nature of borrowers long-term loans which are better matched to the cash

the obligation, perhaps incurring some penalty. For example, in flows generated by their investment. Finally, risk transformation

the case of a certificate of deposit, you as a depositor may by transforming and reducing the risk involved in direct lending

request the withdrawal of funds prior to the maturity date; by acquiring more diversified portfolios than individual savers

can. The expansion of the financial network or an increase in

cu

typically, the deposit-accepting institution will grant this request

but assess an early withdrawal penalty. In the case of certain financial intermediation as denoted by the ration of financial

types of investment companies, shareholders have the right to assets of all kinds of gross national product accompanies

redeem their shares at any time. growth. To a certain extent, growth of savings is facilitated by

the increase in the range of financial instruments and expansion

Do

Some life insurance products have a cash-surrender value. This

of markets.

means that, at specified dated, the policyholder can exchange the

policy for a lump-sum payment. Typically, the lump-sum Finally What are the Advantages of Financial

payment will penalize the policyholder for turning in the policy. Institutions?

There are some life insurance products that have a loan value, After discussing the financial institution now tell me students

which means that the policyholder has the right to borrow that is there any advantage of financial institution at all. I am

against the cash value of the policy. sure you all will have the same answer YES. Benefits provided

In addition to uncertainty about the timing and amount of the by financial intermediaries consist of reduction of information

cash outlays, and the potential for the depositor of policyholder and transaction costs, grant long-term loans, and provide liquid

to withdraw cash early or borrow against a policy, a financial claims and pool risks. Financial intermediaries economise costs

institution has to be concerned with possible reduction in cash of borrowers and lenders. Banks are set up to mobilize savings

inflows. In the case of a depository institution, this means the of many small depositors, which are insured. While lending,

inability to obtain deposits. For insurance companies, it means the bank makes a single expert investigation of the credit

reduced premiums because of the cancellation of policies. For standing of the borrower saving on several investigations of

amateurs.

© Copy Right: Rai University

6 11.621.6

Financial intermediaries make it possible for borrowers to • Financial reforms are not merely a question of “credit

MANAGEMENT OF FINANCIAL INSTITUTION

obtain long-term loans even though the ultimate lenders are limits”; they encompass issues involved in “limits of credit”.

making only short-term loans. Borrowers who wish to acquire • State intervention is not the best way to achieve a fair

fixed assets do not want to finance them with short-term loans. distribution of credit.

Although the bank has used depositors funds to make long-

• Financial institutions must evolve from below rather than be

term loans it still promises its depositors that they can

imposed from above. Financial development ought to take

withdraw their deposits at any time on the assumption that the

place at a slow and steady pace rather than in spurts and in a

law of large numbers will hold. Bank deposits are highly liquid

programmed or (time) encapsulated manner.

and one can withdraw the deposit any time, though on some

kinds of deposits the interest previously earned on it has to be • There should be a replacement of large-scale by small-scale,

foregone. Finally, banks by pooling the funds of depositors wholesale by retail, and class by mass banking.

reduce the riskness of lending. Indirect finance in some reduces • The sufficing principle rather than the maximising one

the information and transaction costs of lenders and should power the financial system. The functioning of

different financial institutions must be on the basis of a

al

borrowers, renders deposits liquid and reduces the risk of

lending. communitarian spirit, not competition and profit motive.

The ability of the financial intermediaries to ensure the most • The financing of investment which results in the

i

efficient transformation of mobilized funds into real capital has displacement or retrenchment of labour should be

com Tr

not, however, received the attention it deserves. Institutional discouraged.

mechanisms to ensure end use of funds have not been efficient • The scope for financing various sectors is ultimately

in their functioning, leaving the investor unprotected. Efficient constrained by domestic saving. The substantial increase in

financial intermediation involves reduction of the transaction the total saving in India is unlikely to take place now.

cost of transferring funds from original sabers to financial

rd. F

• The working of the Indian financial system should not be

investors. The total coat of intermediation is influenced by

corporate-sector-centric.

financial layering, which makes the individual institution’s costs

iza D

additive in the total cost of intermediating between savers and

ultimate borrowers. The aggregate cost of financial

intermediation from the original saver to ultimate investor is

• There are limits to the overall and industrial growth, and,

therefore, a “ceiling” on the targeted rate of growth has to be

imposed.

dfw P

much higher in developing countries than in developed • The only legitimate role of the financial markets is

countries. infrastructural, hence they should not exist to provide

opportunities to make quick, disproportionate pecuniary

Criteria to Evaluate Financial Institutions

w.p m

gains.

Given the controversy regarding the contribution of financial

sector, it is necessary to have a framework to evaluate the • It is the primary markets activity of supporting new,

performance of the country’s financial sector. Let us first look at economically and socially productive real investment, trade,

ww Co

the criteria formulated, in the form of questions, by Richard D. and flows of goods and services, which is of foremost

Erb, the former Deputy Managing Director of the International importance. The enthusiasm, hyperactivity, and

Monetary Fund: (i) Do institutions find the most productive preoccupation with the secondary markets ought to be

investments? (ii) Do institutions revalue their assets and avoided.

liabilities in response to changed circumstances? (iii) Do Summary

cu

investors and financial institutions expect to be bailed out of Financial institutions provide various types of financial services.

mistakes and at what price? (iv) Do institutions facilitate the Financial intermediaries are a special group of financial

management of risk by making available the means to insure, institutions that obtain funds by issuing claims to market

hedge, and diversify risks? (v) Do institutions effectively participants and use these funds to purchase financial assets.

Do

monitor the performance of their users, and discipline those Intermediaries transform funds they acquire into assets that are

not making proper and effective use of their resources? (vi) more attractive to the public. By doing so, financial

How effective is the legal, regulatory, supervisory, and judicial intermediaries do one or more of the following: (1) provide

structure? (vii) Do financial institutions publish consistent and maturity intermediation; (2) provide risk reduction via

transparent information? diversification at lower cost; (3) reduce the cost of contracting

These criteria, useful as they are, do not encompass social and and information processing; or (4) provide a payments

ethical aspects of finance which ought to be regarded as mechanism.

important as economic aspects. Therefore, the relevant The nature of their liabilities determines the investment strategy

normative criteria, organising principles, and value premises pursued by all financial institutions. The liabilities of all

which should guide the functioning of the financial system are: financial institution will generally fall into one of the four types

• Finance is not the most critical factor in development. shown in Table 2.

• The use of finance must be imbued with the virtues of

austerity, self--limit, and minimisation.

© Copy Right: Rai University

11.621.6 7

We shall discuss the classifications, roles, functions and

MANAGEMENT OF FINANCIAL INSTITUTION

advantages of the financial institutions in detail in our later

lectures.

Questions to Discuss:

1. What do you mean by Maturity Intermediation?

2. What is Reducing Risk Via Diversification?

3. What is the nature Of Liabilities?

4. What are the Liquidity Concerns?

5. What are the Advantages of financial institutions?

6. What are the criteria To Evaluate Financial Institutions?

Notes:

i al

com Tr

rd. F

iza D

dfw P

w.p m

ww Co

cu

Do

© Copy Right: Rai University

8 11.621.6

MANAGEMENT OF FINANCIAL INSTITUTION

LESSON 3:

FINANCIAL SYSTEM AND ECONOMIC DEVELOPMENT

Learning objectives human and physical capital are its important sources and any

After reading this lesson, you will understand increase in them requires higher saving and investment, which

the financial system helps to achieve. Second, the financial

• Effects of financial system on saving and investment

system contributes to growth not only via technical progress

• Relationship between financial system and economic but also in its own right. Economic development greatly

development depends on the rate of capital formation. The relationship

• A cautionary approach- between capital and output is strong, direct, and monotonic

al

• The process of financial development (the position which is sometimes referred to as “capital

fundamentalism”). Now, the capital formation depends on

• Criteria to evaluate financial sector

whether finance is made available in time, in adequate quantity,

i

Students, today in the class let us discuss the correlation of and on favourable terms-all of which a good financial system

com Tr

financial system and the economic development. The role of achieves. Third, it also enlarges markets over space and time; it

financial system in economic development has been a much- enhances the efficiency of the function of medium of exchange

discussed topic among economists. Is it possible to influence and thereby helps in economic development.

the level of national income, employment, standard of living,

We can conclude from the above that in order to understand the

and social welfare through variations in the supply of finance?

rd. F

importance of the financial system in economic development,

In what way financial development is affected by economic

we need to know its impact on the saving and investment

development?

processes. The following theories have analyzed this impact: (a)

iza D

There is no unanimity of views on such questions. A recent

literature survey concluded that the existing theory on this

subject has not given any generally accepted model to describe

The Classical Prior Saving Theory, (b) Credit Creation or Forced

Saving or Inflationary Financing Theory, (c) Financial Repression

dfw P

Theory, (d) Financial Liberalisation Theory.

the relationship between finance and economic development.

The Prior Saving Theory regards saving as a prerequisite of

The importance of finance in development depends upon the

investment, and stresses the need for policies to mobilise saving

desired nature of development. In the environment-friendly,

voluntarily for investment and growth. The financial system has

w.p m

appropriate-technology-based, decentralised Alternative

both the scale and structure effect on saving and investment. It

Development Model, finance is not a factor of crucial

increases the rate of growth (volume) of saving and

importance. But even in a conventional model of modem

investment, and makes their composition, allocation, and

ww Co

industrialism, the perceptions in this regard vary a great deal.

utilisation more optimal and efficient. It activises saving or

One view holds that finance is not important at all. The

reduces idle saving; it also reduces unfructified investment and

opposite view regards it to be very important. The third school

the cost of transferring saving to investment.

takes a cautionary view. It may be pointed out that there is a

considerable weight of thinking and evidence in favour of the How is this achieved? In any economy, in a given period of

cu

third view also. Let us briefly explain these viewpoints one by time, there are some people whose current expenditures is less

one. than their current incomes, while there are others whose current

expenditures exceed their current incomes. In well-known

In his model of economic growth, Solow has argued that

terminology, the former are called the ultimate savers or

growth results predominantly from technical progress, which is

surplus--spending-units, and the latter are called the ultimate

Do

exogenous, and not from the increase in labour and capital.

investors or the deficit-spending-units.

Therefore, money and finance and the policies about them

cannot contribute to the growth process. Modern economies are characterized (a) by the ever-expanding

nature of business organisations such as joint-stock companies

You All Tell Me What are your Opinions Regarding or corporations, (b) by the ever-increasing scale of production,

this? (c) by the separation of savers and investors, and (d) by the

differences in the attitudes of savers (cautious, conservative, and

Effects of Financial System on Saving and Investment

usually averse to taking risks) and investors (dynamic and risk-

It has been argued that men, materials, and money are crucial

takers). In these conditions, which Samuelson calls the

inputs in production activities. The human capital and physical

dichotomy of saving and investment, it is necessary to connect

capital can be bought and developed with money. In a sense,

the savers with the investors. Otherwise, savings would be

therefore, money, credit, and finance are the lifeblood of the

wasted or hoarded for want of investment opportunities, and

economic system. Given the real resources and suitable

investment plans will have to be abandoned for want of

attitudes, a well--developed financial system can contribute

savings. The function of a financial system is to establish a

significantly to the acceleration of economic development

bridge between the savers and investors and thereby help the

through three routes. First, technical progress is endogenous;

mobilisation of savings to enable the fructification of

© Copy Right: Rai University

11.621.6 9

investment ideas into realities. Figure below reflects this role of providing insurance services and hedging opportunities, and by

MANAGEMENT OF FINANCIAL INSTITUTION

the financial system in economic development. making financial services such as remittance, discounting,

acceptance and guarantees available. Finally, it not only

Relationship Between Financial System and

encourages greater investment but also raises the level of

Economic Development resource allocational efficiency among different investment

channels. It helps to sort out and rank investment projects by

sponsoring, encouraging, and selectively supporting business

units or borrowers through more systematic and expert project

appraisal, feasibility studies, monitoring, and by generally

Economic Development

keeping a watch over the execution and management of

projects.

The contribution of a financial system to growth goes beyond

increasing prior-saving-based investment. There are two strands

al

of thought in this regard. According to the first one, as

Savings & Investment or

Capital Formation emphasized by Kalecki and Schumpeter, financial system plays a

positive and catalytic role by creating and providing finance or

i

credit in anticipation of savings. This, to a certain extent,

com Tr

ensures the independence of investment from saving in a given

Surplus Spending Deficit Spending period of time. The investment financed through created credit

Economic Units Economic Units generates the appropriate level of income. This in turn leads to

an amount of savings, which is equal to the investment already

undertaken. The First Five Year Plan in India echoed this view

rd. F

Income Minus Income Minus when it stated that judicious credit creation in production and

(Consumption + (Consumption + availability of genuine savings has also a part to play in the

Own investment)

iza D Investment)

process of economic development. It is assumed here that the

investment out of created credit results in prompt income

generation. Otherwise, there will be sustained inflation rather

dfw P

Surplus or Saving Deficit or Negative

Saving than sustained growth.

The second strand of thought propounded by Keynes and

Tobin argues that investment, and not saving, is the constraint

w.p m

Financial System on growth, and that investment determines saving and not the

other way round. The monetary expansion and the repressive

policies result in a number of saving and growth promoting

ww Co

forces: (a) if resources are unemployed, they increase aggregate

demand, output, and saving; (b) if resources are fully

employed, they generate inflation which lowers the real rate of

A financial system helps to increase output by moving the

return on financial investments. This in turn, induces portfolio

economic system towards the existing production frontier. This

shifts in such a manner that wealth holders now invest more in

is done by transforming a given total amount of wealth into

cu

real, physical capital, thereby increasing output and saving; (c)

more productive forms. It induces people to hold less savings

inflation changes income distribution in favour of profit

in the form of precious metals, real estate land, consumer

earners (who have a high propensity to save) rather than wage

durables, and currency, and to replace these assets by bonds,

earners (who have a low propensity to save), and thereby

shares, units, etc. It also directly helps to increase the volume

Do

increases saving; and (d) inflation imposes tax on real money

and rate of saving by supplying diversified portfolio of such

balances and thereby transfers resources to the government for

financial instruments, and by offering an array of inducements

financing investment.

and choices to woo the prospective saver. The growth of

“banking habit” helps to activise saving and undertake fresh The extent of contribution of the financial sector to saving,

saving. The saving is said to be “institution-elastic” i.e., easy investment, and growth is said to depend upon its being free or

access, nearness, better return, and other favourable features repressed (regulated). One school of thought argues that

offered by a well-developed financial system lead to increased financial repression and the low/ negative real interest rates

saving. which go along with it encourage people (i) to hold their saving

in unproductive real assets, (ii) to be rent -seekers because of

A financial system helps to increase the volume of investment

non-market allocation of investible funds, (iii) to be indulgent

also. It becomes possible for the deficit spending units to

which lowers the rate of saving, (iv) to misallocate resources and

undertake more investment because it would enable them to

attain inefficient investment profile, and (v) to promote capital-

command more capital. As Schumpeter has said, without the

intensive industrial structure inconsistent with the

transfer of purchasing power to an entrepreneur, he cannot

factor-endowment of developing countries. Financial

become the entrepreneur. Further, it encourages investment

liberalisation or deregulation corrects these ill effects and leads to

activity by reducing the cost of finance and risk. This is done by

© Copy Right: Rai University

10 11.621.6

financial as well as economic development. However, as Second, it has been pointed out that the roles of capital

MANAGEMENT OF FINANCIAL INSTITUTION

indicated earlier, some economists believe that financial formation and finance in development have been unduly or

repression is beneficial. The most recent thinking on this subject disproportionately stressed; that capital shortage is not the

says that the empirical foundations of financial liberalisation are single most important barrier to development. Empirically, it

not robust enough, and that mild, moderate, small repression has been very often found that the rate of capital formation

is more growth promoting than either large-scale repression or increased without raising the growth rate; and the relation

complete laissez-faire. between capital and growth has been one of correlation rather

than causation. It is estimated that in industrialized countries,

capital accumulation could account for at most one--fourth of

the rate of economic growth in the 19th and 20th centuries.

Increase in capital without suitable social, economic, political

conditions cannot cause growth; and, on the other hand,

favourable developments in the conditions just mentioned can

al

achieve much growth with minimum of capital. The

conventional thinking has always stressed the need for

substitution of capital for other factors but the scope and

i

possibilities for this kind of substitution, particularly in the

com Tr

light of factor endowments, have never been really explored.

For growth, much additional capital, and, therefore, much

finance, is not always required; through depreciation allowances,

better composition of capital, appropriate technology, and

higher productivity, a lot of growth can be achieved. The

rd. F

methodology used for estimating the financial resource

requirements (incremental capital-output ratio) is also riddled

iza D with many valuations, measurement, and other problems.

The thrust and message of the above analysis are clearly

expressed in the following statements:

dfw P

• Real growth cannot be bought with money alone (Chandler).

• By and large, it seems to be the case that where enterprise

leads, finance follows (Joan Robinson). Societies in which

w.p m

Financial Sector and Economic Development: a other conditions of growth were favourable were usually

capable of devising adequate financial institutions

Cautionary Approach

(Habakkuk).

Many economists have taken a cautionary view of the role of

ww Co

financial markets in development. The capital market • The role of finance in development is a subsidiary one

enthusiasm and optimism implicit in certain theories of (Newlyn).

finance, viz., Capital Asset Pricing Model and Efficient Market The Process of Financial Development

Hypothesis with their multiple unrealistic, restrictive How does financial development occur? Is it influenced by

cu

assumptions, have been questioned in different ways. economic development? Does the former always precede the

First, it has been argued that the financial sector can perform the latter? The literature talks about “supply leading” and “demand

developmental role if it functions efficiently, but in practice, it is following” financial development. Under the former, financial

not efficient. Tobin’s analysis in this respect is highly instructive. development occurs first and stimulates economic growth.

Do

With logic and examples, he has explained how the prices in Under the latter, as trade, commerce and industry expand, the

financial markets rarely reflect intrinsic values; how very little of financial institutions, instruments, and services needed by them

the work done by the securities industry has to do with also expand as a matter of response. The financial development

financing real investment; how the allocation of funds by is said to be “active” in the first case, and “passive” in the

financial markets is hardly optimal; and that the services of second one.

financial system do not come cheap. According to him, financial Such a characterisation of the process of financial development

system serves us all right. But its functioning does not merit is not very apt. It is difficult to establish precisely the sequence

complacency. Financial activities generate high private reward of real and financial sector developments; the cause and effect

disproportionate to their social productivity. The ‘casino effect’ relationship between them is difficult to disentangle. It will be

of financial markets cannot be forgotten. The speculation in more correct to say that their growths are intertwined,

financial markets is a negative-sum game for the general public. symbiotic, and mutually reinforcing. While financial markets

More recently, through the application of chaos and fractal accelerate development, they, in turn, grow with economic

analyses to financial markets, it has been shown that they are development. In the words of Schumpeter, “the money market

characterized by asymmetry, turbulence, discontinuity, is always the headquarters of the capitalist system, from which

stampedes, non-periodicity, and inefficiency. orders go out to its individual divisions, and that which is

© Copy Right: Rai University

11.621.6 11

debated and decided there is always in essence the settlement of corporate-sector-centric. (k) There are limits to the overall and

MANAGEMENT OF FINANCIAL INSTITUTION

plans for further development. All kinds of credit requirements industrial growth, and, therefore, a “ceiling” on the targeted rate

come to this market; all kinds of economic project are first of growth has to be imposed. (l) The only legitimate role of

brought into relation with each other and contend for their the financial markets is infrastructural, hence they should not

realization in it; all kinds of purchasing power flows to it to be exist to provide opportunities to make quick, disproportionate

sold. This gives rise to a number of arbitrage operations and pecuniary gains. (m) It is the primary markets activity of

intermediate manoeuvres, which may easily veil the supporting new, economically and socially productive real

fundamental thing. Thus, the main function of the money or investment, trade, and flows of goods and services, which is of

capital market is trading in credit for the purpose of financial foremost importance. The enthusiasm, hyperactivity, and

development. Development creates and nourishes this market. preoccupation with the secondary markets ought to be avoided.

In the course of development, it becomes the market for

Questions to Discuss:

sources of income themselves.”

1. What are the effects of Financial System on saving and

Criteria To Evaluate Financial Sector Investment?

al

At the end of the discussion let us evaluate financial sector

2. Discuss the relationship Between Financial System and

critically. Given the controversy regarding the contribution of

Economic Development?

financial sector, it is necessary to have a framework to evaluate

i

the performance of the country’s financial sector. Let us first 3. Discuss a cautionary approach on Financial Sector and

com Tr

look at the criteria formulated, in the form of questions, by Economic Development?

Richard D. Erb, the former Deputy Managing Director of the 4. What are the criteria To Evaluate Financial Sector?

International Monetary Fund: (i) Do institutions find the most Notes:

productive investments? (ii) Do institutions revalue their assets

and liabilities in response to changed circumstances? (iii) Do

rd. F

investors and financial institutions expect to be bailed out of

mistakes and at what price? (iv) Do institutions facilitate the

iza D

management of risk by making available the means to insure,

hedge, and diversify risks? (v) Do institutions effectively

monitor the performance of their users, and discipline those

dfw P

not making proper and effective use of their resources? (vi)

How effective is the legal, regulatory, supervisory, and judicial

structure? (vii) Do financial institutions publish consistent and

w.p m

transparent information?

These criteria, useful as they are, do not encompass social and

ethical aspects of finance, which ought to be regarded as

ww Co

important as economic aspects. Therefore, the relevant

normative criteria, organizing principles, and value premises

which should guide the functioning of the financial system are:

(a) Finance is not the most critical factor in development. (b)

The use of finance must be imbued with the virtues of

cu

austerity, self--limit, and minimization. (c) Financial reforms are

not merely a question of “credit limits”; they encompass issues

involved in “limits of credit”. (d) State intervention is not the

best way to achieve a fair distribution of credit. (e) Financial

Do

institutions must evolve from below rather than be imposed

from above. Financial development ought to take place at a

slow and steady pace rather than in spurts and in a programmed

or (time) encapsulated manner. (f) There should be a

replacement of large-scale by small-scale, wholesale by retail, and

class by mass banking. (g) The sufficing principle rather than the

maximising one should power the financial system. The

functioning of different financial institutions must be on the

basis of a communitarian spirit, not competition and profit

motive. (h) The financing of investment, which results in the

displacement or retrenchment of labour, should be

discouraged. (i) The scope for financing various sectors is

ultimately constrained by domestic saving. The substantial

increase in the total saving in India is unlikely to take place now.

(j) The working of the Indian financial system should not be

© Copy Right: Rai University

12 11.621.6

MANAGEMENT OF FINANCIAL INSTITUTION

LESSON 4:

FINANCIAL SYSTEM AND ECONOMIC DEVELOPMENT

Learning objectives Allocational Efficiency

After reading this lesson, you will understand When financial markets channelise resources into those

investment projects and other uses where marginal efficiency of

• Financial development: some concepts

capital adjusted for risk differences is the highest, they are said to

• Reforms model for economic growth have achieved allocational efficiency.

Today we shall discuss some important concepts most

Innovations

frequently used in financial world..

Financial innovation can be variously defined as the

al

Financial Development: Some Concepts introduction of a new financial instrument or service or practice,

In this section we discuss a few concepts, which describe the or introducing new uses for funds, or finding out new sources

phenomenon of change and development in a financial system.

i

of funds, or introducing new processes or techniques to handle

com Tr

All these concepts are closely inter-related, and at present they are day-to-day operations, or establishing a new organisation-all

widely referred to in the discussions on financial markets. these changes being on the part of existing financial

Efficiency institutions. In addition, the emergence and spectacular growth

What do you mean by efficiency? The ultimate focus of the of new financial institutions and markets is also a part of

efficiency in financial markets is on the nonwastefulness of financial innovation. The word “new” here means not only the

rd. F

factor use and the allocation of factors to the socially most coming into being of what did not exist till then but also the

productive purposes. The following five concepts are useful in new way of using existing instruments, practices, technology,

iza D

judging the efficiency of a financial system.

Information Arbitrage Efficiency

and so on. Similarly, the use or adoption of an already existing

financial instrument, by financial institution(s), which

previously did not do, so is also regarded as an innovation. The

dfw P

This is the degree of gain possible by the use of commonly marked transformation in the roles of financial institutions and

available information. If one can make large gains by using the departure from the conventional notions regarding their

commonly available information, financial markets are said to functions also constitute financial innovation. As per one

be inefficient. Thus, the efficiency is inversely related to this type definition, financial innovations are “unforecastable

w.p m

of gain. Under conditions of perfect market, the possibilities of improvements” in the array of available financial products and

such a gain are nil because the prices in such a market already processes.

reflect fully and immediately all relevant and ascertainable

Financial innovations bring about wide ranging changes as well

ww Co

available information, and no one would know anything that is

as effects in the financial system. They lead to the broadening,

not already known and therefore not reflected in market prices.

deepening, diversification, structural transformation,

Fundamental Valuation Efficiency internationalization and sophistication of the financial system.

When the market price of a security is equal to its intrinsic value They result in the financialisation of the economy whereby

or investment value, the market is said to be efficient. The financial assets to total assets ratio tends to increase. This

cu

intrinsic value of an asset is the present value of the future financialisation may occur with the growth of

stream of cash flows associated with the investment in that institutionalisation or intermediation and securitisation

asset, when the cash flows are discounted at an appropriate rate simultaneously, or it may occur with the growth of one at the

of discount. This again would happen when markets are cost of other.

Do

perfectly competitive. The process of financial innovation has been characterised

Full Insurance Efficiency differently by different authors. These innovations are regarded

This indicates the extent of hedging against possible future as responses to regulatory and tax regimes, financial constraints,

contingencies. The greater the possibilities of hedging and and so on. The literature on the subject suggests the following

reducing risk, the higher the market efficiency. groups of factors as being responsible for financial innovations:

(i) tax asymmetries that can be exploited to produce tax savings;

Functional or Operational Efficiency

(ii) transaction costs; (iii) agency costs; (iv) opportunities to

The market which minimizes administrative and transaction

reduce or reallocate risk; (v) opportunities to increase asset-

costs, and which provides maximum convenience (or minimum

liquidity; (vi) regulatory or legislative change; (vii) level and

inconvenience) to borrowers and lenders while performing the

volatility of interest rates and prices; and (viii) technological

function of transmission of resources, and yet provides a fair

advances.

return to financial intermediaries for their services, is said to be

operationally or functionally efficient.

© Copy Right: Rai University

11.621.6 13

Financial Engineering intermediaries may occur when they are subject to interest rate

MANAGEMENT OF FINANCIAL INSTITUTION

This is perhaps the latest terminological addition to the world ceilings while the open market rates of return are rising.

of finance, which, incidentally, is a new example of the invasion The terms securitisation and disintermediation are often used

of social thinking by technology. After innovations, industrial interchangeably. Although these terms are very closely related,

engineering and social engineering, we now have financial one should be careful in using them interchangeably. A decline

engineering. It basically means financial innovations; the two in the share of only a particular type of financial intermediary,

terms have often been used interchangeably. The dictionary say commercial banks, does not necessarily mean

meanings of innovation and engineering perhaps give a clue to disintermediation. Similarly, securitisation in the second sense

the possible difference between financial innovations and does not involve disintermediation.

financial engineering. To innovate means to introduce new

methods, new ideas, and make changes. To engineer means to Broad, Wide, Deep and Shallow Markets

arrange, contrive, to bring about artfully or skilfully. All these are closely related terms. The broad and wide financial

market attracts funds in greater volume and from all types of

Financial engineering thus connotes development of new

national and international investors. In such a market, financial

al

financial technology to cope with financial changes. It involves

institutions offer, even globally, 24-hour sales and trading

construction, designing, deconstruction, and implementation

capability in debt and equity instruments. The deep market is

of innovative financial institutions, processes, and instruments.

one where there are always sufficient orders for buying and

i

It means the formulation of creative solutions to problems in

selling at fine quotations both below and above the market

com Tr

finance. The development and use of skills, means, techniques,

price, and where there are good opportunities for swap deals. A

tools for changing and managing cash flows and investment

swap deal is a medium-term or long-term arrangement between

features of financial instruments form a part of financial

two parties in which each party commits to service the debt of

engineering. In today’s highly volatile markets, it seeks to limit

the other. In other words, a swap is the exchange of future

financial risk by creating financial instruments for hedging,

rd. F

streams of payment between two or more parties. The shallow

speculation, arbitraging, and by fine-tuning portfolio

market, on the other hand, means an underdeveloped market,

adjustments. It also seeks to maximise profits quickly. The

its underdevelopment being the result of financial repression

iza D

creation of financial derivatives and securitisation are its two

examples. Computer power and human insight are combined

to spot arbitrage opportunities, measure risk, and to react to

or administered finance.

Financial Repression

dfw P

news very fast in financial engineering. It represents economic conditions in which the government’s

regulatory and discretionary policies distort financial prices or

Financial Revolution interest rates (i.e., the real interest rates are kept low or negative),

Some people believe that a veritable financial revolution has discourage saving, reduce investment, and misallocate financial

w.p m

taken place in the world of finance in the recent past. The resources. The government-directed credit program, and direct

concept of financial revolution is an extension of the concepts rather than indirect credit controls predominate in a repressed

of financial innovations and engineering. It is meant to convey system. As indicated above, it is also known as the system of

ww Co

that, of late, the magnitude, speed, and spread of changes in administered interest rates and finance.

the financial sector the world over has been simply tremendous,

prodigious, phenomenal; that it has undergone a “future Financial Reforms, Financial Liberalisation, and

shock”. It indicates that life in the world of finance is no longer Deregulation

easy and that financial markets now work 24 hours a day. The Financial reforms involve instituting policies, which will increase

cu

innovations in computers and satellite communications, and the allocative efficiency of available saving, promote the growth

the linking up of the two have completely changed the of real sector, and enhance the health, stability, profitability, and

production, marketing, and delivery of financial products. And viability of the financial institutions. In theory, they need not

as with every revolution, not all changes have been for the best, necessarily increase the market -orientation of the system, but in

Do

and there have been unexpected consequences. practice at present, they have come to mean greater market

Diversification orientation. Therefore, liberalisation, deregulation, and reforms

In one sense, diversification means the existence or the mean the same thing currently. They refer to the policy of

development of a very wide variety of financial institutions, reducing or removing completely the legal restrictions, physical

markets, instruments, services, and practices in the financial or administrative or direct controls, ceilings on interest rates,

system. In another but related sense, it refers to the presence of restrictions on the flow of funds, official directives regarding

opportunities for investors to purchase a large mix or portfolio sectoral and other allocations of funds, restrictions on the scope

of varieties of financial instruments. With the diversified of activities of banks and other financial institutions, and so

portfolio, investors can minimise the risk for a given rate of on, which exist under the administered finance. It is obvious

return, or they can maximise the return for a given risk. that liberalisation is the process in which the intervention or

interference of the government in financial markets is reduced

Disintermediation

and the markets are allowed, as far as possible, to function on

It refers to the phenomenon of decline in the share of financial

the basis of free market or competitive principles.

intermediaries in the aggregate financial assets in an economy

because people “switch out of’ their liabilities into direct

securities in the open market. Such a flow of funds out of these

© Copy Right: Rai University

14 11.621.6

Privatisation Securitisation

MANAGEMENT OF FINANCIAL INSTITUTION

It is regarded as a necessary part of financial reforms. It means The term “securitisation” is used in financial literature in two

increasing the ownership, management, and control of the senses. First, it means the faster growth of direct (primary)

financial sector by individuals and private incorporated and financial markets and financial instruments than that of

unincorporated bodies. This may be achieved partly by financial intermediaries. In other words, it refers to the growing

denationalisation, disinvestments by the state, allowing private ability and practice of firms to tap the bond, commercial paper,

sector entry, and abstaining from new ownership by the state. and share markets as alternatives to institutional financing.

Second, it refers to the process by which the existing assets of

Prudential Regulation

the lending financial institutions are “sold” or “removed” from

This is another major element of financial sector reforms. It

their balance sheets through their funding by other investors. In

means regulation without suppression, and supervision and

this process, investors are sold securities, which evidence their

control without constriction. It implies that the authorities have

interest in the underlying assets without recourse to the original

not abdicated the role of and responsibility for evolving a

lender. The redemption of these securities does not become the