Professional Documents

Culture Documents

Format Estate TX

Uploaded by

attymaneka0 ratings0% found this document useful (0 votes)

11 views1 pagetaxation

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenttaxation

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pageFormat Estate TX

Uploaded by

attymanekataxation

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

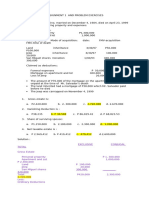

Format (by RR 2-2003) on Married Decedents

Note: Assumed Amounts

NET ESTATE OF MR/S. Abu Bakal

(Filipino and Married decedent)

Died on _________

GROSS ESTATE:

Personal properties

Inherited Farm

Family Home

Claims against Insolvent

Persons

Receivable under RA 4917

Exclusive

Conjugal/community

P 500,000

1,000,000

P 2,000,000

TOTAL

4,000,000

300,000

GE

P 1,800,000

Less: ORDINARY DEDUCTIONS

ELITE:

Funeral Expenses

Judicial Expenses

Claims ag. The Estate

Claims ag. Insolvent Person

Casualty Loss

Unpaid Mortgage

Unpaid Taxes

TRANSFER FOR PUBLIC USE

400,000

VANISHING DEDUCTION

200,000

200,000

P 6,200,000

P 8,000,000

100,000

200,000

250,000

200,000

220,000

80,000

150,000

TOTAL ORDINARY DEDUCTIONS

P 600,000

P 1,200,000

P

1,800,000

NET ESTATE BEFORE SPECIAL DEDUCTION

P 1,200,000

P 5,000,000

P 6,200,000

Less: SPECIAL DEDUCTIONS

Family Home

P 1,000,000

Standard Deduction

1,000,000

Medical Expenses

500,000

Amount Received under RA 4917

300,000

P

2,800,000

NET ESTATE BEFORE SHARE OF SURVIVING SPOUSE

P 3,400,000

Less: SHARE OF THE SURVIVING SPOUSE ( P 5,000,000 X 50% )

P 2,500,000

NET TAXABLE ESTATE

P

900,000

You might also like

- Answers To Assignment 1 and Problem Exercises Taxation2Document4 pagesAnswers To Assignment 1 and Problem Exercises Taxation2anon_52232085033% (3)

- M6 - Estate Tax Payable Students'Document17 pagesM6 - Estate Tax Payable Students'micaella pasionNo ratings yet

- TaxationDocument7 pagesTaxationAltair ColtraineNo ratings yet

- TAXATION 2 Chapter 5 Estate Tax Payable PDFDocument5 pagesTAXATION 2 Chapter 5 Estate Tax Payable PDFKim Cristian MaañoNo ratings yet

- Answers To Assignment 1 and Problem Exercises Taxation2Document4 pagesAnswers To Assignment 1 and Problem Exercises Taxation2Dexanne BulanNo ratings yet

- Tax 2Document6 pagesTax 2Zerjo CantalejoNo ratings yet

- Practice Set No. 1 - Estate Tax - QuestionnaireDocument6 pagesPractice Set No. 1 - Estate Tax - QuestionnaireAeron Arroyo IINo ratings yet

- Government of Andhra Pradesh: RD ST NDDocument3 pagesGovernment of Andhra Pradesh: RD ST NDnmsusarla999No ratings yet

- Taxa2 Quiz3Document14 pagesTaxa2 Quiz3ishinoya keishiNo ratings yet

- Copy 3 ACC 321 Sample Problems For Estate Taxation of Married Individuals and Computation of Tax CreditDocument2 pagesCopy 3 ACC 321 Sample Problems For Estate Taxation of Married Individuals and Computation of Tax CreditMitsuke MitsukeNo ratings yet

- Acctax2 Business CaseDocument9 pagesAcctax2 Business CaseAimiel ReyesNo ratings yet

- Request For Fund FormDocument5 pagesRequest For Fund FormPrincess Aibby CatalanNo ratings yet

- Deductions From Gross EstateDocument14 pagesDeductions From Gross EstatePierreNo ratings yet

- Budgetary Requests - Local Government UnitsDocument4 pagesBudgetary Requests - Local Government UnitsDBM CALABARZONNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument3 pagesSworn Statement of Assets, Liabilities and Net WorthGen GenNo ratings yet

- Activity 6Document4 pagesActivity 6Mystic LoverNo ratings yet

- Assets and Liabilities NEW FormDocument3 pagesAssets and Liabilities NEW FormMay Ann Dimaano-Hulgado100% (2)

- Estate Tax Activities (Questions)Document4 pagesEstate Tax Activities (Questions)Christine Nathalie BalmesNo ratings yet

- 1st Monthly Transfer TaxDocument13 pages1st Monthly Transfer TaxAlexandra Nicole IsaacNo ratings yet

- Paravasible - Motion For ISsuance of Writ of ExecutionDocument3 pagesParavasible - Motion For ISsuance of Writ of ExecutionSanchez Roman VictorNo ratings yet

- (Res./Comm./ Agri., Etc.) : (Use Additional Sheet/s, If Necessary)Document5 pages(Res./Comm./ Agri., Etc.) : (Use Additional Sheet/s, If Necessary)Minerva Sacar-GuilingNo ratings yet

- 2015 SALN FormDocument3 pages2015 SALN FormTaz HalipaNo ratings yet

- Activity 4 Gache, Rosette LDocument4 pagesActivity 4 Gache, Rosette LMystic LoverNo ratings yet

- Estate Tax: Estate Tax Is Imposed On The Right To Transfer Property by Death. It Is Levied On TheDocument29 pagesEstate Tax: Estate Tax Is Imposed On The Right To Transfer Property by Death. It Is Levied On TheNikka Adrienne Menchavez0% (1)

- Tumbocon Vs Ombudsman GR 238103, 238223 06january2020Document15 pagesTumbocon Vs Ombudsman GR 238103, 238223 06january2020CJNo ratings yet

- Routing - Slip - Form - 3d Terrain Model 18 Feb 23Document10 pagesRouting - Slip - Form - 3d Terrain Model 18 Feb 23Ace DumpNo ratings yet

- Less: Ordinary: P 12,400,000 (A) P 19,500,000 (B)Document4 pagesLess: Ordinary: P 12,400,000 (A) P 19,500,000 (B)Mystic LoverNo ratings yet

- Pingol TAX11Document2 pagesPingol TAX11Kristyl Ivy PingolNo ratings yet

- Navarro v. ErmitaDocument4 pagesNavarro v. ErmitaNoreenesse SantosNo ratings yet

- State Bank of India: Self Attested Passport Size PhotographDocument2 pagesState Bank of India: Self Attested Passport Size Photographvsvikash5No ratings yet

- Arnel L. Villeal Deed of Absolute Sale 288k FinalDocument2 pagesArnel L. Villeal Deed of Absolute Sale 288k FinalEdd InciongNo ratings yet

- Aggregate Site App MBDocument2 pagesAggregate Site App MBKen ShackelNo ratings yet

- FY 2012 WFP by Province - District - FinalDocument15 pagesFY 2012 WFP by Province - District - FinalRoy TranceNo ratings yet

- Revised As of January 2015 Per CSC Resolution No. 1500088 Promulgation On January 23, 2015Document3 pagesRevised As of January 2015 Per CSC Resolution No. 1500088 Promulgation On January 23, 2015Paw SaguilloNo ratings yet

- Estate TaxDocument2 pagesEstate Taxucc second yearNo ratings yet

- 2012 Assets Blank FormDocument3 pages2012 Assets Blank Formmark_abad01No ratings yet

- Upper Hinaplanon Barangay-Tax-OrdinanceDocument6 pagesUpper Hinaplanon Barangay-Tax-Ordinancejade capalac100% (1)

- Ae 208 Bustax ProblemDocument3 pagesAe 208 Bustax ProblemPaulo OronceNo ratings yet

- Module 2 DEDUCTION FROM GROSS ESTATE AND ESTATE TAX - Part 2Document33 pagesModule 2 DEDUCTION FROM GROSS ESTATE AND ESTATE TAX - Part 2Venice Marie ArroyoNo ratings yet

- Woodbridge Foreclosure 3.31.11Document1 pageWoodbridge Foreclosure 3.31.11gstro8057No ratings yet

- Sample Problem For Gross EstateDocument5 pagesSample Problem For Gross EstateChristineNo ratings yet

- Paid UnpaidDocument5 pagesPaid UnpaidElisha Lois ManluluNo ratings yet

- Application Summary FormDocument2 pagesApplication Summary FormLiz TomNo ratings yet

- Calc Familyr PensionDocument2 pagesCalc Familyr PensionmicrostrategyhydNo ratings yet

- Exhibits For FEC Complaint Re: DISHDocument173 pagesExhibits For FEC Complaint Re: DISHCause of ActionNo ratings yet

- AppraiserDocument2 pagesAppraiserAnonymous ZRsuuxNcCNo ratings yet

- Nationality FeesDocument4 pagesNationality FeesMansoor RehmanNo ratings yet

- Residential Book - Customer (9 UP) : Courtesy Of: Monique HailerDocument4 pagesResidential Book - Customer (9 UP) : Courtesy Of: Monique HailerMonique HailerNo ratings yet

- Chapter 5 - Estate Tax2013Document12 pagesChapter 5 - Estate Tax2013Anjo Ellis100% (2)

- Robert E Maxwell Financial Disclosure Report For 2009Document8 pagesRobert E Maxwell Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Business and Transfer Taxation: Tax 101 /tax 2 - Midterm ExaminationDocument2 pagesBusiness and Transfer Taxation: Tax 101 /tax 2 - Midterm ExaminationLourdios EdullantesNo ratings yet

- 877-UDMA-Hawker Support Scheme 2020Document4 pages877-UDMA-Hawker Support Scheme 2020Anik MukherjeeNo ratings yet

- Estate TaxDocument1 pageEstate TaxGerald SantosNo ratings yet

- PD 9601 Flatlands PDFDocument2 pagesPD 9601 Flatlands PDFOlivia OliviaNo ratings yet

- Sworn Statement of Assets 2019Document2 pagesSworn Statement of Assets 2019Rayan CastroNo ratings yet

- Agatep 2020 SALN FormDocument2 pagesAgatep 2020 SALN FormDen Deyn AgatepNo ratings yet

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- Sample Police ReportDocument1 pageSample Police Reportattymaneka100% (1)

- DirectoryDocument18 pagesDirectoryattymanekaNo ratings yet

- Legal Procedures Philippines Filing of Complaint and AnswerDocument1 pageLegal Procedures Philippines Filing of Complaint and AnswerattymanekaNo ratings yet

- EvidenceDocument6 pagesEvidenceattymanekaNo ratings yet

- Rules of CourtDocument1 pageRules of CourtattymanekaNo ratings yet

- Individual Compute INCOME TAXDocument1 pageIndividual Compute INCOME TAXattymanekaNo ratings yet

- Regional Trial Court: - (Mrs. Wife)Document6 pagesRegional Trial Court: - (Mrs. Wife)attymanekaNo ratings yet

- Tips From American LawyerDocument8 pagesTips From American LawyerattymanekaNo ratings yet

- Agency Ist QuizDocument1 pageAgency Ist QuizattymanekaNo ratings yet

- Preferential TaxDocument2 pagesPreferential TaxattymanekaNo ratings yet

- Presentation of EvidenceDocument18 pagesPresentation of Evidenceattymaneka100% (1)

- Remedies Assessment DiagramDocument3 pagesRemedies Assessment Diagramattymaneka100% (2)

- 2007 Bar Commerciall Law With ANSWERSDocument9 pages2007 Bar Commerciall Law With ANSWERSattymanekaNo ratings yet