Professional Documents

Culture Documents

Wfreebec

Wfreebec

Uploaded by

Ralph SerraoCopyright:

Available Formats

You might also like

- Request Letter To Practice ProfessionDocument2 pagesRequest Letter To Practice ProfessionJohn Mark Paracad88% (33)

- 2013 REG Last Minute Study Notes (Bonus)Document47 pages2013 REG Last Minute Study Notes (Bonus)olegscherbina100% (3)

- Invitation Letter FAT Group PDFDocument2 pagesInvitation Letter FAT Group PDFTanvir Mahmood Kamal100% (1)

- How Not To Make A Short FilmDocument282 pagesHow Not To Make A Short FilmAshish_Singh_512681% (16)

- Uber@Corporate Governance and Corporate Social ResponsibilityDocument16 pagesUber@Corporate Governance and Corporate Social ResponsibilityAsanka RathnayakaNo ratings yet

- The NANDI Guitar Method Notes UnleashedDocument77 pagesThe NANDI Guitar Method Notes UnleashedNiki100% (3)

- Bec Review SheetDocument7 pagesBec Review Sheettrevor100% (1)

- NINJA Book Reg 1 EthicsDocument38 pagesNINJA Book Reg 1 EthicsJaffery143No ratings yet

- REG NotesDocument41 pagesREG NotesNick Huynh75% (4)

- The Cult of The Moon GodDocument15 pagesThe Cult of The Moon GodJesus LivesNo ratings yet

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- BEC 1 Outline - 2015 Becker CPA ReviewDocument4 pagesBEC 1 Outline - 2015 Becker CPA ReviewGabriel100% (1)

- BEC Review NotesDocument9 pagesBEC Review Notescpa2014No ratings yet

- BEC MaggieDocument48 pagesBEC MaggieJame NgNo ratings yet

- BEC 3 Outline - 2015 Becker CPA ReviewDocument4 pagesBEC 3 Outline - 2015 Becker CPA ReviewGabrielNo ratings yet

- BEC Final Review NotesDocument38 pagesBEC Final Review NotessheldonNo ratings yet

- Chapter 9 & 10 Financial (FAR) NotesDocument7 pagesChapter 9 & 10 Financial (FAR) NotesFutureMsCPANo ratings yet

- BEC Notes Chapter 3Document13 pagesBEC Notes Chapter 3bobby100% (1)

- BEC Study Guide 4-19-2013Document220 pagesBEC Study Guide 4-19-2013Valerie Readhimer100% (1)

- BEC 4 Outline - 2015 Becker CPA ReviewDocument6 pagesBEC 4 Outline - 2015 Becker CPA ReviewGabrielNo ratings yet

- BEC Formula Sheet Mini TestDocument7 pagesBEC Formula Sheet Mini Testcpacfa73% (11)

- Bec Flash CardsDocument4,310 pagesBec Flash Cardsmohit2uc100% (1)

- CPA BEC 1 - Corporate GovernanceDocument3 pagesCPA BEC 1 - Corporate GovernanceGabrielNo ratings yet

- CPA REG Entity BasisDocument4 pagesCPA REG Entity BasisManny MarroquinNo ratings yet

- Reg Flash CardsDocument3,562 pagesReg Flash Cardsmohit2ucNo ratings yet

- CPA Exam REG - S-Corporation Taxation.Document2 pagesCPA Exam REG - S-Corporation Taxation.Manny MarroquinNo ratings yet

- • • • • • • • • • •Document23 pages• • • • • • • • • •hkuluNo ratings yet

- BEC NotesDocument17 pagesBEC NotescsugroupNo ratings yet

- Cfa Level I - Us Gaap Vs IfrsDocument4 pagesCfa Level I - Us Gaap Vs IfrsSanjay RathiNo ratings yet

- FAR Notes CH1: Revenue Recognition 1.0 (Becker 2017)Document12 pagesFAR Notes CH1: Revenue Recognition 1.0 (Becker 2017)charlesNo ratings yet

- FAR Notes Chapter 3Document3 pagesFAR Notes Chapter 3jklein2588No ratings yet

- 655 Week 12 Notes PDFDocument63 pages655 Week 12 Notes PDFsanaha786No ratings yet

- CPA Regulation (Reg) Notes 2013Document7 pagesCPA Regulation (Reg) Notes 2013amichalek0820100% (3)

- 2019 Cpa Bec AnswersDocument14 pages2019 Cpa Bec AnswerssuryaNo ratings yet

- Aud NotesDocument75 pagesAud NotesClaire O'BrienNo ratings yet

- AUD Notes Chapter 2Document20 pagesAUD Notes Chapter 2janell184100% (1)

- PF CMA NotesDocument19 pagesPF CMA NotesvigneshanantharajanNo ratings yet

- Part 3 - Understanding Financial Statements and ReportsDocument7 pagesPart 3 - Understanding Financial Statements and ReportsJeanrey AlcantaraNo ratings yet

- Far Final ReviewDocument13 pagesFar Final ReviewFutureMsCPA100% (1)

- Activity RatiosDocument7 pagesActivity RatiosSUBIR100% (1)

- FinQuiz - UsgaapvsifrsDocument12 pagesFinQuiz - UsgaapvsifrsĐạt BùiNo ratings yet

- 2020 - Far SampleDocument21 pages2020 - Far SamplesuryaNo ratings yet

- BEC Notes Chapter 2Document7 pagesBEC Notes Chapter 2cpacfa100% (10)

- Financial Ratio Analysis FormulasDocument4 pagesFinancial Ratio Analysis FormulasVaishali Jhaveri100% (1)

- CPA Reg Practice Individual TaxationDocument2 pagesCPA Reg Practice Individual TaxationMatthew AminiNo ratings yet

- 2014 Exam Review Simulations FAR - SolutionsDocument113 pages2014 Exam Review Simulations FAR - SolutionsPEDRO ORTIZ50% (2)

- Chapter 2 FAR CPA NotesDocument4 pagesChapter 2 FAR CPA Notesjklein2588No ratings yet

- New-Reg-2023 (N)Document2 pagesNew-Reg-2023 (N)saramohamed5137No ratings yet

- Accounting Study Guide PDFDocument8 pagesAccounting Study Guide PDFgetasewNo ratings yet

- MBA Resume Template From RotmanDocument1 pageMBA Resume Template From Rotmananand.iitd4358No ratings yet

- Wiley CPAexcel - FAR - 13 Disclosure RequirementsDocument2 pagesWiley CPAexcel - FAR - 13 Disclosure RequirementsAimeeNo ratings yet

- REG Exam Format - CPADocument1 pageREG Exam Format - CPAgavkaNo ratings yet

- Auditing and Attestation Content Specification OutlineDocument5 pagesAuditing and Attestation Content Specification OutlineLisa GoldmanNo ratings yet

- Regulation MyNotesDocument50 pagesRegulation MyNotesaudalogy100% (1)

- If You Follow His Strategies, You Will Pass The CPA ExamsDocument4 pagesIf You Follow His Strategies, You Will Pass The CPA Examsagonza70No ratings yet

- SwotDocument3 pagesSwotShahebazNo ratings yet

- Cpa Textbook: Ethics and Responsibility in Tax PracticeDocument5 pagesCpa Textbook: Ethics and Responsibility in Tax PracticeLE AicragNo ratings yet

- 2024 Becker CPA Financial (FAR) Notes - 01.unit OutlineDocument5 pages2024 Becker CPA Financial (FAR) Notes - 01.unit OutlinecraigsappletreeNo ratings yet

- CMA Exam Review - Part 2 - Section A - Financial Statement AnalysisDocument7 pagesCMA Exam Review - Part 2 - Section A - Financial Statement Analysisaiza eroyNo ratings yet

- CPA BEC Virtural Class NOTESDocument19 pagesCPA BEC Virtural Class NOTESRamach100% (1)

- CPA Chapter 4 FAR Notes Inventories & CA/CLDocument5 pagesCPA Chapter 4 FAR Notes Inventories & CA/CLjklein2588No ratings yet

- Cpa NotesDocument120 pagesCpa Notesjobir2008No ratings yet

- BEC CPA Formulas - November 2015 - Becker CPA ReviewDocument20 pagesBEC CPA Formulas - November 2015 - Becker CPA Reviewgavka100% (1)

- Cpa ReviewDocument31 pagesCpa ReviewlordaiztrandNo ratings yet

- And The Day of Hunain Urgent Message To The Revolutionaries of LibyaDocument7 pagesAnd The Day of Hunain Urgent Message To The Revolutionaries of LibyadayofhunainNo ratings yet

- Renewable Energy Policies, Programs and Strategies in Nigeria: A Review and Critical AnalysisDocument14 pagesRenewable Energy Policies, Programs and Strategies in Nigeria: A Review and Critical AnalysisSantiago Tirado RNo ratings yet

- Quantitative Strategic AnalysisDocument16 pagesQuantitative Strategic AnalysisBlaine Bateman, EAF LLCNo ratings yet

- The Modern Rationalist October 2017Document35 pagesThe Modern Rationalist October 2017paufabra100% (1)

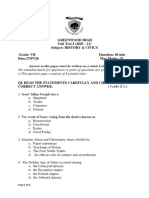

- Greenwood High Unit Test-I (2020 - 21) Subject: History & Civics Grade: VII Duration: 40 Min Date:27/07/20 Max Marks: 25Document3 pagesGreenwood High Unit Test-I (2020 - 21) Subject: History & Civics Grade: VII Duration: 40 Min Date:27/07/20 Max Marks: 25Akshitaa PandeyNo ratings yet

- Is Tithing Required in The New CovenantDocument3 pagesIs Tithing Required in The New Covenantsuhail farooqNo ratings yet

- Global MarketingDocument25 pagesGlobal MarketingKamal SinghNo ratings yet

- HP Printers - 'Unsuccessful Network Installation' Error (Windows) - HP® Customer SupportDocument5 pagesHP Printers - 'Unsuccessful Network Installation' Error (Windows) - HP® Customer SupportManoj AgnihotriNo ratings yet

- Revolutionizing Data Warehousing in Telecom With The Vertica Analytic DatabaseDocument11 pagesRevolutionizing Data Warehousing in Telecom With The Vertica Analytic DatabasegrandelindoNo ratings yet

- Acr Gen. Pta MetingDocument3 pagesAcr Gen. Pta MetingJane MaravillaNo ratings yet

- Quizzes - Topic 2Document6 pagesQuizzes - Topic 2LAN NGO HUONGNo ratings yet

- New Talents: Talent FormatDocument4 pagesNew Talents: Talent Formatjoaollo4954100% (2)

- Littlejohn v. Patrick B Harris Psychiatric Hospital - Document No. 12Document7 pagesLittlejohn v. Patrick B Harris Psychiatric Hospital - Document No. 12Justia.comNo ratings yet

- Kavach PDFDocument12 pagesKavach PDFdr.vyshnavi0909No ratings yet

- MC Script Opening Speech EnglishDocument2 pagesMC Script Opening Speech EnglishShazwanShah100% (3)

- USAID-BHA Indicator Handbook Part II June 2021Document154 pagesUSAID-BHA Indicator Handbook Part II June 2021Amenti TekaNo ratings yet

- Renaissance and Baroques Art Styles-TechniquesDocument64 pagesRenaissance and Baroques Art Styles-TechniquesDONNALYN TORRESNo ratings yet

- Worldschool H009 Pedal Powered Sawmill: Yaro Ligthart, Sytze Winius, Tyro Bekedam and Nicki Pan 06-10-2017Document13 pagesWorldschool H009 Pedal Powered Sawmill: Yaro Ligthart, Sytze Winius, Tyro Bekedam and Nicki Pan 06-10-2017api-352440955No ratings yet

- CBBE Pyramid: Customer Based Brand EquityDocument6 pagesCBBE Pyramid: Customer Based Brand EquityNupur Saurabh AroraNo ratings yet

- What's Your Compatibility With NCT DreamDocument1 pageWhat's Your Compatibility With NCT DreamrencupidNo ratings yet

- The Handmaid's Tale - WikipediaDocument22 pagesThe Handmaid's Tale - WikipediaJaime AdrianNo ratings yet

- He Imes Eader: Obama Promises Rigorous ReviewDocument36 pagesHe Imes Eader: Obama Promises Rigorous ReviewThe Times LeaderNo ratings yet

- Consulting Engagement: Mclachlin, RDocument7 pagesConsulting Engagement: Mclachlin, RSheila Mae AramanNo ratings yet

- Magnetic Nanoparticles For Drug DeliveryDocument11 pagesMagnetic Nanoparticles For Drug DeliverySrinivas NadellaNo ratings yet

Wfreebec

Wfreebec

Uploaded by

Ralph SerraoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wfreebec

Wfreebec

Uploaded by

Ralph SerraoCopyright:

Available Formats

For personal use copy, not for resale

Cost Measurement

1.

abnormal spoilage: expensed in current period

2.

absolute conformance: perfectly or ideally meets standards

26.

focus, 2) continuous improvement, 3) workforce involvement, 4)

top management support, 5) objective measures, 6) timely

recognition, 7) ongoing training

(robust quality)

3.

absorption approach of CVP analysis: no separation of fixed

& variable costs

4.

27.

5.

activity-based costing: activity cost object, any work performed

6.

authoritative standards: set by management only

7.

balanced scorecard: information on multiple dimensions of

28.

direct costs: direct raw materials, direct labor

29.

DL efficiency variance: = standard rate * (actual hours standard hours allowed)

30.

benchmarking: adopt best practices in industry to establish

31.

BEP in sales dollars: = unit price * BE units = total fixed costs /

32.

break even point: production where sales = total costs =

33.

34.

favorable variance: actual cost < standard cost

35.

FIFO cost per EU: = current costs / EU

of joint costs)

36.

FIFO costs: costs incurred during the period are applied to EU

calculating economic value added: 1) required return =

37.

FIFO EUs: = beginning units completed + units started &

11.

breakeven point in units: = total fixed costs / CM per unit

12.

by-product: incidentally from main product (has no allocation

14.

completed + units partially complete at end

investment * cost of capital, 2) income after taxes - required

return = EVA

38.

fixed costs: does't change if cost driver changes, varies per unit

cause & effect (Fishbone) diagram: problems contributing

39.

flexible budgets: 1) calculate budgeted per unit price (variable

to defects: machinery, method, materials, manpower

15.

cost from master budget), 2) apply actual volume to budgeted per

unit price & variable costs, 3) compare to actual volume at actual

price & costs for variance analysis

coefficient of correlation (r): strength of linear relationship,

ranges from -1 to +1

16.

17.

18.

coefficient of determination (R2): how much the

40.

forecasting analysis: probability/risk analysis

independent variable affects the dependent variables, ranges

from 0 to 1

41.

gap analysis: studying difference between industry best

conformance costs: prevention (prevent production of

practices and organization's current practices

42.

goalpost conformance: compliance within an acceptable

defective units) & appraisal (discover & remove defective units

before shipping)

range (zero defects)

43.

high-low fixed costs: = total costs - variable costs

contribution approach of CVP analysis: variable/direct

44.

high-low method: variable cost per unit = (highest total cost -

costing for internal decision-making only

19.

equivalent units: amount need to complete one unit of

production (usually 1 - %complete)

variable + fixed costs

13.

DM usage variance: = standard price * (actual Q used standard Q allowed)

CM ratio

10.

DM price variance: = actual Q purchased * ( actual price standard price)

standards

9.

DL rate variance: = actual hours worked * (actual rate standard rate)

performance with "critical success factors"

8.

currently attainable standards: costs with employees

appropriately trained but no extra effort

absorption approach to net incom: revenue - COGS = gross

margin - operating expenses (SGA) = net income

critical factors of total quality management: 1) customer

contribution approach to net income: revenue - variable

lowest total cost) / (highest volume - lowest volume)

45.

costs = contribution margin - fixed costs = net income

high-low variable costs: = variable cost per unit * low volume

(or high volume)

20.

contribution margin ratio: = CM / unit price

46.

ideal standards: costs when perfect efficiency & effectiveness

21.

control charts: results by batch/interval plotted on acceptable

47.

job order costing: DM + DL + MOH (IM + IL) -> WIP -> FG -

range, trending towards improved quality conformance or

deteriorating

22.

controllable margin: = CM - controllable fixed costs =

contribution by SBU

23.

controllable variance: variance can be prevented

24.

conversion costs: = DL + MOH

25.

cost determination: need selling price to determine allowable

production costs

Free Notes .. Not for resale

> COGS

48.

joint product: two or more products from a common input

49.

Kaizen improvement: continuous, cost reductions in

manufacturing stage

50.

linear regression: relationship between 2 variables

51.

manufacturing: inventory, COGM, COGS

52.

margin of safety: excess of sales over BE sales

53.

margin of safety %: = margin of safety $ / total sales

54.

margin of safety in $: = total sales $ - BE sales $

For personal use copy, not for resale

Cost Measurement

55.

marginal cost: sum of costs required for a one-unit increase =

81.

sales quantity variance: = (actual units sold - budgeted units)

variable costs + avoidable fixed costs

56.

market share variance: = (actual market share - budgeted

57.

market size variance: = (actual market size - expected market

58.

mechanics of master budgets: driven by sales budget ->

x budgeted mix ratio x budget unit CM for product

82.

sales volume variance: = (actual units sold - budgeted units) *

83.

selling price variance: = (actual price/unit - budgeted

84.

semi-variable (mixed) costs: has both fixed & variable

85.

sensitivity analysis: experimenting with different parameters

86.

separable costs: incurred after split-off point

87.

simple linear regression: one independent variable (y = A +

88.

split-off point: where joint products recognized as individuals

89.

standard cost per unit: targets for production

normal spoilage: included in standard cost (increases per unit

90.

standard costing systems: used for all manufacturing costs

costs

91.

standard costs: aggregate, firm expects to incur

63.

overhead application rate: = budgeted MOH costs / budgeted

92.

standard direct costs: = standard price * standard quantity

cost driver

93.

standard overhead costs: = predetermined application rate *

64.

overhead variance models: 1) net overheard variance (one-

market share) x actual industry units x budgeted unit CM

standard CM per unit

size) x budgeted market share x budgeted unit CM

production budget -> selling and & admin budget -> personnel

budget -> pro forma income statement -> pro forma balance

sheet -> pro forma cash budgets

59.

methods of allocating joint costs: 1) unit-volume ratio, 2)

60.

MOH applied: = overhead application rate * actual cost driver

61.

nonconformance costs: internal failure (cure defect

NRV at split off point, 3) ultimate sales value at point of sale

discovered before shipping) & external failure (cure defect

discovered after customer receives item)

62.

65.

price/unit) * actual units sold

aspects, graphically as step pattern

and logging range of results

Bx)

standard quantity

way), 2) two-way variance, 3) three-way variance

94.

target cost: = market price - required profit

Pareto diagrams: quality control issues from most to least

95.

three-way overhead variance: spending variance + efficiency

frequent

66.

67.

variance + volume variance

partial productivity ratios: = quantity of output / quantity of

96.

total productivity ratios: = quantity of output / costs of inputs

single input used

97.

transfer price: price charged by one division to another in

participative standards: set by management & individuals

held responsible

68.

period costs: selling, general & admin, interest expense

69.

positive EVA: performance is meeting standards

70.

prime costs: = DL + DM

71.

process costing: averages costs, used mostly for homogeneous

same business/entity

98.

transfer pricing methods: 1) market price, 2) cost, 3)

negotiated prices, 4) dual pricing

99.

two-way overhead variance: budget (controllable) variance +

volume (uncontrollable) variance

100.

items

72.

process improvement: activity-based management: use of

101.

74.

product costs: direct materials, direct labor, manufacturing

overhead

102.

unfavorable variance: actual cost > standard cost

production report for process costing: units accounted for

103.

unit contribution: unit sales price less unit variable costs

= units charged to dept & costs accounted for = costs charged to

dept

75.

profit after BEP: units after BEP sold * CM per unit

76.

quality audits: studying Strengths and Weaknesses

77.

relevant range: range where assumptions of cost drivers are

104.

required sales for target profit: = (fixed costs + target profit)

105.

required sales for target profit before taxes: = variable

costs + fixed costs + (target profit after tax / (1 - tax rate))

80.

sales mix variance: =(actual product mix ratio - budgeted

ratio) x actual units sold x budgeted unit CM for products

Free Notes .. Not for resale

variable costs: changes proportionately with cost driver,

constant per unit

106.

weighted average cost per EU: = beginning costs + current

costs / EU

107.

weighted average costs: costs of beginning inventory +

current costs are applied to EU

/ CM ratio

79.

units started & completed: = units transferred out less

beginning inventory units

valid

78.

types of responsibility segments (strategic business

units): 1) cost SBU: control, 2) revenue SBU: generate, 3) profit

SBU: target profit, 4) investment SUB: return on assets

ABC & ABM towards TQM

73.

types of cost drivers: theoretical (executional/ST,

structural/LT) & operational (volume-based, activity-based)

108.

weighted average EUs: = units completed + EU of WIP at end

of period

For personal use copy, not for resale

Market Structure

1.

Describe a market structure that includes a few

11.

providers.: Oligopoly market. In an oligopoly market there are

few providers of goods or services. In a monopoly there is only

one provider; in perfect competition or monopolistic competition

there are many providers.

2.

Describe the justification for natural monopolies.: A

monopoly exists where there is a single provider of a commodity

for which there are no close substitutes and where entry into the

market is difficult. Natural monopolies exist where there is

increasing return to scale of operations and is justified by a

single entity being able to satisfy demand at a lower cost than

two or more firms. Public utilities have been traditional examples

of natural monopolies.

3.

4.

Describe the nature of the market structure in the U.S.

economy.: The U.S. economy is a mix of market structures with

different commodities/industries operating in different market

structures.

5.

Describe the point of short-run profit maximization for

a firm in an oligopoly industry.: Short-run profit is

maximized where marginal revenue is equal to rising marginal

cost (provided price > average total cost).

6.

Describe the point of short-run profit maximization for

a firm in monopolistic competition.: Short-run profit is

maximized where marginal revenue is equal to rising marginal

cost (provided price > average total cost).

7.

Describe the point of short-run profit maximization for

a firm in perfect competition.: Short-run profit is

maximized where marginal revenue is equal to rising marginal

cost; total revenue will exceed total costs by the greatest amount

at that point.

8.

12.

13.

14.

15.

In which form of market structure is a "price war" most

likely to occur?: Oligopoly, because each firm in the industry is

aware of the actions of other firms in the industry.

16.

List examples of reasons why monopolies exist.: 1)

Control of raw materials or processes;

2) Government granted franchise (i.e., exclusive right);

3) Increasing return to scale (i.e., natural monopolies).

17.

List the characteristics of a perfect monopoly.: 1) A single

seller

2) A commodity for which there are no close substitutes;

3) Restricted entry into the market.

18.

List the characteristics of an oligopoly.: 1) A few sellers

2) Firms sell either a homogeneous product (standardized

oligopoly) or a differentiated product (differentiated oligopoly);

3) Restricted entry into the market.

19.

List the characteristics of monopolistic competition.: 1)

A large number of sellers;

2) Firms sell a differentiated product or service (similar but not

identical), for which there are close substitutes;

3) Firms can enter or leave the market easily.

20.

List the characteristics of Perfect Competition: 1) A large

number of independent buyers and sellers, each of which is too

small to separately affect the price of a commodity;

2) All firms sell homogeneous products or services;

3) Firms can enter or leave the market easily;

4) Resources are completely mobile;

5) Buyers and sellers have perfect information;

6) Government does not set prices.

How are long-run profits determined for a firm in an

Free Notes .. Not for resale

In what ways do firms in an Oligopoly market compete?:

Firms in an oligopoly market compete based on quality, service,

distinctiveness, etc., but not on price, which might incite a "price

war."

Collusion.: 1) Overt Collusion = Firms conspire to set output,

price or profit; illegal in the U.S.;

2) Tacit Collusion = Firms follow price charged by the price

leader in the market; not illegal in the U.S.

Oligopoly Industry?: A firm in an oligopoly industry will

make profits in the long-run if average total cost is less than

market price, and can continue to do so because entry into the

market is restricted.

In the long-run, how may a monopoly firm increase its

profits?: A monopoly firm may increase its profits in two ways:

1) Reduce cost by changing the size if its operations;

2) Increase demand through advertising, promotion, etc.

Distinguish between Overt Collusion and Tacit

10.

How are long-run profits determined for a firm in

perfect competition?: There are no long-run profits possible

in a perfectly competitive market. If profits are made in the shortrun, more firms will enter the market and increase supply, thus

decreasing market price until all firms just breakeven.

Describe the point of short-run profit maximization for

a firm in perfect monopoly.: Short-run profit is maximized

where marginal revenue is equal to rising marginal cost. The

price charged at that quantity will depend on the level of the

demand curve.

9.

Monopolistic Competition?: There are no long-run profits

possible in a monopolistic competition. If profits are made in the

short-run, more firms will enter the market and lower the

demand for each firm until each just breaks even.

Describe the least likely market structure in the U.S.

economy.: Perfect Competition. A market or industry with all of

the criteria of perfect competition is virtually nonexistent in the

U.S. economy. Monopoly, monopolistic competition and

oligopoly markets are common.

How are long-run profits determined for a firm in

21.

Under Monopolistic Competition, what determines

whether a firm makes a profit or not?: The relationship

between the price (P) that can be charged and the firm's average

total cost (ATC). If ATC < P, the firm will make a profit.

Otherwise, it will either breakeven (ATC = P) or have a loss (ATC

> P).

For personal use copy, not for resale

Market Structure

22.

What are the four market structures normally considered in economic analysis?: 1) Perfect competition;

2) Perfect monopoly;

3) Monopolistic competition;

4) Oligopoly.

23.

What is a "Price taker" Firm?: The assumption that a firm in a perfectly competitive market must accept ("take") the price set by the

market and can sell any quantity of its commodity at that price. Thus, the demand curve faced by a single firm in perfect competition is a

straight horizontal line at the market price.

24.

What is the shape of the demand curve for a Firm in Monopolistic Competition?: Downward sloping and highly elastic

25.

What is the shape of the demand curve for a firm in Perfect Competition?: The demand curve faced by a single firm in a perfectly

26.

What is the shape of the demand curve for a Firm in Perfect Monopoly?: Downward sloping (and, since the firm is the only firm

(because there are close substitutes for the good or service offered).

competitive market is a straight horizontal line originating at the price set by the market (of all firms).

in the industry, it is also the industry demand curve).

Free Notes .. Not for resale

For personal use copy, not for resale

Information Technology

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

accounting

information

system

input (source document) -> journalize ->

ledger -> trial balance -> financial

statements

databases

relational technology

decentralized

processing

power, applications, & work spread over

many locations where remote computer

performs portion of processing

ad hoc report

can be created on demand using specific

queries

application

service

providers

provide access to programs on rental basis

decision support

systems

combine management's subjective

judgments and objective analytical data

demand reports

available on demand

backdoor

means to access that bypasses normal

security

25.

denial-of-service

attack

flood of information preventing users

from accessing target computer

backup files

genealogy

recent: son, prior: father, oldest:

grandfather

26.

e-business

more general, any IT used to perform

business processes

batch

processing

groups of transactions processed

periodically

27.

e-commerce

buying and selling electronically

electronic access

controls

user IDs and PWs, security levels restrict

access to programs & applications

brute-force

attack

try every possible key/password until found

electronic data

interchange

computer to computer exchange of

electronic transaction documents

business 2

business perks

speed, timing, personalization, security,

reliability,

30.

electronic funds

transfer

third-party vendor/intermediary transfers

electronic payments

business

information

system

computer system to record and summarize

business transactions

31.

enterprise

resource

planning systems

ERP = integrates and automates many

business processes with data centrally

located and accessible by various

departments

categories of

risk

errors, intentional acts, disasters

centralized

processing

maintain data & process at central location

32.

exception

reports

specific condition

cold site

a separate facility that does not have any

computer equipment, but is a place where

employees can move after a disaster

33.

executive

information

systems

senior executives have access to internal

and external information, assist in

monitoring business conditions

communication

protocols

common set of rules allowing network to

communicate

34.

extranets

allow outside clients to access company's

network

components of

BIS

hardware, software, network, people, data

& information

35.

file librarian

store/protect programs & tapes

36.

firewalls

prevent unauthorized users from access

computer

operator

schedule processing jobs, running &

monitoring scheduled production jobs

four main system

risks

strategic risk (risk of choosing

inappropriate technology), operating risk

(risk of doing right things the wrong

way), financial risk (having financial

resources lost, wasted, or stolen),

information risk (risk of loss of data

integrity, incompleteness, or hackers)

control clerk

logged/scheduled input & output,

maintained error & correction logs

CRM general

rules

20% of customers generate 80% of sales

and 5-10 times more costly to bring new

customer than to repeat business from

existing customer

functional

system made of

hardware technician -> network admin > software developers

functions

performed on

data

collect, process, store, transform,

distribute

gateways/routers

translate one set of protocols to another

hardware

components

central processing unit (primary

storage), secondary storage (hard

drives), peripherals (input & output

devices)

21.

22.

23.

24.

28.

29.

37.

38.

customer

relationship

management

sales automation & customer service with

the objective of increasing customer

satisfaction in order to increase

revenue/profits

data sizes

bit -> byte -> field -> record -> file

40.

database

management

system

tool, separate program

41.

Free Notes .. Not for resale

39.

For personal use copy, not for resale

Information Technology

42.

43.

44.

hot site

remote site that contains all equipment,

supplies, and telecommunications a

business needs and is ready immediately in

the event of a disaster

push

reporting

more automated, sent to PC

RAM v. ROM

temporary v. permanent primary storage

security

admins

assign initial passwords & maintain them,

maintain operating security systems &

security software

server

accessible through software

steps of

disaster

recovery

1) assess the risks, 2) identify mission-critical

applications & data, 3) develop a plan, 4)

determine responsibilities, 5) test data

recovery plan

supply

management

systems

sales: what, when, where, and how much

from customer to original supplier

system

admins

database admin, network admin, web admin

system

analyst

design internally developed application

system sataisfy end users' requirements

system

programmer

installing, troubleshooting, monitoring, &

maintaining OS

transaction

tagging

follow transactions through client's system

for audit purposes

transmission

media

cables

trojan horse

appears to be useful

types of

controls

general controls, application controls,

physical controls, segregation of duties

types of

databases

operational, analytical, data warehouses,

distributed, end-user

types of

disaster

recovery

outside disaster recovery service, internal

disaster recovery, multiple data center

backups

types of

firewalls

packet filtering, circuit filtering gateways,

application filtering

value added

networks

privately owned 7 managed

virus

requires host program

wide area

networks

national & international communications

79.

workstation

used by end-users

80.

worm

can run independently

60.

61.

internetbased

networks

internet protocols & public communications

62.

intranets

geographically separate LANs within

company

63.

system analyst v. computer programmers,

computer operator v. computer programmers,

security admin v. computer operators &

programmers

65.

create empty database, database queries,

database maintenance (tuning), application

development

66.

management

information

systems

provide managerial and end users with

reports, assist in decision making

67.

millions of

instructions

per second

(MIPS)

measure of processing power

68.

modems

allows communicate with others, device that

converts between digital and analog

representation of data

network

interface card

an interface fitted inside a personal computer

or network terminal which allows it to

communicate with other machines over a

network

network OS

peer to peer or client/server system

network

topologies

bus, ring, star, tree

53.

node

device connected to network

54.

normalization

separating data into logical tables

objectoriented

databases

comments, drawings, images

online real

time

processing

(OLRT)

update master files as data is entered,

random access storage only

periodic

scheduled

report

predefined format

phishing

phony messages to get sensitive information

(spam)

physical

access

controls

restricted access to computer rooms

45.

46.

47.

48.

49.

50.

51.

52.

55.

IT segregation

of duties

64.

major uses of

DBMS

69.

70.

71.

72.

73.

74.

75.

76.

77.

56.

57.

58.

59.

Free Notes .. Not for resale

78.

You might also like

- Request Letter To Practice ProfessionDocument2 pagesRequest Letter To Practice ProfessionJohn Mark Paracad88% (33)

- 2013 REG Last Minute Study Notes (Bonus)Document47 pages2013 REG Last Minute Study Notes (Bonus)olegscherbina100% (3)

- Invitation Letter FAT Group PDFDocument2 pagesInvitation Letter FAT Group PDFTanvir Mahmood Kamal100% (1)

- How Not To Make A Short FilmDocument282 pagesHow Not To Make A Short FilmAshish_Singh_512681% (16)

- Uber@Corporate Governance and Corporate Social ResponsibilityDocument16 pagesUber@Corporate Governance and Corporate Social ResponsibilityAsanka RathnayakaNo ratings yet

- The NANDI Guitar Method Notes UnleashedDocument77 pagesThe NANDI Guitar Method Notes UnleashedNiki100% (3)

- Bec Review SheetDocument7 pagesBec Review Sheettrevor100% (1)

- NINJA Book Reg 1 EthicsDocument38 pagesNINJA Book Reg 1 EthicsJaffery143No ratings yet

- REG NotesDocument41 pagesREG NotesNick Huynh75% (4)

- The Cult of The Moon GodDocument15 pagesThe Cult of The Moon GodJesus LivesNo ratings yet

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- BEC 1 Outline - 2015 Becker CPA ReviewDocument4 pagesBEC 1 Outline - 2015 Becker CPA ReviewGabriel100% (1)

- BEC Review NotesDocument9 pagesBEC Review Notescpa2014No ratings yet

- BEC MaggieDocument48 pagesBEC MaggieJame NgNo ratings yet

- BEC 3 Outline - 2015 Becker CPA ReviewDocument4 pagesBEC 3 Outline - 2015 Becker CPA ReviewGabrielNo ratings yet

- BEC Final Review NotesDocument38 pagesBEC Final Review NotessheldonNo ratings yet

- Chapter 9 & 10 Financial (FAR) NotesDocument7 pagesChapter 9 & 10 Financial (FAR) NotesFutureMsCPANo ratings yet

- BEC Notes Chapter 3Document13 pagesBEC Notes Chapter 3bobby100% (1)

- BEC Study Guide 4-19-2013Document220 pagesBEC Study Guide 4-19-2013Valerie Readhimer100% (1)

- BEC 4 Outline - 2015 Becker CPA ReviewDocument6 pagesBEC 4 Outline - 2015 Becker CPA ReviewGabrielNo ratings yet

- BEC Formula Sheet Mini TestDocument7 pagesBEC Formula Sheet Mini Testcpacfa73% (11)

- Bec Flash CardsDocument4,310 pagesBec Flash Cardsmohit2uc100% (1)

- CPA BEC 1 - Corporate GovernanceDocument3 pagesCPA BEC 1 - Corporate GovernanceGabrielNo ratings yet

- CPA REG Entity BasisDocument4 pagesCPA REG Entity BasisManny MarroquinNo ratings yet

- Reg Flash CardsDocument3,562 pagesReg Flash Cardsmohit2ucNo ratings yet

- CPA Exam REG - S-Corporation Taxation.Document2 pagesCPA Exam REG - S-Corporation Taxation.Manny MarroquinNo ratings yet

- • • • • • • • • • •Document23 pages• • • • • • • • • •hkuluNo ratings yet

- BEC NotesDocument17 pagesBEC NotescsugroupNo ratings yet

- Cfa Level I - Us Gaap Vs IfrsDocument4 pagesCfa Level I - Us Gaap Vs IfrsSanjay RathiNo ratings yet

- FAR Notes CH1: Revenue Recognition 1.0 (Becker 2017)Document12 pagesFAR Notes CH1: Revenue Recognition 1.0 (Becker 2017)charlesNo ratings yet

- FAR Notes Chapter 3Document3 pagesFAR Notes Chapter 3jklein2588No ratings yet

- 655 Week 12 Notes PDFDocument63 pages655 Week 12 Notes PDFsanaha786No ratings yet

- CPA Regulation (Reg) Notes 2013Document7 pagesCPA Regulation (Reg) Notes 2013amichalek0820100% (3)

- 2019 Cpa Bec AnswersDocument14 pages2019 Cpa Bec AnswerssuryaNo ratings yet

- Aud NotesDocument75 pagesAud NotesClaire O'BrienNo ratings yet

- AUD Notes Chapter 2Document20 pagesAUD Notes Chapter 2janell184100% (1)

- PF CMA NotesDocument19 pagesPF CMA NotesvigneshanantharajanNo ratings yet

- Part 3 - Understanding Financial Statements and ReportsDocument7 pagesPart 3 - Understanding Financial Statements and ReportsJeanrey AlcantaraNo ratings yet

- Far Final ReviewDocument13 pagesFar Final ReviewFutureMsCPA100% (1)

- Activity RatiosDocument7 pagesActivity RatiosSUBIR100% (1)

- FinQuiz - UsgaapvsifrsDocument12 pagesFinQuiz - UsgaapvsifrsĐạt BùiNo ratings yet

- 2020 - Far SampleDocument21 pages2020 - Far SamplesuryaNo ratings yet

- BEC Notes Chapter 2Document7 pagesBEC Notes Chapter 2cpacfa100% (10)

- Financial Ratio Analysis FormulasDocument4 pagesFinancial Ratio Analysis FormulasVaishali Jhaveri100% (1)

- CPA Reg Practice Individual TaxationDocument2 pagesCPA Reg Practice Individual TaxationMatthew AminiNo ratings yet

- 2014 Exam Review Simulations FAR - SolutionsDocument113 pages2014 Exam Review Simulations FAR - SolutionsPEDRO ORTIZ50% (2)

- Chapter 2 FAR CPA NotesDocument4 pagesChapter 2 FAR CPA Notesjklein2588No ratings yet

- New-Reg-2023 (N)Document2 pagesNew-Reg-2023 (N)saramohamed5137No ratings yet

- Accounting Study Guide PDFDocument8 pagesAccounting Study Guide PDFgetasewNo ratings yet

- MBA Resume Template From RotmanDocument1 pageMBA Resume Template From Rotmananand.iitd4358No ratings yet

- Wiley CPAexcel - FAR - 13 Disclosure RequirementsDocument2 pagesWiley CPAexcel - FAR - 13 Disclosure RequirementsAimeeNo ratings yet

- REG Exam Format - CPADocument1 pageREG Exam Format - CPAgavkaNo ratings yet

- Auditing and Attestation Content Specification OutlineDocument5 pagesAuditing and Attestation Content Specification OutlineLisa GoldmanNo ratings yet

- Regulation MyNotesDocument50 pagesRegulation MyNotesaudalogy100% (1)

- If You Follow His Strategies, You Will Pass The CPA ExamsDocument4 pagesIf You Follow His Strategies, You Will Pass The CPA Examsagonza70No ratings yet

- SwotDocument3 pagesSwotShahebazNo ratings yet

- Cpa Textbook: Ethics and Responsibility in Tax PracticeDocument5 pagesCpa Textbook: Ethics and Responsibility in Tax PracticeLE AicragNo ratings yet

- 2024 Becker CPA Financial (FAR) Notes - 01.unit OutlineDocument5 pages2024 Becker CPA Financial (FAR) Notes - 01.unit OutlinecraigsappletreeNo ratings yet

- CMA Exam Review - Part 2 - Section A - Financial Statement AnalysisDocument7 pagesCMA Exam Review - Part 2 - Section A - Financial Statement Analysisaiza eroyNo ratings yet

- CPA BEC Virtural Class NOTESDocument19 pagesCPA BEC Virtural Class NOTESRamach100% (1)

- CPA Chapter 4 FAR Notes Inventories & CA/CLDocument5 pagesCPA Chapter 4 FAR Notes Inventories & CA/CLjklein2588No ratings yet

- Cpa NotesDocument120 pagesCpa Notesjobir2008No ratings yet

- BEC CPA Formulas - November 2015 - Becker CPA ReviewDocument20 pagesBEC CPA Formulas - November 2015 - Becker CPA Reviewgavka100% (1)

- Cpa ReviewDocument31 pagesCpa ReviewlordaiztrandNo ratings yet

- And The Day of Hunain Urgent Message To The Revolutionaries of LibyaDocument7 pagesAnd The Day of Hunain Urgent Message To The Revolutionaries of LibyadayofhunainNo ratings yet

- Renewable Energy Policies, Programs and Strategies in Nigeria: A Review and Critical AnalysisDocument14 pagesRenewable Energy Policies, Programs and Strategies in Nigeria: A Review and Critical AnalysisSantiago Tirado RNo ratings yet

- Quantitative Strategic AnalysisDocument16 pagesQuantitative Strategic AnalysisBlaine Bateman, EAF LLCNo ratings yet

- The Modern Rationalist October 2017Document35 pagesThe Modern Rationalist October 2017paufabra100% (1)

- Greenwood High Unit Test-I (2020 - 21) Subject: History & Civics Grade: VII Duration: 40 Min Date:27/07/20 Max Marks: 25Document3 pagesGreenwood High Unit Test-I (2020 - 21) Subject: History & Civics Grade: VII Duration: 40 Min Date:27/07/20 Max Marks: 25Akshitaa PandeyNo ratings yet

- Is Tithing Required in The New CovenantDocument3 pagesIs Tithing Required in The New Covenantsuhail farooqNo ratings yet

- Global MarketingDocument25 pagesGlobal MarketingKamal SinghNo ratings yet

- HP Printers - 'Unsuccessful Network Installation' Error (Windows) - HP® Customer SupportDocument5 pagesHP Printers - 'Unsuccessful Network Installation' Error (Windows) - HP® Customer SupportManoj AgnihotriNo ratings yet

- Revolutionizing Data Warehousing in Telecom With The Vertica Analytic DatabaseDocument11 pagesRevolutionizing Data Warehousing in Telecom With The Vertica Analytic DatabasegrandelindoNo ratings yet

- Acr Gen. Pta MetingDocument3 pagesAcr Gen. Pta MetingJane MaravillaNo ratings yet

- Quizzes - Topic 2Document6 pagesQuizzes - Topic 2LAN NGO HUONGNo ratings yet

- New Talents: Talent FormatDocument4 pagesNew Talents: Talent Formatjoaollo4954100% (2)

- Littlejohn v. Patrick B Harris Psychiatric Hospital - Document No. 12Document7 pagesLittlejohn v. Patrick B Harris Psychiatric Hospital - Document No. 12Justia.comNo ratings yet

- Kavach PDFDocument12 pagesKavach PDFdr.vyshnavi0909No ratings yet

- MC Script Opening Speech EnglishDocument2 pagesMC Script Opening Speech EnglishShazwanShah100% (3)

- USAID-BHA Indicator Handbook Part II June 2021Document154 pagesUSAID-BHA Indicator Handbook Part II June 2021Amenti TekaNo ratings yet

- Renaissance and Baroques Art Styles-TechniquesDocument64 pagesRenaissance and Baroques Art Styles-TechniquesDONNALYN TORRESNo ratings yet

- Worldschool H009 Pedal Powered Sawmill: Yaro Ligthart, Sytze Winius, Tyro Bekedam and Nicki Pan 06-10-2017Document13 pagesWorldschool H009 Pedal Powered Sawmill: Yaro Ligthart, Sytze Winius, Tyro Bekedam and Nicki Pan 06-10-2017api-352440955No ratings yet

- CBBE Pyramid: Customer Based Brand EquityDocument6 pagesCBBE Pyramid: Customer Based Brand EquityNupur Saurabh AroraNo ratings yet

- What's Your Compatibility With NCT DreamDocument1 pageWhat's Your Compatibility With NCT DreamrencupidNo ratings yet

- The Handmaid's Tale - WikipediaDocument22 pagesThe Handmaid's Tale - WikipediaJaime AdrianNo ratings yet

- He Imes Eader: Obama Promises Rigorous ReviewDocument36 pagesHe Imes Eader: Obama Promises Rigorous ReviewThe Times LeaderNo ratings yet

- Consulting Engagement: Mclachlin, RDocument7 pagesConsulting Engagement: Mclachlin, RSheila Mae AramanNo ratings yet

- Magnetic Nanoparticles For Drug DeliveryDocument11 pagesMagnetic Nanoparticles For Drug DeliverySrinivas NadellaNo ratings yet