Professional Documents

Culture Documents

Completing Accounting Cycle

Uploaded by

Abu ZakiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Completing Accounting Cycle

Uploaded by

Abu ZakiCopyright:

Available Formats

Supplemental Instruction Handouts

Financial Accounting

Chapter 4:

Completing the Accounting Cycle

and Classifying Accounts

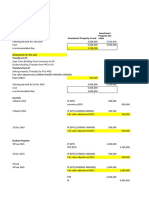

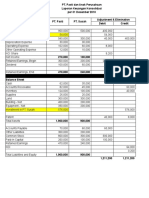

The following adjusted trial balance is for Burns Consulting for the year ended December 31, 2012.

Accounts Payable

Accounts Receivable

Accumulated Depreciation, Building

Accumulated Depreciation, Computer Equipment

Advertising Expense

Bonds Payable

Building

Cash

Computer Equipment

Consulting Fees Earned

Copyright

Depreciation Expense Building

Depreciation Expense Computer Equipment

st

J. Burns, Capital, January 1

J. Burns, Withdrawals

Income Summary

Insurance Expense

Interest Earned

Interest Expense

Interest Payable

Land

Land held for future development

Note Payable due 2013

Note Payable due 2014

Prepaid Insurance

Prepaid Rent

Rent Earned

Rent Expense

Salaries Expense

Supplies

Supplies Expense

Telephone Expense

Unearned Consulting Fees

$4,500

$3,500

$10,500

$35,500

$2,500

$50,000

$210,000

$7,800

$106,500

$217,900

$9,500

$1,500

$7,100

$110,000

$35,000

?

$2,200

$1,500

$1,200

$600

$25,000

$25,000

$10,000

$75,000

$200

$700

$10,200

$7,700

$85,000

$500

$900

$400

$6,500

Required:

A) Prepare the necessary closing entries

B) Prepare a classified balance sheet as of December 31, 2012.

Academic Success Centre

www.rrc.mb.ca/asc

These questions are compiled by Michael Reimer for the Academic Success Centre.

You can find more questions, answers and links to Wise Guys videos at

blogs.rrc.ca/michael

You might also like

- Financial Accounting Workbook Version 2Document90 pagesFinancial Accounting Workbook Version 2Honey Crisostomo EborlasNo ratings yet

- Comprehensive ProblemDocument11 pagesComprehensive Problemapi-295660192No ratings yet

- ACCT504 Case Study 1 The Complete Accounting Cycle-13varnadoDocument16 pagesACCT504 Case Study 1 The Complete Accounting Cycle-13varnadoRegina Lee FordNo ratings yet

- Trial BalanceDocument12 pagesTrial BalanceMarieNo ratings yet

- Forensic Investigation - ReportDocument6 pagesForensic Investigation - Reportjhon DavidNo ratings yet

- Comprehensive Accounting Cycle Review Problem Copy 2Document12 pagesComprehensive Accounting Cycle Review Problem Copy 2api-252183085No ratings yet

- Financial Accounting Workbook PDFDocument89 pagesFinancial Accounting Workbook PDFDianne Jonnalyn Cuba100% (1)

- T24 Accounting Set-Up - For Consolidation - R15Document87 pagesT24 Accounting Set-Up - For Consolidation - R15Jagadeesh JNo ratings yet

- Financial Management AssignmentDocument53 pagesFinancial Management Assignmentmuleta100% (1)

- How To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditFrom EverandHow To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditNo ratings yet

- Afar Partnership LiquidationDocument42 pagesAfar Partnership LiquidationKrizia Mae Uzielle PeneroNo ratings yet

- Acc 311 - Exam 1 - Form A BlankDocument12 pagesAcc 311 - Exam 1 - Form A BlankShivam GuptaNo ratings yet

- The New BarangayDocument36 pagesThe New BarangayShekeinah CalingasanNo ratings yet

- Asssessment Method 2 - Case Study: Instructions For StudentsDocument22 pagesAsssessment Method 2 - Case Study: Instructions For StudentsAsfara Amir Sheikh67% (6)

- 1P91+F2012+Midterm Final+Draft+SolutionsDocument10 pages1P91+F2012+Midterm Final+Draft+SolutionsJameasourous LyNo ratings yet

- AkuntansiDocument3 pagesAkuntansier4sallNo ratings yet

- BASEL Norms MCQDocument15 pagesBASEL Norms MCQBiswajit Das100% (1)

- Capital Budgeting Project Evaluation TechniquesDocument16 pagesCapital Budgeting Project Evaluation Techniquessamuel kebedeNo ratings yet

- W4Me Problem 3Document8 pagesW4Me Problem 3Jason Berglund0% (1)

- JDC TemplatesDocument20 pagesJDC TemplatesjiiNo ratings yet

- Comprehensive Exam EDocument10 pagesComprehensive Exam Ejdiaz_646247100% (1)

- CHAPTER - 5 - Exercise & ProblemsDocument6 pagesCHAPTER - 5 - Exercise & ProblemsFahad Mushtaq20% (5)

- Due Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2Document7 pagesDue Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2kaomsheartNo ratings yet

- Project Cover Sheet: Higher Colleges of TechnologyDocument26 pagesProject Cover Sheet: Higher Colleges of Technologyapi-302300965No ratings yet

- 2012 Final Exam SolutionDocument14 pages2012 Final Exam SolutionOmar Ahmed ElkhalilNo ratings yet

- Unit 10 Financial Accounting and ReportingDocument11 pagesUnit 10 Financial Accounting and ReportingMohammadAhmad0% (2)

- Project 1 Summer 2014 (1) - 1-1Document7 pagesProject 1 Summer 2014 (1) - 1-1Sammy Ben MenahemNo ratings yet

- DK Goel Solutions Class 11 Chapter 22 DK Goel Book Available For FreeDocument1 pageDK Goel Solutions Class 11 Chapter 22 DK Goel Book Available For Freetwinkle banganiNo ratings yet

- Simplified Accounting For Entrepreneurs (SAFE) Assignment - Part 1 Journalizing, Posting, Trial BalanceDocument4 pagesSimplified Accounting For Entrepreneurs (SAFE) Assignment - Part 1 Journalizing, Posting, Trial BalanceDarwin Dionisio ClementeNo ratings yet

- FDNACCT Quiz-3 Set-A Answer-KeyDocument4 pagesFDNACCT Quiz-3 Set-A Answer-KeyPia DigaNo ratings yet

- Comprehensiveexam eDocument10 pagesComprehensiveexam eNghiaBuiQuangNo ratings yet

- ACCT 1005 Worksheet 2 RevisedDocument10 pagesACCT 1005 Worksheet 2 RevisedAndre' King100% (1)

- Practice Exam 1gdfgdfDocument49 pagesPractice Exam 1gdfgdfredearth2929100% (1)

- CAT-CB Questionnaires (Encoded)Document13 pagesCAT-CB Questionnaires (Encoded)Anob Ehij100% (1)

- FDNACCT Quiz-3 Set-C Answer-KeyDocument4 pagesFDNACCT Quiz-3 Set-C Answer-KeyPia DigaNo ratings yet

- f1 Answers Nov14Document14 pagesf1 Answers Nov14Atif Rehman100% (1)

- Adjusting Entries Justin Park CASEDocument20 pagesAdjusting Entries Justin Park CASEDKzNo ratings yet

- College of Business and Management: Central Mindanao University Department of AccountancyDocument11 pagesCollege of Business and Management: Central Mindanao University Department of AccountancyErwin Dave M. DahaoNo ratings yet

- (Template) BAC-2-Module-1-Review-of-Basic-AccountingDocument4 pages(Template) BAC-2-Module-1-Review-of-Basic-AccountingCharmaine Montimor Ordonio100% (1)

- Problem p2 41 Continues With The Consulting Business Begun in Problem PDFDocument1 pageProblem p2 41 Continues With The Consulting Business Begun in Problem PDFTaimour HassanNo ratings yet

- Accrual Accounting Concepts: Accountants Divide The Economic Life of A Business Into Reporting PeriodsDocument36 pagesAccrual Accounting Concepts: Accountants Divide The Economic Life of A Business Into Reporting PeriodsDhafra Sanchez'sNo ratings yet

- CH 04Document4 pagesCH 04Nusirwan Mz50% (2)

- TradesDocument3 pagesTradesAlber Howell MagadiaNo ratings yet

- Completing The Accounting CycleDocument64 pagesCompleting The Accounting CycleYustamar RamatsuyNo ratings yet

- Accounting Textbook Solutions - 12Document19 pagesAccounting Textbook Solutions - 12acc-expertNo ratings yet

- Group Assignment 1Document2 pagesGroup Assignment 1Adis TsegayNo ratings yet

- ACC101 Chapter2newDocument19 pagesACC101 Chapter2newRahasia RommelNo ratings yet

- FDNACCT Quiz-3 Set-B Answer-KeyDocument4 pagesFDNACCT Quiz-3 Set-B Answer-KeyPia DigaNo ratings yet

- Adjusment Smpe Closing PeriodicDocument1 pageAdjusment Smpe Closing PeriodicalfarisizaiNo ratings yet

- Completing The Accounting CycleDocument47 pagesCompleting The Accounting CycleMeagan NelsonNo ratings yet

- Fundamentals of AccountancyDocument17 pagesFundamentals of AccountancyKimberly MilanteNo ratings yet

- The Accounting CycleDocument21 pagesThe Accounting Cycleulquira grimamajowNo ratings yet

- FDNACCT - Quiz #1 - Answer Key - Set ADocument5 pagesFDNACCT - Quiz #1 - Answer Key - Set AleshamunsayNo ratings yet

- LiabilitiesDocument6 pagesLiabilitiesnikkibausa100% (1)

- 2010 Yr 9 POA AnsDocument112 pages2010 Yr 9 POA AnsMuhammad SamhanNo ratings yet

- Financial Accounting Workbook Version 1Document89 pagesFinancial Accounting Workbook Version 1Jellekia WatsonNo ratings yet

- Chapter 4 Question ReviewDocument11 pagesChapter 4 Question ReviewNayan SahaNo ratings yet

- 3 ProblemsDocument8 pages3 ProblemsHassan SheikhNo ratings yet

- FA Case Study Ch04a OkendoDocument1 pageFA Case Study Ch04a OkendoSha EemNo ratings yet

- Ecomprehensiveexam eDocument12 pagesEcomprehensiveexam eDominic SociaNo ratings yet

- Practice Questions 1 (AIS)Document8 pagesPractice Questions 1 (AIS)UroobaShiekhNo ratings yet

- Advanced AccountingDocument13 pagesAdvanced AccountingprateekfreezerNo ratings yet

- MT ACCT311 OP55 Exam PracticeDocument10 pagesMT ACCT311 OP55 Exam PracticeDavid West100% (1)

- CdbaseDocument130 pagesCdbaseAbu ZakiNo ratings yet

- Cover Letter Learning DevelopmentDocument1 pageCover Letter Learning DevelopmentAbu ZakiNo ratings yet

- Reume 1Document4 pagesReume 1Abu ZakiNo ratings yet

- CN ResumeDocument2 pagesCN ResumeAbu ZakiNo ratings yet

- 2-Skin Benefits For PlumDocument9 pages2-Skin Benefits For PlumAbu ZakiNo ratings yet

- 1-Seeds of Various Fruits With Respective BenefitsDocument9 pages1-Seeds of Various Fruits With Respective BenefitsAbu ZakiNo ratings yet

- Egg Yolk OilDocument35 pagesEgg Yolk OilAbu ZakiNo ratings yet

- EmployeesDocument5 pagesEmployeesAbu ZakiNo ratings yet

- Second Module Exercises-7Document34 pagesSecond Module Exercises-7Abu ZakiNo ratings yet

- P2-6a 001Document1 pageP2-6a 001Abu ZakiNo ratings yet

- Notes On Financial AccountingDocument11 pagesNotes On Financial AccountingAbu ZakiNo ratings yet

- Solution Manual Advanced Financial Accounting 8th Edition Baker Chap012 PDFDocument79 pagesSolution Manual Advanced Financial Accounting 8th Edition Baker Chap012 PDFYopie ChandraNo ratings yet

- 2020 BValuation ReportDocument440 pages2020 BValuation Reportraj28_999No ratings yet

- BibliographyDocument5 pagesBibliographyKen PimenteroNo ratings yet

- Acc501 Assignment solutionDocument2 pagesAcc501 Assignment solution2myofficesheetNo ratings yet

- Snake LTD - Class WorkingsDocument2 pagesSnake LTD - Class Workingsmusa morinNo ratings yet

- Icfai Foundation For Higher Education University: A Project Report ONDocument12 pagesIcfai Foundation For Higher Education University: A Project Report ONkishore kittuNo ratings yet

- Entrepreneurial Finance 6th Edition Leach Solutions Manual Full Chapter PDFDocument45 pagesEntrepreneurial Finance 6th Edition Leach Solutions Manual Full Chapter PDFinverse.zinkthxzut100% (13)

- HW - Third AttemptDocument49 pagesHW - Third AttemptRolando GrayNo ratings yet

- Uflex Ar 2020 21Document181 pagesUflex Ar 2020 21Sarath ChandruNo ratings yet

- Abdul Samad (01-112182-043)Document5 pagesAbdul Samad (01-112182-043)ABDUL SAMADNo ratings yet

- Bayer Annual Report 2018 PDFDocument279 pagesBayer Annual Report 2018 PDFJimena CaycedoNo ratings yet

- Contoh Eliminasi Lap - Keu KonsolidasiDocument44 pagesContoh Eliminasi Lap - Keu KonsolidasiLuki DewayaniNo ratings yet

- A Study On Growth of Limited Liability Partnerships (LLPS) in India - An Innovative Vehicle For Entrepreneurial DevelopmentDocument28 pagesA Study On Growth of Limited Liability Partnerships (LLPS) in India - An Innovative Vehicle For Entrepreneurial DevelopmentDr.P.GovindanNo ratings yet

- Unit 4 - Income From Capital GainsDocument10 pagesUnit 4 - Income From Capital GainsAvin P RNo ratings yet

- Bahan Investasi Tambang PT Lagadar AbadiDocument8 pagesBahan Investasi Tambang PT Lagadar AbadiBintangNo ratings yet

- Санхүүгийн Тайлангийн МАЯГТ Англи Хэл ДээрDocument13 pagesСанхүүгийн Тайлангийн МАЯГТ Англи Хэл Дээрmunkhtsetseg.tsogooNo ratings yet

- Problems of Capital BudgetingDocument4 pagesProblems of Capital Budgetingm agarwalNo ratings yet

- Solusi Inventory Downstream-UpstreamDocument19 pagesSolusi Inventory Downstream-UpstreamKurrniadi AndiNo ratings yet

- IAS 16 Property, Plant and EquipmentDocument4 pagesIAS 16 Property, Plant and Equipmentisaac2008100% (5)

- Instructions For Form W-8BEN-E: (Rev. October 2021)Document20 pagesInstructions For Form W-8BEN-E: (Rev. October 2021)Samuel Albert PedroNo ratings yet

- ANSWER KEY ON PARTNERSHIP MOCK TESTxDocument6 pagesANSWER KEY ON PARTNERSHIP MOCK TESTxzhyrus macasilNo ratings yet

- C Law Unit II - Securities Exchange Board of India (SEBI ACT)Document5 pagesC Law Unit II - Securities Exchange Board of India (SEBI ACT)Mr. funNo ratings yet

- NITL Annual ReportDocument1 pageNITL Annual ReportKristi DuranNo ratings yet

- IAS 24 Related Party Disclosures: All Financial StatementsDocument11 pagesIAS 24 Related Party Disclosures: All Financial Statementsmusic niNo ratings yet