Professional Documents

Culture Documents

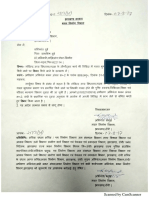

Atm Application Form State Bank of Bikaner and Jaipur

Uploaded by

akshatjain30010 ratings0% found this document useful (0 votes)

230 views6 pagesAtm Application form state bank of bikaner and jaipur

Original Title

Atm Application form state bank of bikaner and jaipur

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAtm Application form state bank of bikaner and jaipur

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

230 views6 pagesAtm Application Form State Bank of Bikaner and Jaipur

Uploaded by

akshatjain3001Atm Application form state bank of bikaner and jaipur

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 6

Eo ee ie site Fore ws wae

State Bank of Bikaner & Jaipur

rea eres water fete & Ferg srqera— ATT

Re da site dor ws TI et

rt

‘feria

Rela,

Ry een es whe a PA ee fs epee o_o wet af oI

mre EA / a RT eT eae a PT PITTATR

1. Gen tear

2. aR aTieR: ar ag,

3. FAST are wT ATH fre a W eel ae eT TE

(rere sears a aT ATA)

4. ger [| after [| ame () f Ks)

fa [ raga [ TTT

5. eerie

at) ease

‘fer

6 swam

TTT

CTI

fr

Be IE as TEL TR Fer sre a A / Hy feeb the were era | Ge Preett ee rel aA /em edtoore area / aee € TET

SAT TT HA & Fy Ge TAH es ere HeLa oe Avett aA ee a fey ars aret ahaha & fore area B/E 1

vad,

am arma:

AF 2., aaaee Serer

A 3, RTE

‘ae wrafara STAT TE En ar er ve aT

cs 2 Ree et MER TANT :

ar eT A RTC BT STAG | #

ard Pf

aftr ee

secu (4.)/(Aen)/ tes

er GE aE r/R PS

an ‘State Bank of Bikaner & Jaipur

Request Form for ATM Facility .

‘The Branch Manager, Place

‘State Bank of Bikaner & Jaipur

Branch Date

Dear Sir,

We request the Bank to issue ATM Card in the name given below against Savings Bank / Current Account No.

in mylour name. My/Our particulars end accounts details are as under

4. Account Number

2. Account Type Savings Current

3. Name of Account holder in whose name ATM Card is desired

(First Name / Middle Name / Last Name)

4. Maie[ | Femae[ —] Teno. To

Date of Bir

5. Permenent Adages :

‘Mobile No, LI

6. Mailing Address

PN

We have read and understood all the terms and conditions regarding ATM facility, enclosed with this. Form. We accept and

‘agree to be bound by the said terms and conditions and to any changes made by the Bank from time to time.

‘Yours faithfully,

Name 1 ‘Signature

Name 2. Signature

Name 3. Signature

For Office Use Only Received ATM Card & PIN envelope

‘The particulars and Signature a

of the applicant verified. Issue

of Card recommended. Issue of Card

‘Authorised

Manager (Py/(Accts.)/ Customers Signature

Designated ATM Officer__Branch/Chief Manager Date

ae

ges Tear

ence ger dt eka a ie ee Fara ao en rae ers a

en: ae ere elt

seed: eee amore Be end e-beam ar TE

ae Srksote per we mI

secdar rr rg ar serra tere ip TE

ha ea: rea exe, tera fa 7 esr er ana tes aera are seer aero Fee sore Per aE)

2. ase mrs

Den Sa earths Fer ee ark ah crt ea arb, Fer caret td arenes oom algae rare & 1

2.2 sen sort ty ar ee her a st Fes

2.3 deqgwemat eae, ffir ent ora, Pete et omen aca at Pe aT eR

3) BA ea SeaTac at te oer et ara ere & 1 eter ears ah eH Fe eer ert are agit eer ge eM AT TT

cueerec feast

2) smear sect ar ae “oe” ot oer a eat

@) are aren ay geet wd baer “Care are” at a ae Fear ar eT BL

2) sagen tere: Perma cig ares Pt rb 5 ah ete ard we er or esa rarer se a AT

ree ro tk fer ere AAU ae eT

8) eer eh eh, ae we arse eee AH er gH AEE, ee TE re TE I a

ae Sh Bam 7 Ree ea Cw FT ba wre wt ee et For aT

2) eer gr ear Pe ee ar, ar yrs rare wert ot ee igre gus Fe ew eee

fear eer, eee ce Re a e/a aT

3. Rar (after cere sem)

ahs sarah et ew a rare Rear ere, Fert cer eT eT ger eT AY eB, Fe eT he sree feat Sear a satpro eT

‘Boe ar Rr gf are se ere me fe ear Re sare CITE aOR BL TR RATT

a erred elas rearere vera ery ate Fat aa orn a Fst ft ft ee ster Stee at mere rT en, eit ag A os CT

mr othe eater Fier tag at ete Bahay a Sere ae eT B | Det fe a dw a aE cafe ae eT

4. tai ot argh Bs asee

erg en de ep ft

. tag ATS + ag fet + tert

4 . eeseaytore

9 Teas - tage ant ad tg agiy/searig oe goat He

5. data area

5.1 er asfaeaatters seems. 40,000/- wets sneer tinh rar Tears, 100) Re tees aS, 100/

= REM AY RTL ay, ae ae er ot oe re at TA a Fee 8 |

5.2. Rita dos rer rear aera Fa eg sae, ef, Bre edares er ah ee ae er

5.3 enc eer eh romero rar ete oes Fe ge Re eto ar re ER ATTN

5.4 og ware eg Ret ra rere ert rr ne EARL TET a ea a A

6. Raxear-ara (ae yf eH rao tonto)

66.1 Separate ees er sir Re ak Ea ro rare gO oe eR a ea Aa Rarer

6.2 eae Rar ed ite sr ae ec eee, tea 25 at ae ta sr 25 em a ena tS

arene he a 6c et

6.3 Res sree ager ot att er et Fk wae eg tte Se aver eat ae ear are

64 amet se eee ter et aaa (ren-grorear ane), ett rere ear ae tc ew eae a aera, Peo ET

are ah ea te ae te at aaa og areata @ oer ae

6.5. gran gee ae a et ho red Re Pa eA eT oe a ae TT

6.6 eaeeannteerfele nro err ah g te, tebe rae, Ree fear fm ar, sa Tee TET

1 ame :

overt Raed eck mc @ en ec after rk or gt, i eres a fet

8. sna:

ea ack rear re at reagan ear the re eh Re a

9. fhm ren =

ae ee rar FB eer (6 se 8 er) at reer Fete oh Ta ee se ck ET

10, eke am er anh ass fly ez

re ak ah eer ae, ya ey ree TE a res 200/- A

© eter aun aE antee (af) & weTET

"

ma

12.

43,

14.2

1s.

asa

19.

20.

a.

2.

23

24.

fais

BOF

age wnf Ht Bae:

ere 7 ner re a 8 er ah aha (Encode) Yar ar rater ah Fe to,

scream mirth err Ha irene aint scranceacan eed eget ree See,

grote ats ertre mere geen

ear her wr et ar / gear re, eer eg ox ae ge ee a Farrar Tat Rt wr

exceed at A Cs, 2100/6 eT rr re a Re ee TE a GT TA TT Mo TE AT

rar a ft, ah ae erat re

eehes rd a emf

er ear ei er he hk chet ar me we He we ett a aie

ser eae ra tr es ae eh aca wre aero ee Be ew re a Ye TT

a fet ft eee eer reir it ah aru a are er et ga

peerercoftam

hea rk wert ae rt B alte eer str Sater art Fa ot ag ews eT et Pea aT

fhe rd mr eR

azure, a ar a re so Be rd ae ahr Be cea er erat ach mara Garey

Rar kere Bt eordares ehh pera ter SAY ENT 1800112211 KAT at ee a & ere & fe TE Sorat ax Rear an Te ee TT

mre, sere Ge, se Bsr as aT eo le ere, wea reo fe Be e/a we

eager meh her holt, Ae rk Fe sea ea aig ee a ae a ka ra TT ETS

mh Rear agi fear arab

ge ere ge ee a he a le (aaet A, 200/-) es mar aa Pear ao, eer a a

3 rq rdw cr he tephra TET

ear ord

a re ware we Pears ert ree ar eT

i) rds rere ae re Re

iy rd T/ ae OA theo a

iy ee ar

iy serge to eh rd a wre erated wg 2 eC

met rd ard rr wees as a Te Ev ae ee ee era ee

ae eke moa ease

eaten andar are

pees yg bana, aterm ato ret ster ag fee ene ee TT

ax mrgonftresrs

ames se dearer eh oe Ret =r eet seer ee cnt fare to ete fee PT

see cere ge Atte ree ee ER ee eee TS TT

amg a

eat rca ones ft org igre ee aT

sbathabchecbekuaad

her seer ee Rat ee ew rarer ar erates rcaTOtt do igre, aA, abr areaTTT TAT

serdar eer Bat gsi eee eT er a hee rd eta sh oT a Reed aTTETE

Reet her rk a Bike are at are ear eee es nT Per ee Te wea TT / eR / T/T SAT

attra deat zat

nd or area IAT

‘es Rt tote ear ft rer At see ee rk at tee sg et Rr & ee et ce ar aT

aa nf 8 et of ar ero tH server ce reer Ret ete wr Fer tem ce, eat ere ee STAT TTT wT

‘sort Reet er nf ar sala ace reer eect ak wd eo Er een wa eg eb tee a Se TTT

Adgwal Rechocat bronzer niet te edrrer sateen thant tre af scare fat

adam

serdar er hn et hg toe Retiro a sre seer ar sree ef ges hg

pth ad ord ra by arremes a

ese Pier sad ac ter ae aR wd ge ko a RRA 3 ee era

fren ea el eter

2) Re Re ae. ope ern NED fest fhe, Sh od, oe oh gh wt tt

2) esto ere pik Bite ce se er Pt of er ee A tte vey

8) ewe er Wher wer ete Ye eer e/a af Yee ar a a a ep ga pt ite

Berar eee Rened eet wa arg nr mt er ee Pe ae Pree en

anton’, fer so HT er oes Re sera gag (Ge) dr

‘fete eens ert tera UH “=

ss ree em gar ar hc ee me te eer 6 ge ee ae eee

tte 1059 rites (wt) & ere

‘Terms & Ci

1. Terms Used

‘The words and phrases included i this document have the meaning set opposite them unless the context indicates otherwise

‘AIM : Automated Teller Machine

‘Card : ATM card issued tothe eustomer for transaction in his account through ATM.

‘Bank: State Bank of Bikaner & Jaipur

Cardholder : The customer ofthe Bank authorised to use the ATM Card

‘ATM Account: The Saving or Curent or any other typeof account so desigsied by the Bank tobe ligble accounts) fr opetatios through

the use ofthe ATM Card.

igibility Criteria

2.1 NoATM Card wil be issued to the accounts in which minor i a soleointsecount holder.

22 NoATM Card willbe issured to iliteat or blind account holder

23 Incase of Joint Accounts Cards can be issued under different names subject tothe following tems and conditions

2) Ether or Survivor / Anyone or Survivor : ATM Card may be issued to any account older.

‘The request for issuing an ATM Card must be signed by ll the account holders

+) Forme of Survivor: Card can be issued only to "Former

«Later of Survivor: Card canbe issued only to "Later

4) Joint Operation: No ATM Card wil be issued where the mode of operation is "Jointly", However, the joint account holers desirous of

‘valing of ATM factity must change the mode of operations suitably.

«) The closing transferor any change in the operational mode of the ATM account wil ot be allowed unless the ATM card(s) is/ere

surrendered along with anatice of minimum seven working days by the cardholder tothe card issuing branch,

4) Allthejointaccount holders agree to be bound by these terms end conditions. The obligation of signatories hereunder willbe joint and several,

‘ste context may require. Any notice/inimation to any one willbe deemed to be notice to all.

3. PIN (Personal Identification Number)

PIN is the seert number given to the ATM card holder which is identified by ATM before authorising any transaction through ATM. First time

the PIN will be generated at random and will be advised tothe customer by the branch, The Customer sat liberty to change the PIN any number

‘oftimes. Customers must preserve the number carefully and do not disclose it to any third party under any ereumstances or by any means

‘whether voluntarily orothervse asthe ATM allows acess to anyone who is having the card and relative PIN andthe same person can make

cash withdrawals. In such an event NO LIABILITY attaches tothe Bank. :

4. Types of Transactions Permitted

44.1 Following transactions are permitted on ATM :

+ Cash Withdrawals * Balance Enquiry + Mini Statement + Services

& Deposits : By Cash

: By Cheque

4 Mail Box : For dropping the indent fr issue of Cheque Book

= For dropping the passbook for updstion,

5. Teansuetions- Withdrawals

511 The maximum amount of cash withdrawals permited would be restricted to Rs, 40,000 per card per day. The minioum amount that can be

within i Re 00 nd al withrvals shoud ben lps of R100 oly, However maximum wihva mit ay be changed

without neice (the cardholder.

52. The Cardholder undertakes to msimain suicint balance inthe ATM account to meet any cach withdrawals or transis or drawings of any

nature whatsoever.

5.3 Ifthe ATM account stands overdravm with anj reson, whatsoever, the interest a applicable to clean overdrafts s per bank's ules fom time

to time willbe levied,

54 Printed ouput isplay on scren of balance enquiry and Mia Statement options includ ucleared amount of deposit ass andthe information

can note produced a an evidence in the court of lav.

6. Transactions - Deposits (Deposit facliey will be introduced in future)

6.1 The deposit of eash and /o cheques shouldbe done by using the envelop thet is inwod by ATM autorasically upon he account holders request

62 Each envelop should not contain more than one payin-lp. Also the number of note pices shoul nt exceed 25, asthe machine cannot handle

‘envelopes of sized thicker than those containing 25 noes.

63 Coins or lose change should not be deposited inthe ATM and wit aot be accepted by the bank.

64 tfany ofthe currency notes deposited isnot found acepible (mutilated or forged) the same wil be searegated and the account given credit for

the Balance amount under advice o customer and the disputed note willbe dealt with inthe manner provided for normal cash Operations.

{65 The cash deposited by the eccount holder using ATM will be subject 0 courting onthe succeeding working day and any discrepancy found wil

benotfed othe account holder.

{66 TheBank’s decision inthisregard willbe final and any claim contrary tothe fndingsby the Bank on actual checking ofthe easvcheque deposited

by the customer of whatsoever nature wil tot be entertained by the Bank.

7. Multiple Accounts:

In case of multiple acount, the bank reserves the right to decide onthe number of acounts ofa Customer which may be linked to hi

account with the Bank.

8. Closing of Account :

All request for closing or transferring an acount must be accompanied by the ATM Card issued tothe account olde)

9. Dormant Account :

i the account of any cardholder becomes domnan (not operated for 6 months), Branch Manager may examine the situation and advise the

castomer to surrender the ATM Card

10. Charges for Issue of ATM Cards

Nofee wouldbe charged for issuing an ATM Card. lowever, sue ofa Second Cardin leu of los/tolen/mutilted card would entail card fee

of. 200

© Presently not

ble: Signature of the Applicant(s)

11, Validity of ATM Cara

11.1 Validiy ofthe ATM Card will be decided bythe Bank fromthe date o its issue anit wil be encoded accordingly. The Card willberenewed only

ifthere are no adverse features found in the previous ATM transactions and the Branch Manager is satisfied with the conduct of tre account.

‘After getting the fresh card prepared, the card would be handed over tothe customer only against the surrender of the old ATM Card,

11.2. The Customer whose ATM Card is lost / stolen may be issued another card after oblaning a Stamped Letter of Indemnity. A fee of Rs, 20/-

would be charged from the Customer for issue of sesond card in iw of stolen card It wl be weated as replacement card with new PIN but

withthe same validity period.

12, Ownership of ATM Card

The overall ounership ofthe ATM Cards rests with the Bank. The Cards are issued to the customers only to help identify themscves to the

[ATM for conducting transactions and they may ain the card til sch time as ther eccount is operational rth Bank recalls the card. The card

holders are required wo surrender the card atthe time of closure of the account or on expiry ofthe card ora any time upon the Banks request.

13, Non-Transfersbility

“The ATM Card isnot transferable and shall be used by the intended card holder.

14, Losa/Thef of the ATM Card

14.1 The cardholder is responsible for and agocs and undertakes to report the Ios /thef and or unauthorised use of the card as so0n a possible in

writing to his account holding branch The cardholder may also notify the Bank through Toll fee No, 1800112211 and confim thatthe card has

been deactivated. The cardholder and the int acount holders, if any, shall be responsible foal the transaction effected bythe use ofthe card

ot withstanding the notice given by the cardholder for lose? and/or unauthorised use of the card until the card iscanclle/confscted!

‘captured and notice to such effect i given in writing by the cad issuing branch to the car holder.

142 Ares ATM card willbe issued in ico of lost/mutiaed damaged ATM card at such fee (presently Rs 200-) as may be prescribed bythe Bank

‘only afer submission of a equeston the format specifi by the bank for this purpose.

15, Captured Card *

15.1 On some ATMs, card may be capure forthe following reasons

4)" Incorrect PIN entered bythe Card Holder thrice in succession _

ii) Card declared as LosySiolen

{i) Mechanical fault with ATM

iv) Card inadvertently lef in ATM Card Reader by the Card Holder

152. The Captured Cards willbe delivered to the Curd Holder ony afer proper identification, verification tothe satisfaction of bank. In cse duplicate

card has already ben isued, the captured card will be destroyed by the Bank.

16, Death ofa ATM Card Holder

Tn eas of death ofa cir holder the Bank must receive the Card back before closing the sccosnt or pemiting oper

Survivors

17, Bank's Li

‘The Bank shall have the right of set-off and lien, irespective of anyother lien or charge, present as wells future onthe deposits held in the

customer's accounts whether in single name or joint name(s) to the extent ofall outstanding dues whatsoever, arising asa result of the facility

extended to andor used bythe customer.

18. Irrevocable Authority

{All Authorisation confered on the bank andthe tems and conditions herein scceped and argeed oar revocable.

19, Authority to Debit the ATM Account

‘The banks record for transactions processed by the use ofthe ATM card shall be conclusive and binding fo ll purposes. The cardholder

alongwith the joint account holder, ian, wil be responsible jot and several oral the transactions relating tothe ATM card and achorises

the bank to debit the ATM account with the drawings of any nature effected by the use ofthe ATM card as per the bak’ records with uch

sharges/eescostinerest related to the ATM card as determined bythe bank from time to ime.

20, Honouring of the Card

‘The Beak shal inno circumstances be lable tothe cardholder ithe ATM card is not honoured inthe desived enanser for wisoever reasons or

‘ifthe ATM service at any centre is disrupted. The bank shall not be liubl for any flue to provide any service orto perform aay obligation

hereunder where such flue i attributable, wheter directly or indirect, to power failure or fuilure of Uninerupted Power Supply systems

or any malfunction of ATM / ATM Card orto insufiiency of cash in ATM or fr any ober reason whatsoever and the bank will not be Liable

for axy consequential or indirect loss or damage tothe cardholder arising out of such situations.

21, Indemnification

“The cardholder shal indemnify the bank fr al loss or damage caused direcly or indirectly by his ac of commssion/omission contrary to any

ofthe terms and conditions or even otherwise.

22, Time required for usue of ATM Card:

limay tke 34 weeks time to deliver the Card and PIN number to Customer from the dateof receipt of pplication fr the same on the Bank's

presribed preform.

23. Change of Terms & Conditions

4) The Bank has the absolute discretion to amend, change, delet or ad any ofthe terms at any ime without prio natie tothe Customer.

) The operating hours of the ATM willbe atthe sole diretion ofthe Bank and any change in timing may be effected by the Bank without prior

fn the account by

©) The Bank reserves the right to deny ATM access or termine the ATM facility / service to any person at its discretion, without assigning

Dispute Resolution

‘The Terms and Conditions mentioned herein above, the usage and operation ofthe card shal be governed bythe laws of India and all disputes

shall be subjectto the exclusive jurisdiction of Cours of Jaipur (Rajasthan).

‘Uwe have read and understood the above rules and accord my/our acceptance hereunder.

The content of above rules have been read out and explained to me/us in my/our mother tongue and Uwe agree to abide by the same,

Place:

Date

‘SBBI/F-1059 ‘Signature of Applicant(s)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Di FittingsDocument1 pageDi Fittingsakshatjain3001No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Aepl BrochureDocument1 pageAepl Brochureakshatjain3001No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Bulk Flow MeterDocument1 pageBulk Flow Meterakshatjain3001No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Government of Karnataka: National HighwayDocument30 pagesGovernment of Karnataka: National Highwayakshatjain3001No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- AEPL Pipes and FittingsDocument10 pagesAEPL Pipes and Fittingsakshatjain3001No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- SARWAHIANDMUDARIYADocument118 pagesSARWAHIANDMUDARIYAakshatjain3001No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- 6DebarredSashikant - 07-Aug-2017 - 57 (1) - 18-Dec-2018 - 67Document1 page6DebarredSashikant - 07-Aug-2017 - 57 (1) - 18-Dec-2018 - 67akshatjain3001No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- (Prop. Advent Age Agency Pvt. LTD.) : K.K. PolymersDocument1 page(Prop. Advent Age Agency Pvt. LTD.) : K.K. Polymersakshatjain3001No ratings yet

- TenderDocument157 pagesTenderakshatjain3001No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Pe-Price-Dt - 12 08 2021Document93 pagesPe-Price-Dt - 12 08 2021akshatjain3001No ratings yet

- Akshat Engineers Private Limited: Resilient Seated Gate Valve / Soft Seated Sluice Valve Sluice Valve Butterfly ValveDocument1 pageAkshat Engineers Private Limited: Resilient Seated Gate Valve / Soft Seated Sluice Valve Sluice Valve Butterfly Valveakshatjain3001No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Application Form PDFDocument6 pagesApplication Form PDFakshatjain3001No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- (Prop. Advent Age Agency Pvt. LTD.) : K.K. PolymersDocument1 page(Prop. Advent Age Agency Pvt. LTD.) : K.K. Polymersakshatjain3001No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Debarredfree Ms Sanjay KR Upadhyay 18-Dec-2018 48Document1 pageDebarredfree Ms Sanjay KR Upadhyay 18-Dec-2018 48akshatjain3001No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- KarcherDocument3 pagesKarcherakshatjain3001No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Pe Price 26 Nov 2020Document93 pagesPe Price 26 Nov 2020akshatjain3001No ratings yet

- Pads Technical Data: WVA WidthDocument2 pagesPads Technical Data: WVA Widthakshatjain3001No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Cash Cheque Deposit Slip Kotak Mahindra BankDocument1 pageCash Cheque Deposit Slip Kotak Mahindra Bankakshatjain30010% (1)

- Publication PDFDocument80 pagesPublication PDFakshatjain3001No ratings yet

- Compression Fittings For HDPE PipeDocument2 pagesCompression Fittings For HDPE Pipeakshatjain3001No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Pe Price 26 Nov 2020Document93 pagesPe Price 26 Nov 2020akshatjain3001No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)