Professional Documents

Culture Documents

This Digital C Opy Is Brough Ttoyouby

This Digital C Opy Is Brough Ttoyouby

Uploaded by

Muhammad KharusaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

This Digital C Opy Is Brough Ttoyouby

This Digital C Opy Is Brough Ttoyouby

Uploaded by

Muhammad KharusaniCopyright:

Available Formats

by

u

o

y

o

t

t

h

g

u

o

r

b

s

i

y

p

o

c

l

a

t

This digi

FBM KLCI 1726.73

0.53

KLCI FUTURES 1727.50

0.50

STI 3353.45

14.59

RM/USD 3.8044

CPO RM2190.00

5.00

OIL US$57.10

0.41

GOLD US$1131.90

PP 9974/08/2013 (032820)

PENINSULAR MALAYSIA RM1.60 (INCLUSIVE OF 6% GST)

MONDAY JULY 20, 2015 ISSUE 2005/2015

FINANCIAL

DAILY

MAKE

BETTER

DECISIONS

www.theedgemarkets.com

4 HOME BUSINESS

Exciting times

ahead for Taliworks

4 HOME BUSINESS

Signature

International

growing from

strength to strength

67 HOME BUSINESS

10 stock picks

in current

weak market

8 HOME BUSINESS

Win a RM1m cash

voucher to buy a

Mah Sing dream

home

26 W O R L D B U S I N E S S

Greek banks to

reopen, PMs new

cabinet takes over

Sarawak Report blocked

PA G E 2

12.00

M ON DAY JU LY 2 0 , 2 0 1 5 TH EEDGE F I N AN C I AL DAI LY

For breaking news updates go to

www.theedgemarkets.com

ON EDGE T V

www.theedgemarkets.com

Sarawak Report blocked

Decision taken due to complaints from the public

Analysts see

limited upside

for Maxis

earnings

CYBERJAYA: The Malaysian

Communications and Multimedia Commission (MCMC)

has admitted to instructing local Internet service providers to

block access to whistle-blower

site Sarawak Report, claiming

that the site was disrupting national stability.

In a statement posted on its

Facebook page, the commission

said the decision was taken due

to complaints from the public.

The site was blocked under

Section 211 and Section 233 of

the MCMC Act, it said.

The site has displayed information that is yet to be verified,

and information that is still under investigation, it said.

The site has not been accessible from Malaysia since yesterday evening, though it could

still be accessed through proxy

servers.

Sarawak Reports editor and

founder Clare Rewcastle-Brown

was planning to issue a statement on the matter at press time.

The Malaysian Insider

Malaysian police to speak to Justo

over disclosure of classified info

The Edge Communications Sdn Bhd

(266980-X)

Level 3, Menara KLK, No 1 Jalan PJU 7/6,

Mutiara Damansara, 47810 Petaling Jaya,

Selangor, Malaysia

Publisher and Group CEO Ho Kay Tat

Editorial

For News Tips/Press Releases

Tel: 03-7721 8219 Fax: 03-7721 8038

Email: eeditor@bizedge.com

Senior Managing Editor Azam Aris

Executive Editors Kathy Fong,

Jenny Ng, Siow Chen Ming,

Surinder Jessy, Ooi Inn Leong

Associate Editors R B Bhattacharjee,

Joyce Goh, Jose Barrock,

Vasantha Ganesan

Editors Cindy Yeap, Kang Siew Li

Assistant Editors Adeline Paul Raj,

Tan Choe Choe

Chief Copy Editor Halim Yaacob

Senior Copy Editors Marica Van

Wynen, Lam Seng Fatt,

Melanie Proctor

Copy Editor Evelyn Chan

Art Director Sharon Khoh

Design Team Cheryl Loh,

Valerie Chin, Aaron Boudville,

Aminullah Abdul Karim,

Yong Yik Sheng, Tun Mohd Zaan

Mohd Zaabah

Asst Manager-Editorial Services

Madeline Tan

Corporate

Managing Director Au Foong Yee

Deputy Managing Director

Lim Shiew Yuin

Advertising & Marketing

To advertise contact

GL: (03) 7721 8000

Fax: (03) 7721 8288

Chief Marketing Ocer

Sharon Teh (012) 313 9056

General Manager, Digital Media

Kingston Low (012) 278 5540

Senior Sales Managers

Geetha Perumal (016) 250 8640

Fong Lai Kuan (012) 386 2831

Peter Hoe (019) 221 5351

Gregory Thu (012) 376 0614

Senior Manager, Integration

Shereen Wong (016) 233 7388

Ad-Trac Manager

Vigneswary Krishnan (03) 7721 8005

Ad Trac Asst Manager

Roger Lee (03) 7721 8004

Email: mkt.ad@bizedge.com

Operations

To order copy

Tel: 03-7721 8034 / 8033

Fax: 03-7721 8282

Email: hotline@bizedge.com

KUALA LUMPUR: The Malaysian

police, upon getting permission

from the Thai police, will speak to

Xavier Andre Justo (pic) over his

claim he had met with key Malaysian opposition politicians with the

intention to sell classified information, Deputy Home Minister Datuk

Seri Dr Wan Junaidi Tuanku Jaafar

said yesterday.

He said it is necessary for the

Malaysian police to meet the former executive of PetroSaudi International Ltd (PSI) to get first-hand

information on the disclosure by

the Thai police following their investigation of Justo.

Inspector-General of Police Tan

Sri Khalid Abu Bakar will meet Justo

upon getting permission from the

Thai police, and only then can the

investigation be carried out, including calling up the Malaysians

involved over the disclosure, he

said when contacted by Bernama.

Bernama had reported Khalid as

saying that the Malaysians involved

would be asked to give statements

on the latest disclosure by the Thai

police following their investigation

of Justo.

Last Thursday, Thai police confirmed that Justo, a Swiss national, had met with key Malaysian

opposition politicians at a hotel

in Singapore to sell confidential

information on PetroSaudi.

Wan Junaidi said the Malaysian

police should be allowed to question Justo before any action is taken

against him.

He said he believed that the Malaysians who had been identified

would offer their full cooperation

in the matter.

He also said that the case should

be handled carefully so that it does

not have any implication for Malaysians as it could undermine democracy and the countrys leadership.

The Thai police arrested Justo on

June 22 on charges of blackmailing PSI, an international company

based in Saudi Arabia linked to a

controversy surrounding 1Malaysia

Development Bhd (1MDB).

Following the alleged sale of

the documents, several emails and

documents were published by the

Sarawak Report news portal that

led to allegations against 1MDB.

Bernama

German minister in Iran with business leaders

BY DEBORA H CO LE

BERLIN: German Economy Minister Sigmar Gabriel flew to Iran

yesterday, becoming the first top

Western official to visit the country since world powers and Tehran

reached a historic nuclear deal.

Gabriel, who is also Chancellor

Angela Merkels deputy and energy

minister, embarked on the threeday trip with a small delegation of

representatives from companies,

industry groups and the sciences,

his ministry said in a statement.

Gabriel is due to hold talks with

Iranian President Hassan Rouhani,

three ministers, the head of the

central bank and the chamber of

commerce following last Tuesdays

landmark nuclear agreement, German news agency DPA reported.

After Tehran, he will travel to the

southern city of Isfahan.

The long-delayed nuclear pact

lays the foundation for normalising economic ties with Iran on the

condition that the steps set out in

it are now implemented, Gabriel

said in the statement.

The head of the German Chambers of Commerce and Industry,

Eric Schweitzer, accompanying

Gabriel, called the trip an encouraging sign for companies that lost

ground to Chinese and South Korean firms in the resources-rich Gulf

state due to Western sanctions.

Iran and the P5+1 group Russia, the United States, China, Britain, France and Germany struck

the agreement with Iran after a

13-year stand-off over its disputed

nuclear programme.

The international agreement

finalised in Vienna aims to ensure

the Islamic republic does not obtain nuclear weapons.

In exchange, the country of 78

million people will be given stepby-step relief from crippling international sanctions.

Schweitzer called for German

companies to be given legal protection for upcoming investments

made in Iran in case Tehran violated

the terms of the nuclear deal and a

trade embargo were imposed again.

Such a framework would give

companies the necessary legal security to return to Iran, he told DPA.

Gabriel later told the Bild newspaper in an article to be published

today that long-term ties with Teh-

ran would depend on Iran recognising Israel.

Israels right to exist must no

longer be questioned. Truly strong,

stable relations will only develop

when this is acknowledged by Iranian policymakers, he said.

I will repeatedly make this clear

during my visit.

Iran and Germany were historically close trade partners but

business dropped off as a result

of the sanctions, declining to 2.4

billion (RM9.89 billion) last year

from around 8 billion in 20032004, according to German figures.

Schweitzer said bilateral trade

could quadruple in the next two to

three years to around 10 billion.

German business leaders have

pointed to pent-up demand in

modernising Irans industrial infrastructure, particularly in the oil

sector, as presenting lucrative opportunities.

Engineering, chemical, pharmaceutical, car parts and railway companies are all eyeing big contracts.

Iran has the worlds fourth largest oil reserves and the second in

gas, meaning it has the biggest combined energy deposits. AFP

IN BRIEF

Taiwans KMT picks

pro-China Hung for

presidential race

TAIPEI: Taiwans ruling Kuomintang (KMT) officially endorsed pro-China candidate

Hung Hsiu-chu yesterday to

run for president next year, as

the deeply divided party faces

a battle to regain public support. Known as xiao-la-jiao

or little hot pepper for her

straight-talking style, Hung is

one of two main female presidential candidates, in elections

likely to see the countrys first

woman leader voted in. But

Hungs conservative views fly

in the face of voter sentiment as

fears grow over increased Beijing influence. Concern about

the islands warming ties with

China was one reason behind

the Beijing-friendly KMTs rout

in November local elections, a

barometer for the presidential

vote next January. AFP

Netanyahu urges US

to hold out for a better

Iran deal

WASHINGTON: Israeli Prime

Minister Benjamin Netanyahu

urged US lawmakers to hold

out for a better Iran deal and

said there was no way to compensate Israel if the nuclear

agreement goes through. I

think the right thing to do is

merely not to go ahead with this

deal. There are many things to

be done to stop Irans aggression and this deal is not one

of them, Netanyahu said on

CBS Face the Nation as he

continued a string of US media

interviews denouncing the deal

reached last Tuesday between

Iran and six major powers. The

deal must be reviewed by Congress, where lawmakers will

have up to 82 days to decide

whether to reject it. AFP

Myanmars Suu Kyi

invokes fathers sacrice

ahead of elections

YANGON: Myanmars Aung

San Suu Kyi invoked the memory of her assassinated father

yesterday, describing upcoming elections as an opportunity

to continue his legacy and bring

real change to the former junta-ruled nation. The Nov 8 poll

will be the first general election in a quarter of a century

to be contested by her National

League for Democracy, which

is expected to make huge gains

at the ballot box if the vote is

free and fair. AFP

Saudi king takes over

entire French beach

VALLAURIS (France): Beach

lovers on the French Riviera

expressed their anger yesterday over the imminent arrival

of the Saudi royal family, who

have ordered a long stretch of

beach to be closed off to the

public. Nestled in the rocks between the coastal railway and

the translucent waters of the

Mediterranean, the grounds of

the royal familys immense villa stretches across a kilometre

of Riviera coastline between

Antibes and Marseille. AFP

4 HOME BUSINESS

M ON DAY JU LY 2 0 , 2 0 1 5 TH EEDGE F I N AN C I AL DAI LY

Exciting times ahead for Taliworks

Company eyeing assets in waste management, toll roads and power generation

BY L EVI N A L I M

KUALA LUMPUR: Taliworks Corp

Bhd, which has a high-powered

board, is in for an exciting time

ahead. The companys joint venture with the Employees Provident

Fund (EPF), TEI Sdn Bhd, will be

the platform for Taliworks to spread

its wings in the local infrastructure

and utilities scene. It, indeed , aims

to gain a presence in the power

generation sector.

Taliworks executive director Ronnie Lim Yew Boon said the group is

eyeing assets in waste management,

toll roads and power generation.

Lim is excited about TEI Sdn

Bhd, in which Taliworks holds a

51% stake and the EPF 49%.

Taliworks is currently grouping

its mature and stable operating infrastructure assets with predictable

cash flows to be injected into TEI.

We are leveraging on our deal

structuring and sourcing abilities

and TEIs shareholders financial

muscle to bid for big projects. We

have big plans in the areas of waste

management, toll roads, power

generation, be it in Malaysia or other developed countries including

Australia, he told The Edge Financial Daily in an interview.

To date, Taliworks (fundamental: 1.3; valuation: 2.4) has injected

RM546 million worth of assets into

TEIs wholly-owned subsidiary,

Cerah Sama Sdn Bhd.

These are mature operational

infrastructure assets, yielding revenue with minimal uncertainties

as the EPFs mandate to us is that

their hurdle rate is a minimum 12%

equity IRR (internal rate of return)

and 6% dividend yield.

Together with EPF, we will go

and acquire more assets, said chief

investment officer Kevin Chin, adding that the size of each of the assets Taliworks is eyeing could be

anywhere between RM500 million

and RM1 billion.

Taliworks is now evaluating

these projects and hopes to secure

them within the next six months.

Taliworks has gathered a

high-powered board in its pursuit

of new assets. Two of its directors,

for example, are experts in power

generation former Malakoff Corp

Bhd managing director Ahmad Jauhari Yahya and former investment

banker Vijay Vijendra Sethu, who

was previously a board member

of Malakoff.

Taliworks surprised investors

with the recent appointment of Ahmad Jauhari and former Economic Planning Unit director-general

Raja Datuk Zaharaton Raja Zainal

Abidin as non-executive directors

of the company.

The addition of these corporate

and public sector heavyweights

strengthens Taliworks already impressive board which includes

former housing and local government minister Tan Sri Ong Ka Ting

as Taliworks chairman.

We hope to achieve double-digit net profit growth moving forward

through organic growth and future

acquisitions, said Lim, adding that

its merger and acquisition activities

will enable the company to yield a

stronger net cash flow, hence more

generous dividends.

Lim (left) and Chin. Lim says the company hopes to achieve double-digit net prot

increase through organic growth and future acquisitions. Photo by Patrick Goh

Taliworks aims to be a company

that offers good dividend and growth

prospects. It has a dividend policy

of distributing 75% of its net profit

(normalised earnings) to shareholders. Year-to-date, it has announced

a total dividend of 10 sen per share.

Also a boon to Taliworks is the

positive progress in Selangors water consolidation efforts.

We are optimistic the Selangor and federal governments will

move on with their water projects

projects we are eyeing include

various water infrastructure improvement and flood mitigation

projects, Lim said.

He noted that Taliworks had successfully clinched one third of the

water projects it bid for in the past,

thanks to its strong track record as

a water treatment specialist.

Its parent company, LGB Bhd,

has its beginnings as a specialist in

water construction projects, from

solid waste management to water

operations and hospital services.

Most of the water supply projects in Selangor were at one point

either built or operated by the LGB

group, said Lim.

He added that Taliworks is also

keen on bidding for non-revenue

water projects in the various states.

It currently has a construction tender book of RM1.2 billion to RM1.5

billion.

The resolution of Selangors water impasse means that Taliworks

would be able to hasten the recovery of the outstanding amount of

RM373 million owed to it by Syarikat Pengeluar Air Sungai Selangor

(Splash), which was deferred as a

result of the impasse.

Taliworks wholly-owned subsidiary Sungai Harmoni Sdn

Bhd manages, operates and

maintains Splashs Sungai Selangor

Phase 1 water treatment facilities.

In the first quarter ended March

(1QFY15) Taliworks net profit

jumped more than four times to

RM15.03 million from RM3.75 million, mainly due to the reversal of

provision for discounting on the

deferred payment by Splash.

Revenue was 28.3% higher at

RM97.02 million from RM75.60 million in the previous corresponding quarter, on higher contribution

from both its construction and waste

management segments, as well as

consolidation of financial results

from the Cheras-Kajang Highway.

Taliworks is also involved in the

highway management business, with

concessions for both the Cheras-Kajang Highway and the New North

Klang Straits Bypass Expressway. It

is looking at an annual 2.5% to 3.5%

traffic growth for its highways moving forward, barring toll rate hikes.

According to Lim, the completion of upgrades of its wastewater

treatment plants in China would

improve the utility divisions performance, as tariff rates would almost triple upon the completion

of each of its plants.

As for its water treatment business, he said Taliworks is looking

to expand the capacity of its plants

in Selangor and Langkawi due to

rising demand for treated water in

the two states.

Taliworks share price has been

on a steady climb since August last

year. The stock has nearly tripled

from RM1.10 a year ago to RM3.08

last Thursday, bringing a market

capitalisation of RM1.32 billion.

Signature International growing from strength to strength

BY GHO C H EE Y UAN

KUALA LUMPUR: Signature International Bhd is set to end its financial year ended June (FY15) with

a record net profit, having already

surpassed earnings for the whole of

FY14 in the second quarter ended

December 2014 (2QFY15).

Analysts expect the kitchen system designer and distributors net

profit to continue to gain traction

over the next two years on the back

of a tender book totalling some

RM400 million.

An analyst at a local brokerage

said Signature is currently bidding

for RM400 million worth of jobs,

including Phase 2 of the Battersea Power Station project (BSP2)

in London and Chinas Country

Garden condominium project in

Iskandar Malaysia, Johor.

The tender bid winner for the

BSP2 kitchen work job, which is estimated to be worth around RM20

million to RM30 million, is expected to be known by the middle of

next year.

The kitchen job contract for the

Country Garden condominium

project which is scheduled for

delivery in the next two years

is estimated to be worth at least

RM100 million. The kitchen jobs

may be broken down into two to

three jobs and should be awarded

by the end of this year.

As per managements guidance,

the groups success rate on its tender book is around 40% to 50%.

Therefore, I believe that Signature

stands a high chance of securing

some of the contracts, the analyst

told The Edge Financial Daily.

He noted that Signature has also

proven its capability to deliver its

projects on time, thus enabling it to

establish a good relationship with

property developers.

Signature saw its net profit for

3QFY15 surge more than 3 times

to RM32.25 million from RM9.06

million a year ago, surpassing the

RM17.84 million net profit posted for

the full FY14. Revenue for 3QFY15

grew 94.9% to RM217.97 million

from RM111.83 million in 3QFY14.

The group attributed the improved performance to higher revenue recorded from its project and

retail division of the kitchen and

wardrobe segment and white goods,

as well as an overall improvement in

margins due to economies of scale.

The analyst expects the project

division of the kitchen and wardrobe segment will continue to be

a major contributor to the groups

results going forward.

Signatures current outstanding

order book is around RM160 million, which will keep it busy for the

next one to two years.

The analyst said should Signature clinch the kitchen job contracts for both BSP2 and the Country Garden condominium project,

it would keep the group busy for at

least five years.

The analyst also sees the development boom in high-rise buildings in the country spell opportunity for Signature to grow further.

The [property development]

trend now is that most of the property developers would choose to

build high-rise buildings priced

from RM500,000 to RM1 million

and above.

Normally these iconic developments will come equipped with

kitchen and wardrobe and other

basic necessities, he added.

CIMB Research senior analyst

Nigel Foo said even after the share

price outperformance this year,

Signatures valuation is still attractive at 5.9 times its FY16 forward

price-earnings.

The stocks valuation could rise

further if the group secures the

Country Garden and the BSP projects over the next few months, he

said in a report dated July 13.

Year-to-date, Signatures share

price has risen 46.3%, outperforming the FBM KLCIs 1.96%

decline. In addition, a new substantial shareholder, Hong Kongs

Value Partners Group, emerged in

mid-June. Value Partners Group

currently owns a 5.6% stake in the

company, said Foo.

Foo believes Signature has the

potential to register record net profit over the next few years even without the Country Garden and the

BSP projects.

He estimates that Signature will

generate a net profit of RM52.3

million in FY16 and RM56.6 million in FY17.

Our current earnings forecasts

do not include any potential earnings from [the] Country Garden

and BSP [projects]. If we assume

that Signature wins 100% of the two

contracts, its order book would rise

by RM340 million.

Based on our earnings sensitivity analysis, Signatures FY16 and

FY17 net profit would rise by 71%

and 76% respectively if the group

secures 100% of the Country Garden and the BSP jobs, he added.

Signature (fundamental: 2.3;

valuation: 2.1) shares closed six

sen or 2.23% higher at RM2.75 last

Thursday, bringing a market capitalisation of RM329.88 million.

The Edge Researchs fundamental

score reflects a companys profitability and balance sheet strength, calculated based on historical numbers.

The valuation score determines if a

stock is attractively valued or not,

also based on historical numbers.

A score of 3 suggests strong fundamentals and attractive valuations.

Go to www.theedgemarkets.com for

more details on a companys financial dashboard.

8 HOME BUSINESS

M ON DAY JU LY 2 0 , 2 0 1 5 TH EEDGE F I N AN C I AL DAI LY

Win a RM1m cash voucher

to buy a Mah Sing dream home

After the closing date, 21 selected finalists will battle it out in the grand finale

PHOTO BY KENNY YAP

BY TA N A I L EN G

t may sound too good to

be true but with just a

few clicks, you could be

on your way to winning a

RM1 million cash voucher

to purchase your Mah Sing

dream home.

A collaboration between The

Edge Media Group and Mah Sing

Group, the online contest will close

on July 31. Thousands of participants from Malaysia and Singapore

have taken part since the contest

started on June 20.

After the closing date, 21 selected finalists will battle it out in

the grand finale, dubbed Survivor Challenge a mix of simple

knowledge and physical games

at Mah Sings Southville City@KL

South in Bangi, Selangor, on Aug 22.

The Edge-Mah Sing Millionaire

Contest web page features a list of

interesting online activities, which

participants can take part in to gain

tokens. The higher the number of

tokens they have, the higher their

chances of being selected as one of

the finalists. The finalists will be revealed on Aug 14.

Mah Sing chief executive officer

(CEO) Ng Chai Yong says, This contest is about making someones dream

of owning a premier lifestyle property

come true. And that is exactly what it

From left: Mah Sing commercial COO Andy Chua, The Edge Communications managing director Au Foong Yee, Mah Sing marketing and

special projects deputy general manager Rachel Leong, Ng, Ho, Mah Sing corporate communications general manager LyannaTew and

The Edge Media Group senior managing editor Azam Aris during the ocial launch of The Edge-Mah Sing Millionaire Contest.

is there are no strings attached

one does not need to be a customer of

Mah Sing or The Edge to participate.

He emphasises that participation

in the contest is free of charge. Basically, anyone can be a millionaire.

We are also hopeful that through

this contest, we will be able to make

a positive change and difference in

someones life. I think the highlight

for us will be seeing the smile on the

winners face, he says.

The Edge Media Group publisher

and group CEO Ho Kay Tat concurs.

We are very excited about the overwhelming response we have been

getting for this contest. The grand

prize voucher for a Mah Sing dream

home has definitely attracted a

sizeable number of participants,

making it THE contest of the year.

We have also seen that through

this contest, more and more people

are learning about the vast array of

proprietary news, research, data,

analytics and tools available on

theedgeproperty.com.

The contest is open to all Malaysians and permanent residents in

Malaysia as well as Singaporeans

and permanent residents in Singapore aged 21 years and above.

Participants must register at theedgeproperty.com and use the

Fair Value tool before moving on to

the dedicated contest page on Mah

Sings website, where they will have

to take part in several online games

and activities to collect tokens.

While most participants are awed

by the main prize, some are sceptical

about their chances of winning and

they think that the prizes would be

won only by those who have close

relations with Mah Sing employees.

However, the terms and conditions of the contest clearly state: Employees of The Edge and Mah Sing

Group and their immediate family

members as well as representatives

and service providers of both companies are not eligible to participate.

The contest marks the 21-year

business relationship between the

two companies. It is also creating

greater awareness of what Mah

Sing has to offer.

With an established presence

of more than 20 years in the property development industry, Mah

Sing has a wide range of residential

projects in the Klang Valley, Johor

Baru, Penang and Sabah for the

winner to choose from.

The contest will also provide

participants with the opportunity

to try out theedgeproperty.com

Fair Value tool to find out the

fair value of any property based on

actual transacted prices.

This comprehensive online

property platform offers a full range

of analytical tools, including indicative valuations, past transactions,

rental rates, trends and hot spots

and new project launches.

Showcase of Mah Sings million-ringgit dream homes

Icon Residence, MontKiara,

Kuala Lumpur

Icon Residence is strategically located in one of the Klang Valleys

most sought-after locations and

a symbol of an unparalleled urban lifestyle. Offering excellent

accessibility, the development

comprises three towers and 1 to

4+1-bedroom units with different

layouts to suit different lifestyles.

Aspen@Garden

Residence, Cyberjaya

Aspen@Garden Residence is the

fourth precinct of the Garden Residence. The 69 limited edition 3-storey bungalows are

designed as dream homes for multi-generational families

and come with 9+1 bedrooms and 9 bathrooms. With a

built-up of 7,796 sq

ft, each home has

open plan interiors. Residents are

also provided with

a luxurious dedicated entertainment floor with a

rooftop garden and

an outdoor Jacuzzi.

Ambrosia@Kinrara Residence, Puchong

Ambrosia@Kinrara Residence offers exclusive 66 three-storey superior semi-detached bungalows with a built-up of

3+1-bedrooms, with builtups of 1,378 to 1,680 sq ft.

The Meridin@

Medini, Johor

Meridin Suites Residences is

part of The Meridin@Medini development, located in

the heart of Medini in Iskandar Malaysia. The project is a

stones throw from Legoland

and the upcoming financial

hub, Medini Business. It offers

flexible spaces with choices

from 1 to 4+1-bedroom lay4,468 sq ft each and 79 three-storey executive bungalows outs with built-ups of 521 to 2,134 sq ft.

with built-ups of 5,688 sq ft onwards. Kinrara Residence

is a mixed-use development located in the fast-growing The Residences@Sutera Avenue, Sabah

Puchong township. It is also situated next to the pristine The ResidencAyer Hitam Forest Reserve.

es comprises

contemporary

Icon City, Petaling Jaya

serviced apartIcon Residenz is one of the components of Icon City an ments atop

integrated development comprising a retail mall, shopof- the 2-storey

fices, office towers and a hotel. Located at the intersection Festive Retail

of Federal Highway and Lebuhraya Damansara-Puchong, Mall. It offers

Icon Residenz offers residents the opportunity to live in three types of

the tallest residential tower in Petaling Jaya.

layouts 1+1,

2 and 2+1 bedThe Loft@Southbay City, Penang

rooms with built-ups of 726 to 1,220 sq ft. Sutera Avenue

Strategically located in Bayan Lepas, Penang, The Loft@ sits on 4.26 acres (1.7239ha) of prime land in Kota KinaSouthbay City has 156 serviced suites in two towers. balu, fronting Kota Kinabalus Coastal Highway and just

The freehold luxury suites offer six layout types of 3 and 3.9km from the Kota Kinabalu International Airport.

P R O P E RT Y S NA P S H

M O N DAY J U LY 20 , 20 1 5 T HEED G E FINA NCIA L DA ILY

T 9

Source: theedgeproperty.com

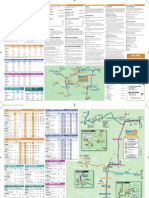

Self-sufficient Subang Jaya

Subang Jaya non-landed residential average price

This week, we focus on the non-landed residential properties in the

well-established neighbourhood of Subang Jaya, originally developed by

Sime UEP Bhd in the 1970s. The areas referred to in this study also include

Taman Wangsa Baiduri, Taman Mutiara Subang and Taman Bukit Pelangi.

Subang Jaya is a highly sought-after address given the abundance of retail

and commercial, healthcare and educational amenities in the vicinity.

The township comprises mostly terrace houses, with condominium

developments mainly concentrated around the retail belt of SS16 and the

Subang Jaya lake in SS12. There are also a few apartments clustered around

the tertiary institutions in SS15.

Prices in Subang Jaya have grown steadily. Based on theedgeproperty.

coms analysis of transactions, the average transacted price per square foot

(psf) of non-landed residential properties was RM581 psf in 3Q2014, up

15% y-y from RM506 psf in 3Q2013.

Total transaction volume for the 12 months to 3Q2014 fell 28.9% from

277 to 197 units. Transaction activity is likely to pick up to reflect the

completion of Isola at the end of 2014. Also, transaction data received

has yet to reflect the sales of Pandora Serviced Residences at Tropicana

Metropark, reportedly priced between RM600 and RM 800 psf.

The landscape in Subang Jaya is set to change with the upcoming 88-acre

Tropicana Metropark integrated development.

Another catalyst is the Kelana Jaya LRT extension to Putra Heights, due for

completion at end 2016. The Kelana Jaya Line will intersect the Port Klang

Line at the existing Subang Jaya station. There will also be two new stations

at SS15 and SS18, improving connectivity within Subang Jaya.

Subang Jaya non-landed residential volume

The Analytics are based on the data available at the date of publication and may be subject to further revision as

and when more data is made available to us.

For more of such information across Malaysia and Singapore, log on to the

theedgeproperty.com. The one-stop portal for all your property needs,

theedgeproperty.com oers price and transaction records, trend analysis,

research classieds, and more all for FREE!

Source: theedgeproperty.com

Why investors think Japan has some hot property

BY L ESL I E SHA FFER

TOKYO: Japans economy is barely growing, its

population is falling and wages have long been

stagnant, but investors both inside and outside

the country see surprisingly big opportunities

in its property market.

It has become difficult for general households to keep up with rising housing prices

while employment and income are stagnating,

Deutsche Bank said in a June note, citing data

showing Tokyo condos cost more than nine

times annual household income.

In demographic terms, we expect the nationwide housing demand to remain weak, it

said, citing the steady decline of people in the

25- to 44-year-old age bracket.

But that hasnt stopped property prices from

marching higher. Japans residential property

price index for March rose 1.5% from a year

earlier, while the Tokyo index was up 4.7%.

Tokyo condominium prices were up 8.9% over

the same period. The Tokyo condo prices may

be getting at least some of their boost from an

ageing Japanese population, particularly as

inheritance taxes have been increasing.

There are many high-net-worth individuals

who invested in expensive city centre condos

(particularly tower condos) as a tax-saving

measure, Deutsche Bank said. Investment

in rental apartments has been also increasing.

We view this to be the result of inheritance tax

countermeasures. Thats because properties

get taxed at the governments assessed valuation, which is generally lower than the purchase price, while cash would be taxed at the

full value, noted Ku Swee Yong, an international property adviser at Century 21 Singapore.

They will buy at full price, Ku said, noting

hes had clients lose out on transactions because they were competing with buyers who

werent seeking discounts.

Despite the competition for deals and a 10%

in the year ahead. That compares with some

analysts expectations for the yen to remain

relatively rangebound.

In addition to rental yield and capital appreciation, [Taiwanese investors] look at whether they can get profit from a strong currency

when disposing of a [property], So said. He also

noted Taiwan investors tend to prefer mature

property markets when venturing overseas.

That lines up with one of the attractions of

investing in Japan property that Ku highlighted: the costs in Japan tend to be transparent

and well-documented.

To be sure, not everyone sees an investment case for residential property in Japan.

Top locations for residential investment are

probably reasonably safe for rental returns,

said Alexander Karolik Shlaen, an economist and chief executive officer of Panache

Management, a luxury brands and real estate investment adviser. But everything else

is probably to forget about it, because theres

no real demand coming from the local market.

Theres no population growth. Theres population reduction, he said. If you are looking

for the yield, it could be interesting. If you invest for capital growth, then I would say dont

expect much.

But Shlaen, who said he lived in Japan for

more than 10 years, added that hes looking at

investments related to tourism and hospitality to take advantage of the uptick in tourism.

But has the interest in Japan property inflated

a bubble? Not yet, according to Century 21s Ku.

We dont have a lot of credit going into the

property market, he said. The banking system

is still very closed off to foreigners, with just

two banks in Tokyo willing to lend and then

usually only around half the purchase price,

Ku noted. CNBC

to 20% rise in prices over the past two years, he

still sees the market as a good one for foreign

investors, noting the increases have come after

more than 20 years of declines.

For one thing, the yens 18% drop against

the US dollar since the beginning of 2014

makes properties in Japan better value for

foreign investors. Ku also noted that Japans

rental yields remain competitive, and rental

cash flow is likely to remain positive even as

interest rates normalise because of the countrys long history of low rates.

Ku is also positive on the governments

moves to relax rules on employment passes,

allowing in more foreign workers, as well as

offering long-term visas for potential retirees

over the age of 60. My colleagues in Hong

Kong are pushing Japan properties, Ku noted. Rich Chinese buyers ... are coming in to

shop for properties too.

Investors in Taiwan, formerly a Japanese

colony, are also interested in Japan property.

Taiwans own property market has cooled recently and rental yields there have fallen, Cliff

So, executive director at REPro Knight Frank, a

property agency in Taiwan, told CNBC in May.

In addition to cultural ties with many

Taiwanese speaking Japanese investors

there are also interested in Japan property because of the exchange rate. The Taiwan dollar

hasnt lost a lot of ground against the US dollar its down around 2.7% so far this year

but some analysts expect it to fall further For more, visit www.cnbc.com

A row of houses in central London. The BoE is

maintaining policies aimed at restricting riskier

mortgage borrowing . Photo by Reuters

UK house prices

jump 1.7%

BY J IL L WA R D & S COT T H A MILTO N

LONDON: House prices in the United

Kingdom surged the most in five months in

June as a shortage of property for sale continued to put upward pressure on values.

The average cost of a home rose 1.7%

from May to an average 200,280 (RM1.18

million), mortgage lender Halifax said earlier this month. From a year earlier, prices

jumped 9.4%.

Supply remains very tight, said Martin Ellis, an economist at Halifax. This

shortage has been a key factor maintaining house price growth at a robust pace

so far in 2015.

On a less volatile quarterly basis, prices rose 3.3% in the three months till June,

up from 2.7% in the first quarter. Ellis said

rising employment and real wage growth,

coupled with low borrowing costs, are also

fuelling the market and there has been a

recent modest pick-up in demand.

Nevertheless, Bank of England (BoE)

governor Mark Carney isnt taking chances.

Citing momentum in the market, he said

this month the central bank is maintaining measures aimed at restricting riskier

mortgage borrowing. Bloomberg

10 ST O C KS W I T H M O M E N T U M

M ON DAY JU LY 2 0 , 2 0 1 5 TH EEDGE FI N AN C I AL DAI LY

This column is an analysis done by Asia Analytica Sdn Bhd on the fundamentals of stocks with momentum that were picked up using proprietary algorithm by

Anticipatory Analytics Sdn Bhd and that rst appeared at www.theedgemarkets.com. Please exercise your own judgment or seek professional advice for your specic

investment needs. We are not responsible for your investment decisions. Our shareholders, directors and employees may have positions in any of the stocks mentioned.

DENKO INDUSTRIAL CORP BHD (-ve)

THE thinly-traded shares of Denko (Fundamental: 0.8/3, Valuation: 0.9/3) saw renewed

trading interest last week, gaining 21.2% in

just 4 days to close at 31.5 sen on Thursday.

Johor-based Denko operates in two segments: manufacturing of plastic injection

moulding and high precision plastic parts

as well as wholesaling of foodstuff and consumer goods. Over the past 5 years, it alternated between profit and loss.

Denko returned to the black in FYMar2015

with a net profit of RM 3.1 million, thanks to

DENKO INDUSTRIAL CORP BHD

increased contribution from manufacturing,

especially from the plastic parts sub segment.

Gearing stood at 21% as at end-March, down

from 46% a year ago.

The company is disposing an underutilised warehouse in Penang for RM7.7 million which will be used to repay borrowings and for working capital purposes.

Upon completion of the transaction, Denko

will realise a disposal gain of RM5.4 million and reduce its accumulated losses to

RM2.4 million.

Valuation score*

0.90

0.80

Fundamental score**

9.45

TTM P/E (x)

TTM PEG (x)

0.55

P/NAV (x)

TTM Dividend yield (%)

29.25

Market capitalisation (mil)

104.47

Shares outstanding (ex-treasury) mil

0.76

Beta

0.18-0.33

12-month price range

*Valuation score - Composite measure of historical return & valuation

**Fundamental score - Composite measure of balance sheet strength

& protability

Note: A score of 3.0 is the best to have and 0.0 is the worst to have

HOCK SENG LEE BHD (-ve)

HSL (Fundamental: 2.4/3, Valuation: 1.2/3)

saw renewed investor interest last week,

rising 3.8% to close at RM1.90 on Thursday.

The Sarawak-based infrastructure company is seen as a beneficiary of increased

government spending on infrastructure projects, including the RM27 billion Pan-Borneo

highway and roadworks for Sarawak Corridor

of Renewable Energy (SCORE).

HSL is mainly involved in civil and marine engineering, construction works, and

property development. The company has

HOCK SENG LEE BHD

a solid track record of over 30 years, having

completed about 800km of roads in Sarawak.

At end-March 2015, it has outstanding

orderbook of RM870 million.

Meanwhile, its property arm currently

accounts for only 5% of total sales, but is

expected to be a significant contributor going forward. The companys latest property

development is La Promenade a 200-acre

mixed development with potential GDV of

over RM2 billion strategically located along

Kuching-Samarahan Expressway.

Valuation score*

1.20

2.40

Fundamental score**

13.03

TTM P/E (x)

(5.47)

TTM PEG (x)

1.70

P/NAV (x)

1.47

TTM Dividend yield (%)

1,044.08

Market capitalisation (mil)

Shares outstanding (ex-treasury) mil 549.52

0.98

Beta

1.60-1.97

12-month price range

*Valuation score - Composite measure of historical return & valuation

**Fundamental score - Composite measure of balance sheet strength

& protability

Note: A score of 3.0 is the best to have and 0.0 is the worst to have

NCB HOLDINGS BHD (-ve)

NCB (Fundamental: 2.05/3, Valuation: 0.8/3)

closed up 3.5% to a one-year high of RM4.15

last Thursday, after its major shareholder,

MMC Corp, announced that it is acquiring

KWAPs 9.08% stake in NCB for RM186.5

million or RM4.37 per share.

Upon completion of the acquisition, MMC

will hold 30.13% stake in NCB, up from 21.05%.

This came after MMC Corp acquired a 5.3% stake

in NCB, last month, from the Port Klang Authority for RM86.2 million or RM3.45 per share.

NCB HOLDINGS BHD

Sharing similar ports and logistics assets,

NCB and MMC are exploring a synergistic

collaboration between their ports and logistics business.

MMC owns Johor Port, Penang Port and

Port of Tanjung Pelepas in Johor as well as

land transport company JP Logistics Sdn Bhd.

NCB operates Northport in Port Klang and

owns logistics provider Kontena Nasional Bhd.

MMC is 51.8%-controlled by tycoon Syed

Mokhtar whereas NCB is 53.4%-owned by PNB.

Valuation score*

0.80

2.05

Fundamental score**

88.78

TTM P/E (x)

(8.83)

TTM PEG (x)

1.33

P/NAV (x)

1.75

TTM Dividend yield (%)

1,885.71

Market capitalisation (mil)

Shares outstanding (ex-treasury) mil 470.25

0.47

Beta

2.07-4.01

12-month price range

*Valuation score - Composite measure of historical return & valuation

**Fundamental score - Composite measure of balance sheet strength

& protability

Note: A score of 3.0 is the best to have and 0.0 is the worst to have

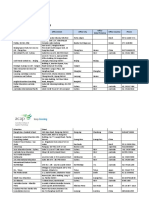

DENKO INDUSTRIAL CORP BHD

(ALL FIGURES IN MYR MIL)

Financials

Turnover

EBITDA

Interest expense

Pre-tax prot

Net prot - owners of company

Fixed assets - PPE

Total assets

Shareholders' fund

Gross borrowings

Net debt/(cash)

DENKO INDUSTRIAL CORP BHD

RATIOS

DPS ($)

Net asset per share ($)

ROE (%)

Turnover growth (%)

Net prot growth (%)

Net margin (%)

ROA (%)

Current ratio (x)

Gearing (%)

Interest cover (x)

HOCK SENG LEE BHD

(ALL FIGURES IN MYR MIL)

Financials

Turnover

EBITDA

Interest expense

Pre-tax prot

Net prot - owners of company

Fixed assets - PPE

Total assets

Shareholders' fund

Gross borrowings

Net debt/(cash)

HOCK SENG LEE BHD

RATIOS

DPS ($)

Net asset per share ($)

ROE (%)

Turnover growth (%)

Net prot growth (%)

Net margin (%)

ROA (%)

Current ratio (x)

Gearing (%)

Interest cover (x)

NCB HOLDINGS BHD

(ALL FIGURES IN MYR MIL)

Financials

Turnover

EBITDA

Interest expense

Pre-tax prot

Net prot - owners of company

Fixed assets - PPE

Total assets

Shareholders' fund

Gross borrowings

Net debt/(cash)

NCB HOLDINGS BHD

RATIOS

DPS ($)

Net asset per share ($)

ROE (%)

Turnover growth (%)

Net prot growth (%)

Net margin (%)

ROA (%)

Current ratio (x)

Gearing (%)

Interest cover (x)

FY12

FY13

FY14

FY2015Q4

31/3/2012

31/3/2013

31/3/2014

31/3/2015

78.3

0.4

2.3

(9.4)

(9.2)

55.1

55.1

35.0

23.2

21.1

87.0

9.1

1.4

1.1

0.8

49.4

50.6

39.3

20.8

19.3

74.4

4.1

0.9

(4.5)

(3.6)

44.4

45.6

36.3

17.1

16.8

22.8

3.3

0.2

1.9

2.8

54.3

69.4

53.5

13.7

11.3

FY12

FY13

31/3/2012

31/3/2013

31/3/2014

0.33

(23.23)

(31.03)

(11.74)

(14.86)

0.82

60.21

0.18

0.38

2.11

11.06

0.90

1.48

1.04

49.08

6.50

0.35

(9.55)

(14.39)

(4.85)

(7.50)

1.04

46.16

4.84

FY14 ROLLING 12-MTH

0.51

7.91

7.71

3.86

6.23

1.48

21.16

8.90

FY12

FY13

FY14

FY2015Q1

31/12/2012

31/12/2013

31/12/2014

31/3/2015

603.3

124.4

0.6

121.1

90.7

113.9

495.4

479.9

(198.8)

548.4

118.6

0.4

114.0

85.2

123.5

552.6

537.0

(157.8)

604.7

109.5

0.4

103.2

76.9

120.3

611.5

596.0

(149.4)

186.5

28.0

0.1

26.3

19.6

121.8

630.7

615.6

(85.0)

FY12

FY13

31/12/2012

31/12/2013

31/12/2014

FY14 ROLLING 12-MTH

0.03

0.82

20.40

3.74

3.93

15.03

19.70

1.85

213.37

0.03

0.98

16.76

(9.09)

(6.05)

15.54

16.26

2.07

272.47

0.03

1.08

13.58

10.26

(9.71)

12.72

13.22

2.55

280.93

0.03

1.12

14.33

27.54

(2.38)

11.87

13.94

2.98

292.54

FY12

FY13

FY14

FY2015Q1

31/12/2012

31/12/2013

31/12/2014

31/3/2015

978.8

252.6

1.4

154.2

125.8

865.8

1,443.4

1,383.9

56.9

(242.3)

919.4

195.9

4.1

94.1

51.7

1,087.7

1,498.3

1,407.3

208.6

52.2

831.0

126.0

5.3

18.6

27.9

1,077.9

1,809.3

1,404.6

580.9

123.9

198.0

43.7

1.4

18.1

11.6

1,055.6

1,906.6

1,416.2

474.9

3.4

FY12

FY13

31/12/2012

31/12/2013

31/12/2014

FY14 ROLLING 12-MTH

0.66

2.94

8.34

5.47

(20.87)

12.85

8.00

1.76

180.45

0.08

2.99

3.70

(6.07)

(58.90)

5.62

3.51

0.79

3.71

47.80

0.07

2.99

1.98

(9.61)

(46.10)

3.35

1.68

1.39

8.82

23.64

0.07

3.01

1.49

(6.64)

(10.05)

2.55

1.33

1.77

0.24

24.22

1 2 I N V E ST I N G I D E A S

M ON DAY JU LY 2 0 , 2 0 1 5 TH EEDGE FI N AN C I AL DAI LY

Note: This report is brought to you by Asia Analytica Sdn Bhd, a licensed investment adviser. Please exercise your own

judgment or seek professional advice for your specic investment needs. We are not responsible for your investment

decisions. Our shareholders, directors and employees may have positions in any of the stocks mentioned.

I N S I D E R A S I AS S TO C K O F T H E D AY

POWER ROOT BHD

(ALL FIGURES IN MYR MIL)

POWER ROOT BHD

POWER Root (Fundamental: 2.8/3, Valuation: 2.1/3) is one of the countrys top three

instant coffee maker and is best known

for its Alicafe, Ah Huat and Pearl coffee

brands. We like the company for its longterm growth potential, capable management, strong fundamentals and decent

dividends, although near-term earnings will

be affected by weaker consumer sentiment.

For FYFeb2012FY2014, net profit more

than doubled to RM38.8 million, fuelled by

strong growth in both strong domestic and

export markets. During the same period,

dividends increased from 4.5 sen to 9 sen.

Power Root ended its FY15 with a strong

4QFYMar15 results, boosted by the timely

completion of a small property development

project in Johor. The project contributed

RM40.0 million in revenue and RM10.3

million in net profit.

As a result, it declared a special dividend

POWER ROOT BHD

of 2.5 sen, bring up total dividends for FY15

to 10 sen. This translates into a payout ratio

of 70%, or an attractive yield of 4.6%.

Excluding the one-off contribution from

property development, Power Root posted

RM343.2 million in revenue for 13MFYMar15, compared with RM306.9 million

for 12MFYFeb14. Normalised net profit,

however, fell to RM36.2 million, from 39.7

million in FY14.

Core net margin for FY15 contracted

by 2.4 percentage points, reflecting the

softening consumer sentiment and the intensifying competition in the local coffee

premix market.

Nonetheless, it has a sturdy balance sheet

with a net cash position of RM54.2 million

(equivalent to 18 sen per share) to support

dividends and tide it over bad times. Going

forward, Power Root plans to grow its market share in the Middle East where instant

coffee penetration is still low.

The stock trades at fairly reasonable valuations, at an ex-cash normalised trailing

12-month P/E of 16.9 times and P/B of 2.7

times vis--vis the F&B industry average

P/E of 17 times and P/B of 3.8 times.

Insider Asia will feature a new stock pick on every alternate day.

Income Statement

Turnover

EBITDA

Depreciation

EBIT

Associates

Interest income

Interest expense

Extraordinary gain/(loss)

Pre-tax prot

Net prot - owners of company

Balance sheet

Fixed assets - PPE

Biological assets

Intangibles & goodwill

Cash and equivalents

Total current assets

ST borrowings

Total current liabilities

Total assets

Shareholders' fund

Long term borrowings

POWER ROOT BHD

RATIOS

DPS ($)

Net asset per share ($)

ROE (%)

Turnover growth (%)

Net prot growth (%)

Net margin (%)

ROA (%)

Current ratio (x)

Gearing (%)

Interest cover (x)

FY12

FY13

FY14

FY2015Q4

29/2/2012

28/2/2013

28/2/2014

31/3/2015

217.0

25.6

6.4

19.1

0.5

0.3

0.1

19.4

15.8

279.4

46.6

6.1

40.5

(0.1)

0.7

0.5

1.3

42.0

34.4

306.9

54.7

5.5

49.2

(0.0)

0.6

0.7

0.9

50.0

38.8

100.4

23.7

1.6

22.2

0.1

0.3

0.2

(0.4)

22.0

19.2

72.1

5.4

29.7

149.9

7.1

43.9

189.5

185.5

1.6

75.0

5.3

38.3

202.0

10.7

73.2

211.7

204.0

2.8

74.1

5.3

47.5

241.5

12.4

99.4

223.3

220.7

1.0

80.2

4.9

67.5

226.6

12.5

76.8

238.0

230.9

0.8

FY12

FY13

29/2/2012

28/2/2013

28/2/2014

FY14 ROLLING 12-MTH

0.05

0.62

8.67

17.43

29.73

7.30

8.47

3.42

83.96

0.07

0.68

17.66

28.71

116.99

12.31

17.14

2.76

95.06

0.09

0.73

18.28

9.84

12.89

12.65

17.84

2.43

79.32

0.10

0.77

19.23

24.89

11.14

11.24

18.76

2.95

87.49

14 B R O K E R S C A L L

M ON DAY JU LY 2 0 , 2 0 1 5 TH EEDGE F I N AN C I AL DAI LY

Maxis takes

conservative

dividend approach

AirAsia Bhd

FYE DEC (RM MIL)

Revenue

Ebitda

Ebit

PBT

Net profit

Core net profit

Core EPS (sen)

Core EPS growth (%)

PER (x)

Net dividend (sen)

2014

2015F

2016F

5,415.7

1,358.9

639.4

22.7

82.8

355.6

12.8

0.4

10.1

4.6

5,621.1

1,857.6

1,042.7

738.7

561.4

561.4

20.2

57.8

6.4

7.0

5,923.2

2,175.8

1,332.7

789.3

599.9

599.9

21.4

6.3

6.0

8.0

Source: Company, MIDFR

Maxis Bhd

(July 16, RM6.51)

Maintain hold with an unchanged

target price (TP) of RM7.19: Maxis Bhd continued to show a positive turnaround in the second

quarter of financial year ending

Dec 31, 2015 (2QFY15), but took

a conservative approach to dividends with a second interim dividend per share (DPS) of five sen

(1QFY15: five sen). We maintain

our hold rating on the stock as

we believe earnings forecast reratings are unlikely due to a more

competitive environment.

Maxis first-half (1HFY15) results

were within our and consensus expectations, as its core net profit of

RM922 million accounted for 47%

of our and consensus full-year estimates, respectively. Maxis declared

a second interim DPS of five sen

(85% payout), bringing year-to-date

(YTD) DPS to 10 sen (88% payout).

We maintain our FY15 (estimate)

DPS of 26 sen, in anticipation of a

special DPS in 4QFY15.

Maxis had a decent 2HFY15, as

service revenue grew 3.3% yearon-year (y-o-y) to RM4.22 billion,

mainly on good growth traction in

prepaid. Service revenue growth

would have been higher at 4.5%

y-o-y if not for three months or

RM50 million worth of free voice

and SMS given to prepaid users as

part of the goods and services tax

(GST) implementation. 1HFY15

net profit, however, was flattish

y-o-y at RM923 million due to

higher interest expense (+15.2%

Maxis Bhd

FYE DEC (RM MIL)

Revenue

Ebitda

Pre-tax profit

Net profit

EPS (sen)

PER (x)

Core net profit

Core EPS (sen)

Core EPS growth (%)

Core PER (x)

Net DPS (sen)

Dividend yield (%)

EV/Ebitda (x)

Affin/Consensus (x)

2013

2014

2015E

2016E

2017E

9,084.0

4,573.0

2,496.0

1,765.0

23.5

27.7

2,097.0

27.9

2.3

23.3

40.0

6.1

12.4

-

8,389.0

4,296.0

2,436.0

1,721.0

22.9

28.4

1,910.0

25.4

(8.9)

25.6

40.0

6.1

13.5

-

8,607.9

4,312.5

2,665.5

1,968.4

26.2

24.8

1,968.4

26.2

3.1

24.8

26.0

4.0

13.4

1.0

8,724.9

4,353.7

2,760.1

2,038.5

27.2

24.0

2,038.5

27.2

3.6

24.0

27.0

4.1

13.3

1.0

8,831.0

4,415.5

2,934.3

2,167.4

28.9

22.5

2,167.4

28.9

6.3

22.5

28.0

4.3

13.1

1.0

Source: Company, Affin Hwang estimates

y-o-y) and higher depreciation

(+5.4% y-o-y).

1HFY15 earnings before interest, taxes, depreciation and amortisation margin improved by 0.8

percentage point (ppt) to 51.9%

mainly due to lower direct costs

as a result of not absorbing the

prepaid service tax.

Amid an intense price competition, management said it is comfortable with its existing product offerings and intends to offer customers

a superior network and better customer experience at its distribution

network. Maxis already leads the

industry with a long-term evolution

population coverage of 41%, and

targets 50% by year-end.

Post-paid revenue is still stagnant due to the impact of repricing

pay-per-use data rates in 3QFY14.

Nonetheless, Maxis is seeing a

good traction from its MaxisONE

Plan (15% of post-paid base).

We maintain our hold rating

on Maxis with an unchanged discounted cash flow-derived TP of

RM7.19. While we are positive on

Maxis turnaround efforts, we believe that earnings forecast reratings are unlikely due to the more

competitive environment. Any

disappointment in future dividends could trigger a de-rating of

the stock, while earnings forecast

reratings would surprise positively. Affin Hwang Capital, July 16

Bursas 2QFY15 results in line, buoyed by derivatives

Bursa Malaysia Bhd

(July 16, RM8.07)

Maintain hold with an unchanged

fair value of RM8.90: We maintain

our hold recommendation on Bursa Malaysia Bhd with an unchanged

fair value of RM8.90 per share, based

on financial year ending Dec 31,

2015 forecast (FY15F) price-earnings ratio (PER) of 23 times.

Bursa reported second-quarter

FY15 (2QFY15) net profit of RM49.5

million (quarter-on-quarter, q-o-q:

+5.2%) to extend its first half FY15

(1HFY15) earnings to RM96.5 million. The results were within expectations, accounting for 47% of

our and 48% of market estimates.

Management declared an interim dividend of 16.5 sen, which is

equivalent to a payout ratio of 91%.

No special dividend is expected in

the near term. Despite the pared

down market sentiment due to the

difficult domestic and global environment, Bursas performance in

1HFY15 is commendable, slightly

buoyed by growth in its derivatives

and Islamic products.

Derivatives trading revenue in

1HFY15 grew 11.9% year-on-year

(y-o-y), mainly attributed to volatile palm oil prices in the quarter,

which spurred crude palm oil futures (FCPO) trades. FCPO makes

up 81% of average daily contracts

(ADC). This was due to hedging

and speculation activity by market

participants. ADC stood at 50,612

contracts.

Its Bursa Suq Al Silas trading

revenue (Islamic product) also doubled due to the higher conversion

of deposits to murabaha, and the

introduction of tenor-based pricing.

Equities trading revenue, which is

Bursas key contributor, was unchanged at RM116 million.

However, Bursas securities market statistics disappointed slightly,

with the average daily traded value

lower at RM2 billion (y-o-y: -8%).

Also, trading velocity dropped two

percentage points to 28%. We be-

lieve that this is due to the poor

retail participation and market sentiment, as reflected by the FBM

KLCI dipping below 1,700 points

twice this year.

On another note, stable revenue

had enhanced slightly from higher depository services and market

data. Operational expenditure in

1HFY15 was also unchanged generally. Looking ahead, the market

environment for the remaining of

FY15 will be challenging.

However, we believe the growth

of its derivatives and Islamic products, as well as further initial public

offering revenue will negate any

negativity felt in the equities market. Bursa earlier last week loosened its regulations for the ACE

Market to attract more listings. We

leave our FY15F (forecast) to FY17F

earnings estimates unchanged.

The stock is currently trading at 21

times FY15F PER, slightly below its

5-year PER average of 22 times.

AmResearch, July 16

AirAsias valuation

remains attractive

AirAsia Bhd

(July 16, 18.5 sen)

Maintain buy with a lower target price (TP) of RM1.82: Since

December, AirAsia Bhds share

price has been languishing on

a barrage of bad news, most of

which we believe is caused by

external factors out of managements control. It started with the

unfortunate crash of QZ8501 in

December 2014, which we opine

is the worst thing that could happen for an airline.

When things were turning for

the better, the department of civil

aviation of Thailand came under

scrutiny by the International Civil Aviation Organization, which

prompted a review of flight permits imposed by countries like

Japan and South Korea.

Then came the earthquake

in Nepal, the Middle East respiratory syndrome outbreak in

South Korea, a review by the Indonesian ministry of transport

on airlines with negative equity

positions and ash cloud troubles

within the Indonesian archipelago causing a temporary closure

of several airports. Add in to the

mix a report by a foreign research

firm drawing attention to AirAsias receivables, and we arrive at

todays share price lower steeply by 52.6% year-to-date (YTD).

While not all of these events

had an impact on AirAsias operations directly, we believe that

both investor and customer sentiment has been dented for AirAsia

which was still recovering from

an intense competition from Malaysia Airlines (MAS).

Financial year ending Dec

31, 2015 (FY15) core earnings

forecasts have been reduced as

we impute a slower recovery in

yields and lower load factor. We

have reduced our yield growth

forecast for FY15 to -2% (from flat

growth). In addition, we are revising our load factor assumption

down to 78% (from: 81%) as the

impact of fuel surcharge removal

was milder than expected. As a

result, we have reduced our FY15

core earnings to RM561 million.

Value emerged from the selldown. AirAsia is currently trading

at an attractive valuation of 6.4

times forward FY15 price-earnings ratio (PER) and 0.79 times

price-to-book value. We believe

that the current share price has

priced in most of the negative

factors. At this juncture, we opine

that the major risk faced by AirAsia is an impairment of its receivables from associates amounting to RM1.2 billion which are

overdue.

However, we believe that the

possibility of a write-down is unlikely and will only be used if all

other options have been exhausted as impairment tests have been

conducted and the associates

remain a going concern.

Nevertheless, management is

actively working to alleviate this

risk through a sale and leaseback of 16 of its aircraft fleet

owned for RM1.5 billion, which

we believe should be completed

in the second half of 2015; and

issuance of convertible bonds

amounting to RM1 billion followed by the initial public offering of Indonesia AirAsia and

Philippines AirAsia.

We expect jet fuel prices to remain low in line with our house

view of crude oil prices of between US$60 (RM228) per barrel and US$70 per barrel for this

year. Additionally, the anticipated

rationalisation of routes by MAS

is starting to take shape with frequency reductions of between

20% and 50% to begin in August

on popular destinations such

as Kuala Lumpur (KL) to Hong

Kong, KL to Manila and KL to

Ho Chi Minh City, which would

benefit AirAsia through pricing

fares more profitably and securing higher load factors.

We maintain our buy call

on AirAsia as its business prospects are on the mend. Most

notably, forward ticket sales as

at July for the third quarter of

FY15 (3QFY15) and 4QFY15 have

been brisk at +18% year-on-year

for the group while forward load

factors are estimated at 80%, in

line with our latest forecasts for

the year.

Fuel expenses have come

down 9.2% y-o-y in 1QFY15 and

we are further expecting an improvement of 21% for FY15. Our

TP of RM1.82 is based on 9 times

forward PER to FY15 earnings

per share.

We have reduced our forward PER to 9 times (from 10

times) due to external factors.

In the worst-case scenario, we

believe that the floor price of

AirAsia should be at 1 times its

FY14 book value translating into

a share price of RM1.68 MIDF

Research, July 16

16 B R O K E R S C A L L

M ON DAY JU LY 2 0 , 2 0 1 5 TH EEDGE F I N AN C I AL DAI LY

Hartalega has been

increasing operating

productivity

Hartalega Holdings Bhd

(July 16, RM8.60)

Maintain neutral with a higher target price (TP) of RM9.12: We recently hosted Hartalega Holdings Bhd

on a regional non-deal roadshow.

Capacity expansion at its next-generation integrated glove manufacturing complex (NGC) remains on track

with better-than-expected operating

productivity.

Hartalega has been commissioning two lines per month since January 2015 and management expects

the 14th line to be operational by

end-July. All 24 lines of Plant 1 and

2 are expected to be commissioned

by December this year, bringing total

capacity to 20 billion pieces (Decem-

ber 2014: 14 billion pieces).

NGC has recorded a 33% jump in

productivity to 2.6 workers per million gloves per month (wpmgpm),

compared with the pre-NGC setup

of 3.9 wpmgpm. Management is exploring ways to incorporate further

automation and lean manufacturing

practices to bolster productivity to

two wpmgpm

Hartalega is cautious about

the outlook for the average selling price (ASP) of gloves due to

increased competition, especially

in the nitrile glove segment. We

lower our average nitrile glove ASP

assumption to US$24 (RM91.20

per 1,000 pieces) for financial year

2016 (FY16) from US$26 previous-

Zhulian comes in within expectations

Zhulian Corp Bhd

(July 16, RM2.05)

Maintain underperform with an

unchanged target price (TP) of

RM2: Net profit of RM23.7 million

(-7% year-on-year) is deemed

within expectations, accounting

for 45.1% of our full-year forecast. A consensus comparison is

not available as the stock is not

widely tracked.

The group has proposed a

dividend of 1.5 sen per share,

bringing year-to-date (YTD) dividend per share (DPS) to three

sen, which is below our expectation of 10 sen in the financial year

ending November 2015 (FY15)

due to the lower-than-expected

payout ratio.

Y TD, first half of FY15

(1HFY15) revenue fell 16.2% to

RM110.5 million due to the lower

sales in the local market on the

back of persistent weak consumer

sentiment. Operating profit grew

14.2% despite lower revenue as

1HFY14 was dragged down by

higher expenses incurred in marketing plans and higher start-up

costs for the Myanmar operations.

Profit before tax (PBT ) declined marginally by 0.6% to

RM31.9 million due to the lower contribution from Thai associates (-19.1%), but net profit fell

by a greater quantum of 7% due

to the higher effective tax rate

(25.8% versus 20.7%).

Quarter-on-quarter (q-o-q),

revenue for the second quarter (2Q) of FY15 was flattish at

RM55.3 million while operating

profit fell marginally by 1.3% to

RM10.1 million. However, contribution from associates slumped

by 34.6% to RM4.6 million due to

the weak market conditions in

Thailand. That brought net profit

down by 11.5% to RM11.1 million.

Moving forward, the group is

aiming to attract more distributors, particularly young entrepreneurs who are looking for low

entry cost ventures by adopting

a small ticket items strategy.

Although the strategy may be

able to attract a higher core distributor force (CDF) in the long

run, we foresee that earnings will

be dragged down by the transition period in the short term,

based on the experience of another local multilevel marketing

players.

All in, we maintain our cautious stance on the company in

view of the tough operating environment in Malaysia as consumer sentiment succumbed to

a six-year low in 1QFY15. With

the goods and services tax (GST)

being implemented in 2Q, we

do not expect the sentiment to

recover quickly.

Meanwhile, the Thailand

market is still weak judging

from the lacklustre contributions from associates. We make

no changes to our earnings forecast, but we revise downwards

our DPS forecast from 10 sen

for both FY15E (estimate) and

FY16E to seven sen and 7.5

sen, respectively, by assuming

a more conservative payout ratio

of about 60% to be in line with

the YTD payout trend.

We roll over our valuation

base year from FY15E to FY16E.

We also switch our valuation

methodology from blended

price-earnings ratio/price-to

book value (PER/PBV) valuation to PER valuation in view of

its stabilising earnings trend. Our

TP is unchanged at RM2, based

on 16.1 times FY16E PER, which

is close to -0.5 standard deviation over the three-year mean.

Kenanga Research, July 16

Hartalega Holdings Bhd

FYE MAR (RM MIL)

2014

2015

2016F

2017F

2018F

Total turnover

1,107

1,146

1,454

1,889

2,187

Reported net profit

233

210

263

352

422

Recurring net profit

233

210

263

352

422

(0.2)

(9.9)

25.4

33.8

19.9

Recurring net profit growth (%)

0.31

0.27

0.32

0.43

0.51

Recurring EPS (RM)

0.15

0.12

0.14

0.19

0.23

DPS (RM)

27.5

31.9

26.7

20.2

16.8

Recurring P/E (x)

6.86

5.46

4.77

4.24

3.85

P/BV (x)

25.8

32.4

14.7

14.3

14.3

P/CF (x)

1.7

1.4

1.7

2.2

2.7

Dividend yield (%)

18.1

21.7

16.3

12.4

10.3

EV/Ebitda (x)

27.3

19.0

19.1

22.2

24.0

Return on average equity (%)

Net cash Net cash Net cash Net cash Net cash

Net debt to equity (%)

Our vs consensus EPS

(7.6)

5.6

14.8

(adjusted) (%)

Source: Company data, RHB

Nitrile glove.

ly. Nevertheless, we expect the

improvement in productivity to

more than offset the ASP decline

and boost operating margins going forward.

After updating our assumptions

on productivity and ASP, we adjust

our earnings forecasts by -9% to

7% for FY16-24F. The key downside risk to our forecasts remains

the execution of NGC, while the

upside risk includes further weakening of the ringgit.

Hartalega has proposed a one-forone bonus issue which is expected to

be completed sometime in September to December 2015. The corporate

exercise would improve Hartalegas

trading liquidity.

While Hartalegas growth pros-

pects are intact with 24% earnings per

share compound annual growth rate

for FY16 to FY18, we believe this has

been well reflected in current price