Professional Documents

Culture Documents

Engineering Economics and Costing Assignment

Uploaded by

Sachin SahooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Engineering Economics and Costing Assignment

Uploaded by

Sachin SahooCopyright:

Available Formats

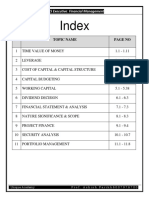

ENGINEERING ECONOMICS AND COSTING ASSIGNMENT

1. Suppose I want to be able to withdraw Rs.5, 000 at the end of five years and

withdraw Rs. 6,000 at the end of six years, leaving a zero balance in the

account after the last withdrawal. If I can earn 5% on my balances, how much

must I deposit today to satisfy my withdrawals needs?

2. Suppose you wish to retire forty years from today. You determine that you need

Rs.50, 000 per year once you retire, with the first retirement funds withdrawn one

year from the day you retire. You estimate that you will earn 6% per year on your

retirement funds and that you will need funds up to and including your 25th

birthday after retirement.

a) How much must you deposit in an account today so that you have enough

funds for retirement?

b) How much must you deposit each year in an account, starting one year from today, so

that you have enough funds for retirement?

3. Perform a present worth analysis of equal-service machines with the costs shown below, if

the MARR is 10% per year. Revenues for all three alternatives are expected to be the same.

4. Evaluate alternative with helps of rate of return methods.

5. By using PW & AEW method evaluate the alternative by assuming i=10%

You might also like

- Calculate Present and Future Values of Cash Flows Using Discounting and CompoundingDocument4 pagesCalculate Present and Future Values of Cash Flows Using Discounting and CompoundingKritika SrivastavaNo ratings yet

- The Time Value MoneyDocument4 pagesThe Time Value Moneycamilafernanda85No ratings yet

- Time Value (Financial Management)Document9 pagesTime Value (Financial Management)Keyur BhojakNo ratings yet

- Financial Management Time Value ProblemsDocument39 pagesFinancial Management Time Value Problemsprashanth1911820% (2)

- TVM ProblemsDocument10 pagesTVM ProblemsVaibhav Jain0% (1)

- Time Value Money Calculations University NairobiDocument2 pagesTime Value Money Calculations University NairobiDavidNo ratings yet

- Multiple Choice Questions: Source: G. Mankiw, Principles of EconomicsDocument8 pagesMultiple Choice Questions: Source: G. Mankiw, Principles of EconomicsSachin Sahoo80% (5)

- Time Value of Money Class ExerciseseDocument2 pagesTime Value of Money Class ExerciseseRohan JangidNo ratings yet

- FM NotesDocument182 pagesFM NotesShrikant RathodNo ratings yet

- NCERT Class XI Accountancy Part IIDocument333 pagesNCERT Class XI Accountancy Part IInikhilam.com67% (3)

- A Haven on Earth: Singapore Economy Without Duties and TaxesFrom EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNo ratings yet

- TVM Problems: Calculating Present and Future ValuesDocument3 pagesTVM Problems: Calculating Present and Future ValuesAnshuman TewariNo ratings yet

- Cost of CapitalsDocument11 pagesCost of Capitals29_ramesh170No ratings yet

- Debt and TaxDocument1 pageDebt and TaxChandramani JhaNo ratings yet

- Time Value of Money - Ques For PracticeDocument3 pagesTime Value of Money - Ques For PracticeNitesh NagdevNo ratings yet

- Engineering Economics - Practice ProblemsDocument5 pagesEngineering Economics - Practice ProblemsSai Krish PotlapalliNo ratings yet

- Time Value of Money - Practical ApplicationsDocument3 pagesTime Value of Money - Practical Applicationsmanoj_yadav7350% (1)

- CF Assignment - 2Document2 pagesCF Assignment - 2vishnu607No ratings yet

- Homework QuestionsDocument6 pagesHomework Questionsgaurav shetty100% (1)

- EEFM Assignment 1 ModifiedDocument2 pagesEEFM Assignment 1 ModifiedChinmay Swain0% (1)

- Compound Interest Calculator: 30 ExercisesDocument4 pagesCompound Interest Calculator: 30 ExercisesDilina De SilvaNo ratings yet

- Problem Set 04 - Introduction To Excel Financial FunctionsDocument3 pagesProblem Set 04 - Introduction To Excel Financial Functionsasdf0% (1)

- Exercises (Time Value of Money) : TH TH THDocument2 pagesExercises (Time Value of Money) : TH TH THbdiitNo ratings yet

- Ex. T.V.MDocument2 pagesEx. T.V.MGeethika NayanaprabhaNo ratings yet

- 03a TVM QuestionsDocument2 pages03a TVM QuestionsSaad ZamanNo ratings yet

- Corporate Finance worksheet calculationsDocument3 pagesCorporate Finance worksheet calculationscyclo tronNo ratings yet

- Basic Excel Functions - ProblemsDocument31 pagesBasic Excel Functions - ProblemsSushma Jeswani TalrejaNo ratings yet

- Time Value of Money Course AssignmentDocument4 pagesTime Value of Money Course AssignmentSyed Osama Ali100% (1)

- TVM Question 55Document8 pagesTVM Question 55jaiNo ratings yet

- Part I - Chapter 2 - TDDocument22 pagesPart I - Chapter 2 - TDCharbel YounesNo ratings yet

- 0ecd7tvm AssignDocument1 page0ecd7tvm AssignAman WadhwaNo ratings yet

- Assignment 1: 15 Financial Problems with SolutionsDocument2 pagesAssignment 1: 15 Financial Problems with SolutionsJeevan GonaNo ratings yet

- Practice Problems For Chapter 2Document5 pagesPractice Problems For Chapter 2Lacey Blankenship100% (2)

- Homework on savings, investments, annuities and loans (Deadline 27 NovDocument2 pagesHomework on savings, investments, annuities and loans (Deadline 27 NovcbarajNo ratings yet

- TVM Questions IDocument4 pagesTVM Questions IRUTVIKA DHANESHKUMARKUNDAGOLNo ratings yet

- Time Value of Money Problems SolvedDocument13 pagesTime Value of Money Problems SolvedGajendra Singh Raghav50% (2)

- FINANCIAL MANAGEMENT Chapter 2Document37 pagesFINANCIAL MANAGEMENT Chapter 2JackNo ratings yet

- Questions TVMDocument3 pagesQuestions TVMkrdaksh14No ratings yet

- Sec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffDocument4 pagesSec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffNaveen KumarNo ratings yet

- Recurring Deposit and Loan CalculationsDocument2 pagesRecurring Deposit and Loan CalculationsGaurav SomaniNo ratings yet

- CF AssignmentDocument3 pagesCF AssignmentP.Umasankar SubudhiNo ratings yet

- Present Value and Future Value ProblemsDocument6 pagesPresent Value and Future Value ProblemsBhanu SharmaNo ratings yet

- Fundamentals of Engineering Economic Analysis Assignment ExercisesDocument4 pagesFundamentals of Engineering Economic Analysis Assignment ExercisesdsadadadNo ratings yet

- VSGHDDocument2 pagesVSGHDReshmith FFNo ratings yet

- Applied Corporate Finance TVM Calculations and AnalysisDocument3 pagesApplied Corporate Finance TVM Calculations and AnalysisMuxammil IqbalNo ratings yet

- Exam Practice Question MBADocument11 pagesExam Practice Question MBAsudhakar dhunganaNo ratings yet

- TVM: Time Value of Money Concepts and Retirement Planning ExamplesDocument8 pagesTVM: Time Value of Money Concepts and Retirement Planning ExamplesSocio Fact'sNo ratings yet

- Compilation For Final Exam 1 Converted 1Document7 pagesCompilation For Final Exam 1 Converted 1Trending News and TechnologyNo ratings yet

- FM Module 2 ExerciseDocument1 pageFM Module 2 ExercisePrayag GokhaleNo ratings yet

- SONCIO - CEE109-1831 - ULO2a Let's AnalyzeDocument4 pagesSONCIO - CEE109-1831 - ULO2a Let's AnalyzeCHRISTIAN MART SONCIONo ratings yet

- FM TVM Practice Questions G5jmfcwesn PDFDocument2 pagesFM TVM Practice Questions G5jmfcwesn PDFValiant MixtapesNo ratings yet

- FINANCE KEY POINTSDocument4 pagesFINANCE KEY POINTSTintin Brusola Salen67% (3)

- Home Take Exxam EEDocument2 pagesHome Take Exxam EEznabugrmay20adiNo ratings yet

- Questions On Time Value of MoneyDocument1 pageQuestions On Time Value of MoneySheetal VermaNo ratings yet

- FM Assignment 1Document3 pagesFM Assignment 1Joseph KingNo ratings yet

- Tutorial - I For FM-I: Effective Interest Rate (EIR)Document3 pagesTutorial - I For FM-I: Effective Interest Rate (EIR)Sriram VenkatakrishnanNo ratings yet

- Solution Time Value of Money 4 PV of Single and Series of Cash Flows and PV of Annuity Ordinary Mf4dtGPKncDocument10 pagesSolution Time Value of Money 4 PV of Single and Series of Cash Flows and PV of Annuity Ordinary Mf4dtGPKncShareshth JainNo ratings yet

- Problem Set 04 - More Problems Using Financial FunctionsDocument2 pagesProblem Set 04 - More Problems Using Financial FunctionsShashwatNo ratings yet

- BT Chap 5Document4 pagesBT Chap 5Hang NguyenNo ratings yet

- Ekonomi TeknikDocument2 pagesEkonomi Tekniksanjaya aryandiNo ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- The 401K First Aid Kit: Stop Your Portfolio Bleeding and Get Back to Financial HealthFrom EverandThe 401K First Aid Kit: Stop Your Portfolio Bleeding and Get Back to Financial HealthNo ratings yet

- Resident Certificate PDFDocument2 pagesResident Certificate PDFsandeep0% (1)

- BANKING COMMITTEESDocument4 pagesBANKING COMMITTEESSachin SahooNo ratings yet

- DipikaDocument3 pagesDipikaSachin SahooNo ratings yet

- Bank Board BureauDocument10 pagesBank Board BureauSachin SahooNo ratings yet

- Gsi NotesDocument66 pagesGsi NotesHexaNotesNo ratings yet

- Kurukshetra June-14Document53 pagesKurukshetra June-14PranNath100% (1)

- Front CompressedDocument2 pagesFront CompressedSachin SahooNo ratings yet

- Mark DistributionDocument1 pageMark DistributionSachin SahooNo ratings yet

- ApplicationForm PDFDocument2 pagesApplicationForm PDFkeerthiNo ratings yet

- Banking QuizDocument28 pagesBanking QuizSachin SahooNo ratings yet

- Selectes Study On Derivative Market: 1) Development of Financial Derivatives Market in India-A Case StudyDocument1 pageSelectes Study On Derivative Market: 1) Development of Financial Derivatives Market in India-A Case StudySachin SahooNo ratings yet

- List of Steel Furnitures Industries in OrissaDocument3 pagesList of Steel Furnitures Industries in OrissaSachin SahooNo ratings yet

- Engineering Economics & Costing AssignmnetDocument1 pageEngineering Economics & Costing AssignmnetSachin SahooNo ratings yet

- 14 Fundamental Principles of Management Formulated by Henry FayoDocument11 pages14 Fundamental Principles of Management Formulated by Henry FayoSachin SahooNo ratings yet

- EtcDocument3 pagesEtcSachin SahooNo ratings yet

- Calculate BEP and analyze contingenciesDocument7 pagesCalculate BEP and analyze contingenciesSachin SahooNo ratings yet

- Ugc Net EconomicsDocument17 pagesUgc Net EconomicsSachin SahooNo ratings yet

- IBPS PO SyllabusDocument2 pagesIBPS PO SyllabusSachin SahooNo ratings yet

- DR Rojalini SahooDocument5 pagesDR Rojalini SahooSachin SahooNo ratings yet

- Mpil Project TitleDocument5 pagesMpil Project TitleErik LopezNo ratings yet

- MigrationsDocument14 pagesMigrationsSachin SahooNo ratings yet

- Migration TopicsDocument3 pagesMigration TopicsSachin SahooNo ratings yet

- ECON 201 12/9/2003 Prof. Gordon: Final ExamDocument23 pagesECON 201 12/9/2003 Prof. Gordon: Final ExamManicks VelanNo ratings yet

- Advert SingDocument3 pagesAdvert SingSachin SahooNo ratings yet

- Edp QBDocument113 pagesEdp QBSachin SahooNo ratings yet

- EntrepreneurshipDocument1 pageEntrepreneurshipSachin SahooNo ratings yet

- Insurance Digest - V3Document88 pagesInsurance Digest - V3Sachin SahooNo ratings yet

- Ugc Net Economics PrintDocument11 pagesUgc Net Economics PrintSachin SahooNo ratings yet