Professional Documents

Culture Documents

The Reserve Bank of India

Uploaded by

34354Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Reserve Bank of India

Uploaded by

34354Copyright:

Available Formats

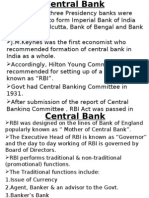

The Reserve Bank of India (RBI, Hindi: भारतीय िरजवर बैक) is the central bank of India

and controls the the monetary policy of the rupee as well as 171 billion US-Dollar

(2006) currency reserves. The institution was establisehd on 1 April 1935 during the

British-Raj in accordance with the provisions of the Reserve Bank of India Act, 1934

[1]

and plays an important part in the development strategy of the government.

The central bank was founded in 1935 to respond to economic troubles after the first world war.

[2]

The Reserve Bank of India was set up on the recommendations of the Hilton Young

Commission. The commission submitted its report in the year 1926, though the bank was not set

up for another nine years. The Preamble of the Reserve Bank of India describes the basic

functions of the Reserve Bank as to regulate the issue of Bank Notes, to keep reserves with a

view to securing monetary stability in India and generally to operate the currency and credit

system in the best interests of the country. The Central Office of the Reserve Bank was initially

established in Kolkata, Bengal, but was permanently moved to Mumbai in 1937. Though

originally privately owned, the RBI has been fully owned by the Government of India since its

nationalization in 1949.

Between 1950 and 1960 the indian government developed a centrally planned economic policy

and focused on the agricultural sector. The administration nationalized commercial banks[3] and

established, based on the Banking Companies Act, 1949 (later called Banking Regulation Act) a

central bank regulation as part of the RBI. Beside that the central bank was orderd to support the

economic plan with loans.[4]

As a result of bank crashes the reserve bank was requested to establish and monitor a deposit

insurance system. It should restore the trust in the national bank system and was initialized on 7.

Dezember 1961. The indian government founded funds to promote the economy and used the

slogan Developing Banking. The Gandhi administration and their successors restuctured the

national bank market and nationalized a lot of instituts.[5] As a result the RBI had to play the

central part of control and support of this public banking sector.

Monetary Authority

• Formulates, implements and monitors the monetary policy.

• Objective: maintaining price stability and ensuring adequate flow of credit to productive

Inflation still a dominant concern: RBI24-FEB-10 Concerned over surging food

prices, the Reserve Bank of India (RBI) today said that controlling inflation

continues to be a "dominant" concern.sectors.

Savings - The interest rates on NRE Savings deposits shall be at the rate applicable

to domestic savings deposits. Currently the interest rate is 3.5%.

You might also like

- Role of RBI in Control of Credit - Economics Project Class 12 (2019-20)Document22 pagesRole of RBI in Control of Credit - Economics Project Class 12 (2019-20)Anonymous JbDKaC78% (134)

- Samiksha Work Final PDFDocument78 pagesSamiksha Work Final PDFSANKET ThakurNo ratings yet

- Reserve Bank of IndiaDocument10 pagesReserve Bank of IndiasardeepanwitaNo ratings yet

- History of Reserve Bank of India An OverviewDocument7 pagesHistory of Reserve Bank of India An Overviewanusaya1988No ratings yet

- Introduction of Reserve Bank of IndiaDocument9 pagesIntroduction of Reserve Bank of IndiaAbeer Mansingh MahapatraNo ratings yet

- History: Reserve Bank of India Act, 1934Document15 pagesHistory: Reserve Bank of India Act, 1934neha shaikhNo ratings yet

- Project Role of RBI Word Doc.3Document66 pagesProject Role of RBI Word Doc.3nilesh dhivreNo ratings yet

- Reserve Bank of India Act, 1934Document5 pagesReserve Bank of India Act, 1934neha shaikhNo ratings yet

- Reserve Bank of India - WikipediaDocument22 pagesReserve Bank of India - WikipediaVishnuNo ratings yet

- Introduction of Reserve Bank of IndiaDocument14 pagesIntroduction of Reserve Bank of IndiaGirish Lundwani88% (42)

- BankingDocument49 pagesBankingRitu BhatiyaNo ratings yet

- Document ....Document29 pagesDocument ....maariswee9No ratings yet

- Reserve Bank of IndiaDocument32 pagesReserve Bank of Indiachakri.iiitnNo ratings yet

- Reserve Bank of India भारतीय रिरज़र्व बैंकDocument14 pagesReserve Bank of India भारतीय रिरज़र्व बैंकRahul MittalNo ratings yet

- Reserve Bank of IndiaDocument17 pagesReserve Bank of IndiaamanNo ratings yet

- Of RbiDocument16 pagesOf RbiMohit VinayakNo ratings yet

- Reserve Bank of IndiaDocument22 pagesReserve Bank of IndiaSrinivasarao KurraNo ratings yet

- Reserve Bank of IndiaDocument21 pagesReserve Bank of IndiaAcchu BajajNo ratings yet

- History: The Old RBI Building in MumbaiDocument7 pagesHistory: The Old RBI Building in MumbaiAkshay JainNo ratings yet

- History of RbiDocument4 pagesHistory of RbiNot urs ManNo ratings yet

- Unit - 1: Introduction To Indian Banking SystemDocument109 pagesUnit - 1: Introduction To Indian Banking SystemDr. S. Nellima KPRCAS-CommerceNo ratings yet

- Reserve Bank of India WikipediaDocument11 pagesReserve Bank of India WikipediaMradul YadavNo ratings yet

- CONCLUSIONDocument12 pagesCONCLUSIONAniket ShigwanNo ratings yet

- Role of RBI Under Banking Regulation Act, 1949Document5 pagesRole of RBI Under Banking Regulation Act, 1949Jay Ram100% (1)

- Reserve Bank of India-Central Bank of India: HistoryDocument22 pagesReserve Bank of India-Central Bank of India: HistorymaggyfinNo ratings yet

- Banking Law Unit 2Document17 pagesBanking Law Unit 2D. BharadwajNo ratings yet

- Reserve Bank of India (RBI)Document12 pagesReserve Bank of India (RBI)bss kanthNo ratings yet

- Rbi ProjectDocument37 pagesRbi ProjectSupriya ThakurNo ratings yet

- Unit 2Document13 pagesUnit 2Vicky KumarNo ratings yet

- The Bank Was Constituted ToDocument7 pagesThe Bank Was Constituted Toprv3No ratings yet

- Role of RBI Under Banking Regulation Act, 1949Document11 pagesRole of RBI Under Banking Regulation Act, 1949Jay Ram100% (1)

- Reserve Bank of IndiaDocument16 pagesReserve Bank of IndiaAlpa GhoshNo ratings yet

- Reserve Bank of India - WikipediaDocument44 pagesReserve Bank of India - WikipediaAditi KumariNo ratings yet

- Reserve Bank of IndiaDocument10 pagesReserve Bank of Indiadev sharmaNo ratings yet

- Rbi Shubham WordDocument3 pagesRbi Shubham WordAniket ShigwanNo ratings yet

- Reserve Bank of IndiaDocument9 pagesReserve Bank of IndiaArun DalalNo ratings yet

- Role and Functions of Reserve Bank of IndiaDocument5 pagesRole and Functions of Reserve Bank of Indiaanusaya1988No ratings yet

- Monetary Policy of The RbiDocument8 pagesMonetary Policy of The RbiAbhay KumarNo ratings yet

- Central BankDocument24 pagesCentral BankShailesh RathodNo ratings yet

- History of Indian BankingDocument23 pagesHistory of Indian BankingLaxman KambleNo ratings yet

- Careers CloudDocument35 pagesCareers Cloudaravind lagishettiNo ratings yet

- Blackbook ProjectDocument42 pagesBlackbook ProjectTasbi KhanNo ratings yet

- RESERVE BANK OF INDIA (Shivam)Document6 pagesRESERVE BANK OF INDIA (Shivam)nishantarya283No ratings yet

- Indian Banking SystemDocument57 pagesIndian Banking Systemsamadhandamdhar6109100% (1)

- Major Activities of RBIDocument9 pagesMajor Activities of RBIPrateek GuptaNo ratings yet

- Performance of Indian Banking SystemDocument40 pagesPerformance of Indian Banking Systemnikhil mudhirajNo ratings yet

- Unit-Vii Central BankDocument14 pagesUnit-Vii Central Bankadarsh jainNo ratings yet

- Registration For Wiki Conference India 2011Document18 pagesRegistration For Wiki Conference India 2011Jasjeet KaurNo ratings yet

- RESERVE BANK OF INDIA Its Origin, Structure and Function - ReportDocument11 pagesRESERVE BANK OF INDIA Its Origin, Structure and Function - ReportAnirban DebNo ratings yet

- Formatted Introduction To RBIDocument3 pagesFormatted Introduction To RBIParamita HalderNo ratings yet

- The Reserve Bank of IndiaDocument5 pagesThe Reserve Bank of IndiaWilliam SpencerNo ratings yet

- Section B RBIDocument8 pagesSection B RBIAnubhav Chauhan 14No ratings yet

- Central Banking and Monetary PolicyDocument6 pagesCentral Banking and Monetary Policyrishit0504No ratings yet

- Reserve Bank of IndiaDocument15 pagesReserve Bank of IndiaAnkit SinghNo ratings yet

- Role of RbiDocument12 pagesRole of RbiNavneet RanaNo ratings yet

- Central Bank Edit-1Document3 pagesCentral Bank Edit-1Vanlalbiakdiki ChhangteNo ratings yet

- Role of The Reserve Bank of IndiaDocument51 pagesRole of The Reserve Bank of Indiapadmavathi mandry100% (1)

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet