Professional Documents

Culture Documents

Multiple Choice Questions and Answers On FA

Multiple Choice Questions and Answers On FA

Uploaded by

PriyankaMathurOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Multiple Choice Questions and Answers On FA

Multiple Choice Questions and Answers On FA

Uploaded by

PriyankaMathurCopyright:

Available Formats

:: 1 ::

(1)

(2)

(6)

(7)

(8)

(9)

(10)

(11)

(12)

(13)

(14)

(15)

(16)

(17)

(18)

(19)

(20)

(13)

(14)

(15)

(16)

(17)

Special donations are carried to the.of the balance sheet.

Ans. liabilities side

Any profit on the sale of a cricket bat of a club will be taken to.

Ans. income and expenditure account

Cash paid to creditors can be calculated from..

Ans. creditors account

Under the net worth method of single entry the net profit is calculated by comparing

capital in the beginning and capital.

Ans: at the end

Credit sales is computed from.......

Ans. total creditors account

Capital in the beginning is ascertained from .

Ans. opening balance sheet.

Bills receivable endorsed but dishonoured is debited to

Ans. debtors account

Bills receivable received during the year is credited to .

Ans. debtors' account

Bills receivable as endorsed is debited to ..

Ans. creditors' account

Bills payable honoured during the year will be debited to

Ans. bills payable account

Bills payable dishonoured during the year will be credited to

Ans. creditors account.

The amount of interest is credited by the buyer to...

Ans.vendor account

The depreciation in the books of buyer is charged on..

Ans.the cash price

Stock at the shop is debited to

Ans.shop stock account

The goods with customers are transferred from stock in shop account.

Ans. at hire-purchase price

If the rate of gross profit for department X is 25% of the cost and its sales amount to

Rs. 1,00,000, then the amount of gross profit will be equal to

Ans.Rs. 20,000

Repairs to machines in different departments are to be allocated on the basis of....

Ans: actual cost

Under debtors system, the branch account is..

Ans. nominal account.

Petty expenses paid by the branch out of petty cash maintained on imprested

system will be shown on the ..branch account.

Ans.debit side

Under the branch trading and profit and loss account system, the branch account is

of the nature of .

Ans.personal account

Under trading and profit and loss system, the remittances made to the branch

are to the branch account

Ans. Credited

Under trading and profit and loss system, the profits of a branch are.branch

account

:: 2 ::

Ans.debited to branch account

(18) The difference of the two sides of the branch account, under branch trading and

profit and loss account system, shows .. from the branch.

Ans.amount due

(19) Branch adjustment account is in the nature of..

Ans.nominal account

(20) If the branch has collected money from a customer of the head office, then (in the

head office books) branch account is..

Ans.debited

(21) In case of foreign branches, the remittances to and from head office should be

converted at

Ans.actual rate at which the remittances were made.

(22) Cash remitted by branch but not received by the head office is debited by the head

office to

Ans.cash-in-transit account.

(23) Goods sent by the head office to the branch not received by the branch are credited

by H.O. to

Ans.branch account

(24) Goods sent by branch x to branch y, will be debited to

Ans.branch y

(25) Closing stock + cost of goods soldPurchases =

Ans.opening stock

(26) The main object of the average clause is to discourage..

Ans.under insurance

(27) Under the average clause, the loss is suffered by both insurer and insured

a.

Ans.in the ratio of risk covered

(28) Royalty account is in the nature of..

a.

Ans.nminal account

(28) If the right to recoup the shortcomings has expired, they are transferred by the

lessee to

Ans.Profit and loss account

(29) The receipts and payments account records receipts and payments of both apital

and .nature.

Ans.revenue

(30)

Income and Expenditure accunt is a

Ans. nominal account

(31) The income and expenditure account begins with .

Ans. no balance

(16)

(17)

When the lessor receives payment, the credits

(i) Lessee account

(ii) Royalty account

(iii) Short workings account.

Ans.(i) Lessee account

Royalty earned by the lessee is credited to

(i) Sub-lessee account

(ii) Profit and loss account

(iii) Royalty receivable account.

Ans.(iii) Royalty receivable account.

:: 3 ::

(18)

(19)

(20)

(21)

(22)

(23)

(24)

(25)

(26)

The balance of royalty payable account is transferred to

(i) Profit and loss account

(ii) Royalties suspense account

(iii) Production account.

Ans.(iii) Production account.

The balance of royaltys receivable account is transferred to

(i) Profit and loss account

(ii) Royalties suspense account

(iii) Production account.

Ans.(i) Profit and loss account

Under the double account system, the profit and loss account is called

1. Profit and loss account

2. Income and expenditure account

3. Revenue account.

Ans.(iii) Revenue account.

Under the double account system, the profit and loss appropriation account is

called

(i) Net revenue account

(ii) Profit and loss appropriation account

(iii) Profit and loss account.

Ans. (i) Net revenue account

The depreciation on the fixed assets, under the double account system, is shown as

4. Depreciation reserve on the liabilities side of the general balance sheet

5. A deduction from the fixed assets

6. An expenditure on capital account in the first section of the balance sheet.

Ans. (i) Depreciation reserve on the liabilities side of the general balance sheet

Under the double account system, interest on debentures is shown in

(i)Revenue account

(ii) Net revenue account

(iii) Profit and loss account.

Ans.(ii) Net revenue account

Share forfeited account is shown on

7. Liabilities side of the general balance sheet

8. Credit side of the net revenue account

9. Credit side of the receipts and expenditures on capital account

Ans.(iii) Credit side of the receipts and expenditures on capital account

A fixed asset originally acquired for Rs. 20,000 is to be replaced by new one. The

estimated cost of replacement of the original asset is Rs. 30,000. Hence, the

revenue charge equals

(i) Rs. 20,000

(ii) Rs. 10,000

(iii)Rs. 30,000.

Ans. (iii) Rs. 30,000.

A fixed asset originally acquired for Rs. 20,000 is replaced by a new asset costing

Rs. 50,000. But the estimated cost of replacement of the original asset is B Rs.

30,000. Hence, the capital charge equals

10. Rs. 20,000

11. Rs. 50,000

:: 4 ::

(27)

(28)

(29)

12. Rs. 30,000.

Ans.(i) Rs. 20,000

A fixed asset originally acquired for Rs. 20,000 is replaced by a new asset. The

estimated cost of the replacement of the original asset is Rs. 30,000. The sale

proceeds of old material amounted to Rs. 2,000.Hence, the revenue charge equals

(i) Rs. 28,000

(ii) Rs. 18,000

(iii) Rs. 30,000.

Ans.(i) Rs. 28,000

Calls in advance are shown on the

13. Liabilities side of the general balance sheet

14. Expenditure side of receipts and expenditures on capital account

15. Receipts side of receipts and expenditures on capital account.

Ans.(iii) Receipts side of receipts and expenditures on capital account.

Plant and machinery is shown on the

(i) Assets side of the general balance sheet

(ii) Expenditure side of the receipts and expenditures on capital account

(iii) Receipts side of the receipts and expenditures on capital account.

Ans.(ii) Expenditure side of the receipts and expenditures on capital account

:: 5 ::

(30)

(31)

(32)

(33)

(34)

(35)

(36)

(37)

The value of goodwill, according to the simple profit method, is

16. The product of current year's profit and number of years

17. The product of last year's profit and number of years

18. The product of average profits of the given years and number of years.

Ans.(iii)The product of average profits of the given years and number of years.

The goodwill of a business is to be valued at 3 years' purchase of the average

profits of the last three years. The profits of the last three years are Rs. 5,000, Rs.

6,000 and Rs. 7,000 respectively. Hence, the goodwill be valued at

(i) Rs. 18,000

(ii) Rs. 12,000

(iii) Rs. 15,000.

Ans. (i) Rs. 18,000

A business has a capital of Rs. 40,000 at the end. It had earned profits of Rs. 5,000

during the year. Hence, the average capital of the business will be

(i) Rs. 42,500

(ii) Rs. 37,500

(iii) Rs. 35,000.

Ans.(ii) Rs. 37,500

If the average capital of a business is Rs. 60,000 and the normal rate of profit is

15%, then the normal profits will amount to

(i) Rs. 10,000

(ii) Rs. 9,000

(iii) Rs. 15,000.

Ans.(ii) Rs. 9,000

If the super-profits of a business are Rs. 6,000 and the normal rate of profit is 10%,

then the amount of goodwill as per the capitalisation method will be

(i)Rs. 60,000

(ii) Rs. 600

(iii) Neither of the two.

Ans.(i)Rs. 60,000

It is given that net assets available for equity and preference shares amount to Rs.

90,000. The paid up capitals are 10,000 equity shares of Rs. 2 each and 5,000

preference shares of Rs. 10 each. Therefore, value of an equity share will be

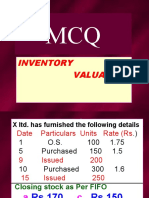

(i) Rs. 2 per share

(ii) Rs. 4 per share

(iii) Rs. 5 per share.

Ans.(ii) Rs. 4 per share

It is given that net assets available for equity and preference shares amount to

Rs. 1,87,000. The paid-up capitals are10,000 equity shares of Rs. 4 each and

5,000 preference shares of Rs. 10 each. Therefore, value of a preference share will

be (i) Rs. 10 per share

(ii) Rs. 8 per share

(iii) Rs. 20 per share.

Ans.(iii) Rs. 20 per share.

Under the yield method of valuation of equity share capital, if for an equity share

of Rs. 50, the normal rate of return is 10% and the expected rate of return is 5%,

then the value of an equity share will be

19. Rs. 25

20. Rs. 50

:: 6 ::

(38)

(39)

(40)

(41)

(42)

(43)

(44)

(45)

21. Rs. 100.

Ans.(i) Rs. 25

For calculating the value of an equity share by intrinsic value method, it is

essential to know

(i) Normal rate of return

(ii) Expected rate of return

(iii) Net equity.

Ans.(iii) Net equity.

For calculating the value of an equity share by yield method, it is essential to know

(i)Expected rate of return

(ii) Called-up equity share capital

(iii) Capital employed.

Ans. (i) Expected rate of return

For calculating price-earnings ratio, it is essential to know

(i) Market value per share

(ii) Nominal value per share

(iii) Paid-up value per share.

Ans.(i) Market value per share

For calculating the value of an equity share by earning capacity method, it is

essential to know

(i)Nominal value per share

(ii) Rate of earning

(iii) Dividend per share.

Ans.(ii) Rate of earning

A Ltd. and B Ltd. go into liquidation and a new company X Ltd. is formed. It is a

case of

(i) Absorption

(ii) External reconstruction

(iii) Amalgamation.

Ans.(iii) Amalgamation.

X Ltd. goes into liquidation and a new company Z Ltd. is formed to take over the

business of X Ltd. It is a case of

(i) Absorption

(ii) External reconstruction

(iii) Amalgamation.

Ans.(ii) External reconstruction

X Ltd. goes into liquidation and an existing company Z Ltd. purchases the business

of X Ltd. It is a case of

(i) Absorption

(ii) External reconstruction

(iii) Amalgamation.

Ans.(i) Absorption

Accumulated profits include

(i) Provision for doubtful debts

(ii) Superannuation fund

(iii) Workmen's compensation fund.

Ans.(iii) Workmen's compensation fund.

:: 7 ::

(46)

(47)

(48)

(49)

(50)

(51)

(52)

(53)

Liabilities (not accumulated profits) of a company include

(i) General reserve

(ii) Pension fund

(iii) Dividend equalisation fund.

Ans. (ii) Pension fund

When the expenses of liquidation are to be borne by the vendor company, then the

vendor company debits

(i) Realisation account

(ii) Bank account

(iii) Goodwill account.

Ans. (i) Realisation account

When the expenses of liquidation are to be borne by the purchasing company, then

the purchasing company debits

(i) Vendor company's account

(ii) Bank account

(iii) Goodwill account.

Ans. (iii) Goodwill account.

When the purchasing company makes payment of the purchase consideration, it

debits

(i) Business purchase account

(ii) Assets account

(iii) Vendor company's account.

Ans. (iii) Vendor company's account.

The vendor company transfers preliminary expenses (at the time of absorption) to

(i) Equity shareholders' account

(ii) Realisation account

(iii) Purchasing company's account.

Ans. (i) Equity shareholders' account

For paying liabilities not taken over by the purchasing company, the vendor

company credits

(i) Realisation account

(ii) Bank account

(iii) Liabilities account.

Ans.(ii) Bank account

In case of inter-company holdings, the purchasing company, at the time of payment

of the purchase consideration, surrenders the shares in the vendor company by

crediting

(i) Vendor company's account

(ii) Shares in the vendor company account

(iii) Share capital account.

Ans.(ii) Shares in the vendor company account

The share capital, to the extent already held by the purchasing company, is closed

by the vendor company by crediting it to

(i) Share capital account

(ii) Purchasing company's account

(iii) Realisation account.

Ans.(iii) Realisation account.

:: 8 ::

(54)

(55)

(56)

(57)

(58)

(59)

(60)

(61)

In case of sub-division of share capital the total number of shares

(i) Increases

(ii) Decreases

(iii) Does not change.

Ans.(i) Increases

If the shares of smaller denomination-are converted into the shares of higher

denomination without changing the total amount of share capital, then it is a case

of

(i) Consolidation of share capital

(ii) Sub-division of share capital

(iii) Decrease in unissued share capital.

Ans.(i) Consolidation of share capital

When a company converts its equity shares into the capital stock, then the account

to be credited is

(i)Equity share capital account

(ii) Equity capital stock account

(iii) No entry is required.

Ans.(ii) Equity capital stock account

A Ltd. with a share capital of 10,000 equity shares of Rs. 10 each fully paid

decides to repay Rs. 5 per share thus making each share of Rs. 5 fully paid. It is a

case of

(i) Reducing share capital by returning the excess capital

(ii) Reducing the liability on account of uncalled capital

(iii) Reducing the paid-up capital.

Ans.(i) Reducing share capital by returning the excess capital

For writing off the accumulated Josses under the scheme of capital reduction, we

debit

(i) Share capital account

(ii) Accumulated losses account

(iii) Capital reduction account.

Ans.(iii) Capital reduction account.

If there is any balance in the capital reduction account after writing off all the

accumulated losses, then the same is transferred to

22. Share capital account

23. Capital reserve account

24. General reserve account.

Ans.(ii) Capital reserve account

A company has issued capital of 10,000 equity shares of Rs. 10 each fully paid. It

decides to convert its capital into 20,000 equity shares of Rs. 5 each. It is a case of

(i) Consolidation of share capital

(ii) Sub-division of share capital

(iii) Decrease in unissued share capital.

Ans.(ii) Sub-division of share capital

If the creditors are willing to reduce their claims against the company, (hen the

amount of reduction in their claim will be transferred to

(i) Share capital account

(ii) Creditors account

(iii) Capital reduction account.

Ans.(iii) Capital reduction account.

:: 9 ::

(62)

(63)

(64)

(65)

(66)

(67)

(68)

(69)

Any loss on revaluation of the assets at the time of internal reconstruction, will be

charged from

(i) Revaluation account

(ii) Share capital account

(iii) Capital reduction account.

Ans.(iii) Capital reduction account.

A contingent liability, not provided for, materialised to the extent of Rs. 1,000. The

insurance company paid Rs. 600 in respect of this liability. Hence, the amount to

be charged from the capital reduction account will be

(i) Rs. 600

(ii) Rs. 400

(iii) Rs. 1,000.

Ans.(ii) Rs. 400

A banking company can pay dividend on its shares without writing off

(i) Preliminary expenses

(ii) Brokerage

(iii) The bad debts (provided adequate provision has been made).

Ans.(iii) The bad debts (provided adequate provision has been made).

It is given that the paid-up capital, reserves and share premium account have

balances amounting to Rs. 10,00,000 Rs. 9,00,000 and Rs. 1,50,000 respectively. It

is also given that the profits of the company for the current year are Rs. 1,00,000.

ft should make a transfer of

(i) Rs. 30,000 to statutory reserve

(ii) Rs. 25,000 to statutory reserve

(iii) May be exempted from making such transfer.

Ans.(iii) May be exempted from making such transfer.

Provision for bad debs and doubtful debts is

(i) Not shown anywhere in the published accounts of a banking company

(ii) Shown on the debit side of the profit and loss account

(iii) Shown as a deduction from the interest and discount income on the credit side

of profit and loss account.

Ans.(i) Not shown anywhere in the published accounts of a banking company

Rebate on biffs discounted account is a

(i) Real account

(ii) Personal account

(iii) Nominal account.

Ans.(ii) Personal account

If the balance of rebate on bills discounted is given in the trial balance, it will be

taken to

(i) Debit side of the profit and Joss account

(ii) Credit side of the profit and loss account as a deduction from interest and

discount

(iii) Liabilities side of the balance-sheet.

Ans.(iii) Liabilities side of the balance-sheet.

Money at call and short notice is shown

(i) On the liability side of the balance sheet

(ii) On the asset side of the balance sheet

(iii) It is a contra item.

Ans.(ii) On the asset side of the balance sheet

:: 10 ::

(70)

(71)

(72)

(73)

(74)

(75)

(76)

(77)

Provision for taxation is shown

(i) On the debit side of the profit and loss account

(ii)As a deduction from interest and discount on the credit side of the profit and

loss account

(iii)On the asset side of the balance sheet.

Ans. (ii) As a deduction from interest and discount on the credit side of the profit

and loss account

Loans, cash credits and overdrafts are shown

(i) On the asset side of the balance sheet

(ii) On the liability side of the balance sheet

(iii) These are contra items.

Ans.(i) On the asset side of the balance sheet

Bills discounted and purchased are shown

(i) On the asset side of the balance sheet

(ii) On the liability side of the balance sheet

(iii) Neither of the two sides.

Ans.(i) On the asset side of the balance sheet

Deposits and other accounts are shown

(i) On the asset side of the balance sheet

(ii) On the liability side of the balance sheet

(iii) These are contra items.

Ans.(ii) On the liability side of the balance sheet

A general insurance company carrying on two or more types of business prepares

only

(i) Revenue accounts in respect of different businesses

(ii) Profit and loss account (including appropriation account)

(iii) Separate revenue accounts for each type of business and combined profit and

loss account.

Ans.(iii) Separate revenue accounts for each type of business and combined profit

and loss account.

Reserve for unexpired risks appearing outside the trial balance under adjustments

is

25. Shown on the debit side of the revenue account and liabilities side of the

balance sheet

26. Shown on the credit side of the revenue account and asset side of the balance

sheet

27. Shown as a contra item in the balance sheet.

Ans. (i) Shown on the debit side of the revenue account and liabilities side of the

balance sheet

Reinsurance premium is shown

28. On the debit side of revenue account

29. On the liability side of the balance sheet

30. As deduction from the premiums on the credit side of the revenue account.

Ans.(iii) As deduction from the premiums on the credit side of the revenue

account.

Expenses of management (not applicable to any particular business) are shown in

(i) Revenue account

(ii) Profit and loss account

:: 11 ::

(78)

(79)

(80)

(81)

(82)

(83)

(84)

(iii) Profit and loss appropriation account.

Ans.(ii) Profit and loss account

Transfer fees are credited to

(i) Revenue account

(ii) Profit and loss account

(iii) Profit and loss appropriation account.

Ans.(ii) Profit and loss account

Legal fees in respect of claims are shown in

(i) Revenue account

(ii) Profit and loss account

(iii) Profit and loss appropriation account.

Ans.(i) Revenue account

It is given that claims paid during the year amounted to Rs. 1,00,000. The claims

outstanding in the beginning and at the end were Rs. 15,000 and Rs. 10,000

respectively. Hence, the amount to be debited to revenue account will be

(i) Rs. 1,00,000

(ii) Rs. 1,15,000

(iii) Rs. 95,000.

Ans.(iii) Rs. 95,000.

It is given that additional reserve for unexpired risks was Rs. 50,000 in the

beginning of the year. The net premium for the current year were Rs. 4,00,000 and

the additional reserve for unexpired risks was to be increased by 5% of the net

premiums. Hence, the amount of the additional reserve will be

(i) Rs. 20,000

(ii) Rs. 50,000

(iii) Rs. 70,000.

Ans.(iii) Rs. 70,000.

It is given that the balance being profit of the last year amounted to Rs. 80,000.

During the current year, the business suffered a loss of Rs. 20,000 and dividends

amounting to Rs. 15,000 were paid in respect of the previous year. Hence, the

profit and loss appropriation account will be credited by

(i) Rs. 65,000

(ii) Rs. 45,000

(iii) Rs. 80,000.

Ans.(i) Rs. 65,000

It is given that premiums, reinsurance premiums and commission on reinsurance

ceded amounted to Rs. 10,00,000, Rs. 50,000 and Rs. 30,000 respectively. Hence,

premiums will be shown in the revenue account at

31. Rs.10,00,000

32. Rs. 9,50,000

33. Rs. 9,20,000.

Ans.(ii) Rs. 9,50,000

Postulates of Accounting are:

(i) Exchange

(ii) Period

(iii) Unit of measure

(iv) All of these

Ans.(iv) All of these

:: 12 ::

(85)

(86)

(87)

(88)

(89)

(90)

(91)

(92)

(93)

Meaning of Net Assets is :

(i) Total Assets Total Liabilities

(ii) Fixed Assets + Current Assets

(iii) Total Assets Current Liabilities

(iv) Total Assets Outside Liabilities

Ans.(iv) Total Assets Outside Liabilities

Valuation of closing stock is to be made:

(i) on cost price

(ii) on market price

(iii) cost price or market price, whichever is less

(iv) None of these

Ans.(iii) cost price or market price, whichever is less

According to the cost concept, the assets are always valued at :

34. on cost price

35. on market price

36. on purchase price

37. None of these

Ans.(iii) on purchase price

Under Hire Purchase System depreciation is charged :

(i) On cash price

(ii) Hire purchase price

(iii) Market price

(iv) None of these

Ans.(i) On cash price

Hirer charges depreciation on:

(i) Hire purchase price

(ii) Cash price.

(iii) Lower of the two

(iv) None of these

Ans.(ii) Cash price.

What is transferred to Hirer under hire purchase system :

(i) Ownership of assets

(ii) Possession of asset

(iii) Ownership and possession of asset

(iv) None of these

Ans.(ii) Possession of asset

Hire Purchase Act is :

(i) 1932

(ii) 1956

(iii) 1972

(iv) 1872

Ans.(iii) 1972

The Sale of Goods Act is applicable in: (i) Credit Purchases (ii) Cash Purchases

(iii) Cash Sales (iv) None of these

Ans.(i)Credit Purchases

What is transferred to Hirer under Instalment Payment system :

(i) Ownership of Assets

(ii) Possession of Assets

(iii) Ownership and Possession of assets

:: 13 ::

(iv) None of these.

Ans.(iii) Ownership and Possession of assets

(94) Branch Adjustment Account is prepared:

(i) By Dependent Branch

(ii) By H.O. of Dependent Branch

(iii)By H.O. of Independent Branch

(iv) None of these

Ans.(ii) By H.O. of Dependent Branch

(95) Which account is prepared to find out the amount of closing stock:

(i) Head Office A/c

(ii) Branch A/c

(iii) Memorandum Stock A/c

(iv) None of these

Ans.(iii) Memorandum Stock A/c)

(96) Branch account under debtor system is:

(i) Real account

(ii) Personal account

(iii) Nominal account

(iv) None of these

Ans.(iii) Nominal account

(97) Branch Adjustment account is in the nature of :

(i) Real account

(ii) Nominal account

(iii) Personal account

(iv) None of these

Ans.(ii) Nominal account

(98) In foreign branch fixed assets shall be converted at:

(i) Opening rate

(ii) Average rate

(iii) Rate of the date of purchase

(iv) None of these

Ans.(i) Opening rate

(99) By what rate the balance of H.O. a/c is converted in foreign branch :

(i) Opening rate

(ii) Closing rate

(iii) Average rate

(iv) None of these

Ans.(iv) None of these

(100) The Gross Profit of a business being Rs. 3 lakh and the amount of loss of Profit

Policy being Rs.1,50,000 then the claim for loss Rs. 20,000 will reduce to :

(i) Rs. 12,000

(ii)Rs. 15,000

(iii) Rs. 20,000

(iv) None of these.

Ans.(ii) Rs. 15,000

(101) Loss of Profit Policy indemnity :

(i) Capital Loss

(ii) Revenue Loss

(iii) Budgeted Loss

:: 14 ::

(102)

(103)

(104)

(105)

(106)

(107)

(108)

(109)

(iv) Gross Loss.

Ans.(iii) Budgeted Loss

The value of closing stock Rs. 72,000, the amount of the Policy was Rs. 63,000,

the Actual loss of stock Rs. 54,000, there was an average clause in the Policy.

Calculate the amount of claims:

(i) Rs. 47,250

(ii)Rs. 54,000

(iii)Rs.72,000

(iv) None of these

Ans.(i) Rs. 47,250

The rate of Gross Profit on sales is 20%. Sales up to date of fire amounted to Rs.

1,00,000. Find Amount of Gross Profit:

(i) Rs. 20,000

(ii) Rs. 25,000

(iii)Rs. 50,000

(iv) None of these

Ans.(i) Rs. 20,000

The rate of Gross Profit on cost of sales is 25%. Sales up to date of fire amounted

to Rs. 1,00,000. Find amount of Gross Profit:

(i) Rs. 20,000

(ii) Rs. 25,000

(iii) Rs. 50,000

(iv) None of these

Ans.(i) Rs. 20,000

Excess of assets over liabilities is called :

(i) Creditors

(ii) Profit

(iii) Capital

(iv) Goodwill

Ans.(iii) Capital

Amount of Drawings is added at the time of finding out profit in single entry

system:

(i) In closing capital

(ii) In opening capital

(iii) Not in any capital.

Ans. (i) In closing capital

The amount of additional capital is deducted at the time of finding out profit in

Single Entry System:

(i) from closing capital

(ii) from opening capital

(iii) not from any capital.

Ans.(i) from closing capital

Following records are made in single entry system, give correct answer:

(i) Only in cash book

(ii) In ledger, posting of personal accounts only

(iii) records in cash book and posting of only personal accounts in ledger.

Ans.(iii). records in cash book and posting of only personal accounts in ledger.

Meaning of single entry system of Book-keeping is:

(i) Only one entry for each transaction.

:: 15 ::

(110)

(111)

(112)

(113)

(114)

(115)

(116)

(117)

(ii) Incomplete double entry system

(iii) Both entries only in accounts

Ans.(ii). Incomplete double entry system

Single entry system of book-keeping system:

(i) is best system

(ii) is scientific system

(iii) is incomplete system

(iv) is most popular system.

Ans.(iii) is incomplete system

Liabilities and assets respectively are Rs. 87,000 and Rs. 92,000. Amount of

difference will be:

(i) Creditors

(ii) Debentures

(iii) Profit

(iv) Capital

(v) None out of these.

Ans.(iv) Rs. 5,000 Capital.

To find out the opening and closing capitals, statement of affairs are prepared:

(i) One

(ii) Two

(iii) Four.

Ans.(ii) Two.

The expenses which are not departmental:

(i) are charged to departments in sales ratio.

(ii) are charged to departments in the ratio of assets employed thereto.

(iii) are charged to general profit and loss account.

Ans. (iii) are charged to general profit and loss account.

Cum-dividend quotation of shares means that the quotation includes:

(i) dividend which may be declared in future.

(ii) dividend declared recently but not yet paid.

(iii) nothing else but the price of the share.

Ans. (ii) dividend declared recently but not yet paid.

A quotation is ex-interest when :

(i) the interest to the date of transaction is to be paid in addition to the settled price.

(ii) interest has already been deducted from the price.

(iii) no adjustment is necessary for interest.

Ans.(i) the interest to the date of transaction is to be paid in addition to the settled

price.

Interest is calculated on:

(i) market price of securities

(ii) purchase price of securities

(iii) book value of securities

(iv) face value of securities.

Ans.(iv) face value of securities.

Meaning of ex-interest price of investment is :

(i) market price + interest

(ii) market price interest

(iii) market price

(iv) none out of these

:: 16 ::

(118)

(119)

(120)

(121)

(122)

(123)

(124)

(125)

Ans.(ii) market price interest

The amount of goodwill is paid by the new partner:

(i) For getting share in future profits

(ii) For Paying Entry Fee

(iii) For Paying Capital

(iv) For getting right over assets.

Ans.(i) For getting share in future profits

The value of goodwill is the highest of:

(i) Dog Goodwill

(ii) Rat Goodwill

(iii) Cat Goodwill

(iv) All the above

Ans.(iii) Cat Goodwill

The present value of annuity of Re. 1 for 8 years at 10% is Rs. 2.487. Super profit

is Rs. 22,000. The amount of goodwill will be :

(i) Rs. 5,471

(ii) Rs. 2,200

(iii) Rs. 71,745

(iv) Rs. 54,714

Ans.(iv) Rs. 54,714

Weighted average profit method is suitable :

(i) When there is stability in profits

(ii) When there is unstability in profits

(iii) When there is increase in profits gradually

(iv) When there is decrease in profits gradually

Ans.(iii) When there is increase in profits gradually

The method of valuation of shares is:

(i) Goodwill Valuation Method

(ii) Income Valuation Method

(iii) Profit Valuation Method

(iv) All the above

Ans.(ii) Income Valuation Method

In comparison to face value, the valuation of shares is usually:

(i) More

(ii) Less

(iii) Equal

(iv) Less or More.

Ans.(iv) Less or More

When value of shares is found out on the basis of its dividend or expected

dividend, it is called :

(i) Asset Valuation Method

(ii) Yield or Income Valuation Method

(iii) Fair Value Method

(iv) None of the above.

Ans.(ii) Yield or Income Valuation Method

The most appropriate method of valuation of shares from the point of view of

investor is :

(i) Net Assets method

(ii) Income Valuation Method

:: 17 ::

(126)

(127)

(128)

(129)

(iii) Net Asset and Income Method

(iv) None of the above.

Ans.(ii) Income Valuation Method

In respect of the valuation of shares, the employed capital means:

(i) Cost price of all the assets

(ii) Market value of all the assets

(iii) Book value of all the assets]

(iv) All the above values

Ans.(ii) Market value of all the assets

The value of per shares on division of amount of net assets by number of share will

be :

(i) Intrinsic Value

(ii) Book Value

(iii) Cost Price

(iv) Market Value

Ans.(i) Intrinsic Value

When one company goes in liquidation and a new company is formed to take over

the business of the company which goes in liquidation, this is called :

(i) Amalgamation

(ii) Absorption

(iii) External Reconstruction

(iv) Internal Reconstruction

Ans.(iii) External Reconstruction

In internal reconstruction :

(i) No company goes into liquidation

(ii) Only one company goes into liquidation

(iii) Two or more companies are liquidated

(iv) One or more companies go into liquidation

Ans.(i) No company goes into liquidation.

:: 18 ::

(130) If the net assets taken over by the company are less than the purchase

consideration, the difference shall be treated as :

(i) Secret Reserve

(ii) Goodwill

(iii) Capital Reserve

(iv) General Reserve

Ans.(ii) Goodwill

(131) Interest on debentures is recorded in :

(i) Capital account

(ii) Net Revenue account

(iii) Revenue account

(iv) Not in any account

Ans.(ii) Net Revenue account

(132) Interest on bank loan is recorded in :

(i) Revenue account

(ii) Net revenue account

(iii) Capital Account

(iv) Not in any account

Ans.(ii) Net revenue account

(133) Equity share capital is recorded in :

(i) General balance Sheet

(ii) Net Revenue account

(iii) Capital account

(iv) Not in any account

Ans.(iii) Capital account

(134) When was banking company regulation act implemented?

(i) 1947

(ii) 1949

(iii) 1950

(iv) 1956

Ans.(ii) 1949

(135) How many schedules are there in the amended from of Final Account of Banking

Company:

(i)

8

(ii) 10

(iii) 12

(iv) 16

Ans.(iv) 16

(136) What is the rate of statutory reserve to be maintained under section 17 of Banking

Company Act?

(i) 10% of Net Profit

(ii) 15% of Net Profit

(iii) 20% of Net Profit

(iv) 30% of Net Profit

Ans.(iii) 20% of Net Profit

(137) In which year 14 Banks were Nationalised?

(i) 1969

:: 19 ::

(138)

(139)

(140)

(141)

(142)

(143)

(215)

(ii) 1971

(iii) 1973

(iv) 1977

Ans.(i) 1969

Paid up capital of a bank should not be less then the following percentage of

subscribed capital :

(i) 25%

(ii) 50%

(iii) 75%

(iv) 100%

Ans.(ii) 50%

If nothing is given) What is the percentage maintained by Marine Insurance

companies for Reserve for Unexpired Risk :

(i) 40% of Net Premium

(ii) 50% of Net Premium

(iii) 60% of Net Premium

(iv) 100% of Net Premium.

Ans.(iv) 100% of Net Premium.

When were General Insurance Companies nationalised:

38. 1955

39. 1969

40. 1971

41. 1973

Ans.(iii) 1971

(If nothing is given) What is the percentage maintained for Additional Reserve :

(i) 10% of Net Premium

(ii) 20% of Net Premium

(iii) 0% of Net Premium

(iv) 25% of Net Premium

Ans.(iii) 0% of Net Premium

(If nothing is given) What is the percentage maintained by Insurance Companies

other than Marine Insurance Company for Reserve for unexpired risk:

(i) 40% of Net Premium

(ii) 50% of Net Premium

(iii) 45% of Net Premium

(iv) 100% of Net Premium

Ans.(ii) 50% of Net Premium

Medical expenses regarding claims are added to:

(i) Claims

(ii) Premium

(iii) Management Exp.

(iv) None of above

Ans.(i) Claims

Livestock in the case of mixed farming is

i. a fixed asset.

ii. a current asset

iii. a wasting asset.

iv. a tangible asset.

Ans. ii. a current asset

:: 20 ::

(216) Crops are valued at

i. market price.

ii. cost price.

iii. capitalised value.

iv. economic value.

Ans. i. market price.

(217) Final accounts of a farmer can be prepared under

i. single entry method.

ii. double entry method.

iii. both single and double entry methods.

iv. none of the above.

Ans. iii. both single and double entry methods.

(218) The cash book usually maintained by the fanner is

i. petty cash book.

ii. two-column cash book.

iii. analytical cash book.

iv. three column cash book.

Ans. iii. analytical cash book.

(219) Livestock purchased will figure in

i. the balance sheet.

ii. the trading account.

iii. the profit and loss account.

iv. the current account.

Ans. ii. the trading account.

(220) Grain consumed by livestock will figure

i. in the livestock account.

ii. in the crop account.

iii. both in the livestock and crop account.

iv. none of the above.

Ans. iii. both in the livestock and crop account.

(221) Which one of the following is the criterion, as per AS-7, for determining the

percentage of completion of contract?

i. Proportion of progress payments received to total contract price.

ii. Proportion of work certified to total contract price.

iii. Proportion of costs Incurred to date to the estimated total contract costs.

iv. Proportion of time taken so far to the total estimated time needed to complete

the contract.

Ans. iii. Proportion of costs incurred to date to the estimated total contract costs.

(222) Notional profit on a contract is Rs. 90,000 and 60% of contract is completed. The

customer pays 80% of work certified. The amount of profit to be reserved for

contingencies is

i. Rs. nil.

ii. Rs.36.000.

iii. Rs. 18.000.

iv. Rs. 42.000.

Ans. iv. Rs. 42.000.

(223) The estimated loss on a contract is Rs. 100 lakhs. For the accounting year ended

31st December 1999, the loss computed on the contract which is 70% completed is

Rs. 60 lakh. The loss to be provided as per AS-7 is

:: 21 ::

(224)

(225)

(226)

(227)

(228)

(229)

(230)

i. Rs. 100 lakhs.

ii. Rs. 40 lakh.

iii. Rs. 30 lakhs.

iv. Rs. nil.

Ans. ii. Rs. 40 lakh.

Progress payments and advances received from customers, in respect of contracts

in relation to work performed, are disclosed in financial statements as

i. a liability.

ii. a deduction from the work-in-progress of the contract.

iii. (i) or (ii).

iv. suspense account.

Ans. iii. (i) or (ii).

Consequential loss policy indemnifies

i. Capital losses

ii. Revenue losses

iii. Budgeted losses

iv. Capital and revenue losses

Ans. ii. Revenue losses

Fire Insurance provides cover for

i. Tangible assets

ii. Intangible assets

iii. Fictitious assets

iv. both tangible and Intangible

Ans. i. Tangible assets

With the opening stock at Rs. 13,500, purchases at Rs. 82,500. sales at Rs.

l,20,000and stock salvaged at Rs. 1,260, the rate of gross profit being 50% on cost,

the stock destroyed in fire will be

i. Rs. 14,740

ii. Rs. 24,740

iii. Rs. 36,000

iv. Rs. 40,000

Ans. i. Rs. 14,740

The average clause in a loss of profits policy protects the

i. Insured

ii. Insurer

iii. Workers

iv. Tax authorities

Ans. ii. Insurer

If indemnity period is six months, standard turnover Rs. 20,000, annual turnover

Rs. 50,000, turnover during indemnity period Rs. 8,000. short sales will amount to

i. Rs. 30,000

ii. Rs. 12,000

iii. Rs. 42,000

iv. Rs. 50,000

Ans. ii. Rs. 12,000

A fire insurance policy is taken up to indemnify

i. Capital losses to tangible property

ii. Revenue losses to tangible property

iii. Capital losses to intangible property

:: 22 ::

(231)

(232)

(233)

(234)

(235)

(236)

(237)

iv. Revenue losses to intangible property.

Ans. i. Capital losses to tangible property

Rent and rates are apportioned to different departments on the basis of

i. Floor area occupied

ii. number of workers

iii. sales of each department

iv. value of the assets kept

Ans. i. Floor area occupied

The turnover ratio is used for the allocation of

i. income tax

ii. bad debts

iii. depreciation

iv. staff welfare expenses

Ans. ii. bad debts

Department A produced 1,000 units at a cost of Rs. 2,000 (excluding interdepartmental transfer costs) and B produced 2,000 units at a cost of Rs. 10,000

(excluding inter-departmental transfer costs). Each department transferred to the

other department at cost one-fourth of its production to be used as raw material.

Total cost of department A is

i. Rs.4.500

ii. Rs.4.625

iii. Rs.3.200

iv. Rs.4,800

Ans. iv. Rs.4,800

Provision for unrealised profit with respect to stocks when transfers are effected at

transfer price is to be charged to

i. departmental trading account

ii. departmental profit and loss account

iii. either (i) or (ii)

iv. general profit and loss account

Ans. iv. general profit and loss account

Branch account under debtors system is a

i. real account

ii. nominal account

iii. personal account

iv. representative personal account.

Ans. ii. nominal account

Branch account under stock and debtors system is a

i. real account

ii. nominal account

iii. personal account

iv. representative personal account

Ans. i. real account

When branch 'A' sends goods to branch 'B' in the books of branch 'A' debit is given

too

i. head office account

ii. branch 'B' account

:: 23 ::

(238)

(239)

(240)

(241)

(242)

(243)

(244)

iii. sales return account

iv. sales returns account

Ans. i. head office account

The cash and credit sales of a branch are Rs, 5,000 and Rs. 10,000 respectively.

The amount collected from debtors is Rs. 10.000. Under debtors system the

amount credited to branch will be

i. Rs. 20,000

ii. Rs. 15,000

iii. Rs. 25,000

iv. Rs. 10,000

Ans. ii. Rs. 15,000

Goods are sent to the branch at 20% margin on selling price. When branch stock

discloses a surplus of Us. 2.000 the amount to be credited to branch adjustment

account (above the line) will be

i. Rs. 2,000

ii. Rs. 400

iii. Rs. 333

iv. Rs. 1,600

Ans. ii. Rs. 400

Goods sent by the head office to the branch but not received by the branch before

the close of financial year are credited by head office to

i. branch account

ii. trading account

iii. goods sent to branch account

iv. goods-in-transit account

Ans. i. branch account

When a branch purchases fixed assets and the asset account is to be kept in the

books of head office, the branch makes the following entry.

i. debits head office credits bank

ii. debits branch credits head office

iii. debits head office credits branch asset

iv. debits branch asset credits bank

Ans. i. debits head office credits bank

Depreciation on branch assets under debtors system is

i. not shown separately in branch account

ii. shown in branch account

iii. not accounted

iv. shown in the profit and loss account of head office.

Ans. i. not shown separately in branch account

Stock reserve in relation to closing stock appears

i. on the debit side of branch account

ii. on the credit side of branch account

iii. on the debit side of profit and loss account

iv. on the credit side of the profit and loss account

Ans. i. on the debit side of branch account

The lessee's right to recover the short working is related lo

i. first five years

ii. last three years

iii. terms of the agreement

:: 24 ::

(245)

(246)

(247)

(248)

(249)

(250)

(251)

iv. none of the above.

Ans. iii. terms of the agreement

In the books of lessee, short workings recoverable in future years are

i. a revenue expense

ii. a normal loss

iii. an asset

iv. a liability.

Ans. iii. an asset

In the event of recoupment of short workings, the lessor

i. debits landlord's account

ii. credits sub-lessee's account

iii. debits short workings account

iv. debits profit, and loss account.

Ans. iii. debits short workings account

In the books of lessor short workings irrecoverable are to be

i. credited to profit and loss account

ii. debited to profit and loss account

iii. credited to Trading account

iv. credited to short workings account.

Ans. iv. credited to short workings account.

In case the right to recoup short workings has expired the balance in short

workings account is transferred by lessee to

i. profit and loss account

ii. landlord's account

iii. minimum rent account

iv. short workings suspense account.

Ans. i. profit and loss account

When short workings are lo be recovered by a sublessee the account to be debited

is

i. lessee's account

ii. short workings account

iii. profit and lessee's account

iv. none of the above.

Ans. i. lessee's account

Under instalment system of purchase, interest suspense account in the books of the

buyer is

i. Debited with the difference between instalment price and cash price.

ii. Credited with the difference between instalment price and cash price.

iii. Debited with the interest payable in respect of instalments due.

iv. Debited with the interest payable in respect of instalments not due.

Ans. i. Debited with the difference between instalment price and cash price.

Under the hire-purchase system the buyer becomes the owner of goods :

i. Immediately after the delivery of goods.

ii. Immediately after the down payment.

iii. Immediately after the first instalment is paid.

iv. Immediately after the payment of last instalment.

Ans. iv. Immediately after the payment of last instalment.

:: 25 ::

(252) A Ltd. sells 100 machines Costing Rs. l,000 at Rs. 1,500 each on Hire-purchase

basis instalment due and received during the period Rs. 9,00,000. The Hirepurchase profit for the period is

i. Rs. 9,00,000

ii. Rs. 50,000

iii. Rs. 30,000

iv. Rs. 15,00,000

Ans. iii. Rs. 30,000

(253) Stock out on hire at cost price is ascertained by

i. Deducting the gross profit margin from instalments not due and unpaid.

ii. Taking the cost in the proportion of paid instalments to total instalments.

iii. Taking the cost in the proportion of value of unpaid instalments to HirePurchase price.

iv. None of the above.

Ans. i. Deducting the gross profit margin from instalments not due and unpaid.

(254) A Ltd. sells 100 machines at Hire-purchase price of Rs. 1,500 payable Rs. 300

Cash down and the balance in 12 instalments equally. 400 instalments became due.

Cash received was Rs. 65,000. instalments due and unpaid are

i. Rs. 40,000

ii. Rs. 5,000

iii. Rs. 80,000

iv. Rs. 85,000

Ans. ii. Rs. 5,000

(255) A tape-recorder was sold at a hire-purchase price of Rs. 1,200, payable in 12 equal

instalments. The buyer paid 4 instalments and the tape-recorders was repossessed

after 7th instalment balance due. The repossessed tape-recorders were valued at

Rs. 850 and its original cost was Rs. 900. Profit on repossession is

i. Rs. 50

ii. () Rs. 50

iii. 400.

iv. Rs. 350.

Ans. i. Rs. 50

(256) Under the net worth method the bases for ascertaining the profit is

i. the difference between the capital on two dates

ii. the difference between the gross assets on two dates

iii. the difference between the liabilities on two dates.

iv. the difference between capital assets and liabilities at close

Ans. i. the difference between the capitals on two dates

(257) Under the net worth method any additions to capital during the accounting period

must be

i. added to profit

ii. subtracted from profit

iii. added to capital

iv. deducted from capital.

Ans. ii. subtracted from profit

(258) Cash received from debtors needed for the construction of cash account can be had

from.

i. total debtors account

ii. balance sheet

:: 26 ::

(259)

(260)

(261)

(262)

(263)

(264)

iii. analysis of cash book

iv. pass book.

Ans. i. total debtors account

Given the opening and closing balances of debtors and the figure of credit sales,

the balancing figure of total debtors account will give

i. bill retired during the year

ii. cash received from debtors

iii. closing balance of bills receivable

iv. bills received during the year.

Ans. ii. cash received from debtors

The closing balance of trade debtors can be located from

i. total debtors account

ii. balance sheet

iii. bills receivable account

iv. cash book

Ans. i. total debtors account

An estimate of assets and liabilities as on a dates is called

i. balance sheet

ii. statement of affairs

iii. statement of capital

iv. trial balance.

Ans. ii. statement of affairs

In the case of highly autonomous branches which make use of local currency

substantially the method of translation most suitable is

i.

Temporal method

ii. Current/Non-current method

iii. Closing rate method

iv. Opening rate method.

Ans. iii. Closing rate method

The gain or loss due to difference in exchange is to be adjusted in the

i.

Reserves

ii. Income statement

iii. Retained profits

iv. Branch current account.

Ans. ii. Income statement

The currency into which the trial balance of the branch is translated is known as

i.

Reporting currency

ii. Local currency

iii. Foreign currency

iv. Translated currency.

Ans. i. Reporting currency

(265) Which one of the following combinations of accounting assumptions are

fundamental as per AS1?

i.

Going concern, consistency, and accrual

ii. Going concern, conservatism, and historic cost

iii. Historic cost, consistency and conservatism

iv. Conservatism, consistency and accrual

Ans. i. Going concern, consistency, and accrual

:: 27 ::

(266) Any change in the accounting policy relating to inventories which has a material

effect in the current or later periods should be disclosed. This is in accordance with

the accounting principle of:

i.

Going concern

ii. Conservatism

iii. Consistency

iv. Disclosure

Ans. iii. Consistency

(267) Historical cost of inventories should normally be determined by using

i.

FIFO, or Weighted average cost formula

ii. FIFO, Base Stock, or Adjusted Selling price formula

iii. FIFO, LIFO or Latest Purchase Price formula

iv. LIFO, Base Stock or Adjusted Selling Price formula

Ans. i. FIFO, or Weighted average cost formula

(268) Which one of the following formulae is not based on historic cost?

i.

FIFO

ii. LIFO

iii. Latest Purchase Price

iv. Specific Identifications

Ans. iii. Latest Purchase Price

(269) Which one of the following methods is best suited to retail business?

i.

FIFO

ii

LIFO

iii. Latest Purchase Price

iv. Retail price method

Ans. iv. Retail price method

(270) Selling and distribution costs are not included in cost of inventories because they

i.

are negligible

ii. do not relate to bringing the inventories in their present location and condition

iii. are period costs

iv. are in relation to specific customers

Ans. ii. do not relate to bringing the inventories in their present location and

condition

(271) Cash flows arising from interest paid in the case of a financial enterprise is a cash

flow from

i. operating activities

ii. financing activities

iii. both (i) and (ii)

iv. investing activities

Ans. i. operating activities

(272) Interest and dividends received in the case of a manufacturing enterprise should be

classified as cash flow from

i. operating

ii. financing

iii. Investing

iv. both (ii) and (iii)

Ans. iii. Investing

:: 28 ::

(273) If net profit is taken as the basis to ascertain cash flow from operations, which one

of the following adjustments is correct and proper?

i. add decrease in current assets and current liabilities

ii. add increase in current liabilities and current assets

iii. add increase in current assets and deduct decrease in current liabilities.

iv. add decrease in current assets and add increase in current liabilities.

Ans. iv. add decrease in current assets and add increase in current liabilities.

(274) The conversion of debt to equity:

i. must be shown on a notional basis as a financing cash flow

ii. must be shown on a notional basis as an investment cash flow

iii. must not be shown as it is a non-cash transaction

iv. none of the above

Ans. iii. must not be shown as it is a non-cash transaction

(275) The cash flows associated with extraordinary items should be separately classified

as a cash flow from

i. operating activities

ii. investing activities

iii. financing activities

iv. under (i) or (ii) or (iii) as is appropriate

Ans. iv. under (i) or (ii) or (iii) as is appropriate

(276) Profit or loss for the period includes

i. Ordinary activities

ii. Extraordinary activities

iii. Prior period Items

iv. All the above.

Ans. iv. All the above.

(277) The perception of extraordinary events must be made with reference to

i. Business ordinarily carried on by an enterprise

ii. The frequency with which such events are expected to occur

iii. Both (i) and (ii)

iv. The size of the transaction.

Ans. i. Business ordinarily carried on by an enterprise

(278) Prior period Items must be shown

i. In the current profit and loss account along with the ordinary activities

ii. In the current profit and loss account in a manner that their impact on the

current profit or loss can be perceived

iii. As adjustments to reserves

iv. As a separate Item in the balance sheet.

Ans. ii. In the current profit and loss account in a manner that their impact on

the current profit or loss can be perceived.

(279) A change in the estimated life of the asset, which necessitates adjustment in the

depreciation is an example of

i. Prior period item

ii. Ordinary Item

iii. Extraordinary item

iv. Change in the accounting estimate.

Ans. iv. Change in the accounting estimate.

:: 29 ::

(280) A change in the accounting policy should be made

i. When state so directs

ii. For compliance with an accounting standard

iii. For better presentation of financial statements

iv. All the above.

Ans. iv. All the above.

(281) Depreciable assets are assets which

i. are expected to be used during more than one accounting period

ii. have a limited useful life

iii. are held by the enterprise for use in the production or supply of goods and

services

iv. all the above

Ans. iv. all the above

(282) AS-6 is applicable to which one of the following assets?

i. Goodwill

ii. Livestock

iii. Plantation

iv. Plant and Machinery.

Ans. iv. all the above.

(283) A change in the method of depreciation is made only

i. If the adoption of new method is required by statute

ii. for compliance with an accounting standard

iii. If the change would result in better presentation of the financial statements

iv. all the above.

Ans. iv. all the above.

(284) When a change in the method of depreciation is effected the deficiency or surplus

arising from retrospective re-computatlon of depreciation in accordance with new

method is

i. to be ignored

ii. to be adjusted in the accounts in the year in which the change is effected

iii. to be spread over the remaining period of the life of (he asset.

iv. to be charged or credited to capital reserve.

Ans. ii. to be adjusted in the accounts in the year in which the change is effected

(285) The following factor is to be considered for estimating the useful life of a

depreciable asset

i. Expected physical wear and tear

ii. obsolescence

iii. legal or other limits on the use of assets

iv. all the above.

Ans. iv. all the above.

(286) The stage of completion of a contract is determined on the basis of :

i. proportion of costs incurred to date to the estimated total contract costs

ii. survey of work performed

iii. completion of physical proportion of the contract work

iv. either (i) or (ii) or (iii)

Ans. iv. either (i) or (ii) or (iii)

(287) Revenue is recognised on the basis of:

i. percentage of contract completion

ii. architect's certificates

:: 30 ::

(288)

(289)

(290)

(291)

(292)

(293)

(294)

iii. payments received from the customer

iv. either (i) or (iii)

Ans. i. percentage of contract completion

Which one of the following is an example of a direct cost of a contract?

i. selling costs

ii. research and development costs

iii. cost of hiring plant and equipment for the contract

iv. general administration cost

Ans. iii. cost of hiring plant and equipment for the contract

Which one of the following is a cost that may be allocated to contracts as it is

attributable to contract activity?

i. insurance

ii. claims from third parties

iii. research and development

iv. selling costs

Ans. i. insurance

Estimated total loss on the contract:

i. spread over accounting periods equally

ii. must be recognised as an expense immediately

iii. allocated on the basis of architects certificates

iv. allocated on the basis of percentage of completion

Ans. ii. must be recognised as an expense immediately

Which one of the following is excluded in research and development costs?

i. Amortisation of patent and licences

ii. Payment to outside bodies for research and development projects related to the

enterprise

iii. Cost of materials and services consumed.

iv. Costs incurred on research to maintain existing products.

Ans. iv.Costs incurred on research to maintain existing products.

The benchmark treatment of research and development costs is

i. to expense it in the year in which it is incurred

ii. to treat such expenditure as deferred revenue expenditure

iii. (i) or (ii)

iv. to capitalise such expenditure and provide depreciation

Ans. i. to expense it in the year in which it is incurred

Deferred research and development costs are amortised on the basis of

i. sales of the product

ii. use of the product or process

iii. time basis (time during which the product is used or sold)

iv. all the above

Ans. iv. all the above

Research and development costs should be expensed in the year in which it is

incurred if

i. estimated research and development costs exceed the future revenues

ii. the technical feasibility of the product has not been established.

iii. the management has no intention to produce the product

:: 31 ::

(295)

(296)

(297)

(298)

(299)

(300)

(301)

iv. adequate revenues do not exist to complete the project and market the product

or process

v. all the above.

Ans. v. all the above.

Which one of the following items is not dealt with by AS-9?

i. Revenue recognition on sale of goods

ii. Revenue recognition on rendering of services

iii. Revenue recognition on the use of resources of the enterprise

iv. Unrealised gains on the holding of current assets.

Ans. iv.Unrealised gains on the holding of current assets.

Which one of the following items is dealt with by AS-9?

i. Realised and unrealised holding gains in relation to fixed assets

ii. Unrealised holding gains in relation to current assets

iii. Revenue recognised on rendering of services

iv. Realised or unrealised gains from foreign currency translation.

Ans. iii. Revenue recognised on rendering of services

Completed service contract method is applicable to which one of the following?

i. Sale of software products

ii. Sale of software development

iii. Installation fees

iv. Royalties.

Ans. iii. Installation fees

In the case of consignment sales revenue is to be recognised on

i. Preparation of pro-forma invoice by the consignor

ii. Receipt of goods by the consignee

iii. Receipt of cash by the consignor

iv. Sale of goods to a third party

Ans. iv. Sale of goods to a third party

Which one of the following is not a component of the cost of fixed asset?

i. Installation costs

ii. Financing costs

iii. Administration and general expenses

iv. Start up and commissioning costs.

Ans. iii. Administration and general expenses

A decrease in net book value arising on revaluation of fixed assets is to be debited

to be

i. revaluation reserve

ii. Profit and loss account

iii. General reserve

iv. Capital reserve.

Ans. ii. Profit and loss account

Items of fixed assets that have been retired from active use and are held for

disposal should be stated at :

i. Net book value

ii. Net realisable value

iii. Lower of the net book value and net realisable value

iv. Higher of the net book value and net realisable value.

Ans. iii. Lower of the net book value and net realisable value

:: 32 ::

(302) Fixed assets purchased on hire-purchase terms are recorded at:

Ans. cash value

(303) When an asset is revalued at higher than original cost, the accumulated

depreciation is

Ans.credited to revaluation reserve

(304) While translating the financial statements of foreign branches, fixed assets are

translated by applying ..

Ans. rate at the date of transaction.

(305) Exchange differences arising on repayment of fixed asset-linked liabilities should

be adjusted to

i. Profit and loss account

ii. Fixed asset account

iii. Revaluation reserve

iv. Capital reserve.

Ans. ii. Fixed asset account

(306) Closing rate is used for translating

Ans. Monetary items.

(307) The carrying amount for current investments is.

Ans.lower of cost and fair value

(308) Investments in properties are to be shown under

Ans. long-term investments.

(309) Amalgamation adjustment account is opened in the books of the transferee

company to incorporate

Ans. the statutory reserves of the transferor company

(310) As per AS-14, purchase consideration is the amount agreed payable to

Ans. shareholders.

(311) Under the 'Purchase Method of Accounting', the transferee company incorporates

in Its books

Ans. the assets, liabilities and statutory reserve of the transferor company

(312) Under the pooling of interests method the difference between the purchase

consideration and share capital of the transferee company should be adjusted

to

Ans. general reserve

(313) As per AS-14 purchase consideration is what is payable to

i. Shareholders

ii. Shareholders and debenture holders

iii. Shareholders and creditors

iv. Debenture holders and creditors

Ans. i. Shareholders

(314) When amalgamation is in the nature of merger, the accounting method to be

followed is:

i. Equity method

ii. Purchase method

iii. Pooling of interests method

iv. Consolidated method

Ans. iii. Pooling of interests method

(315) Amalgamation adjustment account is opened in the books of transferee company to

incorporate

i. The assets of the transferor company

:: 33 ::

(316)

(317)

(318)

(319)

(320)

ii. The liabilities of the transferor company

iii. The statutory reserves of the transferor company

iv. The non-statutory reserves of the transferor company

Ans. iii. The statutory reserves of the transferor company

Under the purchase method of accounting, the transferee company incorporates

in its books:

i. The assets and liabilities of the transferor company

ii. The assets, liabilities and statutory reserves of the transferor company

iii. The assets, liabilities and non-statutory reserves of the transferor company

iv. The assets, liabilities and reserves of the transferor company.

Ans. ii. The assets, liabilities and statutory reserves of the transferor company

Under the pooling of interests method the differences between the purchase

consideration and share capital of the transferee company should be adjusted to;

i. General reserve

ii. amalgamation adjustment account

iii. Goodwill or capital reserve

iv. Either (ii) or (iii)

Ans. i. General reserve

Any balance is the capital reduction account after writing off lost capital is

transferred to

i. Capital reserve account

ii. Share surrendered account

iii. Capital reorganisation account

iv. Contingency reserve

Ans. i. Capital reserve account

In a scheme of reorganisation amount of shares surrendered by shareholders is

transferred to

i. Capital reduction account

ii. Share surrendered account

iii. Capital reorganisation account

iv. Capital reserve

Ans. ii. Share surrendered account

Amounts sacrificed by shareholders are credited to

i. Capital reserve account

ii. General reserve account

iii. Capital reduction account

:: 34 ::

(321)

(322)

(323)

(324)

(325)

(326)

(327)

(328)

iv. Contingency reserve account

Ans. iii. Capital reduction account

For a company to carry out capital reduction, permission is required from

i. The competent court

ii. Controller of Capital issues

iii. Company Law Board

iv. Central Government.

Ans. i. The competent court

Consent of the creditors is required for

i. Sub-dividing the shares

ii. Consolidation of shares

iii. Increasing share capital

iv. Return of capital.

Ans. iv. Return of capital.

Capital reduction account is used in the case of

i. internal reconstruction

ii. external reconstruction

iii. amalgamation of Companies

iv. absorption of one company by another

Ans. i. internal reconstruction

Banks prepare the accounts for the

i. Calendar year

ii. Financial year

iii. Cooperative year

iv. Diwali year

Ans. ii. Financial year

Banks show the provision for income-tax under the head

i. Contingency accounts

ii. Contingent liabilities

iii. Other liabilities and provisions

iv. Borrowings

Ans. iii. Other liabilities and provisions

The heading other assets does not include

i. Silver

ii. Interest accrued

iii. Inter-office adjustment (Dr.)

iv. Gold

Ans. iv. Gold

Rebate on bills discounted is

i. An item of income

ii. A liability

iii. income received in advance

iv. Income Outstanding

Ans. iii. income received in advance

A non-banking asset is

i.

An item of office equipment

ii. Any asset acquired from the debtors in satisfaction of claim

iii. Money at call and short notice

:: 35 ::

(329)

(330)

(331)

(332)

(333)

(334)

(335)

iv. Furniture and fixtures

Ans. ii. Any asset acquired from the debtors in satisfaction of claim

A non-performing asset is

i.

Money at call and short notice

ii. An asset that ceases to generate income

iii. Cash balance in till

iv. Cash balance with RBI

Ans. ii. An asset that ceases to generate income

When income is to be recognised on cash basis, a distinction should be made

between

i.

Performing and non-performing assets

ii. Banking and non-banking assets

iii. Monetary and non-monetary assets

iv. Current and non-current assets

Ans. i. Performing and non-performing assets

A valuation balance sheet is prepared by a

i. trading company

ii. banking company

iii. manufacturing company

iv. life insurance company

Ans. iv. life insurance company

A general insurance business carrying on more than one type of insurance business

prepares

i. a separate revenue account for each type of business.

ii. a separate profit and loss account for each type of business.

iii. a separate revenue account and combined profit and loss account.

iv. a separate revenue account and profit and loss account for each type of

business.

Ans. iii. a separate revenue account and combined profit and loss account.

Survey expenses for marine insurance claims must be

i. added to claims

ii. added to law charges

iii. added to management expenses

iv. shown as a separate item

Ans. i. added to claims

Expenses of management must be

i. charged to Profit and Loss Appropriation A/c .

ii. charged to different revenue accounts

iii. charged to profit and loss account

iv. reduced from investment income

Ans. ii. charged to different revenue accounts

During a year a general insurance company ha. the following details :

Lakh of Rs.

Premiums received

500

Premiums on re-insurance accepted

100

Premiums on re-insurance ceded

200

The amount to be credited as premium to revenue account should be

i. Rs. 500 lakhs

ii. Rs. 600 lakhs

:: 36 ::

(336)

(337)

(338)

(339)

(340)

(341)

(342)

iii. Rs. 700 lakhs

iv. Rs. 400 lakhs

Ans. iv. Rs. 400 lakhs

Income tax on interest, dividend and rent should be

i. debited to provision for taxation

ii. debited to profit and loss account

iii. debited to profit and loss appropriation account

iv. deducted from interest, dividends and rents

Ans. iv. deducted from interest, dividends and rents

Cash at call and short notice will appear in the Balance Sheet

i. as a separate item

ii. under the heading 'Cash'

iii. under the heading 'other accounts'

iv. either (i) or (ii)

Ans. ii. under the heading 'Cash'

When an asset is replaced;

i. the current cost of replacement is written off to revenue.

ii. the original cost of the asset is written off to revenue.

iii. the original cost reduced by the amount of depreciation is written off to

revenue.

iv. the lower of (i) or (ii).

Ans. i. the current cost of replacement is written off to revenue.

Original cost of an asset Rs. 5,00,000. Present cost of replacement Rs. 6,50,000.

Amount spent on replacement Rs. 7,60,000. The amount chargeable to revenue

will be:

i. Rs. 6,50,000

ii. Rs. 5,00,000

iii. Rs. 7,60,000

iv. Rs. 2,60,000

Ans. i. Rs. 6,50,000

Interest on debentures is shown in:

i. Revenue account

ii. Capital account

iii. Net revenue account

iv. Capital account

Ans. iii. Net revenue account

When an asset is replaced, any amount realised on sale of old materials will be

credited to

i. Replacement account

ii. Asset account

iii. Revenue account

iv. Net revenue account

Ans. i. Replacement account

Cost of license is shown in the

i. Capital account

ii. Revenue account

iii. General balance sheet

iv. Net revenue account

Ans. i. Capital account

:: 37 ::

(343) Contingencies reserve is created:

i. to declare dividends during years when profits are inadequate.

ii. to meet abnormal expenses which are beyond the control of management.

iii. strengthen generally the financial position of the company.

iv. either (ii) or (iii)

Ans. iv. either (ii) or (iii)

(344) The essential feature of the double account system is:

i. for every debit there is a corresponding credit.

ii. the presentation of capital receipts and capital expenditure in a separate

account.

iii. the presentation of assets at original cost, the depreciation to date being

shown to the credit of depreciation reserve account.

iv. all the above

Ans. iv. all the above

(345) Under double account system, depreciation is credited to

Ans. depreciation reserve account.

You might also like

- Auditing McqsDocument22 pagesAuditing Mcqshaider_shah88226786% (14)

- Cost Accounting Sample Question Paper (100 Marks & 75 MarksDocument5 pagesCost Accounting Sample Question Paper (100 Marks & 75 MarksVishnuNadar50% (2)

- AssigmentDocument8 pagesAssigmentMuhammad Rafique0% (1)

- Multiple Choice Quetions - Financial AccountingDocument4 pagesMultiple Choice Quetions - Financial Accountingshabukr100% (4)

- Multiple Choice Questions and Answers On FADocument37 pagesMultiple Choice Questions and Answers On FArbdubey2020100% (1)

- Cost Accounting Objective Type QuestionsDocument2 pagesCost Accounting Objective Type QuestionsJoshua Stalin Selvaraj75% (16)