Professional Documents

Culture Documents

Course: Public Finance and Fiscal Policy

Uploaded by

Mian EjazOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Course: Public Finance and Fiscal Policy

Uploaded by

Mian EjazCopyright:

Available Formats

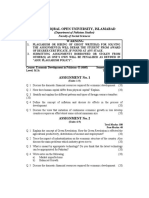

Course: Public Finance and Fiscal Policy (808)

Semester: Autumn, 2010

Level: M.Sc Economics

Total Marks: 100

Pass Marks: 40

(Units 15)

Q.1 Define merit and mixed goods. Also highlight the distinguishing features of both

goods.

(20)

Q.2 Describe the problems encountered during budget preparation, its implementation

and evaluation in Pakistan.

(20)

Q.3 Describe different discount rates and which should be appropriate discount rate for

appraisal of public project?

(20)

Q.4 Define Gini- coefficient and its relation to Lorzen curve. Mention other measures

of income inequality and also show effect of a tax on income distribution.

(20)

Q.5 What is the rational of wealth taxation? Is wealth taxation progressive and can a

property- owner shift property-taxes partially to others?

(20)

ASSIGNMENT No. 1

(Units 15)

Total marks: 100

Pass Marks: 40

Q.1 What is meant by discretionary policy?

Q.2

(20)

Do you agree with the statement that a contractionary fiscal policy and expansionary

monetary policy are considered to be most suitable for economic growth?

(20)

Q.3 Why marginal cost pricing principle fail in case of decreasing cost industry?

(20)

Q.4 Describe the problems of debt management.

(20)

Q.5 Write notes on the followings.

a)

Ingredients of Economic Development

b)

(10+10)

Pricing of Social Facilities

You might also like

- Paper 3 PYQDocument14 pagesPaper 3 PYQSaurabh PatelNo ratings yet

- 4671Document2 pages4671ali hasnainNo ratings yet

- AIOU Assignment 402Document4 pagesAIOU Assignment 402ziabuttNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Economics) WarningDocument4 pagesAllama Iqbal Open University, Islamabad (Department of Economics) WarningSidra RaniNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Economics) WarningDocument3 pagesAllama Iqbal Open University, Islamabad (Department of Economics) WarningIttrat NissarNo ratings yet

- Allama Iqbal Open University, Islamabad Warning: (Department of Economics)Document3 pagesAllama Iqbal Open University, Islamabad Warning: (Department of Economics)Zabi ZabiNo ratings yet

- 802 QuestionsDocument2 pages802 QuestionsMuhammad NomanNo ratings yet

- Allama Iqbal Open University, Islamabad Warning: (Department of Economics)Document2 pagesAllama Iqbal Open University, Islamabad Warning: (Department of Economics)Kareem Nawaz KhanNo ratings yet

- BBA BIM BBM 2nd Semester Model Question AllDocument22 pagesBBA BIM BBM 2nd Semester Model Question AllGLOBAL I.Q.No ratings yet

- PYQs - International - Economics - 2Document5 pagesPYQs - International - Economics - 2TusharNo ratings yet

- 0402 (Eng) Allama IqbalDocument4 pages0402 (Eng) Allama Iqbalwww.18531509075No ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Economics)Document3 pagesAllama Iqbal Open University, Islamabad: (Department of Economics)Imtiaz AhmadNo ratings yet

- Paper 4 PYQDocument16 pagesPaper 4 PYQSaurabh PatelNo ratings yet

- 2704 Development EconomicsDocument2 pages2704 Development Economicsmeelas123No ratings yet

- Answer ALL Questions A (10 × 2 20 Marks)Document3 pagesAnswer ALL Questions A (10 × 2 20 Marks)Vem Baiyan CNo ratings yet

- Economics Class 12Document5 pagesEconomics Class 12temaso8570No ratings yet

- Eee - PGDMDocument3 pagesEee - PGDMaayush yadavNo ratings yet

- 2nd Year EnglishDocument8 pages2nd Year EnglishKAJAL YADAVNo ratings yet

- BSC (Hons) Economics and Finance - Shlm301: As Per University RegulationDocument8 pagesBSC (Hons) Economics and Finance - Shlm301: As Per University Regulationheet21No ratings yet

- MCOM 1st Year English PDFDocument8 pagesMCOM 1st Year English PDFakshaykr1189No ratings yet

- EconomicsDocument9 pagesEconomicsjainayan819No ratings yet

- New 1st Semester English (MCO-01,04,05,21)Document6 pagesNew 1st Semester English (MCO-01,04,05,21)liwag20537No ratings yet

- Rakesh - Fcbs@mriu - Edu.in Swatiwatts - Fcbs@mriu - Edu.in: Create A Single PDF File of Answer Sheet/sDocument2 pagesRakesh - Fcbs@mriu - Edu.in Swatiwatts - Fcbs@mriu - Edu.in: Create A Single PDF File of Answer Sheet/sSandeep BeniwalNo ratings yet

- IMC Unit 2 Mock Exam 2 V18 March 2021Document33 pagesIMC Unit 2 Mock Exam 2 V18 March 2021SATHISH SNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Pakistan Studies) WarningDocument2 pagesAllama Iqbal Open University, Islamabad (Department of Pakistan Studies) WarningShah ZamanNo ratings yet

- IMC Unit 2 Mock Exam 1 V18 March 2021Document33 pagesIMC Unit 2 Mock Exam 1 V18 March 2021SATHISH SNo ratings yet

- MARK SCHEME For The November 2004 Question PapersDocument6 pagesMARK SCHEME For The November 2004 Question PapersKarmen ThumNo ratings yet

- Paper 2 PYQDocument16 pagesPaper 2 PYQSaurabh PatelNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Pakistan Studies) Faculty of Social SciencesDocument2 pagesAllama Iqbal Open University, Islamabad: (Department of Pakistan Studies) Faculty of Social SciencesHamy DimahNo ratings yet

- Master of Commerce: 1 YearDocument8 pagesMaster of Commerce: 1 YearAston Rahul PintoNo ratings yet

- PEM Chapter 5Document48 pagesPEM Chapter 5mohamed100% (1)

- 1st Year Assignments 2019-20 (English)Document8 pages1st Year Assignments 2019-20 (English)NarasimhaNo ratings yet

- 4659Document2 pages4659saad ahmadNo ratings yet

- Model Question Set IIA-Indian EconomyDocument3 pagesModel Question Set IIA-Indian EconomyLata BinaniNo ratings yet

- 4659Document2 pages4659Mansoor Ahmad0% (2)

- Question PaperDocument11 pagesQuestion PaperNithya TheressaNo ratings yet

- Macroeconomic Theory ECO208 - Chapter 1: Murat Alp CelikDocument12 pagesMacroeconomic Theory ECO208 - Chapter 1: Murat Alp CelikMicah NgNo ratings yet

- Azərbaycan Dövlət İqtisad Universiteti Beynəlxalq İqtisadiyyat Məktəbi Beynəlxalq İqtisadiyyat (İngilis Dilli) KafedrasiDocument5 pagesAzərbaycan Dövlət İqtisad Universiteti Beynəlxalq İqtisadiyyat Məktəbi Beynəlxalq İqtisadiyyat (İngilis Dilli) KafedrasiNihad PashazadeNo ratings yet

- ZFD O4 o YDb LG ICWSn K7 VQDocument8 pagesZFD O4 o YDb LG ICWSn K7 VQgauravyadav06092006No ratings yet

- 9708 Oct Nov 2010 All Mark SchemesDocument50 pages9708 Oct Nov 2010 All Mark SchemessamNo ratings yet

- 9708 Economics: MARK SCHEME For The October/November 2006 Question PaperDocument4 pages9708 Economics: MARK SCHEME For The October/November 2006 Question PaperKarmen ThumNo ratings yet

- M4 - Set 1 Speaking TopicsDocument2 pagesM4 - Set 1 Speaking TopicsHUY LÊ TRỊNH QUỐCNo ratings yet

- IGNOU Assignments PDFDocument10 pagesIGNOU Assignments PDFKaivalya ShimpiNo ratings yet

- Peter Swan Economics of Standardization UpdateDocument83 pagesPeter Swan Economics of Standardization UpdateAlexander MartinezNo ratings yet

- ECONOMICS (Code No. 030) : RationaleDocument8 pagesECONOMICS (Code No. 030) : RationaleKhalkho UmeshNo ratings yet

- Paper - Business Economics-Ii: Maharishi Institute of Management, BangaloreDocument3 pagesPaper - Business Economics-Ii: Maharishi Institute of Management, BangaloreDivakara ReddyNo ratings yet

- Navodaya Vidyalaya Samiti: No. of QuestionsDocument2 pagesNavodaya Vidyalaya Samiti: No. of QuestionsPankaj PatidarNo ratings yet

- Collabration Programme M.com EnglishDocument13 pagesCollabration Programme M.com EnglishAmit YadavNo ratings yet

- Economics HandoutDocument4 pagesEconomics HandoutSamadarshi SiddharthaNo ratings yet

- International EconomicsDocument7 pagesInternational Economicsbekaruse00No ratings yet

- Final Assessment - Introduction To Economics - 05082021Document1 pageFinal Assessment - Introduction To Economics - 05082021TabishNo ratings yet

- 2 EconomicsDocument8 pages2 EconomicsNiki Sarkar73No ratings yet

- Paper 1 Essay QuestionsDocument26 pagesPaper 1 Essay QuestionsSteve0% (2)

- ECONOMICS (Code No. 030) : RationaleDocument8 pagesECONOMICS (Code No. 030) : RationaleAshish GangwalNo ratings yet

- 9708 s05 Ms 2 PDFDocument7 pages9708 s05 Ms 2 PDFTawanda B MatsokotereNo ratings yet

- Methodology for Impact Assessment of Free Trade AgreementsFrom EverandMethodology for Impact Assessment of Free Trade AgreementsNo ratings yet

- Economic Indicators for East Asia: Input–Output TablesFrom EverandEconomic Indicators for East Asia: Input–Output TablesNo ratings yet

- Fundamentals of Business Economics Study Resource: CIMA Study ResourcesFrom EverandFundamentals of Business Economics Study Resource: CIMA Study ResourcesNo ratings yet

- Model answer: Launching a new business in Networking for entrepreneursFrom EverandModel answer: Launching a new business in Networking for entrepreneursNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- HSSC-II Short Notes CH 4Document7 pagesHSSC-II Short Notes CH 4Mian EjazNo ratings yet

- Important Long QuestionsDocument1 pageImportant Long QuestionsMian EjazNo ratings yet

- Hum Wohi Hen Bus Zara Thikana Bdal Lia HaiDocument1 pageHum Wohi Hen Bus Zara Thikana Bdal Lia HaiMian EjazNo ratings yet

- Basic Mcqs of Computer Science (It) For Nts and PSC Test: Posted by OnDocument5 pagesBasic Mcqs of Computer Science (It) For Nts and PSC Test: Posted by OnMuhammad KashifNo ratings yet

- Results - B.A.Document1 pageResults - B.A.Mian EjazNo ratings yet

- HSSC-II Short Notes CH 3Document6 pagesHSSC-II Short Notes CH 3Mian EjazNo ratings yet

- cs703 MidDocument11 pagescs703 MidMian EjazNo ratings yet

- BA English Test Ch.1 (B) Annual 2016Document2 pagesBA English Test Ch.1 (B) Annual 2016Mian EjazNo ratings yet

- New Daily BDC Report 02.09.2016Document2 pagesNew Daily BDC Report 02.09.2016Mian EjazNo ratings yet

- Name of Paper Marks Obtained Total Marks Status: CongratulationDocument1 pageName of Paper Marks Obtained Total Marks Status: CongratulationMian EjazNo ratings yet

- Questions: (Ii) Sun, Rain, Curving SkyDocument1 pageQuestions: (Ii) Sun, Rain, Curving SkyMian EjazNo ratings yet

- Theme of DR FaustusDocument3 pagesTheme of DR FaustusAbdulRehman94% (17)

- RegisDocument1 pageRegisDhiraj PradhanNo ratings yet

- PPSC Lecturer of Computer Science Past Paper QuestionsDocument19 pagesPPSC Lecturer of Computer Science Past Paper QuestionsMian Ejaz0% (2)

- Solution Assignment No 2Document8 pagesSolution Assignment No 2Mian EjazNo ratings yet

- Homework 4Document4 pagesHomework 4Mian EjazNo ratings yet

- 16 Support & Movement: NameDocument2 pages16 Support & Movement: NameMian EjazNo ratings yet

- ADocument1 pageAMian EjazNo ratings yet

- ASSISTANT Director Land RecordDocument32 pagesASSISTANT Director Land RecordMian EjazNo ratings yet

- l13 HandDocument20 pagesl13 HandMian EjazNo ratings yet

- Outlines DFFDocument2 pagesOutlines DFFMian EjazNo ratings yet

- Web Generated Bill: Lahore Electric Supply Company - Electricity Consumer Bill (Mdi)Document2 pagesWeb Generated Bill: Lahore Electric Supply Company - Electricity Consumer Bill (Mdi)Mian EjazNo ratings yet

- Ba English Poems Download NotesDocument17 pagesBa English Poems Download NotesMian Ejaz75% (12)

- CS704 - Advanced Computer Architecture-II: Due DateDocument2 pagesCS704 - Advanced Computer Architecture-II: Due DateMian EjazNo ratings yet

- ADocument1 pageAMian EjazNo ratings yet

- ADocument1 pageAMian EjazNo ratings yet

- University of The Punjab - ChallanDocument2 pagesUniversity of The Punjab - ChallanMian EjazNo ratings yet

- An Optimizing Pipeline Stall Reduction AlgorithmDocument13 pagesAn Optimizing Pipeline Stall Reduction AlgorithmMian EjazNo ratings yet